Equity markets closed mixed across the US, Europe, and APAC. US and benchmark European government bonds closed higher on the day. The US dollar, gold, and silver closed lower, while oil, natural gas, and copper were higher on the day.

Americas

- Most major US equity indices closed higher except for the Russell 2000 -0.9%; Nasdaq +1.2%, S&P 500 +0.7%, and DJIA +0.3%.

- 10yr US govt bonds closed -3bps/1.70% yield and 30yr bonds -4bps/2.40% yield.

- CDX-NAIG rolled to series 36.1 to close 57bps and CDX-NAHY closed -4bps/297bps. The best 15-minutes of the CDX-NAHY performance today began at 9:35am EST which was five minutes before the start of the S&P 500's best 15-minutes of the day.

- Corporations are selling new bonds and using the money they raise to buy back existing notes, despite those repurchases come at a cost of high call premiums that would be lower or even zero if the company waited anywhere from a few months to a year. More of these deals may be coming, with at least another $70 billion of outstanding bonds that would make sense to refinance now instead of waiting for the next date at which buybacks become cheaper, according to a Bloomberg Intelligence analysis. (Bloomberg)

- DXY US dollar index closed -0.2%/91.74.

- Gold closed -0.2%/$1,738 per troy oz, silver -2.1%/$25.77 per troy oz, and copper +0.7%/$4.14 per pound.

- Crude oil closed +0.2%/$61.56 per barrel and natural gas closed +1.9%/$2.62 per mmbtu.

- Energy and power companies tracked by Refinitiv have raised more than $20 billion in the high-yield bond market so far this year, an all-time record for data going back to 1996. (FT)

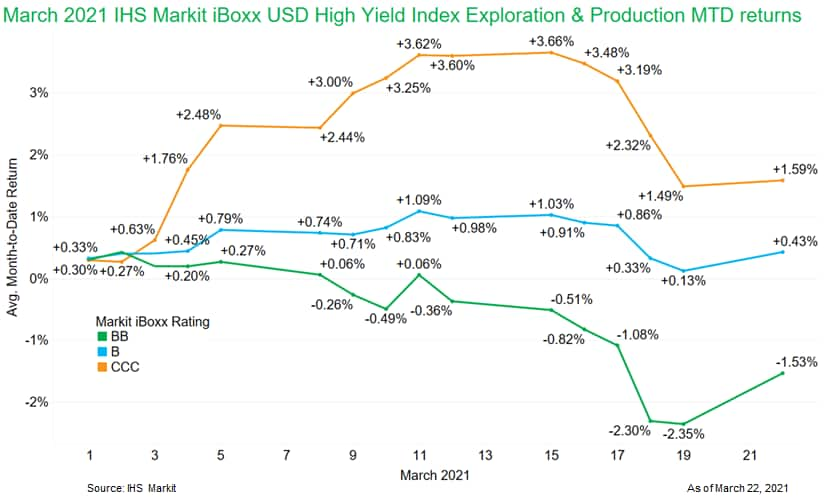

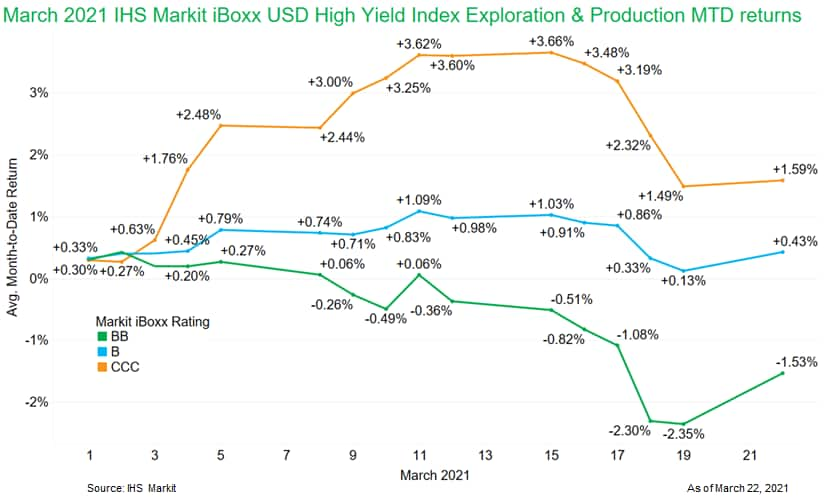

- As of today's close (22 March), CCC rated exploration & production constituents from the IHS Markit iBoxx USD High Yield Index are outperforming BB and B rated issues in the sector, with BB bonds returning an average of -1.53% month-to-date, B +0.43%, and CCC +1.59%. We note that all rating cohorts are well below the peaks in performance this month.

- Back down to earth, for now. Oil paper markets finally acknowledged they were running well ahead of the global recovery this year. Product markets outside gasoline remain oversupplied and refiners outside the US are still contending with relatively weak net margins standing in the path of the crude demand recovery. The Chinese import engine is throttling back slightly and looking to cheaper pastures (e.g. Iran) and winter storms have left North America once again swimming in crude while taking less of a bite out of products than initially hoped. A little extra Iranian oil helps loosen up the prompt market and loosens some the work done by OPEC+ to keep oil markets tight. These barrels might eventually test the patience of Saudi Arabia, who still holds the brunt of sidelined spare capacity. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- The Biden administration officials are crafting a plan for a multipart infrastructure and economic package that could cost as much as $3 trillion and fulfill key elements of President Biden's campaign agenda, according to people involved in the discussions. The first proposal would center on roads, bridges and other infrastructure projects and include many of the climate-change initiatives Mr. Biden outlined in the "Build Back Better" plan he released during the 2020 campaign. That package would be followed by measures focusing on education and other priorities, including extending the newly expanded child tax credit scheduled to expire at the end of the year and providing for universal prekindergarten and tuition-free community college, the people said. (WSJ)

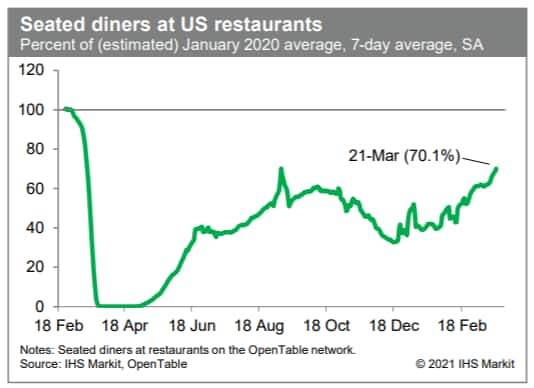

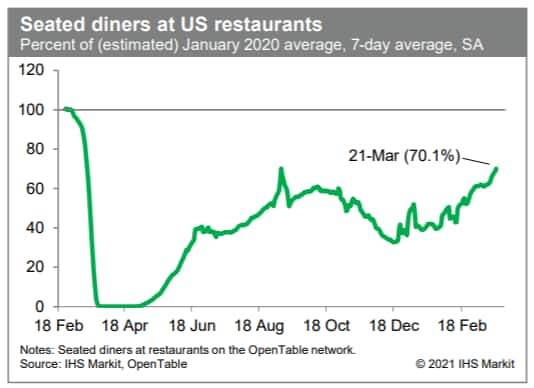

- Averaged over the last seven days, the count of seated diners on the OpenTable platform was about 70% of the (estimated) January 2020 level. This continues a firming trend since last December, as the spread of the virus is slowing, mandated restrictions on indoor dining are easing, and weather conditions are becoming more amenable to outdoor dining. Still, recovery in the restaurant industry has a long way to go. (IHS Markit Economists Ben Herzon)

- US existing home sales plunged 6.6% in February to a 6.22-million-unit annual rate; sales were up 9.1% from a year earlier. Sales were up in the West and down in the other three regions. (IHS Markit Economist Patrick Newport)

- Total inventory (data go back to February 1999) and inventory of single-family homes (data go back to June 1982) were unchanged at a record lows of 1.03 million and 870,000, respectively.

- Low inventories continued to drive home prices up. The median price of a single-family home was up a sizzling 16.2% from a year earlier, while the average price was up 13.1%. All four regions are seeing double-digit increases in both the median and average price.

- Properties took 20 days to sell in February, down from 21 in January and 36 in February 2020.

- Small shareholders may now have a say on how oil companies announce their net-zero goals to limit GHG emissions not just from their refinery operations but also from the transport and delivery of their end products, such as gasoline, plastics, and other petrochemicals. The US Securities and Exchange Commission (SEC) on 19 March denied separate requests by ConocoPhillips and Occidental Petroleum to omit votes on proposed shareholder resolutions to set specific interim GHG reduction targets in their quest for net-zero carbon emissions. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- Chart Industries has been awarded a contract for two 15 ton per day hydrogen liquefaction plants. The scope of contract includes supply of the hydrogen liquefaction system, liquid hydrogen storage tanks, and trailer loadout bays. The hydrogen liquefaction plants will utilize Chart's helium refrigeration technology and delivery is scheduled for the second quarter of 2022. The liquefication system will utilize gaseous hydrogen from Plug Power's in-house electrolyzers and renewable electricity. The US-based plants will be located in the Mid-Atlantic and Southeast and are expected to be online before the end of 2022. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- The dealers' associations in California and Texas (United States) have issued letters to Volvo Cars, expressing concern that the brand's business model on electric vehicles (EVs) could violate state franchise laws. The franchise laws are designed to prevent a dealer from having to compete with a manufacture in terms of retail sales. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Stellantis, Ford, Nissan announced on 20 March impacts on their vehicle production because of the global semiconductor shortage, including building vehicles without necessary modules and holding them until assembly can be completed. As of 19 March, prior to these latest announcements, IHS Markit forecasts global vehicle production volume at risk in the first quarter from the semiconductor shortage was 1.259 million units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Velodyne Lidar demonstrated a rider-based pedestrian automatic emergency braking (PAEB) system solution, according to company sources. In a new video released by Velodyne, the company's rider-based PAEB solutions perform well under all circumstances and were advantageous over radar and camera-based systems. In the near future, the National Highway Traffic Safety Administration (NHTSA) could incorporate PAEB to its New Car Assessment Program (NCAP) under the Advanced Driver Assistance Systems (ADAS) head. (IHS Markit Automotive Mobility's Tarun Thakur)

- Volkswagen (VW) is to idle four factories in Brazil for 12 days beginning on 24 March over the growing number of COVID-19 infections in the country, media reports state, citing a company statement on 19 March. The corporate statement reportedly said, "Only essential activities will be maintained. Administrative employees will work remotely." According to the reports, VW took the decision after negotiations with the metalworkers' union, which represents workers at the plants. The union is pressuring companies in the region to take such actions amid the rise in COVID-19 cases. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed mixed; UK +0.3%, Italy +0.3%, Germany +0.3%, France -0.5%, and Spain -1.8%.

- 10yr European govt bonds closed higher across the region; Germany/Italy/UK -2bps and France/Spain -1bp.

- The European iTraxx indices rolled to series 35.1, with iTraxx-Europe closing 55bps and iTraxx-Xover 272bps.

- Brent crude closed +0.1%/$64.62 per barrel.

- Fugro is expanding its Edinburgh office to open new marine chemistry and biology laboratories, where a team of 40 marine chemists, biologists, and environmental scientists and consultants support a range of environmental Geo-data services. These new laboratories will support Fugro's growing green industry client base in the offshore wind, marine cables and coastal development sectors, offering them an expanded range and increased capacity of laboratory services, including marine fauna identification and a range of organic and inorganic analysis. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Porsche CEO Oliver Blue has said he would be open to an initial public offering (IPO) for the company if parent company Volkswagen (VW) Group was open to investigating this avenue. According to a Bloomberg report, Blume appeared keen on the idea in a briefing with US reporters. He said, "I think Porsche could be an interesting part for thinking about an IPO. Porsche is an asset to VW Group as it is its most profitable unit and its biggest profit contributor of all, despite selling around 2.5% of the group's combined sales volume. (IHS Markit AutoIntelligence's Tim Urquhart)

- CGG's subsidiary Sercel and Kappa Offshore Solutions jointly launched PIKSEL, a new high-resolution 3D marine seismic solution for renewable energy applications. Capitalizing on Sercel's Sentinel® streamer technology, widely recognized for its outstanding robustness and accurate measurement capabilities, and Kappa Offshore Solutions' expertise in equipment integration and hydrodynamic modeling, PIKSEL can acquire high- and ultra-high-precision seismic data using a new and highly efficient process, meeting the requirements of the market for high-resolution site surveys. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Ferrero Group announced a bolder move into ice cream production with the help of its Spanish subsidiary Ice Cream Factory Comaker (ICFC) based in Alzira. Ferrero's international expansion in the ice cream category will initially be based on Ferrero Rocher and Raffaello branded ice creams, announced Antonella Sottero, managing director of Ferrero Ibérica. The ice creams will initially be sold in Spain, Italy, France, Germany and Austria. However, this is only the first phase of expansion in Europe and Ferrero Ibérica intends to add new products to the ice cream portfolio and expand to more markets. Ferrero acquired a dominant ownership stake in Spanish private label ice cream manufacturer ICFC from the Lamsfus family in July 2019. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

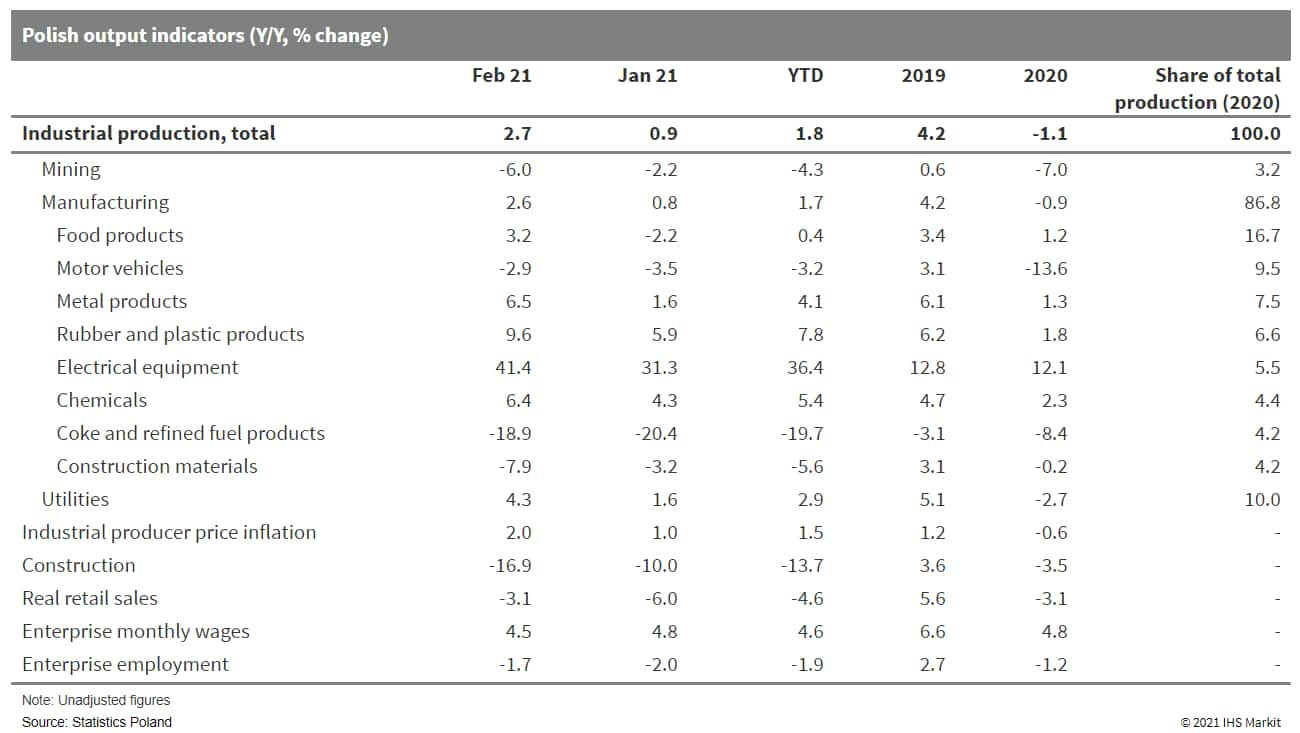

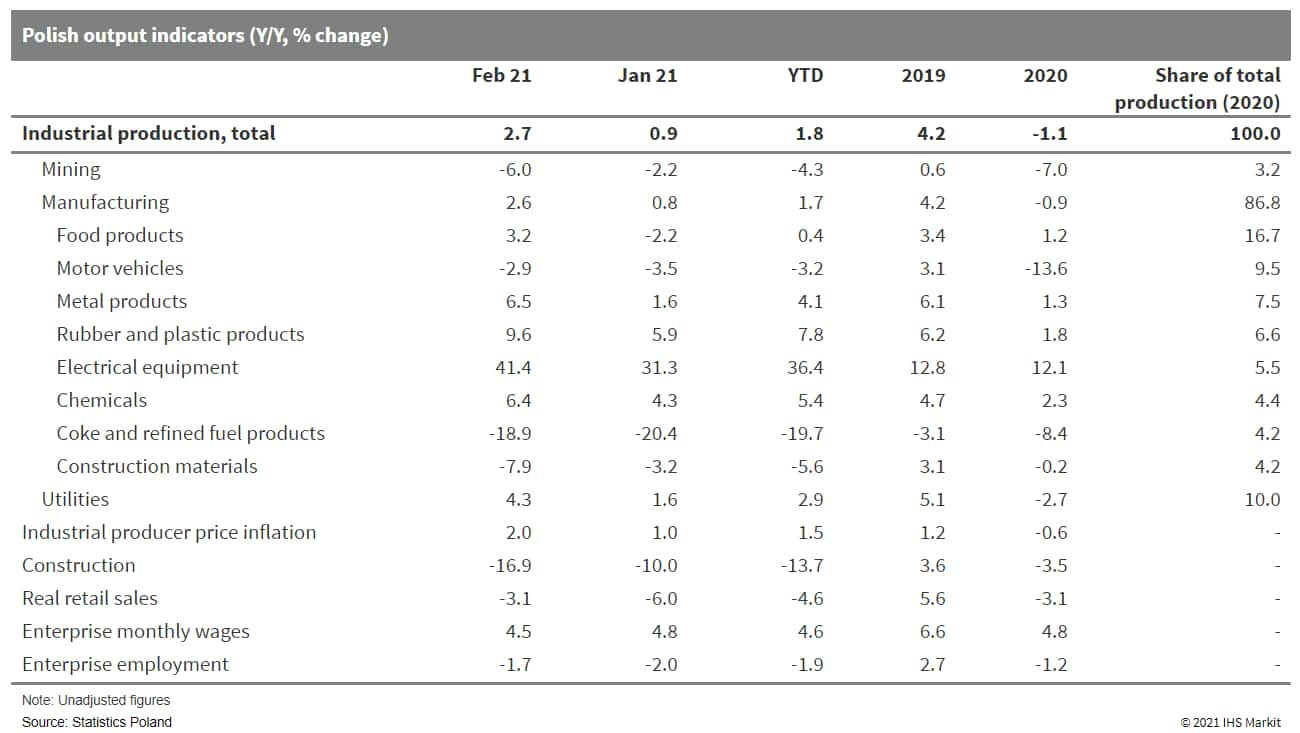

- Poland's unadjusted industrial production rose by 2.7% year on year (y/y) in February, while seasonally adjusted output increased by 0.4% month on month (m/m). By sector, manufacturing and utilities production increased, but mining output continued to decline. (IHS Markit Economist Sharon Fisher)

- The reopening of non-essential stores in shopping centers sparked a 5.3% m/m jump in seasonally adjusted retail sales (including the car sector), which surpassed the pre-COVID-19 virus level in February 2020 for the first time since the crisis began. In unadjusted terms, real sales remained below the year-earlier level (falling by 3.1% y/y), despite a revival in the clothing and footwear category.

- On the labor front, nominal enterprise wages rose by 4.5% y/y, slightly weaker than the January figure. Meanwhile, the opening of shopping centers meant that paid employment fell by 1.7% y/y, a more modest decline than in January.

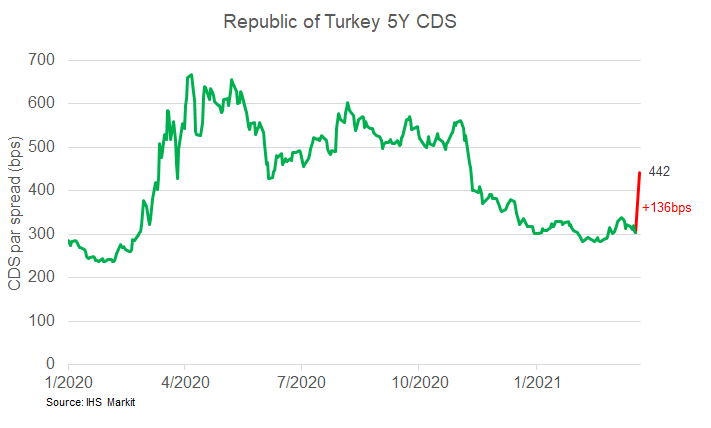

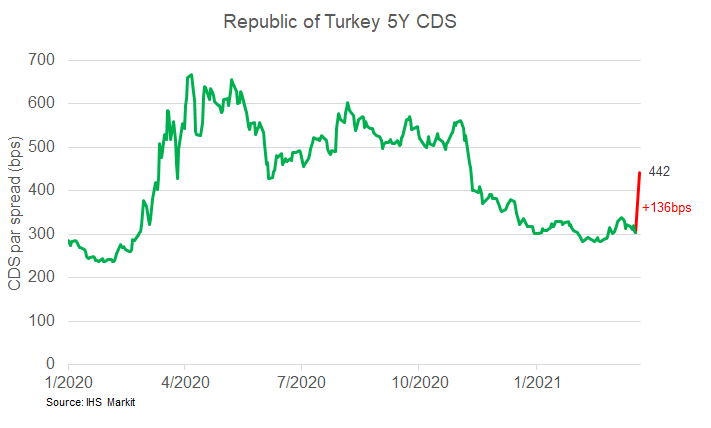

- Turkish President Recep Tayyip Erdoğan dismissed the Turkish Central Bank governor, Naci Ağbal, on 19 March, four months after his appointment, and replaced him with Sahap Kavcioğlu, an academic and a former MP from the ruling Justice and Development Party (AKP) who has previously advocated a policy of lower interest rates, aligning with Erdogan's own preferred unorthodox position. Ağbal was removed a day after the Turkish Central Bank increased interest rates by 200 basis-points, from 17% to 19% (versus annual CPI inflation of 15.6% and core "goods" inflation of 17.3% in February when last reported). After the removal of Naci Ağbal, the Turkish lira weakened as much as 14% in Asian markets, trading around 8.4 against the US dollar, and Turkey's 2031 bond fell eight percentage points, before recovering after a pledge by Finance Minister Lütfi Elvan to continue efforts to control inflation. (IHS Markit Country Risk's Emre Caliskan)

- The Republic of Turkey's 5yr CDS closed +136bps/442bps on the announcement of the dismissal of the Turkish Central Bank governor.

- Saudi Aramco has announced full-year 2020 net earnings of 183.76 billion Saudi riyals ($49.0 billion), down 44% on 2019, on sales that fell 30% to $204.83 billion. Cash flow from operating activities totaled $76.08 billion, a decline of 31% compared with the prior year. The company has also declared its previously announced full-year 2020 dividend of $75 billion. (IHS Markit Chemical Advisory)

- Planned total capital expenditure (capex) for 2021 will be around $35 billion, up from $27 billion in 2020 and also higher than the pre-COVID 2019 total of $33 billion, but lower than its previous guidance of $40-45 billion.

- Aramco's downstream expansion saw it complete the $69.1-billion acquisition of a 70% ownership stake in Sabic on 16 June last year, which has transformed the company "into a major global petrochemical player with operations in more than 50 countries," it says.

- Central bank data point to a 2.2% contraction in Uganda's real GDP during the first quarter of fiscal year (FY) 2020/21, which is equivalent to the third quarter of 2020. Real GDP growth during the same quarter a year before stood at 8.7%. (IHS Markit Economist Alisa Strobel)

- Annual headline inflation rose to 3.7% in January 2021, but core inflation fell by 0.4 percentage point compared to the previous month amid lower costs in the service sector as well as lower transportation costs.

- The financial account rose mainly as a result of an increase of more than 99.5% in budgetary-support loan disbursements to USD2,414 million related to the COVID-19 pandemic. This brought the balance-of-payments surplus up to USD607.1 million in reserve assets. Foreign reserves therefore stood at USD3.8 billion at the end of 2020.

- African banks are exposed to environmental risks that may threaten their credit quality and profitability as climate change makes shocks more frequent and severe, according to Moody's Investors Service. Moody's estimates that the 49 banks it rates across 14 African countries have extended almost $218 billion in credit to environmentally sensitive sectors, an amount equivalent to nearly 29% of their total loans. (Bloomberg)

Asia-Pacific

- Most APAC equity markets closed mixed; Mainland China +1.1%, Australia +0.7%, South Korea -0.1%, India -0.2%, Hong Kong -0.4%, and Japan -2.1%.

- China had administered 74.956 million doses of COVID-19 vaccines for emergency use as of 20 March, according to the National Health Commission (NHC) at a press conference on 21 March. Earlier in March, the media reported that China aimed to vaccinate 40% of its 1.4 billion population by the end of June, and 70-80% by the end of 2021 or early 2022, according to CDC officials. (IHS Markit Economist Lei Yi)

- The authorities are banning Tesla's electric vehicles (EVs) from entering military facilities in China over concerns that the vehicles' cameras might collect sensitive data, reports Reuters. The Wall Street Journal reports that China was limiting use of Tesla vehicles by employees of military and "key state-owned companies" over the same security concern. Tesla CEO Elon Mush commented on the news on 20 March during the China Development Forum that Tesla would be shut down if it its cars were used to spy. Musk stressed that "there is a very strong incentive for us to be very confidential with any information". (IHS Markit AutoIntelligence's Abby Chun Tu)

- SAIC intends to create a new ecosystem for the development of its R-branded EVs, leveraging its partnerships with leading tech companies such as Alibaba Group, NVIDIA, Luminar, and Tencent. The ES33 will be the first model powered by technologies introduced under the R-TECH brand. These new technologies are expected to deliver next-level user experiences in terms of automated vehicle operation, smart cabin, and intuitive connectivity system to R models. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Foxconn is negotiating with Vietnamese electric vehicle (EV) startup VinFast regarding co-operation to develop batteries and other components for EVs, according to electrive.com. Foxconn is seeking to buy EV production lines from VinFast. The talk also involves potential co-operation on EV batteries and other components. The reported talk, which has yet to be confirmed by either of the companies, is said to be at an early stage. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japanese automakers including Toyota, Nissan, and Honda are trying to evaluate the impact of a fire at Renesas Electronics's factory last week on their production, according to Reuters. According to the report, the impact could be global as Renesas accounts for 30% of the supply of global microcontroller unit chips used in cars. The fire broke out in one of the clean rooms at the company's plant in Naka city, north of Tokyo (Japan), resulting in production stoppages and burning of about 2% of the facility's manufacturing equipment. About two-thirds of the affected production is reported to be automotive chips. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A consortium of JGC, NGK Insulators, and MCS International has been awarded a contract for the construction of Mongolia's first solar power generation project with a battery energy storage system, as well as operations and maintenance services, for the Ministry of Energy of Mongolia. The consortium will construct a solar power generation system with a capacity of 5MW, a battery energy storage system with a capacity of 3.6MWh, and an energy management system in Uliastai, Zavkhan Province, Mongolia by the spring of 2022. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

Posted 22 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.