Major US equity indices closed mixed and most APAC and European markets were lower on the day. US government bonds closed mixed and the curve flatter, while benchmark European bond yields were lower. IG credit indices were flat on the day for European iTraxx and CDX-NA, while the corresponding high yield indices closed wider and tighter, respectively. The US dollar, oil, natural gas, copper, and gold closed higher and silver was lower.

Americas

- US equity indices closed lower mixed; Russell 2000 +0.9%, Nasdaq +0.8%, S&P 500 -0.1%, and DJIA -0.7%.

- 10yr US govt bonds closed +2bps/1.73% yield and 30yr bonds -2bps/2.44% yield.

- The Federal Reserve will let a significant capital break for big banks expire at month's end, denying frenzied requests from Wall Street. In response to the pandemic, the Fed had let lenders load up on Treasuries and deposits without setting aside capital to protect against losses. That relief will lapse March 31 as planned, the Fed said in a Friday statement. (Bloomberg)

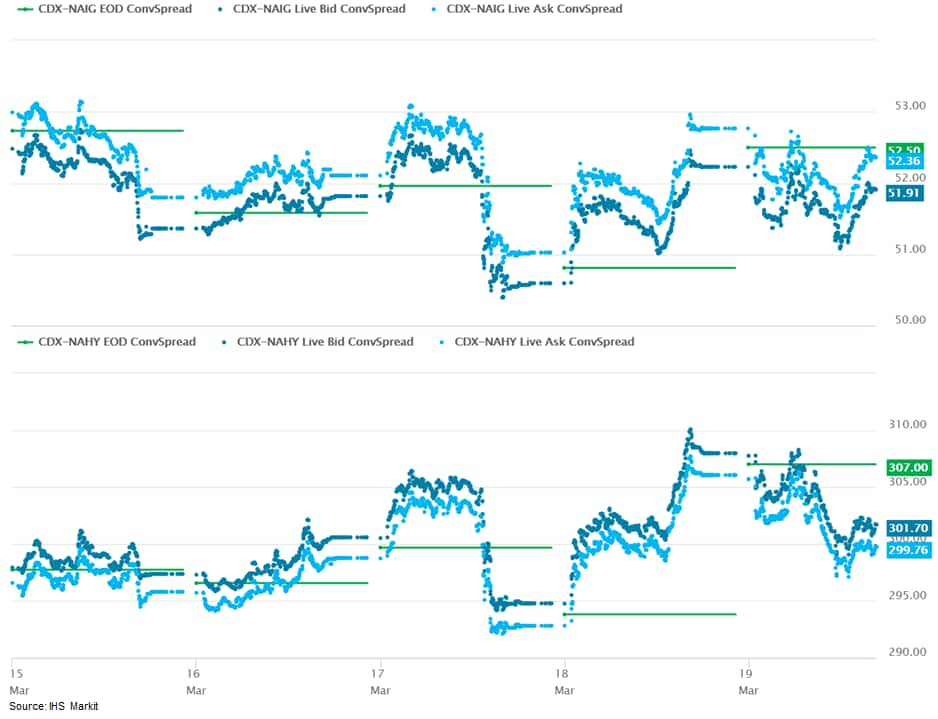

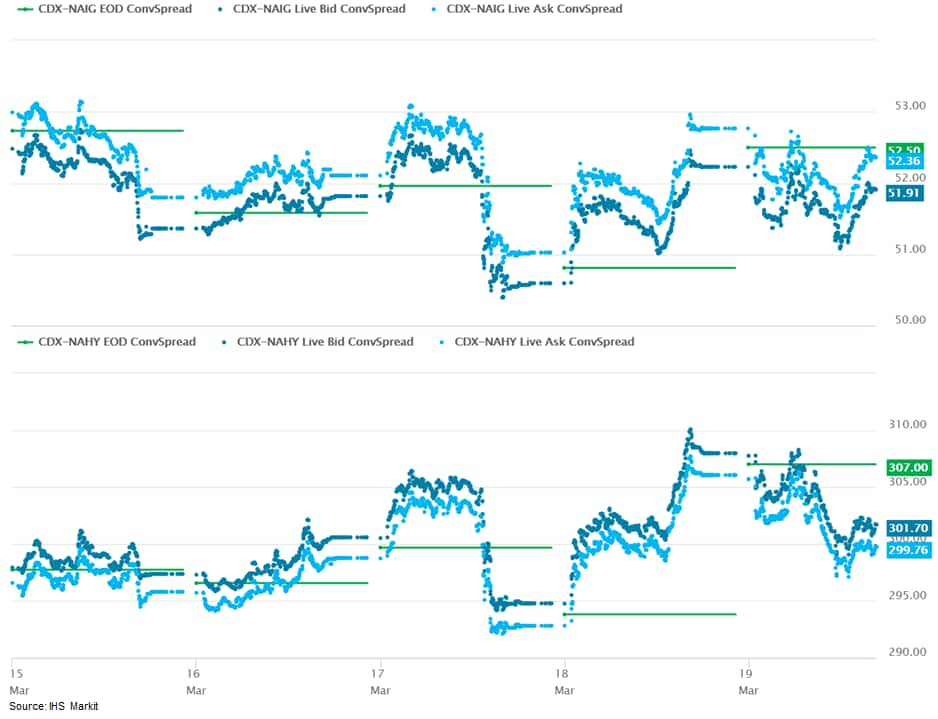

- CDX-NAIG closed flat/52bps and CDX-NAHY -6bps/301bps, which is -1bp and +3bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/91.92.

- Gold closed +0.5%/$1,742 per troy oz, silver -0.1%/$26.32 per troy oz, and copper +0.1%/$4.11 per pound.

- Crude oil closed +2.3%/$61.44 per barrel and natural gas closed +2.2%/$2.57 per mmbtu.

- Ford has announced downtime at its plant in Cologne, Germany, and production shift cuts at US plants over the semiconductor supply issue. In addition, the automaker plans to build some vehicles in the United States without the necessary microchips, hold the inventory, and install the microchips when they become available. The company statement says that Ford is to produce F-150 pick-ups and Edge sport utility vehicles (SUVs) in the US and Canada without certain parts, including "electronic modules that contain scarce semiconductors. Ford will build and hold the vehicles for a number of weeks, then ship the vehicles to dealers once the modules are available and comprehensive quality checks are complete". In addition, Ford is cancelling shifts at the Louisville Assembly Plant in the US over a semiconductor-related shortage. The plant produces the Ford Escape and Lincoln Corsair. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) maker Rivian has announced its plans to install more than 10,000 chargers by the end of 2023, according to a CNET roadshow report. It will have an Adventure Network (limited to Rivian-vehicle owners only) with 3,500 DC fast chargers at 600 stations with 200 kW of capacity in the beginning, which will be increased to 300 kW eventually, helping R1T pick-up and R1S sport utility vehicle (SUV) owners get 140 miles of range in 20 minutes of charging. The company will also have a Waypoint charging network (available to all brands of EVs) with 10,000 chargers in places such as shopping centers, restaurants, hotels, and parks in the United States and Canada by the end of 2023. These chargers will be rated at 11.5 kW with an addition of 25 miles of range per hour of charging. The automaker also revealed that Amazon is testing its electric delivery vans in San Francisco. The automaker will expand the program to 14 more cities in 2021. (IHS Markit Automotive Mobility's Tarun Thakur)

- Proterra is to supply batteries to commercial electric vehicle (EV) startup Lightning eMotors, according to a joint statement by the companies. The battery supply deal is expected to support production of nearly 100 vehicles by Lightning eMotors in 2021 and up to 3,000 vehicles annually by 2023. The Proterra battery will power the upcoming Lightning Electric Transit purpose-built commercial vehicle, which is configurable as a delivery van, ambulance, school bus, or recreational vehicle, among other types of vehicle. The Class 3 vehicle is based on the Ford Transit chassis, with Lightning eMotors expecting to deliver its first Electric Transit by the end of 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The American Farm Bureau Federation and more than 30 other ag groups are urging the Biden administration not to ban chlorpyrifos, warning that failure to renew the registration of the organophosphate insecticide "could lead to catastrophic yield losses" for growers across the US. A joint letter sent to EPA by the Farm Bureau and its allies argues that chlorpyrifos is a "critically important" crop protection tool that can be used safely and say alternatives are inadequate and costly. The ag interests also contend EPA has overestimated the potential harm from exposure to very low levels of chlorpyrifos via food and drinking water while also underestimating the economic benefits to farmers. The insecticide's effectiveness against a broad class of insect pests, including some that have become resistant to other insecticides, has made it "one of the most popular and effective tools for agricultural producers in the United States," the groups say in their letter. "EPA should consider carefully and establish with a strong level of confidence any genuine risks before considering any actions that might result in growers losing access to this critical tool." (IHS Markit Food and Agricultural Policy's JR Pegg)

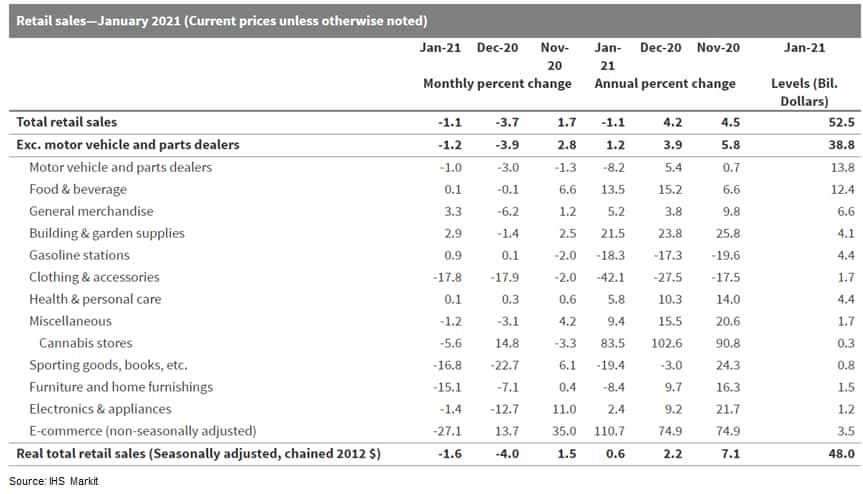

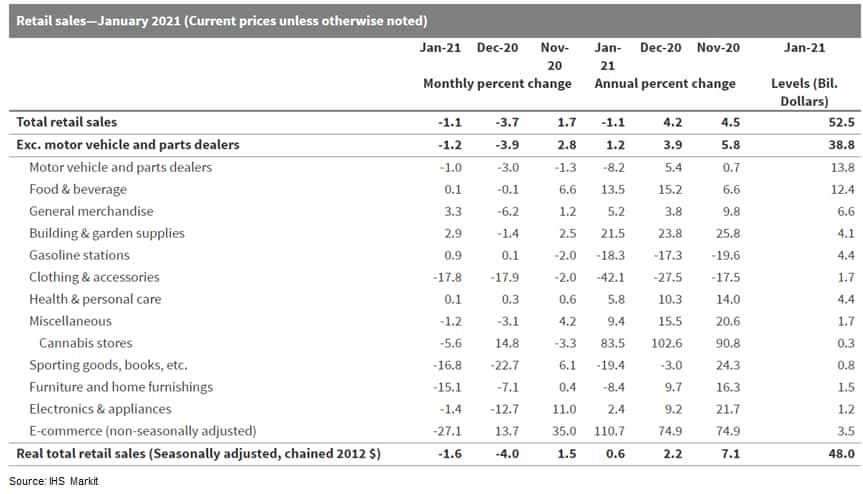

- Canada's retail sales were down 1.1% month on month (m/m) to $52.5 billion in January, considerably less than the 3.7% m/m decline seen in December. (IHS Markit Economist Evan Andrade)

- Retail sales excluding vehicles and parts and gasoline stations fell 1.4% m/m.

- In volume terms, retail sales were down 1.6% m/m.

- Statistics Canada's preliminary estimate for February showed a sales increase of 4.0% m/m in February.

- According to data from the Colombian National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística: DANE), industrial production has stagnated, falling by 6.4% year on year (y/y) in January; retail sales also fell by the same amount. (IHS Markit Economist Lindsay Jagla)

- Colombia's January 2021 total industrial production remained 6.4% below January 2020 levels, driven primarily by annual contractions in mining and quarrying at -21.0%. Coal mining (-33.3%) and crude oil and gas extraction (-15.0%) remain the greatest negative drivers in this sector.

- Except for water treatment and distribution, which increased by 1.2% y/y, the three other industrial sectors (mining and quarrying, manufacturing, and gas and electricity management) remain below pre-COVID-19-virus levels.

- Retail sales, after increasing in annual terms in October and November, fell back to below pre-COVID-19-virus levels in the following two months; retail sales fell by 6.4% y/y in January. Twelve out of 19 merchandise lines have contracted in annual terms, with fuel for motor vehicles (-9.0%), motor vehicles for personal use (-15.3%), and clothing and textiles (-32.6%) driving the contraction.

- Chile's seasonally adjusted economy advanced by 6.8% quarter on quarter (q/q) during October to December (fourth quarter), compared with the third quarter of 2020. The acceleration resulted from the gradual lifting of confinement measures, early withdrawals of pension funds, and economic measures that supported household consumption and were reflected by a positive result for commercial activity. The overall result for 2020 was a 5.8% contraction. Performance was negative for most activities, except for public administration, mining, financial services, communications, and information services. (IHS Markit Economist Claudia Wehbe)

- At its 17 March policy meeting, the Central Bank of Brazil (Banco Central do Brasil: BCB) increased the policy rate from 2.00% to 2.75%, in response to accelerating inflation that reached 5.2% at the end of February. (IHS Markit Economist Rafael Amiel)

- Driven by higher commodity prices and food prices, inflation has consistently increased since May 2020, when it amounted to a low 1.8%. Despite higher agricultural output during 2020, food prices increased substantially because of disruption in the distribution channels.

- The depreciation of the exchange rate also played a role in higher domestic inflation, not only because of higher prices of imported goods, but because producers have a higher opportunity cost of serving the domestic market when they could export their produce.

- In recent months, increasing oil prices in international markets are also putting upward pressure on transportation costs and, in general, on most goods and services in the economy.

- Core inflation, which excludes items with high price volatility such as agricultural products and energy-related goods, amounted to 2.6% at the end of the 12-month period ending February 2021. Inflation in services is very low because of lockdowns and other restrictive measures imposed as a result of the COVID-19-virus pandemic.

- The BCB assesses that core inflation is above levels compatible with its inflation target; the central bank targets inflation at 3.75% +/- 1.5 percentage points.

Europe/Middle East/Africa

- European equity markets closed lower; Italy -0.7%, UK/Germany/France -1.1%, and Spain -1.5%.

- 10yr European govt bonds closed higher; UK -4bps, France/Germany/Spain -3bps, and Italy -2bps.

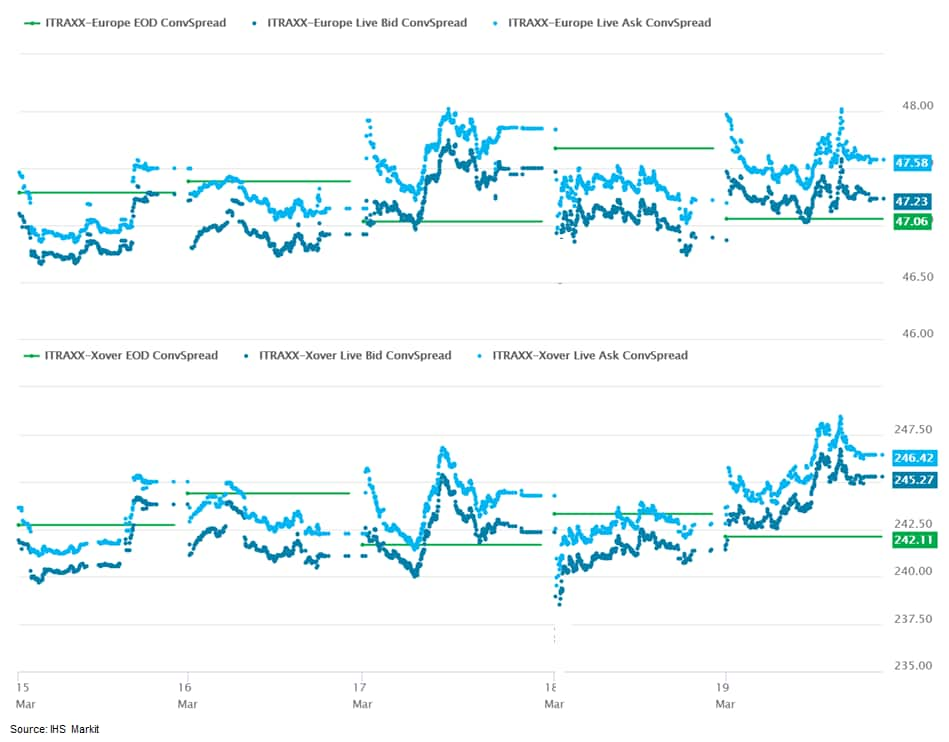

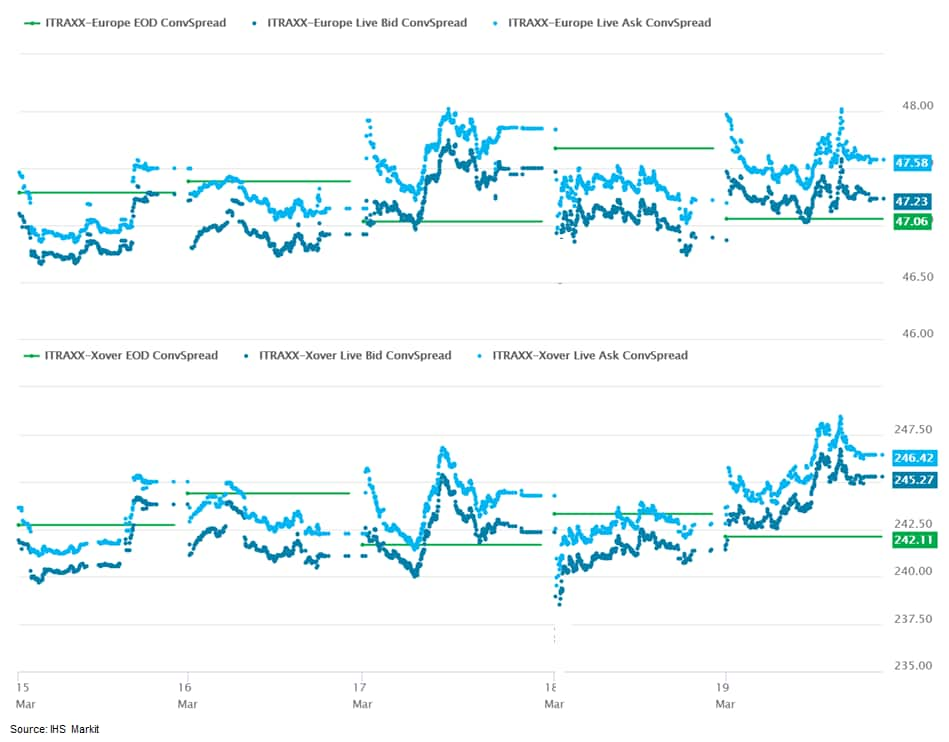

- iTraxx-Europe closed flat/47bps and iTraxx-Xover +4bps/246bps, which is flat and -2bps week-over-week, respectively.

- The Bank of England (BoE) has kept its monetary policy unchanged following its latest meeting. Furthermore, it gave no indication that it plans to raise interest rates anytime soon despite the prospect of above-target inflation from next April onwards. (IHS Markit Economist Raj Badiani)

- The BoE's Monetary Policy Committee (MPC) voted unanimously to maintain the bank rate at 0.1% at its meeting that ended on 17 March and did not hold a vote to impose negative rates.

- The MPC agreed unanimously for the BoE to continue with its existing programs of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves.

- The target is to increase the total stock of these purchases to GBP895 billion (USD1.2 trillion) by the end of this year, consisting of government and non-financial investment-grade corporate bonds, at GBP875 billion and GBP20 billion, respectively.

- As of 17 March 2021, the total stock of the Asset Purchase Facility (APF) was GBP785 billion, which included an increase of GBP40 billion as part of the GBP150-billion program of UK government bond purchases planned for 2021, which was announced on 5 November 2020.

- The UK government is cutting the purchase price subsidy on battery electric vehicles (BEVs) from GBP3,000 (USD4,173) to GBP2,500, according to a statement from the Department for Transport (DfT). The government also says that the price ceiling on which the subsidy can be applied will be lowered from GBP50,000 to GBP35,000. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volkswagen (VW) brand hosted its annual press conference this week, discussing its financial performance in 2020 and outlining its efforts on digitalization and on laying the groundwork for a transition to creating vehicles as software-defined products. In 2020, VW's sales revenues dropped to EUR71.1 billion (USD84.5 billion), from EUR88.4 billion in 2019. VW brand's chief financial officer Alexander Seitz provided an overview of the brand's performance in 2020 and an insight into its expectations for 2021, from a financial perspective. As with all nearly all other automakers, the COVID-19 pandemic created significant disruption and caused lost production and sales last year. In 2020, VW brand's unit sales were about 2.8 million units, a drop of 23%, Seitz said. By 2023, VW expects to have a free cash flow of between EUR1 billion and EUR2 billion, and the level to be firmly above EUR2 billion in 2025. VW also identified two key risk areas. First, Seitze noted that the success of measures to control the COVID-19 pandemic in main sales markets would be "of decisive importance". Second, he noted that the semiconductor shortage could have an impact on results in 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Porsche has outlined some of its plans for research and development (R&D) on advanced automotive battery designs and its charging technology. According to an Autocar report, the company is looking at the use of silicon, rather than graphite, anodes in battery packs to improve energy density and reduce charging times. Porsche is looking at potentially offering this new battery type on low-volume performance flagship models and customer motorsport cars. However, the firm says that power units used in its future volume production cars will also benefit from the knowledge gained in these projects. (IHS Markit AutoIntelligence Tim Urquhart)

- The French government has announced a tightening of COVID-19 restrictions in 16 new departments. These regions, which include Île-de-France, account for around 40% of the country's GDP. (IHS Markit Economists Diego Iscaro and Bibianna Norek)

- Retail classified as 'non-essential' will have to close during the duration of the lockdown, while travel between regions will not be allowed. Schools will remain open.

- The measures will be effective from the evening of today (Friday 19 March) and are expected to remain in place for a month.

- While the French government has been reluctant to introduce a new national lockdown, measures had gradually been tightened since the start of 2021. For example, a night-time curfew had been implemented in January, while regional measures had been implemented in regions such as Alpes-Maritimes.

- The increase in the number of COVID-19 cases has accelerated substantially since the start of March, but the national figures mask stark regional variations. For example, earlier this week the intensive-care-unit (ICU) occupancy rate in the Paris region was above 100% for the first time since May 2020, compared with a national average of 83.9%.

- Lineage Logistics, the world's largest temperature-controlled storage and logistic solutions provider, has announced the completion of 12 acquisitions across five European countries, including The Netherlands, Denmark, Belgium, Poland and Norway. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- The new coldstores span over a total of 2.5 million sq. ft. and have 90 million cubic feet of capacity. The latest acquisition was Coldstar which features a highly automated operation in the 'Golden Triangle' of Denmark, strategically located between Jutland, Zealand and Germany. Coldstar adds nearly 7.0 mln cb ft. and over 20,000 pallet positions of cold storage capacity to the Lineage network serving approximately 65% of the Danish retail market.

- In Denmark, Lineage has also acquired Lundsøe Køl og Frys, Super Frost Sjaelland A/S (one location), Kolding (one triple-net leased facility) and Kanalholmen (one triple-net leased facility). In the Netherlands a deal was struck for Vriescentrale Asten (focused on meat processing) and Frigo Group's Heerenberg B.V. in Heerenberg. F.A.I.S. - Flexible Automation Innovative Solutions entered the list of new acquisitions for Belgium.

- In Norway there is one leased facility near Larvik Harbour and one operation in Moss called Moss Cold Storage, while the storage giants will own six locations across Poland following the acquisition of Pago Sp. z o.o.

- The competition authority in Poland has authorized 3.7 GW of offshore wind capacity following the roll out of subsidies for its attractive emerging offshore wind market. The authority approved the three projects for two joint ventures involving international developers and companies part-owned by the Polish Treasury on 12 March. The joint venture of Danish offshore wind developer Ørsted and state-backed Polish utility Polska Grupa Energetyczna (PGE) won approval to develop a pair of wind farms with a total capacity of 2.5 GW. PGE and its subsidiaries already operate 17 onshore wind farms in Poland in addition to hydropower, solar PV, gas-fired and coal-fired power. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- The Turkish central bank has raised its main policy rate by 200 basis points, surprising the market on the upside and providing a much-needed lift to the lira. IHS Markit believes that this rate rise will be the last of the current rate-tightening cycle. Turkey is boxed into maintaining a defensive monetary policy throughout 2021. (IHS Markit Economist Andrew Birch)

- The other policy rates - the overnight and late liquidity rates - remain tied to the main policy rate, moving in line with the one-week repo rate.

- The continued acceleration of inflation during February, combined with renewed lira weakness, prompted the TCMB into action at the March meeting.

- After the initial pivot to more defensive monetary policy in November 2020, the lira was the strongest emerging-market currency in the world over the following two-and-a-half months, until the lack of action at the February meeting. Since that February meeting, the lira has been the weakest emerging-market currency in the world, depreciating by 7.7%, erasing all the gains made since the beginning of the year.

Asia-Pacific

- Most APAC equity markets closed lower except for India +1.3%; Australia -0.6%, South Korea -0.9%, Hong Kong -1.4%, Japan -1.4%, and Mainland China -1.7%.

- The BoJ left its monetary policy unchanged at the 18 and 19 March monetary policy meeting. The bank will continue quantitative and qualitative monetary easing (QQE) with yield curve control (YCC). The BoJ also maintained its commitment to raise the monetary base until the year-on-year (y/y) rate of increase in the observed Consumer Price Index exceeds 2% and stays above this target in a stable manner. Reflecting its review of the effectiveness of monetary policy tools to achieve the 2% price stability target, the bank has decided on the following modifications: (IHS Markit Economist Harumi Taguchi)

- Establishing an interest scheme to promote lending, which will be linked to the short-term interest rate

- Clarifying the range of 10-year Japanese government bond (JGB) yield functions to about 0.25% to either side of the target

- Raising the upper limits of purchases of exchange-traded funds (ETFs) to about JPY12 trillion (USD110 billion) and real estate investment trusts (J-REITs) to about JPY180 billion, as necessary; these upper limits were originally set as temporary measures in response to the effect of the COVID-19 pandemic.

- The introduction of the interest scheme to promote lending will give incentivised interest rates to financial institutions' current account balances corresponding to the amount of outstanding funds provided through measures to promote lending. This could mitigate the effect on financial institutions' profits at the time of rate cuts depending on the amount of lending.

- Japanese public utility company JERA plans to develop a 600 megawatt (MW) offshore wind power generation project and install up to 63 wind turbines in waters off Aomori prefecture, the northern tip of the country's main island of Honshu. The wind farm would be the newest proposed renewables project for Japan's largest power provider, as the company moves towards meeting its commitment to reach net-zero emissions for its operations worldwide by 2050. JERA has so far participated in offshore wind projects in the UK and Taiwan, most recently the Formosa 3 project off the central-western coast of Taiwan, comprising three separate sites with a total potential capacity of 2 GW. JERA holds a 43.75% share of the Formosa 3 project, while Macquarie's Green Investment Group and EnBW hold 31.25% and 25%, respectively. (IHS Markit Climate and Sustainability News' Soo Cheng Bernadette Lee)

- Fujifilm (Japan) plans to invest JPY100 million (USD920,000) in stem cell therapy-focused biotech Cuorips (Japan), Fujifilm said in a statement. In addition to the investment, which Fujifilm plans to carry out by purchasing shares in Cuorips under a third-party allotment scheme, the two companies signed a partnership agreement giving Fujifilm the priority negotiation right for contract development and manufacturing of Cuorips's allogeneic induced pluripotent stem cell (iPSC)-derived cardiomyocyte sheet in the US. The cardiomyocyte sheet is undergoing an investigator-initiated clinical study at Osaka University (Japan) in patients with serious heart failure. Further financial details were not disclosed. (IHS Markit Life Sciences' Sophie Cairns)

- Chinese autonomous vehicle (AV) startup Momenta said it has raised USD500 million from SAIC Motor, Toyota Motor, and auto parts supplier Bosch, according to Reuters. Other investors in the funding round include Daimler AG, Temasek, Yunfeng Capital, and Tencent. The startup did not disclose the valuation. Momenta has attracted several major OEMs in the automotive sector in its C-round fund raising. The startup has already developed technologies to enable AV operation on highways and city roads and realize functions such as auto parking. (IHS Markit Automotive Mobility's Abby Chun Tu)

- SAIC Motor has announced plans to begin offering vehicles in partnership with Luminar Technologies in 2022, according to media reports. SAIC plans to install Luminar's LiDAR sensors and software in its new R brand vehicle line and eventually to include the equipment as standard across all of its vehicles in China. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Chinese ride-hailing giant Didi Chuxing (DiDi) Autonomous Driving has signed an agreement with the local authority of Huadu district, Guangzhou, China, to collaborate on intelligent-connected vehicle (ICV) projects, reports Gasgoo. As a part of the terms of the agreement, DiDi Autonomous Driving will promote the research and development, driverless testing, and commercial operations of its autonomous driving technologies in Huadu district. (IHS Markit Automotive Mobility's Tarun Thakur)

- Indian Minister of Road Transport and Highways Nitin Gadkari revealed finer details of the new vehicle scrappage scheme yesterday (18 March) in the Lok Sabha, reports Autocar. The new policy will offer incentives to owners to scrap their old and unfit vehicles through registered scrapping centers. The scrapping center will provide approximately 4-6% of ex-showroom price of new vehicles as scrap value for old vehicles; automakers will provide a 5% discount on the purchase of a new vehicle against the scrapping certificate; and state governments will offer a road tax rebate of up to 25% for personal vehicles and up to 15% for commercial vehicles (CVs). (IHS Markit AutoIntelligence's Isha Sharma)

- In real (inflation-adjusted), seasonally adjusted, q/q terms, New Zealand's expenditure-side GDP fell 1.5% during the fourth quarter of 2020 - surprising on the downside versus market expectations, which had anticipated slight growth. In annual terms, GDP fell 1.2% in 2020, more or less in line with IHS Markit's forecast for the year owing to backwards revisions by Statistics New Zealand (SNZ) with the fourth-quarter release. (IHS Markit Economist Andrew Vogel)

- Gross fixed capital formation was down 1.4% q/q - a smaller drop than expected, helped in large part by continued growth in residential building construction (1.9% q/q).

- The biggest drags came from plant, machinery, and transport equipment spending (-3.3% q/q), non-residential building (-4.5% q/q), and other construction (-7.5% q/q).

- It should be noted that the drop in business investment was larger than the decline in gross fixed capital formation - likely due to government investment spending.

Posted 19 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.