All major US equity indices closed higher, while APAC and European markets were mixed. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA credit indices closed modestly tighter across IG and high yield. The US dollar and natural gas closed lower, while oil, silver, copper, and gold closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed higher and all traded in positive territory the entire session; Nasdaq +1.4%, S&P 500 +1.0%, DJIA +0.5%, and Russell 2000 +0.5%.

- 10yr US govt bonds closed -2bps/1.60% yield and -2bps/2.30% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -3bps/291bps.

- DXY US dollar index closed -0.2%/89.84.

- Gold closed +0.4%/$1,885 per troy oz, silver +1.5%/$27.91 per troy oz, and copper +1.0%/$4.53 per pound.

- Crude oil closed +3.9%/$66.05 per barrel and natural gas closed -0.6%/$2.96 per mmbtu.

- In a press release, Cabot Oil & Gas Corporation announced the signing of an agreement to acquire Cimarex Energy Co. in an all-stock transaction valued at $9.61 billion. The transaction is expected to close by the end of the fourth quarter of 2021. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Under the deal, Cimarex shareholders will receive 4.0146 common shares of Cabot for each Cimarex share. Based on Cabot's closing price on 21 May 2021 and 102.8 million Cimarex shares outstanding at 30 April 2021, the total equity offer value is $7.35 billion or $71.50 per share. The offer price is a 0.44% premium to the 21 May closing price of Cimarex.

- The total transaction value includes the assumption of Cimarex's 31 March 2021 working capital surplus of $102.07 million and $2.36 billion of long-term debt and liabilities.

- On closing, Cabot shareholders will own approximately 49.5% and Cimarex shareholders will own approximately 50.5% of the combined company on a fully diluted basis. The combined company will operate under a new name, Cabot said.

- The combined company expects the merger to generate annual synergies of approximately $100 million within 18 months to two years.

- Cimarex holds approximately 560,000 net acres in the Permian and Anadarko basins. The Permian operations in Texas and New Mexico cover the Delaware Basin Wolfcamp Shale and Bone Spring Sands, with the Anadarko assets in the Woodford and Meramec Shales in Western Oklahoma. Net proved reserves were 531 MMboe (57% oil and NGLs; 84% developed) at year-end 2020 and net production averaged 219,683 boe/d (58% oil and NGLs) during the first quarter of 2021.

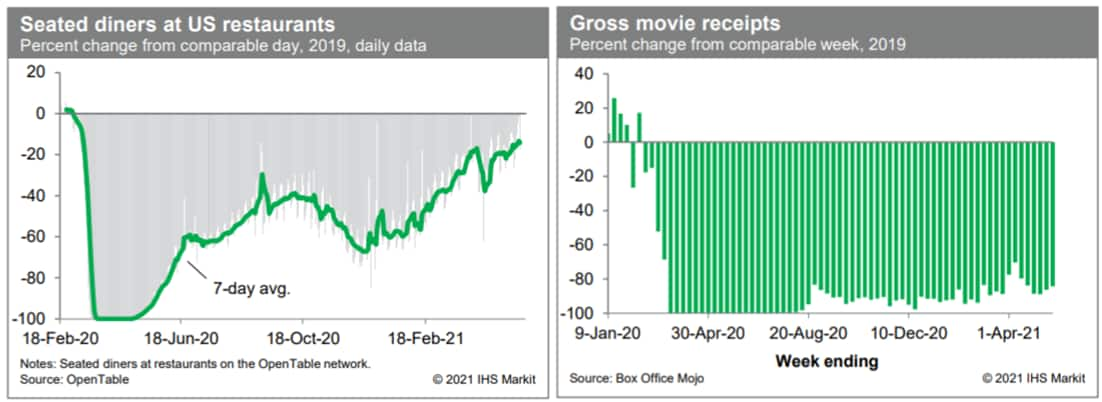

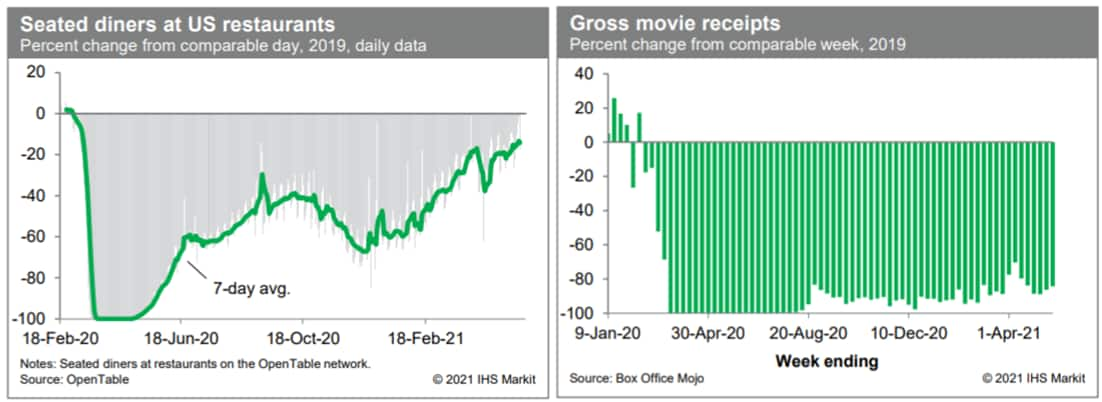

- The trend in restaurant activity has continued to improve in recent days. Averaged over the week ending yesterday, the count of seated diners on the OpenTable platform was only 14% below the comparable period in 2019. This is a vast improvement from earlier this year, as restrictions on restaurants continue to be relaxed and as an increasing share of the population becomes vaccinated. Meanwhile, gross movie receipts last week were 84% below the comparable week in 2019. Movie-theater activity remains depressed but has shown signs of life, unevenly, over the last couple of months. (IHS Markit Economists Ben Herzon and Joel Prakken)

- The Governor of California, Gavin Newsom, has released the May Revision of California's state budget for 2021-22, which proposes removing the exclusion of income-eligible undocumented seniors (aged 60 and over) from the state Medicaid program, known as Medi-Cal. As noted by California's Health Consumer Advocacy Coalition, Health Access, which welcomed the proposed expansion, other proposed measures include taking back more than USD700 million in state subsidies for those with insurance coverage in California. Health Access suggested that these subsidies "could have furthered lower premiums and deductibles for hundreds of thousands of Californians". Health Access also criticized the proposed budget's failure to eliminate the Medi-Cal asset test that excludes some seniors and people with disabilities. An expansion for undocumented seniors had previously been included in Governor Newsom's initial 2020 state budget, but had been withdrawn in the face of a forecast downturn in the budget that did not ultimately materialize. (IHS Markit Life Sciences' Milena Izmirlieva)

- Fisker has announced it will deliver a version of the Ocean EV utility vehicle modified for papal transportation, including modifications for the Pope's ability to greet crowds. The company claims this will be the first all-electric vehicle (EV) for the Pope. In a Fisker statement, Henrik Fisker said, "I got inspired reading that Pope Francis is very considerate about the environment and the impact of climate change for future generations. The interior of the Fisker Ocean papal transport will contain a variety of sustainable materials, including carpets made from recycled plastic bottles from the ocean." The modified Ocean promises the "first exhaust-free and emissions-free experience for those gathered for blessings by His Holiness." The car will have an all-glass, bulletproof cupola for accessibility and visibility of the Pope. Fisker plans to deliver the vehicle in 2022, presumably after regular production starts. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Environmentalists have filed a petition with EPA calling on the agency to revamp its pesticide risk assessment process to fully consider the potential harms to soil ecosystems. The Center for Biological Diversity and Friends of the Earth contend the current process falls far short, underestimating the risk of pesticides to soil invertebrates and microorganisms and failing to address the indirect effects that loss of soil life can have on ecosystems. The 34-page petition notes that EPA estimates 50-100% of agricultural chemicals end up in the soil and that overuse of pesticides has been identified as a major cause of soil biodiversity loss. The environmental groups also cite a peer-review paper they published earlier this month - along with researchers from the University of Maryland - that found widespread harm to beneficial soil invertebrates from pesticides. (IHS Markit Food and Agricultural Policy's JR Pegg)

- The US state of California's Department of Motor Vehicles (DMV) has issued a permit to startup Pony.ai to test its autonomous vehicles (AVs) without a human back-up driver, reports TechCrunch. The new permit allows the company to test its six AVs without a driver behind the wheel on designated streets in Fremont, Milpitas, and Irvine. The vehicles can operate on roads with posted speed limits not exceeding 45 miles per hour in clear weather and light precipitation. Significance: Pony.ai is the eighth company after Waymo, Nuro, AutoX, Zoox, Cruise, Baidu, and WeRide to receive a permit from the DMV for driverless testing. (IHS Markit Automotive Mobility's Surabhi Rajpal)

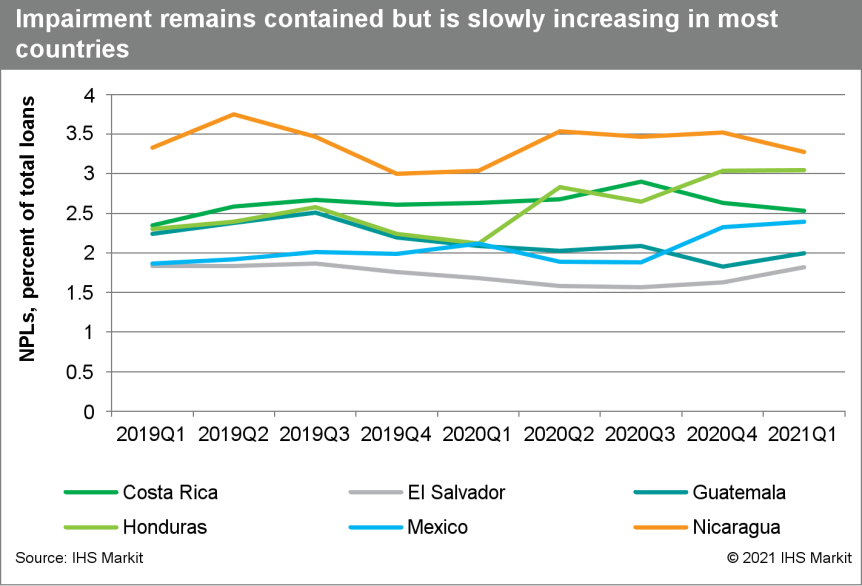

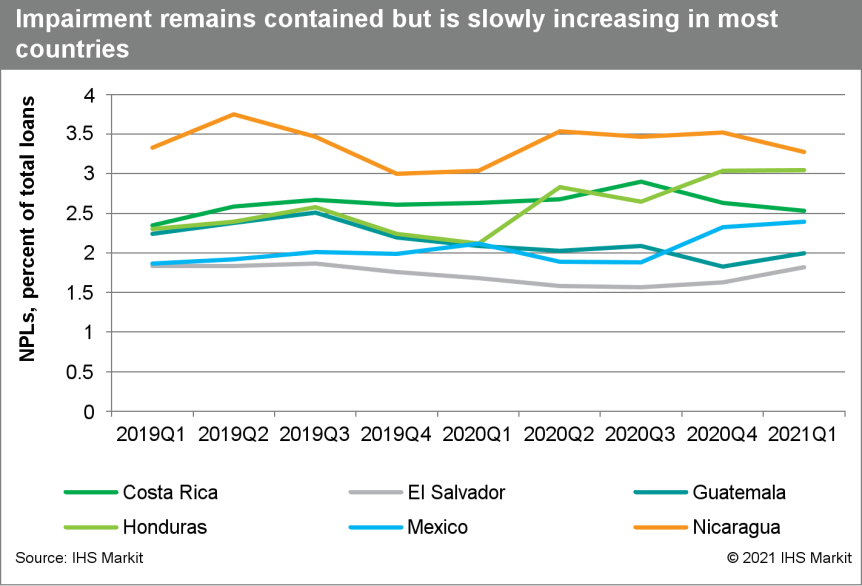

- IHS Markit has analysed the main banking indicators for Costa Rica, El Salvador, Guatemala, Honduras, Mexico, and Nicaragua. Our key findings indicate that credit growth remains depressed in most of the region; in addition, profitability continues to be contained and impairment is increasing slowly. During the rest of 2021, we expect a very moderate recovery in credit growth and profitability, although impairment will continue to rise. All averaged figures presented here are calculated by simple (non-weighted) averages. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Credit continued to be either stagnant or contracting during the first quarter of 2021. In March 2021, the average credit growth in the region was -2.4% year on year (y/y), replicating the contraction observed at the end of 2020. The sharp economic downturn of all these countries continued leading a credit decline in the region.

- Non-performing loans (NPLs) continue to remain low, but are increasing slowly. In the first quarter of 2021, NPLs remained at an average of 2.5% of total loans, up by 0.2 percentage point when compared with the first quarter of 2020. Forbearance measures instituted in these sectors are likely to be maintaining this, not reflecting the real impairment.

- Capital ratios remain adequate, but Honduras's leverage ratio is a key risk to watch in future. With an average capital adequacy ratio of 17.0% in March 2021, the region continues to display strong capital ratios. These indicators were also maintained over the ratio of non-weighted shareholders' equity to total assets at 11.5% in the regional average.

Europe/Middle East/Africa

- European equity markets closed mixed; UK +0.5%, France +0.4%, Spain flat, and Italy -0.3%.

- 10yr European govt bonds closed higher; Italy/UK -2bps and Germany/France/Spain -1bp.

- iTraxx-Europe closed -1bp/52bps and iTraxx-Xover -4bps/257bps.

- Brent crude closed +3.0%/$68.37 per barrel.

- According to the UK Office for National Statistics (ONS), the number of workers on payroll grew for the fifth successive month when rising by 97,000 month on month (m/m) during April. (IHS Markit Economist Raj Badiani)

- Nevertheless, the number of payroll workers remained 772,000 below February 2020, its pre-coronavirus disease 2019 (COVID-19) virus pandemic level, with the ONS reporting the "largest falls in payrolled employment have been in the hospitality sector, among those aged under 25 years, and those living in London."

- The ONS reports that total UK employment (all aged 16 plus) increased by 84,000 quarter on quarter (q/q) or 0.3% q/q to 32.4 million in the three months to March 2021, compared with the three months to December 2020.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure decreased by 121,000 in the three months to March, standing at 1.675 million.

- The UK unemployment rate stood at 4.8%, down from 5.1% in the three months to December 2020. This was partly due to the rising economic inactivity rate during the third national lockdown, which started in early January.

- Furthermore, the number of vacancies continued to recover, averaging 657,000 over the three months to April; the ONS's experimental monthly vacancy statistics for April itself were "at near pre-pandemic levels".

- Total pay in real terms rose by 3.1% y/y in the three months to March, which was the seventh successive gain.

- UK logistics businesses have been resilient since the pandemic started. Logistics UK, the trade association, has warned that the logistics costs are likely to increase in the short to medium term. Elizabeth de Jong, Logistics UK's policy director, stated at the group's launch of its annual Logistics Report 2021: "A reduction in supply of international shipping containers, and ships to carry them, led to significant rises to the cost of moving goods and services internationally; by the end of 2020, shipping container rates had increased by 185% year-on-year and air freight costs rose significantly when cargo space was constrained due to the grounding of passenger flights. Many logistics businesses are already operating on very tight profit margins of only 2%, or just 1% for those in road transport. These rises will make it harder to find the funds they need to develop their operations by investing in green technology, such as in alternatively fueled vehicles, upskilling the existing workforce or funding new recruits while continuing to pay wages and other business costs. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- UK-based connected-car data startup Wejo is planning to go public through a reverse merger deal with Virtuoso Acquisition Corp, a special purpose acquisition company (SPAC). It could value the startup at USD1 billion, reports Reuters. The deal's terms can be still altered as it has not been closed yet, and the funds raised through investors involved in Private Investment in Public Equity (PIPE) have also not reached an agreement. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- German lawmakers have passed a bill that will allow Level 4 autonomous vehicles (AVs) to operate on public roads, reports Automotive News Europe (ANE). Vehicles with Level 4 autonomous capability require no human intervention, but their applications are limited to specific conditions. The bill requires the vehicles to have a human operator to check in case of an emergency, either by sitting inside it or accessing it remotely. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tesla CEO Elon Musk has said that he is looking into the possibility of opening a production site for the brand in Russia, according to a Bloomberg report. Musk was speaking at a Kremlin-backed educational forum where he made an online appearance for 45 minutes. He said, "I think we're close to establishing a Tesla presence in Russia, and I think that would be great. Over time, we will look to have factories in other parts of the world, potentially Russia at some point." Tesla is currently trying to complete its first production site in Germany but has faced delays on environmental legal challenges. It is unlikely to face the same level of bureaucracy in Russia but it is more likely, at this stage at least, that Musk was simply attempting to charm his hosts with the idea of establishing production in Russia. (IHS Markit AutoIntelligence's Tim Urquhart)

- Nigeria's real GDP slowed by 14.1% quarter on quarter (q/q) but increased by 0.5% year on year (y/y) during the first quarter of 2021. Oil-GDP expanded by 35.6% q/q but was still 2.2% below its level a year ago. Non-oil GDP fell by 17.1% q/q, but increased by a modest 0.7% y/y. (IHS Markit Economist Thea Fourie)

- Non-oil GDP found support from a 2.2% y/y expansion in agricultural output, with all sub-components recording positive annual growth: crop production was up by 2.3% y/y followed by livestock (up by 1.6% y/y), forestry (up by 1.2% y/y) and fishing (up 3.2% y/y).

- Other sectors which contributed to the positive non-oil GDP growth performance included manufacturing (up 3.4% y/y), construction activity (up 1.4% y/y) and services, particularly electricity, gas, stream and air (up 8.6% y/y) and water supply, sewerage and waste management (up 14.7% y/y). The IT and communication sector expanded by 6.4% y/y while health and social services accelerated by 4.6% y/y during the first quarter of 2021.

- Demand lagged behind supply in the economy, as suggested by the weak performance of the wholesale and retail trade sector, with output falling by a further 2.4% y/y during the first quarter. Output in the transport and storage sector fell by 21.8% y/y, with road transport slowing by 23.7% y/y, rail down by 7.3% y/y, water transport down by 6.4% y/y, and air transport down by 11.7% y/y. The finance and insurance industry also contracted by 0.5% y/y during the first quarter of 2021.

- Zambia's authorities expect the country's GDP to recover with growth in 2021, following the 3.0% contraction recorded in 2020, according to the statement of the Bank of Zambia (BoZ) following the MPC meeting on 17-18 May. (IHS Markit Economist Thea Fourie)

- The economy will benefit from a strong performance in the electricity sector, combined with a recovery in education and public administrative output.

- The impact of the COVID-19 pandemic was still prevalent in the domestic economy during the first quarter, the MPC warns, with output in the copper mining industry, retail trade sales, and international passenger arrivals on a declining trend.

- The MPC expects that headline inflation will remain above the BoZ's inflation target range of 3-6% over the medium term. Nonetheless, the MPC has toned down its medium-term inflation expectations in view of the good crop harvest expected for the 2020/21 agricultural year, which will limit food price inflation, combined with the benefits of higher copper prices and a return of non-resident interest in government securities on the exchange rate.

- Risk to the inflation outlook remains high, of which rising fiscal deficits, higher global oil prices, and rising inflation in major trading partners pose the most prominent. An increase in energy prices (fuel and electricity costs) and the evolving COVID-19 pandemic in the region also pose near-term risks to the BoZ's inflation outlook.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +0.3%, Australia +0.2%, India +0.2%, Japan +0.2%, Hong Kong -0.2%, and South Korea -0.4%.

- The European Parliament on 20 May adopted a non-binding resolution stating that the ratification process of the EU-China Comprehensive Agreement on Investment (CAI), agreed in principle in December 2020, would be "frozen" by the Parliament while Chinese sanctions remain in place. It also criticized Beijing's "confrontational approach" and "unsubstantiated and arbitrary" sanctions against European individuals and entities. The resolution was widely supported by EU parliamentarians, being approved by 599 to 30 votes with 58 abstentions. China's Foreign Ministry Spokesman Zhao Lijian told a 21 May press conference that the European Union was interfering in China's domestic affairs, and that he hoped the bloc would abandon "confrontational actions". China has not yet announced specific additional measures in response to the European decision. The likelihood of China reversing its sanctions to facilitate ratification of the CAI within its original schedule will remain low if the EU continues to challenge Beijing on politically sensitive areas such as human rights, a stance that has consistently triggered adverse reactions and retaliatory measures by China. However, the Chinese response to the European Parliament's resolution has so far been relatively measured, with state media outlet Xinhua highlighting that the Chinese legal review and the translation process for the CAI are still proceeding normally, while suggesting that its ratification process could continue in the future. (IHS Markit Country Risk's Petya Barzilska and David Li)

- BYD has secured an order for the supply of 50 units of its 40-foot, low-floor electric bus model from public transport operator Gruppo Torinese Trasporti (GTT) in the city of Turin, Italy. According to a company statement, the two parties have reached a framework agreement for the supply of an additional 50 BYD 40-foot buses after deliveries of the first batch are completed. The majority of these buses are to be built at BYD's production facility in Komárom, Hungary. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Geely has acquired, through one of its subsidiaries, a 40% stake in semiconductor company Guangdong Xinyueneng Semiconductor, reports Gasgoo. The company has registered capital of CNY400 million (USD62 million) and focuses on the design, manufacturing, and sale of integrated circuits and manufacturing of discrete semiconductors. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Renault-Nissan, while rejecting claims from an employee union that COVID-19 safety protocols were being ignored at its Oragadam plant in Tamil Nadu (India), has told an Indian court that there was a "compelling need" for the automaker to continue production at its plant to fulfil pending export orders of about 35,000 vehicles, and 45,000 pending domestic orders of Nissan Magnite and Renault Kiger cars, reports Reuters. The Renault-Nissan workers have petitioned a court to stop operations since social distancing norms were not being followed properly and company-provided health benefits were outweighed as compared to the risk to their lives. (IHS Markit AutoIntelligence's Tarun Thakur)

- Credit rating agency S&P Global Ratings (S&P) has shifted the outlook for Vietnam to Positive, while affirming the rating at BB (equivalent to 47.5 on the IHS Markit numerical scale). The country's economic resilience to the COVID-19 virus pandemic-induced shock and an improving track record in the government's administrative capacity were the key factors driving the outlook change. (IHS Markit Economist Jola Pasku)

- S&P expects Vietnam's economy to rebound to 8.5% in 2021, with support from export-oriented manufacturing and strong domestic demand. In its view, Vietnam's increased competitiveness as a manufacturing hub combined with a young, educated and competitive workforce should ensure robust growth over the medium and long term.

- S&P assesses that the delay of the government debt repayment obligation in October 2019 was due to administrative capacity constraints and not because of financial resource stress. The introduction of a directive in January 2020 that empowers Vietnam's Ministry of Finance to make full and immediate payment of guaranteed government debt obligations directly to the creditors is an indication of improved administrative processes, according to S&P.

- The rating agency maintains that Vietnam's fiscal metrics have remained stable, despite increased pressure on revenue collection and accelerating expenditures related to the pandemic. S&P projects Vietnam's fiscal deficit to expand to over 4% of GDP in the near term due to lingering risks associated with the global pandemic while also recognizing that Vietnam is equipped with adequate fiscal buffers.

Posted 24 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.