Most major European equity indices closed higher, APAC markets were mixed, and all major US indices closed lower. US and benchmark European government bonds closed higher. CDX-NA closed wider across IG and high yield, iTraxx-Europe closed flat, and iTraxx-Xover was slightly tighter on the day. The US dollar, copper, and silver closed higher, gold was flat, and oil and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices where higher most of the day, but changed course in the afternoon to close lower; DJIA -0.9%, S&P 500 -1.1%, Nasdaq -1.3%, and Russell 2000 -1.9%.

- 10yr US govt bonds closed -6bps/1.81% yield and 30yr bonds -5bps/2.13% yield.

- CDX-NAIG closed +2bps/57bps and CDX-NAHY +6bps/323bps.

- DXY US dollar index closed +0.2%/95.74.

- Gold closed flat/$1,843 per troy oz, silver +2.0%/$24.72 per troy oz, and copper +2.5%/$4.58 per pound.

- Crude oil closed -0.3%/$85.55 per barrel and natural gas closed -5.1%/$3.65 per mmbtu.

- The U.S. hospital-staffing shortage exacerbated by the latest COVID-19 wave is showing signs of easing, but many West Coast and rural states are still seeing the worst of it. Over the past seven days, about 16.7% of U.S. hospitals have reported critical staffing shortages, down from a recent peak of 18.7% on Jan. 9, according to data from the Department of Health and Human Services. Fewer facilities are reporting shortages in populous New York, Florida and Illinois. (Bloomberg)

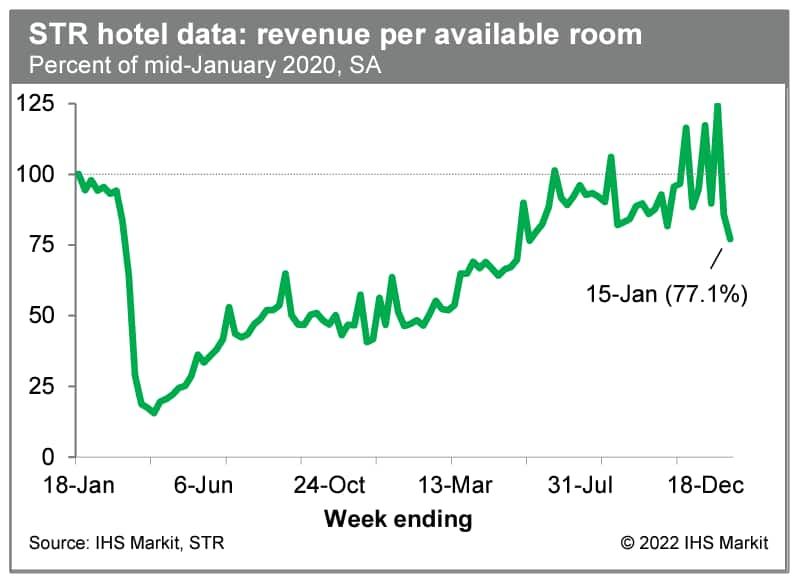

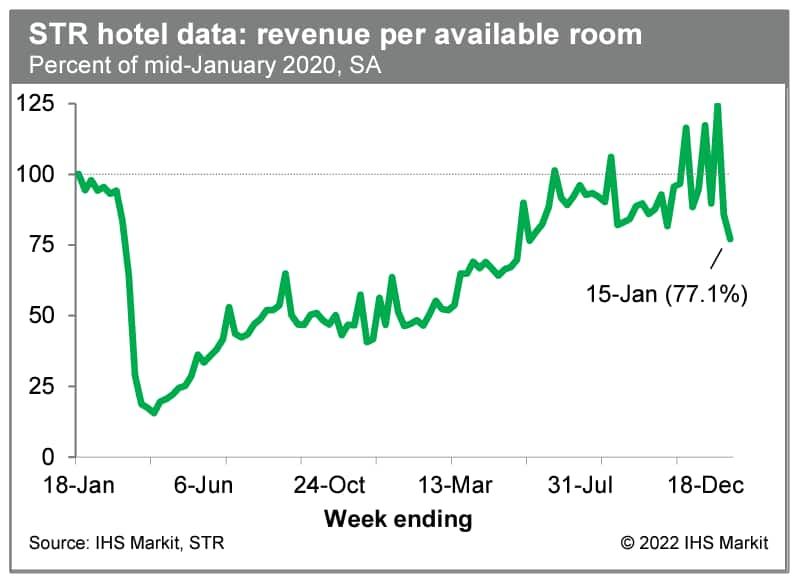

- Revenue per available room last week, after seasonal adjustment, was 77.1% of the mid-January 2020 level (estimate based on weekly data from STR). These data have been volatile in recent weeks, but the last two weekly readings have been materially below prior averages. This suggests the current wave of COVID-19 infections is weighing on travel activity (as is also indicated by a recent weakening of US airport daily passenger traffic from TSA). (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- US existing home sales fell 4.6% to a 6.18-million unit annual rate in December; sales were down in all four regions. December's update closes the book for the year 2021 and its fourth quarter (outside of data revisions). Existing home sales totaled 6.12 million in 2021—the highest since 2006 and 8.5% higher than 2020. (IHS Markit Economist Patrick Newport)

- The average and median price of a home increased 11.0% and 16.9%, respectively, in 2021. The growth rates of both prices slowed in the second half. In December, the median price stood 15.8% higher than 12 months earlier, down from the peak in May 2021 of 23.6%; the average price was 9.6% higher than a year earlier, down from the May peak of 16.9%.

- Sales fell in the first half and picked up in the second, climbing 4.6% to a 6.33-million rate in the fourth quarter, the second-highest reading since the fourth quarter of 2006.

- Inventory and the months' supply for homes fell to all-time lows of 910,000 and 1.8 months in December (data start in January 1999). Inventory of single-family homes and the months' supply also ended the year at all-time lows of 780,000 units and 1.7 months (data start in 1982).

- Properties took 19 days to sell in December, up from 18 days in November and down from 21 days in December 2020; 79% of homes sold in December were on the market less than a month.

- Freddie Mac's 30-year fixed-rate mortgage has risen to 3.56%, up from 3.05% four weeks ago. This has yet to dent demand. The Mortgage Bankers Association's Purchase Index (four-week average) increased last week and remains at high levels.

- US seasonally adjusted initial claims for unemployment insurance jumped by 55,000 to 286,000 in the week ended 15 January, rising to its highest level since last October. The rising trend in claims could be indicative of a slowing job market amid the Omicron-induced surge in cases. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) rose by 84,000 to 1,635,000 in the week ended 8 January. Despite moving higher in the latest reading, the current level of continuing claims is below the 2019 average (1,700,000). The insured unemployment rate rose 0.1 percentage point to 1.2%.

- There was a total of 255,142 claims under Pandemic Emergency Unemployment Compensation (PEUC) and Pandemic Unemployment Assistance (PUA) in the week ended 11 December—the last week data are available for. According to the Department of Labor, any ongoing claims under these programs represent claims for weeks of unemployment prior to the two programs' expiration on 6 September 2021.

- In the week ended 1 January, the unadjusted total of continuing claims for benefits in all programs rose by 180,114 to 2,128,752.

- Customs data shows that US organic fresh produce imports soared by over 30% to about $1.0 billion in January-November 2021. Main origins are Mexico, Peru, Ecuador, Chile, Argentina. Raspberries commanded the highest import price. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- In January-November 2021, organic bananas are the most imported produce, at 512,000 tons, with Ecuador accounting for over 42% of the volume, followed by Mexico at 25%. The US imports organic bananas from seven origins; the average import price from Ecuador was the lowest at $630 per ton compared to Dominican Republic's $890/ton, the highest point. The average import price was $685/ton, 2.3% down y/y.

- Organic hass avocado imports concentrate on fruits from Mexico, Peru and Colombia, with a total of 57,000 tons, 31% up y/y, equivalent to $181 million, 41% up y/y. The average import price was $3,200/ton, 8% up y/y.

- Total organic apple imports were 32,000 tons (9% up y/y) from four origins, with Chile contributing 45% of the volume. Fruits from New Zealand rose 17% by volume, far outpacing Chile (5% up y/y), at an average price of $2,200/ton, about $500/ton more than Chile's.

- US organic mango imports amounted to 54,000 tons in January-November 2021, 56% up y/y, valued at $60 million, up 47% y/y. Mexico accounted for 85% of the total volume, at an average price of just over $1,000/ton, 6% down y/y.

- The US recorded a strong demand for organic lemons, with 11,000 tons imported, 32% up y/y, worth $9.5 million, 44% up y/y. The average import price rose 9% y/y to $890/ton. Mexico dominates the imports with an 84% volume share while Argentina boosted its shipments by 460% to 1,400 tons. Argentina's price was about $840/ton.

- The US imports organic pears from Argentina, Chile and Canada with a total of 13,000 tons imported in January-November 2021. Argentina held a 97% market share while shipments from Chile surged to 350 tons from 72 tons in the same period of the previous year. The average import price was $1,400/ton, 6% down y/y.

- The US imports organic blueberries from five origins, with Peru, Chile and Mexico accounting for 97% of the volume. Total import volume (35% up y/y), value (55% up y/y) and prices (14% up y/y) went up strongly to 37,000 tons, $341 million, $9,160/ton, respectively. Fruits from Peru surged by 184% y/y to 15,000 tons, at an average price of $8,900/ton, over $2,000/ton higher than Chile's.

- GM is taking its zero-emissions business beyond vehicles, announcing further plans for its Hydrotec fuel-cell technology business. GM plans to deliver Hydrotec-based mobile and fixed power systems for a multitude of uses, including charging EVs, powering work sites, supporting the military, and providing emergency power. GM's efforts to develop its fuel-cell technology business outside of the light-vehicle space should enable the company to create a new revenue source, as well as scale up some technologies. However, these efforts also entail the company moving out of its core business, and even outside of transportation, into power storage and generation. Ultimately, the efforts could prove to be a natural evolution of its business that helps the company to scale up the new technology and obtain profitable revenue sources, as well as make a meaningful mark in the shift to a zero-emissions world. Alternatively, as with other side projects that automakers have taken on over the years, the new business might not end up aligning as well with the core business as the fundamentals indicate. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nikola has announced a collaboration with Proterra for long-term battery supply; the batteries will be used for zero-emission Class 8 semi-trucks, including the Nikola Tre battery electric vehicle (BEV) and Tre fuel-cell electric vehicle (FCEV). A statement from Nikola says that the Proterra-powered Nikola semi-trucks are due to start production in the fourth quarter of 2022, after Proterra delivers prototypes in the second quarter of 2022. Nikola CEO Mark Russell said in the statement, "With the growing demand for the Nikola Tre BEV and FCEV, we have actively pursued battery supply through a dual source strategy. We look forward to collaborating with Proterra, which is expected to bring industry-leading heavy-duty EV battery solutions to Nikola's battery-electric and fuel cell electric vehicle platforms." The announcement did not include any details related to financial terms, nor did it comment on how many batteries Proterra will supply. Proterra is growing its business, and already has contracts with Lightning eMotors and Volta. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Chilean National Development Agency (Corfo) selected six green hydrogen production projects for development in late December, accelerating the country's effort to become a world leader in the emerging clean energy. Winning bids would result in more than 45,000 metric tons (mt)/year of new green hydrogen capacity, with each of the plants expected to begin operations in 2025 or earlier. Representing commitments by international energy and chemicals companies of more than $1 billion in investment, the projects are (IHS Markit Net-Zero Business Daily's Kevin Adler):

- Faro del Sur. Enel Green Power Chile, a subsidiary of the Italian energy firm Enel, will produce 25,000 mt/year in the Magallanes Region, using 240 MW of new wind power. "The green hydrogen is expected to be sold to HIF Chile, a company that will produce ethanol and e-gasoline for export to Europe," Corfo said. Chilean industrial firm AME is the lead developer, and it's joined in a consortium by state-owned oil company Enap, German engineering firm Siemens, and Enel. Construction has started on this project.

- HyPro Aconcagua. German chemicals company Linde will produce 3,000 mt/year of green hydrogen in the Valparaiso Region, using 20 MW of power. The output will replace part of the current production of gray hydrogen that they have installed in the Aconcagua oil refinery for National Oil Company (ENAP), Corfo said.

- HyEx-Green Hydrogen Production. French utility and oil and gas producer Engie will produce 3,200 mt/year in the Antofagasta Region using 26 MW of new power. Chilean mining services firm Enaex will buy the green hydrogen as a feedstock to produce green ammonia for export.

- Antofogasta Mining Energy Renewable. French industrial gases producer Air Liquide will produce 60,000 mt of e-methanol using green hydrogen, captured CO2, and 80 MW of renewable energy.

- Hydrogen Green Bahia Quintero. GNL Quintero, a Chilean natural gas and LNG firm, will produce 430 mt/year of green hydrogen from a plant in the Valparaiso Region, using 10 MW of new power.

- H2V CAP. CAP, a Chilean mining and steel company, plans to produce 1,550 mt/year of green hydrogen in the Biobio Region, using 20 MW of renewable power.

- Also in December, the H2 Magallanes project was announced, and it will include 10 GW of wind capacity in southern Chile to power an 8-GW green hydrogen electrolyzer and an ammonia plant. Total Eren, the developer subsidiary of French energy giant TotalEnergies, is the lead developer.

Europe/Middle East/Africa

- Most major European equity markets closed higher except UK -0.1%; Italy/Germany +0.7%, Spain +0.5%, and France +0.3%.

- 10yr European govt bonds closed higher; Italy -4bps, Spain/UK -3bps, and France/German -2bps.

- iTraxx-Europe closed flat/54bps and iTraxx-Xover -2bps/261bps.

- Brent crude closed -0.1%/$88.38 per barrel.

- UK-based startup Urban-Air Port has reportedly agreed to sell a minority stake to Hyundai's air taxi arm, Supernal. According to a report by Bloomberg, Urban-Air Port said that the infused capital would support the development of 200 facilities for flying taxis across the world over the next five years. As part of the deal, Supernal will be given a seat on Urban-Air Port's board, and the move will allow Hyundai to "shape the broader advanced air mobility market from the ground up". Hyundai plans to create a platform dedicated to urban air mobility (UAM) and to introduce passenger and cargo air vehicles in 2028. It recently formed a new company, Supernal, which is an evolution of its UAM division. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A large swath of seabed has been reserved for offshore wind farms in Scotland, raising the capacity bar for both fixed and floating wind. Scotland's land manager this week offered 17 projects the right to reserve specific areas of seabed for a combined £699.2 million ($949.78 million). Altogether, the projects have a capacity of 24.8 GW, three times the 8 GW capacity offered by the UK in February at the UK Crown Estate seabed leasing round. The capacity exceeds Scotland's 2020 target to build 11 GW of offshore wind in the next decade. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- In July, Crown Estate Scotland opened bids on the round, attracting developers from abroad with Scotland's strong wind resources.

- The capacity offered is Europe's largest for any single offshore wind tender or lease round. "It's also the largest space awarded for floating offshore wind. So, this is a breakthrough for floating offshore wind," said IHS Markit Senior Research Analyst Diego Ortiz Garcia.

- But challenges lie ahead for the floating wind projects due to the high cost and limited supply chain of the emerging technology involved. This is especially true as subsidies have not been confirmed, according to Garcia.

- High floating wind project construction costs contrast with currently plunging costs to build fixed-bottom offshore wind projects. "The floating wind projects will definitely need some kind of support, but the fixed projects are today quite competitive in terms of Levelized Cost of Energy, and can potentially go without a subsidy," Garcia said.

- IHS Markit forecasts that costs for floating wind projects, which currently cost 82% more than their fixed counterparts, will decrease to 50% of those costs by 2030.

- The ECB concluded during its December 2021's ECB policy meeting that progress on the economic recovery and rising inflation were consistent with a "step-by-step" reduction in the pace of its net asset purchases over the coming quarters. However, it judged that monetary accommodation was still needed for inflation to stabilize at the 2% target over the medium term. (IHS Markit Economist Ken Wattret)

- First, the discussions were dominated by differences of opinion about the prospects for inflation and related risks - understandably given the unprecedented surge in eurozone inflation over the past year (see first chart). Some members noted that the December 2021 projections had contained the largest cumulative upward revision to the inflation projections in the history of the exercise. In mitigation, however, it was stressed that almost two-thirds of the upward revision to inflation for 2022 was due to developments in volatile energy prices.

- It was also pointed out that core inflation had increased strongly over recent months, and inflation had become more broad-based, with barely any of the items in the Harmonised Index of Consumer Prices (HICP) still exhibiting the low rates of change prevailing in the pre-pandemic period. This cautioned against portraying the current high level of inflation as being the result of just energy price developments and temporary factors.

- There was elevated uncertainty as to where inflation would settle in the medium term after the current "hump". Models calibrated on pre-pandemic data might not be well suited to capturing major structural changes or a potential switch from a lower to a higher inflation regime. The longer inflation remained substantially above the target, the more it could become entrenched in longer-term inflation expectations, which could then spill over into wage growth and actual inflation.

- Although it was noted that the latest available data for negotiated wages suggested annual growth of around 1.5% and did not point to second-round effects so far, it was recalled that developments in wage growth lagged those in other economic variables, and such effects should hence not be expected in the data at this stage.

- Reference was made to the disinflationary impact of the Omicron wave of the COVID-19 pandemic through lower global commodity prices. However, the point was also made that the balance between the disinflationary and inflationary consequences of Omicron was uncertain. It would most likely affect supply adversely and, in line with previous experiences during the pandemic, could also entail significant upside risks to inflation.

- The second key point from the account was the increased emphasis on financial instability risks. In line with the ECB's new monetary policy strategy agreed in 2021, the Governing Council would formally assess the interrelation between monetary policy and financial stability twice a year. While macroprudential policy was the first line of defense, the impact of accommodative monetary policy on property and financial markets warranted close monitoring, especially since some medium-term vulnerabilities had intensified.

- Some Governing Council members refused to support the December 2021 announcements. They retained reservations about various elements, including the recalibration of Asset Purchase Programme (APP) purchases, the extension of the minimum Pandemic Emergency Purchase Programme (PEPP) reinvestment period, and the statement about flexibility in future asset purchases beyond the confines of the specific circumstances of the pandemic.

- France's business sentiment index stands at 107 in January, down from 109 in December 2021. The index has declined for the second successive month, following four consecutive increases, but it remains well above its long-term average of 100. The decline in sentiment has been particularly acute in the service sector, where the index has fallen from 107 in December to 105 (it had peaked at 114 in November 2021). Service-sector providers have reported significantly lower expected activity and demand, while the index measuring expected employment has also declined. (IHS Markit Economist Diego Iscaro)

- The index measuring expected selling prices in the service sector has reached a level not seen since 1990. The correlation between this index and service price inflation has been quite strong since the start of the pandemic, and may point to further increases in service price inflation during the first quarter of this year (see chart below).

- Meanwhile, confidence in the manufacturing sector has improved for the fourth consecutive month as a substantial increase in order books has helped to offset a decline in personal and general production expectations. The quarterly manufacturing survey also suggests that supply difficulties have eased during the three months to January, with the number of firms reporting being limited in their production by supply difficulties declining from 49% in October 2021 to 40% in January 2022 (this is the first fall since October 2020).

- The confidence indices in the retail trade (105, following 107 in December) and construction (113, following 115) sectors have declined in January. In both cases, they remain above their long-term average of 100.

- U.S. chemicals and plastics producer Eastman Chemical Company plans to build in France the world's largest advanced recycling facility, the company said this week. This $1 billion facility, which is expected to be operational by 2025, will use Eastman's polyester renewal technology, which it calls PRT, to recycle up to 160,000 mt/year of hard-to-recycle plastic waste. These are currently incinerated because it either cannot be mechanically recycled, Eastman said. Eastman did not specify the kinds of polymers it will produce at this facility. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- This multi-phase project includes units that would prepare mixed plastic waste for processing, a methanolysis unit to depolymerize the waste, and polymer lines to create various first-quality materials for specialty, packaging, and textile applications, said Eastman.

- The company will use its molecular recycling technology to break down this waste into its molecular building blocks, to be reassembled into virgin-quality material. This enables potentially infinite reuse of materials by repurposing them after lifecycles, potentially reducing greenhouse gas emissions by up to 80% versus traditional methods.

- Eastman also plans to operate by 2025 an innovation center for molecular recycling that would research alternative recycling methods and applications to curb plastic waste incineration instead of fossil feedstock.

- The company said that LVMH Beauty, The Estée Lauder Companies, Clarins, Procter & Gamble, L'Oréal and Danone have signed letters of intent for multiyear supply agreements from this facility.

- Advanced recycling is also known as molecular recycling or chemical recycling. Solvents, heat, enzymes, and other techniques are used to purify or transform plastics at the molecular level.

- According to Eastman, it uses two different types of molecular recycling technologies, carbon renewal technology and polyester renewal technology.

- The company's PRT takes polyester plastics, such as soft drink bottles, carpet, or polyester-based clothing, breaking them down to basic monomers. These monomers are then sent through a polymerization process to make final products.

- Eastman's carbon renewal technology, which it terms CRT, uses a broad mixture of plastic waste such as mixed plastics, textiles, and carpet as source materials. This mixture is converted to small molecules that are used to make new products.

- According to Eastman, the two main differences between PRT and CRT are the type of feedstock, and the outputs produced. CRT can process a broad mix of plastic waste except polyvinyl chloride (PVC), whereas PRT uses polyester as input.

- The UAE's Rebound Plastic Exchange plans to start recycled plastic trading by the middle of this year, its parent business International Holding Company (IHC) said in an exchange filing this week. Rebound Ltd, IHC's newly formed subsidiary, believes that the Rebound Plastic Exchange can help efficiently recycle plastic at scale, reduce the impact of world plastic pollution, and open new economic opportunities in a global business it estimates is worth AED 56 billion ($15.25 billion), according to IHC's statement on the Abu Dhabi Securities Exchange (ADX). (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- According to IHC, close to 100% of plastic waste can be recycled, but the global rate of plastic recycling sits at just 15%. There is expected to be a 6 million mt deficit of recycled content based on the many commitments of global brands, many of whom are aiming for 20-30% increases by 2025.

- IHC said that Rebound Plastic Exchange is a point of market entry for the estimated 80% of countries without domestic capacities to process or consume plastic feedstock, or both. By 2025, it estimates that roughly 5 million mt of recycled plastic will have been traded via Rebound.

- DHL Global Forwarding will partner IHC, to provide laboratory tests based on accepted international standards for materials before being traded, IHC added.

- South Africa's headline inflation rate accelerated by 0.6% month on month (m/m) to 5.9% during December 2021. This leaves South Africa's average inflation rate for 2021 at 4.5%, up from the 3.3% recorded in 2020. (IHS Markit Economist Thea Fourie)

- Transport cost made a 2.3-percentage-point contribution to the annual inflation rate during December alone following the 40.5% year-on-year (y/y) rise in average fuel prices during the month. This was followed by a 1.0-percentage-point contribution from the food and non-alcoholic beverages category and a 1.0-percentage-point contribution from the housing and utilities sub-category, which include administrative prices such as water, electricity, and other services costs. The South Africa Statistical Services (StatsSA) reported a 14.0% y/y rise in electricity costs during December.

- "Core" inflation, excluding fuel, administrative and food prices, increased at a slower pace to average 3.4% during December. Service inflation averaged 3.3% during December, while the steepest jump in inflation were recorded for non-durable consumer goods, rising by 10.5% y/y compared to 3.5% y/y for durable goods and 2.1% for semi-durable goods.

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +3.4%, Japan +1.1%, South Korea +0.7%, Australia +0.1%, Mainland China -0.1%, and India -1.1%.

- Mainland China's one-year loan prime rate (LPR) cut will help boost credit expansion and total social financing in mainland China in the first quarter of 2022. Further monetary and fiscal easing policies are still expected over the first half of the year. (IHS Markit Economist Yating Xu)

- The People's Bank of China (PBOC) lowered the benchmark loan prime rate (LPR) on 20 January, following the medium-term lending facility (MLF) loan rate cut earlier this week.

- The PBOC lowered the one-year LPR by 10 basis points (bps) from 3.8% to 3.7%, the second consecutive reduction since December 2021. Meanwhile, the five-year LPR has been reduced by 5 bps, to 4.6%, marking the first cut to the five-year LPR since April 2020, when the central bank broadly eased monetary policy to offset COVID-19 impacts.

- The LPR cut comes largely expected following the MLF loan rate cut earlier this week and the lower year-on-year (y/y) GDP growth rate registered in fourth quarter 2021. The PBOC stated at an 18 January briefing that it aims to "open the monetary policy toolbox wider, maintain stable money supply, and avoid a collapse in credit". On the same day, China's National Development and Reform Commission also pledged to introduce upfront policies to support the economy, including advancing infrastructure investment. These statements and measures reflect the Chinese authorities' growing concerns about the economy, and signal a generally positive attitude toward policy easing to stimulate domestic demand and help prevent a sharp slowdown in 2022. IHS Markit currently expects mainland China to register 5.4% y/y GDP growth in 2022.

- Japan's trade balance recorded a deficit of JPY582 billion (USD5.1 billion) on a non-seasonally adjusted basis in December 2021. The seasonally adjusted trade deficit also narrowed by 8.1% to JPY435 billion. Export growth weakened to 17.5% year on year (y/y) following a 20.5% y/y rise in the previous month, while import growth also softened to 41.1% y/y after a 43.8% y/y rise. In volume terms, both exports and imports rose modestly, by 2.0% y/y and 1.0% y/y, respectively. Continued sharp increases in prices of import goods outpacing prices for export goods combined with the weak yen (9.5% weaker than the year-earlier level) continued to keep the trade balance in a negative territory. (IHS Markit Economist Harumi Taguchi)

- The softer export growth stems from weaker exports to the European Union (up 9.7% y/y) and to Asia (up 16.6% y/y), which were partially offset by the acceleration of exports to the US (up 22.1% y/y). Major contributors to export growth were exports of autos (up 17.5% y/y), iron and steel (up 75.1% y/y), and semiconductors (up 26.9% y/y).

- Imports of mineral fuels remained the major driver of imports, contributing 20.1% percentage points of total imports. In particular, higher prices of crude oil boosted imports of crude oil to 116.6% y/y, but imports only rose by 7.1% in volume terms. Beside mineral fuels, imports of semiconductors (up 70.5% y/y) and non-ferrous metals (up 73.2% y/y) were major contributors to the overall growth of imports.

- Honda has announced that it has invested in US-based software company Helm.ai to strengthen its position in the area of artificial intelligence (AI) and computer vision technologies. According to Honda's press statement, the investment will help the companies create more value in the field of intelligence in mobility. Helm.ai was founded in 2016 and is based in California (United States). The company focuses on developing software that can train neural networks without relying on simulation and on-road testing data, which can expedite timelines and reduce the costs of AI-based projects. The investment will help Honda to achieve its ambition of establishing itself as a prominent player in the field of autonomous vehicles and future mobility. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai has partnered with IonQ, a leader in trapped-ion quantum computing, to use quantum computers to develop more effective batteries, according to a company statement. The partnership will create the largest battery chemistry model yet to be run on a quantum computer, simulating the structure and energy of lithium oxide. Quantum-powered chemistry simulation is expected to significantly enhance the quality of next-generation lithium batteries by improving their charge and discharge cycles, as well as their durability, capacity and safety, according to the automaker. "This creative collaboration with IonQ is expected to provide innovation in the development of basic materials in virtual space for various parts of the future mobility," said TaeWon Lim, executive vice-president and head of materials research and engineering center at Hyundai Motor Group, adding, "We're excited to step into the upcoming quantum era and take advantage of the opportunities that await with more effective battery power". (IHS Markit AutoIntelligence's Jamal Amir)

- Delhi's state government has signed an agreement with Convergence Energy Services Limited (CESL) to set up charging and battery-swapping stations for two-, three-, and four-wheelers at its Transport Department's cluster bus depots, reports ET Auto. According to the report, the charging and battery-swapping stations will be installed at 14 locations, with six charging points (three for two- and three-wheelers and three for four-wheelers) at each location. CESL will procure, install, operate, and maintain the charging units and related infrastructure, as per the deal. The company will begin the installation work immediately and plans to wrap it up in the next four months. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The joint venture (JV) between Chinese-based SAIC Motor and Thai-based Charoen Pokphand (CP) Group, SAIC Motor-CP, which assembles MG-brand vehicles in Thailand, plans to invest THB2.5 billion (USD75.6 million) to build a plant to produce batteries for battery electric vehicles (BEVs) in Thailand, reports the Bangkok Post. This comes ahead of local BEV production in 2023 for sales locally and for export. "We already have a battery production facility for plug-in hybrid electric vehicles in Chon Buri, but we want to expand production capacity to produce BEV batteries to support exports," said Zhang Haibo, president of SAIC Motor-CP Co. and MG Sales (Thailand), adding "The EV [electric vehicle] industry is growing faster as new Chinese automakers launch more EVs to meet global demand." MG is also conducting a feasibility study into a battery recycling facility as the number of used batteries is expected to increase in the coming years. SAIC Motor has invested THB10 billion in Thailand since 2013. It claims to have the highest investment value of any Chinese company in the Thai automotive industry, highlights the report. MG aims to sell 50,000 vehicles in Thailand this year, up from the 32,000 units it sold in 2021. (IHS Markit AutoIntelligence's Jamal Amir)

- Uber has acquired Australia-based car-sharing platform Car Next Door for an undisclosed amount, according to a company statement. The deal is intended to strengthen Uber's ambition of offering Australians an alternative to private car ownership. Car Next Door will continue to operate independently following the acquisition, with its current leadership team focusing on developing and growing its technology in the domestic market. Will Davies, CEO and co-founder of Car Next Door, said, "This is an exciting opportunity for Car Next Door to achieve our mission of 'freeing people and the planet from the one person one car mentality' years before we otherwise could have. By working with Uber we can scale up our ambitions and look to move Australians away from the over-reliance on the private car which is damaging our planet and making our cities less liveable." This deal builds on Uber's ongoing investments in electric vehicles, micromobility, and public transport to reduce reliance on private vehicle ownership and help achieve greener and more liveable cities. (IHS Markit AutoIntelligence's Surabhi Rajpal)

Posted 20 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.