Most major US equity indices closed higher, while APAC and European markets closed mixed. US and benchmark European government bonds closed sharply higher. CDX-NA closed modestly tighter across IG and high yield, iTraxx-Xover was also tighter, and iTraxx-Europe closed flat. Copper, silver, gold, and natural gas closed higher, while the US dollar and oil were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most US equity indices closed higher except for DJIA flat; Nasdaq +0.7% and Russell 2000/S&P 500 +0.3%.

- 10yr US govt bonds closed -3bps/1.54% yield and 30yr bonds -7bps/2.03% yield, with rates increasing sharply to +3bps for both during the minutes following the CPI report before rallying for the remainder of the day.

- CDX-NAIG closed -1bp/54bps and CDX-NAHY -4bps/311bps.

- DXY US dollar index closed -0.5%/94.08, surging +0.2% shortly after the CPI report to peak at 94.50 and then selling off for the remainder of the day.

- Gold closed +2.0%/$1,795 per troy oz, silver +2.9%/$23.17 per troy oz, and copper +4.4%/$4.52 per pound.

- Crude oil closed -0.2%/$80.44 per barrel and natural gas closed +1.5%/$5.59 per mmbtu.

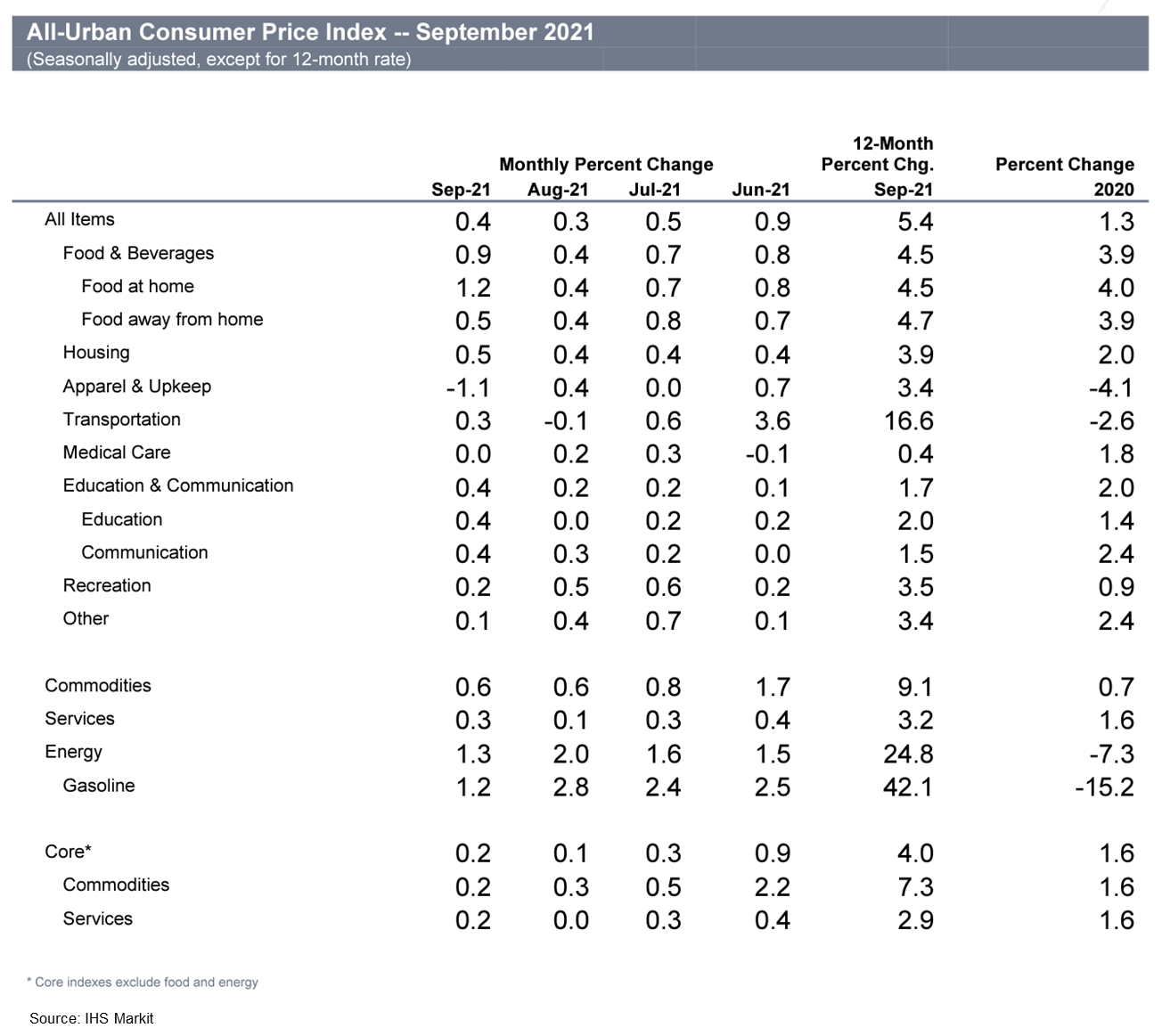

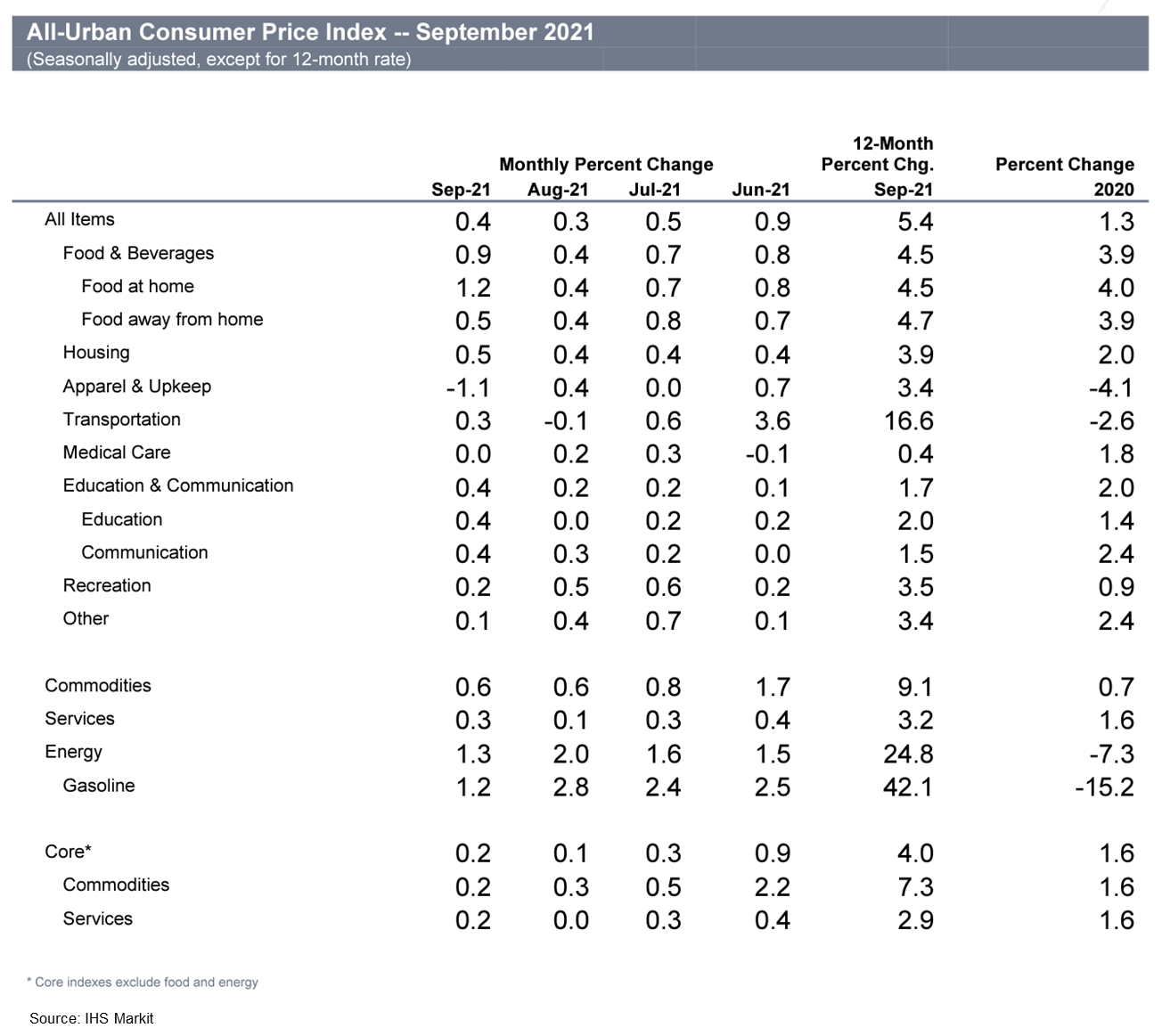

- The US Consumer Price Index (CPI) rose 0.4% in September following a 0.3% increase in August. The core CPI, which excludes the direct effects of moves in food and energy prices, rose 0.2% in September after a 0.1% increase in August. The headline CPI was boosted by price increases for food (0.9%) and energy (1.3%). (IHS Markit Economists Ken Matheny and Juan Turcios)

- During September, large price swings occurred in several components, both negative and positive. Notable declines occurred for used vehicles (0.7%), apparel (1.1%), and several travel-related components including airline fares (6.4%), lodging away from home (0.6%), and car and truck rental (2.9%). The price of used vehicles declined for the second consecutive month but was 42.3% above June 2020.

- The price of new vehicles rose 1.3% in September and is up 8.6% over the six months, as severe supply-chain bottlenecks have resulted in extraordinarily lean inventories and have encouraged dealers to raise prices.

- Rent inflation rose sharply in September, a potential harbinger of large increases in coming months as the surge in house prices translates into higher rents. Owners' equivalent rent (OER) rose 0.4% on the month, the largest increase in five years. Rent of primary residence (RPR) rose 0.5%, the largest increase in two decades. Annual (12-month) rent inflation readings were low in historical context in September, at 2.9% for OER and 2.4% for RPR, but are likely to rise notably in coming months.

- The 12-month change in the overall CPI edged up to 5.4% while the 12-month change in the core CPI remained at 4.0%. IHS Markit experts anticipate that 12-month inflation readings will moderate over the course of 2022 as base effects recede and supply-chain issues are addressed.

- The minutes of the last meeting of the Federal Open Market Committee (FOMC), held on 21 and 22 September, were released today. Policymakers discussed upcoming changes to the Fed's program of securities purchases, progress toward its maximum employment and price stability goals, and risks to the outlook. The pace of recovery in labor markets had slowed at the time of the FOMC meeting, while, for some participants, concerns had intensified that inflation could remain elevated for an extended period and cause longer-run inflation expectations to rise above the Fed's inflation target. Policymakers made no formal decision about when to begin reducing the pace of the Fed's securities purchases, but they did signal that a change was likely soon. The discussion revealed in the minutes was consistent with our expectation that the Fed will begin tapering asset purchases soon according to a plan to end such purchases around the middle of next year. Policymakers' concern about upside risks to inflation and inflation expectations reinforced our expectation that the first increase in the target for the federal funds rate could occur in early 2023. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Global solar module prices will take another two years before they stabilize following the current supply chain tightness, which in the near term will delay construction and installations, analysts told the recent Solar and Storage Finance Summit. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- "We expect to see [solar] module prices return to the normal price decline in the next year or so," Ravi Manghani, managing director of Denver, Colorado-based Clean Energy Associates, said during a 6 October presentation at the summit, which UK-based Solar Media Tech hosted. But, Manghani said, it will take until the end of 2024 for solar module prices to reach 23-24.5 cents/watt prices, "which is where we effectively would have been prior to the upswing in commodity and logistics prices."

- The global weighted-average levelized cost of electricity (LCOE) of utility-scale, solar photovoltaic (PV) plants declined by 85% between 2010 and 2020, from $0.381/kWh to $0.057/kWh in 2020, owing to "improving technologies, economies of scale, competitive supply chains, and improving developer experience," the International Energy Agency said in a June 2021 report.

- At the start of 2020, solar module prices were in the mid-to-low 30 cents/watt and currently they are in the mid-to-high 30 cents/watt, Manghani said.

- On October 13, FERC approved August 19 applications from SE Athos I LLC and SE Athos II LLC for market-based rate authority for solar projects in California (Dockets ER21-2713 and ER21-2714). These are project affiliates of SoftBank Group Corp. (IHS Markit PointLogic's Barry Cassell)

- The 250-MW (nameplate) Athos I Facility, a solar photovoltaic project, would be located in Riverside County, California, within the California ISO market. Athos I includes a tenants-in-common interest in an approximately nine-mile, 230-kV generator-tie line to be jointly owned with Athos II. The tie line is expected to be energized later this year, and Athos I is expected to achieve commercial operation in 2022.

- Athos II is developing, and will own and operate, an approximately 200-MW (nameplate) photovoltaic facility in Riverside County. The Athos II Facility has been expected to achieve commercial operation later this year.

- The New York Power Authority (NYPA) and New York Transco announced October 12 that they are collaborating on proposed solutions to improve transmission capacity that will inject more renewable energy from future offshore wind facilities into the statewide energy grid. (IHS Markit PointLogic's Barry Cassell)

- Their proposed "Propel NY Energy" solution will efficiently deliver clean energy to customers, including those living and working on Long Island and in New York City and Westchester County. Propel NY Energy proposals for new transmission solutions were submitted to the New York ISO on October 11 in response to the NYISO's Long Island Offshore Wind Export Public Policy Transmission Need Project Solicitation.

- Propel NY Energy represents the first collaborative transmission solution proposals between the New York Power Authority and New York Transco. NYPA is the largest state public power organization in the nation, operating 16 generating facilities and more than 1,400 circuit-miles of transmission lines. New York Transco is a New York-based owner, operator and developer of bulk electric transmission facilities.

- New York-based Plug Power announced separate renewable power-sourced, green hydrogen deals with French aircraft manufacturer Airbus and Houston-based Phillips 66 aimed at helping to decarbonize the aviation and industrial sectors, respectively. In partnership with Airbus, Plug Power will study how green hydrogen can be used to decarbonize air travel and related operations. Alongside Phillips 66, the company will "explore ways to deploy Plug Power's technology within Phillips 66's operations, leveraging Plug Power's experience as a full value chain provider within the hydrogen economy." Green hydrogen has the potential to decarbonize the most energy-intensive sectors of the economy. As countries emerge from the pandemic and attempt to kickstart their economies, companies like Plug Power offer industries a low-carbon alternative to fossil fuels. Plug Power provides a range of solutions, from developing fuel cells to producing green hydrogen and blue hydrogen, which is produced from oil and gas facilities equipped with carbon capture. Less than a month ago, Plug Power announced plans to build a 30 metric ton (mt) a day electrolyzer plant in California that will be powered by a new 300-MW solar farm. In previous announcements, the company said it intends to build plants in New York, Tennessee, and Georgia. Combined, the facilities will have a total production capacity of 500 mt/day by 2025. Industrial uses will be the biggest driver of growth, as hydrogen offers an option for reducing the carbon footprint of energy-intensive processes such as making steel and cement. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- According to the 2019 Health Care Cost and Utilization Report published by the non-profit Health Care Cost Institute (HCCI), healthcare spending for individuals under the age of 65 who receive employer-based health insurance coverage increased by 2.9% in 2019 to reach USD6,001. This contributed to a cumulative increase in healthcare spending of 21.8% between 2015 and 2019, which corresponds to USD1,074 per person. The increase was driven partly by greater utilisation and partly by increased prices, with the latter having risen every year since 2015. In 2019, average prices grew by 3.6%, which meant that average prices in 2019 were 18.3% higher than in 2015. The figures include the amount paid for medical and pharmacy claims, but do not include manufacturer rebates for prescription drugs. The HCCI report, which is available here, examined trends within four categories of service: inpatient admissions, outpatient visits and procedures, professional services, and prescription drugs. Of the total USD6,001 spend in 2019, 31.4% was accounted for by professional services, 27.8% by outpatient visits and procedures, 21.6% by prescription drugs, and 19.3% by inpatient admissions. (IHS Markit Life Sciences' Milena Izmirlieva)

- General Motors (GM) and LG Electronics have announced an agreement regarding the costs of the recall of all the Chevrolet Bolt and Bolt electric utility vehicle (EUV) electric vehicles (EVs) produced; LG Electronics will pay USD1.9 billion of the USD2.0 billion price tag, according to a GM statement. The brief statement notes that GM will recognize an estimated recovery in third-quarter earnings of USD1.9 billion as a result. Shilpan Amin, GM VP of global purchasing and supply chain, was quoted as saying, "LG is a valued and respected supplier to GM, and we are pleased to reach this agreement. Our engineering and manufacturing teams continue to collaborate to accelerate production of new battery modules and we expect to begin repairing customer vehicles this month." Automotive News reported that LG Chem and LG Electronics have agreed to share a combined USD1.2 billion for the recall. The LG Group companies noted that talks over the issue had ended, and that some were booked in the July-September quarter and some earlier. LG Chem owns the LG Energy Solutions unit, which provides the batteries; LG Electronics assembles the cells into battery modules and packs. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Fisker CEO and chairman Henrik Fisker has been quoted as saying that Fisker would like its upcoming electric vehicle (EV) program to be produced by Foxconn at the current Lordstown Motors plant, presuming a Foxconn-Lordstown deal materializes. In early October, Foxconn and Lordstown Motors announced a deal for Foxconn to purchase Lordstown's plant, located in Lordstown, Ohio. According to Motor Authority, soon after the CEO was quoted as saying, "If Foxconn ends up acquiring [the Lordstown plant] and if the deal closes, it's our intent to make the Pear with Foxconn in Lordstown." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lucid claims that its Air sedan will be the first production vehicle in the United States with purpose-built LiDAR sensors, as the company announced its DreamDrive and DreamDrive Pro set of advanced driver assistance systems (ADAS). The DreamDrive Pro system, with cameras, radars, and LiDAR, will enable autonomous parking capability, assist with freeway driving, and assist with moving at low speed in traffic. It uses up to 32 on-board sensors, a driver-monitor system (this is not an eyes-free, autonomous system), and on-board ethernet networking for "lightning-quick" communication. The autonomous parking feature will identify parallel or perpendicular parking spots, select gears, and drive forward and reverse to enter or exit a parking spot or position the vehicle in a spot. The sensor kit specifically includes 14 visible-light cameras, five radar units, four surround view cameras, ultrasonic sensors, and "the first automotive installation of LIDAR in North America". Lucid said that the suite enables the system to detect objects a human driver cannot. (IHS Markit AutoIntelligence's Stephanie Brinley)

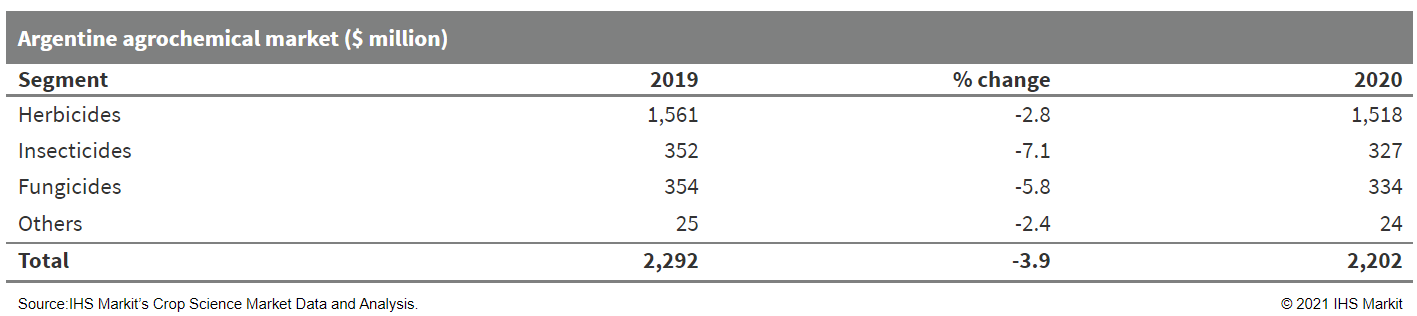

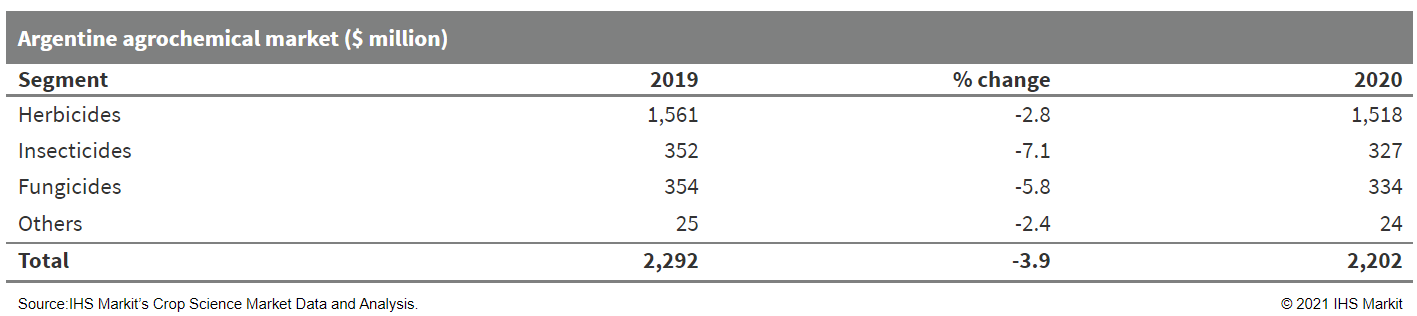

- The Argentine crop protection market fell by 3.9% to $2,202 million in 2020, according to data from stablemate publication Crop Science Market Data and Analysis. Sales in all segments were down on the previous year. The major segment, herbicides, which is dominated historically by glyphosate, declined by 2.8% to $1,518 million. Sales of fungicides saw the largest fall, dropping 7.1% to $327 million, while that of insecticides slid 5.8% to $334 million. (IHS Markit Crop Science's Robert Birkett)

Europe/Middle East/Africa

- Major European equity indices closed mixed; France +0.8%, Germany +0.7%, UK +0.2%, Italy -0.1%, and Spain -0.6%.

- 10yr European govt bonds closed higher; UK -6bps, Germany/Spain -4bps, France -3bps, and Italy -2bps.

- iTraxx-Europe closed flat/53bps and iTraxx-Xover -3bps/269bps.

- The Office for National Statistics (ONS) reports that the UK economy grew by 0.4% month on month (m/m) in August after a downwardly revised drop of 0.1% m/m in July. The figure for August was below the market consensus, which had predicted a 0.5% m/m gain during the month. (IHS Markit Economist Raj Badiani)

- Moreover, this was after real GDP rose by 5.5% quarter on quarter (q/q) in the second quarter of 2021, revised up from an initially published 4.8% q/q increase.

- The level of real GDP in August was 0.8% below the level before the first COVID-19-related lockdown in February 2020.

- Furthermore, the ONS reports that real GDP grew by 2.9% in the three months to August when compared with the previous three months (March to May). This partly reflects the reopening of accommodation and food service activities and an increase in school attendance.

- The largest contributor was the continued recovery in consumer-facing services, which grew by 1.2% m/m in August but remained 4.7% below its pre-pandemic. Accommodation and food service activities and arts, entertainment, and recreation performed well during August, rising by 9.0% m/m. Importantly, festivals, bars, and restaurants in England enjoyed a whole month without COVID-19-related restrictions.

- Production output increased by 0.8% m/m in August, mainly because of the continued increase in the extraction of crude petroleum and natural gas after the recent temporary closure of oilfield production sites for planned maintenance. The reopening of oilfields triggered a gain of 16.0% m/m in mining and quarrying output in August, after a 17.7% m/m increase in July.

- The extraction of crude petroleum and natural gas is back at levels last seen in December 2020, but it remains low by historical standards, with output still 16.3% below its August 2019 level.

- Meanwhile, the manufacturing sector grew by 0.5% m/m during August, following a downwardly revised 0.6% m/m fall in July. The ONS reports rising output in 9 of the 13 manufacturing sub-sectors during August, with the best-performing sector being the manufacture of motor vehicles after global microchip shortages disrupted production in June.

- UK consumers will have to deal with an increase in food prices, Kraft Heinz chief executive Miguel Patricio said during an interview with BBC. Patricio explained that increase in raw material prices, measures to control the COVID-19 virus, labor shortage and higher transport costs, have all contributed to increase production costs for a large range of products. Higher wages and energy prices have also added to the burden for manufacturers. The food giant has already increased prices on more than half of its products in the US and more markets will follow. Prices of tomato paste rose by 30% y/y in the US with the 31% hot break (HB) in 300 gallons bin quoted today at $1,058/ton ex-works and the 31% HB in 55 gallons drum is 24% costlier at $1,102/ton. The tomato crop is well below initial processing intentions due to the drought in California, while stocks are at a record-low. The Chinese triple concentrate is stable at $830/ton fob for the moment. Due to high transport costs and delays in shipping produce, China is the only large tomato producer which had some stocks left before the start of the current season. Chinese processors expect to see their stocks reduced before November when the shipping of the 2021 crop should start. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Eurozone industrial production fell by 1.6% month on month (m/m) in August, the biggest fall since April 2020. The decline matched the market consensus expectation (according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- However, July's initially reported rise of 1.5% m/m has been revised down marginally to 1.4%, while manufacturing production in August contracted by an even larger 2.0% m/m. The first increase in energy production for four months (+0.5% m/m) accounted for the difference.

- As the eurozone industrial production data can be very volatile from month to month, IHS Markit also tracks the three-month-on-three-month rate of change. This has flatlined since April and was barely positive (just 0.1%) in August.

- Net of the various updates and revisions, as of August eurozone industrial production was 1.3% below February 2020's pre-pandemic level.

- Eurozone retail sales volumes, meanwhile, rose by a negligible 0.3% m/m in August, well below the initial market consensus expectation (of +0.8% m/m, according to Reuters' survey). July's already large 2.3% m/m decline in sales has also been revised down to a 2.6% m/m drop.

- The pandemic has reduced the availability of some sub-categories in the retail sales data. Still, in brief, there was a strong divergence of sales of food, beverages, and tobacco (-1.7% m/m) and other sales (+1.8% m/m) in August.

- There was a strong rebound in mail-order and internet sales (9.0% m/m) following successive sharp declines in June and July. Relative to their pre-pandemic level, mail-order and internet sales were up by 33% in August.

- Final September data based on national methodology from Germany's Federal Statistical Office (FSO) have confirmed the flash data release of 30 September, posting 0.0% month on month (m/m) and 4.1% y/y. This 28-year high contrasts starkly with average inflation of 1.4% in 2019 and 0.5% in 2020. (IHS Markit Economist Timo Klein)

- The European Union (EU)-harmonised CPI measure even increased 0.3% m/m in September, raising its - recently lagging - annual rate from 3.4% to equally 4.1% y/y. This exceeds the eurozone average of 3.4% in August. January's reweighting of (only) the harmonized rate to the changed consumer spending patterns in 2020, favoring those categories that showed the largest price increases in 2020, had led to a higher harmonized than national inflation rate during January-April, and a lower one during May-August, but they should now stay broadly similar for the remainder of 2021.

- The national measure of core CPI (ex-food and energy) has edged up further from 2.8% to 2.9% y/y in September, more than twice as high as the 1.4% average during January-April and even further above the December 2020 level of 0.4%. Although this partly owes to the temporarily lower VAT rate during July-December 2020, input price pressures from global supply chain bottlenecks, higher energy prices, and the loosening of pandemic-related restrictions since May have been contributing too.

- The French government has set a new target for the number of locally built electric and hybrid vehicles as part of its new industrial plan announced yesterday (12 October). Under the 'France 2030' plan laid out by President Emmanuel Macron, the country aims to invest EUR30 billion over five years to boost a range of sectors in the country. Of this, EUR4 billion will be spent on transport and mobility, and it has a target for output of 2 million electric and hybrid vehicles per annum being built at this point. (IHS Markit AutoIntelligence's Ian Fletcher)

- French President Emmanuel Macron has unveiled an EUR30-billion (USD35 billion) plan to "reindustrialize", reduce "overdependence" on certain raw material imports, support decarbonization and environmentally sustainable manufacturing, and generally boost the country's high-technology sectors, including pharmaceuticals. The proposed France 2030 strategy arrives six months ahead of a French presidential election campaign in which Macron is seeking a second term. However, the concept of France strengthening its manufacturing autonomy long predates the upcoming election. While the strategy clearly has political drivers, it should not be construed as merely a last-minute pitch to voters. The financial package proposed by Macron would result in EUR4 billion in capital investment and about EUR30 billion in budget spending over around five years. The first tranche of between EUR3 billion and EUR4 billion is envisaged to be allocated from January 2022. The details of the plan relating to the pharmaceutical and healthcare sectors remain vague, except for a headline commitment to develop and produce "at least 20 biomedicines [or biopharmaceuticals] against cancer, emerging diseases and chronic illnesses", as well as rare diseases, by 2030. The industrial impact of this plan on the pharmaceutical sector is potentially significant, particularly in terms of financing start-up biotechs, supporting the growth of domestic French manufacturers, and investing in research and development (R&D) centers. (IHS Markit Life Sciences' Eóin Ryan)

- In response to industry demand, LM Wind Power, a GE Renewable Energy business, is doubling its 107-meter wind turbine blade manufacturing capability at its Cherbourg factory in France through the launch of its second blade mold. GE will also be investing in further upgrades to the plant. The Cherbourg factory, which was opened in April 2018, will look to recruit 200 more employees, above its current 600 headcount. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Through the first eight months of 2021, Turkey's current-account deficit of USD13.992 billion was nearly USD12 billion smaller than it had been in the same period of 2020, according to data from the Central Bank of the Republic of Turkey (TCMB). A 37.0% year-on-year (y/y) recovery of merchandise exports was primarily responsible for the substantial reduction of both the merchandise-trade and current-account deficits. (IHS Markit Economist Andrew Birch)

- Additionally, the nascent service export recovery also contributed to the sharp reduction of the external imbalance. In January-August 2021, total service exports were up by 55.0% y/y in nominal dollar terms - with transport service exports rising by over USD4 billion y/y and travel service exports up by over USD5 billion y/y.

- Somewhat offsetting the improving merchandise-trade and services balances, however, the primary income deficit grew by over USD1.8 billion y/y. With interest rates falling and financial volatility increasing, investment income outflows jumped by over USD2.3 billion y/y.

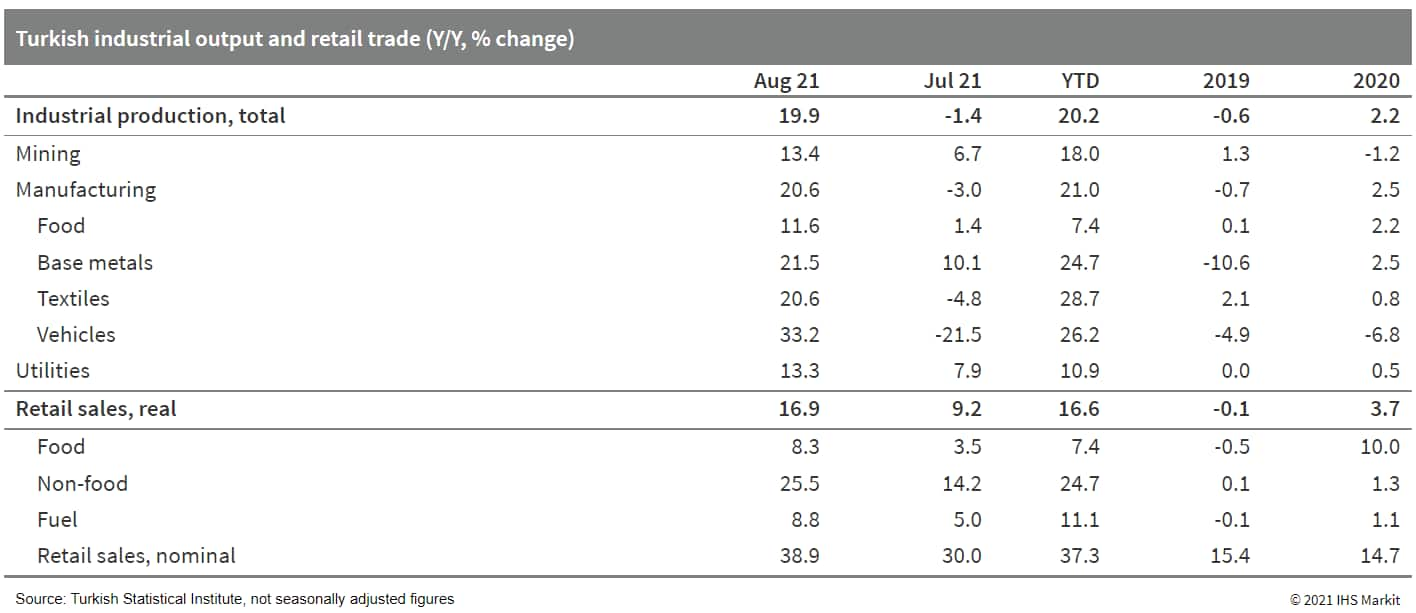

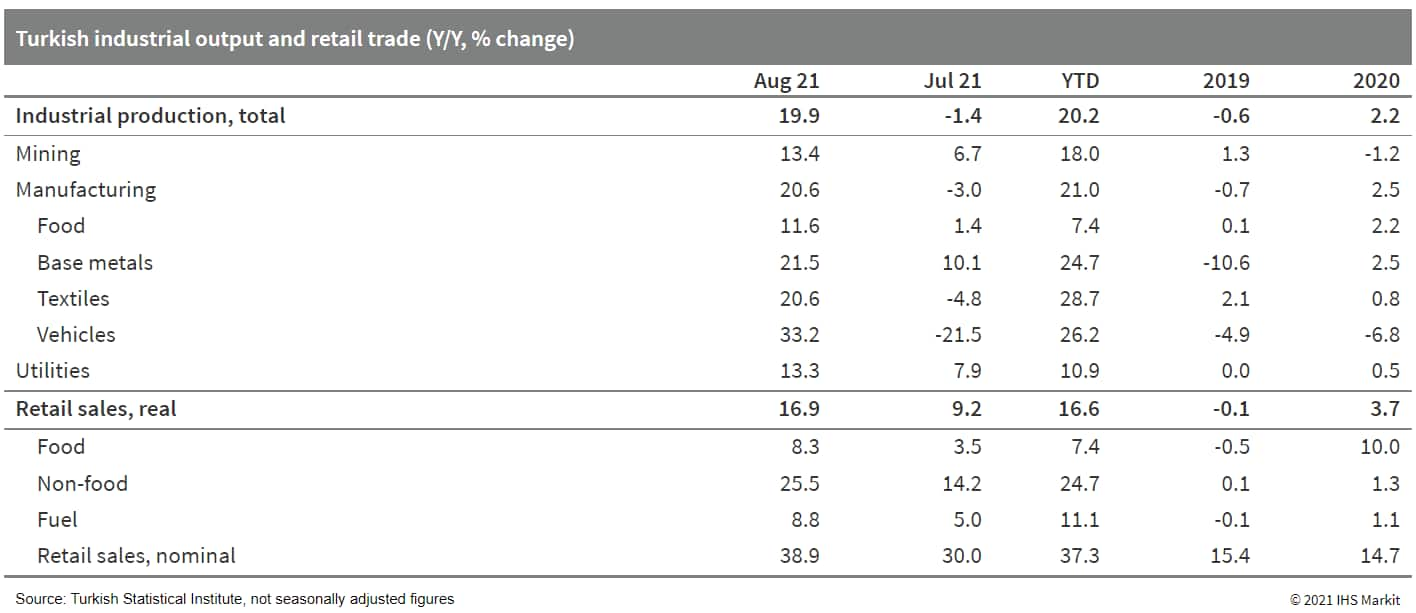

- Turkish industrial production growth gained momentum in August, defying regional trends. That month, total output grew by 5.4% month on month (m/m) in seasonally and calendar-adjusted data. The upturn was stronger than expected, with output recovering from what had been a disappointing July. (IHS Markit Economist Andrew Birch)

- Among the sectors to contribute most strongly to the August revival of output, the manufacture of automobiles and their parts were a surprising source of momentum, adding 1.3 percentage points to headline m/m expansion.

- After the imposition of anti-pandemic measures in the second quarter to battle a surge of COVID-19 infections, the government eased lockdowns in June and July, with most restrictions gone by the end of July. The relaxation of measures contributed to the August recovery.

- The easing of restrictions had a quicker impact on retail trade. Growth there surged by over 15% m/m in June, with subsequent increases in July and August much more modest, but still continuing.

- On 12 October, the EU and Ukraine signed arrangements allowing the latter to join the EU's Common Aviation Area Agreement (ECAA), obliging it to implement European air aviation standards and rules, and allowing carriers based in ECAA member states to fly freely to Ukraine as well as airports in other ECAA signatories. The talks about Ukraine joining the ECAA have been ongoing since 2007, and the initial proposals on an 'Open Skies' agreement since 2013, but they were delayed by unrelated factors such as a UK/Spanish dispute over the status of Gibraltar airport. The new agreement will allow EU airlines to fly unrestricted to Ukraine, with Ukrainian airlines receiving reciprocal access. In the past Ukraine had established 'Open Skies' arrangements with individual EU member states, such as Poland and Italy, which boosted bilateral flights and passenger numbers on these routes. The liberalization of civilian aviation, both for passenger and cargo flights, is a risk-positive development, reducing the regulatory burden for the industry and encouraging an increase in the number of direct flights between Ukraine and EU airports. Ryanair, EU's biggest low-cost airline, which began flying to Ukraine in 2018, already announced plans to expand its presence in the country from five to 12 airports. (IHS Markit Country Risk's Alex Kokcharov)

Asia-Pacific

- Major APAC equity indices closed mixed; South Korea +1.0%, India +0.8%, Mainland China +0.4%, Australia -0.1%, and Japan -0.3%.

- Mainland China's merchandise export growth accelerated from 25.6% year on year (y/y) in August to 28.1% y/y in September in terms of US dollar, according to the General Administration of Customs (GAC). However, merchandise imports rose 17.6% y/y, dropping from a 33.1% y/y expansion the previous month. In terms of 2020-21 average, September exports growth rose by 1.4 percentage points from the previous month and was the fastest since the beginning of the year. (IHS Markit Economist Yating Xu)

- By trade partners, the headline export growth was largely driven by strong demand from the United States with its purchase improving from an expansion of 17.8% y/y in August to 25.5% y/y in September. However, exports to the European Union and Japan moderated, and ASEAN's purchase accelerated only marginally. By export commodities, mechanical and electronic products, especially cellphone that rose 70% y/y, led the headline export growth. Meanwhile, exports of pandemic-control products improved from contraction to expansion, and consumer goods such as toys and bags continued to accelerate, reflecting the sustained global supply-chain disruption caused by the Delta variant spread and the inventory replenishment in Western countries.

- The decline in import growth was partially due to the declining commodity imports under the decarbonization policy as well as the high baseline in the same period last year. The import volumes of steel, copper, and crude oil registered a double-digit contraction in September, driving a significant slowdown in value growth despite the sustained high prices. However, the volume of coal imports in September rose to their highest this year as power plants scrambled for fuel to boost electricity generation to ease the power crunch. Meanwhile, imports of electronic and agricultural products expanded at slower paces compared with August.

- Trade surplus continued to increase from USD58.3 billion in August to USD66.8 billion in September as export growth accelerated while import growth slowed. The cumulative surplus growth rate picked up to 35% y/y from 28.8% y/y a month earlier. Trade surplus with the United States rose further from USD37.7 billion in August to USD42 billion in September.

- New vehicle sales in mainland China fell y/y for a fourth consecutive month during September, due to softer demand for passenger vehicles and commercial vehicles (CVs). According to data released by the CAAM, new vehicle sales on a wholesale basis decreased 19.6% y/y to 2.067 million units last month, while production was down by 17.9% y/y to 2.077 million units. In the year to date (YTD), new vehicle sales are up 8.7% y/y at 18.623 million units, while production volumes are up 7.5% y/y at 18.243 million units. New vehicle sales in China declined y/y for a fifth consecutive month in September, mainly due to the semiconductor shortage affecting global automakers this year. According to IHS Markit's latest forecasts, production losses in mainland China as a result of this issue stood at 364,000, 420,000, and 685,000 units, respectively, during the first, second, and third quarters of this year. The running total for the fourth quarter was kept at 60,000 units last week. Just before the end of September and in the run-up to the national holiday, it was reported that power outages had been experienced in several regions as energy production was cut back to align with quarterly targets. These outages affected the vehicle operations of FAW-Toyota and FAW-Volkswagen (both in Changchun) and SAIC-General Motors (GM) in Shenyang. Initial estimates put the direct impact of this at a combined 5,000 units in the final week of September, while a further direct impact on OEMs and an indirect impact via supplier stoppages are expected to be visible this week and next. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- A consortium of Semco Maritime and PetroVietnam Technical Services Corporation (PTSC) have signed a preferred supplier agreement for the delivery of two offshore substations for the 1,044 MW Hai Long offshore wind project. As part of the scope of work, the consortium will undertake the design, engineering, procurement, construction (EPC) and commissioning work for for the topsides and jacket foundations. The design will be carried out together with ISC Consulting Engineers in the fourth quarter of 2021 , and fabrication will be carried out at PTSC M&C's yard in Vungtau, Vietnam. Work is expected to be completed by 2024, in time for offshore installation. Commissioning is targeted for 2026. The Hai Long project will be developed in three phases, 2a, 2b, and 3, with construction expected to start in 2023. The wind farm is located 50 kilometers off the coast of Changhua county. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Japan's private machinery orders (excluding volatiles), a leading indicator for capital expenditure (capex), fell by 2.4% month on month (m/m) in August following a 0.9% m/m rise in July. The weakness stemmed from a 13.4% m/m drop in orders from manufacturing, which offset a 7.1% m/m increase in orders from non-manufacturing. Orders from the public sector slipped by 1.3% m/m in August following a 14.0% m/m rise in July. Orders from overseas also declined by 14.7% m/m in August after a 24.1% m/m surge in July. (IHS Markit Economist Harumi Taguchi)

- The first drop in five months in orders from manufacturing was largely due to declines in orders from electrical machinery, general-purchase and production machinery, and shipbuilding. On the other hand, the improvement in orders from non-manufacturing was thanks largely to rebounds in orders from wholesale and retail trade, transportation and postal activities, and telecommunications. Demand for machinery related to online shopping and 5G-related hardware helped lift machinery orders from non-manufacturing.

- The August results were weaker than IHS Markit's expectations, but softer orders from manufacturing and a faster increase in orders from non-manufacturing (excluding volatiles) were in line with the industry's outlook for the third quarter of 2021. Orders for metal-cutting machine tools (one type of production machinery) suggest that domestic demand remained resilient in September.

- Japan's ENEOS Holdings is splashing out nearly $2 billion to acquire a compatriot renewable energy project developer, a deal that would help the country's largest oil firm reach its renewable target earlier than scheduled. The Tokyo-listed company 11 October agreed to acquire Tokyo-based Japan Renewable Energy (JRE) for ¥200 billion ($1.76 billion) from US investment bank Goldman Sachs and Singaporean sovereign wealth fund GIC. JRE, 75% of which is owned by Goldman Sachs and 25% by GIC, had renewable assets totaling 877 MW as of 30 September in the solar, onshore wind, and biomass sectors in Japan and Taiwan. These included 419 MW that is operational and 458 MW under construction. With a target to achieve carbon neutrality by 2040, ENEOS was planning to expand its total renewable power generation capacity to more than 1 GW by the end of fiscal 2022, or 31 March 2023. The company's capacity is expected to exceed 1.22 GW when the JRE transaction is completed in January. (IHS Markit Net-Zero Business Daily's Max Lin)

- Tata Motors has entered into a binding agreement with TPG Rise Climate whereby the latter, along with its co-investor ADQ, will invest in Tata subsidiary TML EVCo, reports Autocar India. According to the source, TPG Rise Climate will invest INR75 billion (USD1 billion) for an 11-15% stake in TML EVCo (translating to an equity valuation of up to INR673 billon), while Tata Motors intends to expand its electric vehicle (EV) portfolio to 10 models by 2026 with a INR150-billion investment in the EV business. TML EVCo will help Tata Motors channel future investments into EVs, dedicated battery electric vehicle (BEV) platforms, advanced automotive technologies, charging infrastructure, as well as battery technologies. The first round of investment is due to be completed by March 2022, while the remainder will be invested by the end of 2022. Tata Motors chairman Natarajan Chandrasekaran said, "I am delighted to have TPG Rise Climate join us in our journey to create a market-shaping electric passenger mobility business in India. We will continue to proactively invest in exciting products that delights customers while meticulously creating a synergistic ecosystem. We are excited and committed to play a leading role in the Government's vision to have 30% electric vehicles penetration rate by 2030." Tata Motors is also implementing Project Helios, under which it has confirmed plans to expand its portfolio to 10 India-specific EVs by 2026, as well as a transition to a modular multi-energy platform. (IHS Markit AutoIntelligence's Tarun Thakur)

Posted 13 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.