All major US equity indices closed higher, Europe was mixed, and all major APAC markets were lower. US government bonds closed higher and most benchmark European bonds were lower. European iTraxx closed almost flat on the day, while CDX-NA was tighter across IG and high yield. Natural gas and gold were higher, the US dollar was flat, and oil, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.7%, DJIA +1.3%, S&P 500 +1.2%, and Nasdaq +0.7%.

- 10yr US govt bonds closed -4bps/1.66% yield and 30yr bonds -2bps/2.40% yield.

- CDX-NAIG closed -2bps/52bps and CDX-NAHY -6bps/296bps.

- DXY US dollar index closed flat/90.75.

- Gold closed +0.1%/$1,824 per troy oz, silver -0.7%/$27.06 per troy oz, and copper -1.0%/$4.69 per pound.

- Crude oil closed -3.4%/$63.82 per barrel and natural gas closed +0.1%/$2.97 per mmbtu.

- Seasonally adjusted (SA) US initial claims for unemployment insurance fell by 34,000 to 473,000 in the week ended 8 May, its lowest level since the week ended 14 March 2020. (IHS Markit Economist Akshat Goel)

- Citing worker shortages, governors in many states—13 at last count—have announced an early end to the pandemic-related federal unemployment programs. The federal pandemic-related unemployment programs, which include the extra $300-a-week payments, the Pandemic Unemployment Assistance (PUA), and the Pandemic Emergency Unemployment Compensation (PEUC), were set to expire on 6 September. They are now slated to expire between 12 June and 3 July in the 13 states that have opted out.

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 45,000 to 3,655,000 in the week ended 1 May. The insured unemployment rate remained at 2.7%.

- Individuals who have exhausted regular benefits are eligible for up to 53 weeks of extended benefits under the PEUC program. In the week ended 24 April, continuing claims for PEUC rose by 291,389 to 5,265,193.

- Independent contractors, self-employed individuals, or individuals who otherwise would not qualify for benefits in regular state programs can apply for claims under the PUA program. There were 103,571 unadjusted initial claims for PUA in the week ended 8 May. In the week ended 24 April, continuing claims for PUA rose by 420,252 to 7,283,703.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 24 April, the unadjusted total rose by 696,152 to 16,855,264.

- The US total producer price index (PPI) for final demand rose 0.6% in April after jumping 1.0% in March. The 12-month change was 6.1%, the largest in the series' history, which goes back to November 2009. The index was up 4.4% from February 2020—it is more informative to compare the latest value to a pre-pandemic value because of "base effects." (IHS Markit Economists Michael Montgomery and Patrick Newport)

- Total goods prices also rose 0.6%, on the heels of a 1.7% gain in March. The PPI for food jumped 2.1% while energy dropped 2.5%.

- Excluding foods and energy, the index jumped 1.0%, following a 0.9% March increase. This index was up 4.7% from a year earlier and 4.5% from February 2020.

- Total services prices climbed 0.6% in April. Transportation and warehousing services grew 2.1% on a rise in airfares. Excluding trade, transportation, and warehousing, services prices firmed a moderate 0.5%.

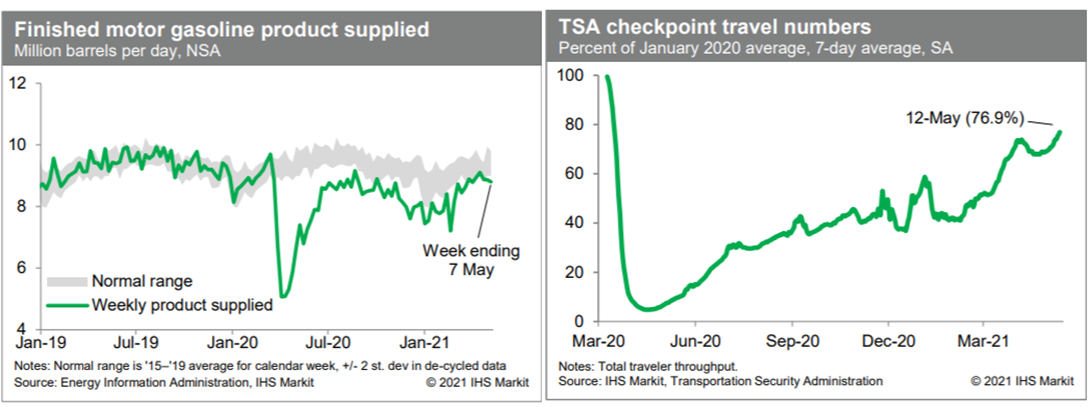

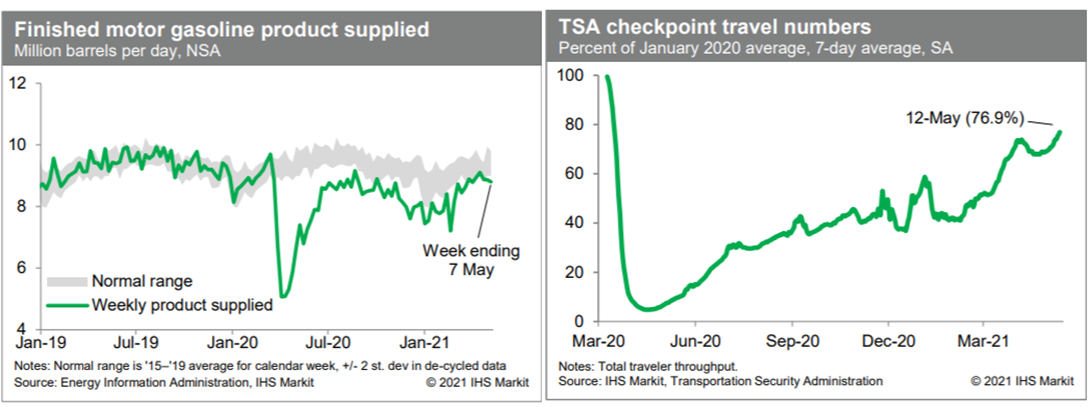

- Consumption of gasoline declined last week but remained close to the lower end of a normal range, indicating a generally healthy level of internal mobility. Meanwhile, passenger throughput at US airports in recent days has been trending higher. As of yesterday, airport foot traffic was running at roughly 77% of the January 2020 level, the highest level of activity so far in the recovery. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Toyota has announced it intends for battery and fuel-cell electric vehicles (BEVs and FCEVs) to make up 15% of its US sales by 2030, and for electrified vehicles to make up 70% of US sales by 2030. These vehicles are part of Toyota's target for selling 8 million electrified vehicles globally by 2030, with a target for 2 million of those to be BEVs or FCEVs. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to media reports, Tesla CEO Elon Musk has indicated a new significantly improved update for the beta autonomous software may be released in the coming weeks. Reuters cites a conversation Musk had with followers on Twitter, which included Musk indicating that subscriptions to the service will be offered in the next month, although the executive did not provide further details. Musk also noted that the autonomous beta program is being updated to address a phantom braking problem. However, Reuters notes that Musk was not clear on the timeline for the new version of the software, quoting Musk as saying, "I think we're maybe a month or two away from wide beta. But these things are hard to predict accurately." (IHS Markit AutoIntelligence's Stephanie Brinley)

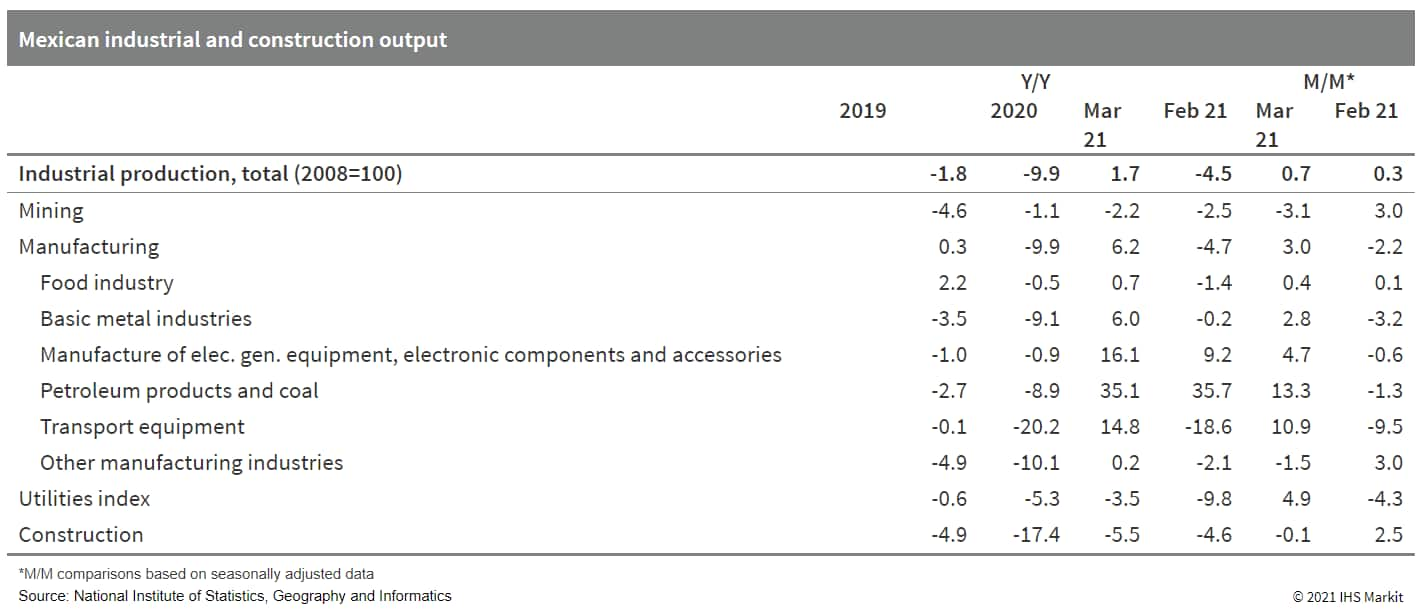

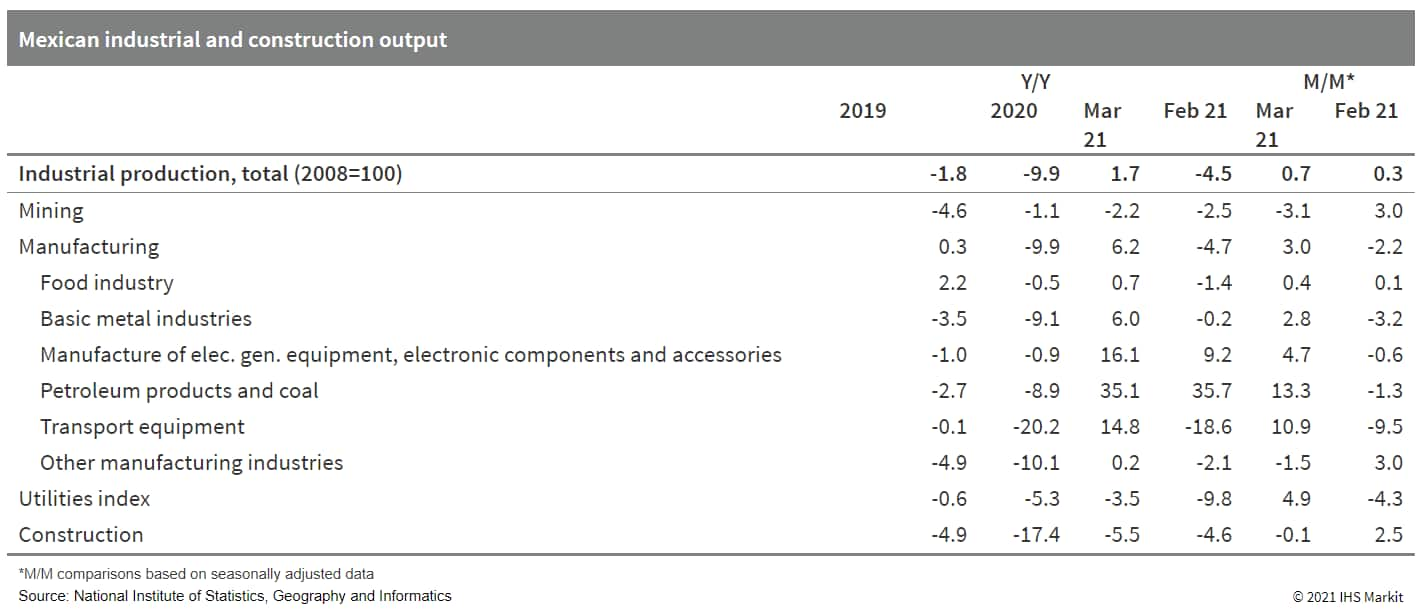

- According to the Mexico's national statistics office (Instituto Nacional de Estadística y Geografía: INEGI), industrial production grew by 0.7% month on month (m/m) in March after a 0.3% m/m increase in February. In addition, industrial output in March remained 2.4% below its February 2020 level, the last pre-pandemic month. This is based on seasonally adjusted data. (IHS Markit Economist Rafael Amiel)

- Manufacturing and utilities were the drivers of growth; strong growth in the US economy is creating momentum for Mexican manufacturing exports.

- Certainly, March benefited from the easing of COVID-19-virus restrictions as compared with February and January. Stronger demand from the US has been an important factor in growth in manufacturing production (except for cars and light vehicles).

- Peru's merchandise exports reached USD4.4 billion in March, 52.9% higher than in March 2020 and 16.2% above March 2019. (IHS Markit Economist Jeremy Smith)

- Mineral exports, which normally account for around 60% of Peruvian exports, occupied an even larger 62.5% share in the first quarter. Exports of copper, gold, iron, zinc, and lead all increased with respect to the first quarter of 2020, and overall mineral exports increased by 29.8% year on year (y/y).

- Surging global commodity prices account for nearly all of the y/y increase in exports; first-quarter export volumes increased by just 2.9% y/y while prices jumped by 23.7% y/y.

- The price of copper, Peru's most important export, reached an all-time high on 10 May. The price surge over the past year has been driven by strong Chinese demand, production and supply-chain disruption, optimism surrounding copper-intensive renewable energy technologies such as electric vehicles, and bullish investor sentiment.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.3%, France +0.1%, Italy +0.1%, Spain -0.5%, and UK -0.6%.

- Most 10yr European govt bonds closed lower except for Germany closing flat; Italy +4bps, Spain/France +2bps, and UK +1bp.

- iTraxx-Europe closed flat/52bps and iTraxx-Xover -2bps/259bps.

- A 150% increase in electricity consumption is expected as a result of the 55% emissions cuts target and other EU climate goals, according to Ørsted Head of Regulatory Affairs Ulrik Stridbæk. "Getting rid of fossil fuels in our current electricity system is going to be the least of our challenges. The biggest challenge is to meet this enormous new demand," he told the online SolarPower summit. As a result of more demand for renewable electricity, end-users may wind up competing for it. "I think there's a puzzle still to cover … which is the volume we're going to need, and the fact that we're all going to need it at the same time," said Marco Mensink, director general of the European Chemical Industry Council. This is a major issue for the electric vehicle sector and industrial users of large amounts of energy, said Mensink. "They need electric chargers to electrify the automotive sector, and then the electricity is simply not there for industry," he said. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- Germany has sold its third green bond, extending its curve to 30 years (after a 10-year debut in September 2020 and a five-year sale in November). (IHS Markit Economist Brian Lawson)

- The issue was originally marketed with a one-basis-point "greenium" or yield saving to reflect its incremental ESG audience.

- It priced at 0.391%, two basis points under its conventional "twin", attracting EUR39 billion in demand.

- According to Reuters, this was a record, beating the EUR33 billion obtained for its Green debut.

- The same source claims Germany is planning to raise a further EUR6 billion from a 10-year auction and tap in late 2021.

- Proceeds will be applied to existing outlays in five eligible categories.

- Overall, Finanzagentur (the German debt agency) flagged "very impressive" demand "in its extent and diversity", stating that "this renewed high interest" confirmed the merits of its "innovative twin concept".

- VW Commercial Vehicles announced it will start testing autonomous systems in Germany with Argo AI in mid-2021, with plans for commercial use in 2025. The development follows the trajectory VW has set out, although this announcement sets a more specific timeline for commercial deployment, in 2025. Although VW and Argo AI are reportedly already testing in six US cities, the latest announcement adds testing in Germany, and also reflects that commercial deployment will begin in VW's home country first. Although the COVID-19 pandemic, as well as ongoing development to ensure safety of autonomous systems, have delayed some launch plans, VW and others have not wavered in determination to be part of this potentially transformational development in transportation. VW Group CEO Herbert Diess earlier has said he expects that as soon as 2035, about 40% of vehicles will be autonomous. (IHS Markit AutoIntelligence's Stephanie Brinley)

- BMW has announced aggressive targets for carbon reduction, including increased efforts relative to materials reduction, reuse and recycling, as well as noting a target for 50% of its global sales of to be electric vehicles (EVs) in 2030 and near-term plans for a hydrogen fuel-cell EV X5. BMW is looking to avoid emission of more than 200 million tons of C02 by 2030, including a focus on reducing vehicle carbon footprint throughout the lifecycle. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volvo Cars has issued a statement indicating it is considering an initial public offering (IPO). If completed, Volvo aims to be traded on the Nasdaq Stockholm stock exchange later this year. In addition, the company announced that it has extended the contract of CEO Hakan Samuelsson to the end of 2022. Volvo Cars says the IPO move would be a logical step in its capital-market plans, enabling new shareholders to participate in Volvo Cars' future. Zhejiang Geely Holding would remain a major shareholder, according to comments from Eric Li, chairman of Geely. (IHS Markit AutoIntelligence's Stephanie Brinley)

- South Africa's real seasonally adjusted manufacturing production increased by 3.4% month on month (m/m) during March, pulling the year-on-year (y/y) growth rate up to 4.1%. Manufacturing production expanded by a modest 0.3% y/y during the first quarter of 2021, the first positive annual growth since the second quarter of 2019. (IHS Markit Economist Thea Fourie)

- Sectors that showed the biggest contribution to the annual rise in manufacturing production include motor vehicles, parts and accessories and other transport equipment (up 25.9% y/y, contributing 2.1 percentage points), and food and beverages (up 10.4% y/y, contributing 3.0 percentage points). Output in the petroleum, chemical products, rubber, and plastic products category showed the biggest contraction during March, falling by 7.1% y/y.

- Seasonally adjusted manufacturing sales increased by 5.9% m/m in March. This followed month-on-month changes of 3.5% in February and 0.1% in January.

- The South African rand has become one of the best-performing emerging-market currencies over the past eight weeks, recouping more than 10% of its value against the US dollar compared with a year earlier. This leaves the value of the rand at close to ZAR14.10:USD1.00, from the 2020 low of ZAR20.63:USD1.00. (IHS Markit Economist Thea Fourie)

- A chain of events has contributed to the rand's exchange rate resilience, most of which factors are expected to support the currency over the short term.

- Periods of US dollar weakness as the COVID-19 pandemic and vaccine rollout unfolds, resilient commodity prices, favorable political and key fiscal developments in South Africa, and a strong current-account performance underlined the rand's strength in recent months.

Asia-Pacific

- All major APAC equity indices closed lower; Australia -0.9%, Mainland China -1.0%, South Korea -1.3%, Hong Kong -1.8%, and Japan -2.5%.

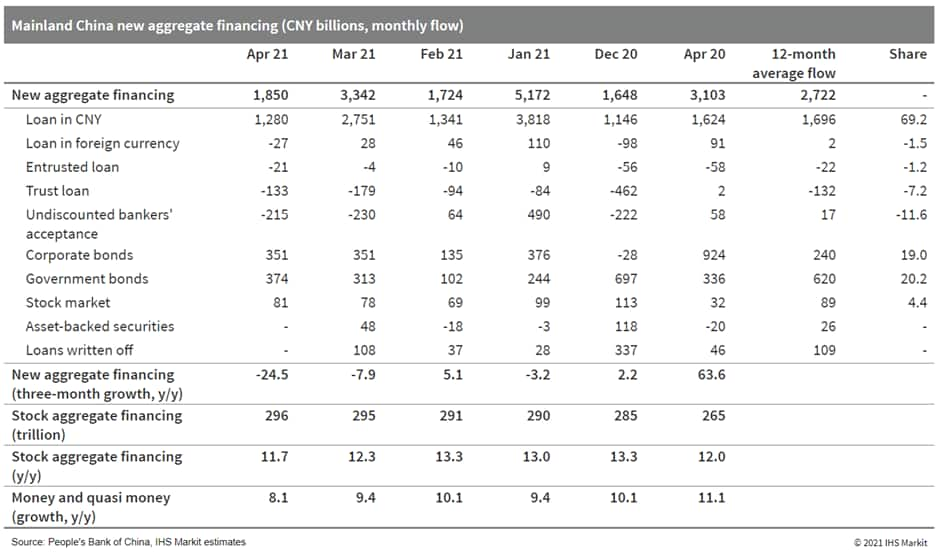

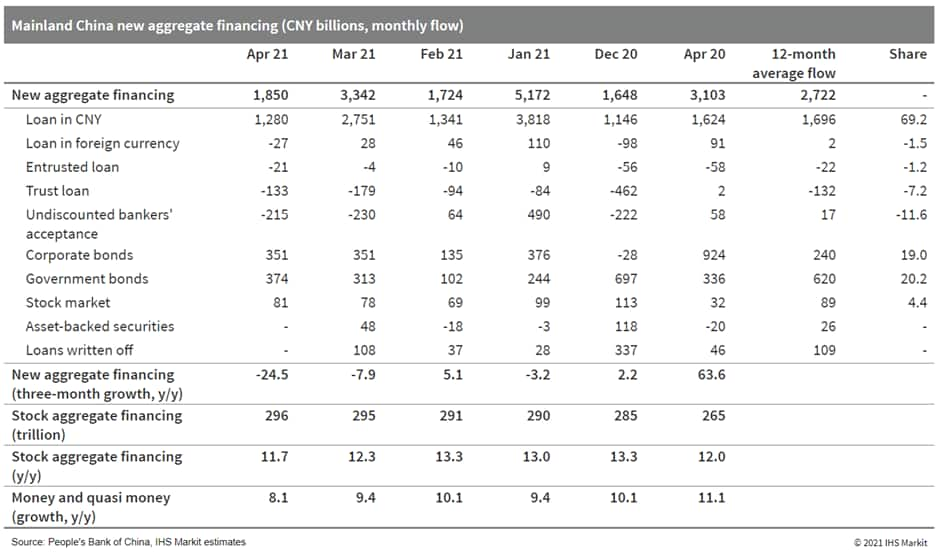

- Mainland China's new total social financing (TSF), the broadest measure of net new financing to the real economy, reached CNY1.85 trillion (USD281.90 billion) in April, according to the People's Bank of China (PBOC). Despite a smaller high-base effect than March, the April TSF release marks a decline of CNY1.25 trillion year on year (y/y), although still higher than 2019 comparable level by CNY179.7 billion. Stock TSF amounted to CNY296.16 trillion, up by 11.7% y/y and down by 0.6 percentage point from the month-ago growth rate. (IHS Markit Economist Lei Yi)

- With a gradual normalization in monetary policy, high-base effect from 2020 continued to drive the y/y decline in TSF, led by corporate bonds and bank loans. Nevertheless, the y/y decline in bank loans largely came from the decline in short-term loans, which can be explained by the loan inspection campaign to call illegal usage of operating and consumption loans for housing speculation.

- Medium-to-long term bank borrowing by households and corporates on the other hand, continued to expand year on year in April, as mortgage demand held up, and manufacturers remained upbeat about investment outlook.

- China Association of Automobile Manufacturers' (CAAM) data indicate strong growth in new vehicle demand for a fourth consecutive month in April, largely thanks to growing demand for sedans, crossovers, SUVs, MPVs, and minibuses. However, when compared with the previous couple of months, the growth rate in April slowed. IHS Markit expects light-vehicle sales in mainland China to grow by 5.0% to 24.85 million units in 2021 and light-vehicle production to increase 5.5% to 24.62 million units. (IHS Markit AutoIntelligence's Jamal Amir)

- Autonomous vehicle (AV) startup WeRide has announced the completion of its Series-C funding round, valuing the company at USD3.3 billion, reports TechCrunch. The startup did not disclose the amount raised but said it totaled "hundreds of millions" of dollars from venture capital investors including IDG Capital, Homeric Capital, CoStone Capital, Cypress Star, Sky9 Capital, and K3 Ventures. Existing investors CMC Capital Partners, Qiming Venture Partners, and Alpview Capital also participated in the round. WeRide plans to use the infused capital to invest in research and development and commercialization as it works towards developing next-generation Level 4 autonomous operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's current-account surplus in March rose by 37.3% year on year (y/y) to JPY2.7 trillion (USD24.2 billion) on a non-seasonally adjusted basis, but fell by 8.0% month on month (m/m) to JPY1.7 trillion on a seasonally adjusted basis. The y/y increase was thanks largely to a rise in the trade surplus by JPY850.4 billion to JPY983.1 billion, offsetting a decrease in primary income (down JPY135.8 billion to JPY2.5 trillion). (IHS Markit Economist Harumi Taguchi)

- The rebound in the trade balance reflected a solid rise in exports (up 16.6% y/y), which outpaced imports (up 3.1% y/y), thanks to solid external demand and partially due to low base effects and the drop-out of negative effects of the February earthquake.

- The resumption of economic activity overseas also lifted service exports (particularly for revenue from the use of intellectual property, as well as from technical/trade-related services), helping narrow the deficit of the service balance by 57.6% y/y to JPY47.1 billion. Primary income softened, largely reflecting larger withdrawals from income of direct investment.

- Sumitomo Chemical has reported full-year 2020 net earnings of ¥46.0 billion ($420 million), up 48% year on year (YOY), on sales that rose 2% to ¥2.28 trillion, with improved performances by its IT-related chemicals and health and crop science segments only partially offset by a loss in its petrochemicals and plastics business. Operating income was almost flat YOY at ¥137.1 billion. The results for the year ended 31 March are in line with guidance issued by the company on 26 April. (IHS Markit Chemical Advisory)

- In the IT-related chemicals segment, Sumitomo says shipments of processing materials for semiconductors, including high-purity chemicals and photoresists, increased on growing demand. Shipments of materials for display applications also rose in the face of increased demand for stay-at-home and remote-work products, it says. Sales increased by ¥26.9 billion YOY to ¥431.8 billion, with core operating income rising ¥14.6 billion to ¥39.7 billion.

- The company's health and crop sciences segment saw annual sales increase YOY after the acquisition of four South American subsidiaries from Nufarm in April 2020, while shipments in India also performed well, it says. Market prices for methionine also increased. Revenue rose by ¥79.3 billion compared to the previous year to ¥423.0 billion, while the improved methionine margins and increased global shipments of crop protection products boosted core operating income by ¥29.5 billion YOY to ¥31.5 billion, it says.

- Lower market prices for raw materials and low price levels for petchem products caused a ¥67.6 billion YOY decline in sales to ¥589.3 billion, with core operating income swinging to a loss of ¥12.0 billion, due to lower shipment volumes and periodic shutdown maintenance at Rabigh Refining and Petrochemical Company (PetroRabigh), the company's joint venture with Aramco in Saudi Arabia.

- Sumitomo's energy and functional materials segment reported a ¥9.8 billion decline in sales to ¥245.2 billion, with core operating income almost flat YOY at ¥20.3 billion, due to improved profit margins as a result of lower raw material prices.

- The pharmaceuticals business reported a ¥30.6 billion rise in revenue compared to the prior year to ¥546.5 billion. Core operating income, however, declined by ¥3.6 billion to ¥71.7 billion, due to higher sales expenses, general, administrative, and R&D costs, it says.

- The South Korean government plans to expand investment and tax incentives for the semiconductor segment in line with efforts to foster the non-memory chip industry and cope with the global supply shortages of automotive chips, reports the Yonhap News Agency. "To cope with the supply shortages in the automotive chips, we plan to focus on expanding support for the 8-inch wafer foundry industry," said South Korean New Industry Minister Moon Sung-wook. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 13 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.