European and APAC equity markets closed mixed and all major US indices were lower. US and most benchmark European government bonds, except UK gilts, closed lower. iTraxx-Europe and CDX-NAIG closed flat, while iTraxx-Xover and CDX-NAHY were slightly wider on the day. Copper, oil, and natural gas closed higher, while gold and silver were lower.

Americas

- US equity indices closed lower; DJIA -0.4%, S&P 500 -0.5%, Nasdaq -1.0%, and Russell 2000 -1.4%.

- 10yr US govt bonds closed +2bps/1.60% yield and 30yr bonds +2bps/2.30% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY +3bps/291bps.

- DXY US dollar index closed -0.5%/91.07.

- Copper closed +1.7%/$4.24 per pound, which is the highest close since July 2011.

- Gold closed -0.5%/$1,771 per troy oz and silver -1.0%/$25.84 per troy oz.

- Crude oil closed +0.4%/$63.43 per barrel and natural gas closed +2.6%/$2.75 per mmbtu.

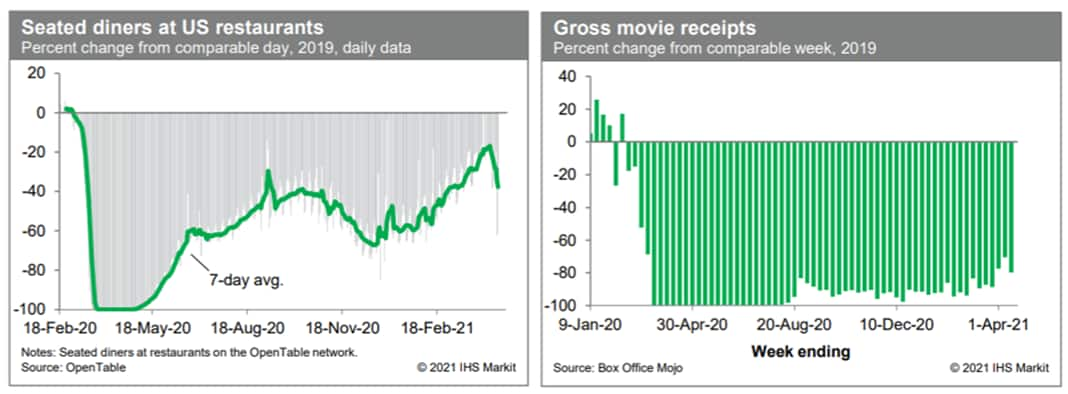

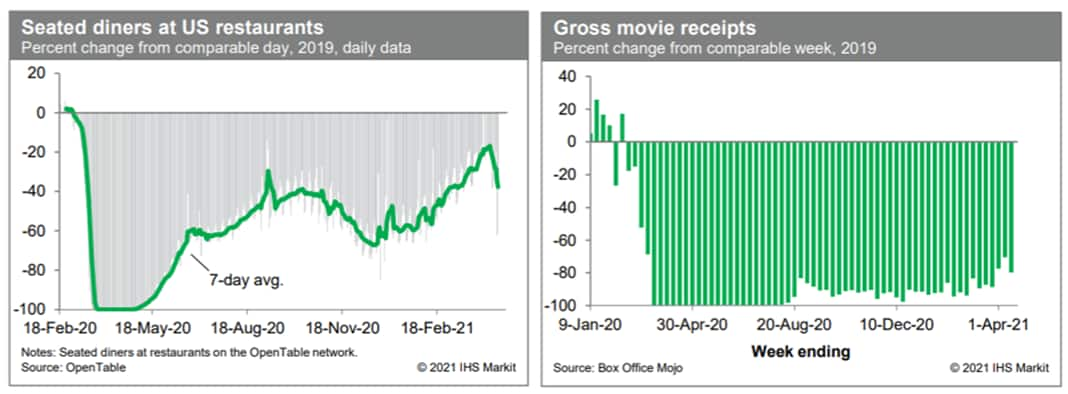

- The count of seated diners on the OpenTable platform weakened in recent days, perhaps reflecting cooler temperatures (and less outdoor dining). Still, restaurant activity remains above levels from the fall and winter. Meanwhile, box-office receipts at US movie theaters backtracked last week. Still, while well below 2019 levels, movie-theater activity is up from levels over the winter. (IHS Markit Economists Ben Herzon and Joel Prakken)

- US organic produce sales increased over 9% year-on-year in Q1 2021 to USD2.2 billion, according to the Organic Produce Performance Report by Organic Produce Network and Category Partners (AC Nielsen's data). Conventional produce value sales grew by only 3% compared with the same period last year, Perishable News reported. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- By volume, organic fresh produce grew by 6% y/y while conventional saw a decline of 0.6% y/y.

- Packaged salads remain the single largest driver of organic dollars, accounting for 17% of all organic sales. In Q1, packaged salad dollars saw a 10% y/y increase. Organic berries have become a key winter category, driving over 15% of total organic produce dollars.

- Within the top 10 categories, fresh herbs (+28%), lettuce (+35%) and tomatoes (+15%) generated the largest percentage gains in dollars.

- Ultium LLC, the JV between General Motors (GM) and LG Energy Solution, has announced a USD2.3-billion investment in a planned new battery manufacturing plant in the US state of Tennessee. The investment involves the construction of a new facility adjacent to GM's facilities in Spring Hill. The batteries produced at the new facility will supply GM's production of electric vehicles (EVs) in Tennessee, beginning with the Cadillac Lyriq. The new facility is due to open in 2023 and it will create 1,300 new manufacturing jobs, according to the announcement. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ride-hailing firm Gett has partnered with Curb Mobility to integrate yellow taxis into its app, reports TechCrunch. This partnership will expand Gett's presence to some 65 cities across the US. Dave Waiser, CEO and co-founder of Gett, said, "Today's partnership cements Gett's position as a technology platform focused on corporate Ground Transportation Management (GTM), where spend is worth [USD]79.6 billion globally. In recent years, we have become the GTM category leader, serving over a quarter of Fortune 500 companies". (IHS Markit Automotive Mobility's Surabhi Rajpal)

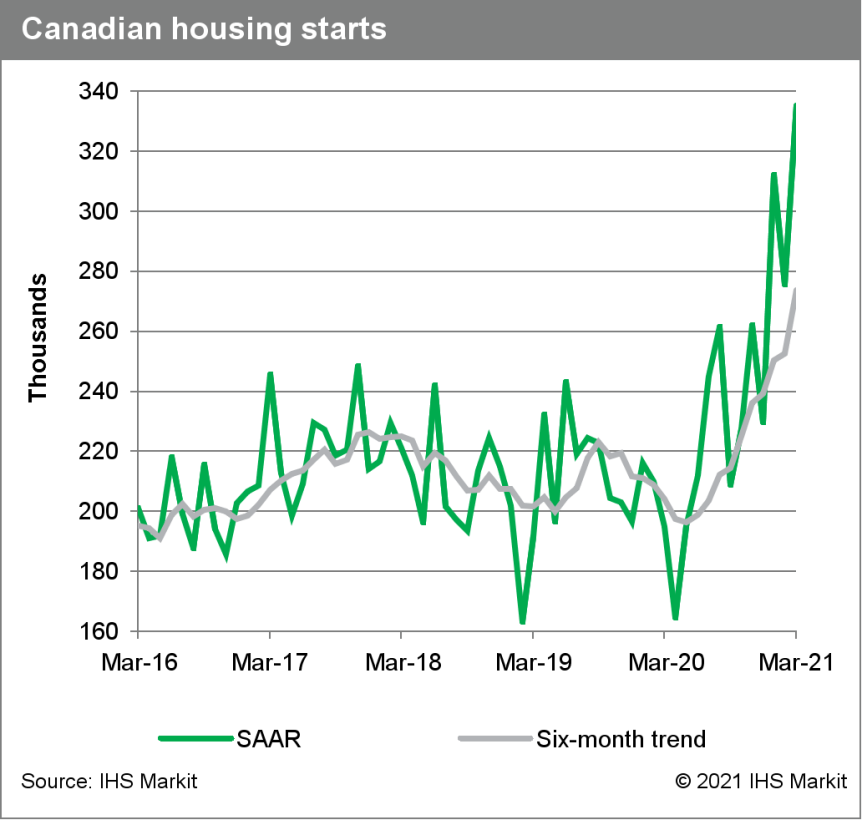

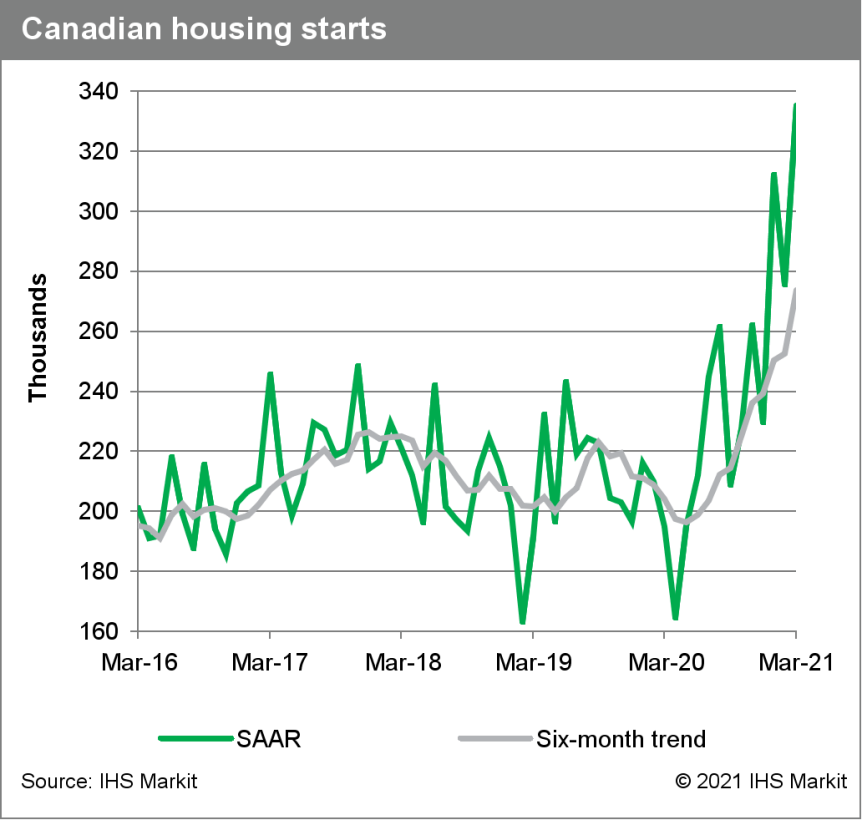

- Canada's housing starts skyrocketed 21.6% month over month (m/m) after the 11.7% m/m decrease in the previous month. (IHS Markit Economist Chul-Woo Hong)

- Urban multifamily starts soared 33.8% m/m to an all-time high while single starts jumped 3.6% m/m, reaching the highest level since April 2010. Rural starts increased 2.0% m/m.

- The overall gain was largely concentrated in Ontario (up 45.0% m/m) and British Columbia (up 57.4% m/m) as starts in both provinces hit a record high.

- Stronger-than-expected homebuilding activities in the first quarter support our forecast that real business investment in residential structures will contribute the most to first-quarter real GDP growth.

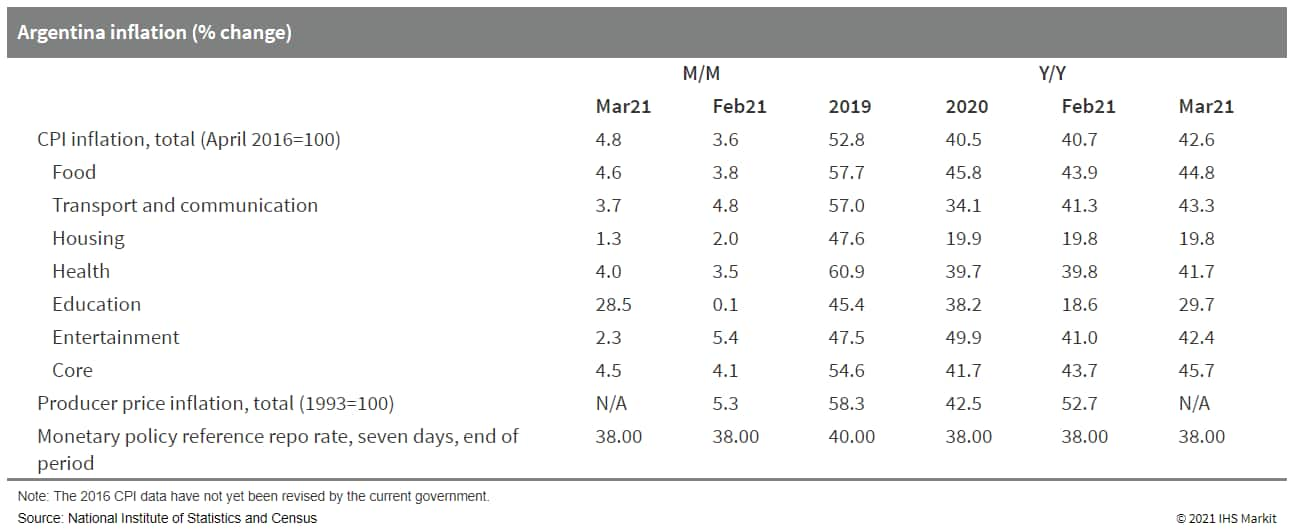

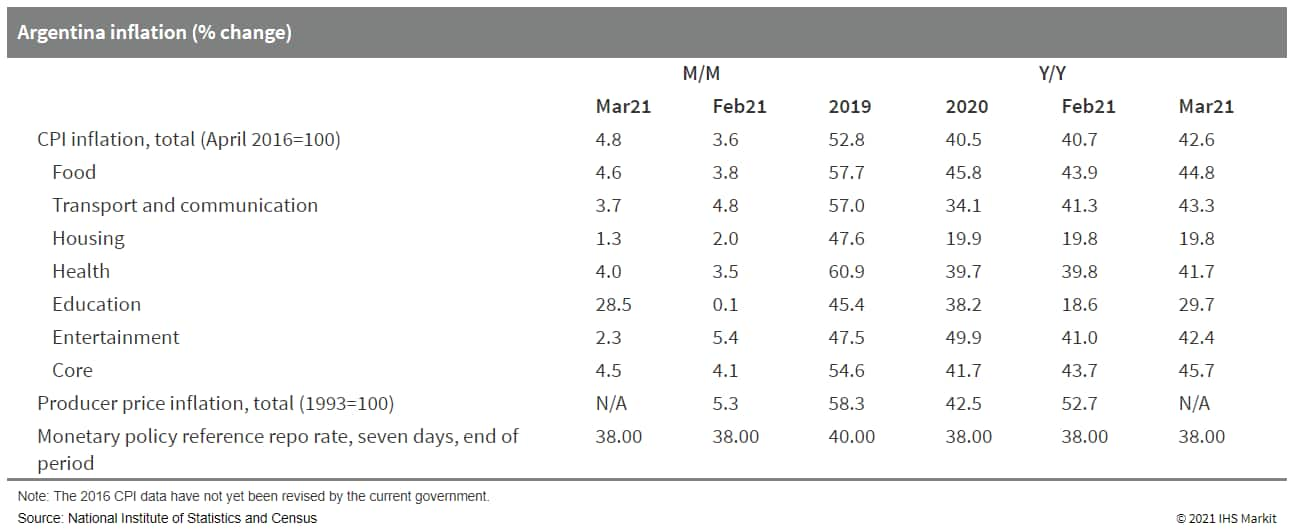

- Argentina's consumer price index (CPI) increased by 4.8% month on month (m/m) during March. The increase in consumer prices was most pronounced in the education, food and beverages, transportation, and culture and entertainment sectors. (IHS Markit Economist Paula Diosquez-Rice)

- Argentina's inflation rate in March was driven by price increases in the food and beverages category, with substantial price rises for beef and other meats, bread, dairy products, and fresh produce, as well as increases in the alcoholic beverages, transportation, and health sectors. The rise in the transportation component was mainly driven by the increase in vehicle prices and the cost of maintenance of personal vehicles.

- The prices of regulated items increased by 4.5% m/m, driven by the adjustment in gasoline prices, while the prices of seasonal items rose by 7.2% m/m. The core inflation rate stood at 4.5% m/m. Wholesale prices climbed by 52.7% year on year (y/y) in February, a significant acceleration compared with the previous month. The annual CPI rate in March continued the accelerating trend of the past few months.

- Inflation expectations for the next 12 months rose in March; Torcuato Di Tella University reported a median of 50% y/y, higher than the previous month. Furthermore, the average expected annual inflation rate rose to 46.3%.

- The inflation expectation survey by the country's central bank, the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA), shows a median of 43.1% in March, 2 percentage points lower than in February.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain +1.1%, France +0.2%, Italy -0.2%, UK -0.3%, and Germany -0.6%.

- Most 10yr European govt bonds closed lower except for UK -1bp; Italy +4bps, France/Germany +3bps, and Spain +2bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover +3bps/247bps.

- Brent crude closed +0.4%/$67.05 per barrel.

- British online grocer Ocado will invest GBP10 million (USD13.8 million) in autonomous vehicle (AV) software company Oxbotica. Following the investment, Ocado will take a seat on Oxbotica's board, reports Reuters. The partnership aims to reduce the cost of last-mile delivery and other logistics by automating the deliveries. The companies expect to deploy AVs that operate in low-speed urban areas or restricted-access areas such as inside its fulfilment centers sooner than those used for deliveries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Porsche has generated a strong increase in sales volume in the first quarter of 2021 with a 36% year-on-year (y/y) rise to 71,896 units, according to a company statement. (IHS Markit AutoIntelligence's Tim Urquhart)

- The huge uplift was largely the result of the Chinese market being hit by the initial outbreak of the COVID-19 virus pandemic in the early weeks of 2020 and strict lockdown measures being imposed by the government during that period; first-quarter 2021 Chinese sales rose by 56% y/y to 21,991 units.

- There was also a strong bounce in the US, with a 45% y/y rise to 17,368 units; growth was supported by strong demand for the Taycan battery electric vehicle (BEV).

- The company sold 19,389 units in Europe, which was an increase of 16% y/y. Of this total 5,957 units were sold in Germany (+14%).

- The Macan was the best-selling model in the first quarter with 22,458 units (+44.4%), followed by the Cayenne with 19,533 units(+6%) and then the 911, with 9,133 vehicles (+7.7%).

- Daimler will hire around 1,000 software programmers in an effort to accelerate the development of its digital vehicle operating systems, according to an Automobilwoche report. They will be employed at the company's S-Class production facility at Sindelfingen, as part of the 'Factory 56' campus, the facility which builds both the S-Class and the newly launched EQS. The new jobs are part of a broader drive to recruit a total of 3,000 programmers worldwide, to strengthen Daimler's software hubs in centers including Berlin, Tel Aviv, Seattle, and Beijing, the weekly magazine reported. (IHS Markit AutoIntelligence's Tim Urquhart)

- Siemens Energy and Total have signed a technical collaboration agreement to study sustainable solutions for CO2 emissions reduction. The collaboration will focus on LNG liquefaction facilities and associated power generation. The agreement will bring together each company's technologies and expertise to deliver industrial-stage solutions such as combustion of hydrogen in gas turbines, all-electrical liquefaction, optimized power generation, the integration of renewable energy in liquefaction plants' power system, and their efficiency enhancement. This agreement follows the announcement made in June 2020 to collaborate and conduct studies exploring possible liquefaction and power generation plant designs to help decarbonize the production of LNG. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Neart na Gaoithe (NnG), Saipem and Harland & Wolff have signed a contract for Harland & Wolff to carry out the fabrication and load-out of eight of the NnG project's wind turbine generator (WTG) foundation jackets to be installed offshore Scotland. With work starting from 1st July, 2021, Harland & Wolff will use its newly acquired Methil facilities in Fife for the fabrication work, creating around 290 direct and indirect jobs. Additional support may be provided as required by the company's other facilities in Arnish, Appledore and Belfast, UK. The foundations, used to support and anchor NnG's WTGs to the seabed, are being supplied and installed by Saipem. Saipem will also supply and install an additional two jackets for the offshore substations. (IHS Markit Upstream Costs and Technology's Helge Qvam)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +1.5%, Hong Kong +0.5%, Australia/South Korea/Japan flat, and India -1.8%.

- Mainland China's new home price inflation averaged 0.41% month on month (m/m) in March, basically unchanged from February, according to the survey conducted by National Bureau of Statistics covering 70 major cities. (IHS Markit Economist Lei Yi)

- The stabilization of month-on-month new home price inflation in March was the result of a weaker inflation in tier-1 cities offset by minor upticks in lower-tier cities. While month-on-month inflation in Beijing and Shanghai decreased by 0.5 and 0.2 percentage points, respectively, home prices in Guangzhou increased by 1.0% m/m, up by 0.1 percentage point from a month ago - marking the highest month-on-month new home price inflation across all surveyed cities. Up to 62 out of the 70 surveyed cities reported month-on-month new home price gains in March, compared with 56 cities in February.

- Average year-on-year (y/y) new home price inflation reached 4.4% in February, up 0.3 percentage point from January. Wider year-on-year price gains were broad across city tiers largely owing to the COVID-19 pandemic-induced low-base effect.

- Swedish carmaker Volvo Cars has signed an agreement with the autonomous vehicle (AV) unit of China's ride-hailing giant Didi Chuxing (DiDi), reports Reuters. Under this agreement, Volvo will supply XC90 sport utility vehicles (SUVs) equipped with backup steering and braking systems, which will be integrated with DiDi's new autonomous hardware platform, DiDi Gemini. According to the report, Volvo Cars will initially provide DiDi with hundreds of cars, and aims to add more of these vehicles as the autonomous test fleet expands. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- CNH Industrial has announced that it has ended discussions to sell its On-Highway business, including its Iveco brand, to FAW Jiefang. According to a statement released on 17 April, CNH Industrial said it "believes there are significant opportunities to develop its On-Highway business by accelerating the deployment of ever more sustainable transport solutions and infrastructure, in line with the EU's Green Deal ambitions". It added that it will instead continue to "pursue its existing plans for a spin-off of these activities in early 2022." (IHS Markit AutoIntelligence's Ian Fletcher)

- Japan's trade balance recorded a surplus of JPY664 billion (USD6.1 billion) in March, up from JPY7.0 billion a year earlier on a non-seasonally adjusted basis. The seasonally adjusted balance also turned to a surplus of JPY298 billion, from a deficit of JPY11 billion in February. (IHS Markit Economist Harumi Taguchi)

- The solid increase in the trade surplus reflected a 16.1% y/y surge of exports while growth of imports softened to 5.7% y/y rise from 11.8% in the previous month.

- The improvements in exports were due partially to the drop-out of the effects of the Lunar New Year holidays of Japan's Asian trade partners and low base effects because of a plunge a year earlier due to global spread of lockdowns.

- The rebound of exports was primarily driven by exports to Asia (up 22.4% y/y), particularly to China (up 37.2% y/y).

- Exports to the European Union rose 12.8% y/y for the first increase in 18 months and exports to the US also turned positive for the first time in five months with a 4.9% y/y increase.

- Major contributors to the increase were exports of autos, non-ferrous metals, plastics, and semiconductor production machinery.

- Although rising commodity prices contributed to lift import prices, the major contributor increasing imports was medical products (up 27.3% y/y).

- On 1 April, Japanese 8.5% tariffs on US frozen potato products, including French fries, were removed. According to the USDA, in 2020, the US exported over USD342 million of potatoes and potato products to Japan, largest overseas market for US potatoes. US potato products accounted for nearly 70% of Japan's total potato product imports. Given a competitive tariff regime and reasonable market access agreements, it is believed that this market can grow by another USD150 million annually (+42%) in the very near future. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Daewoo E&C has formed a consortium with Eumseong-gun, Chungcheongbuk-do, and Korea Asset Investment Management (KAIM) with a view to constructing a hydrogen fuel cell facility in South Korea. The Chungbuk Infra-Energy Consortium plans to build hydrogen fuel cell power facilities with a capacity of 200MW at the Maengdong Ingok Industrial Complex in Chungcheongbuk-do. The project will have the capacity to produce around 1,700GWh of electricity per year, enough to power around 500,000 households. The total cost of the project is expected to be around USD1.3 billion (KRW1.5 trillion) and completion is expected in 2024. This marks a significant milestone for Daewoo E&C's medium- to long-term plan of achieving growth in the renewable energy sector. (IHS Markit Upstream Costs and Technology's William Cunningham)

- South Korean steelmaker Posco has announced plans to build a plant in South Korea to extract lithium hydroxide, which is a key material for electric vehicle (EV) batteries, reports the Yonhap News Agency. Posco's board of directors has approved the plan to build a plant in the southern industrial city of Gwangyang by 2023. Separately, Posco is set to begin building a plant in the coming months near the Salar del Hombre Muerto salt lake in northern Argentina. The plant will have annual production capacity of 25,000 tons of lithium. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 19 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.