All major European and most US equity indices closed lower, while APAC markets were mixed. US government bonds closed lower, while benchmark European bonds closed mixed. European iTraxx closed wider across IG and high yield, while CDX-NA was almost unchanged on the day. The US dollar, oil, natural gas, and silver closed higher, while copper was flat on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq flat; S&P 500 -0.4%, Russell 2000 -0.5%, and DJIA -0.5%.

- 10yr US govt bonds closed +5bps/1.99% yield and 30yr bonds +4bps/2.29% yield.

- CDX-NAIG closed -1bp/67bps and CDX-NAHY flat/370bps.

- DXY US dollar index closed +0.3%/96.37.

- Gold closed +1.5%/$1,869 per troy oz, silver +2.0%/$23.85 per troy oz, and copper flat/$4.51 per pound.

- Crude oil closed +2.5%/$95.46 per barrel and natural gas closed +6.4%/$4.20 per mmbtu.

- Bakken Energy and Mitsubishi Power Americas announce Native American Mandan, Hidatsa, and Arikara (MHA) Nation will be the natural gas supplier for the partners' North Dakota clean hydrogen hub. The partners said on February 9 they have signed a Memorandum of Understanding (MOU) with the tribes for the Great Plains Hydrogen Hub. Bakken Energy, LLC, formerly Bakken Midstream Natural Gas, LLC, and Mitsubishi Power Americas, Inc. announced June 2, 2021 their strategic partnership agreement to build a clean hydrogen hub in North Dakota. Participants in the hub project offered comments on the agreement (IHS Markit PointLogic's Annalisa Kraft):

- "The MHA Nation is excited to become part of this world class clean hydrogen development," Mark Fox, Chairman of the MHA Nation, said. "Natural gas from the Fort Berthold Indian Reservation will enable the clean energy we need to save our planet, and in the process will allow us to put in place the infrastructure needed to end the excessive flaring of natural gas on our lands, improving the quality of life of our members."

- "Our Great Plains Hydrogen Hub achieves the objectives of the Department of Energy's Hydrogen Shot - large scale clean hydrogen production at $1/kg by 2030 - and it does so years ahead of time," Mike Hopkins, Bakken Energy CEO, said. "The redevelopment gives us an unbeatable cost advantage which will enable the build out of infrastructure that will benefit additional hydrogen production, including hydrogen from renewables, on our way to becoming the largest and lowest cost producer of clean hydrogen in the country."

- Mitsubishi Power Americas, Inc. CEO Bill Newsom added: :"The energy transition requires unprecedented collaboration. Partnering with the MHA Nation will enable us to build out the hydrogen infrastructure in the Midwest cost effectively and help accelerate the energy transition. The North Dakota hydrogen hub is critical to achieving net-zero."

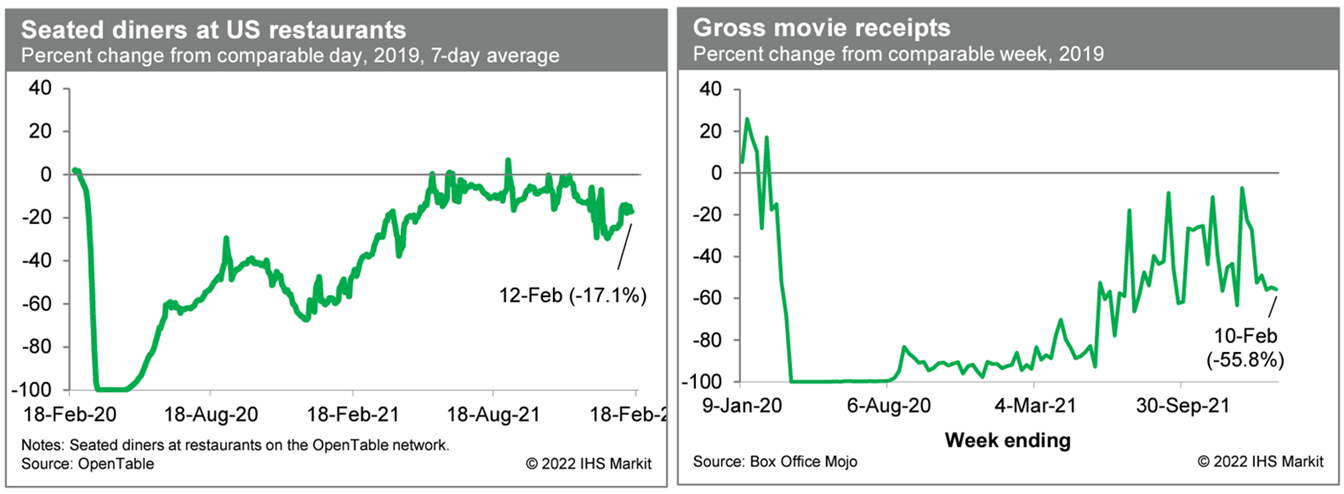

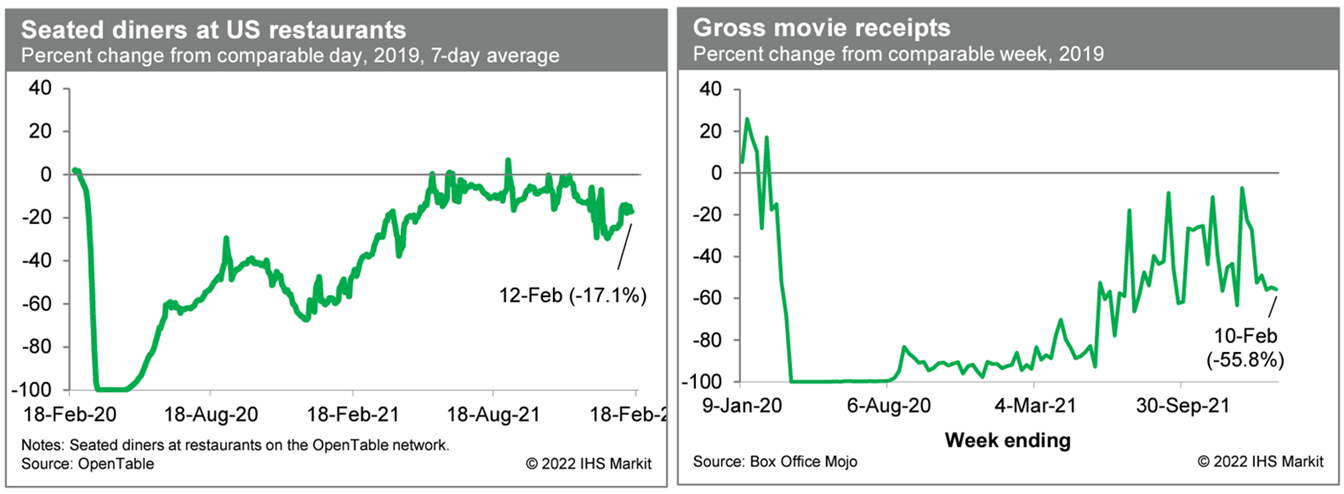

- Averaged over the last seven days, the count of seated diners on the OpenTable platform was 17.1% below the comparable period in 2019. This is below averages from late last year but up from lows in January, when the spread of the Omicron variant was at its peak. Meanwhile, movie-theater revenues last week were 55.8% below the comparable week in 2019, according to Box Office Mojo, indicating ongoing struggles in the movie-theater industry. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The US National Football League's annual championship game, the Super Bowl, is consistently one of the most-watched single television programs in the world. With advertising time during broadcasting of the game costing a reported USD6.5-7.0 million for 30 seconds in 2022, automakers are selective about their participation in this advertising and most frequently use the event in brand-building efforts or to support key new-product launches. However, in 2022, nearly all the auto industry's product-focused adverts highlighted electric vehicles (EVs). The automotive industry's participation in advertising during the Super Bowl game declined in 2021; in 2022, EV messages seemed to be behind the industry's increased participation in advertising during the Super Bowl. Although EVs accounted for only 3% of US registrations in 2021, according to IHS Markit data, this is the area where most automakers are focused on accelerating growth. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Toyota has announced planned investment in two plants in the United States to increase production of hybrid transaxles, involving USD73 million in its West Virginia facility and USD17 million in a Tennessee facility. The West Virginia investment will include increasing the facility's production capacity of hybrid transaxles to 600,000 units per year, as well as production of 120,000 rear motor stators per year. The Tennessee investment increases the facility's capacity to cast hybrid transaxle cases and housings to 1.3 million units per year. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Global orange production for 2021/22 is estimated up 1.4 million tons from the previous year to 48.8 million tons as favorable weather leads to larger crops in Brazil, Mexico, and Turkey, according to a recent USDA report (January 2022). These gains more than offset lower production in Egypt, the EU, and the US. Most of the higher production is expected to go into fruit for processing. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Brazil's production is forecast up 1.8 million tons to 16.5 million; favorable weather during flowering improved fruit set. Consumption is up slightly while fruit for processing is forecast up 16%, accounting for the majority of the increase in available supplies.

- China's production is projected up slightly to a record 7.6 million tons. The forecast is based on higher output in new navel planting areas in Jiangxi and higher yields in Hubei and Hunan provinces, offsetting decreases in southern Jiangxi province where citrus greening disease has affected crops for several years. Consumption and exports are forecast up with the higher production while imports are down.

- US production is forecast to drop 11% to a near record low 3.6 million tons due to poor fruit set in California and the continued decline in area and yields as a result of citrus greening in Florida. Consumption, exports, and fruit for processing are all lower with the drop in production, while imports are projected to be flat due to weak consumer demand.

- EU production is expected to decline 6% to 6.1 million tons due to unfavorable weather and a slight drop in area harvested. Fresh consumption, fruit for processing, and exports are down with the lower supplies. Imports are projected up with the drop in production.

- Egypt's production is forecast to drop by almost 16% to 3.0 million tons due to unfavorable weather during flowering which reduced fruit set. Consumption is forecast lower due to the reduced production. Exports are forecast down due to lower supplies, but a greater share of supply is expected to go towards exports (less to domestic consumption) given high global demand for the fruit.

- South Africa's production is forecast to increase 3% to 1.7 million tons (the highest level in eight years) due to favorable weather and a rise in area. Consumption and exports are up with the rise in production as well as strong demand. The EU is expected to remain the top market, accounting for over 40% of shipments

- Turkey's production is forecast to rise 40% to 1.8 million tons due to favorable weather and higher area and yields. Consumption and exports are up as a result of the increased supplies.

- Citing the presence of nanomaterials in infant formula made by four manufacturers, a formal petition that FDA regulate nanochemical additives in that product class was filed February 10, by nonprofits Center for Food Safety and International Center for Technology Assessment. The groups requested that the agency take immediate steps "to properly regulate nanoscale ingredients and prohibit all engineered nano ingredients in formula until they are demonstrated to be safe for infants." (IHS Markit Food and Agricultural Policy's William Schulz)

- The petition cites a 2017 study by Paul Westerhoff, a professor of environmental engineering at Arizona State University, who found nanomaterials in infant formula made by Gerber, Enfamil, Well Beginnings, and Similac. The nanomaterials found were hydroxyapatite, titanium dioxide, and silicon dioxide.

- A fact sheet on nanoparticles in infant formula was published by Friends of the Earth (FOE), which, along with the US Environmental Protection Agency and US National Science Foundation, supported the analytical studies cited in Westerhoff's paper.

- The fact sheet is derived from a lengthy report on nanoparticles in baby formula published by FOE.

- "We have known for at least a decade that there are health risks associated with nanomaterials. [FOE] is especially concerned about the nanohydroxyapatite in needle form found in the Gerber, Enfamil, and Well Beginnings formula," FOE said. "The European Union Scientific Committee on Consumer Safety (SCCS) found that needle nanohydroxyapatite is potentially toxic, could be absorbed by and enter cells and should not be used in cosmetics such as toothpaste, teeth whiteners and mouth washes. A material that should not be used in cosmetics raises greater concern when used in food."

- On their websites, none of the infant formula manufacturers lists nanoparticle ingredients in their products, including hydroxyapatite.

- Titanium dioxide is approved only as a food additive for whitening, but it is likely that the nano-titanium dioxide in infant formula is used as a brightener for its reflective properties and as an anticaking agent. Nano-silicon dioxide is likely being used as a flow agent in infant formula.

- US-based recycler Evergreen expects to increase its recycled polyethylene terephthalate (rPET) production rate by around 48% in June when it completes upgrades in its facility in Clyde, Ohio, the company said last week. Evergreen said the expansion adds four high-volume, food grade rPET manufacturing lines to its arsenal, boosting its production capacity from an existing 147 million pounds (66,678 mt/yr) to 217 million pounds (98,429 mt/yr) when complete in June 2022. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The company plans to increase plastics recycling rates, and to convert more companies to rPET from virgin PET resin, Evergreen said.

- Evergreen cited a report noting a 10% increase in end-use rPET demand in 2020, with the food and beverage category fastest growing, rising 36% from 2019 to 2020.

- According to Evergreen's partner and investor, trade organization American Beverage, America's beverage companies are designing bottles to be 100% recyclable, so they can be remade into new bottles, reducing the use of new plastic.

- Evergreen said it processes 11.6 billion post-consumer bottles annually, and is one of North America's Top 3 PET recyclers and producer of rPET.

- The company's production base mushroomed from one to four within a single year in 2021 - besides its original facility in Clyde, Ohio, it gained capacities in Albany, New York, Amherst in Canada's Nova Scotia, and Riverside, California.

- Its Evergreen Albany facility, formerly UltrePET, and Evergreen Amherst, formerly Novapet) were acquired from wTe Corp. in November 2021. Evergreen Riverside was acquired from CarbonLite in May 2021. As a result, Evergreen's annual rPET capacity ballooned by 367%, adding 107 million pounds (48,534 mt/yr), additional to the 40 million pounds (18,143 mt/yr) capacity before.

- Paraxylene (PX) is the main feedstock of purified terephthalic acid (PTA). PTA is, in turn, a key raw material for virgin PET. Both PTA and PX are unnecessary in the recycling and production of rPET.

- Head of the Superintendent of Panamanian Banks (Superintendencia de Bancos de Panama: SBP) Amauri Castillo during a press briefing on 9 February stated that borrowers who can prove that their income is still affected by the COVID-19 pandemic but have not approached their respective banks to restructure their debt "still have space for restructuring" despite the end of moratoria in the country in September 2021. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Panama's banking sector instituted one of the widest and longest moratoria in Latin America. The country's moratorium allowed consumption and mortgage borrowers to miss debt payments without any penalization. They were also allowed a penalty-free modification of loans until the end of 2020. This measure was extended to end-2021 (although borrowers had to approach their bank before the end of September 2021 to have access to it) after observing that the economy was still unable to fully recover.

- The SBP reported that the Panamanian sector had USD11.9 billion of modified loans (17.9% of the sector's total credit) as of November 2021, out of which USD2.7 billion were classified as "doubtful of being paid" or as "irrecoverable", representing 4.1% of the sector's outstanding loans.

- The SBP's latest move reinforces IHS Markit's assessment that asset quality is in much-deteriorated shape than what the non-performing loan (NPL) ratio of 1.9% as of November 2021 would suggest. Consequently, and combined with the fact that the economy will not full recover until 2023, we expect a rise in this indicator over the course of 2022. A potential rise by an additional 4.1 percentage points in the NPL ratio would require a significant increase in provisioning over the course of the year since banks have only enough provisions for an increase of an additional 1.4 percentage points.

Europe/Middle East/Africa

- All major European equity markets closed lower; UK -1.7%, Germany -2.0%, Italy -2.0%, France -2.3%, and Spain -2.6%.

- 10yr European govt bonds closed mixed; Germany -2bps, France -1bp, Italy/Spain +2bps, and UK +4bps.

- iTraxx-Europe closed +1bp/68bps and iTraxx-Xover +8bps/332bps.

- Brent crude closed +2.2%/$96.48 per barrel.

- Offshore Renewable Energy (ORE) Catapult has broken ground on its offshore wind robotics center and manufacturing cell for turbine blade research in Blyth, United Kingdom. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- The center will be the first of its kind in the United Kingdom committed to offshore wind, enabling robotic technology developers to access representative, onshore, and offshore test and demonstration environments. The center will increase robotic intervention in the safety, cost reduction, and efficiency of offshore wind farm operations by forming key research and development infrastructure.

- The manufacturing cell will reinforce research into new offshore wind turbine blade technology, materials and manufacturing techniques, including the rapid production of prototype blade enhancements such as vortex generators and edge erosion protection systems.

- In 2020, ORE Catapult invested in a prototype blade manufacturing facility at its National Renewable Energy Centre, focused on reducing blade production costs and increasing production speeds.

- Stellantis is reportedly near a deal with the Italian government that would clear the way for a battery plant in the country. Automotive News Europe quotes Italy's Industry Minister Giancarlo Giorgetti as saying, "We are very close to signing the agreement for the gigafactory in Termoli where Stellantis will make batteries. It's a matter of a few days." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Danish wind turbine manufacturer Vestas has installed the mold for 115.5-metre turbine blades at the blades factory in Nakskov, Denmark. The 115.5m turbine blades will be installed on the V236-15MW prototype offshore wind turbine late 2022. The prototype turbine is then expected to be installed at the Østerild National test center for large wind turbines in Western Jutland, Denmark. The prototype turbine is said to be the tallest and most powerful wind turbine in the world once installed. The model has since been pre-selected by EnBW for the 900MW He Dreiht project off Germany, and Equinor and BP for the 2.1GW Empire Wind 1 and 2 projects off United States. (IHS Markit Upstream Costs and Technology's Chloe Lee)

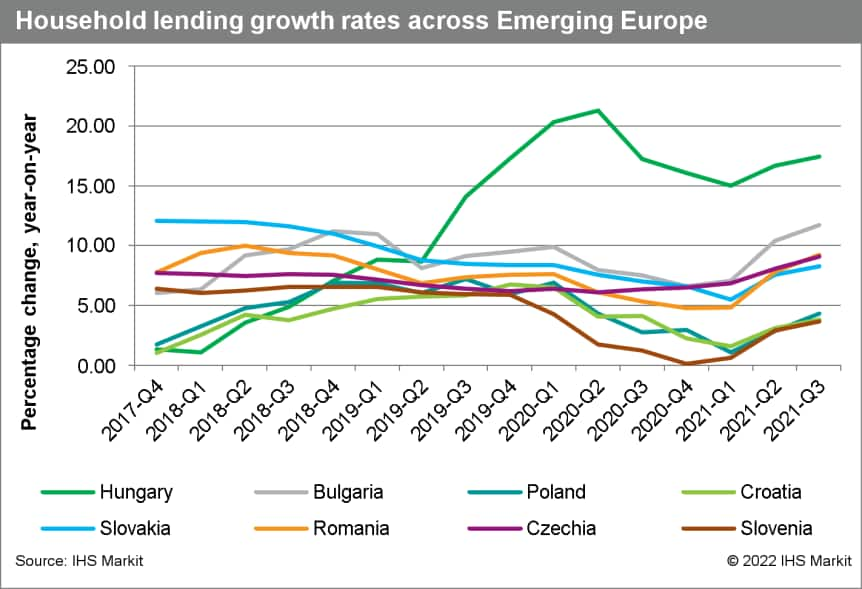

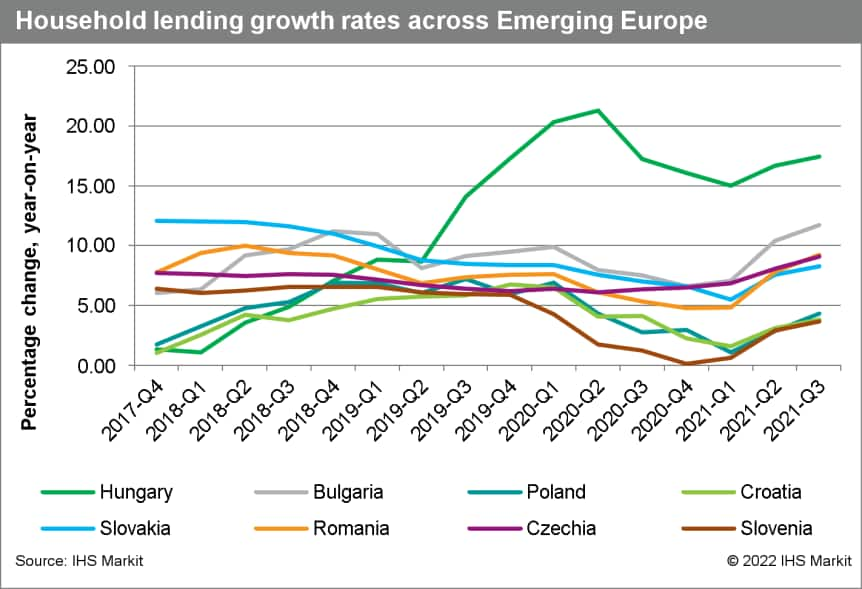

- The European Systemic Risk Board (ESRB) published five warnings and two recommendations on medium-term residential real estate (RRE) vulnerabilities on 11 February. The ESRB has a mandate to issue warnings when significant systemic risks are identified and to make recommendations for remedial action. Warnings were issued to Bulgaria, Croatia, Hungary, Liechtenstein, and Slovakia for failing to sufficiently address newly identified RRE-related vulnerabilities. Moreover, recommendations were sent to competent authorities in Germany and Austria, as both countries were previously identified as having vulnerabilities, which "have not been addressed sufficiently". The ESRB has confirmed that authorities in Germany and Austria have since announced measures to address the vulnerabilities in the RRE sector. (IHS Markit Banking Risk's Natasha McSwiggan and Pedram Moezzi)

- In Bulgaria, the key vulnerabilities identified are elevated house price growth, signs of house price overvaluation, and high mortgage credit growth. Although household indebtedness is relatively low as reflected by a household debt-to-GDP ratio of 24% in 2020, 98% of loans are at variable rates, exposing households to potential interest rate changes.

- Croatia displayed the same vulnerabilities as Bulgaria, plus the additional signs of loosening credit standards. The latter is confirmed by results of the Croatian National Bank (CNB)'s fourth-quarter 2021 lending survey. However, the ESRB has noted that "the quality of the data on lending standards should be ensured as promptly as possible".

- Hungary has similar vulnerabilities with a focus on house price and mortgage credit growth. The housing market in Hungary is characterized as suffering from a supply shortage, further fueling the growth in house prices. A combination of measures has been utilized by the authorities, such as preferential value-added tax for new constructions and "partially sufficient" macroprudential measures to dampen housing demand and price growth. Real estate and construction-purpose credit growth was the fastest growing sector, at 19.5% y/y in the third quarter of 2021.

- Slovakia's vulnerabilities are confined to house price growth, house price overvaluation, and mortgage credit growth. However, it has both the highest and second-highest growth rates for mortgage credit growth and house price growth in the EU, respectively. Credit growth in the household sector reached 8.3% y/y in the third quarter of 2021, compared with 5.9% y/y for total banking-sector loans, in the same period.

- Although Turkey's current-account deficit narrowed and the country attracted net inflows of portfolio investment for 2021 as a whole, the situation was rapidly deteriorating over the final quarter of the year. In 2022, the current-account deficit will not continue narrowing as sharply as it did last year, as high global commodities keep import growth high. Turkey will struggle to keep portfolio investment inward on a net basis if it resumes cutting interest rates as the rest of the world tightens monetary policy. (IHS Markit Economist Andrew Birch)

- Turkey posted a current-account deficit of USD14.9 billion in 2021 according to data from the Central Bank of the Republic of Turkey (TCMB). As a share of estimated GDP for the year, the gap equaled 1.9%. The deficit narrowed sharply from USD35.5 billion and 5.0% of GDP in 2020.

- In 2021, a strong recovery of tourism service exports facilitated the narrowing of the headline current-account deficit, though total export earnings remained far below pre-pandemic levels. Additionally, the merchandise-trade deficit fell by over USD8.7 billion from 2020 to 2021, with the weaker lira contributing to a one-third increase in merchandise exports.

- Although the full-year deficit narrowed sharply, the monthly shortfalls were significant in November and December, averaging over USD3.3 billion per month. High commodity prices and the weaker lira drove up imports in the final months of the year, triggering the dramatic re-worsening of the current-account deficit as 2021 came to a close.

- For 2021 as a whole, Turkey attracted net portfolio investment inflows totaling USD761 million, a turnaround against 2020 when the country saw net outflows top USD9.5 billion. However, portfolio investment was rushing outward over the final quarter of the year. Through September, net inflows had reached USD6.4 billion. Following the rate cuts that began that month, total net outflows of portfolio investment reached nearly USD5.7 billion in the final quarter.

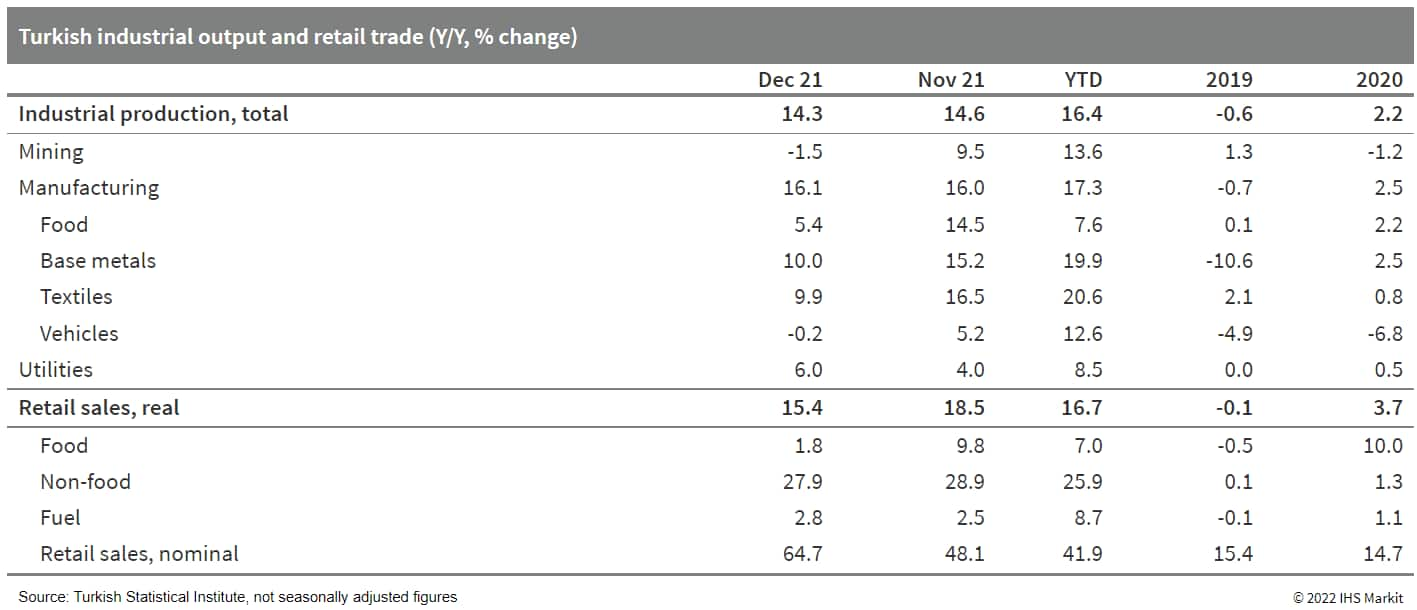

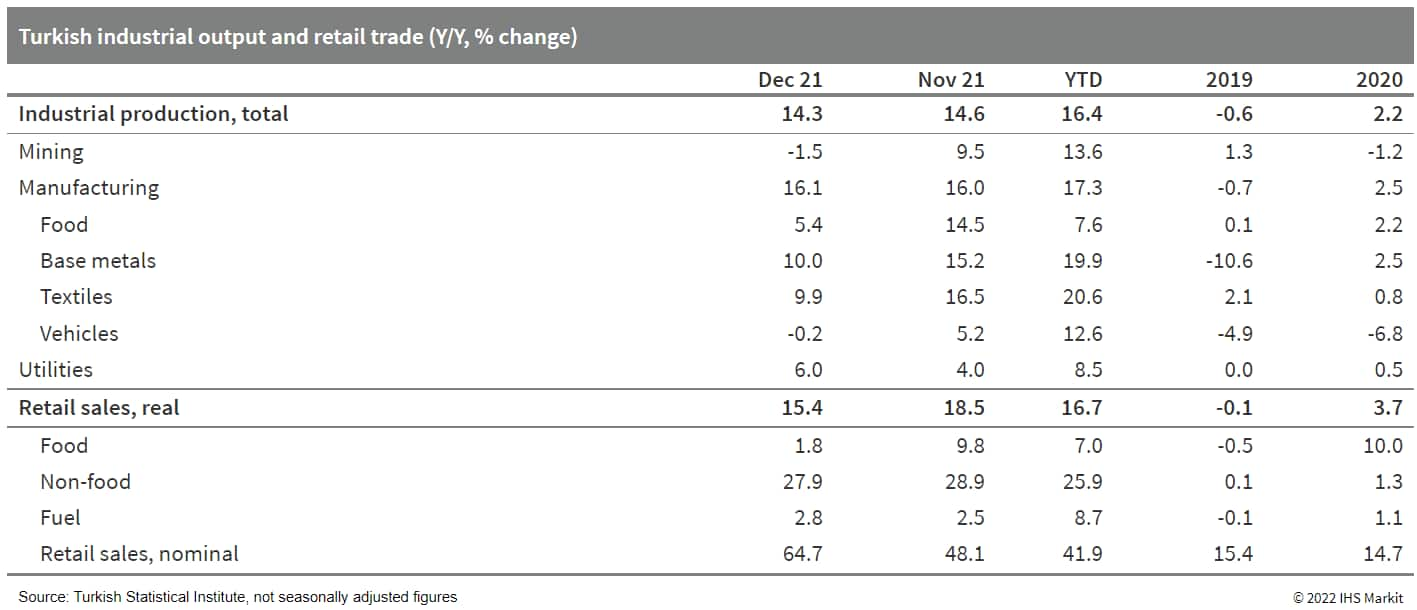

- In 2021 as a whole, Turkish industrial production increased by 16.4% according to data from the Turkish Statistical Institute (TurkStat). Driven by rising external demand and easy credit to finance increased production, growth was particularly strong following two years of sluggish gains. (IHS Markit Economist Andrew Birch)

- Despite waning export demand and growing supply problems, industrial activity continued to expand throughout the final quarter of the year. In each of the months October, November and December, monthly production continued to grow in seasonally and calendar adjusted terms according to data from TurkStat, rising by 1.6% month on month (m/m) in the final month of the year.

- Both for the year as a whole and over the final quarter, the production of capital goods - including base metals - grew particularly fast, pacing overall industrial output. Meanwhile, the once vibrant automotive sector posted below-average performance both for 2021 as a whole and during the final months of the year.

- TurkStat also reported a downturn of retail trade activity in December. In seasonally and calendar adjusted terms, total retail trade in volume terms dipped by 2.7% m/m in December, a sharp turnaround from the preceding six months. Surging inflation severely undermined purchasing power.

- The Dubai Road Transport Authority (RTA) will begin trials of digital maps required for deploying autonomous vehicles (AVs) developed by Cruise Automation by the end of 2022. RTA had a discussion with a delegation from Cruise on the latest developments relating to the agreement signed between the two entities for operating Cruise AVs in providing taxi and e-hailing services. A limited number of Cruise AVs will be deployed in 2023, with plans to progressively raise the number of deployed vehicles to 4,000 by 2030. Mattar Al Tayer, director-general and chairman of the board of executive directors of RTA, said, "The operation of autonomous vehicles contributes to the integration of transport systems by easing the mobility of public transport riders and helping them reach their final destinations. It fits well with RTA's first and last-mile strategy approved last year relating to the first and last sectors of journeys from and to the nearest public transport points. It consists of two sections: groups and individuals", reports Gulf News. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Infinity-E has announced the beginning of negotiations with the Egyptian Ministry of Public Enterprise Sector and sovereign authorities to establish an electric vehicle (EV) charging station company, reports Daily News Egypt. Shams Al-Din Abdel Ghaffar, managing director of the EV sector at Infinity-E, said, "It is scheduled to establish 6,000 EV charging stations within a year at a cost of up to EGP 450m after the company's establishment." Infinity-E aims to establish 120 EV charging stations nationwide by the end of December 2023 at a cost of EGP85 million (USD5.4 million). The company's total investments to establish electric car charging stations is EGP300 million since its establishment. Infinity E, established in 2018, is a subsidiary of Infinity, a company that is engaged in the renewable energy sector in Egypt. (IHS Markit AutoIntelligence's Tarun Thakur)

- South African President Cyril Ramaphosa delivered the State of the Nation Address (SONA) on 10 February, during which he announced the extension of the Social Relief of Distress (SRD) Grant by a year, to the end of March 2023. The SRD is a ZAR350 (USD23) grant introduced by the government in March 2020 to help mitigate the economic impact of COVID-19 pandemic-related restrictions on the poor. The SONA outlines the government's policy priorities for the year and it is to be followed by the announcement of the budget on 23 February. (IHS Markit Country Risk's Langelihle Malimela)

- Higher spending on social services is likely in the upcoming budget, as President Ramaphosa prepares for a leadership contest in the ruling party. The extension of the SRD Grant was expected by IHS Markit, particularly given that the ruling African National Congress (ANC) party holds its five-yearly elective conference in December 2022, at which Ramaphosa will seek a second term as party president. If Ramaphosa is re-elected party president, he will become the ANC's presidential candidate for the 2024 national election. In addition to the SRD, Finance Minister Enoch Godongwana is likely to announce in his budget speech significant increases to other existing grants, including for child support, disability, and older persons.

- Implementation of legislation allowing for greater competitiveness in power generation is likely to be delayed. Ramaphosa also announced that the cabinet had approved amendments to the Electricity Regulation Act, meant to facilitate the establishment of a stand-alone electricity transmission entity within the state-owned power utility Eskom. This is intended to lessen Eskom's reliance on its own power-generation capacity, which is drawn from a very faulty and ageing fleet of coal-fired power stations. The revisions to the Act are to enable the utility to source generating capacity from more-efficient and -reliable sources, including independent power producers.

- Revised oversight measures for state-owned enterprises (SOEs) are unlikely to reduce political interference. The establishment of a new holding company within government, which will house SOEs, is unlikely to achieve the government's stated goal of lessening political interference and corruption within these companies, in our assessment.

Asia-Pacific

- Most major APAC equity markets closed lower except for Australia +0.4%; Mainland China -1.0%, Hong Kong -1.4%, South Korea -1.6%, Japan -2.2%, and India -3.0%.

- Chinese electric vehicle (EV) startup Xpeng has opened its first self-operated store outside China on 11 February. The store, referred by the EV maker as an "experience center", is in Stockholm (Sweden). Xpeng has also entered into partnerships with Bilia, an automotive distributor in Sweden, sand auto retailer Emil Frey in Netherlands to sell its EVs. Xpeng said it plans to open its own store in the Netherlands in March 2022. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Volvo Trucks plans to launch a large-size electrified truck in South Korea in 2023, in a bid to strengthen its position in the country's imported truck market, reports the Yonhap News Agency. "The domestic large truck market is expected to recover to 10,000 units this year, and demand for trucks will improve going forward," said Volvo Trucks Korea president Park Gang-serk. The truck maker sold 2,000 trucks in South Korea last year, accounting for 40% of the imported truck market. It aims to raise the ratio to 50% in 2025. Volvo Trucks entered the South Korean market in 1996, and its total sales in the country are expected to exceed 30,000 units during the first half of this year. It aims to achieve 40,000 in cumulative sales, or a market share of 50%, by 2025, highlights the report. Volvo Trucks's electric vehicle (EV) plans for South Korea are also in line with growing demand for alternative-powertrain vehicles in the country, thanks to positive demand for new models, as well as favorable policies and infrastructure initiatives by the government. (IHS Markit AutoIntelligence's Jamal Amir)

- HHI reported a deeper loss in 2021 owing to provision for wage litigation, higher labor cost as well as higher cost due to inflation. Consolidated net loss for 2021 stood at USD952 million (KRW1.1 trillion), compared to USD693 million (KRW835.2 billion) in 2020. Consolidated net loss for the fourth quarter improved 27% year-on-year (y/y) to USD563 million (KRW675.3 billion) because of corporate tax gain from sale of Brazil subsidiary. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Consolidated operating loss for 2021 stood at USD1.2 billion (KRW1.4 trillion), down from operating profit of USD62 million (KRW74.4 billion) a year earlier. Fourth quarter 2021 consolidated loss widened further from USD151 million (KRW180.9 billion) in 2020 to USD581 million (KRW696.7 billion) as a result of rising costs.

- Consolidated revenue for 2021 rose 4% y/y to USD12.9 billion (KRW15.5 trillion) on the back of higher workload in the shipbuilding division. Fourth quarter consolidated revenue rose 25% y/y to USD3,7 billion (KRW4.5 trillion).

- The Offshore & Engineering segment saw its revenue for 2021 and fourth quarter 2021 halved from 2020 to USD218 million (KRW261.2 billion) and USD65 million (KRW78.5 billion) respectively. This segment's operating loss almost doubled y/y to USD62 million (KRW74.5 billion) for 2021 while it swung to an operating loss of USD12 million (KRW14.2 billion) in the fourth quarter of 2021 from an operating profit of USD16 million (KRW19.2 billion) a year earlier.

- The Shipbuilding segment posted higher revenue for 2021 and fourth quarter 2021 compared to the same period in 2020, with USD11.0 billion (KRW13.2 trillion) USD3.2 billion (KRW3.8 trillion) respectively. Despite higher revenue, this segment swung to operating loss for both periods. Operating loss of USD601 million (KRW720.6 billion) and USD171 million (KRW204.7 billion) were reported for 2021 and fourth quarter 2021 respectively.

- HHI standalone revenue for 2021 stood at USD6.9 billion (KRW8.3 trillion), similar as last year. Fourth quarter 2021 standalone revenue rose 24% y/y to USD2.0 billion (KRW2.5 trillion). HHI standalone net loss for 2021 and fourth quarter 2021 fell deeper to USD679 million (KRW814.2 billion) and USD434 million (KRW520.1 billion) respectively.

- HHI (excluding subsidiaries) secured a total of 77 newbuild orders worth USD14.7 billion in 2021, overachieving its annual target of USD8.9 billion. New orders comprised of three offshore projects (FPSO P-78, Shwe Phase III fixed platform and Shenandoah semi), 27 container ships, 18 LNG carriers, 15 LPG carriers, 6 tankers and 8 special ships.

- Thailand's Finance Ministry plans to propose to the cabinet a reduction of import duty for electric vehicles (EVs) to 40%, 20%, and 0%, depending upon the engine size, reports the Bangkok Post, citing Thailand's Deputy Finance Minister Santi Promphat. Smaller EVs should be subject to lower import tax rates than larger ones as part of the ministry's plan to promote their adoption, he added. The government has also evaluated an adequate incentive to support customers' EV purchases. Furthermore, if EV manufacturers establish manufacturing bases in Thailand, they will be eligible for all government incentives. To qualify for the incentives, they must produce 1.5 vehicles in Thailand for every vehicle imported under the government's support programs. They must also establish local plants within two to three years of getting the incentives. Currently, Thailand's EV import tax rates vary. EVs imported from China enjoy a 0% tax rate under a bilateral agreement between the country and Thailand. Those imported from South Korea are hit with a 40% import tax, while EVs from Europe face an 80% rate, highlights the report. The Thai government aims to boost the alternative-powertrain vehicle sector, one of the country's target industries. The government began promoting the alternative-powertrain vehicle industry in 2017 by launching incentives for automakers, component suppliers, and other companies. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 14 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.