All major European and US equity indices closed higher, while APAC markets were mixed. US and most benchmark European government bonds closed lower. European iTraxx and CDX-NA closed tighter across IG and high yield. Natural gas and copper closed higher, while the US dollar, oil, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; DJIA +1.2%, S&P 500 +1.6%, Nasdaq +2.5%, and Russell 2000 +2.8%.

- 10yr US govt bonds closed +6bps/2.05% yield and 30yr bonds +7bps/2.36% yield.

- CDX-NAIG closed -2bps/65bps and CDX-NAHY -10bps/360bps.

- DXY US dollar index closed -0.4%/95.99.

- Gold closed -0.7%/$1,856 per troy oz, silver -2.1%/$23.34 per troy oz, and copper +0.5%/$4.53 per pound.

- Crude oil closed -3.6%/$92.07 per barrel and natural gas closed +2.6%/$4.31 per mmbtu.

- US producer prices for final demand spiked up 1.0% in January and rose 9.7% from a year earlier. The December gain was revised higher. Energy goods climbed by 2.5% to more than reverse the Omicron-inspired December drop. Food prices climbed by 1.6%, also reversing a December dip. Core goods prices rose 0.8% and were 9.4% above 12 months earlier. (IHS Markit Economist Mike Montgomery)

- Final demand prices for services grew 0.7% in January. Retail and wholesale trade margins climbed by 0.6%. Transportation and warehousing prices were unchanged as air fares fell by 4.2% after climbing a total of 9.0% in the prior two months. The other services complex scored a 0.9% gain on a broad-based advance.

- The producer price report was, in a word, "ugly," but global supply chain woes and past fiscal and monetary stimulus have produced other ugly inflation reports. Indeed, the year-over-year increases for the three most common measures (finished goods, excluding food and energy, and also excluding trade) were all a tad worse in December. The 1% handle just ramps up the fear of double-digit inflation.

- Bottom line: Inflationary pressures persist and are endemic in the economy. There is no one source that can be whisked away, but instead a tangle of interconnected sources, including supply chain issues, the pandemic itself, and reluctant-to-work workers. It may not take decades to tamp down this inflation episode, but it will not happen overnight. The ugly number may also contribute to the size of the Federal Reserve's initial inflation-fighting efforts.

- On February 15 the Biden administration announced government-wide initiatives supporting hydrogen and carbon capture as part of its "Buy Clean Task Force." A White House fact sheet said the administration was announcing at least $9.5 billion for hydrogen initiatives. According to the White House release: "Clean hydrogen can reduce emissions in many sectors of the economy, and is especially important for hard-to-decarbonize sectors and industrial processes, such as steel manufacturing. But clean hydrogen is not yet in widespread use. Targeted investments can help reduce costs, make new breakthroughs, and create jobs for American engineers, factory workers, construction workers, and others." So, the administration said the Department of Energy is announcing the following: Requests for Information on (IHS Markit PointLogic's Annalisa Kraft):

- $8 billion for Regional Clean Hydrogen Hubs: DOE will support development of networks of clean hydrogen producers, potential consumers, and connective infrastructure. These regional hubs will advance the production, processing, delivery, storage, and end-use of clean hydrogen, including innovative uses in the industrial sector. DOE will prioritize hubs that can provide significant training and long-term job opportunities for residents of the region.

- $1 billion for a Clean Hydrogen Electrolysis Program: Electrolysis (using electricity to split water into hydrogen and oxygen) allows for clean hydrogen production from carbon pollution-free power sources like wind, solar, and nuclear. This program will improve the efficiency and cost-effectiveness of these technologies, by supporting the entire innovation chain—from research, development, and demonstration to commercialization, and deployment.

- $500 million for Clean Hydrogen Manufacturing and Recycling RD&D Activities: DOE will also support American manufacturing of clean hydrogen equipment, including projects that improve efficiency and cost-effectiveness and support domestic supply chains for key components, through the Bipartisan Infrastructure Law's Clean Hydrogen Manufacturing Initiative. DOE is also launching Clean Hydrogen Technology Recycling Research, Development, and Demonstration activities, to fund innovative approaches to increase the reuse and recycling of clean hydrogen technologies.

- Mobileye, Beep, Benteler are collaborating on plans to launch micro-transit autonomous vehicles (AVs) in the United States in 2024, according to a joint statement. The collaboration will leverage the partners' expertise to create an AV aimed at first- and last-mile transportation solutions. According to the statement, the three companies plan to "address the end-to-end requirements for developing and deploying autonomous movers with competencies encompassing scalable vehicle development, end-to-end systems integration, autonomous driving platforms and turnkey mobility operations management and technology." The vehicles will be automotive grade, fully electric and autonomous, and deployed in public and private communities in North America. The targeted is an SAE Level 4 vehicle, which means its autonomous capability will be geofenced to specific operational areas. Benteler EV Systems is to provide the scalable and modular platform, develop the autonomous mover, and integrate all individual subsystems into the final vehicle. Production is to be in the United States, although the planned location has not been disclosed. Benteler is to provide industrialization and production of the vehicle. The three companies did not disclose details of several issues, including funding or financial details of the collaboration and planned initial areas of deployment of the AVs. The companies have not disclosed the planned production location or how many AVs they aim to deploy initially. Beep has run AV pilot programs in the US in areas including Yellowstone National Park, Georgia, Florida, and Arizona. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Aurora Innovation has collaborated with truckload carrier US Xpress Enterprises to deploy intelligent autonomous trucks, according to a company statement. As part of the collaboration, Aurora plans to leverage intelligence from US Xpress's digitally enabled fleet, Variant, to determine where autonomous technology may have the greatest impact. The companies plan to identify jointly optimal deployment strategies of Aurora Driver-powered trucks to address unmet demand and improve operational efficiency and productivity. Following the introduction of Aurora's autonomous Driver-as-a-Service product, Aurora Horizon, the companies will explore integrating application programming interfaces (APIs) into Variant to improve dispatching and dynamic routing. (IHS Markit Automotive Mobility's Surabhi Rajpal)

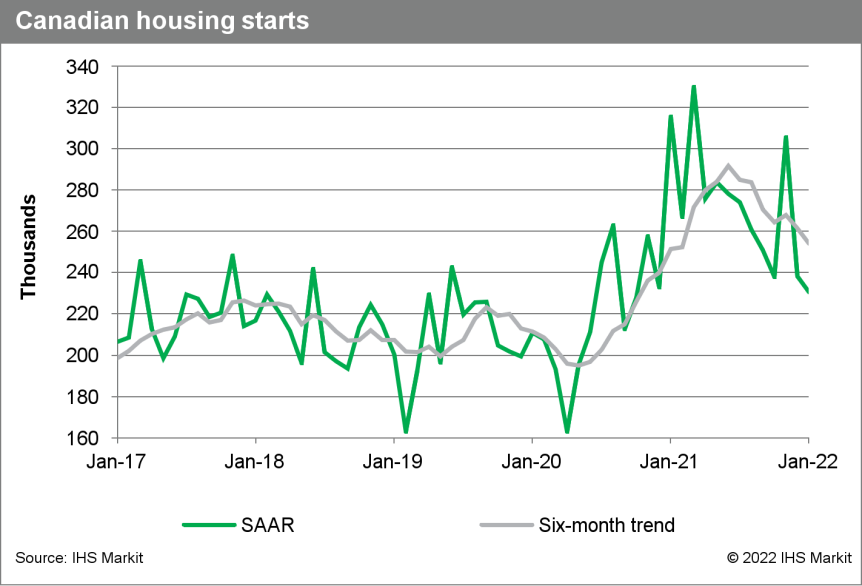

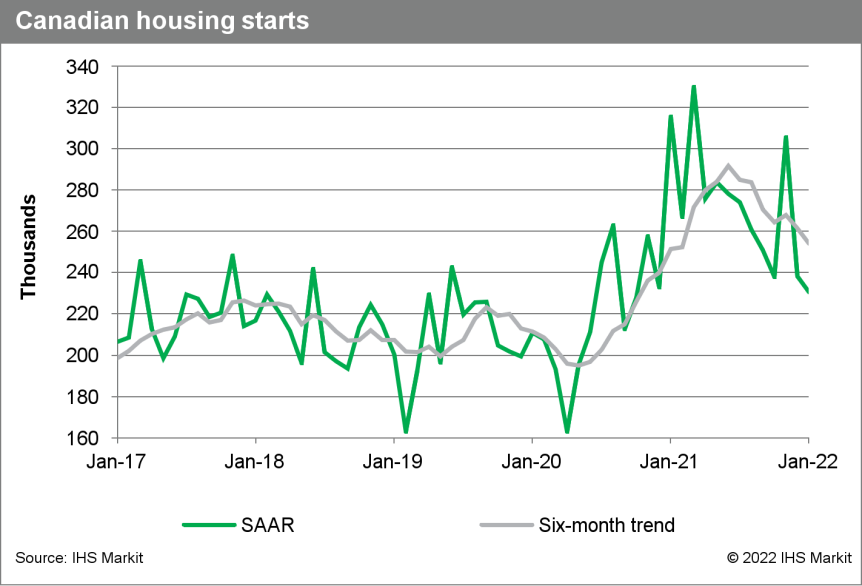

- Canada's housing starts decreased 3.2% month over month (m/m) to 230,754 units (annualized). The decrease was concentrated in urban multiple starts, down 8.8% m/m as urban single starts and rural starts rebounded 6.8% m/m and 10.5% m/m, respectively. (IHS Markit Economist Chul-Woo Hong)

- While the loss was spread across 7 of 10 provinces, a strong rebound in Quebec partially cancelled the overall loss.

- Housing starts were likely affected by severe winter weather in January but will remain solid in the short term.

- Urban multiple starts have declined for six of the past seven months to the lowest level since restrictions on construction were announced in the early months of the pandemic. Yet, urban multiple starts, at 144,332 units, are above the pre-pandemic five-year average. Meanwhile, urban single starts remained at a historically solid level.

- The consistently strong demand pushed existing home prices higher, surging to a record 28.0% year-over-year pace in January. Therefore, combined with strong residential building permits in December, new home supply will continue to advance at a solid level in the first quarter and is expected to moderate in the coming quarters partly because of the faster rise in borrowing rates, anticipated to begin in March. Overall, starts are forecast to average at 229,400 units in 2022, which is a historically strong level.

- Canadian dairy giant Saputo has announced plans to streamline its manufacturing footprint in the US and international markets, while also optimizing and modernizing its manufacturing base. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- The company stated it plans to invest CDN169 million ($133 million) towards the modernization and expansion of its cheese manufacturing facilities in Wisconsin and California. These initiatives will begin in the fourth quarter of fiscal 2022 and are expected to take approximately 24 months to implement. Furthermore, Saputo intends to close its Bardsley Street, Tulare, California, facility in fiscal 2023.

- In the international sector, the company will be streamlining operations in two of its manufacturing facilities in Australia.

- The capital investments and consolidation initiatives are expected to result in annual savings and benefits gradually, beginning in fiscal 2023, and reaching approximately $112 million ($83 million after tax) by the end of fiscal 2025. Costs connected with the capital investments and consolidation initiatives will be approximately $46 million after tax.

- Saputo's third quarter revenues for the fiscal year of 2022, which ended on 31 December, increased 3.7% y/y to CDN3.9 billion. Adjusted EBITDA amounted to CDN322 million, down CDN109 million or 25.3% y/y.

- The company warned that challenging market conditions, including labor shortages, supply chain disruptions, and inflationary pressures, continued to impact its sectors to varying degrees, with the US sector being the most impacted.

- Iveco has announced a BRL1-billion (USD190-million) investment round for its South American operations until 2025. According to a company statement, 60% of the investment is to support product development; 15% is for industrial processes, quality and recruitment; 13% is for after-sales, customer service, and network development; and 12% is for parts location. Overall, the goal of the investment is to strengthen further Iveco's market presence in the region. Iveco states that its sales in the region grew in 2020 and 2021 as a result of expansion of the dealers' network, development of new products and services, and new hiring. In the region, Iveco offers light- to heavy-duty products, has 158 service points in Brazil and Argentina, and covers Brazil from north to south. Iveco also highlights the Brasil Natural Power program of gas-powered heavy trucks. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity markets closed higher; Italy +2.1%, Germany +2.0%, France +1.9%, Spain +1.7%, and UK +1.0%.

- Most 10yr European govt bonds closed lower except for UK -1bp; Italy +1bp, Germany/Spain +3bps, and France +4bps.

- iTraxx-Europe closed -2bps/66bps and iTraxx-Xover -8bps/324bps.

- Brent crude closed -3.3%/$93.28 per barrel.

- Italian oil and gas major Eni has completed the acquisition of a 20% stake in the 1.2 GW Dogger Bank C project off United Kingdom. Equinor and SSE Renewables each sold 10% stake to Eni. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- Eni is already a partner with Equinor and SSE Renewables on the first two phases of Dogger Bank Wind Farm. Following the transaction, the new overall shareholding for the 3.6GW Dogger Bank projects is Equinor (40%), SSE Renewables (40%), and Eni (20%). A consistent combination of equity partners across all three phases of the project is said to enable further synergies across both the construction and operations phase of the Dogger Bank wind farm.

- The Dogger Bank C project is being developed on a different timescale to the first two phases. Offshore export cable installation will commence in the first quarter of 2024; Offshore platform installation will commence in the second quarter of 2024; Foundation installation will commence in the third quarter of 2024; Turbine (14MW Haliade-X) installation will commence in the second quarter of 2025. Project completion is expected by March 2026.

- Ørsted has completed the divestment of 50% stake in the 900MW Borkum Riffgrund 3 project off Germany to Glennmont Partners. This is the Ørsted's first farm-down to an institutional investor signed prior to taking a final investment decision. The transaction, which includes a commitment to fund 50% share of the payments under an EPC contract for the entire wind farm, is valued at approximately USD1.4 billion. As part of the agreement, Ørsted will construct the wind farm under a full-scope EPC contract, perform operations and maintenance services for 20 years, and provide a route to market for the power and green certificates generated by Borkum Riffgrund 3. Borkum Riffgrund 3 will feature Siemens Gamesa 11MW offshore wind turbines. Project commissioning is expected by 2025. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- According to a "flash" GDP estimate for the fourth quarter of 2021 released by Statistics Denmark, the Danish economy grew by 1.1% quarter on quarter (q/q) in seasonally adjusted terms, significantly higher than 0.3% q/q growth recorded in the eurozone. This means that the country continues to stick out as one of the best performers in Western Europe. (IHS Markit Economist Michal Plochec)

- No detailed breakdown of the underlying growth drivers is available in the release, but it is noted that the growth was driven mainly by positive developments in industry and government consumption. The latter increased notably, mostly due to developments in the healthcare system and in the municipalities.

- Separate high frequency-releases reveal that industrial production grew 11.4% year on year (y/y) on average during the fourth quarter, providing strong support to the headline economic growth. The most rapid increases were recorded in non-durable consumer goods which grew by 20.2% y/y during the quarter. Also, capital goods and non-pharmaceutical industrial sector's performance were strong, growing by 6.3% and 6.5% y/y respectively in the fourth quarter of 2021.

- Moreover, the external sector remained strong and supportive in the fourth quarter of 2021. The substantial current-account surplus, a traditional feature of the Danish economy in recent year, has increased through 2021 and as of the year-end exceeded 11% of GDP, a record high for Denmark, driven by rising profit from interests and dividends from offshore investments (primary income) as well as greater services surplus. On the other hand, surplus in goods balance continues to consequently shrink since 2019.

- Early in 2022, surging inflation poses the biggest macroeconomic challenge across Europe. In January, the headline consumer price index spiked to 4.3% y/y, from 3.1% y/y in December, raising concerns about earlier prospects of monetary tightening

- Electric vehicle (EV) charging infrastructure provider Power Dot is aiming to become one of Spain's leading public charging providers, according to a CE Noticias Financieras report. The company has already installed 150 charging points in the country and is planning to install 1,500 chargers by 2025 and expand the network to 3,500 chargers by 2030. Power Dot will particularly look to install its chargers in busy urban areas such as car parks, supermarkets, shopping centers, and restaurants and is looking at partnering with Spanish real estate companies and supermarket companies to roll out this strategy. In Spain, it has already signed contracts with CBRE, Cushman & Wakefield, Ibis, Mercasa, Q8, and Martín López Carburantes. Power Dot's general manager Joao Seabra said, "We are constantly looking for partners who want to be part of this ecological change and we are currently negotiating with some of the most relevant Spanish groups within the real estate management, retail, gas and oil sectors." (IHS Markit AutoIntelligence's Tim Urquhart)

- Cherkizovo, the largest vertically integrated meat producer in Russia, has announced plans to invest RUB8.5 billion ($113 million) in new pig farms in the Tambov Region. The project will enable the company to increase pork output by more than 45,000 tons per year. The group's existing pig farms in central Russia can currently produce over 300,000 tons of meat. (IHS Markit Food and Agricultural Commodities' Max Green)

- The group said it is planning to build four finisher sites in the Tambov region, each capable of accommodating 40,000 pigs.

- Cherkizovo also plans to invest more than RUB4 billion to ramp up the capacity of its feed mill in the Pervomaysky District. The facility currently supplies feed to group's Tambov Turkey division. Following the launch of additional capacities in 2023, the mill is expected to produce between 60 and 80 tons of feed per hour.

- "In the next few years, Cherkizovo plans to significantly increase its meat processing volumes, which means that we are going to need additional pig farms. For their construction, we have opted for the Tambov Region thanks to its sound investment climate and many years of successful projects in pork, poultry, crop, and feed production," said Sergey Mikhailov, CEO of Cherkizovo Group.

- Since 2013, Cherkizovo has invested more than RUB15 bn in the Tambov region.

- General Motors (GM) Middle East has announced the launch of 13 new electric vehicles (EVs) in the region by 2025, reports Zawya. According to the source, the automaker will begin with launching the Chevrolet Bolt electric utility vehicle (EUV), GMC Hummer EV, and Cadillac Lyriq. GM is also signing memoranda of understanding (MOUs) with Emirates Post Group to explore opportunities for BrightDrop, a brand introduced by GM in 2021 that offers a system of connected products targeting first- and last-mile delivery including light commercial electric vehicles, and for Yoshi, a GM-backed, on-demand car maintenance and service startup in Saudi Arabia. Luay Al Shurafa, president and managing director at GM Africa and Middle East, said, "2021 was a landmark year for GM Middle East. The positive sales growth and notable success of our SUV and pick-up truck line-up across the Middle East shows the strength of our vehicles and our commitment to our customers. Through our vehicles, customer service, dealer partners and comprehensive aftersales network, we have listened to what our customers are looking for and delivered. But Sales is just one pillar of our business. Over the past year we have forged ahead delivering on our ambidextrous strategy, making strides towards our vision of a future with Zero Crashes, Zero Emissions and Zero Congestion. We want to be the number one EV company in the region by the end of 2023, and alongside harnessing the power of connectivity through OnStar, the potential of start-ups through BrightDrop and Yoshi and the transformative potential of autonomous vehicle through Cruise we are revolutionizing the industry in this region for our customers." GM, after a successful year in 2021 with 9.4% year-on-year (y/y) sales growth in the Middle East across the Chevrolet, GMC, and Cadillac brands, and with 26% sales growth in its sport utility vehicle (SUV) portfolio and 41% y/y growth in its pick-up trucks, is focusing on business strategies related to cars, EVs, and future mobility. Yesterday, the Dubai Roads and Transport Authority (RTA) said that it will begin trials of digital maps required to deploy autonomous vehicles (AVs) developed by Cruise Automation by the end of 2022. (IHS Markit AutoIntelligence's Tarun Thakur)

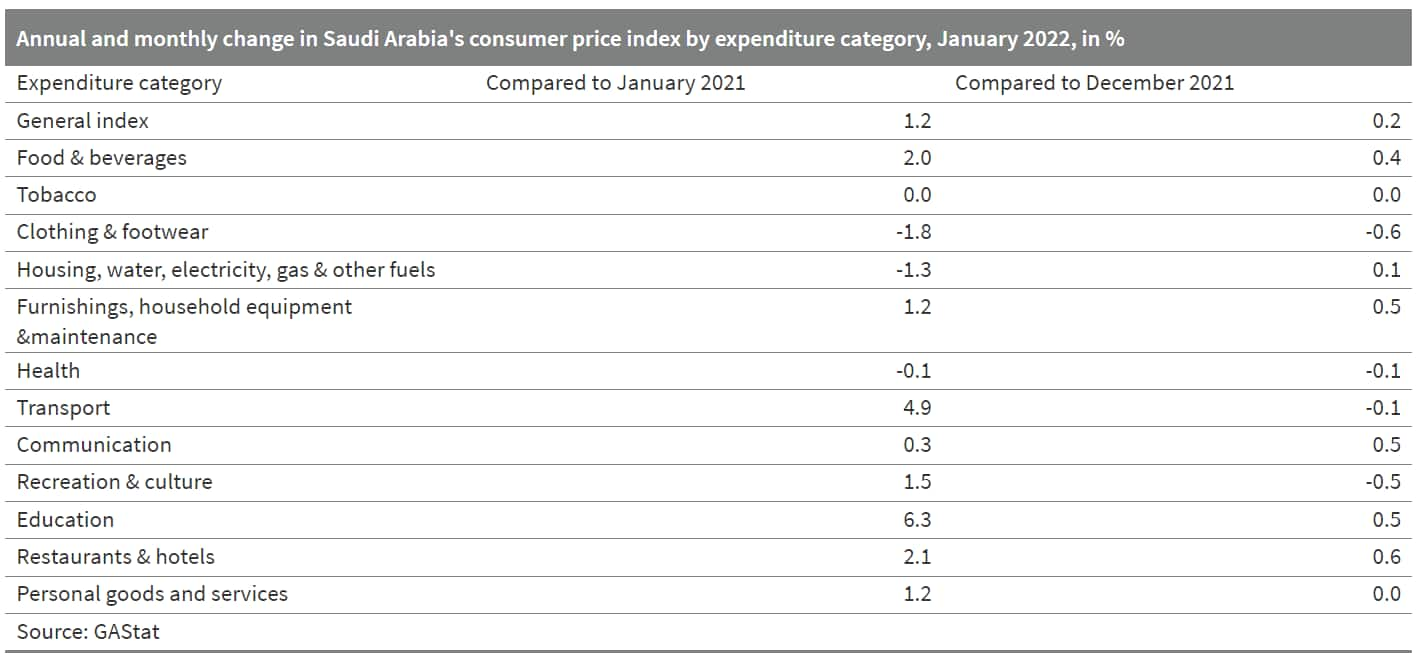

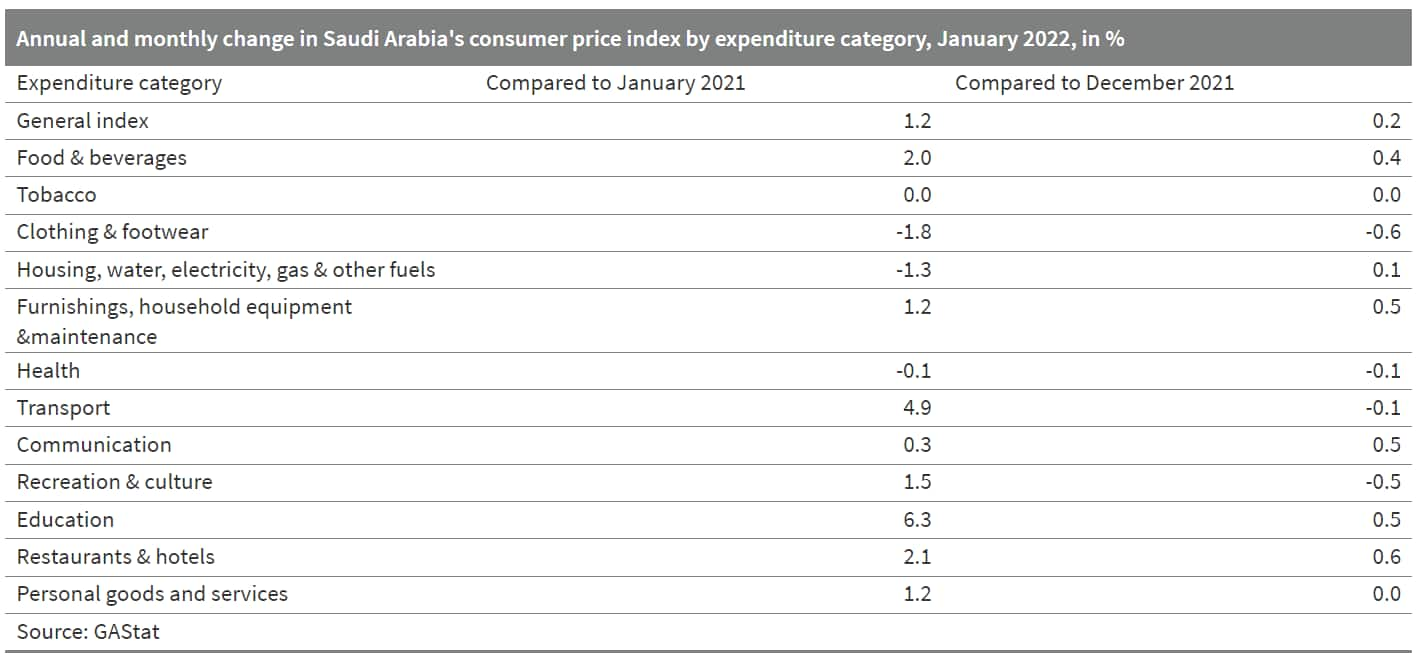

- Saudi Arabia's consumer price inflation in January was still not affected by accelerating inflation rates in much of the western world. IHS Markit expects this to remain so for the rest of the year, although signs of stronger price pressures have been emerging on the wholesale level. (IHS Markit Economist Ralf Wiegert)

- Consumer prices in Saudi Arabia edged up 0.2% in January from December, posting a modest increase according to the General Authority for Statistics (GAStat). On a year-on-year basis, consumer price inflation measured 1.2%, the same level as in December; price inflation has accelerated only mildly over the second half of the year.

- Main price drivers have been food, household equipment, communication, and education costs, which increased between 0.4% and 0.5% on the month in January. On the year, the strongest increases were recorded for food, transport, and education; the transport price increase reflected the rebound of oil prices over 2021.

- Wholesale prices experienced a strong spike of inflation as they went up 12.3% year on year in January; the wholesale price index remained all but unchanged from the previous month (+0.1%), though. Oil price trends are reflected here, since the price index for other transportable goods rose 20.9% on the year, with basic chemicals prices rising by 63.3% and prices for refined petroleum products rising by 29.0%. The world market price for the barrel Brent crude went up by 58% between January 2021 and January 2022, being the key input for both industries.

Asia-Pacific

- Major APAC equity markets closed mixed; India +3.1%, Mainland China +0.5%, Australia -0.5%, Japan -0.8%, Hong Kong -0.8%, and South Korea -1.0%.

- China's Ministry of Industry and Information Technology (MIIT) on 10 February published draft revisions to the country's data security regulation. An earlier version was published on 30 September 2021 for public commentary. The revisions seek to supplement China's Data Security Law - implemented on 1 September 2021 - which regulates all forms of data management such as collection, storage, processing, transfer, and disclosure across several industrial sectors. The September 2021 draft introduced a three-tier data classification mechanism based on perceived risk towards national security with "ordinary", "important", and "core data" categories. The revisions would also remove the requirement that core data are banned from being transferred abroad. However, the revisions specify that MIIT approval must be sought when sending "industrial, telecommunications or wireless radio" data abroad. Furthermore, data owners have a legal responsibility to report any "significant change" in data size or content for the important or core categories, or data that are determined to have an impact on China's political, territorial, military, economic, technological, digital, or ecological resources, or nuclear security stability. Although it is implied that important and core data are in principle allowed to be transferred abroad, companies handling these data categories are likely to be subject to more stringent review processes over potential national security concerns. The proposed revisions specify that local industry-specific regulators are responsible for the supervision of data management, effectively giving local government departments and regulatory authorities - particularly local-level MIIT and Cyberspace Administration offices - additional political power to govern data flow. In particular, the latest update remains vague about what types of data will be considered "important", thus increasing the discretionary power of local authorities. (IHS Markit Country Risk's David Li)

- Eight departments have issued a joint notice to strengthen oversight of China's online ride-hailing industry. The notice said that local regulators must carefully regulate entry into the market, requesting ride-hailing firms not to allow drivers and vehicles without the necessary permits to operate on their platforms. It also stated that that ride-hailing platforms that have committed serious violations such as endangering network and data security, violating users' personal information privacy, or disrupting social order, and which refuse to correct their actions, may be ordered to cease operations or have their apps removed from app stores, reports Caixin Global. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese ride-hailing firm Didi Global Inc. (DiDi) is considering laying off up to 20% of its overall headcount to reduce expenses ahead of its Hong Kong SAR listing. According to a report by Bloomberg, DiDi's core ride-hailing business may be subject to staff reductions of up to 15%. In June 2021, DiDi launched its initial public offering (IPO) in the US, which valued the company at USD67.5 billion. Following this, China's cyberspace regulator, the Cyberspace Administration of China (CAC), ordered the removal of DiDi's app from app stores after finding that the ride-hailing firm had illegally collected users' personal information. The regulator is concerned that DiDi's vast data troves will fall into foreign hands because of the increased public exposure that comes with its US listing. Since then, DiDi has been making changes to the apps to comply with China's Personal Information Protection Law, which came into effect on 1 November. Recently, the company stated that it has begun preparations to withdraw its listing on the New York stock exchange and it is to pursue a listing in Hong Kong SAR. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese authorities will push for the expansion of the country's electric vehicle (EV) charging infrastructure in the next few years to meet demand for 20 million EVs on the road by 2025. According to gasgoo citing a statement issued by several Chinese governmental departments including the National Development and Reform Commission (NDRC), China will improve the public charging network in central urban areas, boost the construction of public charging facilities in peripheral urban areas, and deploy battery swapping stations based on local conditions of different regions. The authorities also urged the housing department to introduce regulations to facilitate the installation of EV chargers in residential buildings. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Apple supplier Luxshare Precision has signed a strategic co-operation framework agreement with Chinese automaker Chery on 11 February, and they plan to form a joint venture (JV) to engage in the development and manufacturing of new energy vehicles (NEVs), reports cnevpost. In a company filing to Shenzhen Stock Exchange, Luxshare said the JV will combine the two companies' resources and expertise to support Luxshare's effort to become a Tier-1 supplier in the automotive component sector and explore contract manufacturing opportunities for OEM clients. Luxshare is one of the most prominent suppliers in Apple's supply chain. The company supplies a range of components to Apple including connection cables, internal iPad cables, MacBook power cables, Apple Watch wireless charging bands, and MacBook Type-C and iPhone adapters. As part of the agreement, Luxshare will acquire a 6.24% share in Chery New Energy, the automaker's NEV division, and a 7.87% share in Chery Auto. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Sapura Energy has received a termination notice from Yunneng Wind Power Co for the transportation and installation (T&I) contract of monopiles for the 640 MW Yunlin offshore wind farm in Taiwan. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- The T&I contract was awarded to Sapura Energy's wholly owned subsidiary Sapura offshore on 15 March 2019 and the project was anticipated to be completed in September 2020. The completion of the project was deferred to September 2023 owing to unresolved technical and operational issues not attributable to Sapura Energy.

- Sapura 3500, Sapura Energy's heavy lift pipelay vessel, has installed the first monopiles for Yunlin OWF in November 2020. Project work completed as of 3 February 2022 stands at 36.85%. Following the termination notice, Sapura Energy will be entitled to cease works, leave the project site and commence legal proceedings against Yunneng Wind Power.

- Japan's real GDP rose in the fourth quarter of 2021, moving up 1.3% quarter on quarter (q/q; or 5.4% q/q annualized) after a 0.7% q/q (or 2.7% q/q annualized) drop in the previous quarter. Full-year GDP growth increased by 1.7% year on year (y/y) in 2021 after a 4.5% y/y decline in 2020, but the figure remains below the pre-pandemic levels. The major reason behind the q/q improvement was a rebound in private consumption, which offset declines in public demand and residential investment, and changes in private inventories. (IHS Markit Economist Harumi Taguchi)

- Private consumption rose by 2.7% q/q in the fourth quarter of 2021 following a 0.9% q/q drop in the third quarter. Easing COVID-19 containment measures drove spending in services (up 3.5% q/q). Improved supply of autos thanks to the softer negative effects of shortages of semiconductors and parts led to a solid rebound in spending on durable goods (up 9.7% q/q).

- Increases in private capital expenditure (capex) and net exports also contributed to the q/q growth. Despite the improvement in auto production in the quarter, relatively modest rebounds of capex (up 0.4% q/q) and exports of goods and services (up 1.0% q/q) reflected the negative effects of supply chain constraints on production for a broad range of capital goods and softer external demand because of the spread of the Omicron variant. The improvement in net exports also stemmed from weak imports, partially reflecting declines in imports of COVID-19 vaccines in line with the progress in vaccine rollout.

- While easing COVID-19 containment measures contributed to the resumption of economic activity, residential investment remained in slump in the fourth quarter (down 0.9% q/q following a 1.6% q/q drop in the previous quarter), reflecting higher material prices. That also made it difficult for progress with public investment (down 3.3% q/q for the fourth consecutive quarter of decline) to meet budgets for infrastructure projects.

- Despite reports on industrial production suggesting increases in producers' inventories in the quarter for rebuilding stocks, changes in private inventories unexpectedly declined and had a 0.1-percentage-point negative contribution to q/q real GDP growth. The Cabinet Office estimates that work-in-process inventory declined.

- Japan's Kaneka Corporation plans to invest in new capacity that will quadruple its renewable polymer production by 2024, the company said last week. The company intends to invest JPY15 billion ($130 million) to construct another 15,000 mt/yr of polyhydroxybutyrate-hexanoate (PHBH) capacity, on top of its existing 5,000 mt/yr. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- This will give the company a total PHBH capacity of 20,000 mt/year at its Takasago City site in Japan's Hyogo Prefecture.

- Kaneka also plans to build capacity in Europe and North America to meet rising demand.

- The company said Japan will mandate a reduction in single-use plastics in April 2022, and that its biodegradable polymer holds promise given its similar functionality to conventional plastics.

- According to Kaneka, PHBH, which it has trademarked as "Green Planet", is a biomass polymer produced by microorganism biosynthesis using plant oils.

- Kaneka said it biodegrades easily both in soil and in both salt and fresh water into CO2 and water, reducing pollution.

- The company estimates that its PHBH can replace roughly 25 million mt/yr of single-use plastics, adding that over 5 million mt/year of its polymer is consumed as straws, cutlery, coffee capsules, bags, films, and others.

- Ford is evaluating the possibility of manufacturing electric vehicles (EVs) at one of its plants in India for export, reports Reuters. Kapil Sharma, director of communications at Ford India, has stated that the company is looking into restarting its India operations under the Production-Linked Incentive (PLI) scheme and has submitted a proposal to the Indian government. "We thank the Indian government for approving Ford's proposal under the PLI scheme for the automobile sector. As Ford leads customers through the global electric vehicle revolution, we're exploring the possibility of using a plant in India as an export base for EV manufacturing", said Sharma. The automaker has not revealed which of the two plants it intends to retain to build EVs. The latest move will mark a return for Ford as the automaker announced in September last year that it has ceased manufacturing vehicles in the country because of accumulated losses of over USD2 billion in the last 10 years. (IHS Markit AutoIntelligence's Isha Sharma)

- PACC Offshore Services Holdings Ltd. (POSH), a Singapore-headquartered offshore marine services provider, will be diversifying its renewables offerings, from operational support in the fixed wind market into the development of the floating wind market. As a result, Marco Polo Marine Ltd. has entered into a share purchase agreement with Kerry TJ Logistics Co. Ltd (Kerry) and Posh Investment Holdings (Taiwan) Pte. Ltd. (POSH) to obtain the entire share capital of PKR Offshore Co. Ltd. (PKRO) and POSH divested its Taiwanese POSH Kerry Renewables Joint Venture (JV). (IHS Markit Upstream Costs and Technology's Lopamudra De)

- Toyota Fleet Management (TFM) has launched a new car-sharing platform for businesses, named Forcefield Share, in Australia. According to a company statement, Forcefield Share is a cloud-based solution to manage scheduling, booking, and reporting on shared vehicles and other assets, allowing fleet managers complete visibility over their assets. ForceField Share was developed in collaboration with TFM's technology partner, PROCON Telematics, supported by TFM's Connected Mobility team. Fleet customers can manage fleets from five to 5,000 cars through this mobility platform. James Bridekirk, TFM's head of product and strategy, said, "ForceField Share has been clearly designed and developed with not only drivers in mind, but also fleet managers who will benefit from productivity and workflow improvements within their fleet". TFM Australia offers insurance, fleet management, leasing, rental, funding, and financial services. TFM says the Forcefield Share solution is a promising platform for fleets to enhance productivity and reduce administrative and fleet costs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 15 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.