All major US and most major APAC equity indices closed higher, while Europe was lower. US government bonds were almost flat on the day and benchmark European government bonds closed mixed. European iTraxx and CDX-NA were modestly tighter on the day across IG and high yield. WTI and Brent both closed higher, with the latter noticeably outperforming. Gold, silver, and copper were all higher on the day. On a positive note, data indicates that the number of US COVID-19 cases and hospitalizations have been improving since the all-time peak earlier this month.

Americas

- US equity markets closed higher; Nasdaq +1.5%, Russell 2000 +1.3%, S&P 500 +0.8%, and DJIA +0.4%.

- 10yr US govt bonds closed +1bp/1.10% yield and 30yr bonds flat/1.84% yield.

- Janet Yellen invoked an enduring era of low interest rates in delivering the Biden administration's opening argument to lawmakers for its $1.9 trillion COVID-19 relief proposal. President-elect Joe Biden's pick for Treasury secretary told the Senate Finance Committee in testimony Tuesday that the slew of spending -- from aid to small businesses and the unemployed to funding for state governments -- was needed to fight the pandemic, while playing down concerns about the debt it creates. (Bloomberg)

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -6bps/298bps.

- DXY US dollar index closed -0.3%/90.50.

- Gold closed +0.6%/$1,840 per ounce, silver +1.8%/$25.32 per ounce, and copper +0.8%/$3.63 per pound.

- Crude oil closed +0.1%/$52.42 per barrel.

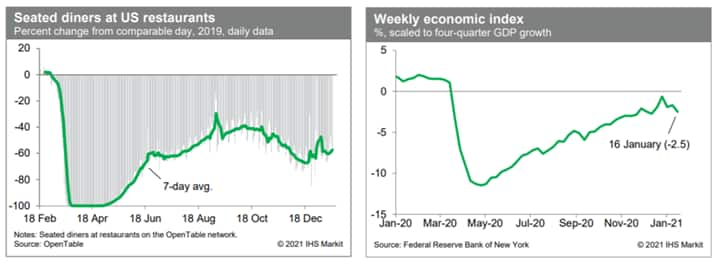

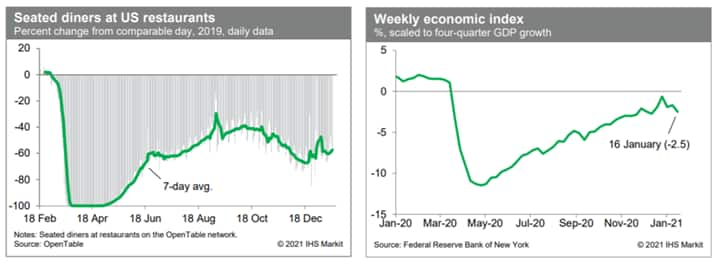

- The count of seated diners on the OpenTable platform in recent days has been about 57% below year-earlier levels. This is an improvement over readings one month ago but is still considerably worse than readings early last fall, before temperatures turned cooler, limiting outdoor seating opportunities. Meanwhile, the Weekly Economic Index, from researchers affiliated with the New York Fed, slipped to a reading of -2.5 last week. If sustained over the balance of the first quarter, this would imply roughly a 2.4% decline in real GDP over the four quarters ending in the first quarter. This is below the 0.9% four-quarter decline in GDP implicit in our latest GDP tracking, perhaps suggesting some downside risk to our forecast. (IHS Markit Economists Ben Herzon and Joel Prakken)

- North Dakota, Idaho, Utah, New York and Kansas are the only states with more patients in hospital than they had seven days ago. That is the fewest number of states with rising hospitalizations since March 23. Overall, the number of people currently in US hospitals being treated for coronavirus fell to a 17-day low of 123,820 from 123,848 on Monday. That tally is down 6.5% from a January 6 peak. (FT)

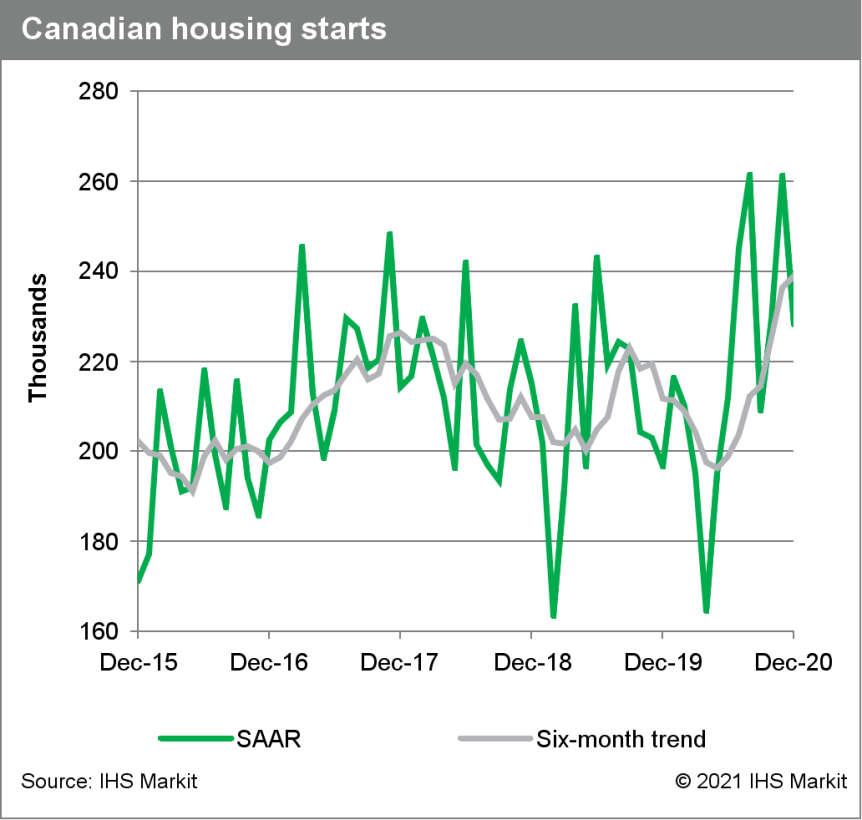

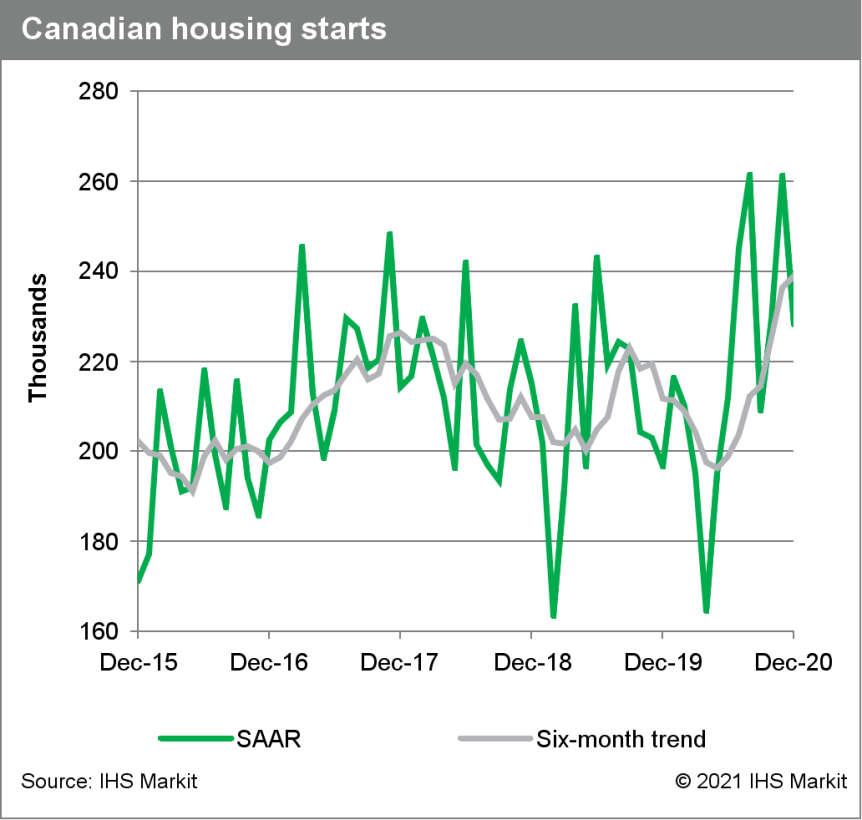

- December Canadian housing starts declined 12.6% month on month (m/m) to 228,279 units (annualized). (IHS Markit Economist Arlene Kish)

- Starts across all segments were down in the month, with the 15.5% m/m drop in urban multi-family units leading the overall decline.

- The December decline in total housing starts was a bit weaker than projected, but annual starts were the strongest since 2017. Strong demand will keep starts elevated but softer in 2021 with slower population growth.

- Although urban and rural housing starts were lower in the month, they remained at robust levels. Given the high levels over the past several months, the six-month housing starts trend hit a 13-year high at 239,052 units.

- Alberta and New Brunswick were the only provinces to buck the national trend, as starts were up in December; however, compared to a year ago, Alberta and most of Atlantic Canada were the only regions where starts were down. Note, CMHC noted that, due to the pandemic, Kelowna housing starts were not included in the December figures. The missing starts would not impact the overall direction of housing trends.

- The last three months saw a solid upswing in rural and single-family units, well above the previous year's levels. Single-family homebuilding is up across all provinces, so this isn't just a specific regional issue; however, looking at the same trend for multi-family units, they are up in six provinces.

- Demand conditions are shifting and homebuilders will have to adjust to meet demand, which will lead to higher costs, as indicated in recent jumps in the new home price index.

- Ontario's latest pandemic restrictions are putting a hold on nonessential construction activity, so new home builds will be lower for most of January and the beginning of February. This announcement will not make a permanent dent on robust housing demand.

- Slightly weaker population growth should not throw current trends off course, as upbeat sentiment about vaccines should lift immigration patterns again soon. Starts are expected to average just above 200,000 units this year.

- General Motors (GM) plans to convert its CAMI plant in Ingersoll, Canada, from production of the Chevrolet Equinox to production of commercial electric vehicles (EVs) for its new BrightDrop business unit, according to a company statement. GM's statement said that the investment is expected to be CAD1 billion (USD800 million) and that this "will support GM's timing to deliver BrightDrop EV600 in late 2021". GM states that the work to convert the plant from producing compact crossover utility vehicles to building full-size commercial EVs will begin immediately. GM expects it to take two years to fully transform the plant from Equinox to EV600 electric commercial van production. Significance: GM's announcement of the plan to convert the Canadian plant follows the announcement of its new delivery solutions business BrightDrop last week. Initially, there was speculation that BrightDrop's first vehicle, the EV600 van, would be produced at GM's Factory Zero, but the automaker's latest announcement ends that speculation. Production of the Equinox is expected to be moved to GM's plant in Ramos Arizpe, Mexico, although that was not confirmed in the statement. IHS Markit expects the Mexican facility will receive investment in order to be able to produce EVs as well, supporting the company's plans to move as quickly as possible to an EV future. The latest news also follows GM's announcement late last year of planned investment in production in Canada, although these were not for EVs. GM states that the plan to convert the Canadian plant is subject to ratification by the Unifor union representing workers at the facility. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In a press release, Kosmos Energy announced a new oil discovery at Winterfell well in Green Canyon Block 944 Gulf of Mexico (GoM). Winterfell well encountered two intervals with a total net pay of 26 meters (85 feet) of oil. The well was drilled to a total depth of about 7,000 meters (22,965 feet) in approximately 1,600 meters (5,249 feet) of water, the company said. The block was awarded in June 2017. The company plans to drill the Zora ILX well in the Gulf of Mexico later this year. In June 2019, Kosmos Energy made its first GoM discovery at Gladden Deep well in Block Mississippi Canyon 800. Beacon Offshore Energy operates the block with a 23.10% interest, with partners Red Willow Offshore (20%), Kosmos Energy (17.5%), Ridgewood Energy (17.5%), Beacon Asset Holdings (11.90%), CL&F Resources (5%), and Houston Energy (5%). (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Continued economic reopening and fiscal and monetary stimulus combined to make November Peru's best economic performance since the COVID-19-virus pandemic began. Nonetheless, the recovery pace continues on a downward trend and labor market weakness persists. (IHS Markit Economist Jeremy Smith)

- Peru's National Institute of Statistics and Information (Instituto Nacional de Estadística e Informática: INEI) reports that monthly output in November rose at a seasonally adjusted rate of 0.9% month on month (m/m), corresponding to a 2.8% year-on-year (y/y) decline.

- The hospitality and restaurants sector continues to be the most significant drag on growth, falling by 44.4% y/y in November. Close behind is transportation and storage with a decline of 21.9% y/y as all major forms of transportation by land, air, and water remain in deep contraction.

- The finance and insurance sector continued its strong performance in 2020, rising by 22.4% y/y in November. This is largely because of significant growth in government-backed credit extended to businesses under the Reactiva Perú programme. Construction, which came to a virtual halt in April and May, was another bright spot in November, rising by 17.3% y/y as many stalled projects resumed and government-funded projects under Peru's economic recovery plan began.

- Labor market conditions improved in the final quarter of 2020, but the overall picture remains bleak; total employment in Metropolitan Lima rose by 5.1% m/m, but levels of unemployment and underemployment, at 13.8% and 47.7%, respectively, are still elevated. In addition, total wage earnings fell by 25.6% y/y, weighing on household consumption.

- The timing and availability of a COVID-19 vaccine and the stringency of containment measures continue to be the most significant drivers of our short-term forecast. Over the past month, a marked increase in COVID-19 cases prompted a new set of measures that was announced on 14 January. These restrictions, which are more targeted than those implemented early last year, represent the first significant reversal of Peru's four-phase reopening plan and were previously unassumed; the potential effects will be considered in IHS Markit's February forecast.

- Meanwhile, Peru has received mixed news about COVID-19 vaccines. Debate over price and delivery details threatens to derail the country's advance purchase agreement with Pfizer, whose vaccine was initially planned to begin arriving as early as this month. On 6 January, President Francisco Sagasti announced new agreements with Sinopharm and AstraZeneca, which will send a combined 52-53 million doses. This comes on top of an expected 13.2 million doses to be received via the COVAX Facility. Sinopharm will reportedly ship the first 1 million doses by the end of January, although the full calendar has yet to be announced.

- The Brazilian government increased the Tax on Commerce and Services (Imposto sobre Circulaçao de Mercadorias e Serviços: ICMS) on new vehicles from 12% to 13.3% in the state of São Paulo, and to 14.5% from April, reports Automotive Business. For used cars, the state tax has increased 207% since a tax value of 18% was applied to 10% of the sale value of the vehicle, but now that has gone up to 30.7%. Auto industry organizations say they intend to file a lawsuit to challenge the increase in ICMS. The entities include the National Federation of Motor Vehicle Distributors (Federação Nacional da Distribuição de Veiculos Automotores: Fenabrave), the National Federation of Motor Vehicle Dealers' Associations (Fenauto Federação Nacional das Associações de Revendedores de Veiculos Automotores: Fenauto), and the Union of Vehicle Dealers and Distributors in the State of São Paulo (Sindicato dos Concessionários e Distribuidores de Veículos no Estado de São Paulo: Sincodiv-SP). According to the report, there was an increase in the 1.8% tax rate to 5.3% on the sale value of the asset, and that has now been readjusted to 3.9% for used vehicles. A statement issued by Fenabrave said, "The increase in the tax burden will cost the State of São Paulo thousands of jobs, company bankruptcies and an increase in consumer prices, in addition to promoting a drop in tax collection, which may cause irreversible damage to the sector and the São Paulo economy. To avoid this scenario, the entities will take all appropriate legal measures to reverse this arbitrary decision, which in practice turns the ICMS into a tax with the effect of confiscation, which is expressly forbidden by the Brazilian Constitution." Despite the opposition of industry organizations to the tax increases, the state of São Paulo has decided to maintain the decision at a time when the vehicle market in Brazil has slowly started to stabilize following the COVID-19 virus outbreak. The increase in ICMS will impact mainly on used-vehicle businesses. The increase in ICMS is also likely to cause a reduction in new vehicle sales due to price increases. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed lower; Spain -0.7%, France/Italy -0.3%, Germany -0.2%, and UK -0.1%.

- 10yr European govt bonds closed mixed; Italy -5bps, France/Spain -1bp, and UK/Germany flat.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -3bps/257bps.

- Brent crude closed +2.1%/$55.90 per barrel.

- Milton Keynes (UK) has launched a project to create and test mobility services using 5G technology. The project has secured GBP4.1 million (USD5.6 million) in funding from various sources, including GBP2.3 million from the Department of Digital, Culture, Media and Sport, reports UKAuthority. The project, named MK5G Create, will operate at Stadium MK and will run from this February until March 2022. The project will involve driverless shuttles and road vehicles for transporting people and goods across the stadium. In addition, the Milton Keynes Council plans to invest the funding into autonomous surveillance vehicles and drones for enhancing security and testing robots and drones for goods delivery and hospitality use. The council will lead the project with partners including BT, Appyway Parking, RDM, Imperium Drive, Metaswitch, MK Dons, Neutral Wireless, City Fibre, Smart City, Connected Places and Satellite Applications Catapults. Pete Marland, council leader, said, "This is another important step in Milton Keynes' journey as a modern, sustainable and forward looking city for the future. Smart city projects like ours can do a lot to inspire and empower other major venues around the world to create better, greener experiences for visitors and staff, and boost their efficiency. Yet again Milton Keynes will be leading the way." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The project Consortium, comprising Wardell Armstrong International Limited (WAI), The Natural History Museum (NHM) and Cornish Lithium Ltd (CLL), has successfully produced lithium carbonate from two UK sources - one from Cornish Lithium's Trelavour project site in Cornwall and another from Scotland. High purity lithium carbonate is a raw material for lithium-ion battery cells, such as those used in electric vehicles. Reimar Seltmann, Research Leader, The Natural History Museum (NHM), said: "These two samples represent the first known production of lithium carbonate from UK hard rock sources and hence are of great importance for the UK economy. The Consortium believes that the positive results from this project will accelerate the development of a domestic supply of battery quality lithium chemicals for the UK automotive and battery industries, and the consequent economic value that such industries would generate." (Cornish Lithium)

- Britishvolt has announced that it is to collaborate with Siemens. According to a statement, Siemens is to provide Britishvolt with "access to its automation, electrification solutions and Digital Twin manufacturing execution technology". Britishvolt has said that this will allow it to simulate the production processes and flows at its forthcoming UK battery plant ahead of its completion, enabling it to optimise the design and efficiency of the facility. Furthermore, Siemens is to provide Britishvolt with its latest design and simulation development tools, which are intended to reduce the time it takes for battery cells to go from laboratory to production at scale. Having finally announced that it has chosen a site for its new battery facility in early December, the company is now accelerating its efforts to achieve its aim of delivering its first lithium-ion batteries at the end of 2023. Having signed up a partner to construct its manufacturing facility, which will be located in Blyth (United Kingdom), and appointing Pininfarina to design it, the agreement with Siemens is intended to speed up the development and implementation process further. It remains to be seen whether Britishvolt will be able to stick to its aggressive timeline for its plans. (IHS Markit AutoIntelligence's Ian Fletcher)

- Audi and Ford are set to change their production schedules at some sites owing to a shortage of semiconductors. Audi's chief executive Markus Duesmann has told the Financial Times (FT) in an interview that the company will delay and slow production of some vehicles owing to a "massive" shortage, adding that it has placed around 10,000 workers on furlough because of it. CNN Wire reports that the issue has affected shift patterns at plants in Germany and Mexico, while production of the A4 and A5 has been provisionally halted at Audi's Neckarsulm (Germany) plant until 29 January. However, Duesmann added that the brand will "do everything we can to keep [production losses] below 10,000 during the first quarter". He also warned that the shortage might have some impact on second-quarter 2021 production "but only in the order in which we build cars" and that the automaker intends to make up for the losses during the second half of 2021. Separately, Ford has idled production at its Saarlouis (Germany) facility, which manufactures the Focus, from yesterday (18 January) to 19 February because of a combination of semiconductor shortages and weak demand. A spokesperson told CNN Wire, "We are closely monitoring the situation and adjusting production schedules to minimize the effect on our employees, suppliers, customers and dealers across Europe," adding, "At this time, we do not anticipate any similar actions at our other European facilities." These are the latest production disruptions related to the shortage in semiconductors for the automotive sector, which began to emerge late last year and is starting to affect more OEMs. In many instances, the shortage is linked to stronger-than-expected demand in the second half of 2020 than previously anticipated in the wake of COVID-19 virus-related production stoppages and demand disruption. The problem is also exacerbated by strong demand experienced by consumer electronics firms. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Volkswagen (VW) Group has increased its emissions pooling to offset the CO2 output of its vehicle range as per the European Union's (EU) latest regulations, according to an Electrive report. The company has already merged its CO2 pool with Chinese OEM Shanghai Automotive (SAIC). However, it has now extended its pooling arrangements to include new Chinese manufacturer Aiways and the Geely-owned British London Electric Vehicle Company (LEVC), which manufactures the BEV London black cab. CO2 pooling allows OEMs to combine their fleet average emissions with manufacturers of plug-in vehicles, to allow a lower overall fleet average emissions total and avoid paying the fines the EU will levy for missing its 95g/km combined fleet average target. VW announced a partnership with SAIC last year and it is now looking to expand its pool in an attempt to meet the stricter 2021 target, for which a company's top 5% of highest emitting vehicles are no longer exempt from the overall fleet average calculation, as was the case in 2020. (IHS Markit AutoIntelligence's Tim Urquhart)

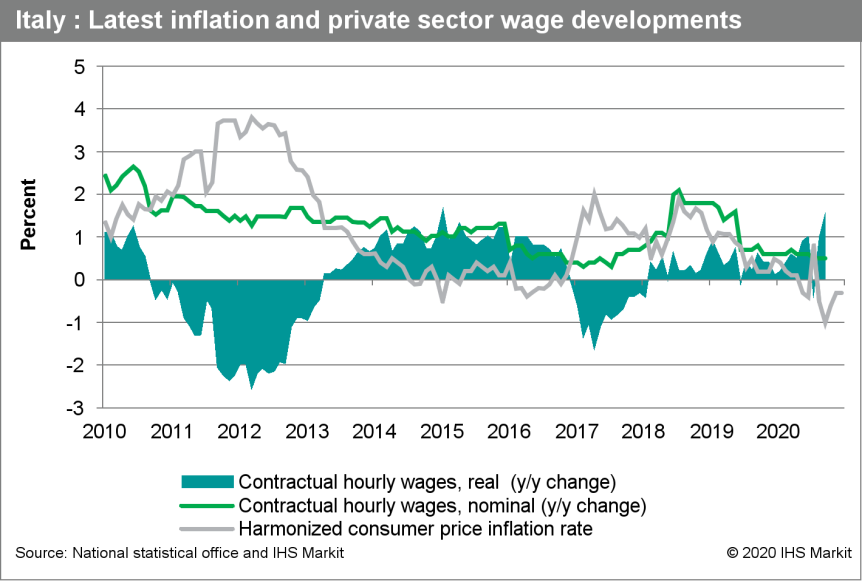

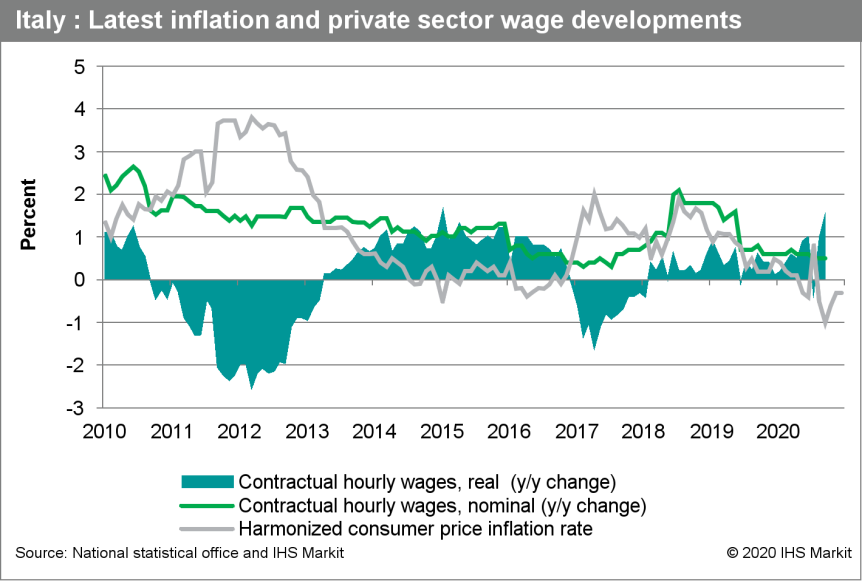

- According to the EU-harmonized measure, consumer price inflation in Italy remained at -0.3% in December. (IHS Markit Economist Raj Badiani)

- On the national measure (NIC), inflation was unchanged at -0.2% during the same month.

- The breakdown of the harmonized index reveals lower clothing and footwear - down 0.2% year on year (y/y) - and communication (down 5.3% y/y) prices.

- Overall, goods prices continued to fall in December, down by 0.8% y/y. Nervous consumers continue to maintain pressure on high street retailers to price generously to attract new business in the face of continued containment measures targeting non-essential shops to contain the coronavirus disease 2019 (COVID-19) virus.

- Energy-related prices continued to fall when compared to a year earlier. Specifically, transport and housing and utility prices in December fell by 2.8% y/y and 2.0% y/y, respectively.

- The main lever remained lower global crude oil prices, which fell by 25.6% y/y to average USD50.0 per barrel in December.

- Consumer-facing services reported stronger price developments during December, up by 0.4% y/y from 0.2% y/y in November.

- Finally, the harmonized core inflation rate (excluding energy and fresh food) was +0.4% in December, up slightly from 0.3% in November.

- Consumer price developments in December were broadly in line with expectations.

- IHS Markit's January update forecasts that overall inflation is likely to average 0.4% in 2021 after standing at -0.1% in 2020. The prospect of higher inflation in 2021 is because:

- Increasingly normalized trading conditions in the second half of 2021 will encourage retailers and consumer-facing services to make bolder pricing decisions.

- Energy-related prices are likely to make a positive contribution to the 12-month-rate CPI during 2021. Currently, we expect global crude oil prices to rise by 15.7% to average USD48.3 pb in 2021. This will lift automotive fuel and energy utility prices notably from the second quarter of this year.

- Inflation is expected to rise moderately to average 0.4% in 2021, lifted by crude oil prices rising by an estimated 16.9% to average USD49.0 pb.

- Muted inflation developments will also help to maintain further real wage growth to provide a welcome boost to household sentiment and purchasing power.

- Brazil's BRF has completed the acquisition of Joody Al Sharqiya Food Production Factory, a food processor based in Dammam, Saudi Arabia. BRF said it acquired the business for an enterprise value of SAR29.7 million - equivalent to about USD8 million. The acquired firm makes poultry, beef and fish products, with a portfolio that includes breaded and marinated cuts and hamburgers. BRF said it plans to invest around USD7.2 million expand the unit's current installed capacity from 3,600 tons per year to 18,000 tons/year. The company said this will further increase its presence in the Saudi market, in line with its strategy of establishing local production and boosting its high value-added product portfolio. Saudi Arabia is the second largest buyer of Brazilian chicken meat, behind only China. Brazilian chicken meat shipments to the Middle Eastern country reached more than 460,000 tons in 2020, worth some USD684 million. Saudi Arabia also imports significant volumes of Brazilian beef - with purchases in 2020 amounting to more than 40,000 tons generating about USD160 million. (IHS Markit Food and Agricultural Commodities' Ana Andrade)

- Navya has launched public trials of its autonomous shuttle service around the Sheba Medical Center campus in Israel. The company will deploy its Autonom Shuttle on a 2.1-km route to transport passengers around the campus. The shuttle will operate on a route with seven stations serving the main hospital buildings and in a complex environment, as it will encounter dense and varied surrounding traffic, pass several bridges, and cross four roundabouts and more than 20 pedestrian crossings. Etienne Hermite, CEO of Navya, said, "I am very pleased with this first public deployment in Israel, especially since our systems are implemented within a complex path. I am also delighted that our partnership with ST Engineering is being extended to Israel, which is a "start-up nation" always at the forefront of the latest technological innovations, with a strong potential." This pilot project is part of the Smart Mobility Initiative and is Israel's first public service of autonomous mobility. It is led by the Israel Innovation Authority (IIA) and the country's Ministry of Transport and Road Safety, in co-operation with ST Engineering and startup Blue White Robotics. Israel is promoting autonomous trials for various use cases for first and last-mile as the country is facing major transportation challenges such as heavy traffic congestion, traffic-related accidents, and air pollution. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Most APAC equity markets closed sharply higher except for Mainland China -0.8%; Hong Kong +2.7%, South Korea +2.6%, India +1.7%, Japan +1.4%, and Australia +1.2%.

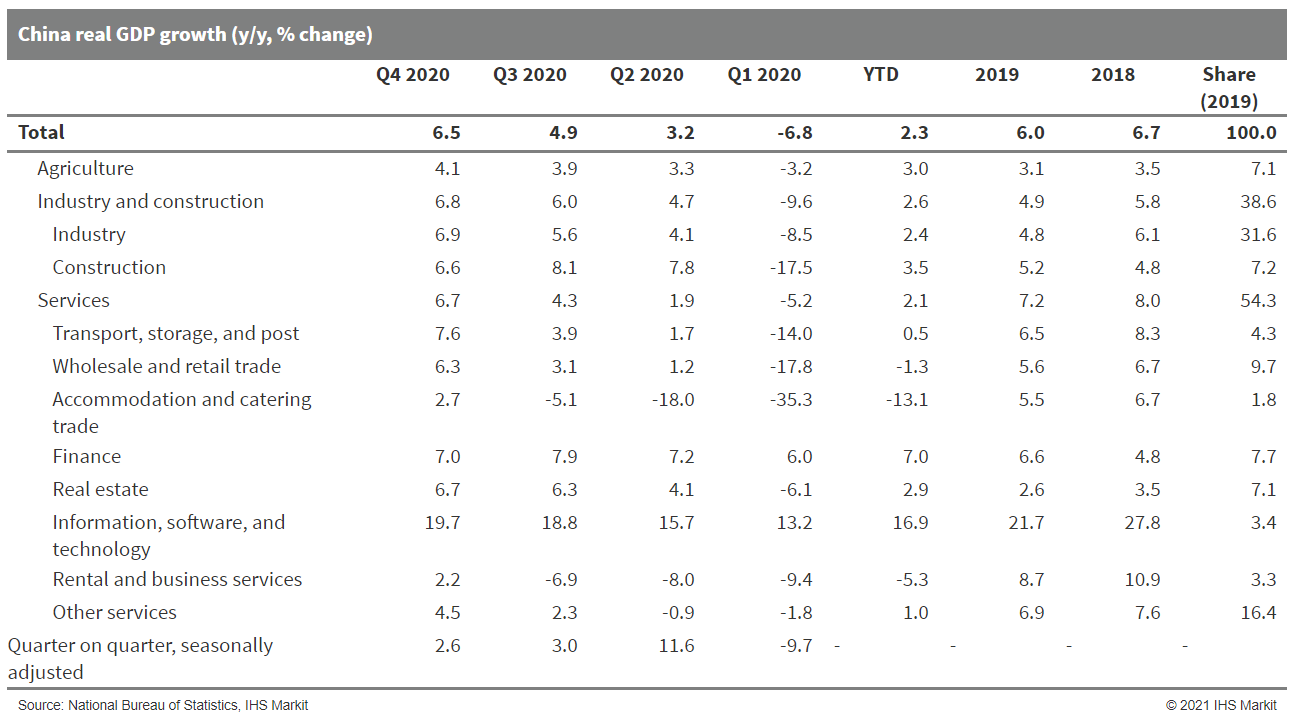

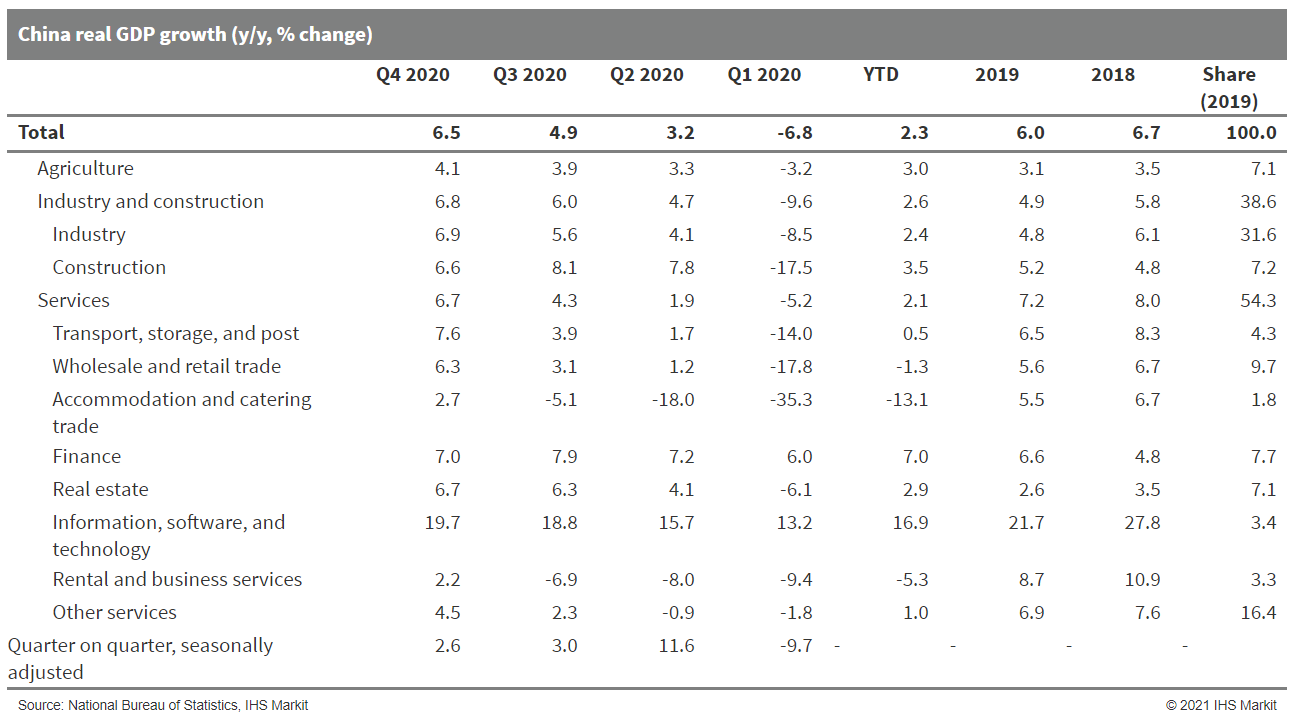

- China's economy returned to potential growth in the fourth quarter and the current growth momentum is expected to continue into 2021. However, uncertainties regarding the pandemic and tightening of real estate sector policies may impede economic recovery in the first quarter. (IHS Markit Economist Yating Xu)

- China's real GDP growth accelerated to 6.5% year on year (y/y) in the fourth quarter of 2020, compared with 4.9% y/y in the third quarter and 6.0% y/y expansion in fourth-quarter 2019. In annual terms, GDP grew 2.3% y/y, down 3.7 percentage points from 2019, the lowest growth rate recorded since 1976.

- Recovery was registered across the agriculture, industry and construction, and services sectors. The industry and construction sector, which expanded by 6.8% y/y, continued to lead economic growth in the fourth quarter. The services sector registered the fastest recovery, with fourth-quarter growth at 6.7%, up by 2.4 percentage points from the third quarter, with the information and financial sectors driving the growth.

- From the demand side, acceleration in consumption and exports were the two main contributors to the headline growth. Consumption contributed 2.6 percentage points, or 40%, to real GDP growth in the fourth quarter, compared with 29% in the preceding quarter. Net exports (exports minus imports) also contributed toward growth as China's trade surplus rose 27.1% y/y for the full year.

- Industrial value-added growth rose to 7.3% y/y in December, hitting an eight-month high. The acceleration in industrial production was partially due to strong overseas demand as the growth of export delivery value accelerated to 9.5% y/y from 9.1% y/y in November. Additionally, December 2020 had two more working days compared with December 2019. Annual industrial value-added growth reached 2.8% y/y, down 3.3 percentage points y/y.

- The Service Production Index declined by 0.3 percentage point to 7.7% in December, suggesting slowing recovery momentum in services as a result of local COVID-19 outbreaks.

- For the full year, the index reading was 0.0, indicating that service production returned to the year-ago level by the end of the year. The information and software, scientific research and technology services, and finance sectors drove growth, while the catering and hotel sector remained the main drag.

- Fixed-asset investment (FAI) expanded 2.9% y/y over the full year. However, in non-cumulative terms, growth (according to IHS Markit estimates) decelerated from 9.6% y/y in November to 5.5% y/y in December. FAI growth for full-year 2020 was 2.5 percentage points lower than the 2019 rate.

- Housing investment increased 7.6% in 2020, up 0.2 percentage point quarter on quarter, mainly owing to accelerations in floor space of new starts and land purchases at the end of the year. Meanwhile, estimated decumulative floor space of completions registered expansion for the third consecutive month in December.

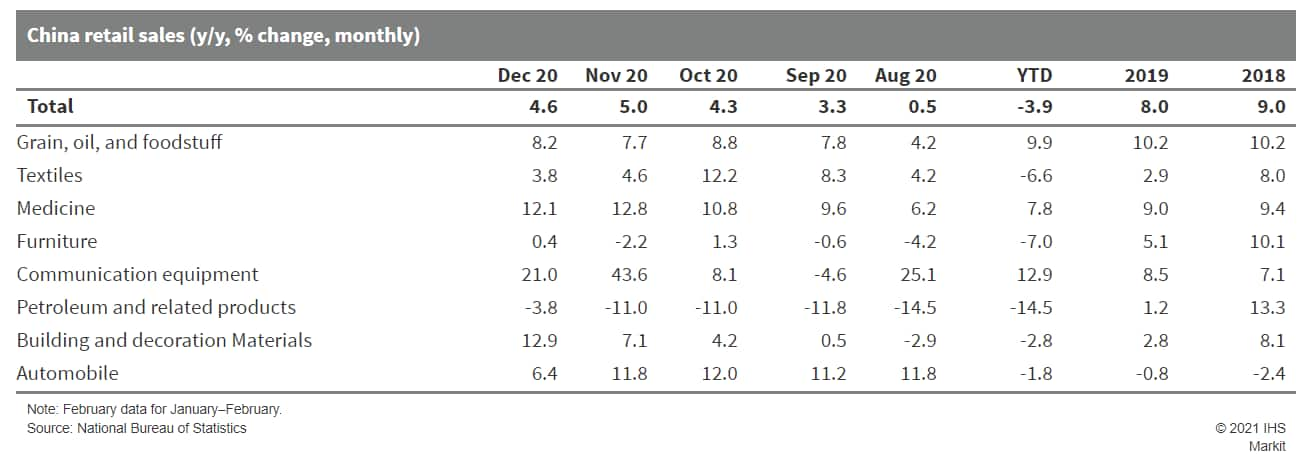

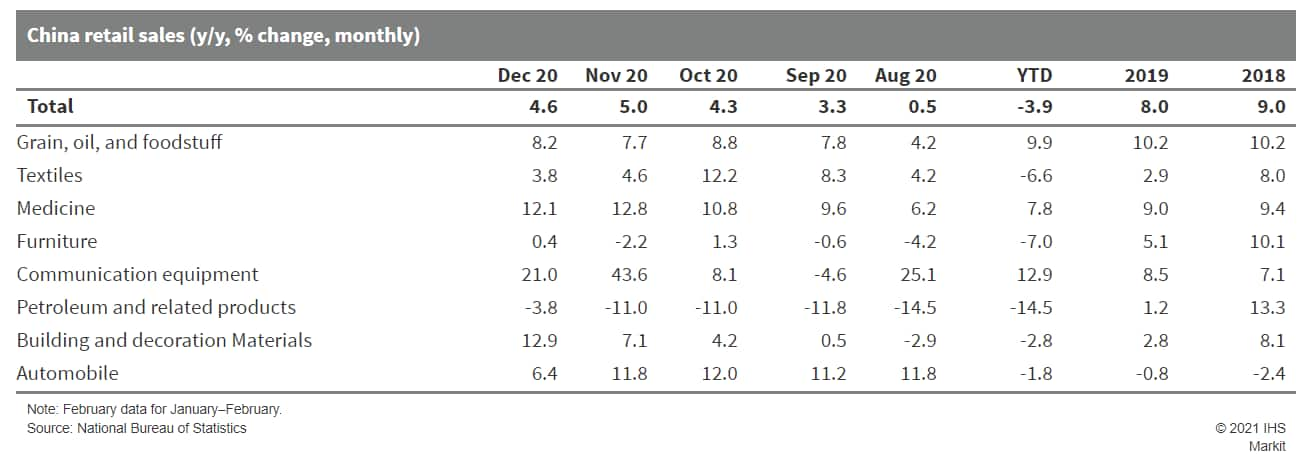

- Nominal retail sales growth fell to 4.6% y/y in December from 5.0% y/y in the previous month. For the full year, retail sales remained in contraction, falling 3.9% y/y, largely dragged down by the catering sector, compared with the 8% y/y expansion registered in 2019.

- China created 11.8 million new jobs in urban areas in 2020, exceeding the 9 million annual target set at the beginning of the year, though the figure remains 1.6 million lower compared with the number of jobs created in 2019. Meanwhile, the surveyed unemployment rate came in at 5.2% in December (the same rate as that recorded in 2019), which is lower than the 6% annual target.

- China's economy has returned to potential growth in the fourth quarter 2020 with strong exports and industrial production as well as tenacity in the real estate sector. The current recovery momentum is expected to continue into 2021 thanks to continuous exports strength, improvement in manufacturing investment and private consumption, expected stable policy, and low base effect. IHS Markit expects China's GDP to increase 7.6% y/y in 2021 before returning to 5.6% y/y growth in 2022.

- The recovery momentum in China is expected to moderate further in first quarter 2021 as resurgence of local COVID-19 outbreaks may impede services and consumption growth. (IHS Markit Economist Yating Xu)

- The services sector was again the key growth engine in the fourth quarter, assuming the mantle traditionally held by the industry and construction sector. Real growth in services rose by 2.4 percentage points to 6.7% y/y in the fourth quarter, with improvement registered across all sub-sectors except finance, which was inhibited by monetary policy tightening. Information and software remained the fastest-growing sector, although the annual growth rate, at 16.9% y/y, is lower than the 21.7% y/y growth registered in 2019. The accommodation and catering and rental services sectors returned to expansion for the first time since the beginning of 2020. Transportation and domestic trade growth accelerated to above the year-ago level.

- Industry and construction remained the fastest-growing component in the economy, but the 0.8 percentage point improvement in the fourth quarter was lower than the improvement registered by the services sector. Also, in quarter-on-quarter terms, growth in the sector moderated, mainly owing to slowing growth in construction, with the deceleration in real estate and infrastructure investment; industry has maintained its strength since the second quarter, expanding 6.9% y/y in fourth-quarter 2020 compared with a 5.6% y/y increase in the third quarter.

- The first-quarter 2020 COVID-19 shock will create a low base for year-on-year growth in 2021, while quarter-on growth is expected to slow further with the normalization of financial and fiscal policy and uncertainties about the pandemic situation.

- Recovery in services is likely to be impeded during the upcoming Lunar New Year holiday, particularly for transportation, domestic trade, accommodation, and catering, owing to the tightening of pandemic controls to contain the new local COVID-19 outbreaks. Recovery momentum in the construction sector may moderate further as efforts to reduce financial risk in the real estate market may curtail real estate investment, and local governments' debt burden could also dampen infrastructure investment. From the demand side, exports are expected to remain strong owing to the continuous global supply shortage while consumption could weaken slightly amid the recent emergence of new local COVID-19 outbreaks.

- Mainland China's new home price inflation averaged 0.12% month on month (m/m) in December 2020, unchanged from the November reading, according to a National Bureau of Statistics survey covering 70 major cities. (IHS Markit Economist Lei Yi)

- The stabilization in December's release came following three consecutive months of decline in average month-on-month (m/m) new home price inflation. By city tier, new home price inflation in December edged up by 0.1 percentage point in tier-1 cities from November while remaining unchanged at 0.1% m/m in tier-2 and tier-3 cities.

- Notably, new home prices in Guangzhou increased by 0.7% m/m, continuing to lead the inflation among tier-1 cities; meanwhile, Shenzhen reported decline of 0.1% m/m in new home prices as tightened regulations gradually cooled down the local property market.

- Up to 42 out of the 70 surveyed cities recorded month-on-month new home price gains in December, compared with 36 cities in November. The number of cities reporting month-on-month price declines fell to 22 from 28 in October.

- Average year-on-year (y/y) new home price inflation further declined to 3.7% in December, led by the 0.3 percentage point disinflation in tier-3 cities. By the end of 2020, year-on-year new home price inflation had either declined or remained unchanged for 20 and 21 consecutive months in tier-2 cities and tier-3 cities, respectively.

- Mainland China's real estate sector has recovered faster from the COVID-19 pandemic shock than the overall economy during 2020. The relaxation of urban residency registration rules, a favorable credit environment, and the sustained recovery in income prospects all contributed to the strength in housing sales and construction.

- Nationwide home price stability is expected to continue in 2021 despite that the economic growth rebound could generate tailwinds for housing demand. The central government has been re-emphasizing de-risking the property sector since the second half of 2020.

- Volkswagen Group China (VW China) and FAW Group signed an agreement on 18 January on the establishment of a joint venture (JV) company to produce premium electric vehicles (EVs) in China. VW China and Audi AG are to hold a stake of 60% in the new Audi-FAW JV company. Headquartered in Changchun, China, the JV will produce EVs based on the Premium Platform Electric (PPE). The PPE, an EV architecture jointly developed by Audi and Porsche, will house several all-electric Audi models to be produced in China from 2024. Audi models from the new JV are to be sold through FAW Audi Sales Company's network. The sales company also manages the distribution of Audi models produced locally by FAW-VW, as well as imported Audi vehicles. Under the new partnership with FAW, Audi said it would be able to increase the number of its locally produced models in China to 12 by the end of 2021. The announcement on 18 January has for the first time confirmed that Audi and VW China will hold a majority stake in the new company, allowing the German automakers to have a greater say in the JV's operations. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese telecom giant Huawei has partnered with local autonomous truck startup Trunk to jointly develop intelligent driving solutions for smart port operations. In addition, the two companies have unveiled their smart port project at Tianjin port, China, reports Gasgoo. Under the project, an autonomous truck deployed with Huawei's intelligent driving computing platform MDC (Mobile Data Center) successfully carried out a whole-vessel operation, including route planning, precise parking, and obstacle response without human intervention. Autonomous trucks are gaining a great deal of traction in the logistics industry because of a growing shortage of drivers and improved efficiency. These trucks enable autonomous loading and unloading of containers in yards, thereby improving efficiency. China's Tianjin port aims to build an autonomous vehicle demonstration zone to enhance the efficiency of handling international shipments. Last year, Tianjin port completed pilot tests of 25 driverless electric trucks. Last year, port terminal operator COSCO Shipping Ports partnered with China Mobile and Dongfeng Commercial Vehicle to demonstrate driverless trucks loading and delivering containers around a port terminal in China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Vietnamese automaker VinFast plans to launch two gasoline (petrol)-powered vehicles and three electric vehicles (EVs) from 2022, reports the Vietnam News Brief Service. With this plan, the automaker aims to capture 30% of the Vietnamese car market and hit the earnings before interest, taxes, depreciation, and amortization (EBITDA) breakeven in the next five years. Furthermore, VinFast plans to launch its EVs in overseas markets, such as the United States, Europe, and Russia. In particular, it plans to launch two out of the three aforementioned EVs in the US in early 2022. The automaker is also expected to start the operation of its electric buses in Vietnam in 2021. VinFast, a new entrant in the car manufacturing segment, aims to produce 500,000 cars a year by 2025, with a local content rate of 60%. It also aims to be one of the top car manufacturers in the Southeast Asian region by 2025. In June 2019, the automaker began deliveries of its Fadil hatchback and in August 2019 it started deliveries of its two luxury models - the Lux A2.0 sedan and the Lux SA2.0 sport utility vehicle (SUV). VinFast has partnered with world-leading automotive technology and manufacturing consulting firms such as BMW, Magna Steyr, and AVL. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 19 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.