All major equity indices closed higher across the globe for the second consecutive day. US and European government bonds closed modestly lower. European iTraxx and CDX-NA credit indices closed tighter across IG and high yield. The US dollar and oil closed higher, with WTI reaching the highest close in slightly more than a year. Silver retreated sharply from yesterday's highs, with gold and copper also lower on the day.

Americas

- All major US equity indices closed higher; Nasdaq/DJIA +1.6%, S&P 500 +1.4%, and Russell 2000 +1.2%.

- 10yr US govt bonds closed +2bps/1.10% yield and 30yr bonds +1bp/1.87% yield.

- CDX-NAIG closed -2bps/53bps and CDX-NAHY -10bps/302bps.

- DXY US dollar index closed +0.2%/91.20.

- Silver closed -10.3%/$26.40 per ounce today and 12.5% below yesterday's peak. It's worth noting that prices yesterday peaked at 21.5% above the lowest level reported on 27 Jan.

- Gold closed -1.6%/$1,833 per ounce and copper -0.8%/$3.52 per pound.

- Crude oil closed +2.3%/$54.76 per barrel, which is the highest closing price since January 23, 2020.

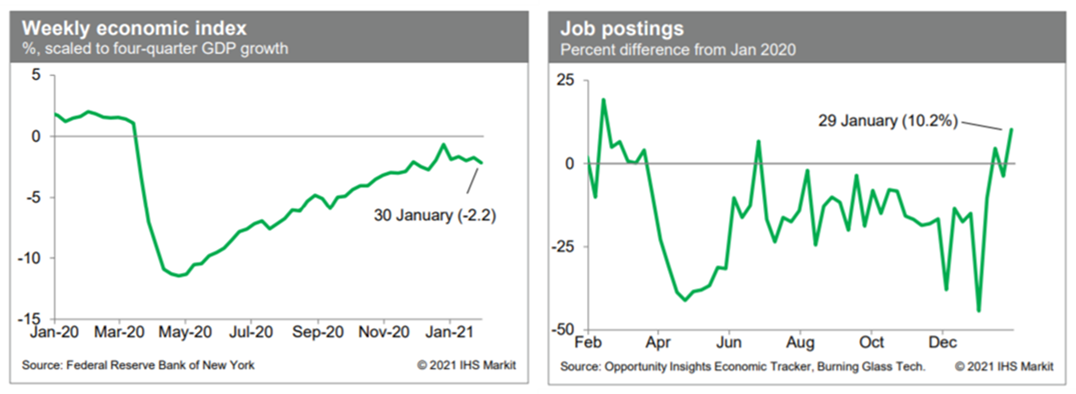

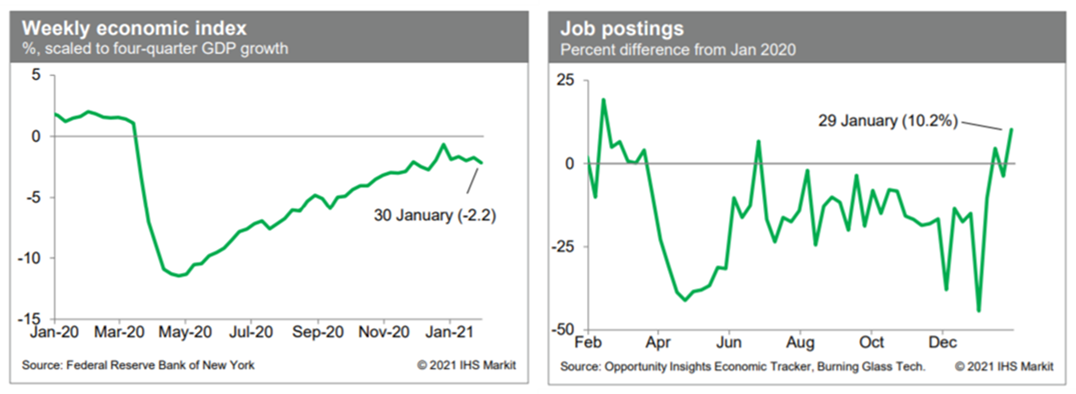

- The Weekly Economic Index (WEI), from researchers affiliated with the New York Federal Reserve, stood at -2.2 last week. If maintained over the balance of the first quarter, this would suggest about a 2.1% decline in real GDP over the four quarters ending in the first quarter; our latest GDP tracking implies only a 0.4% decline over this period. At some point in late March or early April, though, the WEI will turn sharply higher, when the 12-month changes in the input data series turn sharply positive. This suggests considerably less (and perhaps no) tension between recent readings on the WEI and our latest GDP tracking. Meanwhile, job postings in recent weeks have been, on average, at the highest level since prior to the COVID-19 crises, according to the Opportunity Insights Economic Tracker. This is encouraging, as it suggests a notable pickup in labor demand. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Bayer's Crop Science division plans a limited stewarded launch of its genetically modified insect-resistant ThryvOn (MON88702) cotton in 2021 as part of its "Ground Breakers" field trial program in the US. The company anticipates following that with a full commercial launch, pending regulatory approvals and other factors. The USDA's Animal and Plant Health Inspection Service (APHIS) deregulated the cotton trait in January. Bayer says that it will continue to seek additional regulatory approvals in export markets. When commercialized, Bayer plans to make ThryvOn technology available as a trait stack with Bollgard 3 ThryvOn cotton with XtendFlex technology (MON15985xCOT102xMON88701) in its Deltapine brand and select licensees as well. MON88702 produces the Bt mCry51Aa2 toxin. Bayer says that the trait represents the industry's first GM cotton trait to protect against feeding damage from key tarnished plant bug and thrips species. These include tobacco thrips (Frankliniella fusca), Western flower thrips (F occidentalis), tarnished plant bug (Lygus lineolaris) and the western tarnished plant bug (L hesperus). (IHS Markit Crop Science's Sanjiv Rana)

- Ford and Google have announced an agreement where the Google Cloud becomes Ford's preferred cloud provider, aimed at leveraging Google's expertise in data, artificial intelligence (AI) and machine learning. From 2023, all Ford and Lincoln vehicles will be powered by Android, with Google apps built in. Ford and Google have entered into a six-year partnership, creating a new collaborative group called Team Upshift, which is expected to use assets from both companies to "push the boundaries of Ford's transformation, unlock personalized consumer experiences, and drive disruptive, data-driven opportunities. This may include projects ranging from developing new retail experiences when buying a vehicle, creating new ownership offers based on data, and more," according to the statement. With Google as its preferred (but not exclusive) cloud provider, Ford expects to leverage data capabilities to improve customer experience with differentiated technology and personalized services; accelerate its product development, manufacturing and supply chain management; and to "fast-track" data-driven models that give customers real-time notices on things like maintenance requests. On a call discussing the relationship, attended by IHS Markit, Ford noted that the data could speed maintenance and repair with its insight into the vehicle and its own supply chain. The agreement is not exclusive, so Ford can find other partners for China or other markets, as well as ensuring it has another supplier to help support if needed. Google can also work with other automakers. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mexico's flash GDP report identifies both industry and services as growing at around the economy's average during the last quarter of 2020. However, in the full year, industry was significantly affected (down by 10.2%), while the downturn in services was also sizeable (down by 7.9%). Primary activities, mainly agriculture but also including forestry and fishing, grew by 2.0% as they were not affected by the COVID-19-virus lockdowns. (IHS Markit Economist Rafael Amiel)

- Recovery has been only partial for industry and services; while industry fell deeper in the second quarter of 2020 as many factories were fully closed during April and May, the sector grew faster during the second half of the year. At the end of 2020, industrial GDP was 3.4% below levels in the fourth quarter of 2019; meanwhile, services GDP was down by 5.3% year on year and still has a longer way to go to catch up.

- INEGI has also reported that of the 12 million people who left the labor force in April 2020, 9.5 million have returned but there are still 2.5 million fewer people employed compared with pre-pandemic levels.

- Formal employment figures, as measured by the number of people registered with the social security administration, show that as of December 2020 there were 650,000 jobs lost compared with a year earlier. At its peak in July 2020, this figure had reached 900,000.

- In 2021, the major driver of growth for Mexico's economy will be the US economy; Mexican exports of manufactures will benefit from increased demand in the United States. We project that total US imports will grow by 15%.

- Our latest forecast is for Mexico's GDP to grow by 3.7% in 2021, but this does not incorporate either the aforementioned increase in operational risks or the latest fourth-quarter GDP release.

- Although Colombia's 13.4% unemployment rate at the end of 2020 was a noteworthy improvement from the severe unemployment at the peak of the pandemic, which reached up to 21.4% in May, the labor market's recovery has slowed significantly. (IHS Markit Economist Lindsay Jagla)

- Still, job recovery did continue albeit gradually, with the number of employed people growing by 0.5% between November and December. The unemployment rate still rose slightly despite this increase as more people began job searches than were able to find jobs, increasing the number of unemployed people as well.

- Overall, Colombia's employed population remains 5.9% below its December 2019 level. The sectors that continue to have the greatest unemployment compared with 2019 are food services, accommodation, and entertainment.

- Although Colombia's labor market has shown significant resilience following the severe impact of the COVID-19-virus pandemic on employment, the slowdown in job recovery at the end of 2020 shows the more permanent damage caused by the crisis.

- As per IHS Markit's Commodities at Sea, total agribulk shipments from Brazil during December 2020 stood at 8.4mt (down 10% y/y). In terms of different products, soybeans exports slowed for the seventh consecutive month and stood at 0.3mt (down 89% y/y). While there was an increase in shipments of corn (4.2mt, up 44% y/y) and sugar (1.9mt, up 60% y/y). (IHS Markit Maritime and Trade's Pranay Shukla)

- During 2020, Brazil's agribulk shipments stood at 165.3mt (up 11% y/y). In terms of different agribulk products, there was an increase in shipments of soybeans (81mt, up 11% y/y), soybean meal (17.9mt, up 8%), and sugar (24.6mt, up 80%); while there was a decline in shipments of corn (35.6mt, down 11% y/y).

- As per provisional shipments, Brazil's total agribulk exports during January 2021 stood at 5.8mt; with soybeans, corn, soybean meal, and sugar at 0.1mt, 2.7mt, 0.9mt, and 0.5mt, respectively.

- During 2020, Brazilian agribulk exports to China (Mainland) increased in line with its hog herd recovery and high crush margins and stood at 62.5mt (up 13% y/y). The trend is expected to continue in 2021. However, the recent resurgence of African swine fever (ASF) cases in major pig farms in China (Mainland) could hamper some demand projections.

- The Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) on 27 January released its latest monthly banking bulletin. The report provides banking-sector data covering November 2020. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

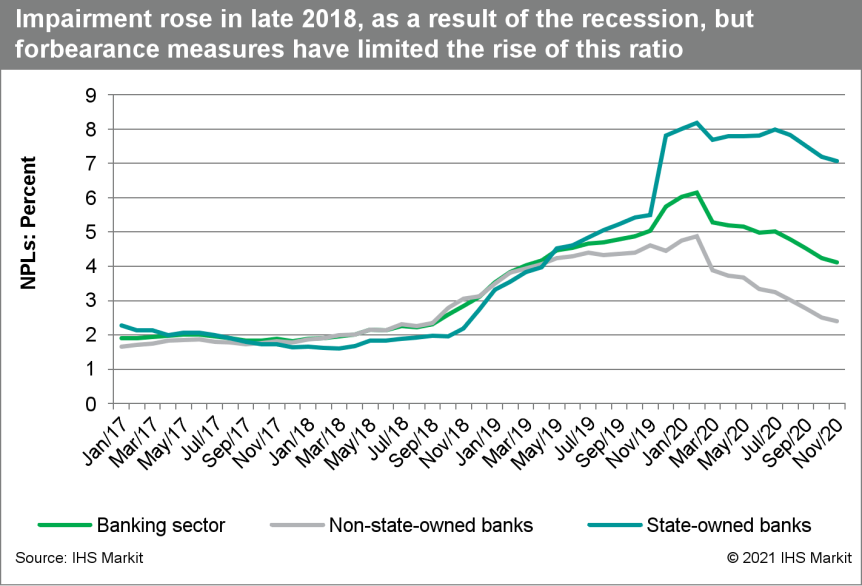

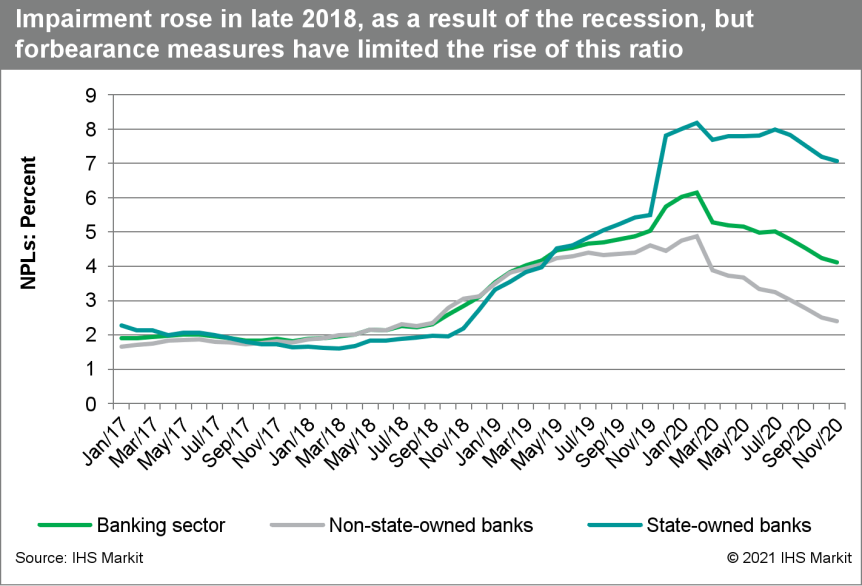

- Overall, key risk indicators display relative stability. The non-performing-loan (NPL) ratio of 4.1% has declined by 2 percentage points compared with its peak in February 2020 and is heavily influenced by household NPLs falling to 2.2% from 4.1% a year before.

- As has been the case since September 2019, capital strength indicators remained high: the capital adequacy ratio (CAR) stood at 23.2%, the tier-1 capital ratio at 21.3%, and the shareholders' equity-to-assets ratio at 15.6%.

- Regarding profitability, the return-on-assets (ROA) ratio was at 2.2%, one of the lowest figures observed over the past five years. Liquidity indicators appear to be robust, with the "broad liquidity ratio" at 64% of total deposits. Moreover, 86.4% of foreign-currency deposits are held as cash in the BCRA.

- The reduction of the NPL ratio is explained by the measures designed to contain the economic effects of the coronavirus disease 2019 (COVID-19)-virus pandemic. These allowed banks to classify NPLs as such if they were overdue by 150 days instead of the standard 90. Moreover, several credit-card balances were refinanced.

- Nevertheless, the deterioration of the economy that began in 2018 and was extended by the sovereign debt renegotiation and the COVID-19-virus crisis, indicates that impairment would be very likely to be higher if forbearance measures were not in place. Therefore, we expect that as these measures are lifted (as of 1 February this is expected to happen in March 2021), we will observe a rise in impairment in the whole sector.

- Furthermore, the increase in provisioning has been limited to privately owned and foreign-owned banks, with their coverage ratios at 194% and 234% of NPLs, respectively; significantly above the ratios displayed a year before at 122% and 100%. However, state-owned banks display this ratio at a low 85%. This is a figure to be observed over the following quarters, given that this segment displays the highest levels of impairment of the banking sector, reporting an NPL ratio of 7.9% in November 2020.

Europe/Middle East/Africa

- European equity markets closed higher; Spain +2.0%, France +1.9%, Germany +1.6%, Italy +1.1%, and UK +0.8%.

- 10yr European govt bonds closed lower; France, Germany, Italy, Spain, and UK all closed +3bps.

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover -11bps/257bps.

- Brent crude closed +2.0%/$57.46 per barrel, which is the highest closing price since February 21, 2020.

- The U.K. coronavirus strain that's sparked concern around the globe has picked up another mutation that appears to make the virus more resistant to vaccines. The mutation is present in the variants that arose in South Africa and Brazil, and is thought to help the virus resist vaccines and antibody therapies -- and infect people who already fought off COVID-19. (Bloomberg)

- Irish passenger car registrations have dropped by 17.8% year on year (y/y) during January because of ongoing COVID-19 virus restrictions. According to the latest data released by the Society of the Irish Motor Industry (SIMI) and published by beepbeep.ie, passenger car demand dropped to 25,188 units, from 30,650 units last year. The leading brand this month was Toyota with 3,777 units registered, although this was a decline of 12.2% y/y. In second place was Hyundai with a drop of 18.9% y/y to 2,729 units, while in third Volkswagen (VW) fell by 20.4% y/y to 2,547 units. Registrations in Ireland's light commercial vehicle (LCV) market retreated by 10.9% y/y to 5,033 units in January, while the medium and heavy commercial vehicle (MHCV) category slipped by 4.5% y/y to 340 units. It is a disappointing start to the year for the Irish market, particularly given how important January is. Indeed, this is typically when a substantial amount of the year's sales take place historically, as January is one of the two age-related numberplate change months during the year. (IHS Markit AutoIntelligence's Ian Fletcher)

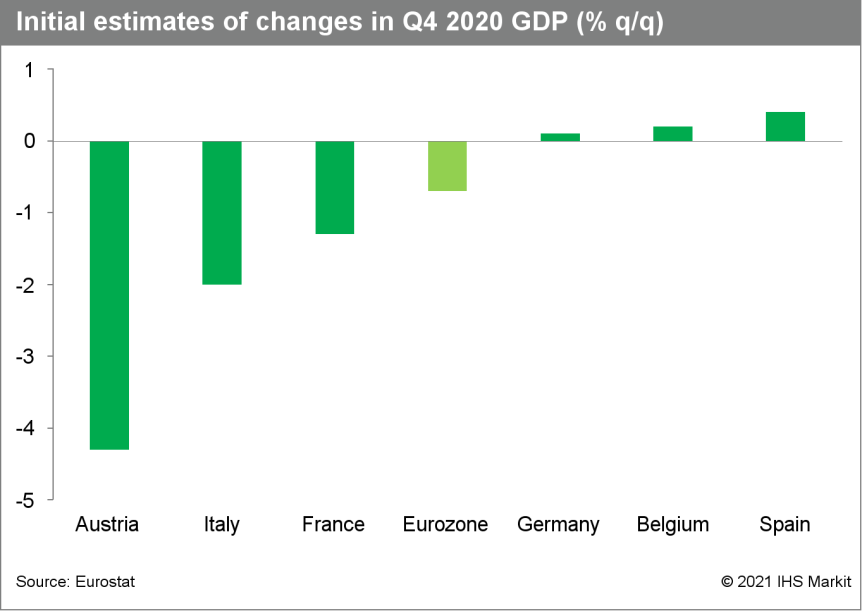

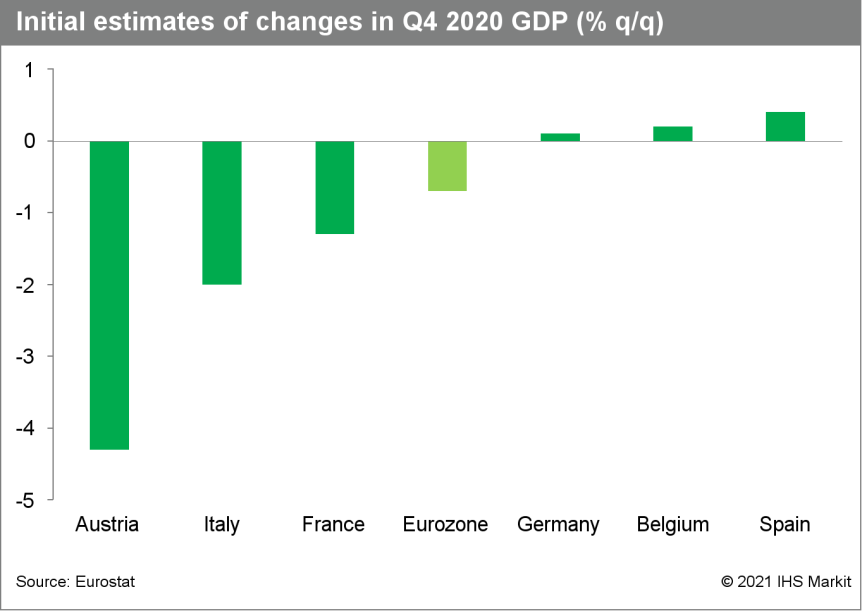

- According to Eurostat's 'preliminary flash' estimate, eurozone GDP fell by 0.7% quarter on quarter (q/q) in the fourth quarter of 2020, the third contraction in four quarters. This initial estimate is based on the data of 17 member states, covering around 93% of eurozone GDP. (IHS Markit Economist Ken Wattret)

- The decline was somewhat smaller than expected. According to Reuters' survey, the market consensus expectation was for a 1.0% q/q contraction.

- Eurozone GDP remained 5.1% below its pre-pandemic level in the fourth quarter of 2019, although this represents a marked improvement from the cumulative decline of 15.0% as of the second quarter of 2020, owing to the exceptional strength of the third-quarter-2020 rebound (12.4% q/q).

- Even factoring in that rebound, eurozone GDP in the fourth quarter of 2020 was at broadly the same level as in the fourth quarter of 2016, implying that the COVID-19 virus has wiped out four years of economic growth.

- In 2020 overall, eurozone GDP declined by 6.8%, a record annual decline by some margin, although again somewhat smaller than expected. IHS Markit's baseline forecast as of January 2021 was for an annual contraction of 7.1%.

- Eurostat's subsequent 'flash' estimate for the fourth quarter of 2020 will be released on 16 February, which may deliver some revisions to prior quarters' data, along with the first estimate of eurozone employment. A breakdown of GDP by expenditure component will follow on 9 March.

- Combining member states' expenditure breakdowns, which are already available with higher frequency activity data, the pattern of expenditure in the fourth quarter of 2020 is likely to have been mixed. Private consumption clearly underperformed, reflecting the nature of the COVID-19 virus restrictions imposed across many member states, while exports held up, supported by more favorable external demand conditions.

- The BMW Group has announced that it will begin sourcing aluminum with immediate effect produced from solar power, according to a company statement. The move is part of BMW's overall plan of lowering CO2 emissions from its supplier network by 20% from 2030. Aluminum production requires large amounts of energy and therefore when it is manufactured from a non-renewable or only partially renewable energy mix, its manufacturing process produces a substantial amount of CO2 emissions. The aluminum produced using solar power is processed in the light metal foundry at the company's Landshut facility to manufacture body and drive train components. Sourcing 43,000 tons of solar aluminum valued in the three-digit million euros will supply nearly half the annual requirements of the light metal foundry at Plant Landshut. Manufacturing these aluminum supplies using solar power will save over 2.5 million tons of CO2 over the next 10 years. This is equivalent to 3% of the CO2 targets the company has set for its supplier network. (IHS Markit AutoIntelligence's Tim Urquhart)

- Tesla is set to receive at least EUR1 billion (USD1.2 billion) in subsidies from the German government relating to the firm's new plant that is currently being built in the state of Brandenburg, according to a Reuters report that cited Business Insider. The European Union has already approved EUR2.9 billion of subsidies for the European Battery Innovation project, which includes more than 40 companies; it is part of the European Battery Alliance which is aimed at decreasing Europe's dependence on automotive battery supplies from China and other parts of Asia. Business Insider reported that Tesla would get direct support to the tune of EUR1 billion from the federal government and the regional state of Brandenburg, where the Tesla factory is being built, as well as any EU aid. However, a spokesperson for the German Economy Ministry said it was as yet unclear how much federal support Tesla would receive, while Brandenburg and Tesla did not put anyone forward for comment. (IHS Markit AutoIntelligence's Tim Urquhart)

- Saipem has won a contract worth USD553 million (EUR460 million) to design, construct and install 64 wind turbine foundations at the Courseulles-sur-Mer wind farm offshore Normandy, France. The contract, awarded by developer Eoliennes Offshore du Calvados (EODC), is subject to a final investment decision and notice to proceed. The Courseulles-sur-Mer Offshore Wind Farm zone is located approximately 16 km off the coast of France's Calvados region, in water depths ranging from 22 to 31 m. The foundations will consist of large steel monopiles with transition pieces. They are to be fabricated in Europe and installed by heavy-lift crane vessel Saipem 3000; installation is understood to be scheduled between June and August 2022. The deployment is set to be one of the HL2 vessel's first in the renewables sector. EODC is a consortium between EDF Renewables, Enbridge subsidiary EIH S.à r.l, and wpd Offshore France. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Italy faces a double-dip recession in early 2021 after the economy lost notable ground - as expected - in the final quarter of 2020. However, we anticipate a less severe GDP contraction during the first quarter of 2021 after Italy relaxed its COVID-19 virus-related restrictions for most regions from 1 February 2021 to reflect falling rate of new infections. (IHS Markit Economist Raj Badiani)

- Italy's National Institute of Statistics (Instituto Nationale di Statistica: ISTAT) estimates that GDP fell again in the final quarter of 2020, amid tight restrictions to tackle a second wave of COVID-19 infections.

- According to the first estimate, Italy's GDP contracted by 2.0% quarter on quarter (q/q) in the fourth quarter. GDP rose by 15.9% q/q in the third quarter, after falling by 17.8% in the first half of 2020 when compared to the last quarter of 2019.

- In annual terms, GDP fell by 6.6% year on year (y/y) in the fourth quarter, and by 8.9% in the full-year 2020.

- This fared better than expected, after we estimated that the economy shrunk by 2.8% q/q in the fourth quarter.

- ISTAT has not provided a detailed breakdown of the fourth-quarter GDP data, but it confirmed falls in value added in industry and services. On the expenditure side, ISTAT reports negative contributions from both domestic demand and net exports.

- IHS Markit expects GDP to contract again in the first quarter of 2021 amid prevailing restrictions to prevent a new spike in COVID-19 infections.

- However, we anticipate a less severe contraction during the first quarter after Italy relaxed its COIVD-19 restrictions for most regions from 1 February 2021 to reflect falling rate of new infections during the second half of January.

- Our January assessment expects the economy to contract by 0.8% q/q in the first quarter of this year, implying Italy faces a double-dip recession.

- The Swiss essential oil and flavor manufacturer Givaudan reported that its 2020 sales reached CHF6.32 billion (USD7.06 billion) in 2020, 1.4% more year-on-year, exceeding previous estimates. The EBITDA increased by 9.6% to CHF1.39 billion in 2020 compared with CHF1.27 billion in 2019, whilst the EBITDA margin was 22.1% in 2020 compared with 20.6% in 2019. On a comparable basis, the EBITDA margin was 22.8% in 2020 versus 21.5% in 2019. Fragrance and beauty business unit sales increased by 4.5% y-o-y to CHF2.92 billion. Taste and wellbeing business unit sales rose by 0.2% to CHF3.39 billion. The company was able to maintain global operations with minimal disruptions despite Covid-19 pandemic effects on the global supply chains. Its net debt at December 2020 was CHF4.04 billion in December 2020, 10% more y-o-y. The increasing debt is a consequence of the acquisition of the US Ungerer flavour processor in Q1 2020. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- According to a 'flash' estimate for the fourth quarter of 2020 by Statistics Sweden (SCB), the Swedish economy grew by 0.5% quarter on quarter (q/q) and declined by 2.6% year on year (y/y) on a calendar-adjusted basis. This is slightly better than the growth of 0.3% q/q in our January baseline and significantly better than the 1.2% contraction in the Riksbank's latest forecast. (IHS Markit Economist Daniel Kral)

- This means that the economy has regained almost two-thirds of the output lost in the first half of 2020. For the full year, the economy contracted by 2.8%, among the best in Europe, slightly better than our latest forecast of a drop of 3.0%.

- There is no detailed breakdown accompanying the release, but the press release states that the growth was led by the production side of the economy, while the consumption side lagged behind. This is consistent with confidence indicators that point to a strong rebound in the manufacturing sector but weaker consumer and services-sector confidence.

- The SCB also released the monthly GDP series until the end of 2020, which shows that growth in December was 0.2% month on month (m/m) after a mild drop in November. This implies that the growth of 0.5% q/q in the fourth quarter of 2020 was likely driven by a large positive carry-over effect between the third and fourth quarters.

- Light-vehicle registrations in Sweden have improved substantially during January, according to data published by the Swedish trade association Bilindustrieföreningen (BIL Sweden). Passenger car registrations have increased by 22.5% year on year (y/y) to 20,573 units. During the month, Volvo was the biggest selling brand with 4,237 units registered, a jump of 51.6% y/y, followed by Volkswagen (VW) which slid by 4.8% y/y to 2,717 units. In third was Kia, its registrations increased 2.1% y/y to 2,001 units. Light commercial vehicles (LCVs) with a gross vehicle weight (GVW) of less than 3.5 tons jumped by 83.2% y/y in the month to 2,149 units. Sales of heavy commercial vehicles (HCVs) with a GVW of more than 16 tons slipped by 8.1% y/y in January to 386 units. While the COVID-19 virus pandemic overhangs the Swedish market, light-vehicle registrations have put in a very much stronger performance than in January 2020, when this was not a factor. The main reason for this has been the low base of comparison due to the changes made to the bonus-malus at the beginning of 2020, when the measurement of CO2 moved to using WLTP rather than NEDC. Nevertheless, IHS Markit forecasts that passenger car registrations will grow by around 3.2% y/y, and LCV registrations will expand by almost 11.4% y/y in 2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- Israel-based connected car data startup Otonomo Technologies will go public through a merger agreement with Software Acquisition Group, Inc. II, a special-purpose acquisition company (SPAC). This will bring Otonomo's market value to USD1.4 billion. The deal involves more than USD307 million in cash, including a USD172.5-million private investment from investors such as Fidelity Management & Research Co. and BNP Paribas Asset Management Energy. As part of the agreement, the combined company will retain the name Otonomo and will be listed on the NASDAQ stock exchange under the ticker symbol OTMO. The deal is expected to be closed in the second quarter of 2021. Otonomo offers a cloud-based software platform that can capture and anonymize vehicle data to help companies to develop apps and services for fleets, smart cities and individual consumers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Kenya's non-seasonally adjusted GDP rebounded by 2.2% q/q during the third quarter of 2020, from an 11.2% q/q contraction in the second quarter, the Kenya National Bureau of Statistics reported. Nonetheless, GDP remains below pre-COVID-19-virus levels and fell by 1.1% year on year (y/y) during the third quarter, from a 5.5% y/y contraction in the previous quarter. Kenya's overall GDP fell by 0.5% y/y during the first three quarters of 2020. (IHS Markit Economist Thea Fourie)

- Real GDP benefitted from resilient growth in the agriculture, mining and quarrying, construction, and public administration sectors of the economy. Sectors that showed a swing towards positive y/y growth during the third quarter from a contraction in the second quarter included electricity and water, transport and storage, information and communication, financial and insurance, and real estate.

- Sectors that continued to record y/y contractions during the third quarter included manufacturing, wholesale and retail trade, accommodation and food services, education, and professional and administrative services, the Kenya National Bureau of Statistics reported.

- Agricultural production in Kenya remains shielded from the impact of COVID-19-virus lockdown measures implemented during the second quarter of 2020, with growth in that sector averaging 6.3% y/y in the third quarter from 7.3% y/y in the second quarter. Agricultural production benefitted from favorable weather conditions while exports of tea, fruit, and sugarcane supported Kenya's overall growth performance during the third quarter.

- Nonetheless, Kenya's economic recovery outside of the agricultural sector remains fragile. There was a second wave of rising COVID-19 cases during the fourth quarter of 2020, with renewed localized lockdowns and movement restrictions introduced by the government over the period.

Asia-Pacific

- APAC equity markets closed higher; India +2.5%, Australia +1.5%, South Korea +1.3%, Hong Kong +1.2%, Japan +1.0%, and Mainland China +0.8%.

- With the Hongguang Mini EV becoming an instant hit in the EV market, a number of automakers, mostly Chinese OEMs, have rolled out their A-segment mini-size models in the market. Model such as the R1 from Great Wall Motor's Ora brand, the Clever EV from SAIC's Roewe brand, and the E300 from SGMW's Baojun brand are some of the best-selling nameplates among recent launches in the segment. During 2020, production volumes of passenger BEVs in China increased 9.4% to 991,000 units. Rising demand for mini-sized models has contributed to the expansion. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) manufacturers NIO and Xpeng Motors have announced their delivery results for January. NIO delivered 7,225 vehicles, an increase of 352.1% year on year (y/y). The deliveries include 1,660 units of the ES8, 2,720 units of the ES6 and 2,845 units of the EC6. As of 31 January, NIO's cumulative deliveries of the ES8, ES6 and EC6 totalled 82,866 units. Xpeng said its vehicle deliveries rose by 470% y/y to 6,015 vehicles in January, setting a new monthly record. The deliveries consist of 3,710 units of the P7 electric sedan and 2,305 units of the G3 sport utility vehicle (SUV). As of 31 January, cumulative deliveries of the P7, which went on sale in July 2020, reached 18,772 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Nissan has received 20,044 bookings for the Note e-power in the first month, against a monthly target of 8,000 units, according to a company statement. The vehicle, which was released in November 2020 and has been on sale since 23 December, is the first full model change in about eight years. Of the 20,000 bookings, over 80% were for the X grade and more than 50% of the customers opted for Nissan connect navigation system, intelligent around view monitor, and adaptive LED headlight system. Nissan unveiled a four-year plan to achieve profitability by the end of fiscal year (FY) 2023/24. As part of the plan, among other factors, the automaker plans to expand its presence in the electrified car segment, including e-POWER, to achieve annual sales of 1 million electric vehicles (EVs) by FY 2023/24 and increase its electrification ratio to 60% in Japan. The new Note is based on the CMF-B platform, replacing the V platform in the previous model. The new model is available in 13 colors with 16-inch aluminum wheels. In the interior, the automaker has installed zero gravity seats and large armrests for enhanced comfort on long-distance trips. There is also a digital gauge display and a wireless charging option. The vehicle is powered by the second-generation e-POWER system with increased motor torque, by 10%. The new Note also gets advanced safety technology that offers 360 degrees of coverage to provide drivers with added assistance. IHS Markit expects sales of the new Nissan Note to be around 149,500 units in 2021. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Indian government's new stimulus measures to revive an economy severely affected by the COVID-19 virus pandemic include a sharp increase in healthcare and capital spending, at the cost of lower allocations for public welfare schemes and capital infusion for banks. The INR34.8-trillion (USD476 billion) budget targets a deficit of 6.8% of GDP in fiscal year 2021-22, after it widened to 9.5% of GDP in the current fiscal year from its original 3.5% target. (IHS Markit Economists Deepa Kumar, Angus Lam, and Hanna Luchnikava-Schorsch)

- The government has been criticized for not spending enough during the pandemic. It is therefore no surprise that the budget is focused on overcoming the pandemic and reviving the economy. It targets a deficit of 6.8% of GDP in FY 2021, including an estimated INR5.54 trillion (about USD80 billion) in capital expenditure - an increase of 34.5% from the previous year's target. This includes sizeable allocations for the power distribution sector, railways, and highways, with a notably large allocation for the development of roads in West Bengal, where the ruling Bharatiya Janata Party (BJP) is seeking a crucial election win in April-May 2021.

- For the healthcare sector, the budget allocates INR2.2 trillion -more than double the FY 2020 allocation. This includes INR350 billion (0.2% of projected GDP) for the COVID-19 vaccination program that commenced in January 2021, with the government planning to vaccinate 300 million people by August 2021. India's total healthcare spending is among the lowest in the world at around 1.5% of GDP in FY 2020. However, it is the world's largest vaccine producer, which would be an advantage in terms of securing sufficient vaccines at an affordable price for the government.

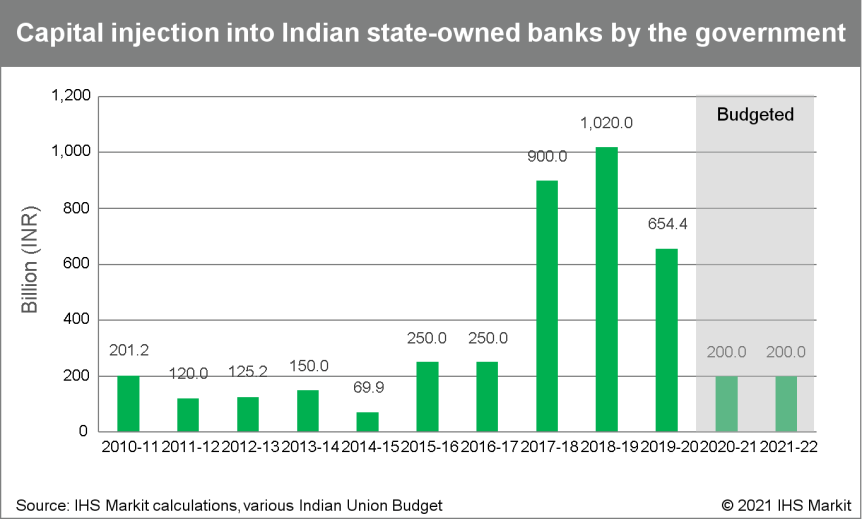

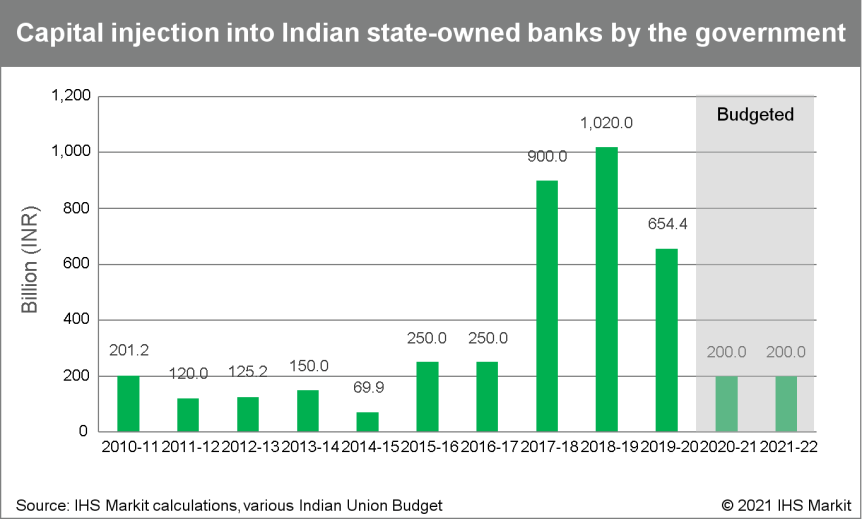

- The government announced a capital infusion worth INR200 billion into public banks (PSBs) in FY 2021 - the same allocation as in FY 2020. It did not make clear whether these will be based on banks' performance, used to boost lending, or to supplement capital, but the amount is lower than IHS Markit expected.

- In addition, the government announced the establishment of an asset reconstruction company (ARC) and an asset management company (AMC) to "take over the existing stressed debt and then manage and dispose" to retail and institutional investors. Although the budget did not provide details for the plan or the initial paid-up capital of the state-owned AMC and ARC, IHS Markit expects that this will supplement the current cohort of ARCs and will likely reduce the write-off that banks have to take on - which, together with the loan restructure scheme, will reduce banks' capital needs, partially compensating for the low amount of capital infusion in FY 2021.

- Although the government left direct taxes unchanged, it raised import tariffs on certain agricultural products, chemicals and plastics, and vehicle parts, among other items. This is the third budget featuring import tariff hikes, which aligns with the government's protectionist stance within the "Make in India" policy. Other revenue measures included a divestment target of INR1.75 trillion from public-sector companies.

- Although the budget is still limited in size and scope, it is a substantial addition to the previously announced stimulus measures, which should provide a boost to domestic demand in FY 2021. Based on the spending priorities, the recovery in demand will be driven by public consumption and investment in FY 2021. With no specific measures to stimulate the labour market and only limited support for the banking sector, the speed of private spending and investment recovery may lag behind, although it will subsequently benefit from the overall improvement in economic activity.

- Southeast Asian ride-hailing giant Grab has closed a USD2-billion five-year term loan facility. The term loan was upsized from the initial principal amount of USD750 million, after receiving strong interest from international institutional investors. The company plans to use these funds to finance corporate activities and diversify its financing resources. Anthony Tan, group chief executive and co-founder of Grab, said, "I am deeply encouraged by the trust placed in us by investors who believe in our mission and recognize the value of our super app platform, as we continue making consistent progress in achieving our growth and sustainability milestones". Grab is focusing on expanding its range of services, from transport to food delivery and payments. The company announced that its net revenue grew by 70% year on year (y/y) in 2020 and has recovered to above pre-COVID-19 virus pandemic levels. It also said that it has achieved segment breakeven for ride-hailing in all its operating markets. The company has reportedly selected Morgan Stanley and JPMorgan Chase for a potential US initial public offering. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 02 February 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.