Most major APAC equity markets closed higher, while most US and European indices were lower. US and benchmark European government bonds closed sharply lower on the day. CDX-NA closed unchanged across IG and high yield, iTraxx-Europe was unchanged, and iTraxx-Xover closed modestly wider. Gold closed lower, silver and the US dollar were flat, and oil and copper closed higher.

Americas

- Most US equity indices closed lower except DJIA +0.2%; Russell 2000 -0.7%, Nasdaq -0.3%, and S&P 500 -0.1%.

- 10yr US govt bonds closed +11bps/1.32% yield and 30yr bonds +9bp/2.10% yield. 10s closed at the highest yield since 26 February and 30s highest since 12 February 2020.

- CDX-NAIG closed flat/51bps and CDX-NAHY +1bp/287bps.

- DXY US dollar index closed flat/90.51.

- Gold closed -1.3%/$1,799 per ounce, silver flat/$27.33 per ounce, and copper +1.1%/$3.83 per pound.

- Crude oil closed +1.0%/$60.05 per barrel, which is the first time it has closed above $60 per barrel since 7 January 2020.

- Ford Motor Company has sold its stake in Velodyne Lidar, a maker of sensors used in the development of autonomous vehicles (AVs), reports Bloomberg. Ford invested USD75 million in Velodyne in 2016. The automaker held a stake of 7.6% or 13.07 million shares in Velodyne at the end of the third quarter of 2020. T.R. Reid, a Ford spokesperson, said, "This is consistent with our efforts to make the best, highest use of capital. We are using Velodyne technology in our autonomous vehicles." Velodyne went public last year through a reverse merger agreement with Graf Industrial, a special-purpose acquisition company. Velodyne is one of the pioneers of LiDAR solutions for advanced driver-assistance systems (ADAS) and AV applications. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Volkswagen (VW) Group has described itself as an 'unintended victim' of a ruling by the US International Trade Commission (ITC) over a dispute between South Korean electric vehicle (EV) battery manufacturers LG Chem and SK Innovation. According to a Reuters report, VW has found itself in the middle of a trade secrets dispute between the two battery makers. The US ITC has ruled in in LG Chem's favor in the dispute. The upshot of this is that SK Innovation may not import components for domestic production of lithium ion batteries for Ford's EV F-150 program for four years, and for VW of America's EV line for two years. VW is obviously unhappy with this ruling and says it needs to be awarded the same grace period as Ford in order to work with suppliers to find an alternative solution to its current contract with LG Chem. (IHS Markit AutoIntelligence's Tim Urquhart)

- Chart Industries has signed Memorandum of Understanding with Matrix Service Company to develop standardized hydrogen solutions in North America. This MoU is in line with both companies' hydrogen strategy to continue to expand commercial arrangements, relationships and geographic diversity, thereby utilizing Chart's expansive hydrogen equipment and liquefaction offerings to develop hydrogen solutions like hydrogen liquefaction plants, marine bunkering, fueling stations, plant expansions, storage expansion, spaceship fueling and other hydrogen related facilities. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Chart Industries has signed a MoU with Svante along with USD15 million investment to develop commercial carbon capture solutions. The objective of the MoU is to develop an integrated carbon capture solution using Svante's rapid adsorption technology to capture carbon directly from industrial post-combustion flue gases and Chart's cryogenic carbon capture technology to make high-purity CO2 products from industrial flue gas streams, and to further explore commercial opportunities. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Ecolab today reported fourth-quarter net income down 24% year-on-year (YOY), to $300.3 million, on net sales down 6%, to $3.07 billion. Adjusted earnings totaled $1.23/share, down 15% YOY and slightly short of analysts' consensus estimate of $1.25/share, as reported by Refinitiv (New York, New York). Growth in healthcare and sciences businesses was offset by declines in industrial businesses. Sales decline "stabilized" in the institutional and specialty, and other, businesses, Ecolab says. (IHS Markit Chemical Advisory)

- Global industrial segment net sales fell 2% YOY, to $1.54 billion, while segment operating income was up 18%, to $316.4 million. Sales grew in the food and beverage and paper businesses, but declined modestly in the water business and decline significantly in the downstream business.

- Global institutional and specialty segment sales fell 21% YOY, to $881.8 million, while segment operating income was down 62%, to $94.4 million. Sales declined significantly in the in the institutional business, and modestly in the specialty business, with both divisions hit by the second wave of COVID-19 infections during the quarter.

- Healthcare and life sciences segment sales grew 26% YOY, to $318.1 million, while segment operating income increased 71%, to $53.8 million. COVID-19 drove demand higher, leading to higher volumes across the segment.

- Other segment sales were down 7% YOY, to $283.2 million, while segment operating income fell 9%, to $43.5 million. A modest increase in the pest elimination business was offset by declines in the rest of the segment, including textile care and colloidal technologies, Ecolab says.

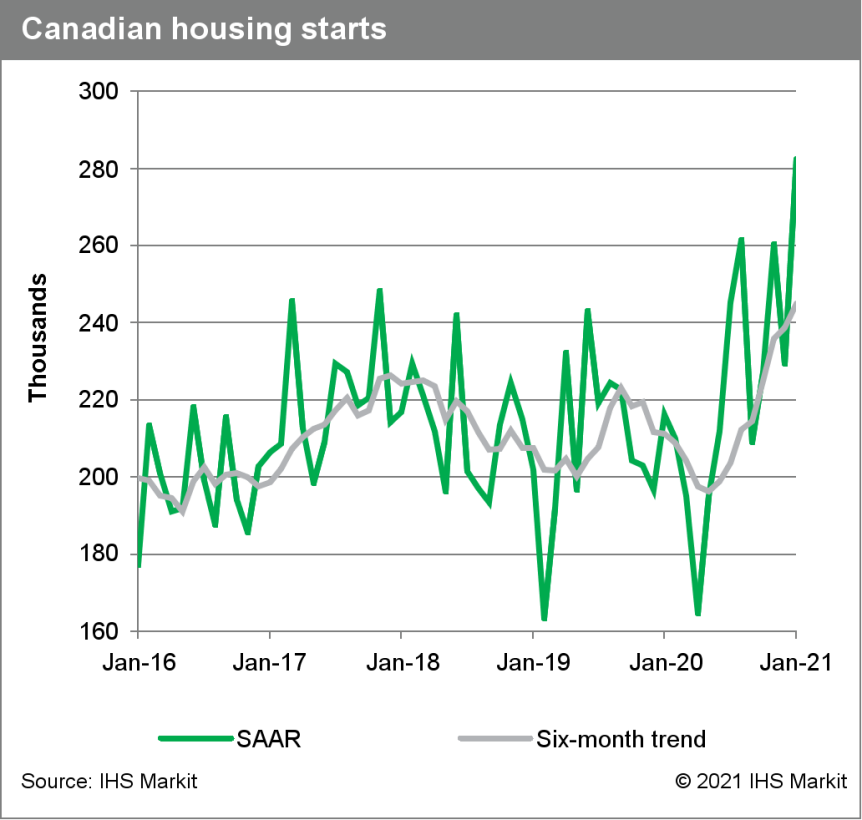

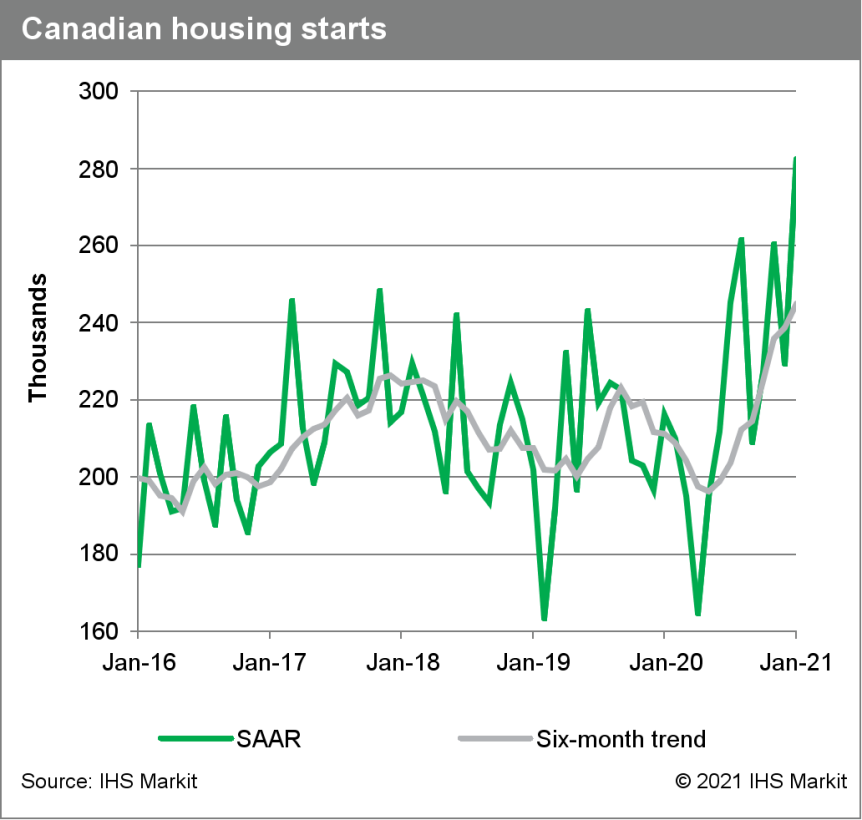

- After the 11.9% month-on-month (m/m) decline in the previous month, Canadian housing starts soared 23.1% m/m to 282,428 units (annualized) in January. (IHS Markit Economist Chul-Woo Hong)

- Urban single and multifamily starts skyrocketed 38.1% m/m and 24.1% m/m, respectively. Rural starts plunged 23.4% m/m.

- January's increase in housing starts was concentrated in Quebec followed by Ontario, despite pandemic restrictions in the construction industry during the month.

- Single-home building activities will likely remain strong in the near term.

- Regionally, British Columbia's starts fell for the second consecutive month, down 17.2% m/m, and Alberta's starts dropped 4.2% m/m.

- The continued upswing in trend housing starts and the much stronger-than-expected leap in January building will result in an upgrade to first-quarter residential investment. Last quarter's building permits trended higher with much of the building activity spilling into the first quarter of this year.

- The Central Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP) directorate opted to hold its policy interest rate constant at its monthly meeting in February, expressing continued support for an expansionary stance. (IHS Markit Economist Jeremy Smith)

- The BCRP's key policy rate, which serves as the reference interest rate for interbank loans, has been held at 0.25%, - a historic low for Peru and the lowest policy rate in Latin America - since March 2020 in an effort to deliver much-needed monetary stimulus to the Peruvian economy.

- In its monthly monetary policy communiqué, the directorate affirmed that its current stance is consistent with achieving annual inflation within the target range of 2% +/- 1% throughout the next two years, noting that economic output is expected to remain below potential over that period, thus lowering the probability of significant upward pressure on inflation.

- The directorate reiterated its intention to maintain a "strongly expansionary monetary posture" for a "prolonged period". This stance includes not only a historically low policy rate but also a wide array of liquidity measures, mostly in the form of government-backed credit to businesses. As of 10 February, the BCRP had executed liquidity injections worth PEN64.6 billion, or 9.2% of estimated 2020 nominal GDP.

- Although the consumer price index rose by 2.7% year on year in January, inflation expectations remain at 2.0%, the midpoint of the target range, for 2021 and 2022.

Europe/Middle East/Africa

- Most European equity markets closed lower except for France being almost flat on the day; Italy -0.7%, Spain -0.6%, Germany -0.3%, and UK -0.1%.

- 10yr European govt bonds closed sharply lower; UK +5bps, Germany/Italy +4bps, France +3bps, and Spain +2bps.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +7bps/243bps.

- Brent crude closed +0.1%/$63.35 per barrel.

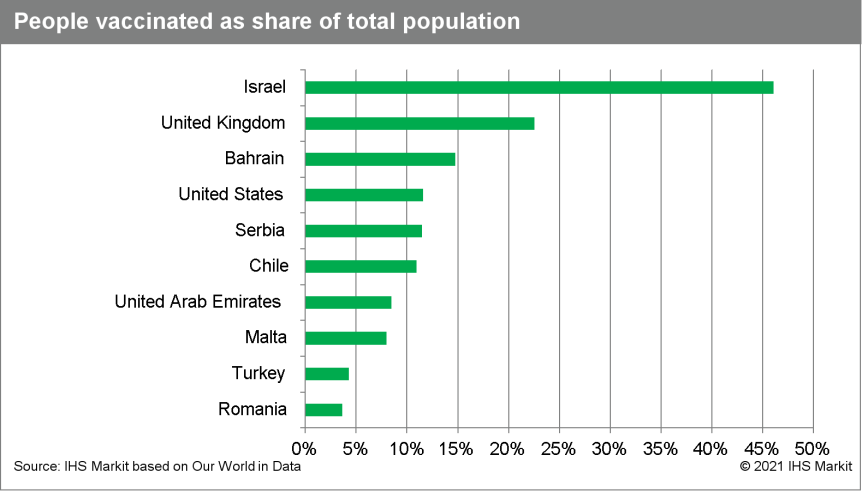

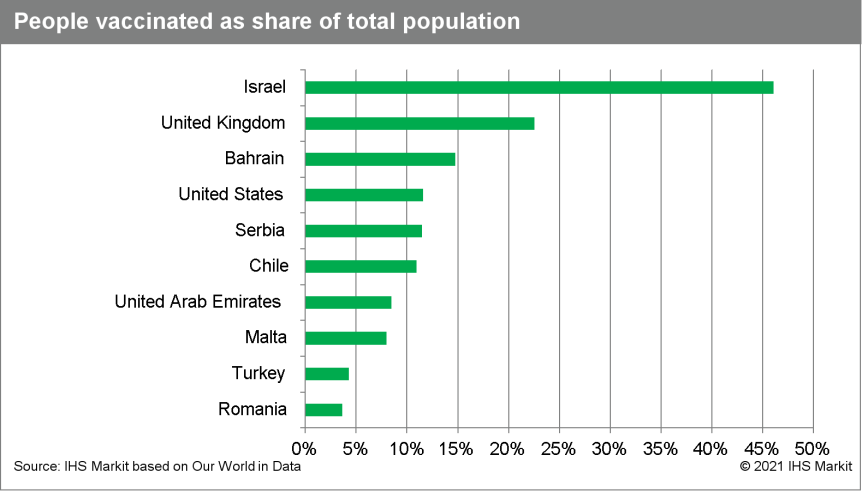

- The long-awaited World Health Organization (WHO) approval of the AstraZeneca (UK) / Oxford University (UK) COVID-19 vaccines produced in South Korea and India pave the way for the mass rollout of vaccines through the COVAX program. This will help some countries, particularly those with no access to vaccines so far, to start launching their mass vaccination campaigns. (IHS Markit Life Sciences' Sacha Baggili and Margaret Labban)

- The winners of the United Kingdom's Offshore Wind Leasing Round 4 have been announced. Sweeping the awards in Bidding Area 1 (Dogger Bank) is RWE Renewables. The company secured two regions in the area for a total of 3.0 GW of proposed project capacity. On par with this is the consortium of EnBW and BP, with two regions in Bidding Area 4 (North Wales, Irish Sea and North Anglesey) for a total of 3.0 GW. Total and Green Investment Group secured 1.5 GW off the Lincolnshire Coast in Bidding Area 2, and Offshore Wind Limited, a joint-venture between Cobra Instalaciones y Servicios and Flotation Energy, was awarded 480 MW in Bidding Area 4, off the Lancashire Coast. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The bidding process has now been concluded and the will progress to the environmental assessment known as a Plan-Level Habitats Regulations Assessment (HRA).

- The bidding process and its newly introduced option fees has courted criticism from various groups such as WindEurope and RenewableUK. Tenderers had to submit bids for option fees in their bids, which are payable annually from the award of seabed rights until the tenderers finalize plans to build the wind farms, up to a maximum of 10 years. Previously in the United Kingdom, The Crown Estate had fixed annual option fees.

- The various groups have alleged that the new bidding system drove options fees upwards significantly to GBP 879 million and have concerns that this will raise project costs for developers and, ultimately, consumers.

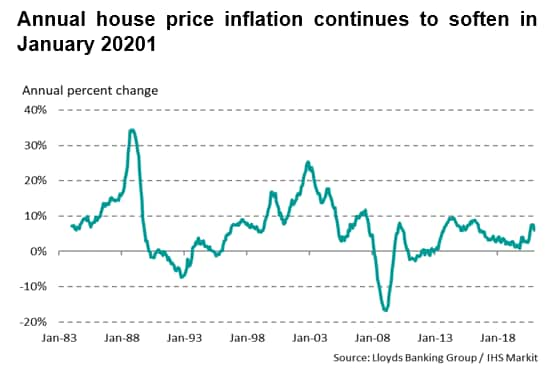

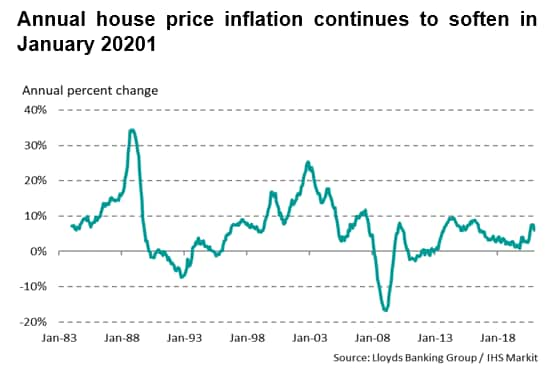

- January's UK Halifax House Price Index (HHPI) provided fresh evidence that the 2020 upturn in the housing market is running out of steam with prices falling at the start of the year and the annual rate of inflation weakening to its lowest recorded level for five months. Since December prices slipped by -0.3%, pushing the standardized house value down to its lowest level since October. Nonetheless, at just under £252,000, typical values remain close to November's record. Moreover, prices are still up around £13,000 compared to a year ago (or, in percentage terms, 5.3%). (IHS Markit Economist Paul Smith)

- Shell New Energies has taken a majority stake (51%) in simply Blue Energy's Kinsale venture. This effectively gives it control over the Emerald floating wind project in the Celtic Sea, 35 to 60 kilometers off the coast of County Cork, Ireland. The joint-venture however will be operated by Simply Blue Energy and supported by Shell's floating wind experts. The project office will be based in Cork City Docklands. The first phase of the Emerald project has a capacity of 300 MW, with the entire project possibly stretching up to 1 GW of capacity. The wind farm will be located near the Kinsale gas fields, which are undergoing decommissioning. (IHS Markit Upstream Costs and Technology's Melvin Leong)

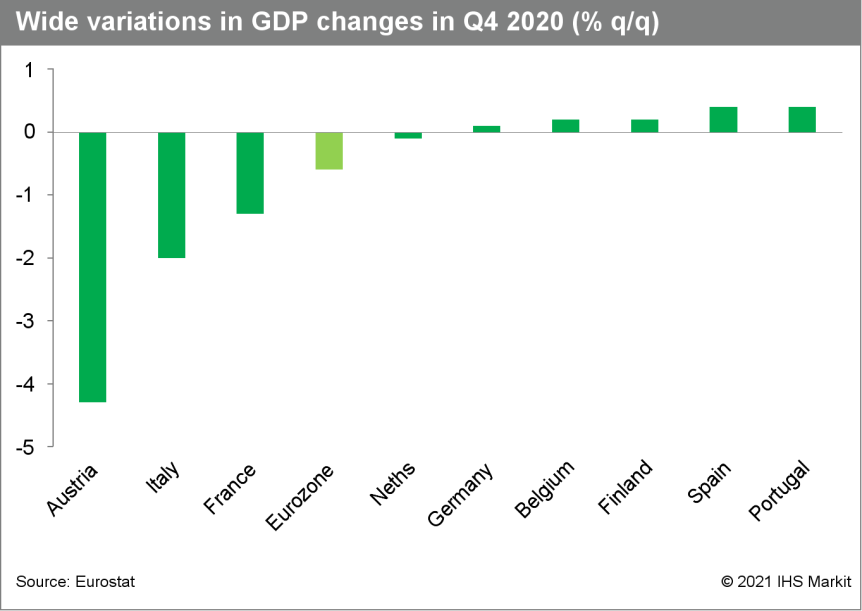

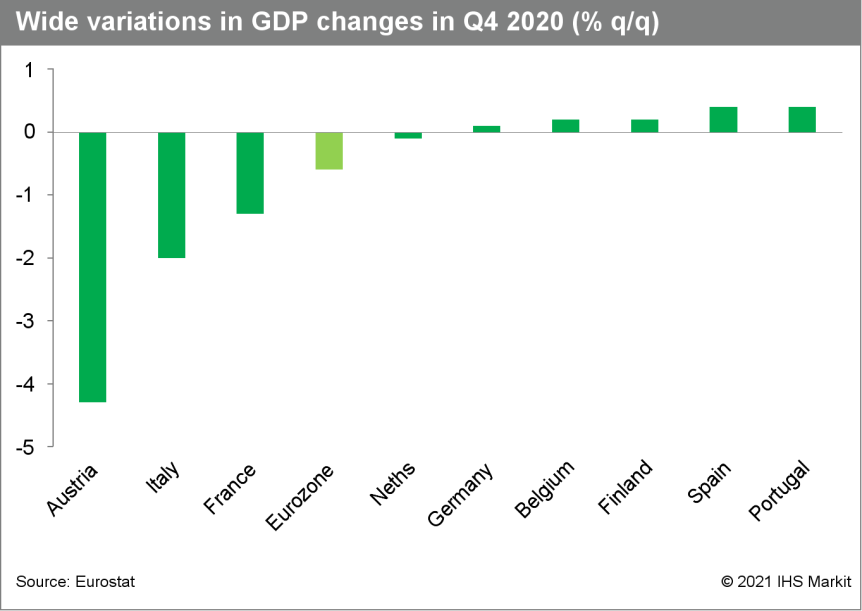

- Variations in COVID-19 virus restrictions and their subsequent easing, plus divergence across sectors, point to a continuation of the recent "noise" in economic data across the eurozone and its member states. We continue to expect a consumer-led growth spurt from the second quarter of 2021 onwards. (IHS Markit Economist Ken Wattret)

- Recent data releases have illustrated the exceptional volatility and divergence of economic indicators across the eurozone and its member states.

- Eurostat's second ('flash') estimate of eurozone GDP in the fourth quarter of 2020 saw a slight upward revision to the initially reported 0.7% quarter-on-quarter (q/q) contraction to -0.6% q/q. Factoring in revisions to back data, eurozone GDP was 5.0% below its pre-COVID-19 virus pandemic level in the fourth quarter of 2019 (versus -5.1% in the initial release).

- On an annual basis, eurozone GDP fell by 6.8% in 2020, a record decline.

- Member states' GDP performance in the fourth quarter last year continued to vary widely, reflecting a range of influences but primarily COVID-19 virus effects. Of the larger economies, Austria (-4.3% q/q) and Italy (-2.0% q/q) underperformed, while Spain and Portugal (both +0.4%) registered the highest q/q rates of growth.

- The European Commission considers introducing an EU deforestation-free label as part of its legislative plans to improve the protection of forests worldwide. At an online event organized by the think tank Farm Europe on 11 February, Jorge Rodriguez-Romero from the Commission's environment department (DG ENVI) said they are looking at a "broad range of possible measures" to step up the EU's actions against deforestation, including labelling but also due diligence, certification and other requirements. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- France's unemployment rate stood at 8.0% during the last three months of 2020, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- The unemployment rate declined from 9.1% during the third quarter of 2020, but it was still up from a reading of 7.1% during the second quarter. The unemployment rate had averaged 8.4% in 2019.

- The pandemic has injected substantial volatility to the unemployment figures, making their interpretation more challenging. Similar to the situation between March and May 2020, the introduction of tight restrictions in late October led many potential jobseekers to stop looking for a job. The INSEE also highlights that the national lockdown also made collecting the data more difficult.

- Underemployment also rose during the fourth quarter but less than during the first lockdown. IHS Markit's measure of the U6 unemployment rate, which includes the headline unemployment rate plus all people marginally attached to the labor force and those employed part time for economic reasons, rose from 20.5% in the third quarter to 21.3% in the fourth quarter of 2020. This compares with readings of 33.3% during the second quarter and an average of 17.8% in 2019.

- A local government in Spain is considering converting Nissan's soon to be closed vehicle production facility in Barcelona to manufacturing batteries for battery electric vehicles (BEVs). Sources familiar with the matter have told Reuters that the regional government of Catalonia is backing the creation of a battery production and recycling plant in the region, referred to as the 'Battery Hub' project. This would be supported by funds allocated to the Spanish government by the European Union's COVID-19 virus fund, with sources suggesting that the government is considering investing in the Nissan site for this use. (IHS Markit AutoIntelligence's Ian Fletcher)

- Saudi consumer prices edged down 0.2% on the month in January and rose 5.7% in annual terms, according to GASTAT, the Saudi Statistical Agency. Price inflation accelerated from 5.3% on the year in December. Discounting for the increase of the VAT rate by 10 percentage points as of 1 July 2020, which added nearly six percentage points to annual price inflation, the consumer price index hardly changed at all. (IHS Markit Economist Ralf Wiegert)

- The breakdown into consumer goods categories revealed that food prices had the strongest impact on the overall price index as they went up by 12.6% year on year, with meat and vegetables prices posting strong leaps. Communication costs also went up markedly (+13.8% on the year).

- Rentals for housing went down by 1.7% on the year. In monthly terms, transport prices had the strongest effect as they rose by 2.0% from December. However, overall price dynamics remained muted in January.

- On 15 February, the IMF reached a staff-level agreement with the Kenyan government on a three-year USD2.4-billion financing package under the IMF's Extended Fund Facility (EFF) and Extended Credit Facility (ECF). (IHS Markit Economist Thea Fourie)

- A multi-year fiscal consolidation approach is to be implemented under the EFF and ECF to address Kenya's debt vulnerabilities. The focus will be placed on increasing the government's revenue steam through higher taxes, tight control of government spending, and addressing the weakness of state-owned entities (SOEs).

- The IMF expects Kenya's GDP to rebound with 7.6% growth during 2021, from an estimated 0.1% contraction in 2020. The reopening of schools and lifting of COVID-19-pandemic-related containment measures underline the growth expectation.

- The IMF's EFF and ECF programs form part of the Kenyan National Treasury's strategy to steer away from high-interest domestic borrowing and more towards concessional and semi-concessional external debt to finance the country's widening fiscal gap. The National Treasury is expected to raise KES123.8 billion (USD1.13 billion) through sovereign bonds sales in the next four months and an additional KES124.3 billion for the upcoming fiscal year, starting in July 2021.

Asia-Pacific

- Most APAC equity markets closed higher, except for India -0.3%; Hong Kong +1.9%, Japan +1.3%, Australia +0.7%, and South Korea +0.5%.

- As per IHS Markit's Commodities at Sea, coal and iron ore discharges during January 2021 at China (Mainland) ports stood at 24.4mt (up 13% y/y) and 105.5mt (up 6% y/y), respectively. (IHS Markit Maritime and Trade's Pranay Shukla)

- There were healthy discharges of thermal coal into China (Mainland) despite almost halt in arrivals of Australian cargoes (0.2mt versus 4.6mt in January 2020). The decline in imports from Australia got compensated with strong arrivals from Indonesia (19.3mt, up 88.5% y/y) and Russia (2.5mt, up 88% y/y). During the reported month there was also discharge of four capes loaded with South African coal.

- In terms of metallurgical coal, there was just 1.4mt of tonnage discharged during January 2021 versus 5mt a year ago. The significant drop in metallurgical coal arrivals was due to the halt of Australian cargoes into the country.

- In terms of domestic supply in Mainland China, there was a significant increase in production at the coal mines leading to a buildup of stockpiles at the pitheads reported to be near capacity. During this time to contain spread of COVID-19, there were restrictions on the movement of people during the Lunar New Year holidays (11-17 February 2021), due to which miners could return to work sooner leading to a faster resumption of mining activities.

- Japanese oil company Idemitsu Kosan has partnered with racing car manufacturer Tajima Motor to market an electric vehicle (EV) this year, according to Nikkei. The four-seater vehicle would be 2.5 meters long, 1.3 meters wide and will be priced between JPY1 million (USD9,494) and JPY1.5 million. The vehicle's body is made of high-performance plastic developed by Idemitsu. It will be powered by lithium-ion batteries and will have a cruising range of 100 km and maximum speed of 60 km/hr. The vehicle may become quite popular among Japanese people who only travel short distances, considering its smaller size, lower price and driving range. It can also become a second car for many people for short grocery runs or going to places where parking is a problem. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tokyo Electric Power Company (TEPCO) Renewable Power, has bought a 30% stake of the TetraSpar floating foundation demonstration project. Other shareholders are Shell (46.2%), RWE (23.1%), and project developer Stiesdal Offshore Technologies (0.7%). The TetraSpar concept seeks to bring down the cost of floating offshore wind and open access to deeper water installations globally. The developer, Stiesdal Offshore Technologies, developed the concept and design from a bottom up approach, working first with manufacturer Welcon to incorporate simplified manufacturing processes. The development is in its final stage pilot project. The TetraSpar foundation components have been manufactured by Welcon, and transported to Grenaa port, Denmark, in the summer of 2020 where they were assembled over two months. The Siemens SWT 3.6 130, 3.6 MW wind turbine will be installed at port and the entire structure towed to the Marine Energy Test Centre near Stavanger, Norway, in time for its 2021 summer commissioning. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The SeaTwirl floating vertical axis wind turbine concept has been granted a patent by the Japanese patent office. To date, the developer and inventor, Swedish company SeaTwirl, has obtained patents in Sweden, the United States, mainland China, and most recently in 2020, Europe, for the divisible nature of the wind turbine. The technology allows the wind turbine to be divisible above and below the house that holds the generator and bearing. The entire generator and bearing housing can thus be replaced just above the water surface, reducing costs and downtime for both installation and maintenance. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- LeddarTech has partnered with Seoul Robotics to develop solid-state LiDAR-based perception solution. This will complement LeddarTech's Leddar Pixell, a 3D solid-state 180-degree LiDAR sensor, designed for shuttles, robotaxis, buses, and heavy commercial vehicles. The partnership is aimed at integrating each other's technical expertise to enhance LiDAR sensor's performance and robustness as well as to shorten time-to-market and reduce costs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Indian government is working to formulate a new policy to develop advanced battery technology for electric vehicles (EVs). According to a report by the Indian Express, the government is looking to institutionalize research and development (R&D) on the next generation of battery technologies for EVs, such as metal-ion, metal air, and hydrogen fuel-cell technologies, to replace lithium-ion batteries. Commenting on the plan, Indian Union Minister Nitin Gadkari said, "About 81% of lithium-ion battery components are available locally and India stands a very good chance for value addition at lower costs. Our mining entities could look for acquiring component assets globally and grab the opportunity, as China has occupied 51%, but still 49% scope is there." (IHS Markit AutoIntelligence's Isha Sharma)

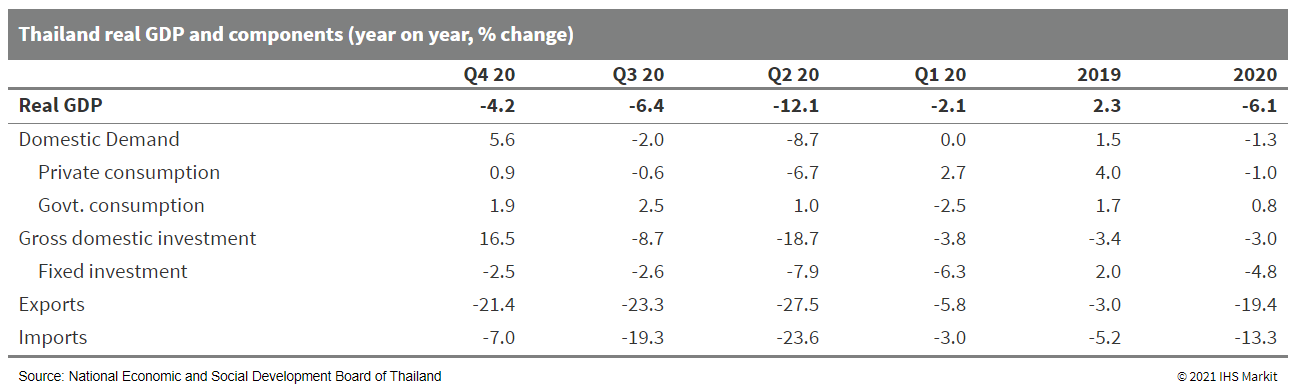

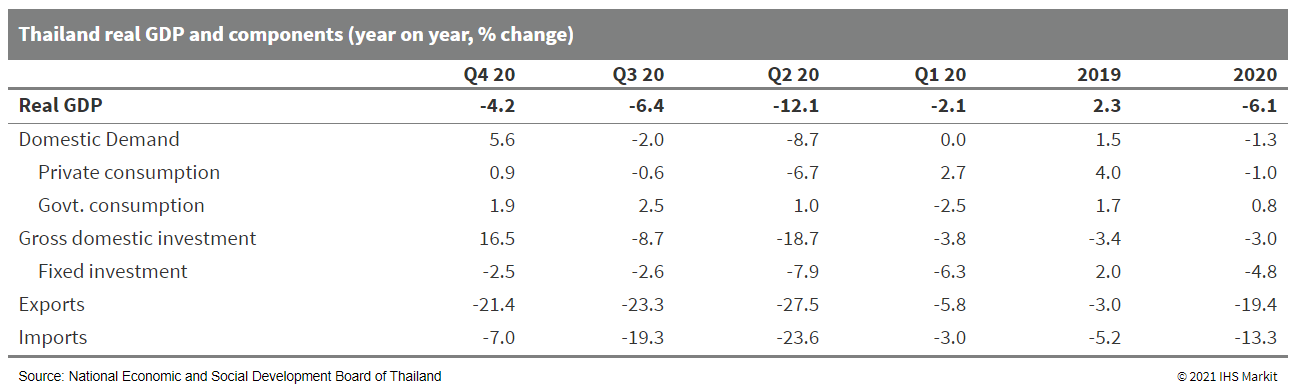

- Latest GDP data suggest that Thailand's economic recovery continued through the final quarter of 2020, as the magnitude of contraction eased to 4.2% year on year (y/y) in the fourth quarter, up from 6.2% y/y in the third. Even so, the Thai economy posted the fastest annual contraction (6.1% y/y) in over two decades, reflecting the huge blow from the COVID-19 virus pandemic in 2020. (IHS Markit Economist Jola Pasku)

- Private consumption expanded by 0.9% y/y during the final quarter on the back of government stimulus measures and special long holidays. Spending on both durable and non-durable goods expanded during the final quarter, but not nearly enough to pull the economy out of negative territory. Private consumption contracted by 1% y/y during 2020.

- The contraction in private investment eased to 2.5% y/y in the fourth quarter due to higher investment in machinery and equipment. This was from higher imports of capital goods from the launch of new mobile phone models. Investment in construction continued to contract, but the pace of contraction eased as the sales of construction materials picked up.

- The government rolled out a USD7-billion fiscal stimulus package last month in response to the second virus wave, which will support private consumption somewhat, but will likely fall short of expediting the economic recovery

- PTT Global Chemical (PTTGC; Bangkok, Thailand) reports that its fourth-quarter net profit climbed to 6.4 billion baht ($214.3 million) from 374 million baht in the year-earlier quarter. Quarterly revenue rose by 3% to 87.5 billion baht. (IHS Markit Chemical Advisory)

- In full-year 2020, revenue fell 20% to 326.2 billion baht. Sales decreased mainly due to a decline in average selling prices, on the back of the COVID-19 impact on worldwide economic conditions and lower demand for end products.

- Net profit plunged 96% to 200.0 million baht from 11.6 billion baht in the previous year.

- At PTTGC's olefins and derivatives business, the company says that the average ethylene price in 2020 was $713/metric ton, down from $823/metric ton in the previous year, due to a weakening of prices during the second quarter caused by a sharp drop in demand caused by COVID-19, the lockdown restriction in many countries, and a slowdown in production among downstream producers. As a result, the market has been oversupplied, the company says. PTTGC's olefin plants had an average utilization rate of 97% last year, down from 102% in 2019.

- In the company's aromatics business, EBITDA plunged 88% in 2020 to 79 million baht, versus 650 million baht. The para-xylene (p-xylene) market was under pressure from the impact of COVID-19, which led to weaker p-xylene demand from downstream products such as purified terephthalic acid and polyester.

- The p-xylene market was supported by strong demand for polyethylene terephthalate (PET) resin because consumers' behavior switched to focus more on hygiene, which led to higher demand for PET for food packaging and single-use bottles. Demand for benzene in late 2020 was strong due to work-from-home arrangements, it says.

- The company's other business unit is refining.

- Vietnam has joined a handful of other countries worldwide authorized to export insects for human consumption to the EU, under the latest European Commission implementing regulation. The implementing law notes that only countries who can guarantee production meets EU hygiene and other requirements for insect farming laid down in the 2017 official controls regulation 2017/625 and a backup 2019 regulation (2019/626). Notably EU law stipulates that only plant-based substrates can be used to feed the insects, not meat or other animal products nor manure. (IHS Markit Food and Agricultural Policy's Sara Lewis)

Posted 16 February 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.