All major APAC and European equity indices closed higher on Friday, while the US was mixed. US and benchmark European government bonds closed sharply lower. CDX-NA and European iTraxx closed almost unchanged on the day across IG and high yield. Copper and oil closed higher, the US dollar was flat, and silver gold and natural gas closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher, except for Russell 2000 -0.4%; DJIA +1.1%, S&P 500 +0.8%, and Nasdaq +0.5%.

- 10yr US govt bonds closed +6bps/1.58% yield and 30yr bonds +2bps/2.04% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY -1bp/300bps, which is -2bps and -8bps week-over-week, respectively.

- DXY US dollar index closed almost flat/93.94.

- Gold closed -1.6%/$1,768 per troy oz, silver -0.5%/$23.35 per troy oz, and copper +2.1%/$4.73 per pound.

- Crude oil closed +1.2%/$82.28 per barrel and natural gas closed -4.9%/$5.41 per mmbtu.

- Revenue per available room at US hotels last week, after seasonal adjustment, was 89.7% of the mid-January 2020 level (the IHS Markit estimate based on weekly data from STR). This is up from recent weeks but still below averages during summer weeks, indicating continued caution on the part of would-be travelers. Meanwhile, averaged over the last seven days, about 241,000 people per day received a first (or only) dose of a COVID-19 vaccination, down from about 277,000 per day the prior week. As of yesterday, 218 million US residents, or about 66% of the population, were at least partially vaccinated against COVID-19. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Total US retail trade and food services sales increased 0.7% in September. Core retail sales were stronger than expected, implying more personal consumption expenditures (PCE) in the third and fourth quarters. (IHS Markit Economists James Bohnaker and William Magee)

- Gasoline station sales rose 1.8% and were up 38% over 12 months. Gasoline consumption in the US has made a full recovery to pre-COVID-19 levels, and elevated pump prices are also supporting nominal gasoline sales. Regular gas prices averaged $3.18/gallon in September, the highest monthly level since 2014.

- Sales at motor vehicle and parts dealers increased 0.5% in September to end a four-month slide, leaving the level of sales still 13% lower than its April peak. Auto sales will not soon approach early 2021 levels as semiconductor chip shortages and high retail prices are expected to persist well into next year.

- Sales at food services and drinking places increased 0.3%, suggesting that the restaurant industry continued to recover modestly in September despite the spread of the Delta variant.

- Retail sales increased strongly and broadly in September as consumers likely funneled more of their spending toward goods and away from services. Ongoing virus concerns could mean a more gradual return to pre-pandemic spending patterns.

- This report may also reflect earlier-than-usual holiday shopping as it has been widely publicized that supply-chain disruptions will result in product shortages and longer delivery times over the next several months.

- The US University of Michigan Consumer Sentiment Index decreased 1.4 points from its September level to 71.4 in the preliminary October reading—still slightly below its nadir in April 2020 and nearly the lowest in a decade. (IHS Markit Economists James Bohnaker and William Magee)

- The decline was driven by worsening views on both the present situation and the future. The present situation index fell 2.2 points to 77.9, and the expectations index declined 0.9 point to 67.2.

- Elevated consumer prices are weighing on sentiment. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.2 point to 4.8% to reach its highest level since 2008. This is likely a reaction to higher gasoline prices, which averaged $3.27/gallon during the week ended 11 October. Pump prices are at a seven-year high.

- However, consumers expect price pressures to ease over the longer term; the expected 5-to-10-year inflation rate declined 0.2 point to 2.8%, which is well within the historical range over the past several decades.

- Views on buying conditions for big-ticket items remained poor. The index of buying conditions for large household durable goods and automobiles slumped further as high prices and limited inventories continue to be challenges. The index for homebuying conditions improved off cycle lows but is severely depressed in a historical context.

- The recent trend in consumer sentiment is somewhat at odds with other measures of consumer activity. Retail sales and data on credit- and debit-card spending suggest that consumers are spending confidently heading into the fourth quarter. The weakness in sentiment is likely a reflection of ongoing anxieties about the Delta variant, even though the number of COVID-19 cases in the US has declined in recent weeks. Higher prices for gasoline and other consumer products are also factors weighing on sentiment. We expect that sentiment will track spending more closely as these factors improve.

- VinFast is planning to start its first deliveries to US customers in 2022, reports Reuters. The automaker's new CEO Michael Lohscheller told the news service in an e-mail, "VinFast will unveil two of our latest EV models, which are VF e35 and VF e36, at the 2021 Los Angeles auto show this November, thus marking our official introduction to the American market." He added that the company already has an office in California and that it expects to inaugurate 60 showrooms in the United States next year. However, he said that the company expects to undertake most sales online in the US, following pre-orders beginning in the first half of 2022. Lohscheller has also indicated that VinFast plans to undertake an initial public offering (IPO) in the US to fund its further growth but said that the "specific timing will depend on the market and other conditions. We will reveal more information at an appropriate time in the future". (IHS Markit AutoIntelligence's Ian Fletcher)

- The Colombian energy regulator published on 26 September the list of the companies that qualified for the third auction of renewable energy projects, to be held on 26 October. The energy ministry also published on 30 September 2021 Colombia's hydrogen roadmap, targeting 1GW of electrolysis capacity by 2030 and escalated usage of fuel-cell vehicles. Both developments point to a rapid expansion in renewables in the country, which would attract large-scale foreign investment and generate thousands of jobs, according to the energy ministry. (IHS Markit Country Risk's Carlos Caicedo)

- Colombia largely relies on hydropower, but has considerable potential to develop renewable sources. The energy matrix in Colombia is currently dominated by hydropower, accounting for 69.6% of power generation, followed by natural gas with 12.3% and coal with 9.3%. Gasoline and diesel account for 7.8%, while non-conventional renewable resources contribute just 1% to energy generation.

- The upcoming October auction is the result of recent landmark regulatory implementation. Several milestones have been accomplished in 2021 to date, such as the approval by Congress of the Energy Transition Bill in June, the award of the first auction of storage in lithium batteries (to be used as backup) in July, and the publication of terms for the third auction of renewable energy slated for 26 October.

- The publication of the hydrogen roadmap adds to Colombia's ambitious plan for renewables. On 30 September 2021, the energy ministry published the country's hydrogen roadmap that "establishes the path for the development, generation and use of this cleaner energy, promoting the consolidation of Colombia's energy transition for the next 30 years", according to the government.

- Colombia appears certain to boost electricity generation coming from renewables, but poor infrastructure and lengthy environmental licensing procedures pose hurdles. Colombia's infrastructure is deficient, and this is likely to slow development of projects. The obsolete power distribution network will require both an overhaul and the construction of additional lines. Poor road and port infrastructure, particularly in the Guajira department, where the largest projects will be located, will slow the delivery of equipment and machinery to production sites.

- All members of the Central Bank of Chile (Banco Central de Chile: BCC)'s board agreed to raise the monetary policy rate again - this time by 125 basis points (bps) - during a board meeting on 12-13 October. (IHS Markit Economist Claudia Wehbe)

- Domestically, consumer prices surged 1.18% in September after advancing by 0.36% month on month (m/m) in August. The result was mainly driven by rising prices across all basket categories.

- Annual inflation accelerated to 5.3% from 4.8% in August, while core consumer price inflation that excludes food and energy prices also spiked to 4.2% from 3.8%.

- Chile's unadjusted monthly economic activity indicator, a proxy for GDP, accelerated from 18.1% year on year (y/y) in July to 19.1% y/y in August, posting another historical record. The result was mainly driven by contributions in services and commerce.

Europe/Middle East/Africa

- All major European equity indices closed higher; Germany/Italy/Spain +0.8%, France +0.6%, and UK +0.4%.

- 10yr European govt bonds closed lower; France/Germany/Spain +2bps, Italy +4bps, and UK +6bps.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -1bp/256bps, which is -2bps and -8bps week-over-week, respectively.

- Brent crude closed +1.0%/$84.86 per barrel.

- Germany-based engineering provider FEV Group has displayed its electric-vehicle concept for car sharing called Shared Vehicle Electric Native or SVEN at the Deutsches Museum in Munich. According to a company release, the vehicle is 8.2 ft long and 5.7 ft wide and comes with 2+1 seating arrangement. SVEN uses solar cells in the roof to boost range and performance and comes with camera and radar sensors for automated driving functions. It is built on the company's FlexBody concept, which helps to provide a high level of crash safety. FEV is an engineering and digital mobility company. It is a service provider of vehicle and powertrain development for hardware and software. The company currently employs 6,300 employees in customer-oriented development centers at more than 40 locations on five continents. In 2020, FEV inaugurated a development and test center for high-voltage batteries for passenger and commercial vehicles. (IHS Markit Automotive Mobility's Isha Sharma)

- KBR's ammonia technology has been selected by ACME Group for its green ammonia project to be built in Oman. Under the terms of the contract, KBR will provide technology license, engineering, proprietary equipment, catalyst, and commissioning services for a plant to produce 300 metric tons per day of ammonia. The plant will be an integrated facility using solar and wind energy to produce green ammonia. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- Aquaterra Energy has secured a master engineering and design service agreement to deliver multiple Sea Swift platforms over a three-year period. The company only disclose the client was supermajor, but IHS Markit understands it to be Chevron Angola. The platforms will be destined for off the coast of the Cabinda Province, offshore Angola. Work has already begun on the first platform, which will be engineered for a 20-year production life in approximately 75m of water. The initial platform will be equipped with solar panels, which will allow the client to power the platform purely from renewable energy. Aquaterra Energy will manage the entire project scope via its in-house engineering and design teams and will work alongside in-country partner. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

Asia-Pacific

- All major APAC equity indices closed higher; Japan +1.8%, Hong Kong +1.5%, South Korea +0.9%, Australia +0.7%, and Mainland China +0.4%.

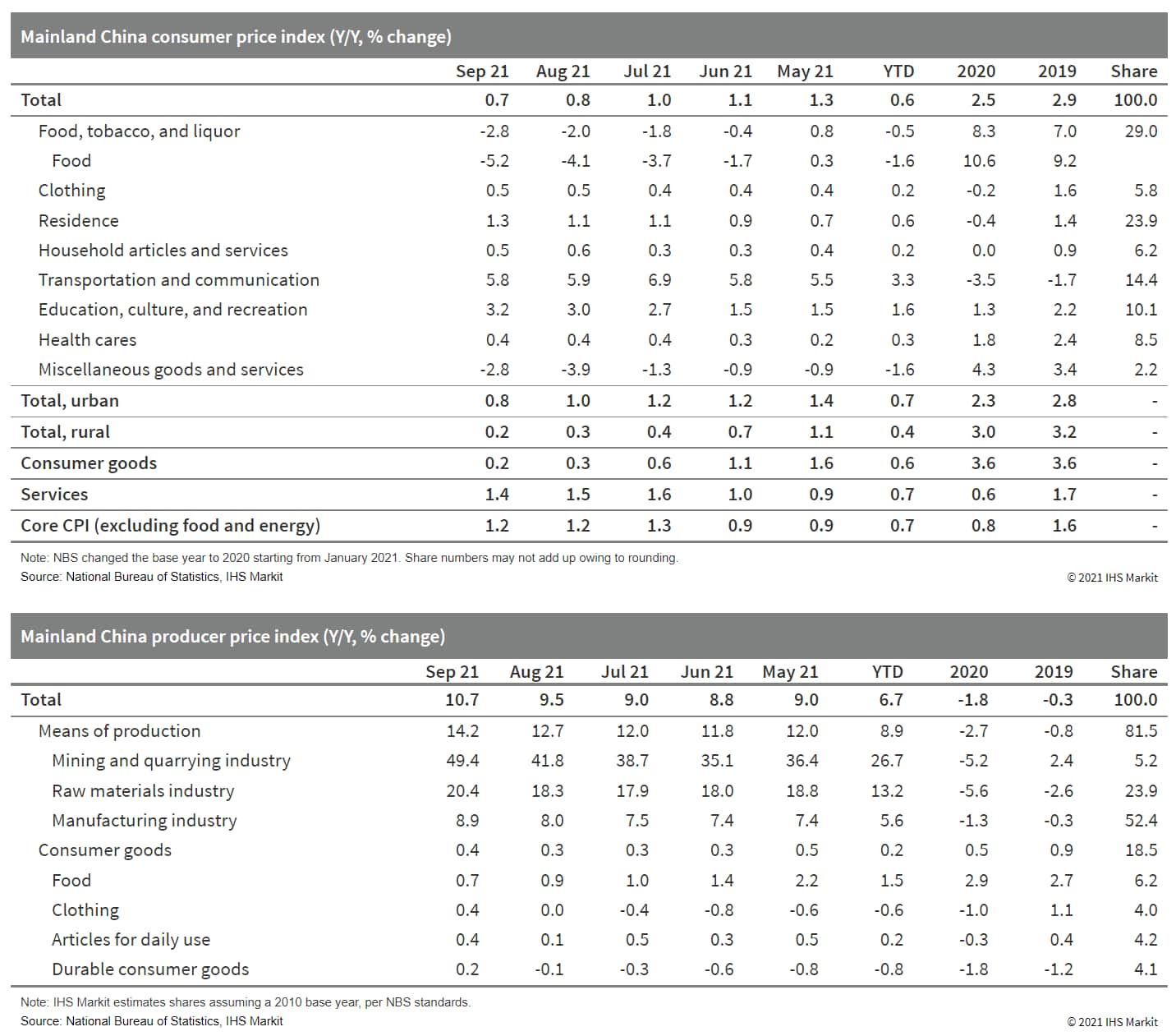

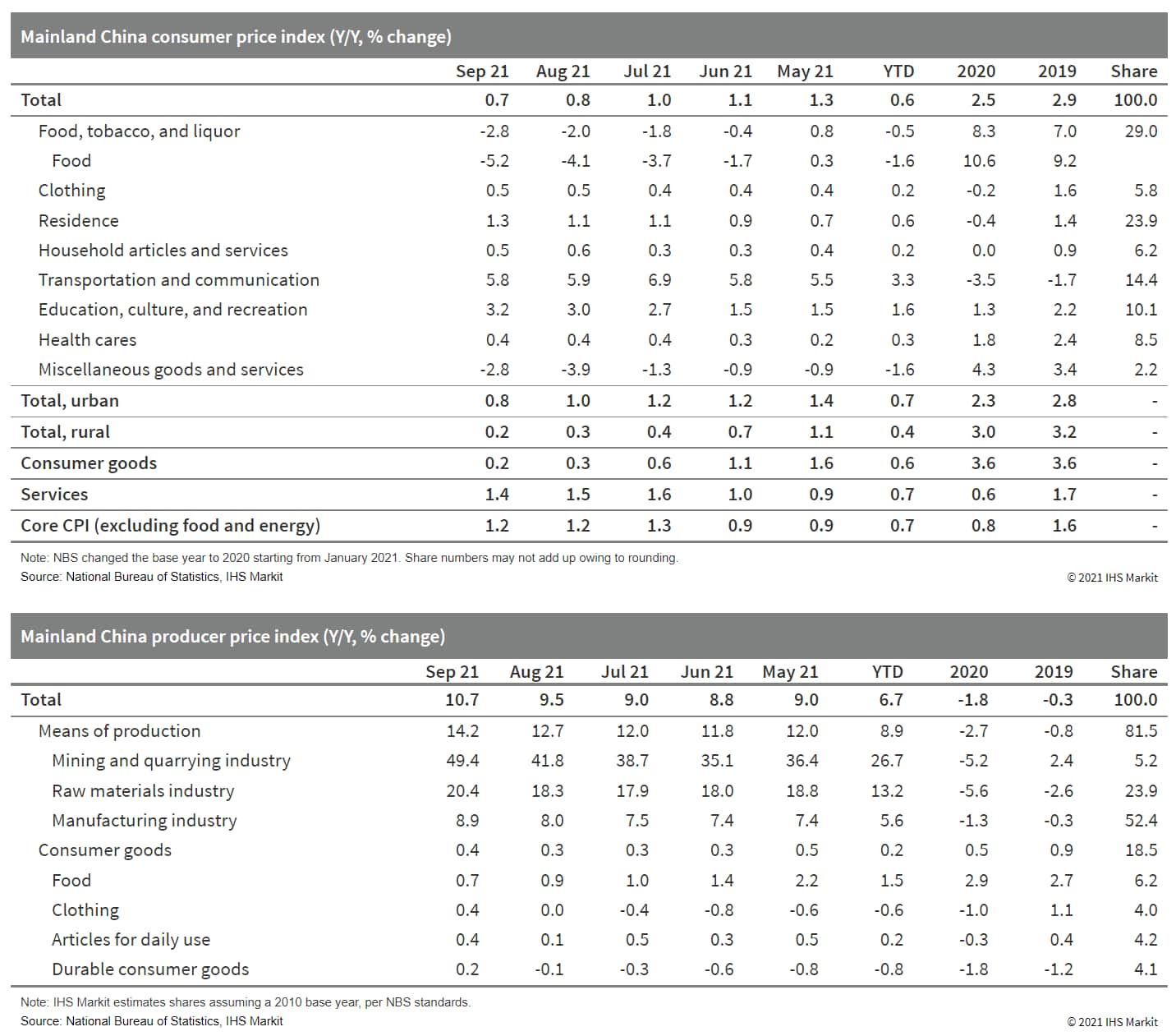

- Mainland China's Consumer Price Index (CPI) increased by 0.7% year on year (y/y) in September, down by 0.1 percentage point from the August reading, according to the National Bureau of Statistics (NBS). Month-on-month (m/m) CPI inflation came in at 0.0%, down by 0.1 percentage point from the prior month. (IHS Markit Economist Lei Yi)

- The disinflation in headline CPI inflation largely came from the widened deflation in food prices, which fell by 5.2% y/y in September. Pork prices deflation, in particular, registered 46.9% y/y in September, up by 2 percentage points from August. Non-food prices, on the other hand, increased by 2.0% y/y in September compared with 1.9% in August, led by rising vehicle fuel prices. Sporadic COVID-19 outbreaks moderated service price inflation, which fell by 0.1 percentage point to 1.4% y/y in September, with air tickets, tourism agency, and hotel accommodation services all reporting weaker inflation than the month before. Excluding the volatile food and energy components, core CPI inflation stayed unchanged from the prior month at 1.2% y/y.

- The Producer Price Index (PPI) inflation hit a record high, ticking up by 1.2 percentage points to reach 10.7% y/y in September. Month-on-month PPI inflation registered 1.2%, up by 0.5 percentage point from August.

- Pony.ai has received permission to conduct driverless tests on public roads in China's capital city, Beijing, according to Business Wire. The technology company has already received a permit to conduct tests on certain sections of Beijing highways in July 2021. Pony.ai is now permitted to conduct driverless testing in an area of around 20 square kilometers covering major subway stations, residential areas, and technology parks in a pilot zone for autonomous driving vehicles. Pony.ai claims to be the first company to test fully autonomous vehicles (AVs) on public roads in both the United States and China. The company has developed an AV system, PonyAlpha, which combines cameras with sensors such as radars and LiDAR, along with artificial intelligence software to detect objects at distances of up to 200 meters. (IHS Markit Automotive Mobility's Nitin Budhiraja)

- Taiwan Semiconductor Manufacturing Co. (TSMC) has announced plans to build a new chip manufacturing plant in Japan in 2022, reports Kyodo News, citing the company's CEO C. C. Wei. TSMC will invest around JPY1 trillion (USD8.8 billion) in the new plant, which will produce 22-nanometer and 28-nanometer chips, and will also receive financial aid from the Japanese government. "Facilitating the domestic production of semiconductors is extremely important," said Japanese industry minister Koichi Hagiuda. The plant is expected to begin operations from the end of 2024 and will be jointly run with Sony Group Corporation. According to sources familiar with the matter, Denso Corporation is also considering joining the project. The latest plan by TSMC is pending approval from its board. The company has not yet disclosed the location of the plant and other details such as capacity. The new plant will focus on the production of chips that are currently having the biggest supply issues because of high demand from automakers and technology companies. (IHS Markit AutoIntelligence's Isha Sharma)

Posted 15 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.