All major US and most European equity indices closed higher, while APAC was mixed. US and benchmark European government bonds closed lower. CDX-NA and European iTraxx closed modestly tighter across IG and high yield. Natural gas, oil, silver, and gold closed higher, while the US dollar and copper closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; S&P 500/Nasdaq +0.7%, DJIA +0.6%, and Russell 2000 +0.4%.

- 10yr US govt bonds closed +4bps/1.64% yield and 30yr bonds +5bps/2.09% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -4bps/297bps.

- DXY US dollar index closed -0.2%/93.73.

- Gold closed +0.3%/$1,771 per troy oz, silver +2.7%/$23.88 per troy oz, and copper -0.5%/$4.70 per pound.

- Crude oil closed +0.9%/$82.44 per barrel and natural gas closed +2.0%/$5.09 per mmbtu.

- The first bitcoin-focused exchange-traded fund rose in its trading debut Tuesday after getting a warm reception from investors. The ProShares Bitcoin Strategy ETF climbed most of the day, gaining nearly 5% to settle at $41.94. About $981 million of shares changed hands over the session, making it the second-most highly-traded ETF debut ever, according to Elisabeth Kashner, director of ETF research at FactSet. (WSJ)

- US builders are working on new houses at a furious pace. The number of homes under construction—an item commonly overlooked in this report—increased to 1.426 million (seasonally adjusted) in September. That is the highest total since January 1974; it partly explains why builders are finding it hard to locate labor and materials. (IHS Markit Economist Patrick Newport)

- The single-family permits category edged down 0.9% (plus or minus 0.8%; statistically significant) to a 1.041 million rate. Single-family permits have slid 18% since January; their year-to-date totals, nonetheless, are the highest since 2007.

- Multifamily permits tumbled 18% from a six-year high to a 548,000-unit annual rate; the quarterly total, 600,000, was the highest since the fourth quarter of 1986.

- Housing starts edged down 1.6% (plus or minus 11.4%, not statistically significant) in September to a 1.555 million annual rate; single-family starts were unchanged at 1.08 million; multifamily starts dropped 5.0% to a 475,000-unit yearly rate.

- Demand remains strong. But builders are fighting headwinds: high material costs, labor shortages, and building material supply chain issues—on top of the pre-pandemic headwinds of a lack of buildable lots and skilled labor.

- Despite steady declines from January and headwinds, total housing starts and single-family housing starts are on track for having their strongest year since 2006. Multifamily starts will post its highest totals since 1986.

- Air Products has announced plans for a $4.5-billion blue hydrogen complex in Ascension Parish, Louisiana, its largest ever US investment. The plant, which will produce more than 750 million standard cubic feet/day of hydrogen, will be the largest blue hydrogen facility globally. Air Products will build and operate the site, which is expected to be operational in 2026. (IHS Markit Chemical Advisory)

- The blue hydrogen produced will be split between supplying Air Products' US Gulf Coast hydrogen pipeline network and used to make blue ammonia for local and export markets. Air Products' hydrogen pipeline network stretches more than 700 miles from Galveston Bay, Texas, to New Orleans, Louisiana, and supplies customers with more than 1.6 billion cubic feet of hydrogen per day from approximately 25 production facilities. Blue ammonia can be exported to global markets for conversion back to hydrogen for transportation and other markets, the company says.

- Blue hydrogen still uses hydrocarbons as feedstock, with the carbon dioxide (CO2) in the production process captured for permanent sequestration. Approximately 95% of the CO2 generated at the Louisiana complex will be captured and transported by pipeline to be sequestered inland a mile underground resulting in the removal of more than 5 million metric tons of CO2 per year, making it the largest permanent carbon capture sequestration operation in the world, Air Products says.

- If all the plant's blue hydrogen produced was used to power either long-haul freight trucks or in energy production, the plant would save more than 4 million tons of CO2 per year versus diesel or more than 8 million tons of CO2 per year versus coal, respectively.

- On October 18, Riverside Solar LLC applied with the New York State Office of Renewable Energy Siting for a permit on an approximately 100-MW (ac) solar facility to be located in the towns of Lyme and Brownville, Jefferson County, New York. "The Project will significantly contribute to the State's clean energy and carbon reduction goals and provide direct environmental and socioeconomic benefits to the State and the local economy," said the application. "The Project is a zero-emission, renewable source of energy that will assist the State in meeting the goals of both the Climate Leadership and Community Protection Act (CLCPA) and State Energy Plan, which include obtaining 70% of the State's energy consumption from renewable sources by 2030, and 100% of the State's energy from clean sources by 2040." The facility will span approximately 1,000 acres and would connect into the regional transmission system on National Grid's Lyme Tap off of the Thousand Island-Coffeen 115-kV line. (IHS Markit PointLogic's Barry Cassell)

- The composition of liquid refreshment beverages (LRBs) sold in the US has changed and the share of 100% juice and juice drinks in the product mix has dropped to 8.4% in 2020 from 10.7% in 2014, according to a new report published by economic and public policy consulting firm Keybridge. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- The share of carbonated soft drinks (CSDs) in LRB sales fell to 33.3% in 2020, down from 40.8% of the total beverage mix in 2014.

- The report, prepared for the American Beverage Association and the Alliance for a Healthier Generation, also reveals that average LRB calories per person fell by 10% halfway to the 20% calorie reduction goal that was set for 2025.

- Significantly, the pace of per person LRB calorie reductions has grown every year since 2016. The largest single year decline of 5.0% (or 9.6 calorie per person per day) was in 2020.

- From 2014 to 2020 per person volumes of full calorie CSDs and 100% juices and juice drinks, which are the source of more than 80% of all LRB calories, fell by 11.0% and 18.6%, respectively. Effectively, the LRB product mix in the US is shifting towards low- and no-calorie beverages.

- The daily juice volume consumption per person fell from 3.7 ounces in 2014 to 3.1 oz in 2020. Meanwhile, the daily CSDs consumption fell from 14.0 oz in 2014 to 12.3 oz in 2020.

- The total volume of eight-ounce equivalent servings of juice fell from 53.04 billion in 2014 to 47.08 billion servings in 2020. As regards CSDs, their consumption amounted to 185.67 billion eight-ounce equivalent servings in 2020, down from 202.80 billion servings in 2014.

- Yet, it is not all bad news for the industry. More recently, however, product reformulations and shifting consumption toward lower calorie versions of these beverages have also made major contributions to calorie reductions within these categories.

- Amazon's Zoox is to begin testing autonomous cars in Seattle, Washington state (United States). The company plans to deploy a fleet of Toyota Highlander vehicles integrated with its sensor technology and autonomous software, reports Automotive News. Zoox expects Seattle's climate to support the development of autonomous technology that can operate in a wider range of environments. The company also plans to open an office in Seattle next year. Zoox, an autonomous vehicle (AV) technology startup that was acquired by Amazon last year, plans to develop fleets of small, on-demand AVs that do not have a steering wheel or interior controls. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota Motor North America (TMNA) plans to invest USD3.4 billion in the United States through 2030 to develop and localise automotive battery production, reports Reuters. TMNA plans to establish a new company and build a new US automotive battery plant together with Toyota Tsusho, Toyota Group's metals trading arm. The company aims to start production at the new plant, which will involve a planned USD1.29-billion investment, in 2025. Toyota expects to create 1,750 new jobs in the country with the plant. Toyota did not provide a location for the proposed plant or details of its planned production capacity and business model, but said that initially it will focus on producing batteries for hybrid vehicles at the plant. (IHS Markit AutoIntelligence's Jamal Amir)

- On October 19, GE Hitachi Nuclear Energy (GEH) and BWXT Canada Ltd. announced a teaming agreement to cooperate on engineering and procurement to support the design, manufacturing and commercialization of the BWRX-300 small modular reactor (SMR). (IHS Markit PointLogic's Barry Cassell)

- Through the agreement, if the BWRX-300 is selected for deployment at Ontario Power Generation's Darlington Nuclear Generation Station, BWXT Canada could provide detailed engineering and design for manufacturability for BWRX-300 equipment and components and ultimately could supply certain key reactor components for the deployment of the BWRX-300 in Canada.

- The BWRX-300 is a 300 MWe water-cooled, natural circulation SMR with passive safety systems that leverages the design and licensing basis of GEH's U.S. NRC-certified ESBWR. GEH is projecting that the BWRX-300 will require significantly less capital cost per MW when compared to other SMR designs.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for France -0.1%; Spain +0.7%, Germany/Italy +0.3%, and UK +0.2%.

- 10yr European govt bonds closed lower; France/UK +3bps and Germany/Italy/France +4bps.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -4bps/254bps.

- Brent crude closed +0.9%/$85.08 per barrel.

- Ford has announced that it is investing GBP230 million in its Halewood facility to enable it to transition to manufacturing components for forthcoming battery electric vehicles (BEVs) built in Europe. According to a statement the site, which currently manufactures vehicle transmissions, will instead assemble electric power units for fully electric passenger cars and light commercial vehicles (LCVs). Output is expected to start in mid-2024, and it is said that the location will have the capacity to produce 250,000 unit per annum (upa). The company said that the investment will secure the future of its workforce at the site, but is subject to and includes support from the UK government's Automotive Transformation Fund. The announcement is the latest welcome news for the UK automotive industry after investment dropped off significantly after the Brexit referendum. During the past 12 months, several other investment decisions have already been announced, helping the UK automotive industry take steps towards an electrified future. This includes plans by Britishvolt to build a large scale battery manufacturing facility in the north of the country that is intended to supply manufacturers. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ride-hailing firm Bolt has launched its services in Bristol, United Kingdom. Bolt is to offer the rides in the city for a base price beginning at GBP3.50 (USD4.82), while the average per-mile rate is GBP1.15 (USD1.60) and the rate-per-minute is GBP0.15 (USD0.21), reports The Bristol Post. Bristol marks Bolt's 12th serviceable city in the UK, joining Birmingham, Cambridge, Leicester, London, Milton Keynes, Newcastle, Nottingham, Peterborough, Portsmouth, Sheffield, and Wolverhampton. Bolt has 75 million customers in 45 countries and is primarily active in Eastern European and African cities. The company, which operates food delivery and ride-hailing services, recently entered the car-sharing market to diversify its revenue streams. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Researchers have warned that the EU's sustainability ambitions for the agri-food sector could end up causing more food insecurity and biodiversity losses in Africa. On 13 October, the European Centre for Development Policy Management (ECDPM) published a paper that urged EU policymakers to address the possible negative consequences of the Farm to Fork strategy (F2F) for Africa.The think tank said the F2F's potential negative impact on EU agricultural production and exports could lead to higher international food prices and increased global food insecurity - given that the EU is one of the biggest agri-food trade forces worldwide. The researchers argued that this will particularly affect Africa because of its reliance on food imports to feed its fast-growing population. They also refer to an analysis by the US Department of Agriculture (USDA) which found that this could cause tens of millions of people to become food-insecure by 2030, mostly in Africa. The ECDPM further highlights that the F2F could shift EU agricultural production to places outside of Europe with less environmentally friendly food production methods, saying this could increase greenhouse gas emissions elsewhere and undermine the EU's sustainability objectives. The researchers claim that Africa has the potential to fill in a part of this production gap, but fear a local expansion of farming could destroy more biodiversity-rich areas across the African continent. The think tank concludes that EU policymakers should make full use of their policy instruments to help developing countries improve the sustainability of their food systems, including through trade agreements, investment support and development aid. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Volvo Cars has revealed more details about its initial public offering (IPO). In a statement, the automaker said that the class B shares that will be sold will be priced at a range of SEK53-68 per share. It added that this would correspond to a market capitalization of the business of between SEK163 billion and SEK200 billion on completion. The final offer price will be set around 27 October, prior to trading beginning as proposed on 28 October. The company also said that the total offer will comprise between 367,647,058 and 471,698,113 newly issued common shares which are expected to yield gross proceeds of around SEK25 billion before transaction costs. It noted that AMF Pensionsförsäkring; Swedbank Robur; If P&C Insurance Ltd; Nordea Investment Management AB, on behalf of Nordea Funds Ltd.; Skandia Fonder AB and Skandia Mutual Life Insurance Company; and Danica Pension have committed to acquire shares valued at around SEK6.4 billion, which represents 26% of the gross proceeds. Volvo Cars' key shareholder, Geely Sweden Holdings, has also granted the option of more shares to be made available to cover any overallotment, which could yield as much as SEK33.75 billion. Separately, Volvo Cars has also announced that it has reached an agreement with Geely Holding to acquire full ownership of its Luqiao (China) manufacturing facility, which it plans to consolidate within its own assets. (IHS Markit AutoIntelligence's Ian Fletcher)

- Angola's real GDP grew by 1.2% y/y in the second quarter 2021, according to data from the National Institute of Statistics (INE), the first growth registered in a quarter on an annual basis since the second quarter of 2019. However, on a quarter-on-quarter (q/q) basis, real GDP fell by 2.4%.(IHS Markit Economist Alisa Strobel)

- The sectoral breakdown of the data shows that agricultural livestock and forestry activities as well as fishing activities grew by 8.5% y/y and 104.2% y/y, respectively, in the second quarter. Manufacturing growth reached 1.4% y/y, following the 1.4% annual decline in the previous quarter. Notably, in the second quarter, output in the electricity and water category recovered with 2.4% y/y growth, from a contraction of 0.3% y/y in the first quarter, and transportation and storage activity recovered with 80.4% y/y growth, from a contraction of 15.6% y/y in the previous quarter, a fifth consecutive quarter of decline.

- In the second quarter, oil extraction and refining continued its decline since the first quarter of 2016, falling on an annual basis by 12.3%. However, on a quarterly basis, the category recorded its first growth since the first quarter of 2020, with activity increasing 0.8% q/q. The mining sector also recorded an annual decline during the second quarter, with output falling by 9% y/y, down from 27.9% growth in the first quarter. The sector also performed poorly on a quarterly basis, with output dropping by 36.9% q/q, down from 20.6% growth in the first quarter.

- IHS Markit has lowered the forecast for Angola's real GDP in 2021, now expecting the economy to grow by 0.2%, its first expansion since 2015 on the back of non-oil industry growth. Non-oil government revenue has recorded an increase of 30% in this fiscal year so far, according to Angola's Ministry of Finance.

- Uber is testing Pool Chance, a feature that allows multiple passengers to share a car travelling in the same direction, in Kenya, reports TechCrunch. The new service, being introduced for the first time in Africa, is expected to be rolled out in Ghana and Nigeria. Lorraine Ondoru, Uber's head of communications for East and West Africa, said, "We are currently trialing a new Uber ride, Pool Chance, which will cut costs for riders in Nairobi [Kenya] when they share their ride with others heading in the same direction. We use this approach when introducing something new and we want to ensure the marketplace remains healthy and balanced. We will share more details once this has been officially launched". Pool Chance is similar to UberPool, which was first launched in the San Francisco Bay Area in 2014 and later expanded to multiple cities across the world. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +1.5%, South Korea +0.7%, Mainland China/Japan +0.7%, and Australia/India -0.1%.

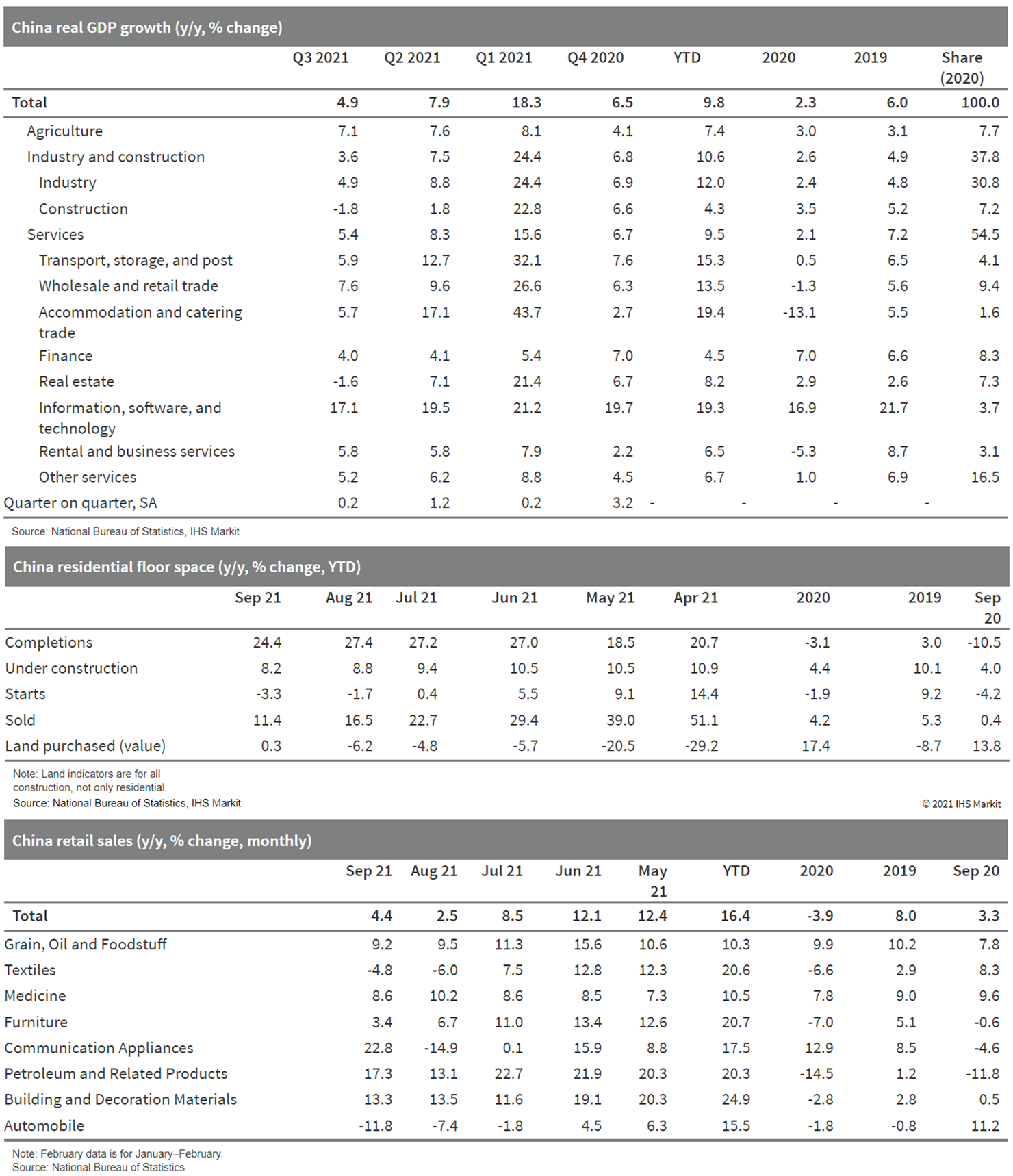

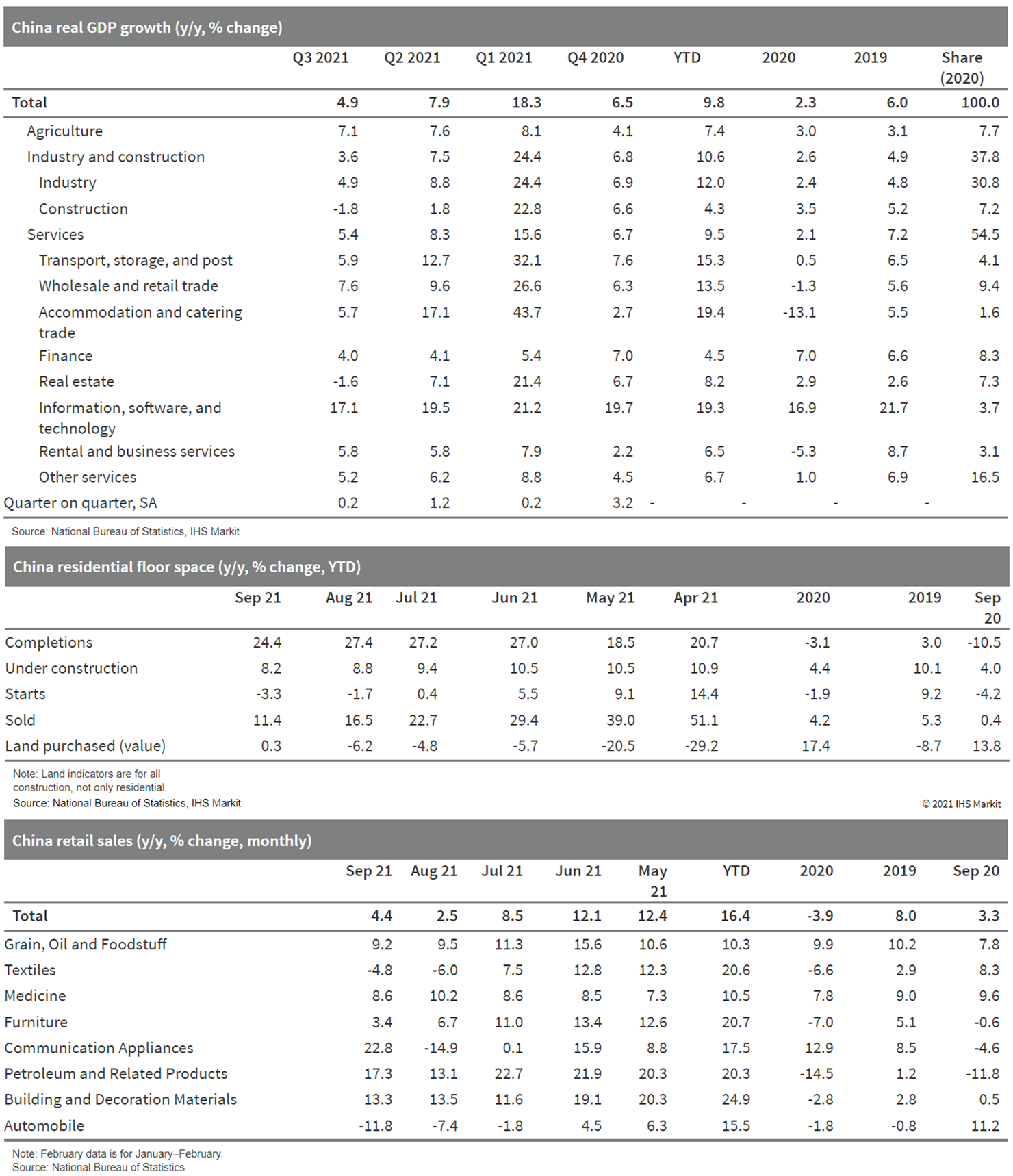

- China's economic expansion lost momentum in the third quarter as the power crunch and soaring commodity prices curbed industrial production, tightening property market regulations and slow local government bond issuance dragged on fixed-asset investment (FAI), and escalating pandemic controls took a toll on retail sales. Further slowdown is expected in the fourth quarter. (IHS Markit Economist Yating Xu)

- Real GDP grew 4.9% year on year (y/y), down from 7.9% in the second quarter. The 2020-21 two-year average growth rate declined from 5.5% in the second quarter to 4.9% in the third quarter. Meanwhile, the cumulative growth for the first nine months of 2021 fell to 9.8% y/y, compared with 12.7% y/y in the first half of the year and 18.3% y/y in the first quarter. Economic recovery continued, but at a much slower pace as quarter-on-quarter (q/q) growth dropped to 0.2% from 1.2% expansion in the previous quarter.

- On the supply side, the headline moderation was broad across the agriculture, industry, and services sectors, with industry and the construction sector leading the deceleration amid the power crunch and impacts from China's decarbonization policy. Industrial value-added growth fell to its lowest over the past five quarters, and construction value-added deteriorated to contraction territory for the first time since the beginning of 2020. Services growth declined by three percentage points, with the accommodation and catering segments hit the hard by the spread of the COVID-19 Delta variant, and real estate value-added falling to contraction amid the tightening of property sector regulations.

- FAI growth on a 2020-21 average basis fell to 3.8% through September from a 4.0% expansion in the first eight months. M/m growth slowed to 0.17%.

- Continuous slowdown in the real estate and infrastructure sectors was the main factor behind the headline weakness in investment growth. Infrastructure investment growth (excluding utilities) declined by to 1.4 percentage point to 1.5% through September, and the IHS Markit estimated de-cumulative changes remained in contraction year on year.

- Nominal retail sales growth rebounded to 4.4% y/y after six consecutive months of moderation and the 2020-21 average growth rate accelerated from 1.5% in August to 3.8% in September.

- Sinic Holdings has added to a growing list of defaults across China's contracting real estate sector as markets are braced for a deadline this weekend for developer Evergrande to settle interest payments on its offshore bonds. Hong Kong-listed Sinic defaulted on $246 million of bonds that were due to mature on Monday, based on Bloomberg data, in line with a warning last week and adding to a $206 million default from luxury developer Fantasia Holdings this month. (FT)

- Chinese tech giant Xiaomi has announced plans to begin mass production of its own cars in the first half of 2024, reports Reuters citing comments from the company's chief executive officer (CEO), Lei Jun. Xiaomi recently completed the official registration of its electric vehicle (EV) business. The new unit, called Xiaomi EV Inc., has registered capital of CNY10 billion (USD1.56 billion) and already has a staff of around 300. The company had earlier said that it plans to invest CNY10 billion in the initial phase of the development and plans a total investment of USD10 billion over the next 10 years to support its EV business. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Toyota's Woven Capital has invested an undisclosed amount in California-based UP.Partners' newly launched USD230-million venture capital fund. The fund is focused on supporting early-stage companies that support multi-dimensional mobility. "Transforming mobility through technology is central to the mission of Woven Planet, and UP.Partners' investment strategy is in complete lockstep. Woven Capital is excited to invest in UP.Partners' fund as they encourage entrepreneurs who are focused on wide-ranging solutions that allow people, goods and information to move more seamlessly, cost-effectively, and sustainably than ever before, benefiting humanity and the health of the planet for all," said Betty Bryant, principal at Woven Capital. The report added that UP.Partners has already made 10 investments to companies including leading flight autonomy company Skydio, manufacturing quality assurance leader UnitX, and electric vertical aircraft developer Beta Technologies. Woven Capital is the investment arm of Woven Planet Group, a spin-off founded in January 2021 from Toyota Research Institute-Advanced Development (TRI-AD). Woven Planet is to act as a decision-maker for the entire group and provide corporate shared services to the operating companies. It has created an USD800-million global growth-stage investment fund, Woven Capital, to invest in startup companies in Toyota AI Ventures that are focused on developing innovative technologies and business models. (IHS Markit AutoIntelligence's Isha Sharma)

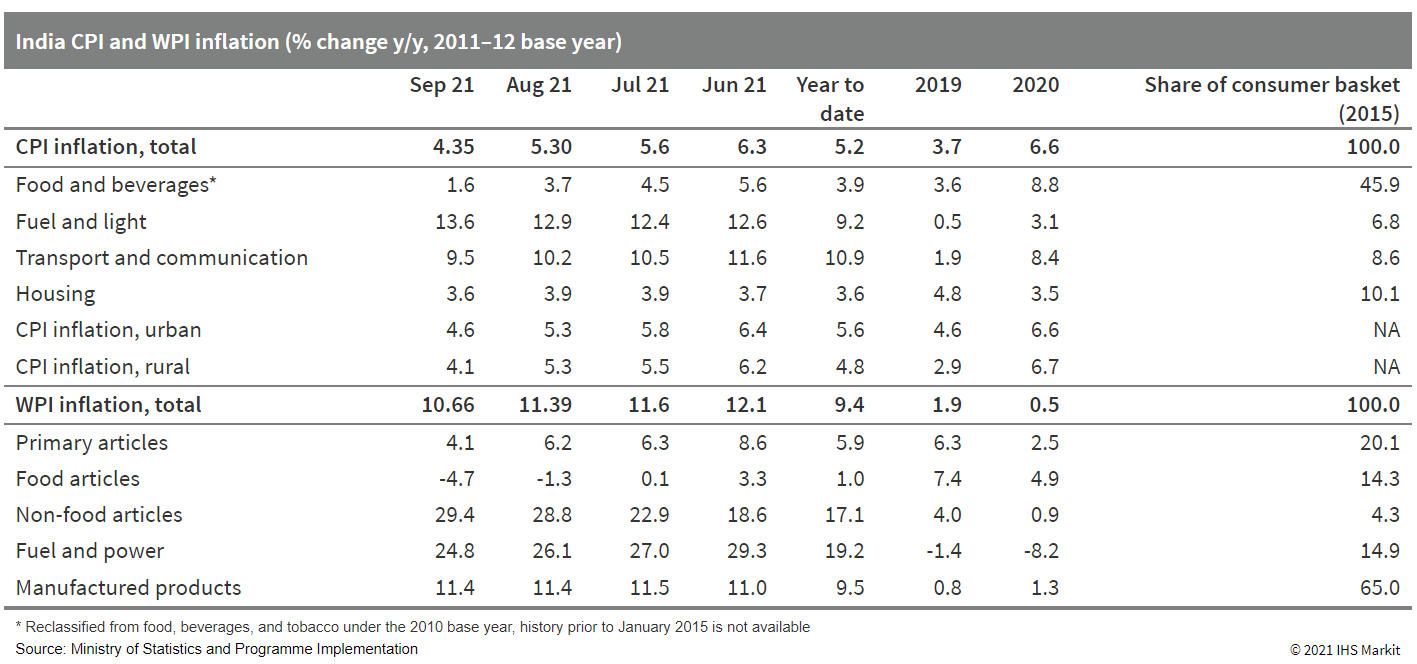

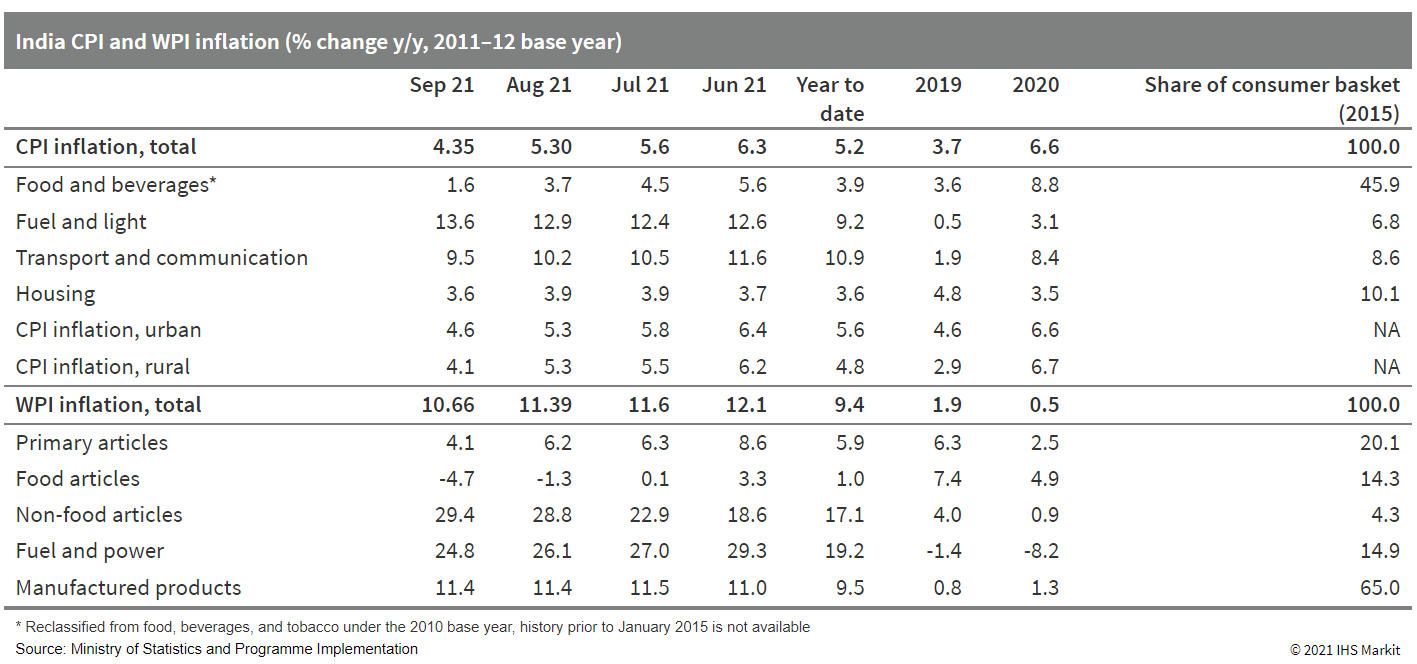

- Moderating food prices and high base effects pushed India's headline consumer price index (CPI) and wholesale price index (WPI) inflation to five-month lows of 4.4% year on year (y/y) and 10.7% y/y respectively in September, while the Reserve Bank of India (RBI) maintained its accommodative policy stance in October. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- CPI inflation eased to 4.35% /y in September from 5.3% y/y in August, brought down by a slower increase in food prices, which account for nearly half of the consumer price basket. By contrast, the fuel and light category of the CPI increased by 13.6% y/y, up from 12.9% y/y in August, reflecting sharp rises in domestic pump and power prices.

- WPI inflation had also moderated since August but remained in double digits for the sixth consecutive month, reflecting high input cost pressures from rising metal and energy prices, acute shortages of key industrial components, and high logistics costs.

- The RBI kept its key policy rates unchanged and an "accommodative" policy stance for the eighth consecutive time during its October policy meeting. The bank was encouraged by rapidly easing food inflation, supported by record summer crop harvests and a favorable outlook for winter crops. However, it acknowledged that core inflation (excluding food and energy) remained sticky at 5.8% in July-August, and that input cost pressures are likely to persist both domestically and abroad.

- Fueled by an increasing preference for locally made active pharmaceutical ingredients (APIs) in India, and a policy drive to entice investment to this segment of the industry, the valuation for API companies has seen a "surge", according to India's Business Line. The news source reports that India's API segment has stepped into the spotlight for mergers and acquisitions (M&A), increasing company valuations and brightening prospects for certified API production plants in the country. Citing examples of Indian API players that are seeking to cash-in on this trend by selling stakes, the source reports that "Hyderabad and Chennai-based API makers" are scouting for investors with valuations of approximately INR15 billion (USD199.853 million) to INR20 billion each. Bengaluru-based RL Fine Chem, for instance, is reported to be in talks with investors, including the Asia-focused Private Equity Fund PAG, to sell 100% of its equity and monetize its API capabilities. (IHS Markit Life Sciences' Sacha Baggili)

- Indonesia's ambitions for cutting its GHG emissions with carbon capture and storage (CCS) moved one step closer to realization after Repsol advanced a project in Sakakemang in South Sumatra. The country, one of the world's top 10 GHG emitters, said in its latest Nationally Determined Contribution that CCS projects could help it achieve net-zero emissions by 2060. While the Indonesian government has yet to develop a regulatory framework for carbon extraction, Repsol earlier this month announced plans to commission a geological CCS plant with a storage capacity of 2 million metric tons (mt) per year in 2027. In an email to Net-Zero Business Daily, the Spanish energy major confirmed the facility would capture CO2 from the Sakakemang natural gas field and store it in nearby depleted gas fields. In 2019, Repsol, Petronas, and MOECO discovered at least 2 trillion cubic feet of recoverable resources in the field's KBD-2X well, the largest gas discovery in Indonesia for nearly two decades. As the project's gas has a high CO2 content of 26%, Repsol said it is developing the CCS project simultaneously to meet the company's target of achieving carbon neutrality by 2050. (IHS Markit Net-Zero Business Daily's Max Lin)

- The Vietnam Petroleum Institute (VPI) has announced the country's first electric vehicle index (EVI), after consulting domestic and foreign experts, reports the Vietnam News Brief Service. Vietnam's EVI reached 1.6 out of five points in the third quarter of 2021. The VPI examined a variety of indicators to evaluate Vietnam's electric vehicle (EV) market. According to the institute, the development of the EV sector has been hampered by unstable and unpredictable regulations, strategies, and technology improvements. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 19 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.