US and APAC equity markets closed mixed, while Europe was lower. US and European benchmark government bonds closed sharply lower. European iTraxx and CDX-NA credit indices closed close to flat on the day. Brent and gold closed unchanged, WTI was lower, and silver and copper higher on the day.

Americas

- US equity markets closed mixed; Russell 2000 -0.9%, DJIA/S&P 500 flat, and Nasdaq +0.6%.

- 10yr US govt bonds closed +3bps/1.11% yield and 30yr bonds +4bps/1.87% yield.

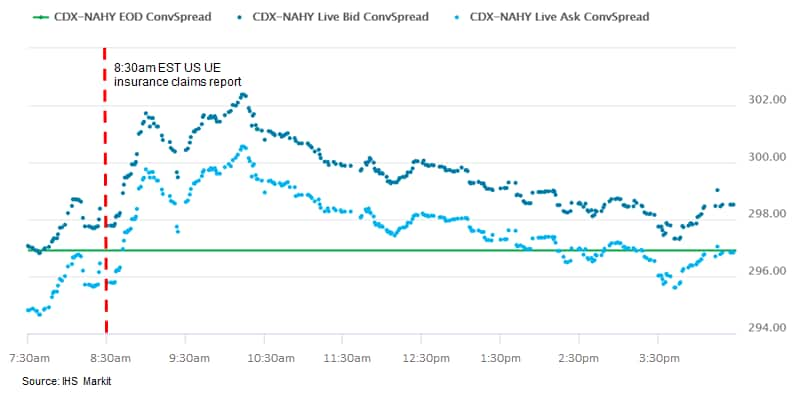

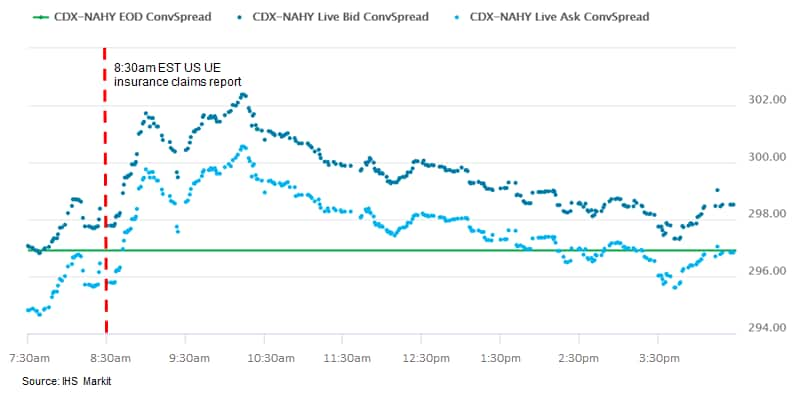

- CDX-NAIG closed flat/51bps and CDX-NAHY +1bp/298bps. CDX-NAHY began widening after the 8:30am EST release of the US initial claims for unemployment insurance and was as wide as +5bps at 10:10am EST before gradually tightening throughout the remainder of the day.

- DXY US dollar index closed -0.4%/90.13.

- Gold closed flat/$1,866 per ounce, silver +0.3%/$25.85 per ounce, and copper +0.3%/$3.65 per pound.

- Crude oil closed -0.3%/$53.13 per barrel.

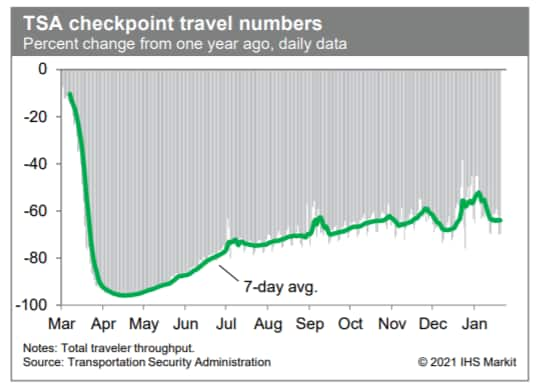

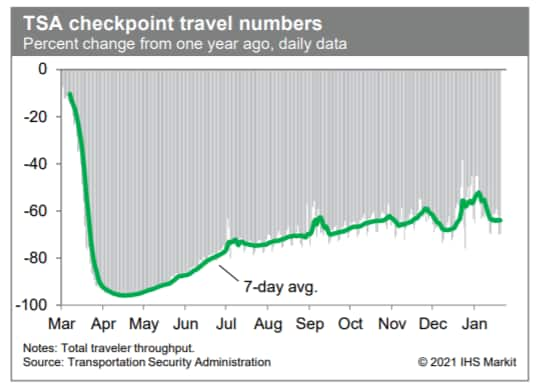

- Passenger throughput at US airports has flattened out in recent days on a seven-day average basis, according to daily data from the Transportation Security Administration (TSA), and is back in line with readings prior to the holidays. This suggests that the holidays provided a temporary boost to the travel sector. The broader recovery has been slow. (IHS Markit Economists Ben Herzon and Joel Prakken)

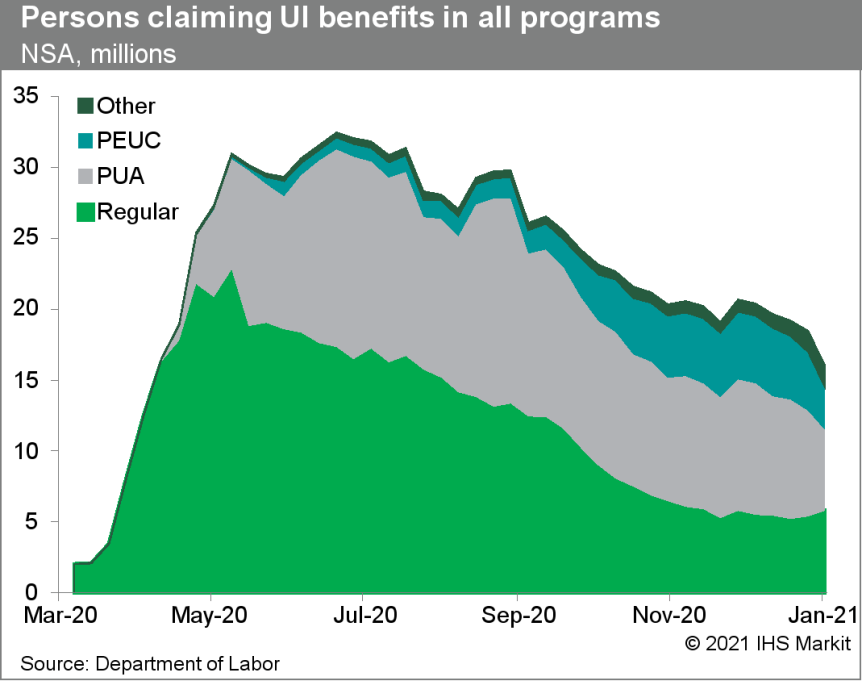

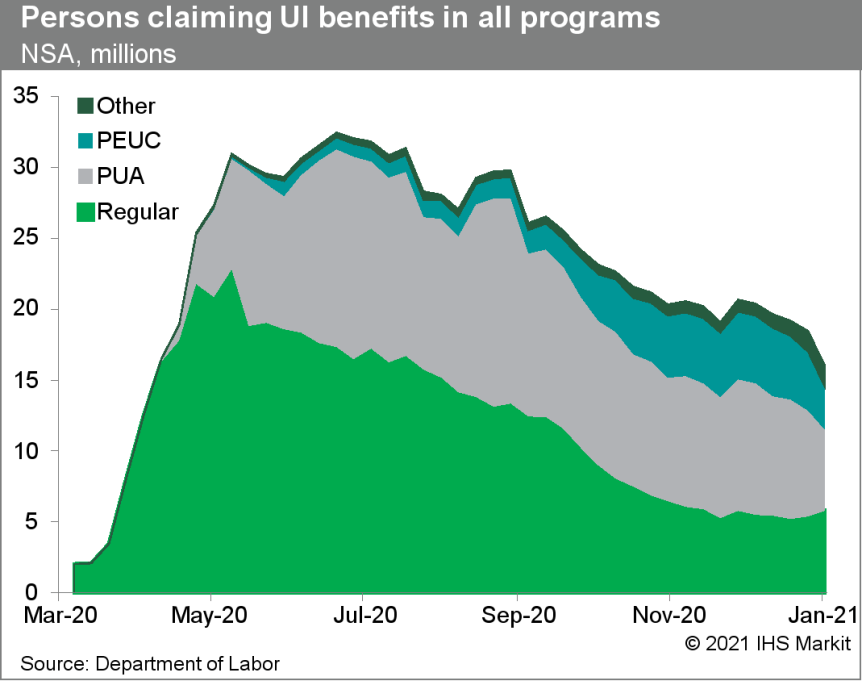

- Seasonally adjusted (SA) US initial claims for unemployment insurance fell by 26,000 to 900,000 in the week ended 16 January. The not seasonally adjusted (NSA) tally of initial claims fell by 151,303 to 960,668. Despite falling last week, initial claims are above levels seen in the past few months, suggesting that the recovery in labor markets is flagging as the pandemic rages on across the country. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 127,000 to 5,054,000 in the week ended 9 January. Prior to seasonal adjustment, continuing claims fell by 203,750 to 5,563,048. The insured unemployment rate was unchanged at 3.6%.

- There were 423,734 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 16 January. In the week ended 2 January, continuing claims for PUA fell by 1,735,491 to 5,707,397, the lowest since late May.

- In the week ended 2 January, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 1,139,309 to 3,026,952. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 2 January, the unadjusted total fell by 2,412,508 to 15,994,519.

- The December US housing starts report provides a first complete look at new residential construction in the fourth quarter and full year. Housing starts increased 11.2% in the fourth quarter, to a 1.592 million rate—the best reading since the third quarter of 2006. Builders started 1.380 million housing units in 2020—also the most since 2006. Single-family starts totaled 991,200 in 2020, the highest since 2007. Multifamily starts were 389,100 last year, down from 402,200 in 2019. (IHS Markit Economist Patrick Newport)

- Housing starts increased 5.8% (plus or minus 11.0%, not statistically significant) in December from November to a 1.669 million rate—the highest since September 2006. Single-family starts jumped 12.0% (plus or minus 13.4%, not statistically significant) to a 1.338 million rate, the highest also since September 2006; multifamily starts dropped 13.6% to a 331,000 units rate.

- The single-family category has surged since April, increasing by an unprecedented 659,000 units to a 1.380 million unit rate. Its share of total starts climbed above 80% in December for the first time since November 2010. That share will likely go up, given a December surge in single-family housing permits and authorized but not started not-seasonally adjusted units ending the year at 103,200 units, the highest in almost 12 years.

- Single-family permits, arguably the most important number in this report, jumped 7.8% (plus or minus 0.9%; statistically significant)—the eighth straight increase—to a 1.226 million rate, which was the highest since August 2006. Single-family permits are surging in all four regions.

- The South and West accounted for 80.4% of single-family housing starts last year, the same as in 2019—but this is up from 69.3% in 2000 and 72% in 2010.

- New US president Joe Biden has asked the Environmental Protection Agency (EPA) to review the currently mandated vehicle emissions rules that apply through the 2026 model year. This action comes as no surprise; however, as the order states it is bound by applicable law and is considering a change, the order to review the rules is not the same as rescinding them. Although new president Biden's intention is to have stricter emissions regulations introduced, the process of revising the rules requires input from the public as well as a thorough, fact-based review. The process will take time and is unlikely to happen quickly. At the time of writing, IHS Markit is monitoring developments but plans no immediate change to our forecast relating to what any potential changes might specifically mean for automakers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup TuSimple has secured undisclosed investment funding from logistics provider Werner Enterprises. The terms of the deal were not disclosed. Werner Enterprises, through this investment, aims to strengthen its commitment towards enhancing the lives of its professional drivers, improve over-the-road safety measures, and create sustainable shipment efficiencies. Cheng Lu, CEO of TuSimple, said, "We are excited to be working closely with Werner Enterprises in bringing our transformational technology to market safely and reliably. Our collaboration with Werner allows our teams to work hand-in-hand to ensure we meet the needs of our customers." In a separate statement, Mark Rourke, president and CEO of logistics firm Schneider, has joined TuSimple's newly established executive advisory board. Schneider will provide its test fleet to TuSimple and in return will have a nominal investment stake in the latter. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry. The company currently has about 40 vehicles in its test fleet and expects to achieve fully autonomous operations in 2021. Two months ago, TuSimple raised USD350 million in a Series E funding round. Last year, Traton and TuSimple announced a global partnership on autonomous trucks, which will involve Scania testing the technology. Werner's investment in TuSimple aligns with its recent ventures in emerging trucking technologies including electrification and hydrogen, telematics, and development of a new transportation management system. In May 2020, Werner launched an initiative, called Werner EDGE, that promotes technology-rich driver solutions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Panama's request for a precautionary and liquidity line (PLL) has been granted by the IMF. The two-year PLL amounts to USD2.7 billion, with a disbursement of up to USD1.35 billion in the first year if requested by Panama. The IMF noted that Panama meets the conditions to have access to a PLL, such as robust institutions and policy framework, strong economic fundamentals, years of good economic performance, and the assurance of continuity of the policy in the future. (IHS Markit Economist Paula Diosquez-Rice)

- The PLL is intended to serve as an insurance against the risk of further external and pandemic-induced shortcomings. The IMF highlighted Panama's current ability to raise funds and noted that the PLL will serve as a confidence boost, which should also help to reduce future financing costs. Panama has relaxed its fiscal responsibility law deficit targets to cope with the pandemic's effect on the economy.

- The IMF expects Panama to return to fiscal consolidation once the pandemic retreats and economic activity becomes vigorous again. Panama's pandemic containment measures have severely reduced activity and the economic activity index declined by 18.2% year on year (y/y) in the first 10 months of 2020; the deepest drops were in the hospitality sector, the construction sector, the retail sector, and the manufacturing sector.

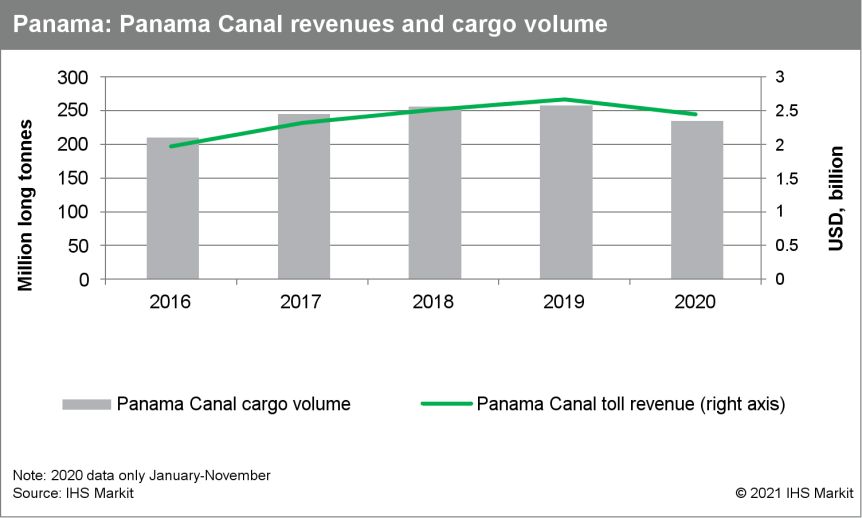

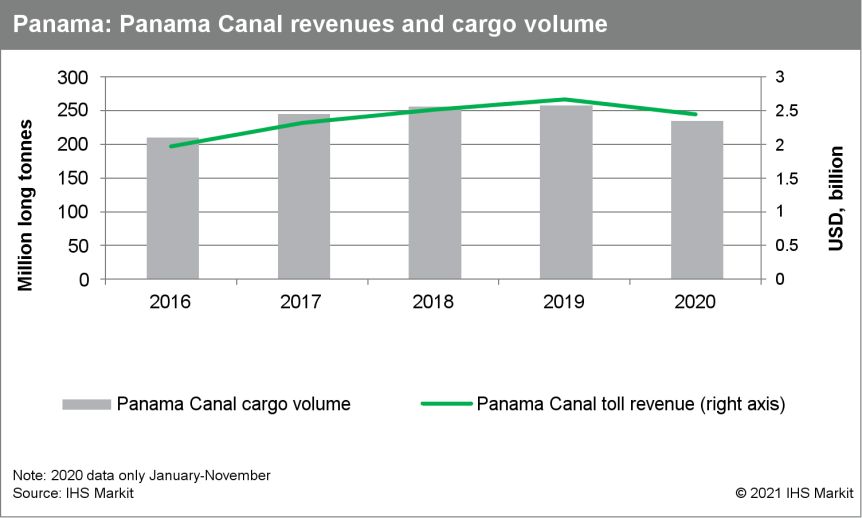

- Central government revenues declined by nearly 30% y/y in the first months of 2020 driven by the steep decrease in retail sales. Meanwhile, activity in the construction sector - measured in square meters built - dropped by more than 60% in 2020. However, activity in the Panama Canal increased slightly in January to November 2020, delivering a rise in toll revenues (0.9% y/y), while activity in the national ports system increased by nearly 10% y/y.

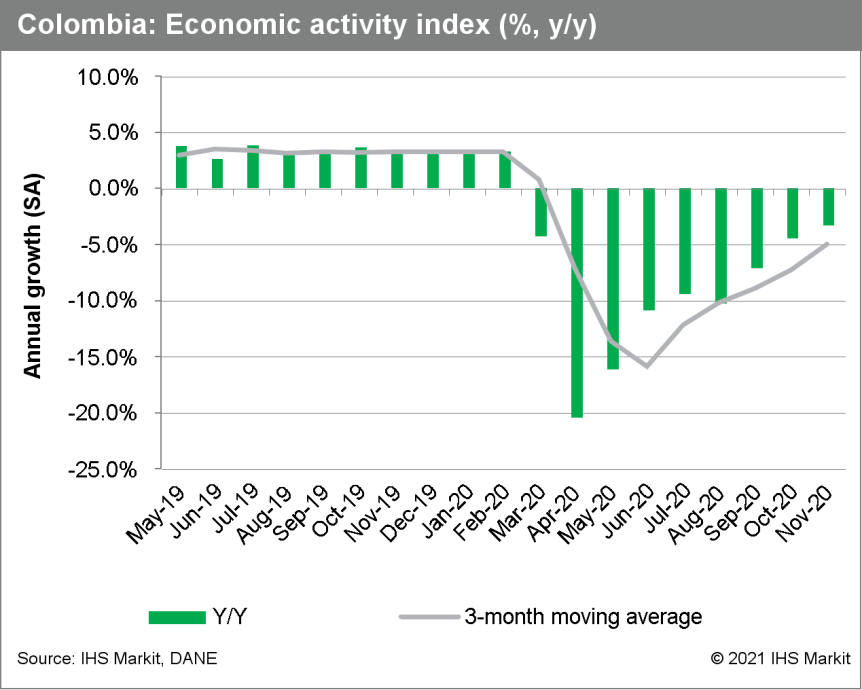

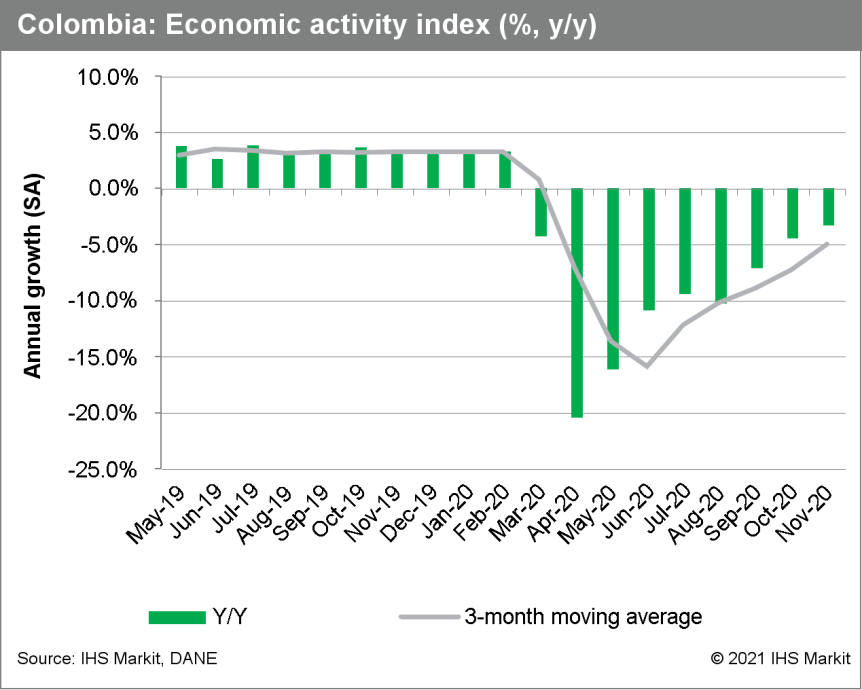

- Colombia's monthly economic activity index contracted by 3.3% year on year (y/y) in November. The rebound in economic activity has been uneven since the severe contractions in March and April, and once again tapered off in November, growing at a much slower rate of 1.2% month on month (m/m) compared with the sharper rebounds that have occurred in earlier months (the fastest monthly rebound occurred in June at 5.9% m/m). (IHS Markit Economist Lindsay Jagla)

- Colombia's industrial production index has followed a similar recovery trend and the index remained 7.1% below 2019 levels in November. This recovery has also tapered off, with industrial production actually declining by 1.4% in monthly terms between October and November, delaying a return to pre COVID-19-virus levels.

- Mining and quarrying continues to put the most downward pressure on the industrial production index, remaining 29.9% below 2019 levels in November. The three-month strike at the Cerrejón mine, coupled with low demand amid the global COVID-19-virus crisis and subsequent lockdowns, accounts for some of this contraction in industrial production.

- Retail sales continue to present an upside for the economy, settling 4.1% above 2019 levels in November.

- Colombia's economic recovery has slowed after sharper, though partial, rebounds immediately following the strict economic shutdown in the second quarter of 2020. Although the majority of isolation measures were lifted between May and August, places with growing case numbers, such as Bogotá and Medellín, have reimplemented curfews and other lockdown procedures at various points in recent months.

- Colombia currently has the fourth highest number of cases per million people in the region. Furthermore, although some countries have begun their vaccination programs, Colombia expects to receive the first doses of the COVID-19 vaccine sometime in February.

- IHS Markit expects Colombia's economic recovery to continue at a slow pace in the first half of 2021 because of the slow rollout of the vaccination program. Based on the country's vaccination program plan, the majority of Colombians will not be vaccinated until 2022.

- A growing number of domestic wineries in Brazil have entered the canned wine market after the first canned wines gained popularity in Brazil, thanks to their practicality. Today, there are at least four national brands producing canned wines. The first Brazilian winery to enter the market was Vivant Wines that launched its first cans with one white (chardonnay), one red (cabernet with merlot) and one rosé (syrah with pinot noir). Company officials said they moved into canned fine and dry wines after noticing a sudden surge in consumption by younger consumers. The company now markets its canned wines in 24 of Brazil's 26 states. "In 2020 alone, we produced around one million cans, and in 2021, we expect to at least triple this production. Most cans are for the domestic market, but we have already started exporting to neighboring markets in the Americas," said Alex Homburger, one of the founders of Vivant Wines. Vinícola Góes, which produces and sells approximately 7 million bottles per year, revealed that its new canning line has the capacity to produce 5,000 cans per hour. "The initial focus is on the domestic market, but we are also eying foreign markets," said Vinícola Góes commercial director Luciano Lopreto. (IHS Markit Food and Agricultural Commodities Vladimir Pekic)

Europe/Middle East/Africa

- European equity markets closed lower; Italy/Spain -1.0%, France -0.7%, UK -0.4%, and Germany -0.1%.

- 10yr European govt bonds closed sharply lower; Italy +8bps, Spain +5bps, and France/Germany/UK +3bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +2bps/250bps.

- Brent crude closed flat/$56.10 per barrel.

- The European Central Bank's (ECB) December 2020 policy meeting concluded with a "recalibration" of its policy stance focused on the Pandemic Emergency Purchase Programme (PEPP) and Targeted Long-Term Refinancing Operations (TLTROs); that is, long-term loans to commercial banks. (IHS Markit Economist Ken Wattret)

- Following the subsequent policy meeting on 20-21 January, the ECB opted to "reconfirm" this stance, in line with expectations.

- The tone of January's policy statement and press conference did not change significantly compared with December 2020's versions. In short, the risks to the outlook remain tilted to the downside, although they have become less pronounced.

- Economic developments since December 2020's meeting were described in the latest press conference as "mixed". Positives cited include the start of COVID-19 vaccination rollout programs, the EU-UK trade agreement, the resilience of manufacturing activity (including IHS Markit's PMIs), and US political developments.

- Less favorable developments cited include the worsening of the pandemic, the new variants of the COVID-19 virus, and related containment measures, while various data releases, including mobility indices, retail sales figures, and IHS Markit's services PMIs, suggest that GDP probably contracted in the fourth quarter of 2020 and will remain weak in the first quarter of 2021.

- The current level of inflation was described as very weak in the press conference, with the rise expected in early 2021 also attributed to "mechanical" factors.

- The next ECB meeting will conclude on 11 March. If the ECB's economic assessment remains the same as now, its policy stance will remain unchanged, with the focus remaining on implementation of the already announced asset purchases and long-term loans to banks.

- Something would need to differ significantly from the ECB's current expectations for its policy stance to be eased again, and we see various areas for potential policy-relevant surprises:

- First, more persistent weakness in the economy. We note that December 2020's Eurosystem projections do not assume a quarter-on-quarter contraction in eurozone GDP in the first quarter of 2021 (which we consider very likely).

- Second, downward surprises on inflation. This does not necessarily imply further declines, as inflation is expected to rise in January 2021 due to German value-added tax (VAT) increases and over the subsequent months as a result of energy price base effects. If inflation rates stay broadly unchanged from now, this would be a significant downward surprise.

- Third, a tightening of financial conditions, including via further exchange-rate appreciation. The euro has softened somewhat against the US dollar recently but is at record highs in trade-weighted terms.

- In the event of surprises on the first two issues above, the ECB would be likely to lean towards continuing to adjust the PEPP and TLTROs. One option on the former would be to front-load asset purchases within the existing PEPP envelope rather than increasing the total volume of purchases.

- Should the third risk factor arise, a further increase in the exchange rate, we believe that this would also bring a reduction in the ECB's deposit facility rate (DFR) into play. We note President Christine Lagarde's comment in the latest press conference that when it comes to policy options, "nothing is off the table".

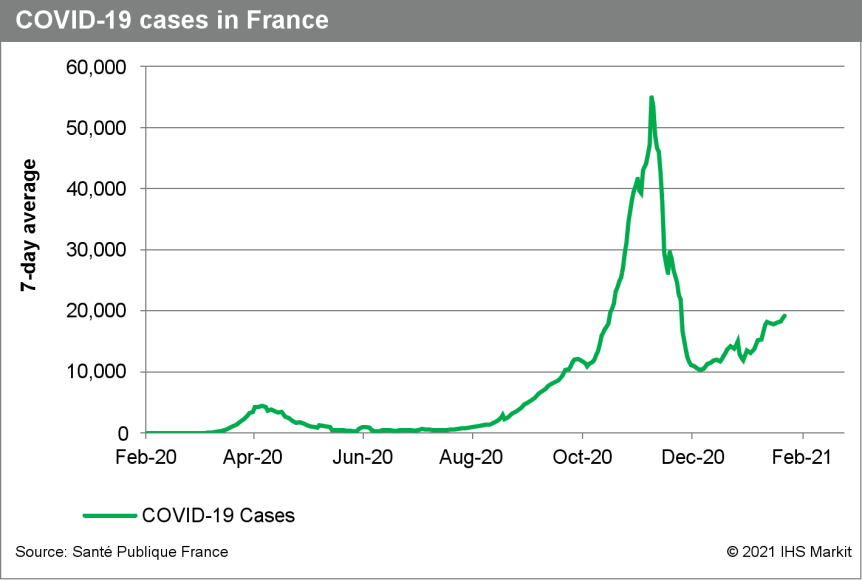

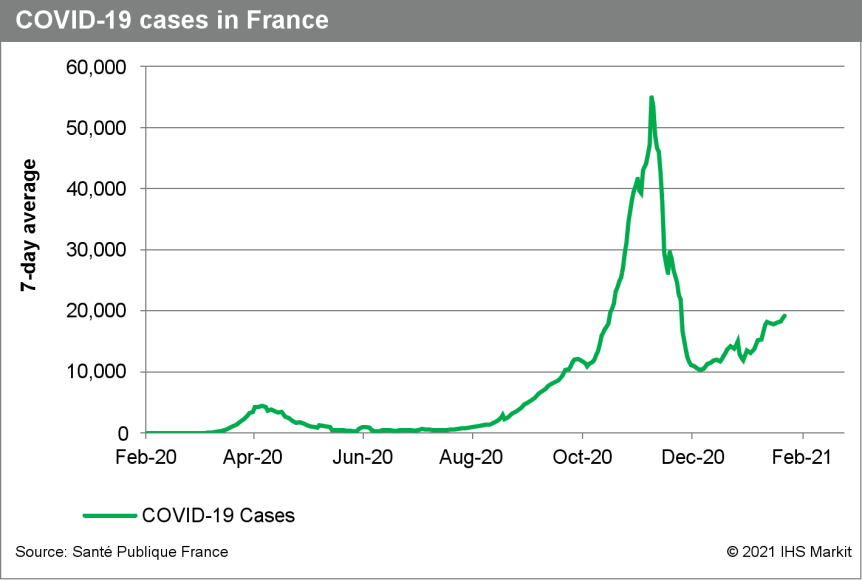

- France's business sentiment index improved by 1 point to 92 in January, following a jump of 12 points in December 2020. The sentiment index now matches its level in September 2020, which had been the highest reading since March 2020, when the effects of the pandemic were just starting to be evident. (IHS Markit Economist Diego Iscaro)

- The modest increase in confidence in December is the result of divergent developments among the different sectors included on the survey. Sentiment in the manufacturing and wholesale trade sectors has risen by 4 points each (with the former reaching its highest level since March 2020). Manufacturing firms have expressed improved past activity and demand levels, while the index measuring their personal production expectations has risen to a four-month high in January.

- Confidence in the service sector has edged upwards by just 1 point in January, as improving expected demand and activity levels were partially offset by a worsening assessment of past activity and, particularly, employment.

- Meanwhile, confidence in retail trade sector, which had improved substantially in November as non-essential retail shops reopened in late October, declined by 1 point.

- As with the wider economic developments, business sentiment has been strongly linked with dynamics of the pandemic and it is likely that this will continue to be the case during the first half of 2021.

- Given the increase in the number of COVID-19 cases and patients in intensive care units (they increased from a post-November minimum of 2,582 in early January to 2,852 on 20 January) we see a high risk of containment measures having to be tightened further in late January/early February, potentially involving the closure of non-essential businesses. Based on this assumption, we currently project real GDP to contract for the second consecutive quarter during the first three months of 2021.

- A joint venture (JV) related to developing the market for hydrogen vehicles is hoping to encourage taxi drivers in Paris (France) to replace their existing vehicles with hydrogen-powered ones, reports Bloomberg News. HysetCo, which is jointly owned by Toyota, Air Liquide and Societe du Taxi Electrique Parisien (STEP), has announced that it has raised EUR80 million and has used this to acquire Slota Group, a taxi operator in the city. It plans to replace the 600 diesel vehicles in its fleet with Toyota's Mirai fuel cell electric vehicle (FCEV). STEP's CEO Mathieu Gardies told the news service that HysetCo is hoping to encourage around 10,000 taxi drivers to change to FCEVs by the end of 2024 through incentives, ready access to vehicles and hydrogen availability, which will improve with the construction of two refueling stations by the end of the year to add to the three already in operation. He also notes that running costs will be similar to those of existing gasoline (petrol) or diesel cars. The ambitious target for getting taxi drivers to change to FCEVs would coincide with the city holding that year's Olympic Games, and is likely to result in a big uptick in tourism around the time of the event in August. The 600 Toyota Mirai FCEVs that are expected to become taxis by the end of the year will join STEP's 100 FCEV powertrain taxis that are already in service. However, getting 10,000 such taxis on the road during the next four years - or around 20% of those in the Greater Paris area - is likely to be an ambitious target given the lack of familiarity with the technology. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Bank of Italy estimates that the economy shrunk again in the last quarter of 2020 after a stronger-than-expected GDP rebound in the previous quarter. (IHS Markit Economist Raj Badiani)

- The central bank believes that the latest available information points to GDP falling by an estimated 3.5% quarter on quarter (q/q) but it acknowledges "a significant estimate dispersion around this central value." This was after GDP rose by 15.9% q/q in the third quarter after falling by 17.8% in the first half of 2020 when compared to the last quarter of 2019.

- The effects of the second wave of COVID-19 infections and the subsequent containment measures have weighed more heavily on services, while manufacturing has been more resilient.

- The resurgence of the pandemic made new measures necessary to restrict economic activity and personal mobility from late October, although they are far less severe than the measures implemented in the first national lockdown during March and April. The main difference is that factories, construction sites and schools remain open, which remains a smaller share of overall value-added hit by the restrictions.

- Indeed, the IHS Markit Italy service PMI reveals the sector remained in a deep downturn in December 2020 as lockdown measures were imposed again. The survey concludes that services remains a substantial drag on Italian economic performance, outweighing a further upturn in manufacturing output.

- Households appeared to more cautious in the fourth quarter of last year. The latest survey of households conducted by the Bank of Italy reveals spending on services remains limited by fears of infection more than by the restrictive measures.

- The retail group Confcommercio shows a significant reduction in spending on services, particularly for recreation and tourism and a smaller decrease in purchases of goods during the fourth quarter. Meanwhile payment flows, namely use of ATMs, continued to contract in the latter stages of 2020 after the marked recovery that followed the end of the first lockdown.

- The central bank estimates that industrial production contracted by 1.0% q/q during the fourth quarter after a sharp increase during the third. It also pinpoints modest declines in the consumption of gas for industrial use and of electricity during the same period.

- The Bank of Italy now expects the Italian economy to grow 3.5% this year, revised from the previous forecast of 4.8%, and follows an estimated 9.2% drop in 2020. The downward revision is because "in the short term, GDP is expected to fall in the current quarter, remain weak at the start of 2021, and then return to significantly stronger growth around the middle of next year."

- The central bank expects the outlook to brighten from mid-2021, underpinned by the rollout of the COVID-19 vaccinations, continued government support and recovery measures financed through the national budget and using funds from the EU Recovery and Resilience Facility.

- Agroponiente Group has introduced a biodynamic agriculture line certified by Demeter as part of the ongoing expansion of its organic production, Fruitnet reports. The company now has 250 hectares of organic production and expects to produce 20,000 tons of organic fruit and vegetables this season, up from 18,000 tons in 2019/20. Demeter International is a major certification organization for biodynamic agriculture and is one of the three predominant organic certifiers. Its certification is used in over 50 countries. Agroponiente currently has red and yellow Palermo peppers, cucumbers, mini watermelons, cherry and pear tomatoes. Its Demeter-certified range will cover cucumbers, eggplant and Palermo and California peppers. Many developed markets have seen strong growth for organic produce sales in 2020. In the UK, organic players benefit from their established home delivery service pre-pandemic. The boom in home delivery service during the lockdowns have encouraged consumers to stick to their shopping habits. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Transport operator Keolis has launched public trials of its autonomous shuttle service in Gothenburg, Sweden. The service will integrate two autonomous shuttles with the public transport network to serve industrial and residential sites. The trials will run for 4.5 months and will be operated by Keolis on behalf of local public transport authority Västtrafik. The autonomous shuttles manufactured by French company Navya, can carry up to eight passengers and have a maximum speed of 20 km/h. The two shuttles will travel along a fixed 1.8-km route serving the Lindholmen Industrial and Science park, reports Intelligent Transport. The service assists passengers to connect with existing bus lines and each shuttle will have a safety operator present to take over in case of emergencies. Bernard Tabary, CEO International Keolis Group, said, "We are delighted to step up our decade-long collaboration with Västtrafik and offer a new mobility solution to Gothenburg residents and visitors with this innovative, sustainable, flexible mode of transportation". Keolis is a public transport operator and has conducted various autonomous shuttle deployments. Since 2016, the company has deployed autonomous shuttles in Australia, Belgium, Canada, France, Sweden, the UK, and the US; transported a total of 200,000 passengers and travelled 100,000 km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

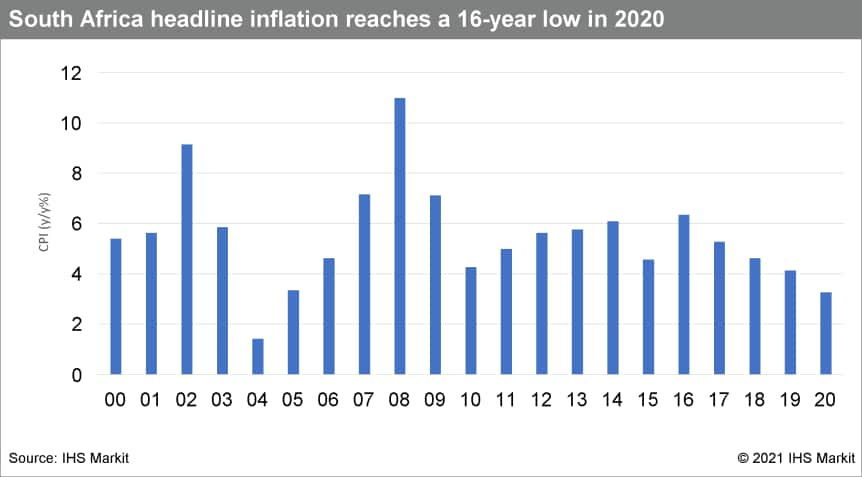

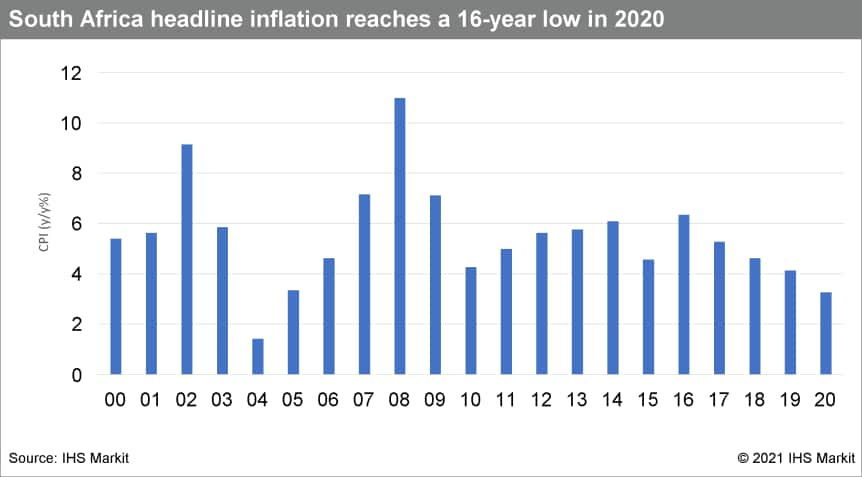

- South Africa's headline inflation rate ended 2020 at 3.1%, marginally down from the 3.2% recorded in November and 4.5% at the beginning of the year. This leaves headline inflation at an average of 3.2% in 2020, a 16-year low. (IHS Markit Economist Thea Fourie)

- The largest contributions to the overall annual increase in headline inflation during December were from food and non-alcoholic beverage prices, up by 6.0% year on year (y/y) and adding 1.0 percentage point to the overall annual inflation rate, and miscellaneous goods and services prices, rising by 7.0% y/y, contributing 1.1 percentage point to the overall annual inflation rate. Housing and utilities prices increased 2.7% y/y in December, contributing 0.7 percentage point to the annual inflation rate.

- Transport costs eased during December, falling by 1.6% y/y. Fuel prices fell by 11.7% y/y last month. Other costs that came down on an annual basis during December included communications, restaurants and hotels, and household goods and services.

- South Africa's headline inflation rate is expected to pick up and average 4.0% in 2021 but remain within the South African Reserve Bank's (SARB) medium-term inflation target range of 3-6%

- The decision by private medical aid funds not to raise their premiums during the first half of 2021 could push headline inflation as low as 2.5% by February 2021. However, annual price increases are expected to pick up from the second quarter onwards. The low base year of comparison, tightening of the output gap, and higher fuel costs are likely to increase headline inflation over the period.

- IHS Markit is of the view that global oil prices could average USD46 per barrel in the first quarter of 2021, rising to USD52.67/barrel by the fourth quarter. The impact of the higher oil prices on overall inflation could be mitigated by a stronger exchange rate of the rand envisioned during 2021. IHS Markit expects the South African rand to average ZAR15.26 against the US dollar in 2021, from an average of ZAR16.46:USD1.0 in 2020.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.5%, Mainland China +1.1%, Australia/Japan +0.8%, Hong Kong -0.1%, and India -0.3%.

- The BOJ left its monetary policy unchanged at its 20-21 January monetary policy meeting (MPM). The bank will continue quantitative and qualitative monetary easing (QQE) with yield curve control and maintained the pace of its asset purchasing and special lending program to support financing in response to the COVID-19 virus pandemic. (IHS Markit Economist Harumi Taguchi)

- The BOJ assessment is that the current economy has picked up in trend, reflecting continued increases in exports and industrial production despite the impact of the resurgence of the COVID-19 virus pandemic at home and abroad. That said, the BOJ expects increased downward pressure stemming from the resurgence of COVID-19 infections to persist for the time being, which led the majority of policy board members to notch down their forecasts for fiscal year (FY) 2020/21 (starting from April) relative to figures in the October 2020 outlook report.

- Nevertheless, the bank's outlooks for GDP growth for FY 2021/22 and FY 2022/23 have been revised upwards, reflecting prospects of a recovery in external demand in line with the development of vaccinations, accommodative financial conditions and upside from the government's economic measures. Its outlook for prices was revised upwards marginally for FY 2020/21 and FY 2021/21, but remained sluggish. The BOJ remarked that its outlooks could change depending on the consequences of the COVID-19 virus pandemic and the magnitude of their impact.

- The BOJ's decision to maintain its monetary policy and special lending program is in line with IHS Markit's expectations, reflecting moderate improvement of economic activity even though the state of emergency for 11 prefectures due to the recent resurgence of COVID-19 infections could weigh on a recovery. The price outlook also suggests the BOJ believes recent deflation largely reflects short-term factors, as price cuts aimed at stimulating demand have not been observed widely to date, although the risks remain skewed to the downside.

- Japan's trade balance remained in surplus in December, largely because of an increase in exports to China. However, the momentum in exports recovery could weaken over the short term. (IHS Markit Economist Harumi Taguchi)

- Japan's trade balance was positive for the sixth consecutive month in December, with a surplus of JPY751 billion (USD7.3 billon) on a non-seasonally adjusted basis, but fell by 13.2% month on month (m/m) to JPY477 billion on a seasonally adjusted basis. The trade balance ended up with a surplus of JPY674 billion in 2020 following two consecutive years of deficits. The sustained surplus reflected the first year-on-year (y/y) increase in exports since November 2018 (up 2.0% y/y), while imports declined at a faster pace (down 11.6% y/y).

- The increase in exports reflected rises in exports to major Asian trade partners, particularly China, which rose by 10.2% y/y, reaching a record high in value terms and the second-highest level since December 2010 in volume terms. Exports to the European Union and the US continued to decline, partially because of disruptions caused by COVID-19-related lockdowns. Major factors contributing to the improvement were higher exports of plastics, non-ferrous metals, and semiconductor machinery, thanks largely to a recovery in production in Asia and greater demand for semiconductors.

- The continued weakness in imports was largely due to lower energy prices, while the contraction of import volumes continued to narrow (to 2.1%). Mineral fuels contributed 8.4 percentage points to the decrease in imports. Imports of aircraft were also a major contributor to the decline.

- The December 2020 results suggest net exports are likely to make a one-percentage-point contribution to quarter-on-quarter (q/q) growth of real GDP in the fourth quarter of 2020 (data is scheduled to be released on 15 February 2020). The sustained recovery in demand in China and the relatively controlled number of new confirmed COVID-19 cases are likely to lift Japan's exports.

- Exports for November show new records for totals as well as China and Hong Kong combined. The month ended at 632.7 million pounds of pork leaving the borders, with 27% of that moving into China. Last year is coming to a close with China likely to take roughly 8% of all US pork for the year, marking a record trend that is not expected to continue. A record volume moved outside US borders for 2020, as well as a record percentage of product, with numbers finalizing in another month. Packers pushed 2.667 million animals through the estimated harvest, up over last year by more than 6%, marking two weeks of exceptional throughput. Bellies were volatile last week, with more than 10% moving in both directions as supply and demand are in a tight battle currently. Futures continue to reflect higher input prices for animal feed in 2021 and are expected to continue raising breakevens and supporting higher hog values as the year progresses. (IHS Markit Food and Agricultural Commodities' Roger Bernard)

- Zhejiang Geely New Energy Commercial Vehicle Group (GCV) and UTI Israel have agreed to form a strategic partnership to introduce GCV's electric commercial vehicles (CVs) to Israel. The first model to enter the Israeli market will be the E200 8T light truck from GCV's Farizon Auto brand. GCV will take the lead on completing the related certification of Farizon Auto CV products, while UTI will handle sales in target markets. According to GCV, the E200 light truck can deliver a maximum range of more than 200 kilometers and takes less than an hour to charge to 80%. Geely sees the potential to expand its sales in overseas markets by leveraging its new-energy CV products. The partnership with UTI will help the Chinese automaker to launch sales of its electric CVs in the Middle East region, including Israel. Battery electric vehicles account for only a fraction of new vehicle sales in the Israeli market, but Chinese automakers have already become among the most active players in the country's electric vehicle (EV) market. Chinese EV startup AIWAYS, for instance, announced a partnership with Israeli distributor Blilious Group last year to introduce its U5 electric sport utility vehicle to the market, while SAIC Motor began sales of the MG EZS in the market at the beginning of 2020. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) startup Sitech signed a strategic co-operation agreement with Chinese truck manufacturer Sinotruk on 20 January to speed up the launch of Sitech's DEV-series models. Sitech will launch a new EV under its DEV series in the second quarter of 2021. The model, to be produced by Sinotruk, is expected to be a mini-size or sub-compact model. The companies said that the partnership will lead to the introduction of EVs targeting the ride-hailing market, although further details were not provided. Sitech launched its first EV, the DEV1, in 2018 under a partnership with Chinese automaker FAW Group. The model is a sub-compact vehicle targeting the entry-level EV market. According to data from the China Association of Automobile Manufacturers (CAAM), less than 200 units of the DEV1 were sold in the country during 2020, down from around 1,900 units sold in 2019. The partnership with Sinotruk will help Sitech adjust its product strategy, especially at a time when the market of mini-size EVs begins to experience increasing demand. (IHS Markit AutoIntelligence's Abby Chun Tu)

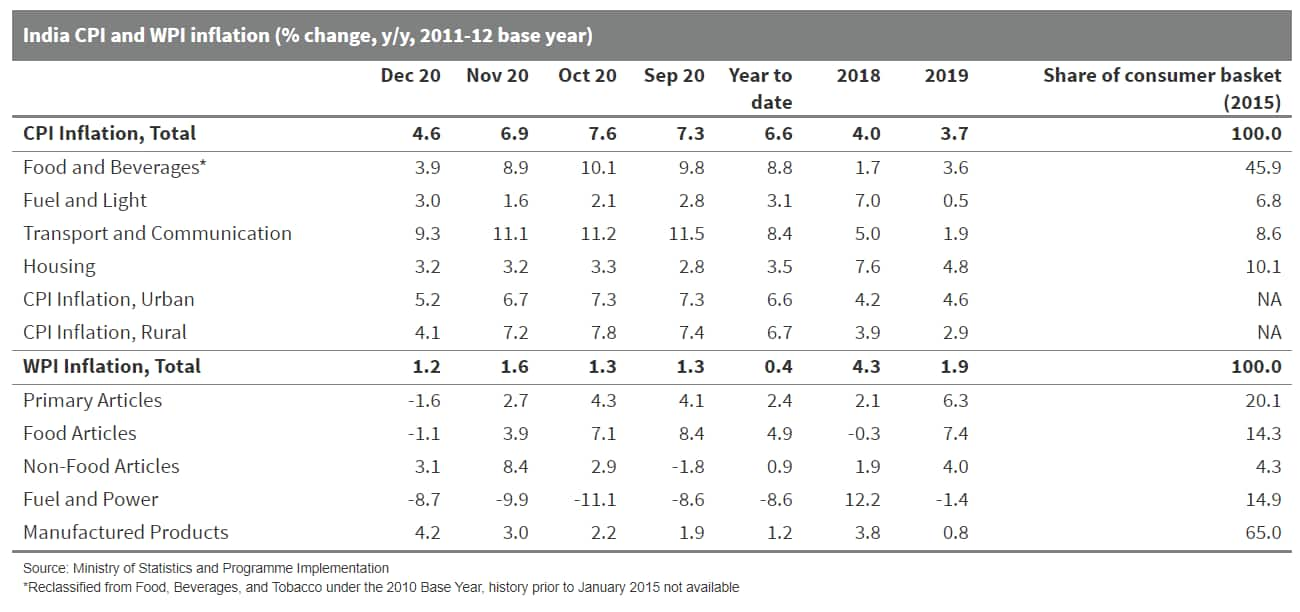

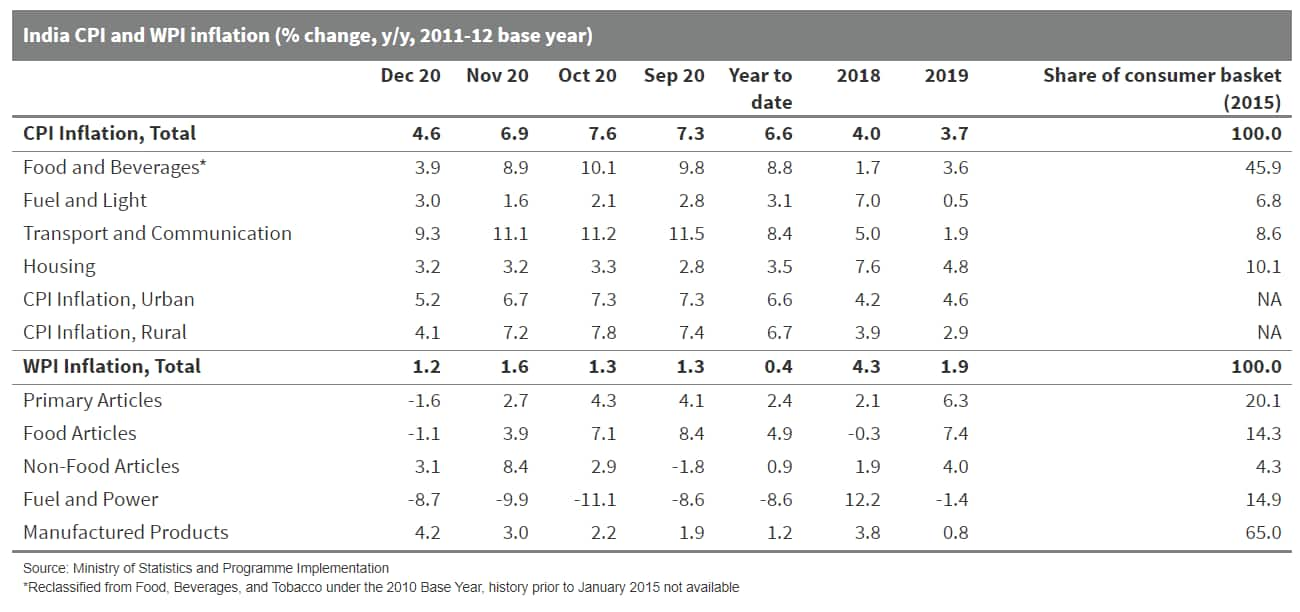

- Inflation eased for the second month in December 2020, but industrial output fell again in November after a short-lived recovery led by the festival boost to demand. Positive developments in containing the COVID-19 virus pandemic and higher government spending will support further recovery but the economy may still surprise on the downside. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- Consumer price index (CPI) inflation eased to 4.6% year on year (y/y) in December from 6.9% y/y in November and from a six-year high of 7.6% y/y only two months ago, according to data released by the Ministry of Statistics and Programme Implementation.

- The easing in headline inflation was led by a sharp drop in food inflation, with the food and beverages category of CPI accelerating 3.9% y/y, down from 8.9% y/y in November.

- Inflation eased for both rural and urban areas, but given the higher share of food in the rural basket, the latter saw a bigger drop in inflation. Since the onset of the COVID-19 virus pandemic, rural consumption has fared significantly better than urban thanks to fewer mobility restrictions and greater government assistance. Even as urban demand is slowly catching up, higher prices for urban consumers, combined with higher unemployment and social benefits in cities will constrain the recovery for some time.

- Wholesale price index inflation also eased to 1.2% y/y in December, down from 1.6% y/y in November. Prices for food and primary articles actually fell in December, while manufactured goods inflation inched up to 4.2% y/y from 3.0% y/y in November. According to the IHS Markit purchasing managers index (PMI) survey, stronger rises in input costs, such as raw materials and labor, are driving inflation in manufactured goods.

- In a separate MOSPI release, the index of industrial production contracted by 1.9% y/y in November, following two months of expansion attributed to the boost in demand from the Indian religious festival season.

- Manufacturing output shrunk by 1.7% y/y, interrupting the tentative recovery in October. Mining sector dropped by a sharp 7.3% y/y, while growth in power generation also slowed to 3.5% y/y from October's 11.2% y/y expansion.

- On a use-based approach, production of both consumer durable and non-durable goods slipped by 0.7% y/y, pointing to cuts to even essential spending after the festival ended.

- Capital goods production contracted by 7.1% y/y, while growth in infrastructure and construction goods also slowed. Even as public capital expenditure has started to improve, private investment remains weak.

- November's drop in industrial production did not surprise, given the post-festival slack and the underlying weakness in demand. A broader look at the economy suggests that the recovery is still under way but the momentum may be slowing. Thus, power demand, rail freight traffic, and GST tax collections all expanded in December, but merchandise exports contracted again, while the expansion in services activity and employment generation slowed.

- Inflation risks are also not yet over, even though we still expect the headline inflation to gradually come down in 2021. Even as food prices started to ease along with the rebuilt supply chains after the lockdown, recent farmers' protest against government agricultural reforms are likely to cause new disruptions, potentially leading to another spike in food inflation in coming months. Rising raw material costs will also keep inflation from easing.

- Ride-hailing firm Ola has partnered with Siemens to build advanced electric vehicle (EV) manufacturing facility in Tamil Nadu (India). As part of the partnership, Ola will have "access to Siemens' integrated 'Digital Twin' design and manufacturing solutions to digitalize and validate product and production ahead of actual operations". The facility will be built on Industry 4.0 principles, will deploy around 5,000 robots across various functions, and will be powered by Ola's proprietary artificial intelligence (AI) engine and tech stack, reports The Times Now. Bhavish Aggarwal, chairman and CEO of Ola, said, "Ola is delighted to partner with Siemens to build the most advanced manufacturing facility in the country. This will be our global hub and will set a benchmark in quality, scale and efficiency, demonstrating India's capability to build world-class cutting edge products. We look forward to bringing this factory online in the coming months and putting our products in the hands of customers." Ola announced last month its plans to invest INR24 billion (USD326 million) in establishing EV facility in Tamil Nadu (see India: 15 December 2020: Ride-hailing firm Ola to invest INR24 bil. in EV manufacturing plant). The facility will manufacture electric scooters, with initial annual capacity to produce 2 million. It will create almost 10,000 jobs as Ola prepares to launch the first of its range of electric scooters in the coming months. The facility will build EVs for India, as well as for sale in regions such as Europe, Asia, and Latin America. To achieve its aim, last year, Ola Electric acquired Dutch-based electric two-wheeler manufacturer Etergo for an undisclosed amount. (IHS Markit Automotive Mobility's Isha Sharma)

Posted 21 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.