Major equity indices closed higher across most of the globe today, with the exception of Japanese markets. US government bonds closed slightly higher and benchmark European bonds closed mixed. European iTraxx credit indices were tighter across IG and high yield, while CDX-NA was close to flat on the day. The US dollar closed flat, while oil, gold, silver, and copper were all higher. During the day, markets focused on the official transition of power to newly elected US President Joe Biden, as he began his first day in the Oval Office with a flurry of executive orders, many of which reversed his predecessor's directives.

Americas

- US equity markets closed higher; Nasdaq +2.0%, S&P 500 +1.4%, DJIA +0.8%, and Russell 2000 +0.4%.

- While hindsight is always 2020 (pun intended), the resilience of markets last year was remarkable following the significant disruption in economic activity caused by the COVID-19 pandemic. Though the global economic outlook remained uncertain at the end of the year given the resurgence of the virus, the risk-on trade ended on solid footing as risk appetites were more satiated by the potential impact of vaccines for a broader economic recovery. In turn, underperformance of 60-Month Beta extended further into the final months of 2020 across all our coverage universes. (IHS Markit Research Signals)

- US: Corporate fundamentals such as that gauged by Net Operating Asset Turnover were favored among large cap investors, while high risk and short-term price reversal were successful strategies for small caps

- Developed Europe: The Price Momentum Model and related factors such as Industry-adjusted 12-month Relative Price Strength were rewarded throughout most of 2020

- Developed Pacific: Companies demonstrating high quality and the highest analyst outlook outperformed for the year, as gauged by Fixed Assets Turnover Ratio and 3-M Revision in FY2 EPS Forecasts, respectively

- Emerging markets: The Earnings Momentum Model was successful in distinguishing winners from losers, with a cumulative monthly return spread of 9.1%

- 10yr US govt bonds closed -2bps/1.08% yield and 30yr bonds -1bp/1.83% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY -1bp/297bps.

- DXY US dollar index closed flat/90.47.

- Gold closed +1.4%/$1,867 per ounce, silver +1.8%/$25.77 per ounce, and copper +0.3%/$3.64 per ounce.

- Crude oil closed +0.6%/$53.31 per barrel.

- President Biden on his first day in office took a range of executive actions, including implementing a national mask mandate on federal property, revoking a permit for the Keystone XL oil pipeline and reversing a travel ban from several largely Muslim and African countries, officials said. (WSJ)

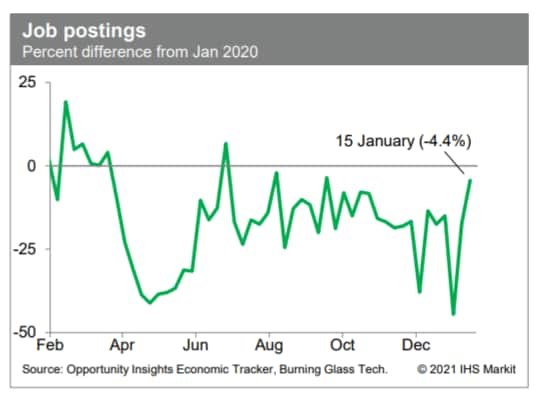

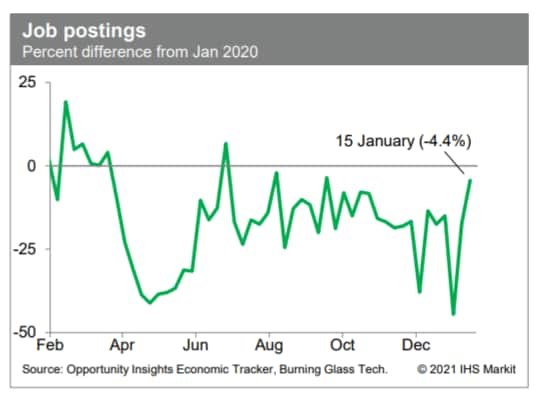

- Containment efforts eased in Delaware and Montana this week, but after rounding the IHS Markit GDP-weighted US weekly containment index held steady at 51.9. This is materially tighter than readings from late summer into early fall but still well below readings from last spring, when containment efforts were first implemented. Meanwhile, job postings for the week ending 15 January were 4.4% below the January 2020 level. This was the best reading in several months, but along with recent readings still indicative of a soft labor market. (IHS Markit Economists Ben Herzon and Joel Prakken)

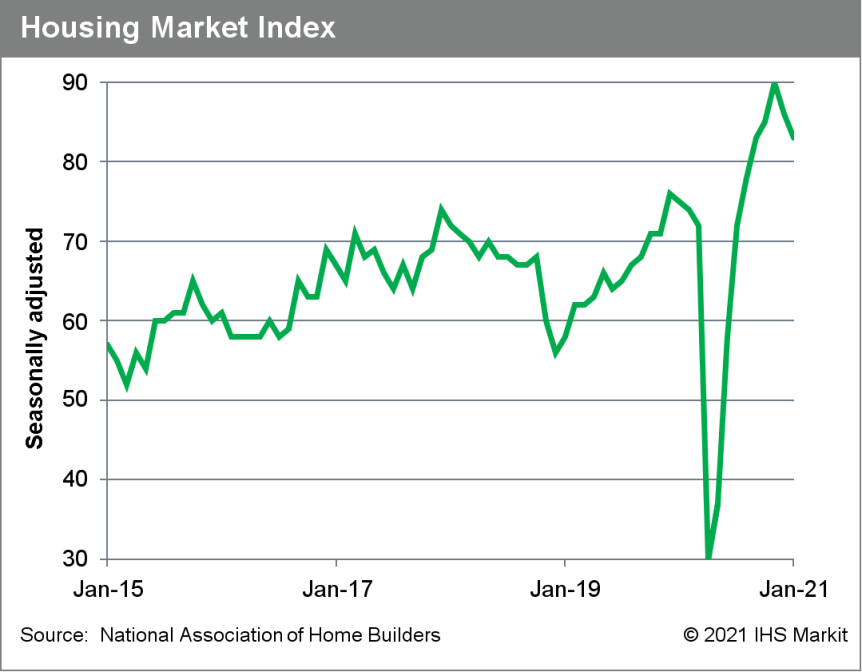

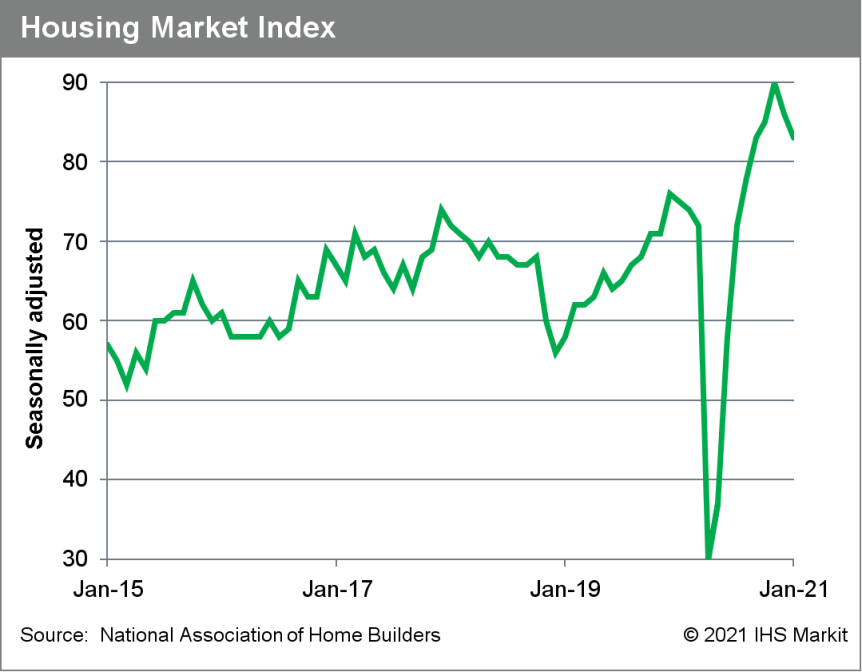

- The headline US housing market index fell three points to 83 in January—still the fourth-highest reading in the index's 35-year history. A reading above 50 says that more builders view conditions as good rather than poor. (IHS Markit Economist Patrick Newport)

- All three sub-indexes were down. The current sales conditions index fell two points to 90, the index measuring sales prospects over the next six months slipped two points to 83, and the traffic of prospective buyers' index lost five points to 68.

- All four regional indexes were down as well. The West fell from a near-perfect score of 96 to 92, the South lost 5 points to 82, the Northeast lost 10 points to 68, and the Midwest lost 1 point to 81.

- The headline index has shed seven points in two months. The drop is likely related to lumber prices, which have shot up in the past two months. The Random Length Lumber Continuous Contract (ticker symbol: LB00) is currently trading at $700 per thousand board feet last week, up from about $500 per thousand board feet in November and $425 per thousand board feet a year ago.

- Indeed, the report usually highlights an issue. This month's: "Builders are grappling with supply-side constraints related to lumber and other material costs, a lack of affordable lots and labor shortages that delay delivery times and put upward pressure on home prices." Tariffs on Canadian softwood lumber were cut from 20% to 10% in December—that will help matters some.

- Despite burning numbers, we believe that the recent strength in the single-family market for new construction is temporary and that housing starts will start running out of steam in the second quarter, dipping before stabilizing in about two to three years at a level set by increases in the number of households.

- Ashland says it has agreed to acquire the personal care business of Schülke & Mayr (Norderstedt, Germany) for €262.5 million ($317.0 million) in an all-cash deal. Schülke & Mayr is owned by private equity firm EQT (Stockholm, Sweden). The deal will be financed with available cash and bank financing, and is expected to be immediately accretive to Ashland's earnings. The acquired business makes additives for personal care products, with a particular focus on preservatives. The deal bolsters Ashland's efforts in its specialty additives business, and "is an excellent example of the type of bolt-on acquisition opportunities that will help advance our strategy and support the profitable growth of our core businesses," says Ashland chairman and CEO Guillermo Novo. The deal also improves Ashland's environment, social, and governance (ESG) positioning in the personal and household care markets, the company says. "This acquisition further aligns our portfolio with the 'clean beauty' trend in the personal care industry and helps us solve for a new generation of consumers who are shifting to products with milder and safer ingredients," Novo says. "Our combined biotechnology competencies further strengthen our ability to create new sustainable solutions in broader fields of application." One analyst estimates that Ashland paid an EBITDA multiple of about 11.3 times for the business. "We estimate an additional €83-96 million in sales and €20-23 million in EBITDA absent any synergies," says Laurence Alexander, an analyst with Jefferies (New York, New York). The deal boosts personal care to about 26% of Ashland's 2020 sales, Alexander adds. Ashland is likely to continue pursuing bolt-on acquisitions, according to Alexander. "The company has previously indicated that M&A activity will likely continue in the personal care, life sciences, and architectural coatings markets," he notes. (IHS Markit Chemical Advisory)

- Paccar and tech start-up Aurora have signed an agreement to develop, test and commercialize autonomous trucks, according to a joint statement released on 19 January 2021. Paccar will provide "autonomous-enabled" vehicles, along with its aftermarket parts distribution, finance and other transportation solutions. Aurora will provide autonomous technology, including the hardware, software and operational services. "Both partners will work closely together on all aspects of the collaboration, from component sourcing and vehicle technology to the integration of the Peterbilt and Kenworth vehicles with the Aurora Driver. The partnership also includes vehicle validation at the PACCAR Technical Center and production support in PACCAR factories," the statement says. Paccar aims to deploy Kenworth T680 and Peterbilt 579 trucks with the Aurora Driver autonomous technology in the "next several years." Paccar's tie-up with Aurora comes after Daimler announced a relationship with Waymo. In December 2020, Aurora also agreed to acquire Uber's autonomous vehicle (AV) unit, strengthening its AV development. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Rivian has announced that it has closed a USD2.65-billion investment round. This brings total funding to USD8 billion since 2019, the company noted. According to a company statement, the financing was led by funds and accounts advised by T. Rowe Price Associates, with participation from Fidelity Management & Research Company, Amazon's Climate Pledge Fund, Coatue, and D1 Capital Partners plus other new and existing investors. T. Rowe Price Associates had led two other financing rounds for Rivian. In December 2019, it led a USD1.3-billion financing round and in July 2020 a USD2.5-billion financing round. In a statement, Rivian CEO RJ Scaringe said, "This is a critical year for us as we are launching the R1T, the R1S and the Amazon commercial delivery vehicles. The support and confidence of our investors enables us to remain focused on these launches while simultaneously scaling our business for our next stage of growth." (IHS Markit AutoIntelligence's Stephanie Brinley)

- There were no interest rate changes by the Bank of Canada, as expected, and the Bank is continuing its quantitative easing program of bond purchases of $4 billion per week. (IHS Markit Economist Arlene Kish)

- The January Monetary Policy Report (MPR) baseline forecast estimates Canada's real GDP declined 5.5% last year, rebounds 4.0% this year, advances 4.8% next year, and climbs 2.5% in 2023. The annual 2021 inflation outlook was revised up to 1.6%, followed by 1.7% in 2022. Inflation will average 2.1% in 2023.

- Based on historical data revisions, the bank has raised its estimate for potential output growth average from 1.2% to 1.4%.

- There was no change in the Bank's extraordinary forward guidance. Excess slack in the economy will persist until 2023, when the Bank is expected to raise interest rates. The next policy announcement is scheduled on 10 March.

- The policy announcement details were as expected. The update on the Canadian economic and inflation outlooks is aligned with IHS Markit projections.

- The Bank is assuming that after a decent bump in the final quarter of last year, the elevated pandemic restrictions will result in a drop in first-quarter real GDP, falling 2.5% quarter on quarter at annualized rates. The January IHS Markit macroeconomic forecast calls for a minor uptick in first-quarter growth.

- The Bank and IHS Markit assume a moderate economic boost in the second quarter as restrictions are lifted once again. The Bank assumes that a lift in foreign demand will support the recovery of Canadian exports.

- The upwardly revised projection for global growth is pegged at 5.6% this year, 4.6% next year, and 3.9% in 2023. The Bank's new domestic economic forecast is based on positive contributions from the impact of its earlier-than-anticipated rollout of the vaccine in addition to Canadian and US government stimulus measures.

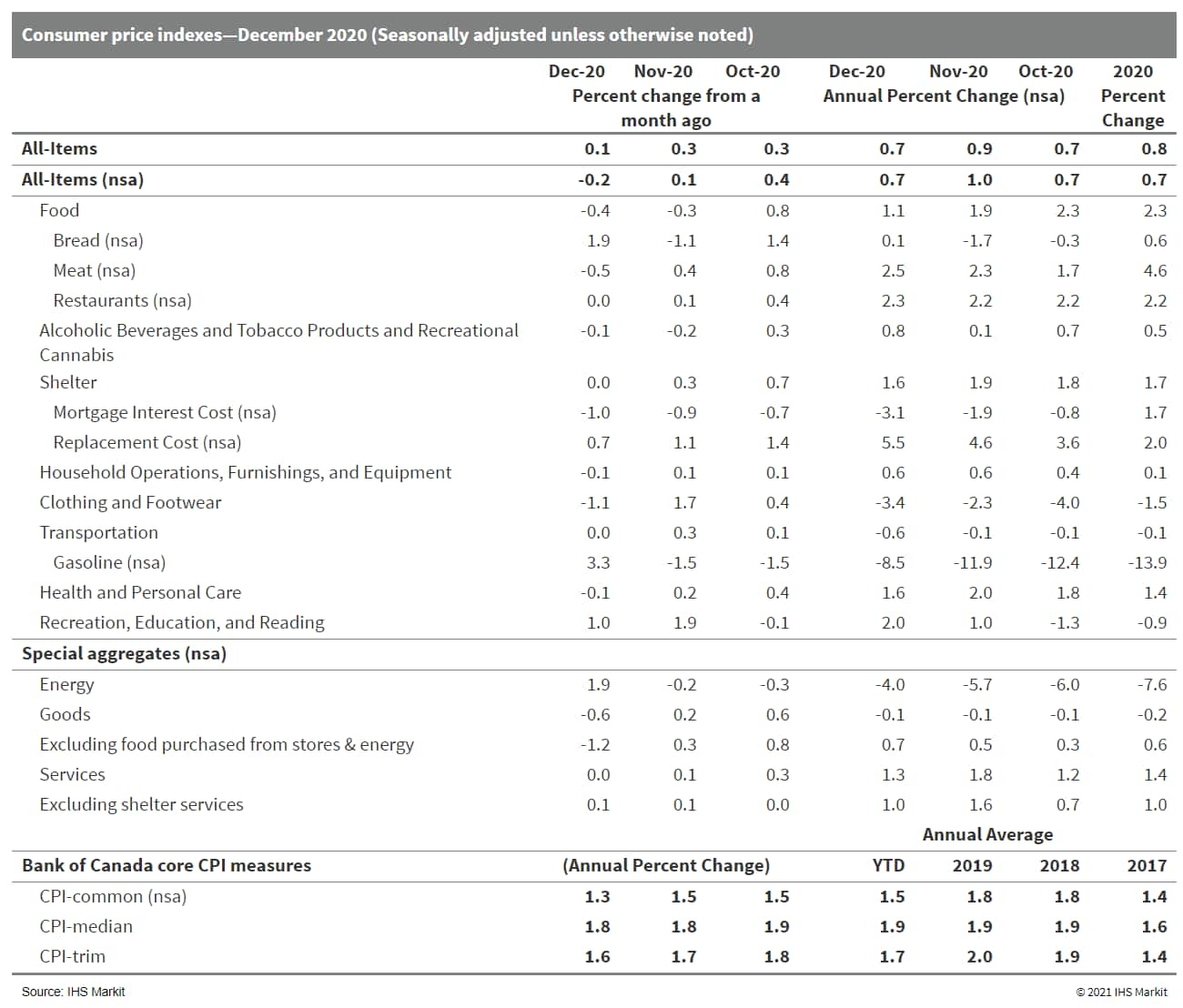

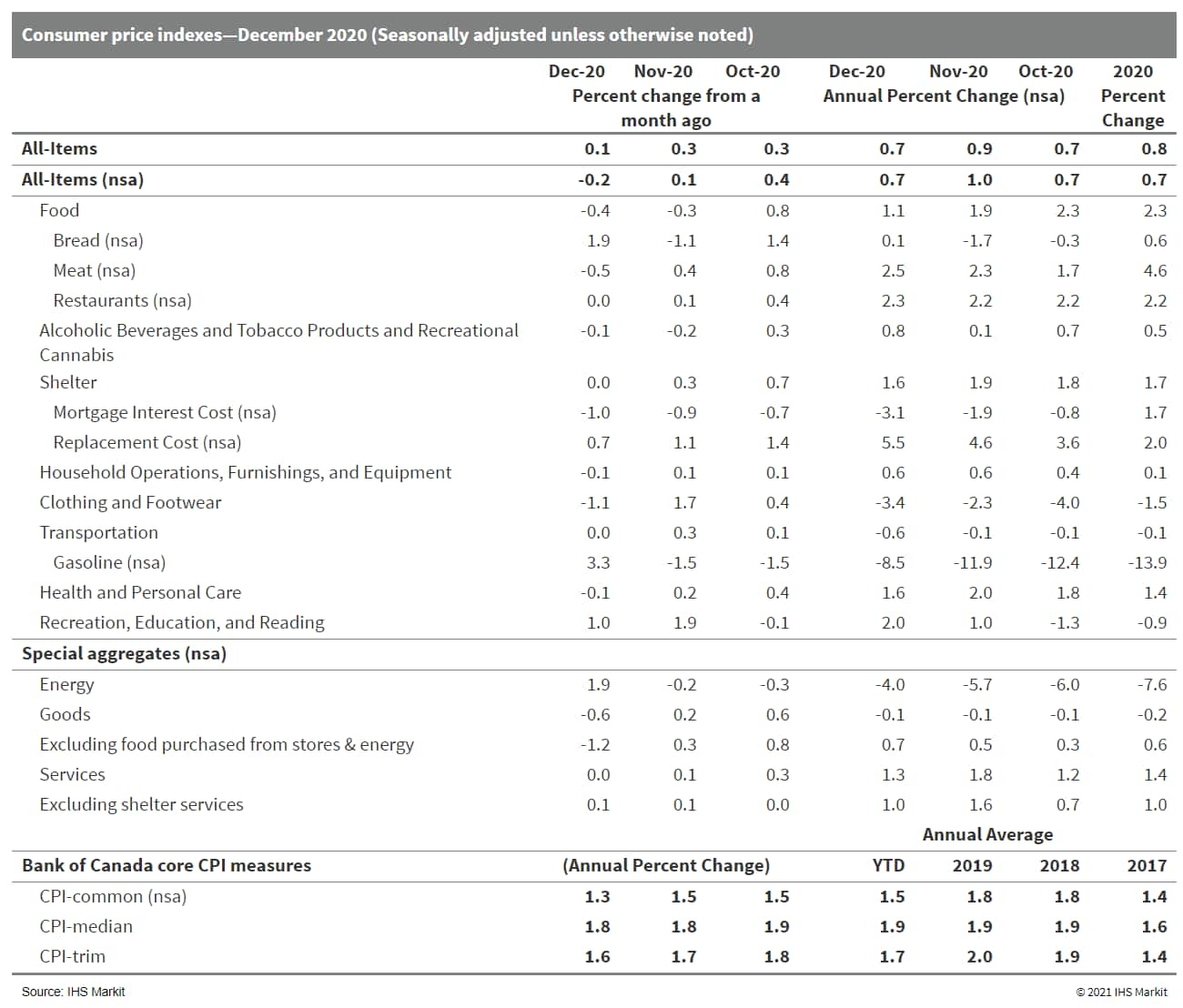

- Canada's consumer prices increased 0.1% month on month (m/m) on a seasonally adjusted basis (sa) but declined 0.2% m/m on a non-seasonally adjusted basis (nsa). (IHS Markit Economist Arlene Kish)

- Annual inflation slowed to 0.7% year on year (y/y).

- Two of the three Bank of Canada core consumer price inflation rates softened, averaging 1.6% y/y.

- The year ended on a note of mixed messages as upbeat news with the initial approval of a vaccine in Canada was offset by the quick spread of the pandemic resulting in stronger imposed lockdown measures. Total inflation averaged 0.7% y/y (nsa) and 0.8% y/y (sa) in 2020, the slowest rates since 2009.

- Look for perkier inflation rates this year as the economy comes out of the lockdown once again and excess capacity is reduced from stronger demand conditions with the widespread rollout of the COVID-19 virus vaccination.

- Food price inflation was weaker than anticipated at 1.1% y/y, slowing total inflation. Food price inflation was the weakest in 31 months as there was a big slowdown in food purchased from stores thanks to the decline in fresh fruit prices. Fewer restaurants were open for indoor dining, but food prices marginally quickened to 2.3% y/y. Total price inflation was also sharply lower on hefty discounts on air transportation prices, which were down 14.5% y/y.

- The shelter and health and personal care inflation rates were trending up through November but reversed course in December.

- Prices for recreation, education, and reading bucked the overall trend as price inflation doubled.

- Travel services, specifically tours, advanced markedly, but because tours were not permitted the increase in the index is mostly overstated.

- Prices for alcoholic beverages and tobacco products and cannabis products jumped higher compared with a year earlier as they came off a low base given that prices dropped from the previous month.

- Core inflation measures are weakening but remain within the Bank of Canada's target range. As such, the Bank will maintain its accommodative policy measures given that much of the current price weakness is deemed temporary, like the annual declines in gasoline prices. Inflation is poised to head higher in 2021.

- As per IHS Markit's Commodities at Sea, total coal & petcoke shipments from WC Canada during 2020 stood at 43.9mt, down 6% y/y. Shipments from Vancouver port (comprising of Neptune and Westshore terminal) stood at 32mt (down 13% y/y); while Prince Rupert (comprising of Ridley Terminal) stood at 11.9mt (up 24% y/y). The decline in shipments from Vancouver port was mainly due to reduced shipments from Neptune Coal Terminal as the terminal underwent five months of maintenance from May until September 2020. During maintenance work at Neptune, Teck Resources diverted coal tonnage to Ridley and Westshore terminal. In terms of import countries, during 2020, Canadian coal and petcoke shipments declined to South Korea (12.4mt, down 4% y/y), Japan (13mt, down 4%), India (3.8mt, down 25%), Taiwan (2mt, down 30%) and the Netherlands (0.7mt, down 43%). The only exception was shipments to Mainland China where shipments increased to 6.1mt (up 11% y/y). Amidst reports of China (Mainland) halting Australian metallurgical coal imports, there was an expectation of an increase in the sourcing of Canadian coal from the Chinese steel mills. Teck had announced late last year it could garner higher prices for its metallurgical coal sales to China (Mainland) versus other destinations. Canadian mining major mentioned its additional spot sales to China achieved an average premium of more than US$35/t above Australian FOB spot pricing at the time each sale was concluded. During 4Q20, Teck Resources planned to sell 5.8-6.2mt of coal, with 20% to China (Mainland). Teck reported sold three metallurgical cargoes for US$160-165/tonne. In 2021, Teck Resources plans to sell 7.5mt of coal to China (Mainland) with contracts priced on a CFR basis. For 2019 metallurgical coal shipments stood at 25mt and for 2021 anticipated at 21.6-22mt, respectively. (IHS Markit Maritime and Trades' Pranay Shukla)

- The Chilean government has announced the participation of Chinese electric vehicle (EV) company BYD in efforts to aid the transition from conventional taxis to electric taxis, reports the Xinhua news agency. Chilean Minister of Energy and Mining Juan Carlos Jobet said, "Today, taxi drivers face major hurdles in accessing electric vehicles, mainly it comes down to the initial investment, familiarity with the technology and charging." According to the source, the program will offer subsidies for those making the transition from conventional to electric taxis, will sell and install residential electric chargers, and will provide an annual follow-up of EVs. BYD will offer its e5 sedan as an EV under the program. The vehicle, which comes with regenerative braking, has a range of up to 400 kilometers. Chile has been at the forefront of development of electric mobility and there have been efforts to stimulate EV demand in the country with the installation of charging points. Chile also has about 23% of the world's supply of lithium, which is used in most EV batteries. In December 2018, the Chilean government set a target for EVs to account for 40% of private vehicle sales and 100% of government fleet sales in the country by 2050; to support this, Chile will offer exemption from taxes and traffic restrictions, as well as subsidies and fast-track licenses for taxi drivers who switch to more efficient vehicles. In 2019, Chile announced plans to convert its mass transit bus fleet to EVs by 2050. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed higher; Italy +0.9%, Germany +0.8%, France +0.5%, UK +0.4%, and Spain +0.1%.

- 10yr European govt bonds closed mixed; Italy +3bps, Spain/UK +1bp, and France/Germany flat.

- iTraxx-Europe closed -2bps/49bps and iTraxx-Xover -9bps/248bps.

- Brent crude closed +0.3%/$56.08 per barrel.

- The Office for National Statistics (ONS) reports that the increase in the United Kingdom's 12-month-rate consumer price index (CPI) doubled to 0.6% in December 2020. (IHS Markit Economist Raj Badiani)

- During 2020, inflation averaged 0.9%, well below the Bank of England's target of 2.0%.

- The biggest contributor to the higher inflation rate in December was the increased cost of transport services such as air fares, with the pace of increase more than doubling to 7.2% year on year (y/y). The ONS reports that "transport costs, including air, sea and coach fares, as well as petrol prices, rose as some travel restrictions eased during parts of the month".

- The 12-month rate for prices of food and non-alcoholic beverages fell to -1.4% in December from -0.6% in November. This was unexpected given that the strict coronavirus disease 2019 (COVID-19) virus-related restrictions across the UK continued to boost supermarket food sales. However, the collection of data was completed by mid-December 2020, which failed to capture the impact on prices from the reported stock shortages in supermarkets at the end of the month.

- Clothing and footwear prices dropped by 1.8% y/y, a smaller decline than in November. Nevertheless, they fell in nine months during 2020, which suggests that high-street retailers resorted to price discounting to clear stock and improve their financials.

- Restaurant and café prices rose for the fourth straight month in December, by 1.3% y/y. This was unexpected after the value-added tax (VAT) rate was cut from 20% to 5% in the hospitality, accommodation, and tourist attraction sectors from mid-July 2020.

- The effect of notably lower global crude oil prices, compared with a year earlier, remains an important narrative. Specifically, crude oil prices (dated Brent) are likely to fall notably in y/y terms during the first quarter of 2021, placing further downward pressure on automotive fuel and energy utility prices. However, oil prices are expected to post significant y/y gains from the second quarter of 2021 onwards.

- IHS Markit's January update forecasts that inflation is likely to average 1.4% in 2021 and 1.6% in 2022 after standing at 0.9% in 2020.

- An agreement has been reached on funding for a new Jaguar Land Rover (JLR) global parts distribution hub, reports the Coventry Telegraph. Intermediate Capital Group is to back a new 3-million-square-foot facility in Mercia Park that is being built by IM Properties in Leicestershire. A spokesperson for JLR said the move would enable it to centralize and streamline its UK-based global spare parts business, adding that it formed part of the company's long-term strategic global planning. The location will bring together the operations that currently take place across 10 sites in the UK, including three core locations at Baginton, Honeybourne, and Desford. These are run by Neovia, Unipart, Ceva Logistics and Panalpina. As such, this should create efficiencies and cost savings as well as improvements in its service for customers overseas. The operations are set to begin moving to this location in September 2022 and this will be complete in early 2023. (IHS Markit AutoIntelligence's Ian Fletcher)

- The net percentage of European banks reporting a tightening of credit standards for loans to enterprises rose in the fourth quarter for the second straight quarter (from +19 to +25). (IHS Markit Economist Ken Wattret)

- The net percentage of banks tightening credit standards reached the highest level since the first quarter of 2012, although it remained well below the peaks seen during the global financial crisis (+68).

- The tightening was driven mainly by heightened uncertainty surrounding the economic recovery and concern over borrowers' creditworthiness, in the context of renewed COVID-19 virus-related restrictions.

- Credit standards for loans to households tightened in the fourth quarter, both for house purchases and consumer credit, although to a lesser extent than for loans to enterprises (net percentages of +7 and +3, respectively) and at a slower pace than earlier in 2020.

- The deteriorating economic outlook, increased credit risk of borrowers, and lower risk tolerance were all cited as contributing to the tightening of credit standards for loans to households.

- Loan demand from enterprises continued to weaken in the fourth quarter, with the net percentage (-12) at its lowest since the fourth quarter of 2013. However, this followed a record-high net percentage in the second quarter of 2020 (+62) as emergency liquidity needs rocketed during the first wave of COVID-19 virus-related lockdowns as economic activity collapsed.

- Inventory and working capital needs continued to contribute to increased loan demand from enterprises in the fourth quarter, although at a lesser rate than in the first half of 2020, likely reflecting precautionary liquidity buffers built up in prior quarters. Demand for loans for fixed investment weakened for the fourth straight quarter.

- Demand for housing loans continued to increase in the fourth quarter (+16), reflecting a catch-up after the collapse earlier in 2020 during the initial phase of lockdowns. In contrast, demand for consumer credit and other lending declined (-9), with low consumer confidence a contributory factor.

- At a national level, credit standards on loans to enterprises tightened in Germany (+6), France (+41), and Spain (+20) in the fourth quarter, but were unchanged in Italy. Heightened perception of risk was the main factor driving the tightening, particularly in France, possibly reflecting concerns about the relatively high indebtedness of French businesses. Demand for loans from enterprises was also relatively weak in France (-47).

- For loans to households for house purchases, credit conditions also tightened markedly in France (+24) but were unchanged in the other three largest member states.

- Looking ahead to the first quarter of 2021, the BLS data are expected to continue in the same vein. Banks expect credit standards to continue to tighten for loans to enterprises, although at a lesser rate than in the fourth quarter of 2020 (+20). Tighter credit standards are also expected for loans to households for housing loans and consumer credit, although at a lesser rate than for enterprises (+13 and +5, respectively).

- Banks expect net demand to increase somewhat in the first quarter of 2021 for loans to enterprises (+5) and for consumer credit (+4), while net demand for housing loans is expected to decline (-3).

- The biggest headline emanating from the EU in 2020 was about the quantitative reduction targets for chemical pesticides with the Farm to Fork strategy. The stage for that had already been set at the close of 2019, when a new European Commission began operating. (IHS Markit Crop Science's Sanjiv Rana)

- After some delays, the Commission revealed its strategy in May, setting a target to reduce the "overall use and risk" of chemical pesticides by 50% and the use of more hazardous pesticides by the same amount by 2030. In order to achieve this, it promised to "reinforce" the environmental risk assessment of pesticides, facilitate biopesticide approvals, and take action to reduce the length of the approval process by EU member states.

- Facing criticism from the industry as well as EU Agriculture Ministers about issuing targets without first doing an impact assessment, the Commission subsequently admitted that the reduction targets were only "aspirational". EU Commissioner for Health and Food Safety Stella Kyriakides said that the quantitative targets in the strategy were "aspirational targets, based on ambitious but realistic pathways". Any proposals to make these targets legally binding will be accompanied by impact assessments, she added.

- EU Agriculture Ministers cautioned that the targets must recognize the different "starting points" and progress made by individual member states on national pesticide reduction programs. The Commission must produce "clear, comprehensive, transparent, science-based and performance-orientated" guidance and recommendations for member states, the Ministers stressed.

- Meanwhile, the European Crop Protection Association (ECPA) revealed plans to invest over €14 billion ($17.1 billion at the current rate) in new technologies and more sustainable products by 2030. Of this sum, it intends to infuse €10 billion ($12.2 billion) into precision technologies and the remaining €4 billion ($4.9 billion) on innovations in biopesticides.

- Rolls-Royce is said to be working on a battery electric vehicle (BEV) product that could be a standalone model in its own right, reports Autocar. The enthusiast publication has said that it has learnt of a Phantom BEV prototype at a research and development (R&D) facility in Munich (Germany), but understands the company favors an entirely new car as a BEV, rather than basing it on an existing model. BMW Group is also said to have filed a trademark for the name 'Silent Shadow' that could be used on such a vehicle. The magazine suggests that it will use powertrain technology used in the new BMW iX crossover, while development of the vehicle has been twinned with that of the BMW i7, a luxury sedan that is set to rival the forthcoming Mercedes EQS. However, it is also expected to use Rolls-Royce's new aluminum space frame architecture rather than a BMW-derived platform. The brand also claim to have developed a powertrain in both rear- and four-wheel drive layouts with a battery which could exceed 500km. Autocar reports that plans are also being firmed up for a BEV variant of the Cullinan, with a twin-motor system offering four-wheel drive, also derived from the BMW iX. Rolls-Royce dabbled with the concept of a BEV over a decade ago when it showed the Phantom-based 102EX concept. Although the vehicle was said to offer many of the desirable traits that a customer of the brand could want, such as the instantaneous torque and silent running, the technology was very much in its infancy and one of the most notable issues was the short range - said to be around 125 miles. EV developments in the intervening years seem to be leading the company to reconsider the possibility, especially as the brand's CEO Torsten Müller-Ötvös has indicated that the company will forego plug-in hybrid electric vehicles (PHEVs) as an interim step. If true, Rolls-Royce would be following in the footsteps of the announcement made by its former sibling and now rival Bentley, which intends to launch its first BEV in 2025 and become solely a BEV brand in 2030. (IHS Markit AutoIntelligence's Ian Fletcher)

- BASF expects to post "better-than-expected" operating profit of €1.11 billion ($1.35 billion) for the fourth quarter of 2020, up 32% year on year (YOY) and well above analysts' consensus estimate, driven by strong performances in the company's materials, chemicals, and industrial solutions businesses. (IHS Markit Chemical Advisory)

- Sales are also expected to beat consensus estimates, rising more than €1.30 billion YOY, or 8%, to €15.90 billion for the fourth quarter, BASF says in preliminary figures released today. This was driven mainly by higher volumes and prices, with negative currency effects having an offsetting impact, it says. EBIT including special items are expected to be €932 million, compared with €579 million a year earlier and also above consensus estimates, as compiled by Vara Research on behalf of BASF.

- The operating business "performed better than expected in the fourth quarter," with the €1.11-billion EBIT excluding special items beating consensus by 32% and also up sequentially, €532 million ahead of the third-quarter figure of €581 million, BASF says.

- The materials, chemicals, and industrial solutions segments "considerably exceeded average analyst estimates for EBIT before special items," it says. EBIT before special items fell slightly short of consensus in the surface technologies and nutrition and care segments, and was "considerably below" consensus for the agricultural solutions segment, due mainly to negative currency effects, it adds.

- For full-year 2020, BASF expects to post EBIT before special items of €3.56 billion, down 23% from €4.64 billion in 2019 but 8% above consensus and 14% more than BASF's own previous guidance of €3.0-3.3 billion. The decrease is due primarily to "considerably lower earnings" contributions from the chemicals, surface technologies, materials, and agricultural solutions segments, it says.

- The nutrition and care segment recorded slightly lower full-year EBIT before special items and the industrial solutions segment was level with the prior year, it notes.

- Full-year sales are expected to be €59.15 billion, almost flat with the 2019 figure of €59.32 billion, beating consensus by 2% and also 3% higher than BASF's most recent guidance issued in October of €57-58 billion.

- Prime Minister Giuseppe Conte's ruling coalition won a confidence vote in the Senate (upper legislative chamber) yesterday (19 January), although with 156 votes in favor, 140 against, and 16 abstentions, it fell short of an absolute majority of 161 senators. The vote was triggered by the defection of Matteo Renzi and his Italia Viva party from the ruling coalition on 13 January over disagreements on spending priorities and whether to utilize all available EU funding capacity, including resources potentially available from the European Stability Mechanism (ESM), which the Five Star Movement (Movimento Cinque Stelle: M5S) vehemently opposes (see Italy: 12 January 2021: Italia Viva threatens to leave Italy's ruling coalition over spending priorities disagreement, but snap elections remain unlikely). On Monday (18 January), the Conte administration comfortably won a parallel vote in the Chamber of Deputies (lower house), securing 321 votes in favor to 259 against. The loss of its absolute majority in the Senate after Italia Viva's defection means that Conte's coalition government is now in a significantly weaker position to pass legislation. Any major measures, including annual budgets, require an absolute majority in the upper house. This position risks impeding the effective disbursement of funds and the implementation of projects worth up to EUR209 billion (USD253 billion), Italy's share of the EU Recovery Fund. (IHS Markit Country Risk's Dijedon Imeri)

- Stellantis, the company born of a merger between Groupe PSA and Fiat Chrysler Automobile (FCA), held its first press conference on 19 January 2021, with CEO Carlos Tavares outlining expectations that the company's newfound scale will provide a "shield" against job losses and plant closures. The company's new scale, Tavares says, will enable far more efficiencies in purchasing and research and development. Those benefits, Tavares expects, will mean the company can deliver a stronger mix of vehicles at the appropriate price points for all of its brands. Tavares focused the conversation on the benefits that being a larger company can bring to improved profitability. Tavares noted that if the financial results of FCA and PSA from 2019 were aggregated, the results would have included adjusted operating profit of EUR12 billion and adjusted operating profit margin of 7%, with automotive operational free cash flow of more than EUR5 billion. Tavares also highlighted the complementary global operations of the two, although he acknowledged that neither of the companies had achieved success in China so far, and this is an area to be addressed and improved. Now that Stellantis has been formed, the company has to begin the work of integrating and making the best use of its new scale. Stellantis will report its full-year 2020 financials on 3 March 2021, combining FCA and PSA performance during one of the most disruptive years the auto industry has ever seen. Next steps include developing the strategies that will take Stellantis and its brands to profitability and sales targets; with the mix of former FCA and PSA employees and brand dedication existent in the company, this may be less of a challenge than it might appear. For the full fruition of the merger to appear will still take five to ten years, and as Tavares noted, external forces could alter plans yet again. (IHS Markit AutoIntelligence's Stephanie Brinley and Ian Fletcher)

- Israeli company Storedot has announced that it has developed a new battery technology for automotive use that can be charged in just five minutes, therefore removing one of the key consumer objections to the mass take-up of battery electric vehicles (BEVs), according to a Reuters report. The technology is still in its prototype stage and Storedot is looking for a partner to bring it to production, which is likely to take some years, but it is still an important development in the automotive industry's shift to electrification. Storedot is currently seen as one of the most exciting companies working in the automotive battery space with companies such as BP and automotive battery manufacturer Samsung among its backers. It has already demonstrated its ultra-fast charging battery technology on small scale applications such as scooters and drones, and it has now tested the technology successfully in an automotive battery application. The key to the new battery technology is that it replaces the graphite that is used in the existing lithum-ion battery chemistry's anode with a new material, which is referred to as metalloid nanoparticles. The battery technology concept will have to go through a rigorous program of proving and testing before it can be considered for commercial use, as well as ensuring it can be efficiently and cost-effectively produced. But there is little doubt that the claims for the new battery are very impressive, and could be a major component to increasing the take-up of BEVs if successfully commercialized. However, rapid charging automotive application batteries are likely to divert attention to arguably the last major objection to mass BEV adoption, namely the quality of the public charging infrastructure. The kind of fast chargers that would allow Storedot's prototype battery to be fully charge in five minutes are still relatively scarce. The best current commercially available fast charging standard is the 350w/h fast charger developed by Porsche for the Taycan, which can offer 80% of a full charge in 22 minutes. Most EVs cannot charge this fast, and these kind of fast chargers are still incredibly rare and are being rolled out I small numbers due to the limited number of vehicles that can use them. Storedot is targeting being able to offer 100 miles of charge in five minutes using the current level of charging infrastructure. It will have to adapt the battery - if it is commercialized - to offer a faster charging solution no matter what sort of charger it is plugged into, for the technology step change to really make a difference. (IHS Markit AutoIntelligence's Tim Urquhart)

- Uganda's current-account deficit widened during the third quarter of 2020 owing to higher government and project imports, despite a moderate uptick in export growth. (IHS Markit Economist Alisa Strobel)

- The country's goods and services imports reached USD2.667.66 million during the third quarter of 2020, up by 41% compared with the previous quarter and by 7% from the first quarter of the year. The biggest driver of this growth in the goods segment was non-oil-related imports. Both government and project imports accelerated by 54% compared with the previous quarter and by 13% compared with the first quarter of 2020. In contrast, private-sector import demand fell by 7% during the third quarter of 2020 compared with the first quarter.

- Total export growth during the third quarter of 2020 was lower compared with the first quarter, with goods exports reaching USD588.24 million in the third quarter, down by USD192.20 million compared with the first quarter of 2020. In contrast, tea, flowers, and cement exports showed the biggest improvement from the first quarter of 2020, while coffee exports reached USD140.78 million, similar to the level seen at the start of the year, the highest since the first quarter of 2017.

- Services-export growth experienced a steep decline in the third quarter of 2020 compared with the first quarter, despite a moderate recovery compared with the previous quarter. This is mainly owing to a steep decline in the tourism segment, with an output fall of 82% during the third quarter of last year compared with the first quarter.

- It comes as no surprise that private-sector import demand remained downbeat during the second and third quarters of 2020. While we expect a gradual improvement in private-sector demand as business expectations suggest a pick-up in business activity in 2021, growth in Ugandan private-sector credit is expected to remain depressed at the start of the year. This is expected to weigh down on domestic demand. Subdued credit growth in Uganda's private sector can likely be aggravated by business closures related to a return of a lockdown to prevent the spread of the COVID-19 virus.

- Although economic growth is expected to rebound in the short term, we do see increased risks related to externalities for the Ugandan economy. Lower-than-expected global economic growth could have a negative impact on the country's trade balance. Therefore, this is seen as a significant downside risk. Delays in public investment and weather-related shocks are considered to be additional problems.

Asia-Pacific

- Most APAC equity markets closed higher except for Japan -0.4%; Hong Kong +1.1%, India +0.8%, South Korea +0.7%, Mainland China +0.5%, and Australia +0.4%.

- The Chinese Ministry of Commerce (MoC) on 9 January issued the "Rules on Countering Unjustified Extraterritorial Application of Foreign Legislation and Other Measures" (the "Rules"). (IHS Markit Country Risk's David Li)

- The Rules are modelled on the European Union's Blocking Statute and are designed to counteract secondary sanctions, or "unjustified foreign legislation and measures in third countries", almost certainly referring to recent US actions. Under the Rules, Chinese persons and entities will have a legal obligation to report "unjustified measures" and to comply with "prohibition orders" issued by the MoC. Chinese entities also should not accept, execute, or observe "unjustified measures" and can pursue legal action against entities that comply with sanctions, in addition to applying for government compensation for non-compliance with foreign rules.

- The Rules have been fast-tracked to circumvent the standard legislative process, indicating political will in the central government to swiftly implement the measures as the new US administration takes office. The prompt passage of the Rules is likely intended to deter possible efforts by the incoming US administration of Joe Biden to rally US allies to further strengthen sanctions against Chinese entities.

- Unlike the EU's Blocking Statue - which explicitly states the countries and actions that are involved - the Rules potentially relate to any "unjustified measures" applied against a Chinese person or entity, providing the State Council with flexibility in issuing prohibition orders.

- The Rules will increase compliance difficulties for companies operating across competing sanction regimes, particularly in defence-related, financial, energy, and technology sectors.

- Further, the "Equal treatment" principles set out in China's 2019 foreign investment law strongly suggest that foreign-invested enterprises in China will be equally bound by the rules, and may be held directly responsible for practices of their parent companies or other subsidiaries abroad - and are therefore prone to punitive action.

- If the Biden administration seeks to expand the scope of US sanctions against China, then more industries will fall under the jurisdiction of the Rules. For example, the Clean Network Initiative seeks to remove a wide range of Chinese suppliers worldwide and establish stronger US export controls banning third countries from selling goods incorporating US technology to China, further increasing the potential range of industries and jurisdictions that could be affected by the Rules.

- Signs of weakening economic recovery in China, such as growing unemployment, corporate and state-owned enterprises engaging in bond defaults or bankruptcies, or continued low productivity - particularly in state-owned companies - would increase the importance of maintaining a positive operating environment for foreign businesses.

- Ratification of the EU-China comprehensive investment agreement, or acceleration in negotiations of multilateral trade or investment agreements, would increase the difficulty of the US forming a broad alliance among Western countries against Chinese companies, and would reduce the need for China to adopt retaliatory measures.

- China imposed sanctions on former Secretary of State Michael Pompeo and other Trump administration officials just as Joe Biden was being inaugurated as president, hitting back at the outgoing team while leaving open the possibility of warmer ties with their successors. Also on the list of 28 people being sanctioned were former President Donald Trump's National Security Adviser Robert O'Brien and his deputy Matt Pottinger, trade adviser Peter Navarro, and U.S. Ambassador to the United Nations Kelly Craft, according to a statement issued Wednesday by China's Foreign Ministry as the inauguration for Biden was taking place. They and their families will be banned from entering China, Hong Kong or Macau, or doing business with China. The officials listed were instrumental in shaping the Trump administration's more confrontational stance toward China, which included a raft of sanctions and a declaration, on its final day, that the government had committed genocide in its Xinjiang region. (Bloomberg)

- China's peanut futures is set to start trading on 1 February 2021 at Zhengshangsuo (ZCE), a commodity exchange at Zhengzhou city of Henan province. The purpose of the peanut futures market is to standardize the industry in terms of quotation and specifications, according to a source at ZCE. The current structure of the spot market is highly fragmented, in which the cultivation is done mainly by small-scale farmers while sales are managed by brokers and traders. China's spot quotations are disorganized with all sorts of varieties and grades by different producing regions quoted and this can be confusing. In the absence of authoritative and standardized practices, farmers and processors tend to receive inaccurate price predictions. The listing of peanut futures is conducive to providing forward price guidance and risk management tools for all the stakeholders in the supply chain. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- China's Zhejiang Geely Holding Group (Geely) has signed an agreement with Tencent to develop smart car technologies. Areas of strategic co-operation between the two companies include developing smart car cockpits and exploring testing of autonomous vehicles (AVs). An Conghui, president of Geely, said, "With a cooperative relationship spanning three years, Geely and Tencent is now deepening their partnership and working to digitalize the entire automotive value chain. At the same time, we hope to fulfil our responsibility to society by jointly promoting sustainable low carbon development throughout the automotive industry." Geely and Tencent have been partners since 2018. The deal with Tencent is the third recent partnership by Geely with companies involved in the tech sector. Earlier this month, Geely partnered with Baidu aimed at manufacturing electric vehicles. In the same month, Geely inked a deal with Apple maker Foxconn to provide contract manufacturing for automakers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Velodyne Lidar has partnered with Trunk.Tech to develop autonomous trucks for the logistics market in China. Trunk.Tech has deployed Velodyne's LiDAR solutions, including Ultra Puck, Puck and Velarray H800 sensors, to strengthen object awareness and detection capabilities for its trucks. Anand Gopalan, chief executive officer of Velodyne Lidar, said, "Trunk.Tech is leading the industry in demonstrating how autonomous vehicle technology, powered by lidar, is bringing major efficiency and safety advances to trucking. We look forward to working closely with Trunk.Tech on creating next-generation autonomous driving solutions that dramatically improve how goods and materials move in logistics networks." Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers, and the technology's improved efficiency. These trucks enable autonomous loading and unloading of containers in yards, thereby improving efficiency. Last year, Shaanxi Heavy Duty Automobile has partnered with Innoviz Technologies to deploy 600 autonomous trucks at one of the biggest ports in China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Aeva has collaborated with Japanese supplier Denso to develop next-generation sensing and perception systems, reports Reuters. Aeva provides a unique LiDAR solution by employing frequency modulated continuous wave (FMCW) technology that can measure distance as well as instant velocity without losing range. The companies plan to advance FMCW LiDAR, bring it to the mass market, and create a society free from traffic accidents. Aeva chief executive Soroush Salehian said, "Achieving high performance is table stakes" for LiDAR sensors, adding, "Achieving high performance at an affordable cost is the holy grail." Aeva, founded by two former Apple Inc. engineers, is in the process of going public through a reverse merger with special-purpose acquisition company (SPAC) InterPrivate Acquisition Corporation (see United States: 3 November 2020: LiDAR startup Aeva to go public through merger). The company says that its newest LiDAR product, called the Aeries, which has a 120-degree field of view, will cost less than USD500 when manufactured in high volumes. Aeva has signed a sensor-system deal with Audi subsidiary Autonomous Intelligent Driving (AID) and ZF Friedrichshafen. Denso is focusing on developing technologies that enhance road safety and eliminate traffic accidents. Last year, it established an innovation laboratory in Pittsburgh (United States), which will focus on research and development of autonomous vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Honda has collaborated with General Motors (GM) and Cruise to launch autonomous mobility service business in Japan. Honda will start conducting trials in Japan using Cruise's test vehicle this year. In future, Honda plans to launch mobility service business using the Cruise Origin, an autonomous vehicle (AV) being developed by these three companies, with focus on offering new transportation solutions. Takahiro Hachigo, president and representative director at Honda said, "This collaboration with Cruise will enable the creation of new value for mobility and people's daily lives, which we strive for under Honda's 2030 Vision of serving people worldwide with the joy of expanding their life's potential. Through active collaboration with partners who share the same interests and aspirations, Honda will continue to accelerate the realization of our autonomous vehicle MaaS business in Japan". Honda's newly established company, Honda Mobility Solutions, will be the operator of such business in Japan. In 2018, Honda invested USD750 million in an immediate equity stake in Cruise as well as commitment for USD2.0 billion over 12 years to develop AVs and technology with GM. Microsoft has joined GM, Honda, and institutional investors in a combined new equity investment of more than USD2 billion in Cruise. Cruise will use Microsoft's cloud computing platform, Azure, for its AVs. Last year, Cruise received the necessary authorization from the state of California to operate without a safety driver in its AVs, specifically in San Francisco. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- DSME, together with Korea Electric Power Technology (KEPCO), advanced into the offshore wind substation market. DSME recently signed a memorandum of understanding (MOU) with Korea Electric Power Technology to jointly develop floating offshore wind substations that can be installed either on land or deep seas. DSME will lead the research with its expertise in the design and construction of offshore facility while KEPCO will provide its expertise in design and construction of electric facility. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Indian electric vehicle (EV) startup Earth Energy EV plans to launch a new electric mini-truck in the country this year, reports the Hindu Business Line. The model will be built on a Skateboard platform that can be adapted to multiple body types. The company aims for a localization rate of nearly 96% for its upcoming products in the B2B and B2C segments. The company's other plans include local production of EV batteries to lower the prices of its models. "We have diligently invested three-and-a-half years to perfect the vehicles and underlying technologies to make reliable and affordable EVs. We are witnessing a huge demand for EV adoption in the Indian market. Our indigenized vehicles are made ground up to put a dent in the stereotypical electric mobility landscape in India," said Rushi Shenghani, CEO and founder of Earth Energy. The report adds that the company is in the advanced stages of setting up a greenfield manufacturing facility in Maharashtra state with an annual capacity of 65,000 units. Earth Energy EV, incorporated in 2017, is owned by Grushie Energy Private Limited. The company is headquartered in Mumbai and also has a research and development (R&D) and manufacturing facility on the outskirts of the city. (IHS Markit AutoIntelligence's Isha Sharma)

Posted 20 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.