All major US equity indices closed higher, while Europe and APAC were mixed. US government bonds closed lower, while benchmark European bonds were mixed. CDX-NA closed tighter across IG and high yield, while European iTraxx was close to unchanged on the day. Oil and natural gas closed higher, while the US dollar, gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +2.2%, S&P 500 +1.6%, Russell 2000 +1.4%, and DJIA +1.1%.

- 10yr US govt bonds closed +1bp/1.46% yield and 30yr bonds +3bps/1.86% yield.

- CDX-NAIG closed -2bps/52bps and CDX-NAHY -7bps/304bps.

- DXY US dollar index closed -0.1%/96.51, declining 0.6% within 60 minutes of the 2:00pm ET release of the FOMC Statement.

- Gold closed -0.4%/$1,765 per troy oz, silver -1.7%/$21.55 per troy oz, and copper -1.8%/$4.18 per pound.

- Crude oil closed +0.2%/$70.87 per barrel and natural gas closed +1.5%/$3.80 per mmbtu.

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon (15 December). As widely expected, the Committee announced that it will accelerate the taper of its bond purchases according to a revised plan that will see purchases fall to zero in the second half of March 2022. It announced no change to interest rates but altered forward guidance for interest rates. Updated guidance, changes to the characterization of inflation—the word "transitory" was eliminated from the post-meeting statement—and revised forecasts suggest a majority of FOMC participants anticipate that it will become appropriate to raise the federal funds rate target around mid-2022, earlier than IHS Markit analysts' assumption for a September "lift-off." (IHS Markit Economists Ken Matheny and Lawrence Nelson)

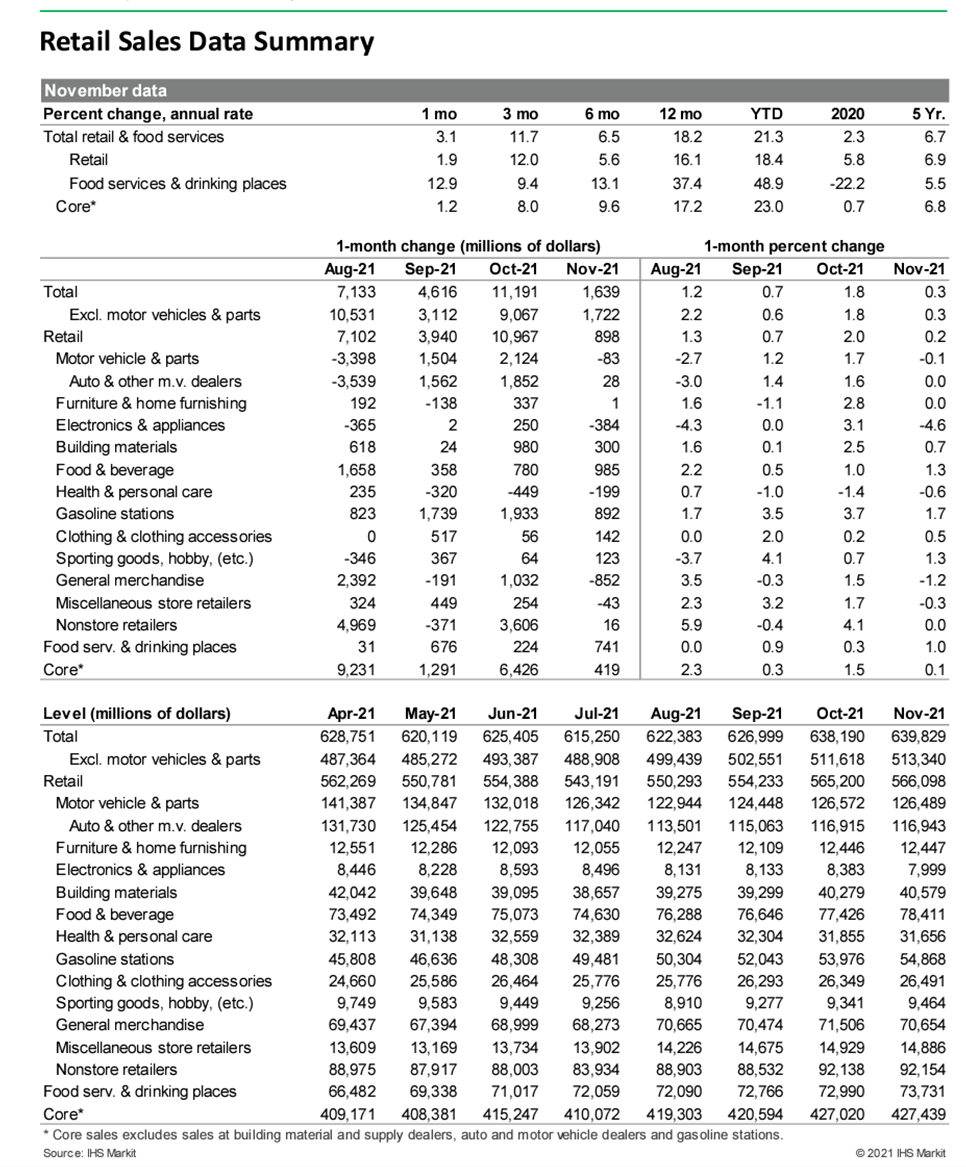

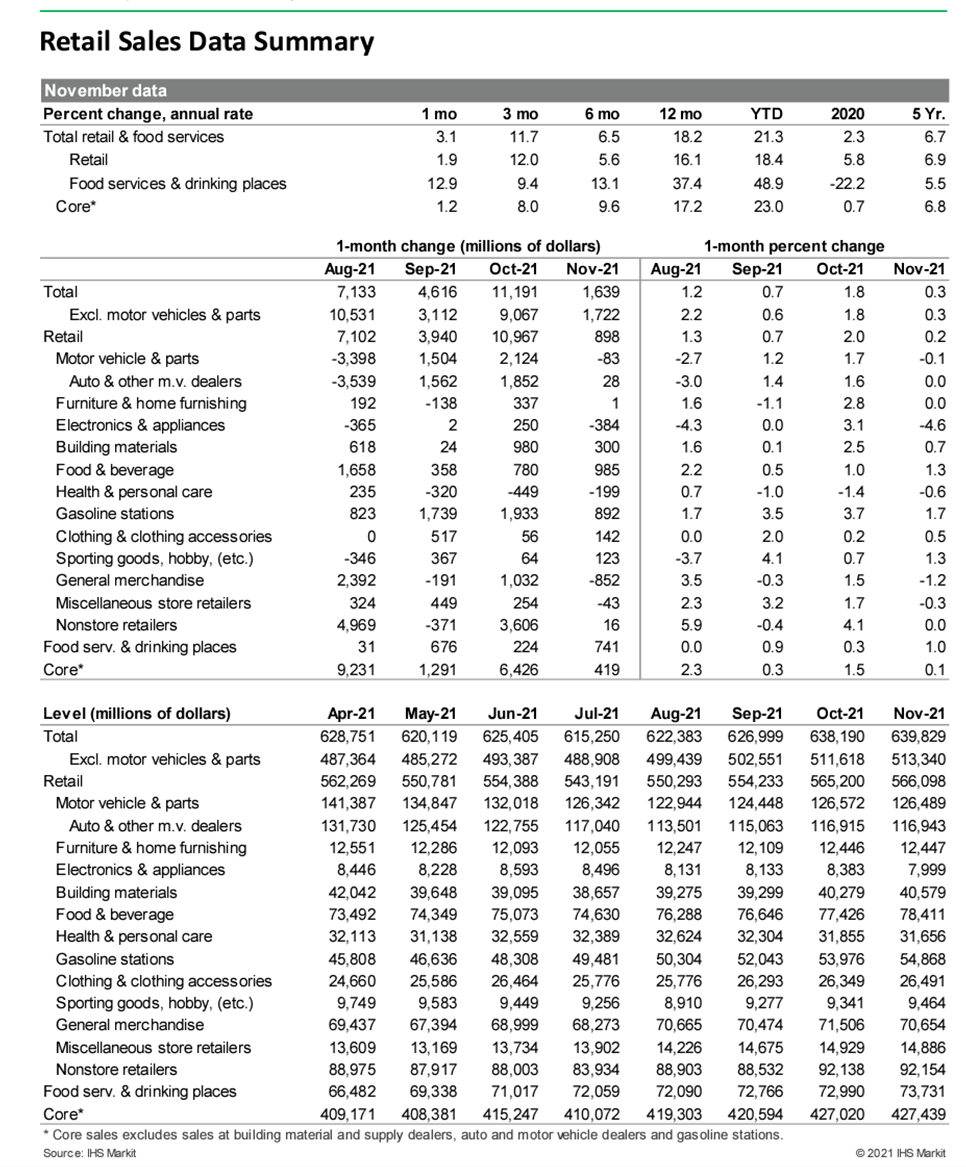

- US total retail trade and food services sales rose 0.3% in November. Expectations were for a considerably larger gain. Nonautomotive sales were also up 0.3% in November, while core sales rose only 0.1%. (IHS Markit Economists Ben Herzon and William Magee)

- Unexpected weakness in sales in November likely was due to early holiday shopping, as news reports of supply chain issues and delays in shipping probably shifted some sales that otherwise would have occurred in November forward into October.

- This likely occurred at electronics and appliance stores and general merchandise stores. Sales in both categories were solid in October (up 3.1% and up 1.5%, respectively) and weak in November (down 4.6% and down 1.2%).

- Another factor in play is a "renormalization" of the composition of consumer spending back toward services (away from goods). In recent forecasts, we have been assuming a slowing in spending on goods in the current timeframe; we may be seeing the leading edge of this renormalization now.

- There were some winners in this morning's report: gasoline stations (up 1.7%), food and beverage stores (up 1.3%), and the sporting-goods group of stores (up 1.3%).

- Both gasoline stations and grocery stores saw large price gains in November. These are categories of spending that generally are not deterred, in the short term, by firming prices—people need food and gasoline—helping to account for the strength in sales in November.

- Despite the soft report, most fundamentals (wages and net worth) remain supportive of consumer spending, but weakness in sentiment currently is a risk for the consumer sector.

- If a recent experience in Iowa is a forecast of things to come, it's possible that pipelines used to move CO2 to carbon capture and storage (CCS) facilities will receive the same landowner opposition that interrupts gas pipeline projects, despite CCS being promoted as a way to reduce carbon emissions and mitigate global temperature rise. (IHS Markit PointLogic's Kevin Adler)

- On 14 December, the Story County Board of Supervisors voted to send a comment letter to the state board that is considering two CCS projects to say that the board opposes the use of eminent domain for the route of CO2 pipelines.

- The projects are in their early stages, with Summit Carbon Solution having submitted an application for the Midwest Carbon Express Pipeline to the Iowa Utilities Board. The other project, Heartland Greenway Pipeline has been proposed by Navigator CO2, but an application has yet to be filed.

- The board is asking for stakeholder input on the need for the projects, their environmental impact, and cost. The board has scheduled 37 hearings, one in each county affected by the pipeline, and a virtual one on 19 January.

- Both projects would ship CO2 in liquid form through Iowa to sequestration facilities in depleted oil fields, one in North Dakota and one in Illinois.

- Midwest Carbon Express Pipeline would have capacity of capturing 12 million mt of CO2 annually at full operation. It would initially serve 12 ethanol production facilities in Iowa and Nebraska and would likely serve fertilizer plants as well. Ethanol production's carbon stream is considered particularly easy to capture because of its purity, and because ethanol sold in certain states such as California earns additional credits for having a lower carbon footprint, the project would benefit from an extra financial incentive not available to other carbon streams.

- FDA's new report on 2020 sales of antimicrobials for food-producing animals shows a 3% drop between 2019 and 2020—largely driven by a reduction in tetracycline sales—and the drop amounts to a 38% decrease since 2015. There are limitations to the data, FDA pointed out, as sales numbers do not indicate how the drugs are actually used in animals. Because the majority of antimicrobials used in animal feed are approved for multiple indications, it is not entirely certain how the drugs are administered. And the data collected on animal drug sales does not indicate whether the drug is used; for example, a veterinarian may purchase drugs but never actually administer them to animals. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Published every year, the 49-page report charts the sales and distribution for FDA-approved antimicrobials by drug class, medical importance, route of administration, indication and dispensing status, as well as species-specific estimates.

- FDA views charting sales volume over time as a valuable indicator of market changes, even though it does not reflect actual usage of the medications. According to the report released on December 14, domestic sales of medically important antimicrobials approved for use in food-producing animals decreased by 3% from 2019 to 2020, and sales of tetracyclines, which represents the largest volume of domestic sales (3,948,745 kg in 2020), dropped by 4%.

- Last year's report showed an uptick in sales by 3% between 2018 and 2019 when the agency said it expected some increases as a large number of medically important antimicrobials were transitioned from over-the-counter status to requiring veterinary oversight at the beginning of 2017.

- In the new report, FDA breaks down sales and distribution by species, with 41% of the antimicrobials earmarked for cattle, 41% for swine, 12% for turkeys, 2% for chickens and 4% for other or unknown species.

- Tetracyclines accounted for 66% of antimicrobials funneled to food-producing animals, followed by penicillins at 13%, macrolides at 7%, sulfonamides at 5%, aminoglycosides at 5%, lincosamides at 2%, cephalosporins at less than 1%, and fluoroquinolones at less than 1%.

- Cattle received some 80% of cephalosporins, 57% of sulfonamides, 54% of aminoglycosides, and 43% of tetracyclines, FDA's report found. Swine received 87% of lincosamides and 42% of macrolides. And 64% of penicillins were intended for use in turkeys.

- Mobility software startup Apex.ai has raised USD56.5 million in a Series B funding round led by Orillion, according to a company statement. ZF, Continental, AGCO, Jaguar Land Rover's InMotion Ventures, Airbus Ventures, Toyota Ventures, HELLA Ventures, and Volvo Group Venture Capital, among others, as well as existing investors Canaan, Lightspeed Venture Partners participated in the funding round. The company plans to use the capital towards accelerating product development and expanding into new application areas and more industries. Apex.AI aims to provide a set of simple-to-integrate application programming interfaces (APIs) that can give automakers access to fully certified autonomous mobility technology. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ford is launching a grocery delivery pilot in southwest Detroit (Michigan, US) using autonomous vehicles (AVs), according to a company statement. The pilot, which will run for six months, is expected to provide around 10,000 pounds of fresh food to mobility-challenged senior citizens living in the area. Ford will deploy autonomous shuttles that will run along a fixed route between the Southwest Detroit Ford Resource and Engagement Center, where grocery bags will be loaded and delivered to residents participating in the program. There will be a safety driver on board to monitor the shuttle. Residents of the Rio Vista Detroit Co-op Apartments senior living center will now receive their existing food deliveries from a complimentary program launched earlier this year by Ford Fund and Gleaners Community Food Bank. Joe Provenzano, mobility director of Ford Motor Company Fund, said, "We're constantly thinking about how to expand our reach in communities for those who don't have access to the most basic goods, like groceries or warm meals. Bringing Ford's mobility expertise together with local collaborations allows us to create innovative solutions that make communities stronger and people's lives better." Delivery services are an attractive option as one of many potential autonomous-vehicle business use cases. The expectation is that, eventually, being able to eliminate the cost of a human driver could make delivery services far more affordable for both the merchant and the consumer. (IHS Markit Automotive Mobility's Surabhi Rajpal)

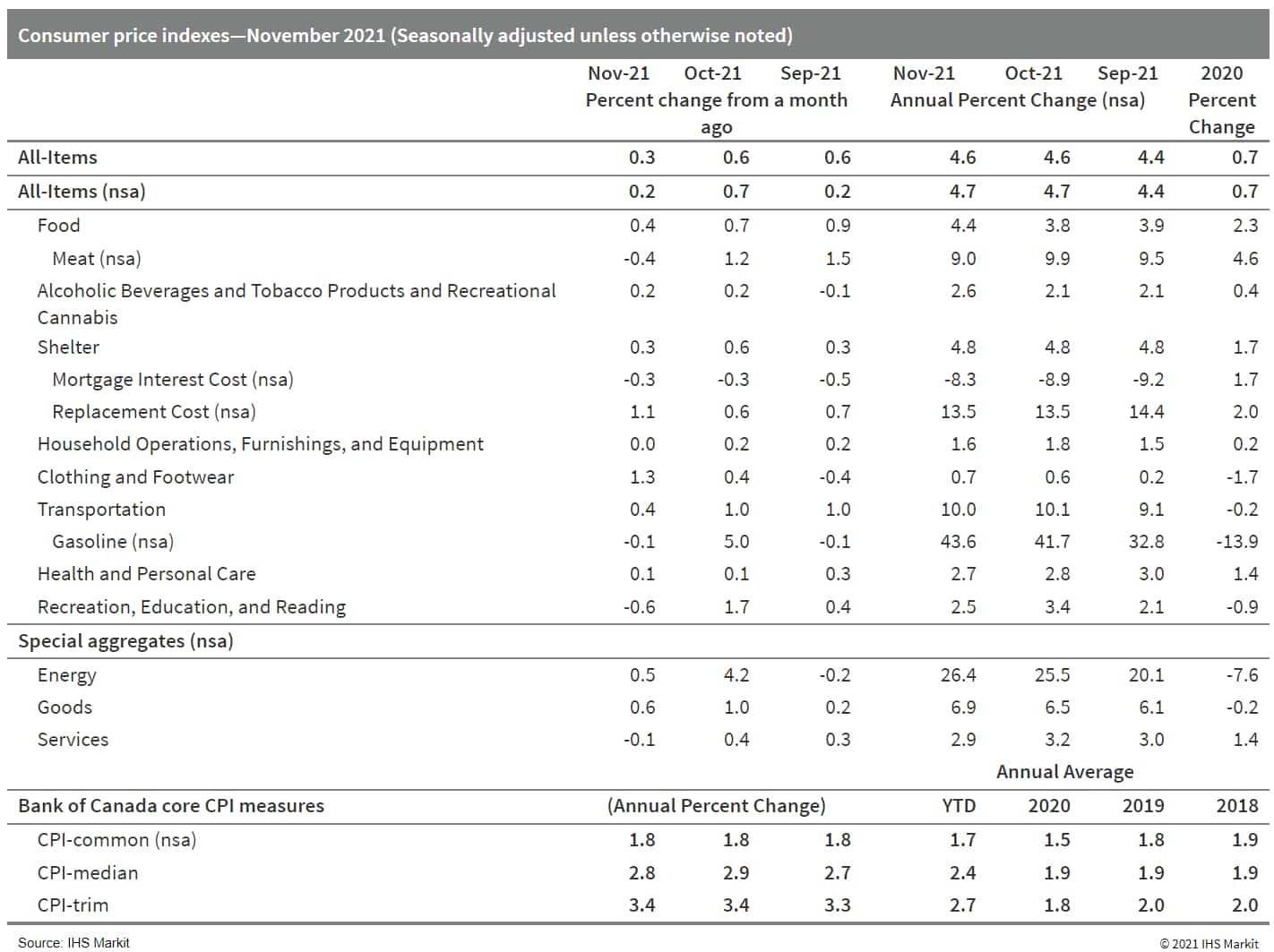

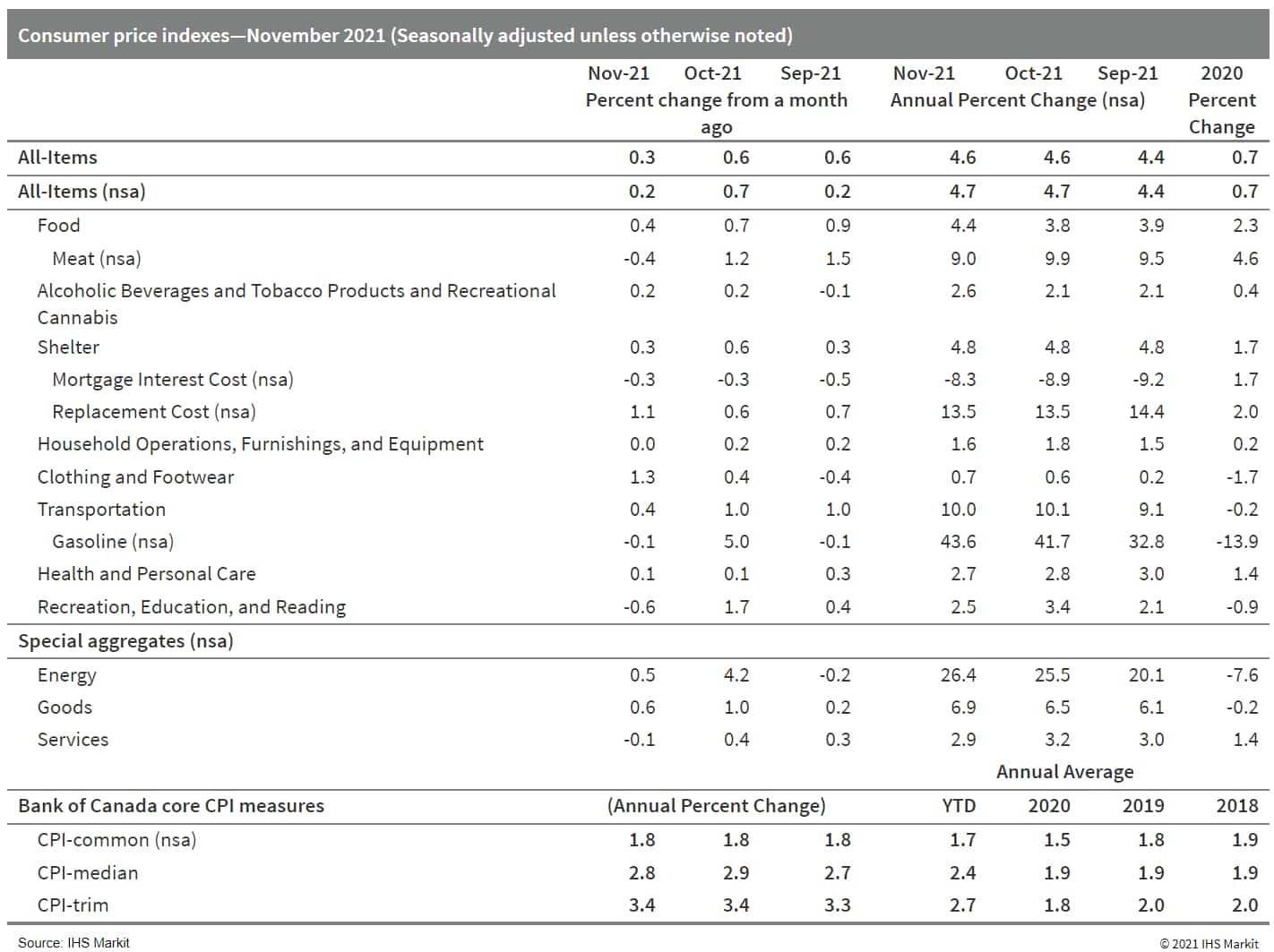

- Canada's inflation trends seem to be less worrisome when compared with the inflation story in the United States given that annual inflation held firm in the month. Gasoline was the biggest upward contributor to annual inflation as prices surged 43.6% y/y. When gasoline is excluded, inflation increased 3.6% y/y—the same rate posted in October. The pace of annual price increases was stronger for food and alcoholic beverages, as well as tobacco products and recreational cannabis. Consumers likely felt the pinch when shopping for groceries as prices accelerated to an almost seven-year high at 4.7% y/y, a boost of 0.8 percentage point from October. Fresh vegetable prices increased, up 2.3% y/y, for the first time since February 2021. Meat prices continue to rise at a strong rate, especially for fresh or frozen beef, as farmers are passing on expensive animal feed costs to consumers. Outside of food and energy, furniture prices continue to spike, rising 8.7% y/y as escalating shipping costs are also passed on to consumers. On the flip side, consumers are continuing to get a price break on cellular phone plans, which declined 17.9% y/y. (IHS Markit Economist Arlene Kish)

- After declining for five consecutive months, Canadian housing starts bounced back strongly in November. Regionally, urban single starts fell in six provinces, with Nova Scotia leading the decrease, down 55.5% m/m, while Ontario's single starts jumped strongly to a three-month high. Ontario's rebound was more notable in multiple starts, surging 81.2% m/m largely because of construction activity in the Toronto area as starts soared to 710,058 units, the highest level since February 2018. Housing starts in other Ontario cities, including Hamilton, Windsor, and Kingston, also strongly picked up. Multiple segments jumped strongly in Manitoba, Saskatchewan, Alberta, and New Brunswick. Given the sharp uptick in November, the six-month moving average trend increased to 267,365 units. (IHS Markit Economist Chul-Woo Hong)

- Housing starts surged 26.4% month over month (m/m) to 301,279 units (annualized), the highest level since March 2021 and the third highest on record.

- Total urban starts spiked 29.2% m/m as the 40.5% m/m leap in urban multiple starts easily offset the 1.2% m/m decline in urban single starts. Rural starts edged down 0.9% m/m.

- The overall gain was widespread in 7 of 10 provinces, led by Ontario.

- Given the stronger-than-expected housing starts and the small upward revision in October's readings, the fourth-quarter housing starts forecast will likely be revised up.

Europe/Middle East/Africa

- Major European equity indices closed mixed; France +0.5%, Italy +0.4%, Germany +0.2%, UK -0.7%, and Spain -1.2%.

- 10yr European govt bonds closed mixed; Italy -2bps, France flat, Germany/UK +1bp, and Spain +2bps.

- iTraxx-Europe closed flat/52bps and iTraxx-Xover -2bps/257bps.

- Brent crude closed +0.2%/$73.88 per barrel.

- The European Commission has launched its Carbon Farming Initiative and hopes it will help EU land managers capture 42 million tons of CO2 by 2033. On 15 December, the Commission published short- to medium-term actions that can support carbon farming and upscale a business model that may someday reward land managers for sequestrating carbon. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- Carbon farming has long been tipped to create one of the most direct commercial links between environmental protection and farmers' income because it can transform a set of agricultural practices, like no-tillage and growing cover-crops, into a credit that is bought on a marketplace by green-minded organizations looking to offset their climate impact.

- However, there are currently not many land managers involved in these markets, while few traders of carbon credits support schemes based on agriculture.

- The Commission acknowledged the agriculture sector has struggled to adopt carbon farming because it is costly and difficulty to measure credits, but the EU executive still thinks public funding can build the foundations for a successful marketplace - largely by using funds from the Common Agricultural Policy (CAP) for 2023-27 and other EU programs such as LIFE and Horizon Europe.

- The Commission's document is pinning a lot of carbon farming hope on the next CAP's eco-schemes, which will reward farmers that go beyond basic green agricultural practices. EU policymakers have agreed to dedicate 25% of the CAP's budget for farmers' direct payments to eco-schemes, which will see about €54 billion of funding spent each year.

- The Office for National Statistics (ONS) has reported that the UK's 12-month rate of consumer price index (CPI) inflation increased from 4.2% in October to 5.1% in November, the highest rate since September 2011. (IHS Markit Economist Raj Badiani)

- During 2020 and 2021, CPI inflation averaged 0.9% and an estimated 2.5%, respectively.

- Meanwhile, the CPI including owner-occupiers' housing costs (the CPIH) rose by 4.6% in the 12 months to November, up from 3.8% in October.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 28.5% year on year (y/y), the eighth successive double-digit increase. This was in line with global crude oil prices rising by 90% y/y to average USD81 per barrel (pb) in November, the 11th successive y/y gain.

- In addition, gasoline (petrol) prices also rose by 33.2 pence y/y to a historical high of 145.8 pence per litre.

- The ONS also reported a further rise in household energy bills during November after the increased regulatory price cap on domestic natural gas and electricity from 1 October. Natural gas and electricity prices increased by 26.1% y/y and 18.8% y/y, respectively.

- Meanwhile, restaurant and café prices increased by 5.2% y/y in November, compared with a gain of 6.3% y/y in October.

- Food prices rose at a brisker rate, increasing by 2.4% y/y in November from 1.1% y/y in October.

- A further rise in second-hand car prices occurred during November, of 27.1% y/y, because of the shortage of semiconductor chips disrupting production of new vehicles.

- The number of UK payrolled employees posted another substantial monthly increase in November, rising by 257,000 month on month (m/m) to 29.4 million. In addition, the figure now stands around 424,000, or 0.8%, higher than its pre-COVID-19 virus pandemic level (February 2020). (IHS Markit Economist Raj Badiani)

- Three of the sectors benefiting from the end of COVID-19-related restrictions reported a further rise in the number of payrolled employees between October and November, namely accommodation and food service activities (up 15.9% m/m), arts and entertainment (up 15.4% m/m), and administrative and support services (up 12.6% m/m).

- It is possible that those made redundant at the end of the furlough scheme will be included in the Real Time Information (RTI) data for a few further months while they work out their notice period. However, responses to the Office for National Statistics (ONS) business survey suggest that the numbers made redundant comprised a modest share of the 1.1 million still on furlough at the end of the scheme.

- The ONS reported that total UK employment (all aged 16 plus) increased by 149,000, or 0.8%, to 32.506 million in the three months to October when compared with the three months to July.

- In annual terms, the number of employed people in the three months to October was 193,000, or 0.6%, higher compared with a year earlier.

- In addition, the recovery in part-time employment remained brisk in November. After falling to 7.7 million in the March-May period, it recovered steadily to stand at 8.1 million in the three months to October.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure decreased by 127,000 in the three months to October to 1.423 million.

- Average annual weekly earnings (total pay including bonuses) growth slowed for a second straight period to 4.9% year on year (y/y) in the three months to October.

- Regular pay (which excludes bonus payments) growth eased further to 4.3% y/y in the three months to October.

- Total pay in real terms slowed for the fourth straight month, rising by a 13-month low of 1.7% y/y in the three months to October.

- The Volkswagen (VW) Group is still developing its diesel engines despite the company's massive electrification push, and its latest family of powertrains is able to use newly developed paraffinic diesel, according to an Autocar report. The newly developed fuel contains bio-components that help the fuel reduce CO2 emissions by up to 95% over conventional diesels. All the company's diesel models that have been delivered since June that use VW's four-cylinder TDI diesel powertrains can be used with the new fuel according to the report. A VW spokesperson said, "Alongside [the] accelerated ramp-up efforts in the area of electric mobility, Volkswagen is further developing the existing range with combustion engines. In this way, the company is responding to different customer needs while at the same time taking into account the internationally varying drive system preferences and the respective general conditions." Paraffinic fuels are produced from biomass waste materials such as hydro-treated vegetable oil (HVO). They are then converted into hydrocarbons by reacting them with hydrogen, and can be added to diesel fuels in any quantity. V-Power Diesel and HVO are the current available options in the UK market, so are in limited supply, but it could take up to 20-30% of road transport fossil fuel market share within the next decade. (IHS Markit AutoIntelligence's Tim Urquhart)

- German mobility startup Vay has raised USD95 million in a Series B funding round, reports TechCrunch. New investors Kinnevik, Coatue, and Eurazeo participated in the round, alongside existing investors Atomico, La Famiglia, and Creandum. Other participants included Project A, Visionaries Club, and Signals, as well as former Alphabet chief financial officer Patrick Pichette and Spotify board member Cristina Stenbeck. The company plans to use the proceeds to triple its headcount, particularly in the engineering department, as it plans to scale up its tele-driving technology in more cities in Europe and the United States. (IHS Markit AutoIntelligence's Tim Urquhart)

- Iveco has signed a memorandum of understanding (MoU) with Air Liquide to develop hydrogen mobility in Europe, according to a company statement. The two companies will work towards a full partnership that will leverage the core competencies of both firms in developing hydrogen-powered medium and heavy commercial vehicle (MHCV) technology. The partners will allocate resources to study the roll-out of heavy-duty fuel-cell electric long-haul trucks coupled with the deployment of a network of renewable or low-carbon hydrogen refuelling stations along the European highway network. (IHS Markit AutoIntelligence's Ian Fletcher)

- Reuters reported on 9 December that mainland China had reportedly requested multinationals to end their commercial ties with Lithuania or face restricted access to the Chinese market, a measure that has not been officially confirmed. China also reportedly temporarily deleted Lithuania from its electronic customs declaration system from 1 December and subsequently to have blocked applications despite its formal restauration. In November 2021, China downgraded its diplomatic relations with Lithuania, after the opening of a Taiwan representative office in September 2021 in Vilnius, which China views as a breach of the "One China Policy". Bilateral relations between China and Lithuania have worsened since early 2020, after Lithuania withdrew from the 17+1 economic co-operation forum involving China and countries in Central and Eastern Europe. Foreign Minister Gabrielius Landsbergis described the latest Chinese move as effectively "unannounced sanctions" and said that Lithuania would seek assistance from the European Union (EU) over what it views as "trade coercion". The EU, according to Bloomberg, raised Lithuania's concerns with the World Trade Organization (WTO), which in turn discussed the issue with China. In 2019, mainland China was the destination of 1.13% Lithuanian exports and the source of 5.12% of its imports. With China-Lithuania trade being modest, Chinese customs restrictions are likely to have only a small immediate impact on Lithuania's economy. However, if China persuades multinationals to reduce their commercial links with Lithuania, this would threaten to restrict foreign direct investment in Lithuania, especially in the manufacturing sector. The EU is likely to continue to seek diplomatic resolution of the issue with China, but is also likely to open a case with the WTO, if it collects sufficient direct evidence of restrictive practices. The alleged action against Lithuania also is likely to support efforts at EU level to enforce existing measures to protect EU interests and encourages focus on new steps to prevent coercive trade practices such as the anti-coercion instrument proposed by the European Commission on 8 December 2021. (IHS Markit Country Risk's Petya Barzilska and Alex Kokcharov)

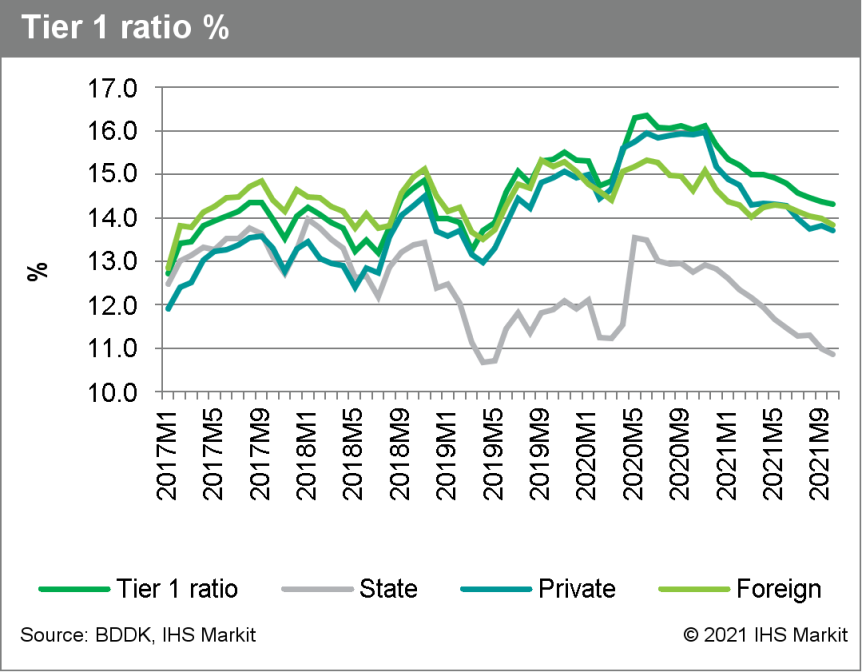

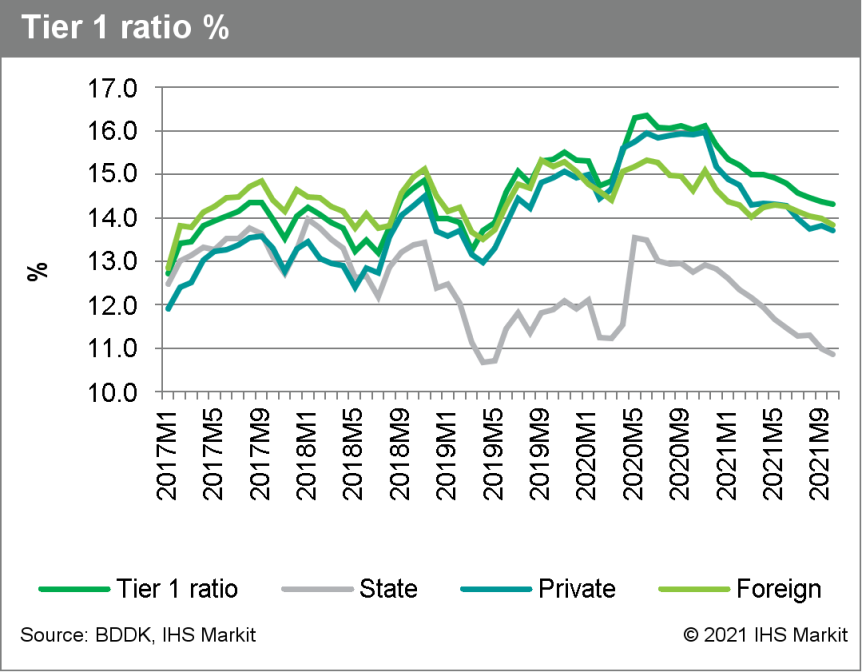

- Turkey's state-owned banks have hinted that they may need TRY60-70 billion (USD4.2-5 billion) of additional capital to boost lending to the economy and could need as much as TRY100 billion, Ahval News reports. The comments were reportedly made during a meeting between President Recep Tayyip Erdoğan, Turkey's finance minister, and top bankers on Monday (13 December). The issue regarding private and foreign-owned banks charging higher interest rates was also reportedly discussed; state-owned banks are currently offering loans to businesses at a rate of around 15.75%, compared with a close to 20% rate charged by other banks. (IHS Markit Bank Risk's Alyssa Grzelak)

- After nearly eight years of above average credit growth, state-owned banks have been expanding loan books at a slower pace compared with private and foreign-owned banks for the last seven months.

- As noted previously, lower capital buffers, particularly lower tier-1 ratios, are weighing on state-owned banks' ability to maintain the kind of robust credit growth that has prevailed over the last five years.

- The average tier-1 ratio reported for state-owned banks by the Banking Regulation and Supervision Agency (Bankacılık Düzenleme ve Denetleme Kurumu: BDDK) was just below 11% - a more than 250-basis-point decline from just after the government's last round of capital injection in mid-2020. This also compared with a tier-1 ratio of about 14% that was reported for both private and foreign-owned banks.

- With profitability among the largest state-owned banks remaining well below the sector average and capital buffers at a smaller margin above requirements than private and foreign-owned peers, IHS Markit assesses that another round of capital injection is likely over the next six months.

- Saudi consumer prices increased by 1.1% on the year in November, accelerating from 0.8% in October, according to the General Authority for Statistics (GASTAT). This is the highest rate in the second half of 2021 after the impact of the value-added tax (VAT) rate hike had faded in July. (IHS Markit Economist Ralf Wiegert)

- Prices edged up 0.2% on the month, a modest increase that was driven by transport costs, recreation and culture, and miscellaneous goods and services. However, since gasoline prices had been lifted in June and food prices rose strongly over the summer months, the consumer price index has not had significant movements of major product categories in November.

- The wholesale price index has been ascending back to 12.5% on the year according to GASTAT in November, also the highest rate in the second half of the year. The impact of domestic forces and supply chain issues have been clearly visible there as prices for wooden products, refinery products, chemicals, and also metal products have been responsible for the acceleration in the first half of the year.

Asia-Pacific

- Major APAC equity indices closed mixed; Japan/South Korea +0.1%, Mainland China -0.4%, India -0.6%, Australia -0.7%, and Hong Kong -0.9%.

- Mainland China's industrial value-added growth accelerated to 3.8% year on year (y/y) in November from 3.5% y/y in the previous month, and the 2020-21 average growth rose from 5.2% to 5.4%. However, the year-on-year growth remained one of the lowest readings since April last year. Meanwhile, the month-on-month (m/m) growth slowed from 0.39% in October to 0.37% in November, despite easing production and power cuts. (IHS Markit Economist Yating Xu)

- By sector, the headline acceleration was largely driven by improvement in downstream sectors as the contraction in auto manufacturing narrowed and high-tech manufacturing, such as computer and communication equipment, maintained double-digit growth. On the other hand, production in upstream sectors remained weak despite easing production limitation.

- Ferrous-metals processing declined by 11.2% y/y and non-ferrous metals processing deteriorated. Meanwhile, manufacturing of railway, ship, and aviation equipment continued to moderate, in line with the weakening infrastructure investment.

- FAI growth declined to 5.2% y/y through November from 6.1% y/y in the first 10 months of the year. On a 2020-21 average basis, the growth slightly accelerated to 3.9% from 3.8%, which has been unchanged for two consecutive months. According to IHS Markit estimates, FAI in October declined by around 2.3% compared to the same period last year, unchanged from the figure a month ago.

- By sector, besides the sustained moderation in real estate investment, weakening infrastructure investment was the main contributor to the headline slowdown. Despite an acceleration of local government bond issuance since the third quarter, infrastructure investment (excluding utilities) growth through November declined to 0.5% y/y, and the estimated de-cumulative figure contracted at a faster rate from last month. Meanwhile, manufacturing investment growth slowed, although it maintained double-digit growth with still-high price inflation.

- Under the easing mortgage polices and financing restrictions to developers, the estimated de-cumulative changes of housing market indicators all recorded improvement from the previous months. Real estate investment improved from a 5.5% y/y contraction in October to a 4.6% y/y contraction in November, as commercial housing sales and floor space of new starts had a slower contraction. In particular, floor space of completion improved from a double-digit contraction in October to a double-digit expansion in November.

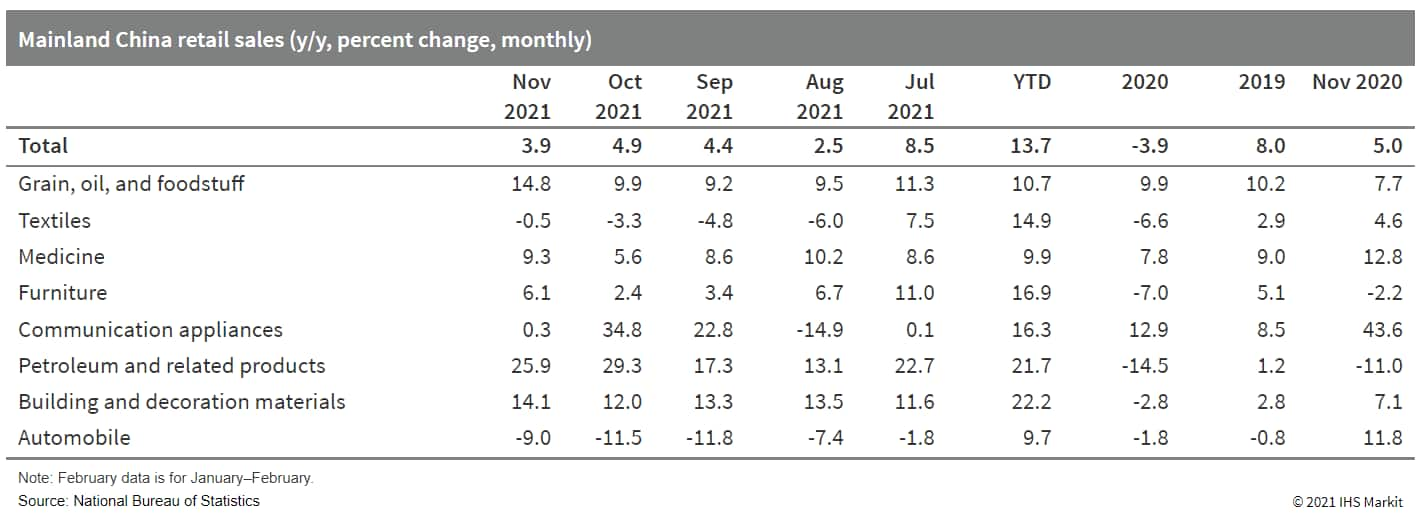

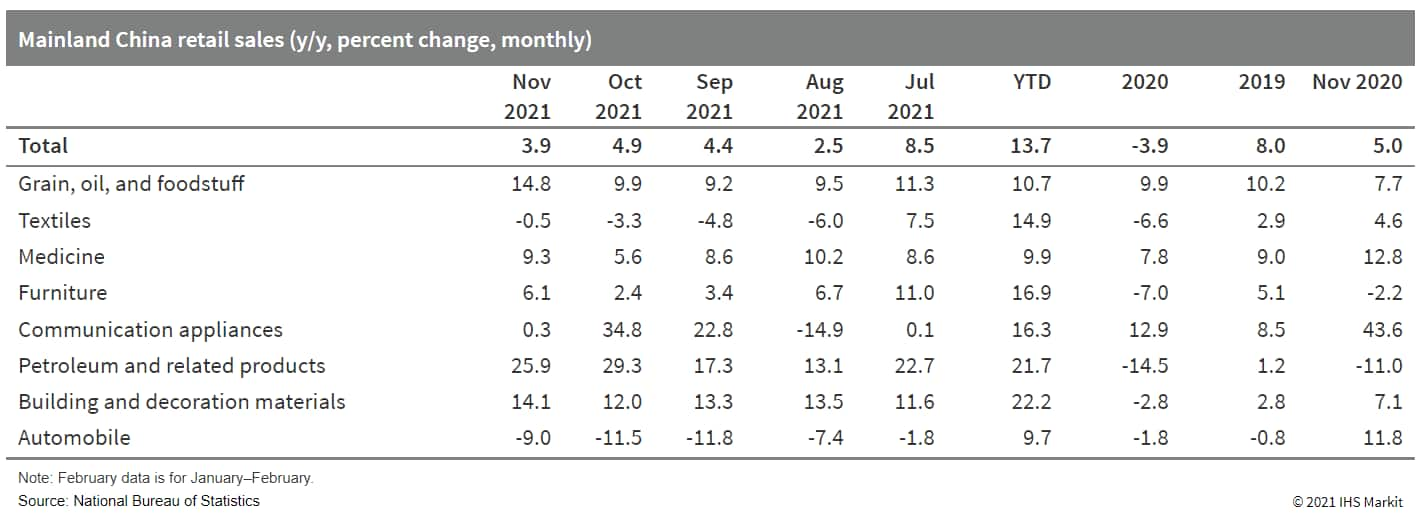

- Nominal retail sales growth declined by 1 percentage point from October to 3.9% in November, and the 2020-21 average growth rose slowed from 4.6% y/y to 4.4%. Real retail sales excluding price inflation reported a greater decline of 1.4 percentage points to only 0.5% y/y in November, reflecting the continuous rise of retail price index (RPI) that increased 3.4% y/y, compared with 2.9% in October and 1.8% y/y in September.

- By consumption items, auto sales, down by 9% y/y, continued to be the major drag on commodity sales, although the decline narrowed from the previous month. Retail sales excluding auto rose 5.4% y/y in nominal terms, down from 6.7% in October, largely owing to the slowing petroleum and related products sales under the falling oil price, while sales of other consumption goods were boosted by the "double-11" shopping festival. Moreover, catering sales fell by 2.7% y/y, compared with a 2% y/y expansion a month earlier, reflecting the COVID-19 impact on services.

- Mainland China's average new home price deflation widened by 0.08 percentage point to 0.33% month on month (m/m) in November, staying in the deflation territory for a third month, according to the survey conducted by the National Bureau of Statistics covering 70 major cities. (IHS Markit Economist Lei Yi)

- All three city tiers reported month-on-month new home price declines in November, and tier-2 cities logged the largest drop across city tiers of 0.37% m/m. For the four tier-1 cities, the minor downtick of 0.03% m/m in the average new home price largely came from the city of Guangzhou, where new home price deflation came in at 0.6% m/m in November, widening from 0.3% m/m in October.

- Up to 59 out of the 70 surveyed cities reported month-on-month new home price declines in November, up by 7 cities from the prior month. Only 9 cities registered month-on-month new home price gains, down by 4 cities from October and falling to single-digit for the first time since first quarter 2015.

- Average year-on-year (y/y) new home price inflation reached 2.4% y/y in November, down by 0.4 percentage point from the month before. Note that while average year-on-year new home price inflation of tier-1 cities stayed above year-ago reading, that of tier-2 and tier-3 cities are lowered by 0.9 and 2.4 percentage points, respectively in November from a year earlier.

- China's Sinopec Zhenhai Refining has maintained petrochemical production amid a COIVD-19 district lockdown, after obtaining special daily transportation passes from authorities, state-linked Zhejiang Online reported this week. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- "The company has obtained 150 special daily passes to facilitate delivery of materials, such as asphalt and sulfur," a Zhenhai Refining source was quoted saying.

- Sinopec Zhenhai was heard operating its paraxylene units normally after a district lockdown Dec. 7, but had lowered monoethylene glycol production to a 70% rate. The company has the capacity to produce 750,000 mt/yr or PX and 650,000 mt/yr of MEG.

- OPIS reported that neighboring Ningbo Zhongjin was on the verge of shutting down PX production over the weekend, before it obtained similar transportation permission at the last hour.

- As lockdown rules in Zhenhai District only allow persons and vehicles to enter but not exit, petrochemical operations reliant on transportation, like Zhenhai Refining, have been disrupted, according to the Zhejiang Online report. Zhenhai District authorities hence arranged special passes to facilitate petrochemical production, and has also temporarily permitted rail transportation of goods.

- Utilizing a "closed-loop" system, Zhenhai transport drivers are not allowed to alight, to minimize contact and hence avoid quarantine measures, the report said. The Ningbo Maritime Department has also facilitated a similar closed-loop transport system at its ports, with 392,600 mt of coal, 221,300 mt of oil and 4,213 mt of LPG imported since lockdown measures began.

- Autonomous vehicle (AV) startup WeRide has received investment funding from major Chinese automaker Guangzhou Automobile Group (GAC Group), according to a blog posted on the Medium website. This investment is a strategic partnership under which the two companies will jointly build a fleet of tens of thousands of robotaxis in the coming years. GAC's X-soul, the automaker's recently introduced electronic and electrical architecture, will be the foundation for the new robotaxi model jointly developed by the two companies. Through their partnership, WeRide and GAC Group aim to construct a comprehensive framework that covers the technology, products, and commercialization of robotaxis. Qinghong Zeng, chairman of GAC Group, said, "GAC has been at the forefront of the industry in intelligent manufacturing and autonomous driving through independent R&D [research and development] and cooperation. WeRide has been well recognized in [the] AD [autonomous driving] industry for its edge in technology and especially in Robotaxi operations. We are very pleased to take another big step forward with WeRide in developing vanguard L4 [Level 4] autonomous driving vehicles." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Sunwoda Electric Vehicle Battery Co Ltd has announced plans to set up a power-battery and energy-storage-battery manufacturing base with an annual capacity of 30 gigawatt-hours (GWh) in Zaozhuang city, Shandong province, China, reports news source Gasgoo. The project is to involve an investment of CNY20 billion (USD3.14 billion) in the building of assembly lines, as well as relevant support facilities. According to the report, Sunwoda currently accounts for 1.3% of China's total installed power-battery capacity and ranks 10th among Chinese power-battery-makers. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A Samsung Engineering led consortium has been awarded a FEED contract by Kilang Pertamina Internasional, a subsidiary of Indonesian state-owned oil company PT Pertamina, for the Trans Pacific Petrochemical Indotama olefin complex project in Indonesia. The other partners in the consortium are PT Technip Indonesia and Indonesian local company Tripatra. (IHS Markit Upstream Costs and Technology's William Cunningham)

- The project, to be built in Tuban, Java Island, Indonesia, will consist of a naphtha cracker with an annual capacity of 1 million tons to produce 700,000 tons of high-density polyethylene (HDPE), 300,000 tons of low-density polyethylene (LDPE) and a large-scale petrochemical complex that produces 600,000 tons of polypropylene (PP) per year.

- An EPC contract with an estimated value of around USD4 billion for the project is expected to be awarded in 2022 when the FEED project is completed.

- Samsung Engineering continues to prioritize winning FEED contracts as a strategy in boosting its success in winning EPC contracts. This has been successful in recent years, with the Korean contractor's two largest recent EPC contracts—the Dos Bocas refinery in Mexico and the Sarawak methanol project in Malaysia—awarded after the company had carried out FEED work.

Posted 15 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.