Most major APAC and all major European indices were lower on the day, while most US indices closed modestly higher. US and benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, oil, and natural gas closed higher, while gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for DJIA -0.6%; Nasdaq +0.6%, Russell 2000 +0.1%, and S&P 500 +0.1%.

- 10yr US govt bonds closed +9bps/1.79% yield and 30yr bonds +9bps/2.13% yield.

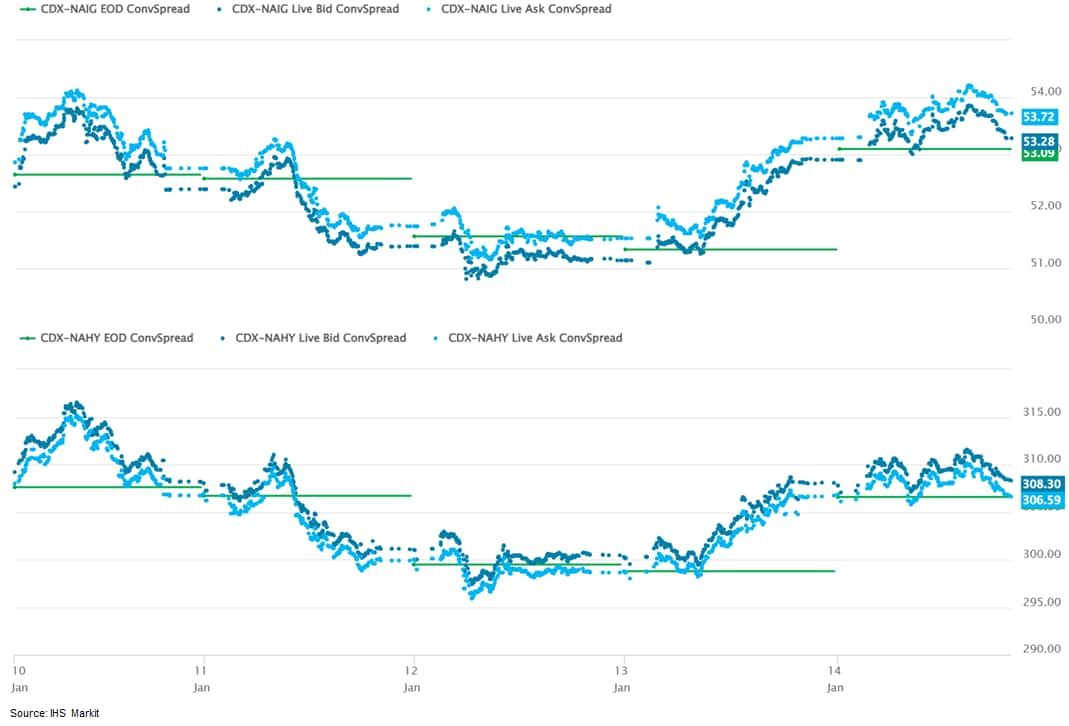

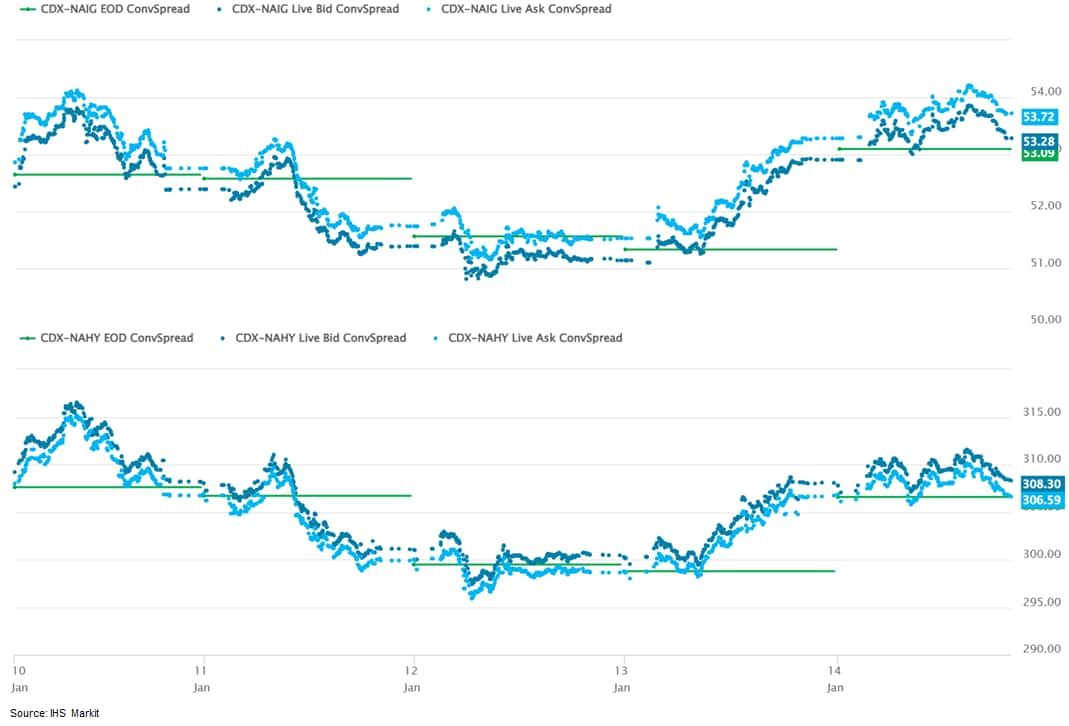

- CDX-NAIG closed +1bp/54bps and CDX-NAHY +1bp/308bps, which is +1bp and flat week-over-week, respectively.

- DXY US dollar index closed +0.4%/95.17.

- Gold closed -0.3%/$1,817 per troy oz, silver -1.1%/$22.92 per troy oz, and copper -2.7%/$4.42 per pound.

- Crude oil closed +2.1%/$83.82 per barrel and natural gas closed +1.9%/$4.08 per mmbtu.

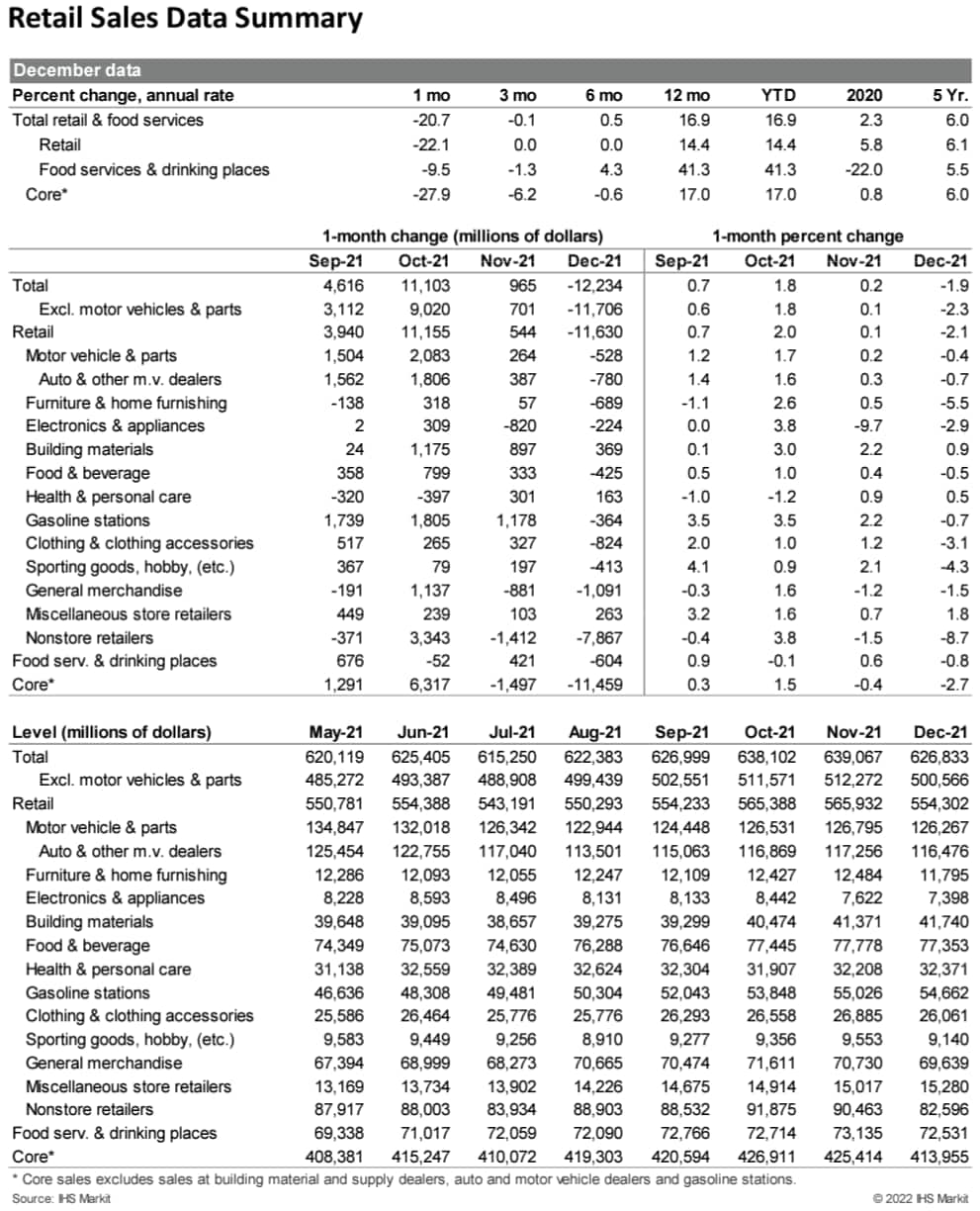

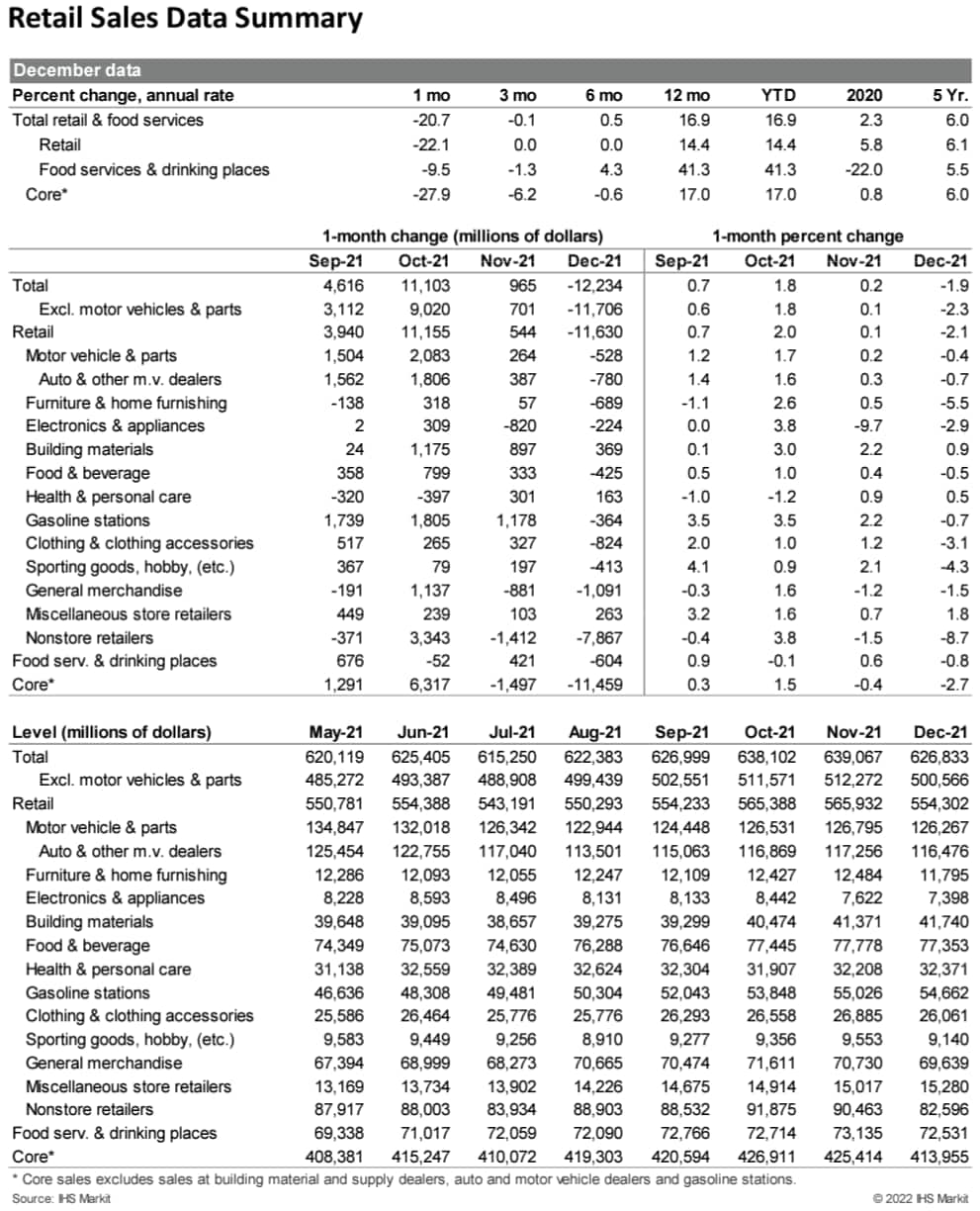

- Total US retail trade and food services sales declined 1.9% in December, a weaker reading than both the consensus and IHS Markit analysts had expected. Nonautomotive sales declined 2.3%, while core sales fell 2.7. (IHS Markit Economists Kathleen Navin and William Magee)

- The weakness in December was likely due, at least in part, to early holiday shopping, as news reports of supply-chain issues and delays in shipping shifted sales forward into October and November.

- Indeed, nearly two-thirds of the decline in total retail sales in December was accounted for by sales at nonstore retailers, which fell 8.7% on the month and would be particularly sensitive to shipping delays. The same thing happened last year, and sales rebounded sharply in January.

- Sales for food services and drinking places declined 0.8% in December. The weakness in dining out is consistent with recent soft readings from the OpenTable data as would-be diners became more cautious given Omicron concerns. We look for a further decline in dining out in January as virus concerns have intensified.

- A positive note in this month's report was continued strength in retail sales at building materials stores, which rose 0.9% in December following upward revisions to both October and November. Recent strength in this sector likely reflects unseasonably warm weather in many parts of the country during that time.

- Overall, IHS Markit analysts view the weakness in today's report as temporary, as most fundamentals, including wages and net worth, remain supportive of consumer spending in the near term.

- Total US industrial production (IP) edged down 0.1% in December, reflecting decreases in manufacturing (down 0.3%) and utilities IP (down 1.5%) that were mostly offset by an increase in mining (up 2.0%). IP declined for the first time in three months but is still 0.6% above its pre-pandemic (February 2020) level and 3.7% higher than it was a year ago. (IHS Markit Economists Ben Herzon and Akshat Goel)

- Manufacturing IP fell 0.3% in December as losses were recorded in the production of both durable and nondurable goods. The output for durable goods fell 0.4%, dragged down by a decline in the production of motor vehicles and parts (down 1.3%), and aerospace and other transportation equipment (down 1.0%). Nondurable manufacturing also edged lower (down 0.2%) even as the two major components—food, beverage, and tobacco products (up 0.2%) and chemicals (up 0.7%)—recorded gains.

- Motor vehicle production and assemblies in November and December were higher than average levels seen earlier in the year when manufacturers first started cutting production owing to a shortage of semiconductor chips used in vehicle components. While the worst of production cuts may be over, IP for motor vehicles and parts is still 6.5% below the February 2020 level as production continues to be constrained by the global chip shortage.

- The output of utilities fell 1.5% in December owing to unseasonably warm weather in the month. Natural gas distribution recorded a large loss of 7.9% due to the reduced demand for heating.

- Mining activity increased 2.0% in December, helped by a 1.7% increase in oil and gas extraction. The index for mining grew at an annual rate of 15.6% in the fourth quarter after declining 0.4% (annual rate) in the third.

- The US University of Michigan Consumer Sentiment Index fell 1.8 points to 68.8 in the preliminary January reading—trending towards the 10-year low recorded in November (67.4). The decline was driven by worsening views on both the present situation and the future. The present situation index fell 1.0 point to 73.2, and the expectations index declined 2.4 points to 65.9. (IHS Markit Economists Akshat Goel and William Magee)

- While the Omicron-induced surge in COVID-19 infections pulled down sentiment, the escalating inflation appears to be the foremost source of drag. At 7.0%, the 12-month increase in the consumer price index (CPI) in December was the highest in nearly 4 decades. The median expected one-year inflation rate in the University of Michigan survey edged higher 0.1 percentage point to 4.9%, its highest level since 2008.

- Households in the bottom half of the income distribution were most affected by higher consumer prices. The index of sentiment for households earning below $100,000 per year declined 6.6 points, while that for households earning over $100,000 per year rose 4.1 points.

- The index of buying conditions for automobiles fell by 11.0 points in January as high prices and limited inventories continue to be a drag on buying sentiment. The price of new vehicles is up 12.3% since March 2021 while used car prices are up 39.0% since March 2021.

- Consumer sentiment remains shaky and the recent trend underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the expectation for strong job and wage growth in the coming months, which should continue to support solid growth of consumer spending. IHS Markit analysts expect that sentiment will track spending more closely as inflation subsides, although these may not align until 2023.

- Automotive News reports that Local Motors is to shutter its operations, citing company executives. According to the report, the company is to close on 14 January, which was confirmed by multiple executives. The company has made no formal announcement, but reports state that company employees posted messages about the situation on social media channels and two employees confirmed the reports to Automotive News. The Automotive News report states that a Local Motors shuttle was in an accident in Toronto, Canada, in December 2021, although it does not indicate clearly if the event had an impact on the decision by the company to shutter operations. According to the report, the incident did result in a shuttle attendant being injured "critically", and the incident is still under investigation. Local Motors had deployed its low-speed autonomous shuttle vehicle the Olli in several areas and was reportedly collaborating on on-demand software for Olli 2.0, as well as partnering with Protean Electric to accelerate deployment of Olli 2.0, according to reports in mid-June 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Wheat futures continued lower Thursday as the market responded lower to larger supply ideas. Minneapolis March wheat led losses, falling 25 cents at $8.95 1/2 while Kansas City lost 18 1/4 cents at $7.59 3/4 and Chicago was down 11 cents at $7.46 3/4. (IHS Markit Food and Agricultural Commodities)

- Matif wheat prices fell to a fresh three-month low as prices were also pressured by larger supply ideas. Strength in the euro and macro-economic worries over rising inflation also weighed on prices.

- Weekly US export sales data released Thursday morning was in line with expectations but not inspiring. Net wheat sales for 2021/22 were at 264,400 tons for the week ended January 6, in line with expectations for sales of 150,000 tons to 400,000 tons.

- Algeria has reportedly extended the deadline in its latest import tender to Friday as negotiations are ongoing.

- Iran's GTC reportedly purchased about 240,000 tons of milling wheat in its January 12 import tender.

- Commodity funds were seen to have been sellers of about 8,000 contracts in the Chicago wheat market Thursday.

- Enbridge Gas announced on January 13 it has launched a "first-of-its-kind" hydrogen blending facility in North America, serving the Markham community. The company said it had partnered with Cummins Inc and was supported by the Canadian Gas Association (CGA), Sustainable Development Technology Canada (SDTC) and NGIF Capital Corporation in deploying the facility, which blends hydrogen into delivered natural gas and thereby, reduces the carbon footprint. Enbridge said the CAN$52.2 million joint venture was a pilot project involving modifications to the Markham Power-to-Gas facility. That facility was built four years ago as part of another Enbridge-Cummins joint venture. Enbridge listed some key facts about the project (IHS Markit PointLogic's Annalisa Kraft):

- Through this pilot project, Enbridge Gas will initially provide a maximum hydrogen blended content of up to two percent by volume of the natural gas supplied to approximately 3,600 customers in Markham, Ontario in Q3-2021, eliminating up to 117 tons of CO2 annually from the atmosphere.

- The pilot project will not impact the standard market cost of natural gas.

- The hydrogen-blending project construction cost was $5.2M.

- The Markham Power-to-Gas facility was commissioned in 2018 through a partnership between Enbridge Gas and Cummins Inc. (which acquired Hydrogenics in 2019) with support from the Province of Ontario. Since then, the facility has provided regulation services to the IESO to help balance electricity supply and demand and ensure system reliability.

- The plant has also proven its potential as a solution to the challenge of storing the province's surplus electrical energy using Enbridge's existing natural gas pipeline infrastructure or in the form of pure hydrogen, which can later be reconverted back to electricity.

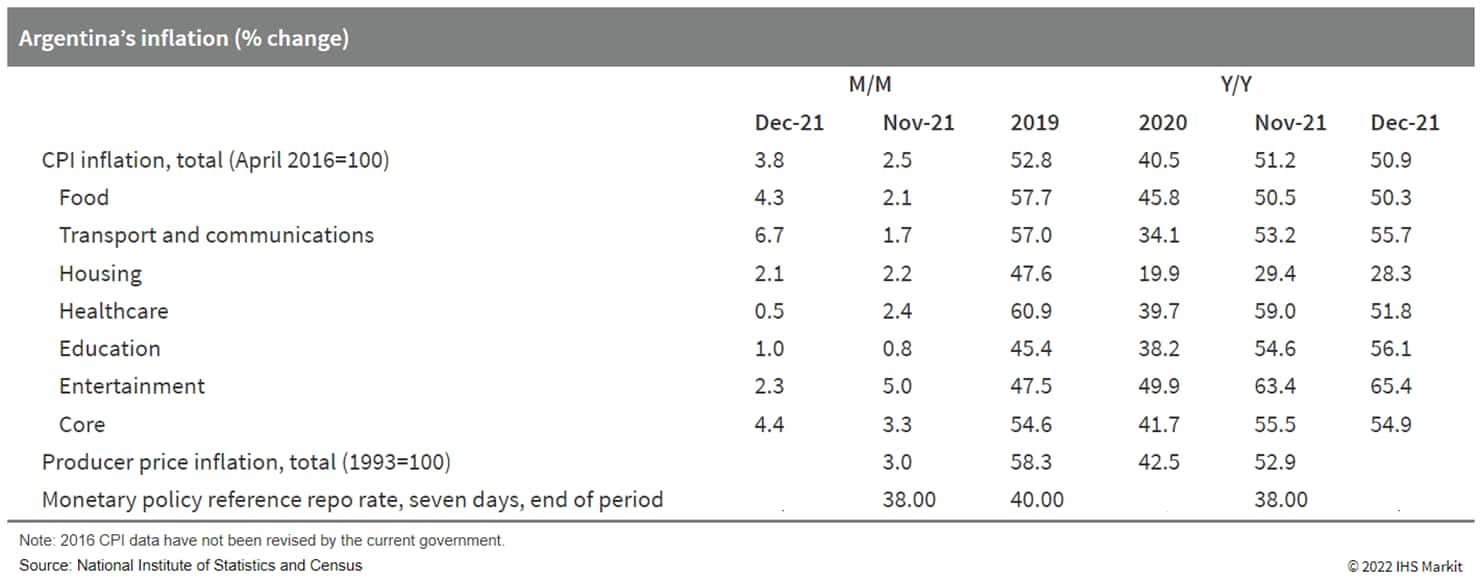

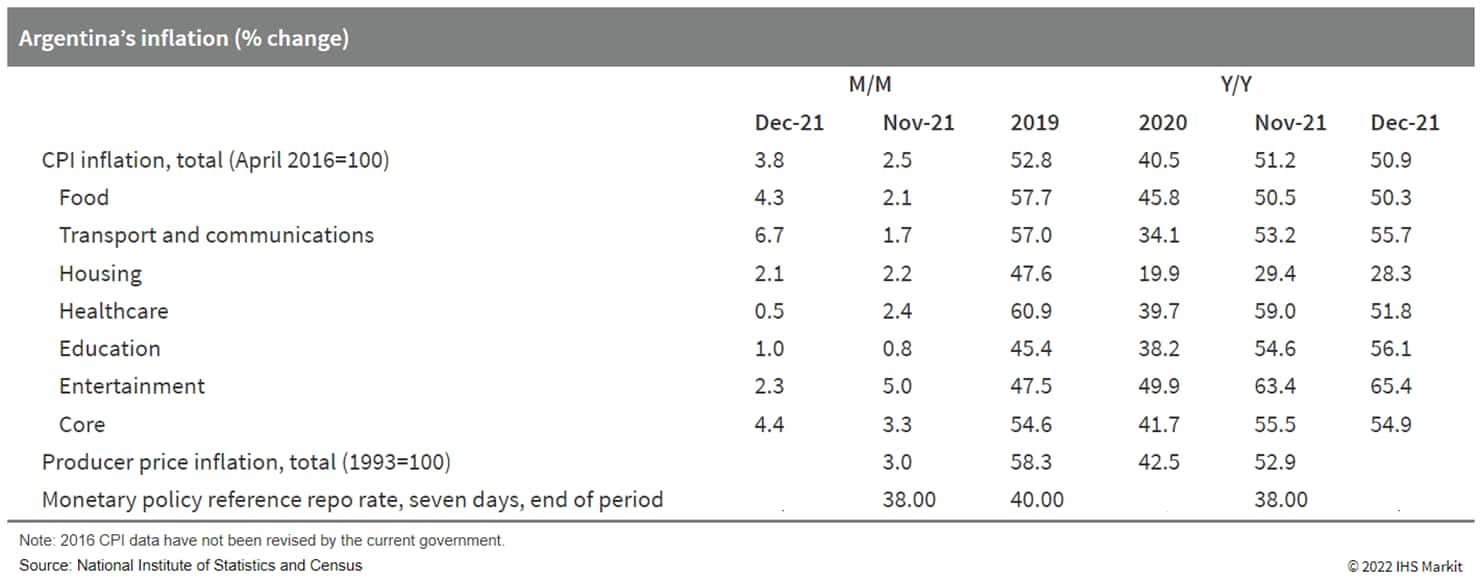

- Argentina's consumer price index (CPI) increased by 3.8% month on month (m/m) during December 2021, accelerating from 2.5% in November. The government is now implementing an extended agreement to maintain control over price freezes on more than 1,300 items until 7 April 2022. (IHS Markit Economist Claudia Wehbe)

- Argentina's inflation was mainly driven by soaring prices in the restaurant and hotel category, mainly propelled by increases in the prices of take-out food and lodging. This was followed by prices in the alcoholic beverages and tobacco category, mainly driven by increases in the prices of cigarettes.

- The food and beverages category had the largest increases across all regions, recording substantial price rises for meats, followed by increases in bread and cereals, dairy products, and eggs, while decreases in the prices of fresh vegetables partially offset the overall increase.

- The prices of regulated items jumped by 1.7% m/m, mainly over the increase in cigarettes. The core inflation rate stood at 4.4% m/m, compared with 3.3% in the prior month, followed by increases in seasonal items at 3.7%, mainly propelled by tourism-related services.

Europe/Middle East/Africa

- All major European equity markets closed lower; Spain -0.1%, UK -0.3%, France -0.8%, Germany -0.9%, and Italy -1.1%.

- 10yr European govt bonds closed sharply lower; France/Germany/Spain/UK +4bps and Italy +5bps.

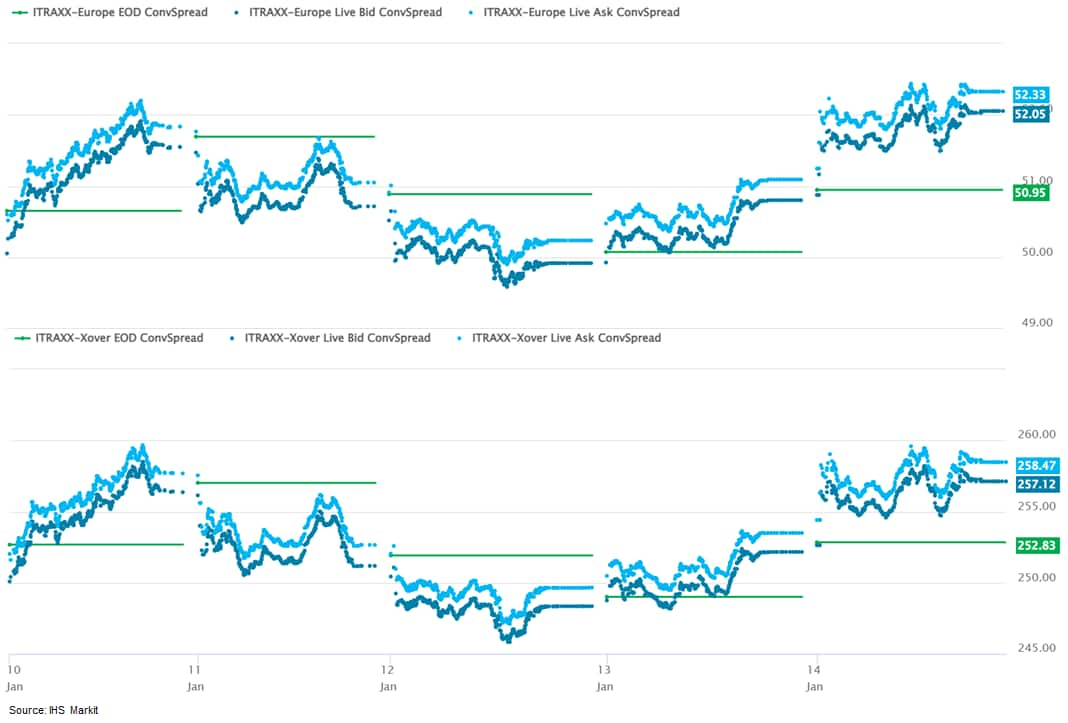

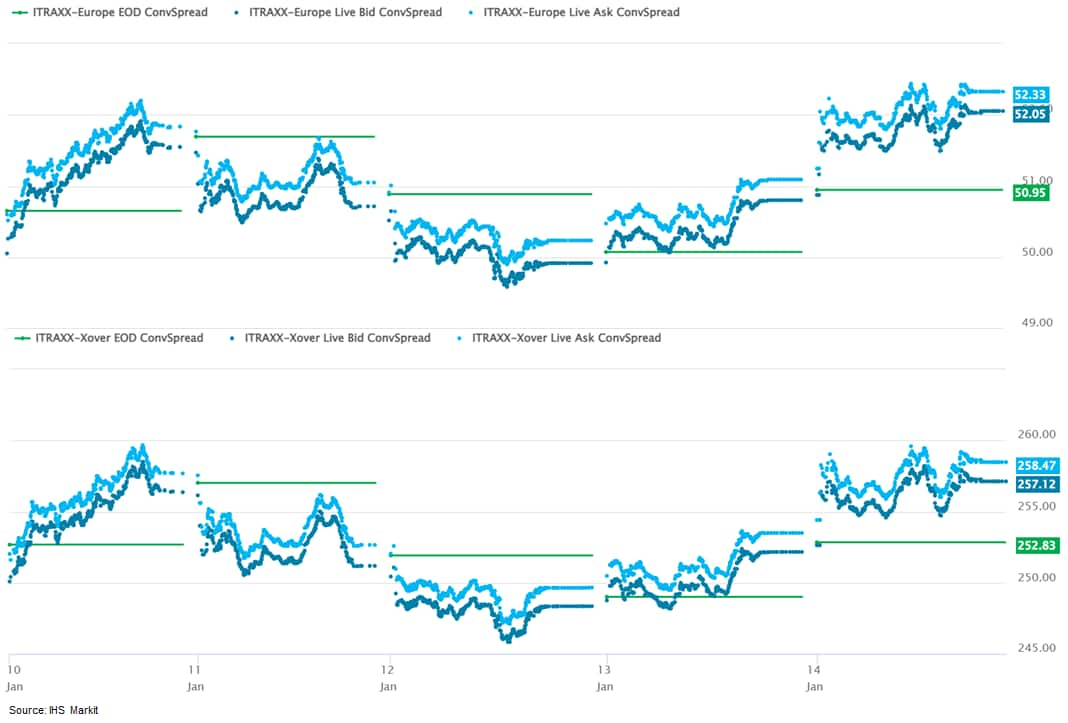

- iTraxx-Europe closed +1bp/52bps and iTraxx-Xover +5bps/258bps, which is +2bps and +5bps week-over-week, respectively.

- Brent crude closed +1.9%/$86.06 per barrel.

- The Office for National Statistics (ONS) reports that the UK economy grew by 0.9% month on month (m/m) in November 2021 after gains of 0.2% m/m in October and 0.6% m/m in September. The figure for November was above the compiled market consensus from Reuters, which had predicted a 0.4% m/m gain during the month. Moreover, this was after real GDP rose by 1.1% quarter on quarter (q/q) in the third quarter of 2021. (IHS Markit Economist Raj Badiani)

- Services output grew by 0.7% m/m in November to rise further above its pre-pandemic level, standing 1.3% higher.

- Output growth in consumer-facing services doubled to 0.8% m/m in November but still trailed its pre-pandemic level by 5.0%.

- The ONS reported that wholesale and retail trade and repair of motor vehicles and motorcycles services performed solidly in November, with output up by 1.4% m/m. Many consumers appeared to have brought forward their Christmas shopping to avoid potential shortages and higher prices nearer the festivities.

- In addition, households felt more comfortable eating out and consuming leisure services during the month, which was a quieter month in terms of COVID-19 developments.

- Production output increased by 1.0% m/m in November 2021 but remained 2.6% below its pre-pandemic level.

- Manufacturing activity was the largest contributor to production growth in November 2021, increasing by 1.1% m/m after 9 out of the 13 manufacturing sub-sectors reported increased output.

- The main drivers of this growth were the manufacture of machinery and equipment not elsewhere classified and the manufacture of transport equipment, up by 7.4% m/m and 3.6% m/m, respectively.

- The main drag was falling mining and quarrying output because of the lower extraction of crude petroleum and natural gas in November.

- Meanwhile, construction output increased by 3.5% m/m in November 2021 following a fall of 1.7% m/m. This was the largest monthly rise in construction output since March 2021, which ensured that the sector's output stood above its pre-pandemic level in late 2021.

- Council planners have approved a potential large-scale electric vehicle (EV) battery production site in the United Kingdom. According to a statement, the planning committees of Warwick District Council and Coventry City Council have handed down positive resolutions on what is referred to as a West Midlands Gigafactory, which would be located on the site of Coventry Airport. The statement added that, following the resolution, "outline planning permission will be formally issued once the associated legal agreement has been signed and government has been consulted". This is expected to take place in March 2022. This is a further step forward for the project company, which is hoping to secure a planning agreement for the site near Coventry to undertake large-scale mass production of EV batteries. Previously, the company has said that the site will cover 53,000 square meters and will have the capacity to deliver up to 60GWh of batteries per annum following an investment of around GBP2.5 billion. The company said it is also expected to create up to 6,000 highly skilled jobs, as well as "thousands more in the wider supply chain in Coventry, Warwickshire and the surrounding areas". The company also aims for electricity to be supplied from 100% renewable resources through a combination of grid supply and solar panels, the latter planned to be the one of the country's largest arrays. The site is expected to be production-ready by 2025, and is also planned to recycle used batteries. Backers of the project include the West Midlands Combined Authority, Warwick District Council, Warwickshire County Council, and Rugby Council, as well as the Warwick Manufacturing Group at University of Warwick, Coventry University, and the Manufacturing Technology Centre. (IHS Markit AutoIntelligence's Ian Fletcher)

- The initial German GDP release for 2021 from the Federal Statistics Office (FSO) reveals the anticipated rebound by 2.7%, following a decline of -4.6% (calendar-adjusted: -4.9%) in 2020 and growth of 1.1% in both 2019 and 2018. The average during 2010-19 was 2.0%. The GDP level of 2021 falls short of that of the pre-pandemic year 2019 by 2.0%, and IHS Markit estimates that the fourth-quarter level in 2021 remained about a percentage point below its 2019 equivalent. Nevertheless, significant ground was regained in 2021 despite impediments from the ongoing pandemic and related supply chain problems. (IHS Markit Economist Timo Klein)

- Ahead of the release of Q4 2021 GDP data on 28 January that will reveal the magnitude of any quarterly revisions that are already contained in the current release of annual numbers (but not published), IHS Markit estimates that GDP grew by only 0.2%-0.3% quarter on quarter (q/q) in the final quarter of 2021. This is down sharply from 1.7% and 2.0% in the two preceding quarters. Note, however, that this slowdown mainly reflects a drop of activity during August-September rather than a worsening during the fourth quarter itself. This means that growth in the first quarter of 2022 is likely to stay positive despite the impact of the renewed surge in infections from the Omicron variant.

- Administrative restrictions imposed during January-May 2021 and subsequently in November-December (though much milder than in the initial months of the year) limited the size of the economic rebound in 2021. Furthermore, global supply chain problems persisted throughout 2021, even worsening temporarily around mid-year. This affected the automobile industry in particular, given a dearth of semiconductors. Based on monthly production data, the sector improved the most during September-November, but car production was still almost 30% below its pre-pandemic February 2020 levels in November. This compares with a shortfall of only 8% in December 2020, implying massive, renewed worsening during January-August 2021 owing to material shortages.

- Fixed investment recouped only around half of their decline of 2020 in 2021. Its increase of 1.3% owed more to equipment spending (3.2%) than to construction (0.5%) and "other investment" such as licenses, software, R&D expenditures (0.7%). That said, equipment spending had plunged by 11.2% in 2020, whereas construction had increased by 2.5% in the first pandemic year as outdoor activity was not affected much by COVID-19 protection requirements. In 2021, by contrast, construction output equally was held back by material shortages.

- German charging infrastructure startup HeyCharge has raised USD4.7 million in its seed fundraising round led by BMW Group's venture capital fund, BMW i Ventures. Statkraft Ventures, the venture capital arm of Norway-based renewable energy company Statkraft, also participated in the round. HeyCharge enables electric vehicle (EV) charging in underground parking garages without an internet connection. Kasper Sage, managing partner of BMW i Ventures, said, "The rapid growth of the electric vehicle market in coming years will necessitate greater infrastructure build-out of charging solutions around the globe. HeyCharge is the first company to enable EV-charging without internet connection, which is a key enabler to cover untapped white-spots. With HeyCharge's technology, it becomes attractive to install chargers in locations that before would have not been commercially viable." Traditionally, to activate an EV charger, an app or RFID card and a proper internet connection are required. However, most underground parking garages does not have an internet access point or the ability to install such boxes. Thus, HeyCharge, which was founded in 2020, has come up with a solution aimed at apartment buildings, offices, hotels, and other underground infrastructure for EVs. The company's SecureCharge technology does not require an on-site internet connection and connects with devices over Bluetooth instead. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Germany's Ministry of Economic Affairs and Climate Action on 11 January released a set of climate proposals alongside a report, aiming to enact a backlog of emissions cuts that will bring the country back in line with its ambitious climate goals. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- Last month, Minister Robert Habeck, who came into power with the three-party ruling coalition on 8 December, told news outlets the country's targets would be missed. The new report from his ministry gave an update on Germany's progress towards emissions reduction targets and "a selection of first projects."

- A new plan is needed because Germany recently set stricter climate targets. A German Constitutional Court ruling in April found Germany's climate targets were too weak, following the complaints of farmers affected by climate change.

- The previous government amended the Climate Action Law, which sets national carbon budgets, to reduce Germany's GHG emissions by 65% by 2030 compared with 1990 levels, reaching net zero by 2045 instead of 2050.

- In August, a related revision to the Federal Climate Change Act entered into force. But this left the new government with a backlog of unabated emissions.

- To reach these targets, the report found "the speed of climate protection must almost triple in view of the goals of the Federal Climate Protection Act compared with the status quo. The pace of emissions reductions must more than double and then nearly triple by 2030. Average annual emissions reduction in the past decade was 15 million tons, but by the second half of this decade it will be over 40 million tons per year."

- The report warned: "It is legally binding to reduce GHG emissions [by 65%] by 2030."

- Under the proposals, the government will revise Germany's Renewable Energy Act (EEG) so that the country's renewable output reaches 80% of electricity consumption by 2030, compared with a prior target of 65%. Renewable energy accounted for 42% of electricity consumption in 2019.

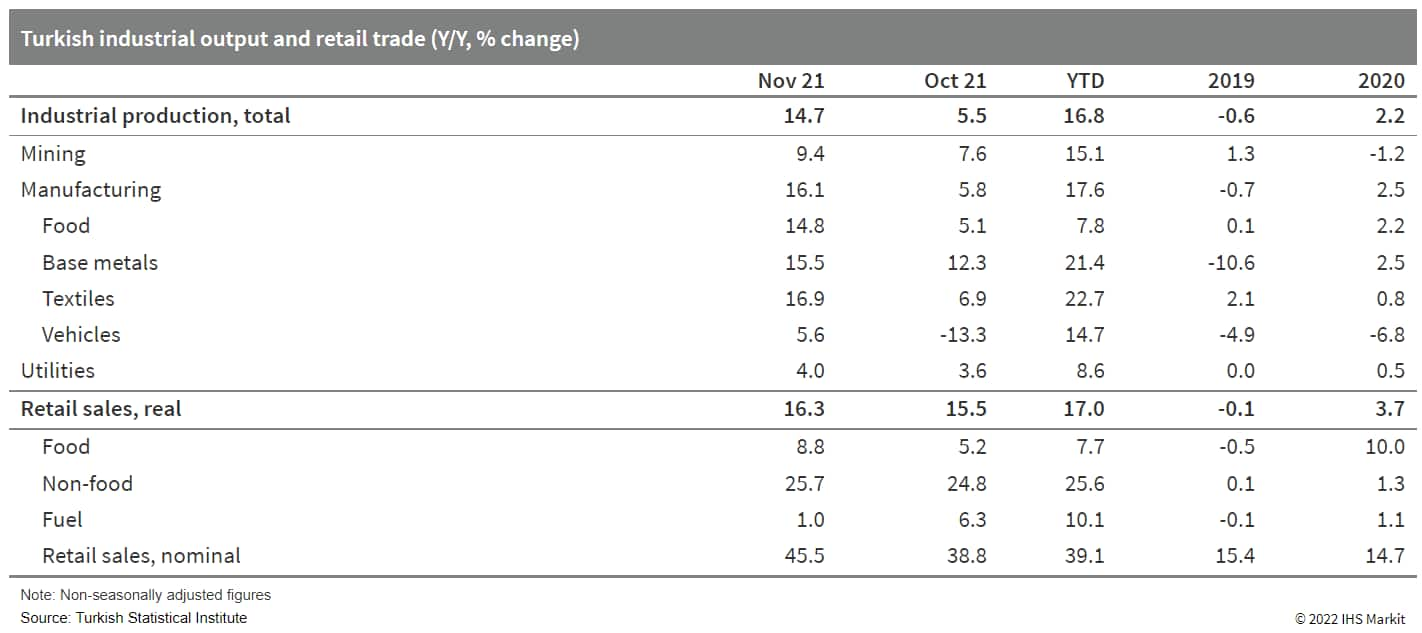

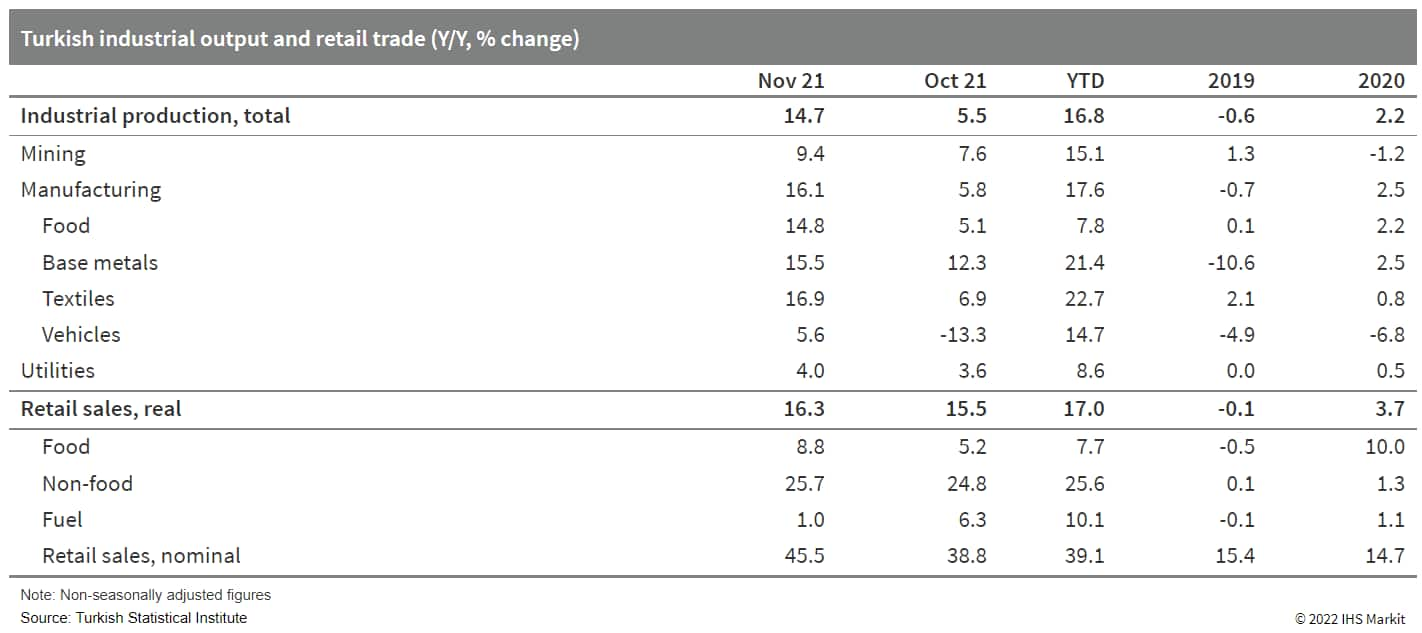

- In November 2021, total Turkish industrial production increased by 3.3% month on month (m/m), according to seasonally adjusted data from the Turkish Statistical Institute (TurkStat). Growth accelerated compared with previous months. Since mid-year 2021, industrial gains had been uneven owing to global transport problems and weakened export demand. (IHS Markit Economist Andrew Birch)

- Just-released data on the current account previously previewed an uptick in transport activity, indicating a softening of global supply issues affecting Turkish industry. The IHS Markit PMI sub-index covering new export business is slowly rallying, also reflecting the slow return of demand for industrial products.

- On the other hand, inflation continues to weigh heavily on industrial activity in the country. The IHS Markit PMI sub-index covering input costs for manufacturers is deteriorating, with respondents to that survey pointing to the depreciation of the lira as the primary factor pushing up cost burdens.

- Inflation is also the key factor behind the continued deterioration of consumer sentiment. The TurkStat-published consumer sentiment index sunk to 70.9 as of November 2021, the most pessimistic (anything below 100) it had ever been, dating back to the beginning of 2012 when the index began.

- Nonetheless, retail trade volume managed to increase by 1.3% m/m in November 2021, according to seasonally adjusted TurkStat data. Among the spending, however, outlays on automotive fuel continued its second-half-2021 downward trend, contracting by 2.2% m/m. Local mobility rates have trended downward as prices on fuel have risen.

Asia-Pacific

- Most major APAC equity indices closed lower except for India flat; Hong Kong -0.2%, Mainland China -1.0%, Australia -1.1%, Japan -1.3%, and South Korea -1.4%.

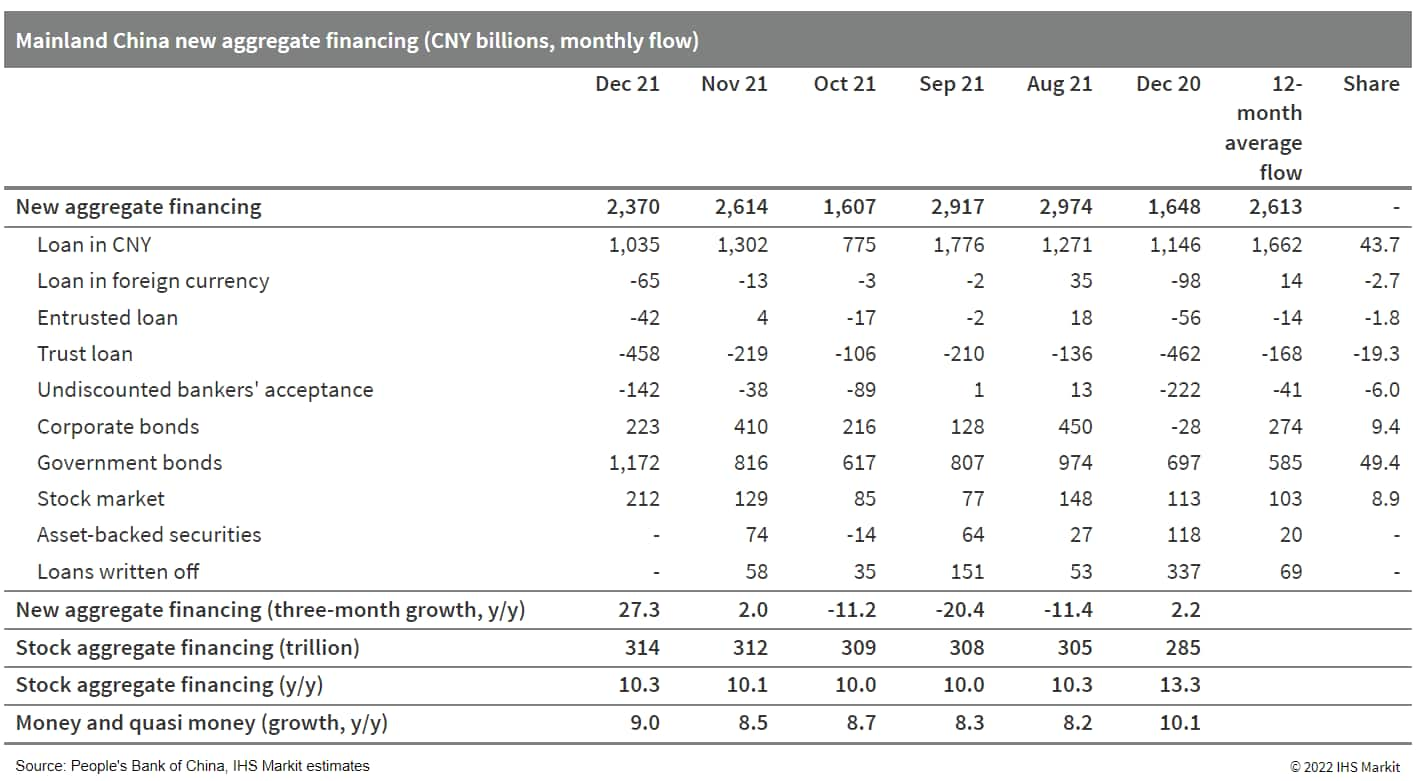

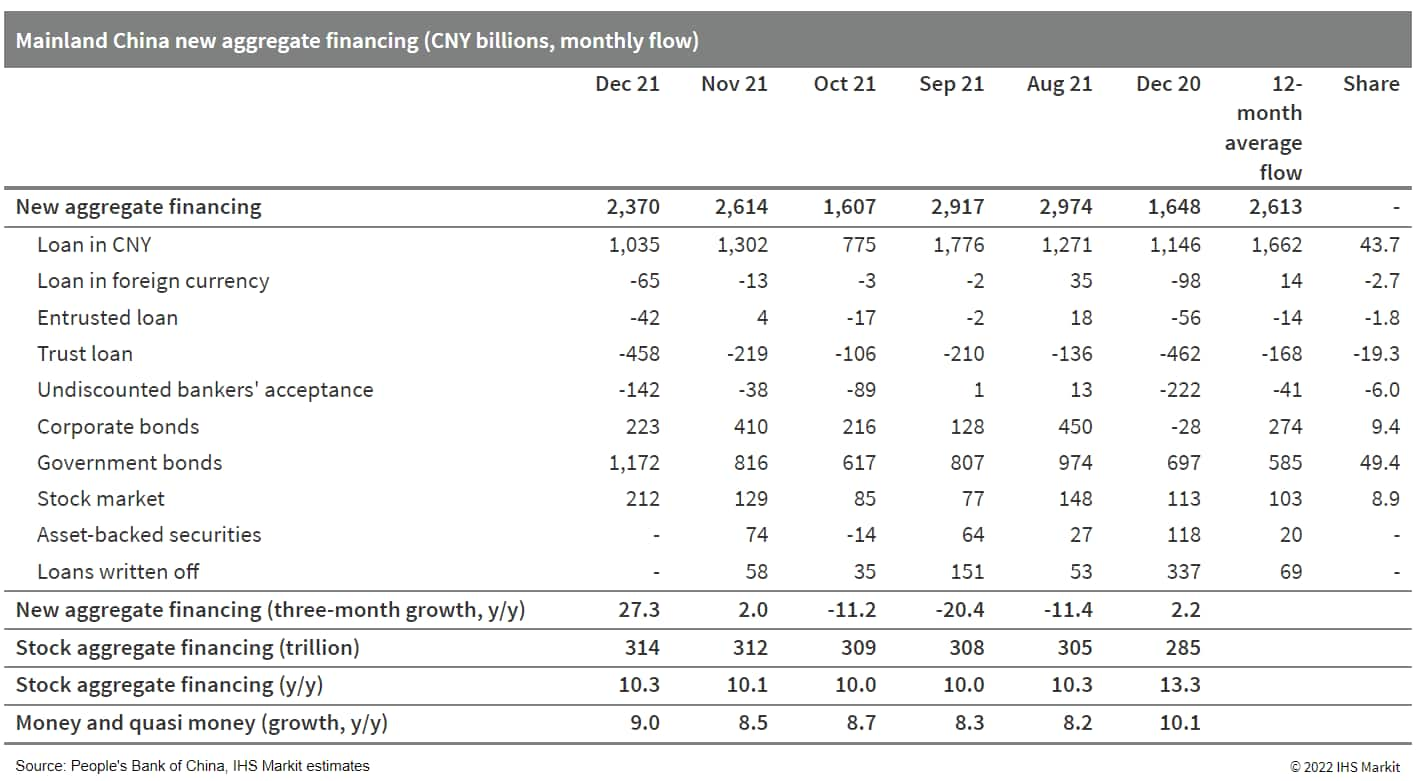

- Mainland China's new total social financing (TSF), the broadest measure of net new financing to the real economy, amounted to CNY2.37 trillion (USD372.22 billion) in December 2021, up by CNY720.6 billion year on year (y/y) and higher than the comparable 2019 level by CNY166.9 billion, according to the People's Bank of China (PBOC). By the end of December 2021, stock TSF expanded by 10.3% y/y, up by 0.2 percentage point from the month-ago reading. (IHS Markit Economist Lei Yi)

- The year-on-year gains in December new TSF were again driven by accelerated government bond issuance, from which net new financing reached CNY1.17 trillion and was up CNY475 billion y/y. Corporate bond issuance also registered notable year-on-year improvement in December, yet this was partially due to the low base effect given the high-profile bond default events in the fourth quarter of 2020.

- New bank loans came in at CNY1.13 trillion in December, lower by CNY123.4 billion y/y as weakness persisted in the borrowing demand of the real economy. Medium-to-long-term borrowing of both households and corporates posted year-on-year contraction in December. This may indicate that the marginal relaxation in mortgage rules since fourth quarter 2021, which supported household borrowing improvement in October and November, may not be sufficient for a continued recovery in home buying therefore the mortgage demand. Though on the corporate front, the year-on-year contraction narrowed slightly in December from the month before.

- Broad money supply (M2) growth ticked up by 0.5 percentage point to 9.0% y/y in December, as fiscal spending showed further signs of improving with the CNY1.03 trillion decline in December fiscal deposits. M1 expanded by 3.5% y/y in December, up by 0.5 percentage point from November and recovered for a second month.

- Cumulatively, new TSF totaled CNY31.35 trillion in 2021, down by CNY3.44 trillion y/y, yet higher than the comparable 2019 level by CNY5.68 trillion. New bank loans for full-year 2021 added up to CNY19.95 trillion, up by CNY315 billion y/y.

- China's authorities have introduced new lockdown and testing protocols after cases of the Omicron variant of the COVID-19 virus were found in the port city of Tianjin. The result has included new production disruptions for both Toyota and Volkswagen (VW). At the time of writing, the measures and their impact are limited to the Tianjin area. According to Reuters, the city began testing its 14 million residents on 12 January 2022. VW Group reportedly has shut down its VW-FAW plant, as well as a components plant in the city because of recent COVID-19 cases at those sites. Reuters reports a VW spokesperson as saying, "Due to the recent COVID-19 outbreaks both the FAW-VW vehicle plant and VW Automatic Transmission Tianjin component factory have been shut down since Monday. Both plants have conducted COVID-19 testing twice for all employees this week and are waiting for the results. We hope to resume production very soon and catch up with lost production. The top priority remains the health and well-being of our employees." The report also states that operations at Toyota's joint-venture plant in Tianjin have been halted since 11 January due to the impact on suppliers of mandatory COVID-19 testing of city residents. "We plan to resume operations as soon as the government's instructions and the safety and security of the local community and suppliers are confirmed and assured," Toyota reportedly said. Great Wall also has a plant in the city, but the Reuters report does not indicate if its output has been affected. At the time of writing, the length of the shutdowns is not certain. This will likely be determined by the test results and how fast the Omicron variant spreads and how many COVID-19 cases are discovered. In Tianjin, VW produces the Chinese-market VW Tayron and Tayron X, as well as the Audi Q3 and Q3 Sportback. In 2022, Toyota's local facilities will produce the Corolla, Allion, IZOA, and Vios. Later this year, several new products are forecast to be added (Corolla Cross, bZ3, bZ4X, and Sienna); it is not clear if the disruption will slow the production of the new models. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Tesla CEO Elon Musk has posted on Twitter about challenges faced by the electric vehicle (EV) maker over its planned sales launch in the Indian market, reports Reuters. In a tweet sent in response to a post by another person, Musk reportedly said, "Still working through a lot of challenges with the government." The comment was made in response to a question posted seeking an update on when Tesla would start sales in India. According to the report, some Indian government officials want the company to commit to local manufacturing before they consider offering any tax breaks. However, Tesla has said it wants to see demand in India through imports prior to production. Although it is willing to consider beginning production in India, Tesla has not fully committed to making that move. The back and forth on Tesla's potential sales in India is ongoing. As Musk's tweet reportedly was in response to a potential customer's question, rather than Musk or Tesla providing a direct update, it should not be taken to indicate any further progress has been made in Tesla's efforts since earlier reports. India levies high taxes on imported vehicles, up to 100%, which would make Tesla's products too costly in the market. Still, reportedly, the company has received approval to launch products in the country and the authorities are evaluating Tesla's request for tax breaks. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ashok Leyland has signed a memorandum of understanding (MOU) to develop autonomous vehicles (AVs) for a range of industrial applications jointly with Aidrivers, a provider of artificial intelligence (AI)-enabled autonomous solutions across industrial mobility, reports the Mint. Under the long-term collaboration, Aidrivers is to provide AI-enabled autonomous solutions and Ashok Leyland is to provide vehicle platforms. The report states that the agreement is aimed at development of AVs, industrial mobility equipment, and other autonomous industrial automation solutions that will be helpful to fleet operators and logistics providers. In addition, Ashok Leyland is investing in the electric vehicle (EV) space and, last year, detailed its electrification roadmap. The company intends to invest up to USD200 million over the next few years in Switch Mobility, its UK-based EV arm. In April 2021, Ashok Leyland revealed plans to create two subsidiaries to focus on the e-mobility market in India. The first subsidiary, Switch Mobility Automotive Limited, is to be established to carry out the company's EV strategy in India, while the second, OHM Global Mobility Private Limited, is to focus on providing Mobility-as-a-Service. (IHS Markit AutoIntelligence's Isha Sharma)

- Thailand's Indorama Ventures Public Company Limited (IVL) is planning to buy Vietnamese polyethylene terephthalate (PET) convertor Ngoc Nghia Industry Service Trading Joint Stock Company (NN), IVL said in a press statement this week. The Thai company said it is in the process of acquiring shares in NN, the Thai company said on Jan. 10. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- IVL said that NN is a leading PET converter in Vietnam having established relationships with major brands. NN has four manufacturing sites in Northern and Southern Vietnam, with a total production capacity of approximately 5.5 billion units of PET preforms, bottles and closures, equivalent to a PET conversion of 76,000 mt/year.

- According to IVL, as NN provides PET packaging products to multinational and Vietnamese brands in beverage and non-beverage industries, and has local market exposure and understanding, this acquisition will strengthen IVL's packaging business in Asia-Pacific high-growth markets.

- IVL wants to expand its footprint in Vietnam, which it expects to become ASEAN's main production hub for the Asia-Pacific region. Its domestic PET packaging market is projected to grow alongside rising consumption and improving living standards, therefore benefitting IVL's largest business segment, Combined PET, said IVL's D K Agarwal.

- IVL will make a tender offer to acquire all of NN's shares through affiliated Indorama Netherlands B.V.

- This transaction is expected to be completed by the first half of 2022.

- The PET bottle chip sector is the second-largest consumer of purified terephthalic acid (PTA) and monoethylene glycol (MEG), and is a crucial downstream user of paraxylene (PX).

- Citigroup announced on 13 January that it has reached an agreement with Singapore's United Overseas Bank (UOB) to sell its operations in Indonesia, Malaysia, Thailand, and Vietnam. The sale will only include Citigroup's retail and credit card businesses, and as per previous announcements, will not include its investment banking business. Citigroup has noted that the sale will result "in the release of approximately US$1.2 billion of allocated tangible common equity, as well as an increase to tangible common equity of over US$200 million". (IHS Markit Banking Risk's Angus Lam)

- Currently, this is only an agreement and the sales are subject to local regulators' scrutiny. However, IHS Markit expects little complications since they are from one foreign bank to another, and as such, the structure of the banking sectors will remain the same.

- Citigroup first announced the sale of its operations in 13 markets in April 2021, and on 11 January, Citigroup announced that it is also selling its Mexican operations to better align with its core strength.

- According to Reuters, the sales involving the Southeast Asian countries would total USD3.65 billion, and we expect that Citigroup will be making more announcements regarding sales of its other regional businesses in the next several weeks.

- Overall, from a risk perspective, the sale of these developing economies' business to another foreign bank is desirable, especially for Vietnam, which has poor risk management and regulatory performance, as it will allow for better management and the transfer of better risk management skills to the economies.

- Brazilian commercial vehicle (CV) manufacturing company, Volkswagen (VW) Truck and Bus, has entered the Philippine market by partnering with local distributor MAN Automotive Concessionaires Corporation (MACC), reports the Manila Times. The CV manufacturer plans to sell cab and chassis models, delivery trucks, and bus. The trucks range from 9 tons to up to 31 tons, in 4x2, 4x4, 6x4, 8x2, and 8x4 executions. Roberto Cortes, the president and CEO of VW Truck and Bus, said that his company's partnership with MACC marks the brand's entry into Asia. MACC will also assemble the trucks and buses under the VW brand in the Philippines. MACC is an exclusive Philippine distributor and an after-sales provider of MAN trucks and buses. The company has stated that the addition of new models will help to cater to a variety of applications, from closed vans, wing-vans, refrigerated vans, drop-sides, flat beds, and people and food and beverage transport, to boom trucks, tipper trucks, and cement mixers, including specialty purpose vehicles. With the latest development, VW Truck and Bus will also enter the Asian market. Since its inception in 1981, the company has exported over 160,000 vehicles to more than 30 countries in Latin America, Africa, the Middle East, and Asia. (IHS Markit AutoIntelligence's Isha Sharma)

Posted 14 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.