All major US and European, and most major APAC equity indices closed higher. US government bonds were almost unchanged on the day, while all benchmark European bonds were lower. CDX-NA closed tighter across IG and high yield, iTraxx-Xover was also tighter, while iTraxx-Europe was close to flat on the day. Natural gas, oil, silver, copper, and gold closed higher, while the US dollar was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +1.2%, S&P 500 +1.0%, Russell 2000 +0.9%, and DJIA +0.7%.

- 10yr US govt bonds closed flat/1.46% yield and 30yr bonds -1bp/1.85% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -4bps/298bps.

- DXY US dollar index closed -0.4%/96.08.

- Gold closed +0.8%/$1,802 per troy oz, silver +1.3%/$22.82 per troy oz, and copper +1.1%/$4.39 per pound.

- Crude oil closed +2.3%/$72.76 per barrel and natural gas closed +2.8%/$3.98 per mmbtu.

- As the state of California adds growing levels of energy storage, GEM A-CAES LLC applied on December 1 with the California Energy Commission for approval to construct, own and operate the 500-MW Gem Energy Storage Center, an Advanced Compressed Air Energy Storage (A-CAES) facility in Kern County, California. (IHS Markit PointLogic's Barry Cassell)

- The Gem Energy Storage Center will deploy proprietary Hydrostor technology consisting of five 100-MW all-electric air compressor and associated power turbine trains, underground compressed air storage cavern, aboveground support facilities and a 10.9-mile interconnection to Southern California Edison's (SCE) Whirlwind Substation.

- "Gem's primary goal is to be a state-of-the-art energy storage and reliability resource," the application noted. "Gem has been designed to deliver up energy and reliability services with no fossil fuel combustion or related air quality impacts. The project will be one of the first commercial applications of Hydrostor's A-CAES technology at this scale. Gem will combine dispatchable, operationally flexible, and efficient energy generation with state-of-the-art A-CAES technology to facilitate the integration of variable renewable energy on the grid and to meet California and regional needs for reliability services."

- The Gem project will be located on an approximately 71-acre project site in unincorporated Kern County, approximately one mile northeast of the community of Willow Springs and seven miles west of Rosamond.

- The main project elements include: five all-electric 100-MW air compressor and power generation turbine trains housed inside a turbine hall and compressor building; underground (approximately 2,000 feet deep) purpose-built compressed air storage cavern; approximately 31-acre by 50 feet deep (average) hydrostatic compensation surface reservoir with approximately 6 to 40-foot-high earthen berms and approximately 565 acre-feet capacity and floating cover to reduce evaporative loss; air conduit (sealed) to facilitate cyclic injection/storage of compressed air and release of compressed air for power generation; water conduit (sealed) to facilitate inflow/outflow of hydrostatic compensation water to/from the surface reservoir and underground storage cavern; aboveground heat exchangers and thermal storage equipment; and control house, electrical gallery and maintenance building connected to the turbine hall.

- "The Gem project will be designed to operate 24 hours per day, 7 days per week with an annual capacity factor of up to 85 percent," the application said. "The facility will typically cycle between Charging Mode (compression/energy storage) lasting approximately 14 hours and Discharging Mode (decompression/power production) lasting 8 hours at nameplate capacity."

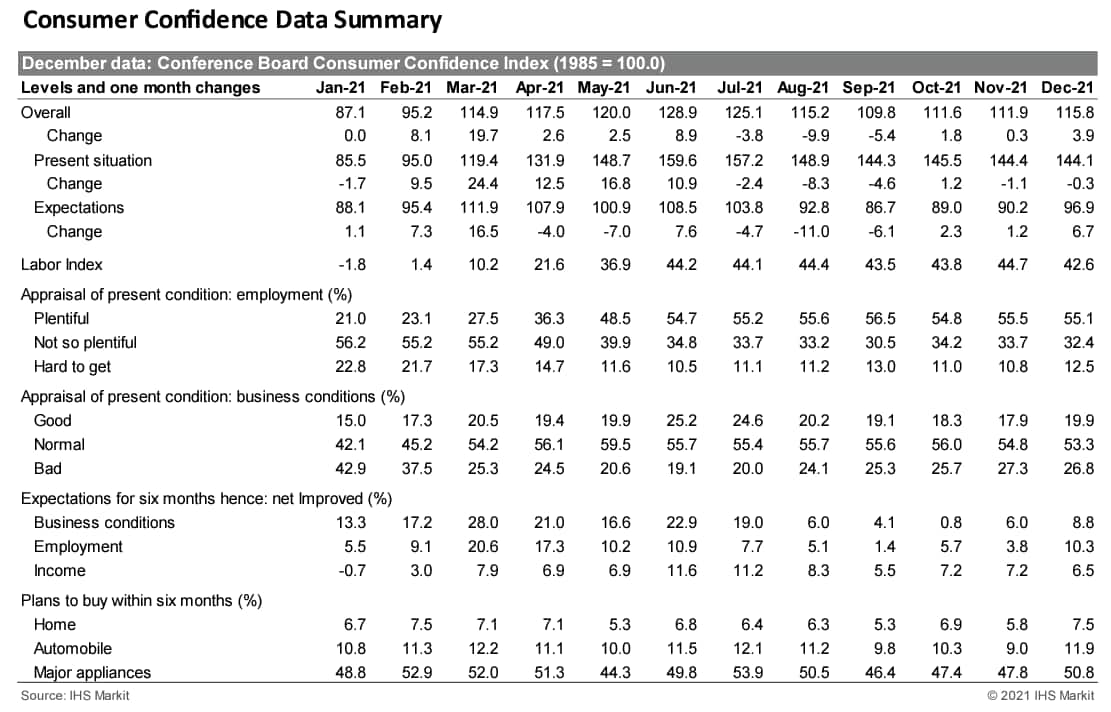

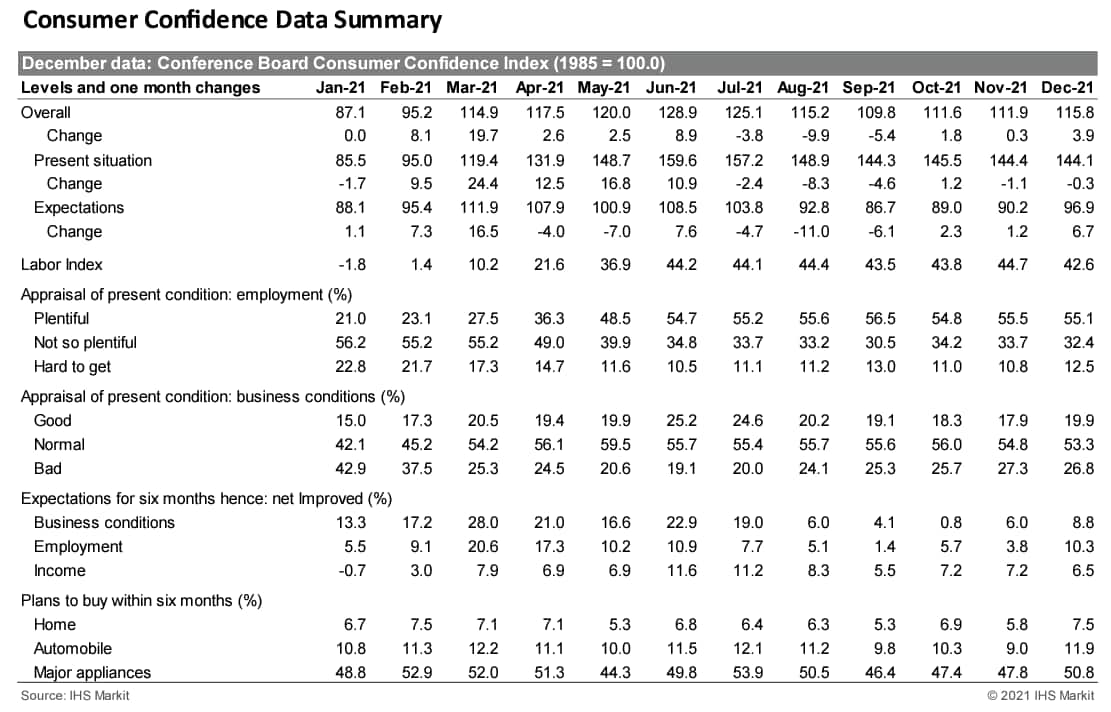

- The US Conference Board Consumer Confidence Index rose 3.9 points to 115.8 (1985=100) in December. November's reading was revised up from 109.5 to 111.9. (IHS Markit Economists Akshat Goel and William Magee)

- The index of views on the present situation edged down only 0.3 point to 144.1 in December, despite headwinds from continued price increases and the emergence of the Omicron variant.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) retreated from a multidecade high of 44.7 to 42.6.

- The expectations index rose 6.7 points to 96.9 with a higher proportion of consumers planning to buy homes, automobiles, major appliances, and vacations over the next six months.

- The expectations index was driven higher by optimism about business conditions and job prospects in the short term, with 26.7% of consumers expecting business conditions to improve, up from 25.6%. A smaller percentage (17.9%) expects business conditions to worsen, down from 19.6%.

- Consumers were also buoyant about their job prospects: 25.1% of consumers expect more jobs to be available in the coming months, up from 22.8%; 14.8% anticipate fewer jobs, down from 19.0%.

- Bottom line: Consumers are looking past the sudden spike in COVID-19 cases and higher prices, but a continued upward trend on both fronts could shatter confidence.

- US existing home sales increased 1.9% to a 6.46-million-unit annual rate in November; sales were unchanged in the Northeast and up in the other three regions. (IHS Markit Economist Patrick Newport)

- Inventory (data go back to October 1999) moved down by 120,000 to 1.11 million units—not far from February's all-time low of 1.03 million.

- Home price growth is slowing. The median price of a single-family home was up 13.9% from a year earlier, down from May's peak of 23.6%; the average price has dropped to the single digits at 8.6%, down from May's 16.9% high point.

- The median price in the South in November was $318,000, compared to $507,200 in the West and $372,500 in the Northeast.

- These house price differentials have led to large population shifts since the pandemic struck. For example, collectively, California and New York have lost 836,00 residents to other states since April 2020, while Florida and Texas have gained 475,000, according to the latest population estimates released yesterday (21 December).

- Properties took 18 days to sell in November, unchanged from October and down from 21 days in November 2020; 83% of homes sold in November were on the market less than a month.

- Bottom line: Entering the 2021 home stretch, sales have picked up speed and are on pace to reach a 15-year high this year; inventories remain lean, are shrinking, and are approaching all-time lows; average home price growth has slowed into the single digits; the incentive to move to another state where housing is relatively inexpensive is still strong.

- USDA continues to increase forecasts for food price inflation for various grocery store items for 2021, but so far has not altered their outlook for all foods, grocery store and restaurant prices for 2021 or 2022. For all food prices in 2021, USDA expects the increase to be from 3% to 4%, a level of food price inflation that they have forecast since August. For grocery store prices, USDA expects them to rise 2.5% to 3.5% from 2020, an outlook which has not changed since August. For restaurant prices, USDA expects them to increase 4% to 5%, the same for both November and December forecasts. (IHS Markit Food and Agricultural Policy's Roger Bernard)

- For 2022, USDA still expects higher prices for consumers compared with 2021, but the rate of increase is seen easing. For all food prices, they are seen up 2% to 3% in 2022 from 2021 levels, while grocery store prices are expected to rise 1.5% to 2.5% versus 2021 and restaurant prices are looked to increase 3% to 4%. All of these forecast levels for 2022 are steady with the marks USDA has forecast since July.

- The food-at-home (grocery store or supermarket) CPI increased 0.3% from October 2021 to November 2021 and was 6.4% higher than November 2020.

- In 2021 thus far compared with 2020, grocery store prices have increased 3.1% percent and restaurant prices have increased 4.2%. The CPI for all food has increased an average of 3.6%.

- Upward shifts continue in several meat categories

- For 2021, USDA now looks for meat, poultry and fish prices combined to rise 6% to 7% compared with 2020, marking the eighth month in a row USDA has raised this forecast level. At this point in 2020, USDA expected meat, poultry and fish prices to be down 0.5% to up 0.5%.

- For 2022, USDA sees meat, poultry and fish prices rising 2% to 3%.

- IHS Markit reports on new models expected to go on sale in the United States in 2022, looking at selected automakers and segments. In 2021, the introduction of new EVs and announcements by automakers of increased investments to accelerate the move to EVs have positioned the vehicle market's future as an electric one. In 2022, the availability of EV products is to continues to grow. Trends that will continue in 2022 include the preponderance of new-vehicle launches being in the utility vehicle categories, while few sports cars will be on the list. The EVs expected to be introduced in 2022 will be significant statements for most of the brands launching them, representing early manifestations of evolving EV strategies. In 2022, IHS Markit estimates about 60 models will be new generations or new introductions in the market. By comparison, about 50 such models went on sale in 2021. In 2023, the number of new EV programs arriving will spike again and we expect about 75 new or redesigned models to go on sale in the US. Based on IHS Markit's US regional segmentation, about 30 new CUVs will go on sale in the US market in 2022, encompassing all sizes and price classes. The forecast sees about 12 new cars arriving and four SUVs. Sales launches of sports cars are expected to reach nine in 2022, including exotic, low-volume vehicles such as the Maserati MC20, Lamborghini Huracan, and Ferrari 296 GTB. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) manufacturer Nikola has agreed to a USD125-million fine to settle civil charges in the United States over accusations of misleading statements to investors, according to media reports. Reuters reports that the US Securities and Exchange Commission (SEC) announced the settlement on 21 December. The SEC accused the automaker of violation of US securities laws by making a number of statements that, it said, were misleading about the company's in-house production capabilities, reservation book, and financial outlook. The statements were made between March and September 2020, prior to the company going public. The settlement follows the filing of civil and criminal charges against company's former CEO, Trevor Milton, in July. Reportedly, the SEC's enforcement director said the company "is responsible both for Milton's allegedly misleading statements and for other alleged deceptions, all of which falsely portrayed the true state of the company's business and technology". Nikola posted a statement on its website, stating that the agreement "resolves and concludes all government investigations of Nikola". (IHS Markit AutoIntelligence's Stephanie Brinley)

- On-demand shuttle service and software company Via has confidentially filed documents with the US Securities and Exchange Commission (SEC) to go public. The company has appointed Goldman Sachs Group Inc. to manage its initial public offering (IPO), reports Bloomberg. Via considered merging with a special purpose acquisition company (SPAC) at one point, but eventually opted for a traditional public listing. Via planned to shut down its ride-hailing operations in two existing markets, New York and Washington, starting on 20 December. Despite rising ridership, the ride-hailing business has been challenged by ongoing driver shortages, prompting giants such as Uber Technologies and Lyft to spend millions to get drivers back onto the platform. Via's real-time ride-sharing services integrate with existing fixed-route transportation infrastructure, enabling commuters to hail a ride using an app. Revenue of Via's software solutions, internally branded as TransitTech, has been doubling year on year, exceeding an annual run rate of USD100 million. The company's software is used by more than 500 partners in 35 countries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ford Motor Co has launched the Ford Go car-sharing platform in Argentina, according to a company statement. The 100% digital solution allows buyers to rent vehicles by the minute, hour or day, or as long as needed. Ford Argentina is working with local startup MyKeego and is to offer more than 60 vehicles in private parking lots with 24/7 access. The sites are where the cars are picked up and returned. Initially, the sites are in the federal capital, Greater Buenos Aires, and Cordoba. Customers are able to reserve and access the vehicles through the FordPass app, with the pricing from ARS26.98 (USD0.26) per minute, ARS998.33 per hour, and ARS5,990 per day. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed higher; France +1.2%, Germany +1.0%, Spain +0.9%, Italy +0.7%, and UK +0.6%.

- 10yr European govt bonds closed lower; Germany/UK +1bp, France/Spain +2bps, and Italy +4bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover -4bps/250bps.

- Brent crude closed +1.8%/$75.29 per barrel.

- Startup electric vehicle (EV) battery manufacturer Britishvolt has partnered with Manz AG, an engineering company, to implement the first expansion stage for cell-assembly of a production line for the manufacture of lithium-ion battery cells in Northumberland, Northern England, according to a company statement. The two companies have agreed on an initial deal of worth more than GBP70 million (USD92.6 million) for the supply of machines to assemble lithium-ion battery cells. The first expansion stage is for production capacity of 4 GWh. (IHS Markit AutoIntelligence's Isha Sharma)

- The German Federal Statistical Office (FSO) has reported that real monthly earnings in the whole economy (including employees in the public sector, including bonus payments, and assuming for analytical purposes that the employment structure of the previous year has remained constant) declined to 0.0% year on year (y/y) in the third quarter, down from 3.0% y/y in the second quarter but still up from an interim low of -2.0% y/y in the first quarter. These annual rates compare with an all-time low of -4.7% in the second quarter of 2020, a series peak of 6.0% in the third quarter of 1992, and a long-term (1992-2020) average of 0.4%. (IHS Markit Economist Timo Klein)

- Nominal wage growth softened much less in the third quarter, declining from the previous quarter's 5.5% y/y to 3.9% y/y. This owes to another sharp rise of consumer price inflation from 2.4% to 3.9%. Nominal wage growth of 3.9% remains well above its long-term average of 2.1%.

- The number of hours worked continued to have an important influence on monthly earnings. The number of people on short-time work schedules has been declining since March and hours worked thus increased by 1.7% y/y. Although this is down from the second quarter's 4.0% y/y, related to base effects, it remains a supportive factor for wages earned per month compared with the year-ago period. Note that government subsidies for short-time work are not classified as earnings as reported in these statistics (employees who are furloughed, i.e., effectively put on 0% short-time, are ignored altogether).

- The third-quarter breakdown for different types of employment shows that nominal wage growth (total: 3.9% y/y) was highest among full-time employees (4.1% y/y), followed by part-time workers (3.2%) and finally the holders of so-called mini jobs (1.5%).

- Renault has announced that it has selected the Dassault Systemes 3DEXPERIENCE cloud-based platform for development of products and mobility services, according to a company statement. The platform is described as a business experience platform integrating 3D design, simulation, and information intelligence software in a collaborative virtual environment. Renault expects the collaboration enabled to improve data sharing and collaboration, speeding development time and reducing costs. Relative to the Renaulution plan announced in January, the project is expected to deliver value creation. Renault expects the faster collaboration and data sharing to help reduce vehicle development time by about one year, as well as reducing costs. As technology development speeds up and pressure to advance electrification across the industry increases, reducing vehicle development time and ensuring rich data sharing have become crucial. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The latest release from Statistics Poland reveals that in November, Poland's unadjusted industrial production (IP) surged by 15.2% year on year (y/y), well above market expectations. In seasonally adjusted terms, growth amounted to 6.5% month on month (m/m). (IHS Markit Economist Michal Plochec)

- In the year to date (YTD; January-November), IP grew by, 14.4%, leaving all the pandemic-related distortions far behind, as the sector declined by only 1.1% in 2020.

- A detailed breakdown reveals that strong growth in November was recorded in multiple branches, including manufacturing of coke and refined fuel products (up by 28.6% y/y), construction materials (up by 26% y/y) and electrical equipment (up by 24% y/y). Manufacturing of motor vehicles increased by 6.9% y/y, after shrinking notably in both October and September.

- In separate releases, real retail trade was reported to spike by 12.1% y/y. In nominal terms, the increase amounted to 21.2% y/y on the back of surging inflation. Construction activity also recorded a robust performance, increasing by 12.7% in November. In the YTD, the sector increased by 7.3% in 2021, after shrinking by 0.6% in 2020.

- The Polish labor market held very strong in November. Employment continued to rise (up 0.7% y/y) and unemployment remained very low (according to Eurostat data it stood at 3.4% in October). Wage pressure continues; average wages in the corporate sector in November increased by 9.8% y/y.

- However, the wider picture is more nuanced, as the positive output data is partly offset by raging producer price inflation. Producer prices surged by 13.2% y/y in November, after spiking by 12% in October.

- In a press release, Aker BP ASA announced the signing of an agreement to acquire Lundin Energy AB for a total consideration of SEK 100.02 billion ($10.95 billion) in cash and stock. The transaction is expected to close in the second quarter of 2022. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Under the deal, Lundin shareholders will receive SEK 71.00 per share and 0.950985 Aker BP shares for each share held. Based on 285.9 million Lundin shares outstanding, the equity offer value consists of SEK 20.3 billion ($2.22 billion) in cash and SEK 79.9 billion (US$9.74 billion) in stock based on Aker BP's closing price on 20 December 2021.

- On closing, Aker BP will be jointly owned by Aker (21.2%), BP (15.9%), Nemesia (14.4%), and other Aker BP and Lundin Energy shareholders (48.6%). Both boards recommend their respective shareholders to approve the agreement. However, current shareholders will retain their existing ownership in Lundin Energy and its renewables businesses.

- Lundin's operations are focused on the Norwegian offshore, with key producing assets are Alvheim (15%), Edvard Grieg (65%), Johan Sverdrup (20%), and Solveig (65%). The company also holds various exploratory concessions in the North Sea, Norwegian Sea, and the southern Barents Sea.

- Lundin's net 2P reserves were 670.9 MMboe (95% oil) and net 3P reserves were 825.9 MMboe (95% oil) at year-end 2020. Net 2C contingent resources based on Lundin's year-end 2020 report adjusted for the acquisition of an additional 25% of the pending Norway Wisting development in December 2021, are estimated at 400.5 MMboe.

- Turkey's Ministry of Treasury and Finance has deployed a new program to shield depositors from lira volatility and discourage further dollarization. President Recep Tayyip Erdoğan first announced the new Foreign Currency-protected Turkish Lira Deposit Account programme following a cabinet meeting on 20 December. Households and banks holding time deposits ranging in maturity from three to 12 months will be eligible to participate in the program. The scheme will see the finance ministry remunerate depositors for any amount that the lira depreciates above the prevailing central bank policy rate at maturity. Depositors will not pay withholding tax on the difference paid. Turkish broadcaster Habertürk reported that Alpaslan Çakar, the head of the Banks Association of Turkey, estimated that USD1-billion worth of foreign-currency deposits had been converted into lira following Erdogan's announcement. (IHS Markit Banking Risk's Alyssa Grzelak)

- The introduction of quasi foreign-currency-indexed accounts backstopped by the Treasury will shift exchange rate risk from banks and households to the government, but many details of the program have yet to be worked out.

- For instance, it was not immediately clear if the difference between the exchange rate and the interest rate would be calculated based on the average prevailing policy rate and exchange rates or the end of period rates. The announcement also suggested that the ministry was 'working' to include Islamic banks in the scheme, suggesting that depositors at Islamic banks are not eligible at present.

- As of 9 December, Turkey's Banking Regulation and Supervision Agency (Bankacılık Düzenleme ve Denetleme Kurumu: BDDK) has reported that of the TRY5,435 billion (USD415.8 billion) of deposits in the banking sector, TRY3,489.7 billion were denominated in foreign currency. The cost of the program to the Treasury could therefore be substantial.

- Using the vague outline of the scheme provided so far, IHS Markit estimates that based on the current policy rate of 14% and the 55% depreciation of the lira since the start of the year (as of 20 December), the new program would have cost the Treasury up to USD86 billion had it been in place.

- Nigerian mobility tech startup Metro Africa Xpress (MAX) has raised USD31 million in a Series B funding round, reports TechCrunch. The latest funding round was co-led by Lightrock and Global Ventures with participation of existing investors Novastar Ventures and Proparco. The company plans to use the infused capital to enter more markets across Africa and extend vehicle financing credit to over 100,000 drivers in the next two years. It plans to launch operations in Ghana and Egypt by the end of the first quarter of 2022, and other additional markets in Francophone and East and Southern Africa by the end of the same year. MAX started its operations in 2015 as a delivery startup using motorcycles before venturing into ride hailing, and later into vehicle subscription and financing services. In 2019, the company started its electric mobility journey and currently provides two-, three-, and four-wheeler electric vehicles (EVs) to drivers through various leasing and financing options. MAX has installed charging stations in the cities of Lagos, Ibadan, and Akure, all in the south of Nigeria. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Most major APAC equity indices closed higher except for Mainland China -0.1%; India +1.1%, Hong Kong +0.6%, South Korea +0.3%, Japan +0.2%, and Australia +0.1%.

- The Global Times and the Security Times reported on 20 December that the People's Bank of China (PBoC) and the China Banking and Insurance Regulatory Commission (CBIRC) have jointly issued a notice regarding support for strong real estate companies to merge and acquire "high-quality projects" and help poorer performing real estate companies to reduce their liquidity risks. According to the reports, the aim is to provide strong real estate companies with liquidity to assist weaker counterparts. (IHS Markit Banking Risk's Angus Lam)

- Although local mainland Chinese authorities have eased real estate purchases, mainland Chinese regulators have not yet relaxed the "three red lines" policy, which is intended to limit the debt and borrowing taken on by real estate companies.

- It is important to note that the latest announcement, which could not be found on either the PBoC or the CBIRC's website, focuses on strong real estate companies purchasing, with the help of banks, "high-quality projects" from at-risk real estate companies.

- IHS Markit Banking Risk Service does not comment on stock market movements, but in the absence of issuing the list of strong real estate companies, stock market in Hong Kong has seen several partially state-owned real estate companies' share prices boosted on 21 December, likely suggesting that these are the strong real estate companies.

- Only 6,000 companies worldwide have managed to self-register with the Chinese General Administration of Customs (GACC), allowing them to export low risk food and drink products to China 10 days ahead of the 1 January deadline, with others set to see their products banned. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- From 1 January GACC requires the inner and outer packaging of all food and drink products entering China to be stamped with the company's registration number.

- For 18 different categories considered high risk, such as meat, fish and dairy products, manufacturers need to register via the national authorities in the country where they are based, a relatively straightforward process.

- For products considered low risk like alcoholic drinks, manufacturers have to self-register using GACC's dedicated online portal or get an agent to do so on their behalf with renewable registration valid five years. If successful, the company receives its registration number within 10 to 15 days.

- However, self-registering has proven a nightmare. The portal only started operating from 1 November and was not available in English for a long time. It has been plagued by technical difficulties meaning companies have not been able to self-register in time.

- GACC is refusing to offer any concessions for manufacturers that have not been able to register, because of technical difficulties, such as the site crashing, telling them they should report the problems to the helpdesk.

- GACC has agreed that goods that have already shipped before the 1 January deadline, with a new decree ensuring that they will be allowed into China without the crucial manufacturer registration number.

- Renault and Geely will reportedly announce a JV which would enable Geely access to South Korea production and help Renault restart operations in China soon, according to Reuters, which cites three unnamed sources. The deal will reportedly involve production of Geely's hybrid vehicles at Renault's manufacturing facilities in South Korea. The potential benefit there is to access duty-free exports to the US market; the US has a free-trade agreement with South Korea, but vehicle imports from China are subject to a 25% tariff. Reuters also reports that the deal has been in the works since early 2021. In addition, the deal could involve joint operations in China. Reuters notes that this could enable Renault to improve presence in South Korea as well as Asia in general, as Renault exited China in 2020. The plan reportedly includes creating an additional brand for Renault to offer in China which would focus on plug-in hybrid vehicles. That new brand would be jointly managed between Renault and Geely, the report states. These new vehicles would use Geely's compact modular architecture (CMA), being used for Geely and Volvo mid-size vehicles already. Renault would handle vehicle design, sales and marketing for the new brand in China. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) startup Haomo.AI has raised CNY1 billion (USD157 million) in a Series A funding round, according to a company statement. Investors participating in the round include Meituan, GL Ventures, Qualcomm Ventures, Shoucheng Holdings Limited and JZ Capital. The company plans to use the proceeds to enhance its research and development (R&D) capability and build its talent pool. Haomo.AI, the former AV unit of Chinese automaker Great Wall Motors, became an independent company in 2019. The company focuses on developing autonomous systems for passenger cars as well as low-speed vehicles for logistics enterprises. Haomo.AI has developed assisted driving system, named NOH (Navigation on HPilot), which is available on Great Wall vehicle models WEY Mocca, Tank 300, WEY Latte, WEY Macchiato and Haval, has assisted users to drive more than 4 million km mainly on highways. By the end of 2022, Haomo expects its advanced driver assistance systems to be available on 34 car models. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup NIO plans to enter the markets of four additional European countries in 2022, after launching sales of its ES8 electric sport utility vehicle (SUV) this year in Norway. CEO William Li said on 18 December that NIO would be introducing "its products and holistic service system to Germany, the Netherlands, Sweden, and Denmark in 2022". (IHS Markit AutoIntelligence's Abby Chun Tu)

- AutoX has unveiled its robotaxi production facility, representing China's first Level 4 robotaxi production line, reports Gasgoo. The facility will manufacture the latest Gen5 system-powered fully driverless robotaxis. Since the opening of the facility in July, the production line has completed three rounds of design and process optimizations to ensure the precision and consistency of AutoX's robotaxis. The production lines are equipped with advanced production technologies and systems, including ABB robots, control and transmission systems designed by Siemens, Omron, Schneider Electric, Philips, SEW, and Mitsubishi. AutoX claims that its fully driverless robotaxis operate in Shenzhen's 65-square-mile serviceable area, which is the largest in China. It said that its autonomous vehicle (AV) platform, AutoX Driver, can handle the densest and most dynamic traffic conditions in cities around the world. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SsangYong has said it has signed a memorandum of understanding (MoU) with Chinese automaker BYD to develop car batteries and produce battery packs for its models, reports The Korea Herald. BYD's wholly owned battery unit, the FinDreams Industry Co. will participate in the battery development project. SsangYong plans to install the car battery developed under the partnership on the U100 EV, which will begin mass production in 2023. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Storage battery manufacturer Exide Industries announced yesterday (21 December) in filing to the Bombay Stock Exchange (BSE) that it will set up a greenfield multi-gigawatt lithium-ion cell manufacturing facility in India. The company's board of directors also approved to participate in the production-linked incentive scheme for national program on 'Advanced Chemistry Cell (ACC)' battery storage, issued by the Ministry of Heavy Industries in August 2021. The total outlay of the scheme is INR181 billion (USD2.4 billion) for five years. The latest move is in line with the Indian government's goal to support electric vehicle (EV) manufacturing as it seeks to increase the share of such vehicles in the country. The government has been working to put in place a supportive framework and is offering incentives to the manufacturers in this space. Exide Industries also seeks to benefit from the subsidy under the PLI scheme. (IHS Markit AutoIntelligence's Isha Sharma)

- Mahindra Electric Mobility (MEML) is looking to double its production capacity and plans to expand its product line-up with the addition of six new vehicles, which will be electric three- and four-wheelers (quadricycles). According to a report by the Economic Times citing people with knowledge of the matter, the company may invest close to INR3 billion (USD39.6 million) into its last-mile mobility business, which is about 10% of its allocated electric vehicle (EV) business investment. Mahindra Electric currently offers the e2oPlus hatchback, eVerito sedan and eSupro passenger van and cargo van, and three-wheelers in the country and also develops EV-related technologies and mobility solutions. The company will enter the quadricycle segment during the next financial year with the Atom. Mahindra Electric has been merged into Mahindra in March this year and has categorised its EV operations into Last-Mile Mobility (LMM) and Electric Vehicle Tech Centre verticals. The report added that the company's LMM division sold about 7,000 EVs in this financial year. (IHS Markit AutoIntelligence's Isha Sharma)

- Electric vehicle (EV) charging network company Charge+Zone and the state government of Gujarat have signed a memorandum of understanding (MoU) to set up 10,000 charging stations in Gujarat on national and state highways. According to a report by the Mint, the USD300-million partnership later aims to expand this to a network of 50,000 charging stations across India. The target is to electrify 10,000 km of national and state highways in the next 3-5 years with super-fast charging stations. Charge+Zone is backed by iCreate (International Centre for Technology and Entrepreneurship), an autonomous centre of excellence of the government of Gujarat and innovation-based start-up incubator. Charge+Zone supports business-to-business and business-to-consumer network for EV charging for both fleet and retail customers and has set up more than 120 charging points across 400 EV charging stations catering to around 3,000 electric cars and buses on a daily basis. (IHS Markit AutoIntelligence's Isha Sharma)

- Denmark's The Lego Group plans to build its first carbon neutral factory in Vietnam, the company announced this month. The company intends to invest $1 billion in the factory, which will be its 6th LEGO factory in the world and 2nd in Asia. Construction is set to begin H2 2022 with a target startup in 2024, according to the company. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The LEGO Group has signed a memorandum of understanding (MoU) with Vietnam Singapore Industrial Park (VSIP) to build this factory on a 44-hectare site in Vietnam's Binh Duong Province.

- This carbon neutral factory will include solar roof panels, while a nearby solar energy project investment will be built by VSIP on behalf of The Lego Group. These together are expected to produce enough renewable energy to match 100% of the factory's annual energy requirements, said the Group.

- The factory will aim to meet a minimum of LEED (Leadership in Energy and Environmental Design) Gold, which it said covers all areas of sustainability including energy, water, and waste. The factory will be designed to accommodate electric vehicles and be outfitted with energy-efficient production equipment, the company said.

- Together with VSIP, The Lego Group intends to plant 50,000 trees in Vietnam to compensate for vegetation removed during construction.

- Before this project was announced, The Lego Group had in September 2020 committed to investing $400 million over three years to sustainability. In line with this, it debuted in June this year a prototype LEGO brick made using recycled plastic, specifically polyethylene terephthalate (PET) from discarded bottles. These are not expected to be near readiness for commercial production.

Posted 22 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.