All major European, US, and APAC equity markets closed mixed. US and benchmark European government bonds closed mixed, with the US curve flatter on the day. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar closed higher, while gold, copper, silver, oil, and natural gas were all lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Nasdaq +0.4%, S&P 500 +0.3%, DJIA flat, and Russell 2000 -0.3%.

- 10yr US govt bonds closed +2bps/1.36% yield and 30yr bonds flat/2.00% yield.

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -4bps/286bps.

- DXY US dollar index closed +0.1%/93.04.

- Gold closed -0.1%/$1,752 per troy oz, silver -1.6%/$23.12 per troy oz, and copper -0.2%/$4.36 per pound.

- Crude oil closed -0.2%/$69.09 per barrel and natural gas closed -3.1%/$3.93 per mmbtu.

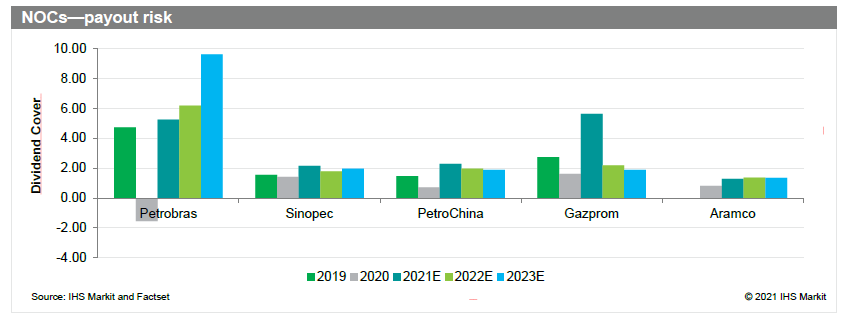

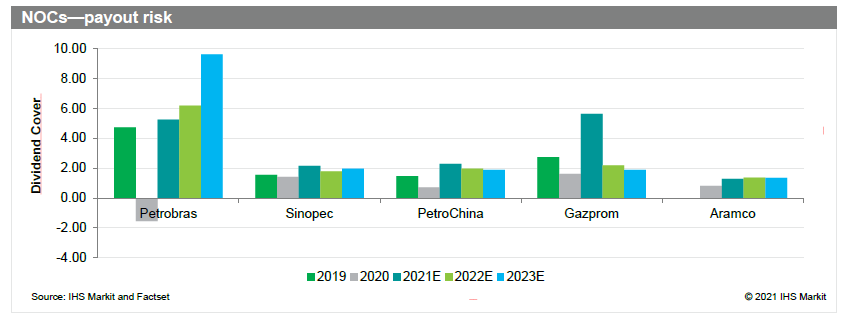

- In the past, oil and gas majors could ignore climate change questions, but time and accelerated pollution and activism have forced them to take notice and be seen to act. ExxonMobil (XOM) was the latest example of a major having to deal with climate activism while Royal Dutch Shell (RBS) was rebuked by a Dutch court that its climate change plans were inadequate. The spotlight has necessitated a shift in priorities over capital allocation in the sector and with this shift, dividends are no longer above criticism for investors. (IHS Markit Dividend Forecasting's Kelvin Menezes)

- European IOC's dividends are less likely to be oil price sensitive compared to their American counterparts

- NOC's energy transition initiatives appear to be muted

- The Midstream segment is likely to experience free cash flow expansion

- Refineries are expected to provide a haven for dividend shareholders

- US seasonally adjusted (SA) initial claims for unemployment insurance fell by 12,000 to 375,000 in the week ended 7 August. While the level of initial claims is trending down and is far below the pandemic-era high, the last time initial claims were consistently above the current level was in late 2011 when the economy was still limping out of the Great Recession. Initial claims closer to 200,000 would suggest a normal level of "churn" for an economy in its prime. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 114,000 to 2,866,000 in the week ended 31 July, hitting its lowest since 14 March 2020. The insured unemployment rate decreased by 0.1 percentage point to 2.1%.

- In the week ended 24 July, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 393,638 to 3,852,569.

- In the week ended 24 July, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 336,195 to 4,820,787.

- In the week ended 24 July, the unadjusted total of continuing claims for benefits in all programs fell by 919,593 to 12,055,290.

- US producer prices climbed 1.0% in July, the same as in June. The total producer price index (PPI) for final demand 12-month change was 7.8% (note: year-on-year comparisons are misleading because of base effects), up from 7.3% in June. (IHS Markit Economists Michael Montgomery and Patrick Newport)

- Final demand for services grew 1.1%, led by transportation and warehousing with a 2.7% climb. Airline fares surged ahead 9.1% to lead that group; the next closest two segments' gains were 0.6%. Trade margins surged ahead 1.7% with last month's villain, vehicle dealers' margins, once again claiming the crown with a matching 17.4% increase—dealerships are profiting from tight inventories.

- Final demand goods prices rose 0.6%, down from 1.2% in June. The PPI for food eased 2.1%, while energy edged up 2.6%.

- The core goods index, which excludes food and energy, increased 1.0% in both July and June—the fourth straight month it has risen by 1% or more. The old-style stage of processing core goods index climbed a tamer 0.8%, so 0.2 percentage points of the 1.0% total was from export products' faster increases.

- The IHS Markit weekly tracking of raw commodity prices has plateaued at a high level in recent weeks, but we appear to be months away from that push to price levels fading as pass-through of past gains winds through the supply chain to final goods. The near-term loss of momentum for commodities seems to be a wave of fear over what the Delta-variant of COVID-19 will do to mainland China.

- Yesterday's US consumer price index (CPI) rose 0.5% in July and the core CPI, which excludes the direct effects of moves in food and energy prices, rose 0.3% in July. Both indices increased 0.9% in June. The CPIs for food and energy rose 0.7% and 1.6%, respectively. The 12-month change in the overall CPI remained at 5.4% in July. The 12-month change in the core CPI eased 0.2 percentage point to 4.3%. (IHS Markit Economists Ken Matheny and Juan Turcios)

- The red-hot pace of price increases for used cars and trucks cooled in July. The index for used car and truck prices rose just 0.2% in July following increases over the previous three months that averaged 9.3%. Shortages of computer chips have hampered production of new vehicles, spurring demand for used vehicles and prompting sharply higher prices.

- More broadly, several pandemic-affected price components were mixed in July, essentially accounting for the more moderate increase in the core CPI of 0.3%. The price index for airline fares declined 0.1% and the price index for car rentals fell 4.6%. In contrast, the CPI for other lodging away from home (hotels and motels) rose 6.8%, continuing its sharp rebound.

- Relative to its immediate pre-pandemic level in February 2020, the core CPI has risen at an annualized rate of 3.2%, underscoring that a portion of the rise in 12-month inflation is due to "base effects"—comparisons with depressed price levels earlier in the pandemic. We expect 12-month inflation readings to moderate as base effects recede and supply-chain issues are addressed.

- Rents have firmed in the past couple of months but the trend in rent inflation remains low. Owner's equivalent rent and rent of primary residence rose 0.3% and 0.2%, respectively, in July. Their 12-month changes were 2.4% and 1.9%, respectively, both below pre-pandemic trends but above lows earlier this year.

- Even as installations of onshore and offshore wind power continue to increase around the world, several of the largest turbine manufacturers and installers say supply chain difficulties are interfering with the industry's ability to reach its potential. In quarterly earnings announcements in the last month, three of the five largest wind turbine original equipment manufacturers as tracked by the Global Wind Energy Council-Vestas, GE Renewable Energy, and Siemens Gamesa-bemoaned COVID-19-induced supply chain delays and the rising cost of steel used to manufacture turbines. And while two of the companies scaled back their 2021 earnings guidance, all three said the outlook beyond this year is very promising. The other top five companies, Goldwind and Envision, are based in China and do not release a great deal of financial or operational information publicly. Executives' comments affirm findings by IHS Markit in its quarterly industry review, published in May. "Sharp price increases in steel, copper, and aluminum were recorded in the later part of 2020 due to the rebound in global consumption. These will put cost pressures on wind turbine manufacturers in the near term before prices stabilize," IHS Markit stated. High prices have persisted throughout the summer. For instance, the front-month US Midwest hot-rolled coil steel futures contract stood at about $1,880/metric ton (mt) on 11 August. The front-month was about $550/mt in August 2020, representing a jump of 240% since that time. With the cost of steel at record levels in North America and well above historic averages in the other key markets of China and Europe, IHS Markit said it would take until the end of 2021 for the market to balance enough for prices to fall back to 2019 levels. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- Yogurt maker Danone is expanding its partnership with Brightseed, a biosciences company that uses its proprietary Forager artificial intelligence system to map and predict the health impact of plant-based compounds. The two companies announced on August 4 a plan for a multi-year collaboration seeking to expand understanding of the world's most common crops and to explore lesser-known plant sources. The goal of the partnership is to establish the blueprint for a health-forward and regenerative food system, while also accelerating Danone's development of plant-based products. The new collaboration builds upon the success of a partnership last year between Danone North America and Brightseed, which made significant strides in identifying biological connections between bioactives present in Danone's raw plant sources and health. For example, in just a few months, Forager was able to identify 10 times more bioactives in a single plant than were previously known, while also uncovering seven new health attributes, Danone said in a statement. Bioactives in plants provide significant health benefits for humans, yet currently less than 1% of these compounds are known to science. Only 12 plants — crops such as corn, rice, wheat, soy, oats and others — account for 75% of the global food system. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- Texas is emerging as the front-runner for the location of electric vehicle (EV) maker Rivian's second assembly plant in the United States, reports Bloomberg. The Bloomberg report cites an internal document related to a presentation of the City of Fort Worth's Economic Development Department that has not been disclosed publicly. According to the report, potentially, USD440 million in grants and a county tax abatement are available for the project. Rivian has reportedly committed to making a USD5-billion investment in its second US plant, including USD2 billion in real property improvements and USD1.6 billion in construction costs, and to completing these initial investments by the end of 2024. The new plant has been referred to as Project Tera in previous media reports, citing various internal documents. The plant is expected to be able to produce 200,000 units per year and potentially create 7,500 jobs by 2027, according to the Fort Worth documents. The reports suggest that other cities remain under consideration by Rivian for its second plant, although Arizona has lost favor over concerns on available infrastructure. The Bloomberg report quotes Robert Sturns, director of economic development of Fort Worth, as saying the city is "very excited to be a finalist for this project and looks forward to continuing the process". (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lightning eMotors has announced an agreement for 7,500 zero-emission Class 4 and Class 5 buses in the United States and Canada from 2021 to 2025. According to a Lightning eMotors press release, the agreement is with Forest Rivers, a company that operates shuttle buses in the US and Canada; the buses under this agreement will be distributed in both countries. Lightning eMotors says that the deal is worth about USD850 million. The company will "build fully electric powertrains and provide charging products, and services for Forest River over the next four and a half years". Lightning eMotors says that it will manufacture the zero-emission powertrains at its facility in Loveland, Colorado (US); the systems will be shipped to Forest River for installation in Class 4 and Class 5 shuttle buses. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber, in partnership with TaxExpress, has launched its Uber Taxi service in the Colombian cities of Bogotá and Cali, reports Reuters. This deal will offer taxi drivers access to the Uber Taxi service. Jose Hernández, TaxExpress general manager, said, "In Colombia we are living through changes and searching for alternatives with former competitors is a part of that". In 2019, Colombia ordered Uber to suspend its service in the country on the basis of unfair competition. Following a three-week suspension of Uber's ride-hailing service in Colombia, it launched a new service model in the country that allows users to rent cars with drivers through a contract between a lessor and a lessee. Since last year, the company has rolled out Uber Taxi in Mexico, Brazil, Chile, Argentina, and Spain. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Germany +0.7%, Italy +0.4%, France +0.4%, Spain flat, and UK -0.4%.

- 10yr European govt bonds closed mixed; Italy/Spain -2bps, France -1bp, Germany flat, and UK +3bps.

- iTraxx-Europe closed -1bp/46bps and iTraxx-Xover -4bps/232bps.

- Brent crude closed -0.2%/$71.31 per barrel.

- The Office for National Statistics (ONS) reports that UK GDP in volume terms grew by 4.8% quarter on quarter (q/q) in the second quarter. This compares with a 1.6% drop in the first quarter and gains of 1.3% q/q and 16.9% q/q in the fourth and third quarters of 2020, respectively. (IHS Markit Economist Raj Badiani)

- This growth was higher than expected, with IHS Markit's latest estimate for the second quarter having been 4.5% q/q.

- In annual terms, the economy rose by 6.5% year on year (y/y) during the first half of this year, after a 9.8% drop in the full year 2020.

- In addition, GDP in the second quarter was 4.4% smaller than it was at the end of 2019, the pre-COVID-19 level.

- Consumer spending regained notable ground during the second quarter, rising by 7.3% q/q, following a fall of 4.6% q/q in the previous quarter. However, it remained 7.0% below its pre-COVID-19 level.

- In addition, household consumption contributed 4.1 percentage points to the 4.8% q/q real GDP increase.

- Watt Electric Vehicle Company (WEVC), which currently builds a small electrically powered coupé, has announced plans to expand into building an electric light commercial vehicle (LCV). In a statement, the company said that this would be underpinned by its new platform, known as the Passenger And Commercial EV Skateboard (PACES), which is said to be an "innovative and highly flexible architecture [that] allows the niche vehicle industry to meet the considerable challenges of transitioning to an electric future by providing a sophisticated, yet cost-effective EV platform 'off-the-shelf'". It adds that it is "highly customizable for different body styles, sizes and configurations" and can support low-to-medium volume vehicle manufacturing, specialist vehicle converter or start-up, and complies with ISO regulations and European Small Series Type Approval safety standards. Amongst its features are a "cell-to-chassis system" that allows the batteries to be fitted in to the primary structure rather than having a separate battery pack, that will optimize stiffness and minimize weight. The company adds that it will reveal a prototype LCV based on this architecture towards the end of the first quarter of 2022, with production set to begin in the UK's Midlands region in the third quarter of 2023 at a rate of between 2,500 and 5,000 units per annum. (IHS Markit AutoIntelligence's Ian Fletcher)

- Madrid-based GRI Renewable Industries has announced plans to build an offshore wind turbine tower factory at Able Marine Energy Park, Hull, in the United Kingdom. The company will invest GBP78 million (USD108 million) in the facility which will have a stated capacity of around 100 offshore towers a year, equivalent of 100,000 tons of steel. Part of the investment will be funded from the UK government's recently announced GBP160 million grant funding for its Offshore Wind Manufacturing Investment Support Scheme. (IHS Markit Upstream Costs and Technology's Melvin Leong)

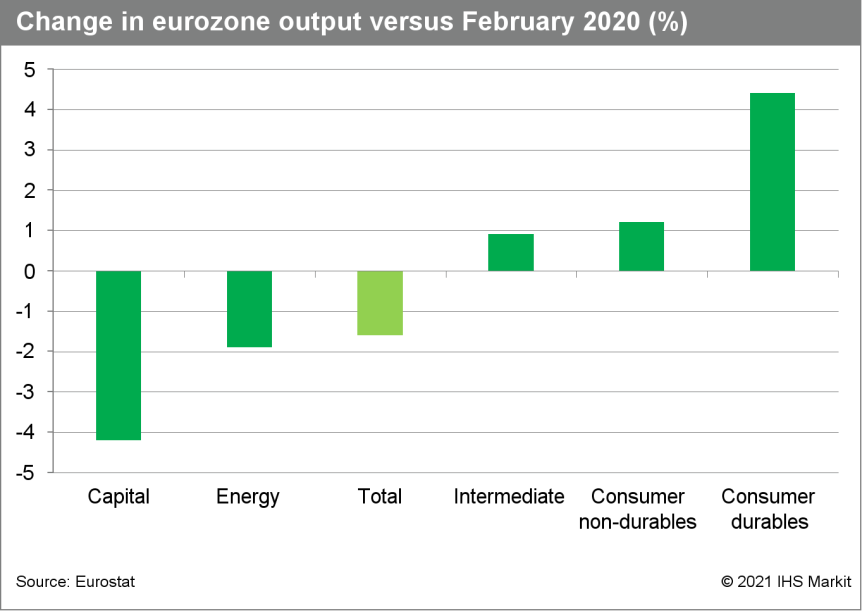

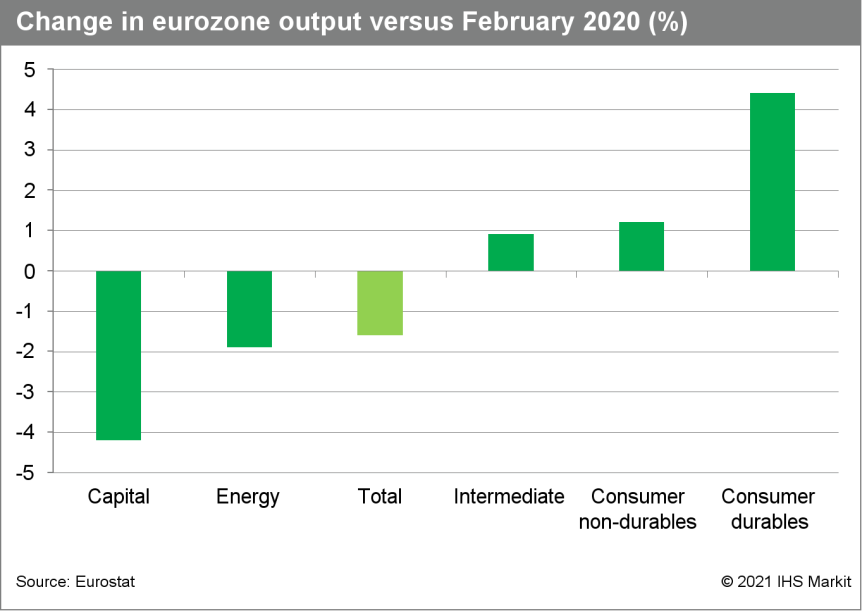

- The eurozone has registered back-to-back output declines for the first time since the initial coronavirus disease 2019 (COVID-19) shock, although with significant variations by good type. (IHS Markit Economist Ken Wattret)

- Eurozone industrial production fell by 0.3% month on month (m/m) in June, slightly below the market consensus expectation (of -0.2% m/m, according to Reuters' survey).

- Given May's 1.1% m/m decline, production thus contracted in consecutive months following increases in 10 of the prior 11 months.

- On a year-on-year (y/y) basis, industrial production rose by 9.7%, down by 30 percentage points from April's high, although given extreme distortions from COVID-19-related base effects, levels of production are a more helpful gauge of the cycle.

- Following June's decline, eurozone industrial production was 1.6% below February 2020's pre-pandemic level.

- June's manufacturing production data were broadly similar. Output fell by a slightly larger 0.4% m/m and was also down by 1.6% versus February 2020's level.

- As in May, production of capital goods (-1.5% m/m) and energy (-0.6% m/m) were again primarily responsible for the contraction in June, with production of consumer durables in particular but also non-durables continuing to outperform.

- A similar pattern is evident in the levels of production by type of good relative to February 2020. Production of capital goods is more than 4% below its pre-pandemic level, while output of intermediate (0.9%), consumer non-durables (1.2%), and consumer durables (4.4%) is above the levels in February 2020.

- Ireland's consumer prices, measured by the European Union's harmonized index, rose by 2.2% year on year (y/y) in July. Inflation had stood at 1.6% y/y in June. (IHS Markit Economist Diego Iscaro)

- Inflation had been negative for most of 2020, averaging -0.5%. However, higher oil and other commodity prices have driven a substantial acceleration since the start of the second quarter, and July's reading was the highest since late 2012.

- In July, inflation was boosted substantially by higher transport costs (+7.9% y /y, following +3.1% y/y in June), while housing/electricity costs also accelerated further (+5.3% y/y, following +4.9% y/y). Transport costs increased mainly due to higher prices for diesel/gasoline (petrol), as well as rising airfares.

- Meanwhile, higher prices of home heating oil and electricity/gas boosted housing costs in July.

- Prices in restaurants/hotels also increased markedly (+3.1% y/y), pushed up by higher prices for alcoholic drinks/food, as well as higher costs of hotel accommodation.

- On the other hand, prices of clothing/footwear collapsed by 7.2% y/y in July, driven by negative base effects from a 1.5% y/y increase in July 2020.

- Core inflation (i.e., excluding energy and unprocessed food) stood at 1.4% in July, up from 0.9% y/y in June.

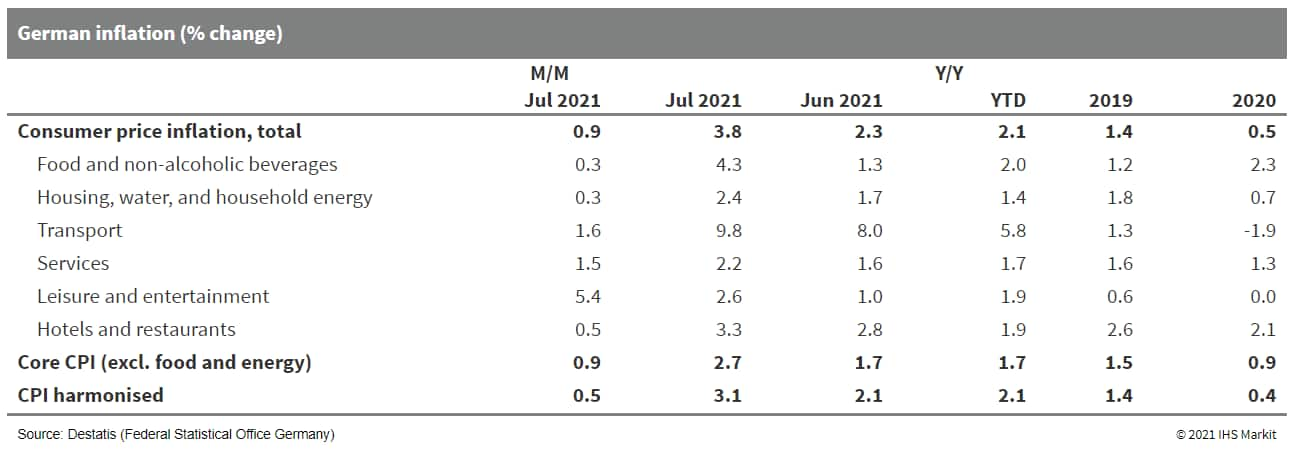

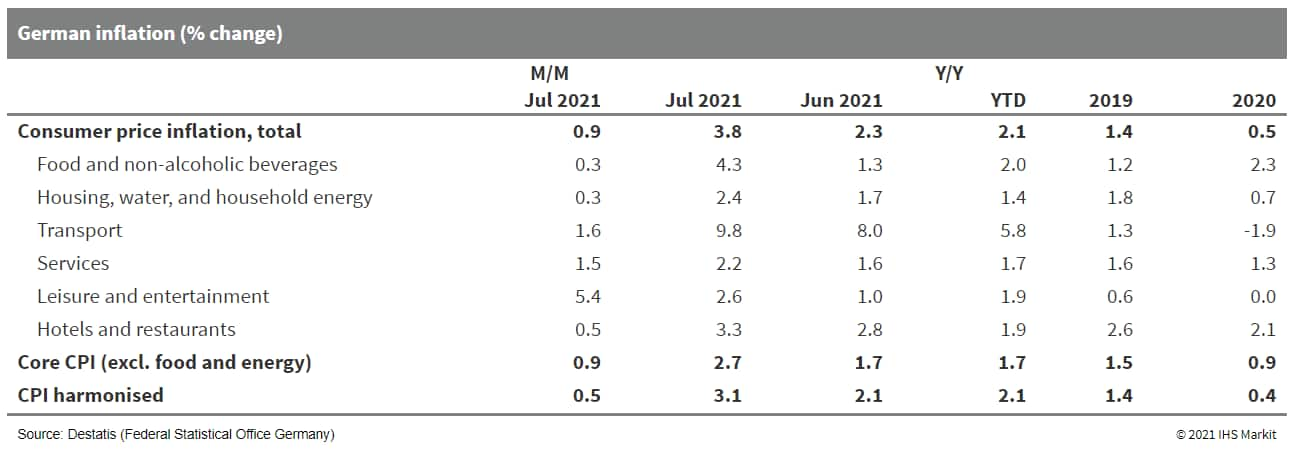

- Various measures of German consumer price index (CPI) inflation jumped by at least one percentage point in July, with much, but not all, of this owing to the base effect caused by the temporary value-added tax (VAT) cut implemented in July 2020. Ongoing pipeline pressure linked to supply-chain disruption is also contributing. (IHS Markit Economist Timo Klein)

- Final July data based on national methodology from the Federal Statistical Office (FSO) confirm the "flash" data release of 29 July, posting readings of 0.9% month on month (m/m) and 3.8% year on year (y/y). The latter represents a sharp increase from 2.3% in June, contrasting starkly with average inflation of 1.4% in 2019 and 0.5% in 2020.

- The EU-harmonized CPI measure increased by a more limited 0.5% m/m in July, which nonetheless pushed its annual rate up from 2.1% to 3.1% y/y. This compares with -0.7% y/y as recently as December 2020 and now markedly exceeds the eurozone average (2.2%).

- July's national measure of core CPI inflation (excluding food and energy) jumped from 1.7% to 2.7% y/y, well above the 1.4% average during the first four months of 2021, let alone the December 2020 level of 0.4%. Most of this latest leap owed to the base effect of the implementation of a temporary VAT cut in July 2020 that expired six months later. However, the loosening of pandemic-related restrictions since May has contributed too, as companies returning to business - be it those providing for non-essential goods or those engaged in recreation and cultural activities - are taking advantage of pent-up consumer demand to try and recoup some of the losses they sustained during the lockdown periods. Annual inflation rates for those categories thus increased by more than the one percentage point warranted by the VAT effect alone.

- Mercedes-Benz has updated its Car-to-X communication system to add functions that can detect large potholes, according to a company statement. New C-Class and S-Class models, as well as the EQS, are deployed with the updated system, which can detect potholes or speed bumps. If the chassis control unit registers such a hazard and the "Car-to-X Communication" service is enabled, the information along with positional data is sent to the Mercedes-Benz Cloud in real time over the mobile phone network. This alerts other Mercedes-Benz cars in the area with an audible warning and the icon is visually highlighted about 10 seconds before reaching the relevant lane section. In most of the Mercedes-Benz cars the warnings are issued via an audible alert as "Traffic event ahead", but it will be stated as "Look out, pothole!" or "Attention, speed bump" in new C-Class, S-Class, or EQS models. The new alerts are now available in selected markets worldwide, and in all 36 languages recognized by the infotainment system. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Lanxess says its second-quarter net profit dropped 87.5% year on year (YOY), to €100 million ($117 million), on sales up 27.5%, to €1.83 billion. The decline in net profit is attributed mainly to the extraordinary proceeds included in the company's prior-year results from the sale of its 40% stake in chemical park curator Currenta, the company says. Sales were lifted by increased demand as well as higher selling prices that were driven by rising raw material costs, Lanxess says. The company managed largely to pass on the "sharp increase" in raw material costs in all segments through price hikes, it says. Second-quarter EBITDA increased 24.7% YOY, to €247 million, and EBIT more than doubled, to €125 million, prompting the company to raise its full-year earnings guidance.

- Increasingly strong demand from the automotive industry has benefited mainly Lanxess's engineering materials business, which reported 73.8% YOY growth in sales, to €424 million. EBITDA pre exceptionals more than doubled YOY, to €68 million, "despite higher freight and energy costs and the unavailability of a key supplier," the company says. Lanxess expects the business's earnings to significantly exceed the previous year's low level in the current year, due mainly to the strong recovery of the automotive industry. (IHS Markit Chemical Advisory)

- The company's advanced intermediates business recorded 17.4% higher YOY sales, to €505 million, driven by higher volumes and prices. EBITDA pre exceptionals fell 6.8% YOY, to €96 million, impacted by higher energy and freight costs, the company says. "Earnings in the prior-year quarter also included positive price effects, as lower raw material prices were not passed on to the market immediately," the company adds. Lanxess expects business for advanced intermediates in 2021 to be slightly above the previous year's level.

- Lanxess's specialty additives business saw sales rise 28.5% YOY in the second quarter, to €568 million, on increasingly strong demand and higher selling prices, the company says. EBITDA pre exceptionals was €89 million, up 48.3% YOY. The company continues to expect that full-year earnings in specialty additives will surpass the previous year's level significantly.

- Sales of the company's consumer protection business were up 4.3% YOY, to €314 million, on higher volumes and positive contributions from the recently acquired Intace and Theseo, Lanxess says. EBITDA pre exceptionals was €65 million, down 4.4% YOY due to higher energy and freight costs, and price effects, the company says. Lanxess expects the business to significantly exceed its prior-year performance thanks to the portfolio effect of the Emerald Kalama Chemical acquisition that was completed earlier this month.

- The latest PMI data signaled quicker growth of the Italian private sector economy during July, as the loosening of COVID-19 restrictions provided a sustained boost to client demand across manufacturing, services and construction, with the latter also continuing to benefit from government eco- and super-bonus tax relief schemes. (IHS Markit Economist Lewis Cooper)

- The All-Sector Output Index - a weighted average of the comparable manufacturing, services and construction PMI indices - rose to 58.4 and signaled the second-strongest rate of expansion in all-sector output in 15 years, behind only January 2018.

- At 55.8, the Italy Construction Total Activity Index® pointed to a sixth straight monthly rise in activity. The rate of expansion remained sharp, despite easing further from May's 14-year high. Much like the manufacturing sector, supply-side constraints weighed on construction output in July. Lead times for inputs lengthened to a near record degree amid reports of severe material shortages, with constructors noting that delayed inputs had put the brakes on some projects.

- Client demand remained buoyant, however, in part due to the eco- and super-bonus schemes introduced by the Italian government. The incentives, launched first in 2020, provide tax relief of 110% for expenses used to improve the energy efficiency of properties, and have been widely attributed by survey respondents to strong demand in the construction sector since their inception.

- Supply-side constraints and material shortages have also led to unprecedented inflationary pressures in recent months. The Italy All-sector Input Prices Index hit a near 21-year high in July and pointed to a severe rate of cost inflation, with rising input prices recorded across each of the three monitored sectors.

- Manufacturing saw the steepest increase in costs, followed by construction, although both experienced a slight easing of inflationary pressures from record highs recorded in June. Services firms too have felt the impact of cost inflation, with supply-side constraints, as well as rising wage bills, noted as drivers of the fastest increase in operating expenses since September 2008 during July.

- Renault Group's RCI Bank and Services unit has announced that it has acquired Spanish car subscription start-up Bipi. According to a statement, the company provides a multi-brand platform that provides a subscription offers for used cars. RCI Bank and Services has said that it support Bipi to accelerate its growth and to open new markets, together with its current supply partners and in conjunction with Renault Group's dealership partners. At the same time, Bipi will design the subscription model for RCI Bank and Service's Mobilize activities. (IHS Markit AutoIntelligence's Ian Fletcher)

- The costs of an upcoming carbon-related export rule in the European Union (EU) could amount to more than $900 million annually for trading partners in Turkey, a new study suggests. The proposed rule, called the Carbon Border Adjustment Mechanism (CBAM), aims to prevent carbon-intensive industrial activity from taking place in non-EU countries, for import to EU-area customers. It is one of the elements of the Fit for 55 package of proposals released by the EC in July to enable the EU to reach its goal of 55% GHG reductions by 2030 from 2005 levels. The study, released on 29 July by the Climate Change and Sustainable Transition consultancy, was commissioned by the European Bank for Reconstruction and Development (EBRD). As proposed, CBAM will put Turkey's aluminum, cement, and steel sectors under special pressure. Turkey neighbors the EU and serves as a close trading partner with the European bloc. The fee would reflect that manufacturers in Turkey pay a carbon price below that of competitors in the EU. In terms of financial impact, much depends on how extensive the new CBAM measures will be trading partners outside the EU, the EBRD said. That variation will move according to type, or "scope," of emissions, as well as differences among sectors. (IHS Markit Net-Zero Business Daily's William Fleeson)

- South Africa's month-on-month real seasonally adjusted manufacturing production fell for a third consecutive month during June. The South African economy's manufacturing sector performance remains lackluster due to insufficient demand and raw material shortages. (IHS Markit Economist Thea Fourie)

- The 0.7% month-on-month (m/m) decline in real seasonally adjusted manufacturing output in June pulled the year-on-year (y/y) growth rate down to 12.7%, from 38.0% y/y in May and 83.0% y/y in April. The suspension of most business activities during April-May 2020 following the introduction of coronavirus disease 2019 (COVID-19) pandemic-related government restrictions left the base of comparison last year significantly lower during the second quarter of 2021.

- The monthly fall resulted in a 1.0% quarter-on-quarter (q/q) slowdown in real seasonally adjusted manufacturing production during the second quarter of 2021. Six of the 10 manufacturing sub-sectors recorded contractions over this period, the national statistical service, Statistics South Africa (StatsSA), reports.

- The petroleum, chemical products, rubber, and plastic products division reported the largest contraction during the second quarter (with output down 7.3% and contributing minus 1.4 percentage point), while the basic iron and steel, non-ferrous metal products, metal products and machinery division made the largest positive contribution (with growth of 3.0% and contributing 0.6 percentage point). Other sub-sectors that made a positive contribution included furniture and other manufacturing (up 4.4% and contributing 0.1 percentage point) and the wood and wood products, paper, publishing, and printing (up 1.2% and making a 0.1-percentage-point contribution).

- Nominal seasonally adjusted manufacturing sector sales fell by 0.3% m/m in June. Sectors making the biggest contribution to the 2.3% q/q rise in nominal seasonally adjusted manufacturing sales during the second quarter included food and beverages followed by the basic iron and steel, non-ferrous metal products, metal products, machinery sub-category and petroleum, chemical products, rubber, and plastic products sub-category.

- Mauritius's annual CPI inflation rate maintained its upward trajectory in July, increasing to a 40-month high of 6.5% y/y from 5.9% y/y in June. (IHS Markit Economist Archbold Macheka)

- Notable price surges were recorded in the transport category, with a 2.9-percentage-point rise to 8.7% y/y from 5.8% y/y in June.

- Alcoholic beverages and tobacco prices increased 10.3% y/y in July, compared with 8.2% y/y in June. Additional upward price pressure came from clothing and footwear costs, which rose 2.5% y/y in July from 2.3% y/y in June; recreation and culture (4.7% y/y from 4.3% y/y for the same months); miscellaneous goods and services (5.4% y/y from 4.8% y/y); and housing and utilities (0.1% y/y from 1.7% y/y).

- However, inflation for food and non-alcoholic beverages slowed to 9.4% y/y in July from 10.7% y/y in June.

- Month on month, CPI inflation decelerated to 0.3% in July from 1.5% in the previous month. CORE1 inflation, which excludes food, beverages and tobacco components and mortgage interest on housing loans from headline inflation, printed 4.9% y/y in July, compared with 1.7% y/y in July last year. CORE2 inflation, which excludes food, beverages and tobacco, mortgage interest on housing loans, and electricity, gas, other fuels from headline inflation, was 5.0% y/y in July, compared with 2.5% y/y in July 2020.

- Coca-Cola HBC, one of the bottlers in the Coca-Cola system, has reached agreement to acquire approximately 94.7% of Coca-Cola Bottling Company of Egypt (CCBCE) from its major shareholders and certain of its affiliated entities for an agreed combined purchase price of $427 million. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- The proposed transaction will allow Coca-Cola HBC Holdings direct access to the second largest non-alcoholic ready-to-drink market in Africa by volume, as Nigeria and Egypt account for roughly one-quarter of the continent's population.

- Coca-Cola HBC, which agreed to buy CCBCE from a wholly owned affiliate of The Coca-Cola Company (TCCC) and MAC Beverages Limited (MBL), operates plants in Europe, Africa, and Asia.

- The proposed transactions involve the acquisition of a majority stake of approximately 52.7% of CCBCE from MBL for $304 million and completion of the MBL transaction is expected to take place in late Q4 2021.

- In addition, the proposed transactions include the acquisition of approximately 42% of CCBCE from a wholly owned affiliate of TCCC for approximately USD123 million, subsequent to, and conditional upon, completion of the MBL transaction.

Asia-Pacific

- Major APAC equity markets closed mixed; India +0.6%, Australia +0.1%, Japan -0.2%, Mainland China -0.2%, South Korea -0.4%, and Hong Kong -0.5%.

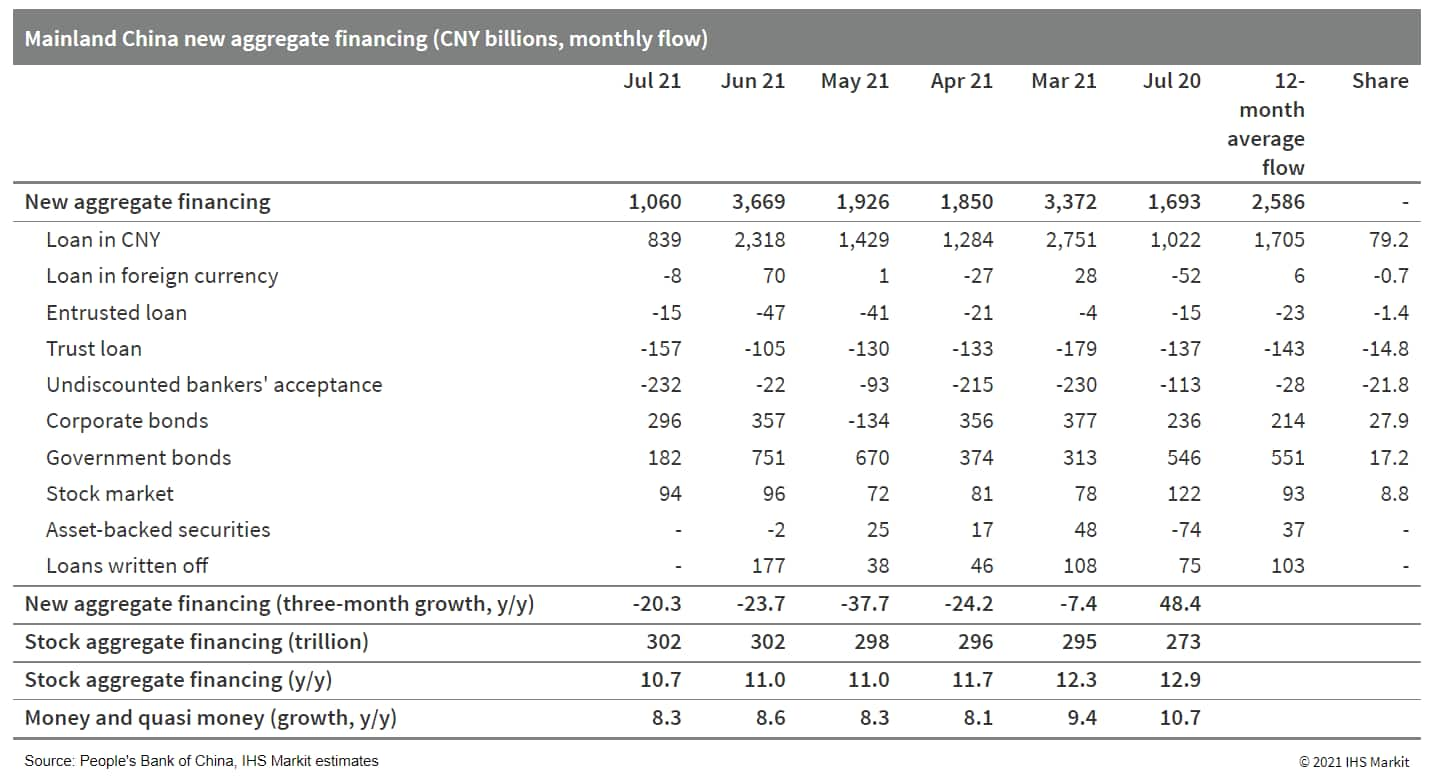

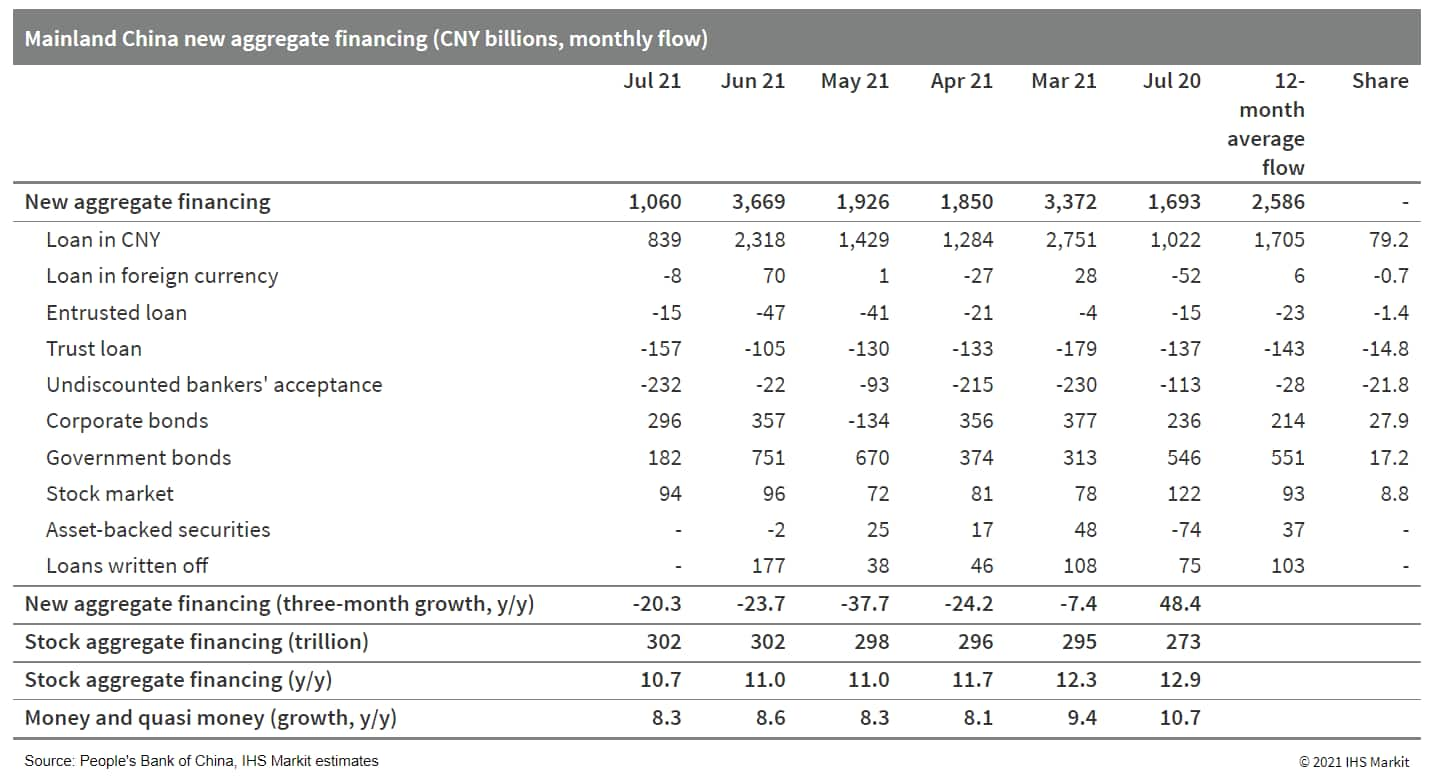

- Mainland China's new total social financing moderates in July, driven by slow government bond issuance and weak bank loans. (IHS Markit Economist Lei Yi)Mainland China's new total social financing (TSF), the broadest measure of net new financing to the real economy, amounted to CNY1.06 trillion (USD163.7 billion) in July, down by CNY636.2 billion year on year (y/y) according to the People's Bank of China (PBOC). Stock TSF reached CNY302.49 trillion by the end of July, representing a year-on-year growth of 10.7%, down by 0.3 percentage point from June.

- The moderation in new TSF was largely due to the weakness in government bond issuance, which registered year-on-year decline of CNY364 billion. The sluggish pickup in fiscal expenditure so far this year is also reflected in the increase in fiscal deposits, which rose CNY600.8 billion y/y. Regarding bank lending to the real economy, medium-to-long-term financing demand weakened for both corporates and households in July. The year-on-year expansion in overall corporate borrowing entirely came from paper financing; all components of household borrowing declined year on year in July, with medium-to-long-term loans logging a third consecutive month of year-on-year contraction as tightened mortgage availability continued to bite.

- Broad money supply (M2) expanded by 8.3% y/y in July, lower by 0.3 percentage point from the growth in the prior month. M1 grew by 4.9% y/y in July, down by 0.6 percentage point from June and marking the sixth month of consecutive decline.

- Cumulatively, new TSF totaled CNY18.8 trillion in the first seven months of 2021, a CNY3.77 trillion year-on-year reduction but higher by CNY2.89 trillion versus the comparable 2019 level. New bank loans amounted to CNY13.84 trillion, up by CNY761.6 billion y/y through July.

- US exporters have made little progress in increasing their US horticultural shipments to China, according to a recent USDA report. The US-China Economic and Trade Agreement (Phase One) granted market access for new products such as avocadoes, blueberries, and nectarines in February 2020. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Export opportunities for US fruit products include introducing new fruit varieties, engaging consumers through e-commerce platforms, and expanding into a greater number of Chinese cities. However, the quality of Chinese domestic produce has improved steadily and increasingly competes with imported fruits, especially those with overlapping seasons, such as products from the US.

- In the first half of this year, China's total fruit imports by value was dominated by both tropical fruits from neighboring ASEAN countries and products from Free Trade Agreement (FTA) partners (New Zealand, Australia and Chile) with countercyclical seasonal production to China. For ASEAN countries with land borders, transportation of products was less impacted by increases in international logistics costs.

- US horticultural products have many similar constraints as other US exports to China due to the bilateral environment, high international shipping costs and China's COVID-19 testing/disinfection requirements. However, the perishable nature of horticultural exports adds another level of complexity for US produce.

- Established and new-to-market US horticultural products must also compete with domestically produced fruits, China's retaliatory Section 232 and Section 301 tariffs, and other country products that qualify for zero tariffs under FTAs.

- China's ongoing retaliatory Section 232 tariffs (at 15% in addition to normal MFN rates) and competitor FTAs put US horticultural products at a disadvantage. Multiple countries including Peru, Mexico and Chile have market access for several of these fruits.

- Continental has carried out a wide-ranging global study into consumer attitudes towards autonomous vehicle technology, which found a greater degree of acceptance in China and Japan in comparison to Europe and the US. The Continental Mobility Study: "From Driver to Passenger: Automated Driving Is Gaining Acceptance Worldwide" surveyed 5,000 respondents in Germany, France, the US, China, and Japan, asking for their views on mobility. It found that while in general more and more drivers see benefits to autonomous vehicles, there is still skepticism, particularly in Europe and the US. However, openness to driver assistance systems and automated driving is very high, while safety-related functions such as turn assist systems are seen as being particularly positive. There is a great deal of agreement across the countries in terms of the current arguments against autonomous vehicle operation: in all countries, around 80% of respondents say that legislation has so far not created a relevant framework for technical development on the manufacturer side. They also argue that policymakers should establish central guiding principles for use in daily road traffic. (IHS Markit AutoIntelligence's Tim Urquhart)

- Autonomous vehicle (AV) startup Pony.ai is considering holding its plan to go public in New York through a merger with a special purpose acquisition company (SPAC), reports Reuters. This comes after Pony.ai failed to obtain assurances from the Chinese government regarding increasing scrutiny levels against technology firms. According to the report, Pony.ai is now seeking to raise money in a private fundraising round at a valuation of USD12 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China has urged the automakers to strengthen their data protection and store locally generated data in the country, reports Reuters, citing a new policy by the Ministry of Industry and Information Technology. According to the report, under the guidelines, automakers will need to obtain permission from regulatory authorities both when they need to export critical data and before they update in-car systems. The authorities are expected to implement the Data Security Law in September, which would require companies that process "critical data" to conduct risk assessments and submit reports. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- MG Motor India has introduced the concept of Car as a Platform (CAAP), according to company sources. The automaker is in the process of building an ecosystem that comprises various in-car services as well as subscriptions in the functional areas of utility, entertainment (including personalized engagement), security, insurance, and consumer payment, among others. The automaker is reportedly working with various global ecosystem partners and third parties on emerging technologies such as blockchain, machine learning, and artificial intelligence (AI) to form the CAAP support system. The automaker will also offer opportunities to developers to create applications and services. MG Motor, while looking to take "first mover" advantage, aims to create safer and smarter driving experiences such as on-demand in-car needs while addressing the convenience of its customers. (IHS Markit AutoIntelligence's Tarun Thakur)

- Australian researchers have found red seaweed has the ability to reduce cow and sheep methane production by up to 90% when mixed with stock feed. The findings have led the South Australian Government to recently announce AUD1.5 million in funding over two years to support the establishment of a commercial seaweed industry in the state. It says seaweed production could be worth AUD140 million a year in South Australia with the potential to create 1,200 jobs. This has also prompted the first licenses to establish a commercial seaweed farm to be granted and a partnership between seaweed producers and livestock companies. Two licenses were granted in January to allow a commercial seaweed farm to be established on South Australia's Yorke Peninsula. The production leases and licenses were granted to the Narungga Nation Aboriginal Corporation (NNAC). NNAC is working in partnership with CH4 Global, a company focused on farming marine seaweeds for commercial purposes to reduce greenhouse emissions in the livestock industry. Meanwhile, CH4 Global last month announced a world-first agreement to supply enough Asparagopsis seaweed supplement for up to 10,000 head of cattle to an agriculture hub near the South Australian city of Port Pirie. Cattle are a major contributor to greenhouse gas emissions with every one of the 1.5 billion cows on the planet producing about 100kg of methane a year. Research by Australia's peak scientific body CSIRO found that the red seaweed Asparagopsis mixed with regular cattle feed at a rate of 100 grams per cow per day reduced methane production by 90%. (IHS Markit Food and Agricultural Commodities' Max Green)

- Southeast Asia made up the largest proportion of new deaths related to COVID-19 in the past seven days, while the Western Pacific region showed the highest increase in cases and mortality, the World Health Organization (WHO) said in its COVID-19 Weekly Epidemiological Update published on 10 August (see here). According to the data, as of 8 August, Southeast Asia represented 32% of new COVID-19-related deaths (20,702 deaths), followed by the Americas at 30% (19,832); Europe at 15% (9,562); the Eastern Mediterranean at 9% (6,000); and Africa and the Western Pacific, at 7% (4,743) and 7% (4,633) respectively. In terms of cumulative COVID-19 deaths, however, the Americas represented the largest proportion of deaths in the seven-day period at 47% (2,030,101); followed by Europe at 29% (1,230,343); Southeast Asia at 14% (590,988); the Eastern Mediterranean at 6% (242,229); Africa at 3% (122,025); and the Western Pacific at 2% (69,722). The Western Pacific, however, showed the greatest weekly increase in mortality, with a 46% jump over the previous seven-day period. Southeast Asia's spike in deaths related to COVID-19 is alarming, given the regional countries' early efforts - and arguably, success in Thailand, Cambodia, Laos, and Vietnam - in controlling the spread of their outbreaks. Vietnam, for example, had earned early praise for its strict COVID-19 control measures. However, the country is now expanding its lockdown measures amid a surge in the Delta variant, with authorities reporting 7,623 new confirmed COVID-19 cases, with more than 85% of its total 177,813 confirmed cases recorded only in the past month. According to data from Johns Hopkins University, approximately half of Vietnam's total 2,327 deaths related to COVID-19 were reported in the past month. (IHS Markit Life Sciences' Sophie Cairns)

- Vietnamese conglomerate Vingroup JSC has contributed VND510 billion (USD22.3 million), equivalent to 51% of the total capital, to establish VINES Energy Solutions JSC (VinES), reports the Vietnam News Summary. Pham Nhat Vuong, chairman of Vingroup, contributed VND485 billion or 48.5% of the capital, and Phan Thu Huong owns 0.5%. VinES's main business is manufacturing batteries and accumulators. (IHS Markit AutoIntelligence's Jamal Amir)

- The prospects for a blossoming of floating solar generation capacity in Indonesia accelerated over the past couple of weeks, including construction starting on the nation's biggest facility to date and the unveiling of plans for a project over 10 times the current recordholder's size. Such developments are representative of a wider flowering of floating solar prospects across the globe since the start of 2021, especially in Asia, IHS Markit Senior Research Analyst Christine Beadle told Net-Zero Business Daily. In Indonesia, floating solar is set to form part of a wider, technology-agnostic push into renewables, as the world's largest coal exporter seeks to expand its generation fleet to meet the growing electricity needs of about 270 million people. Indonesia has the world's fourth-largest population. State-owned utility monopoly Perusahaan Listrik Negara (PLN) began construction on a 145-MW floating solar facility in the first week of August. The project is expected to begin commercial operations in November 2022, it said 3 August. The $140-million Cirata floating solar project is a joint venture between PLN and a unit of UAE-backed clean energy developer Masdar. Cirata is backed by a power purchase agreement signed in January 2020 with another unit in the PLN family. The developers say it is the largest floating solar project currently under construction in Southeast Asia. Cirata is seen as the first of many floating solar projects by the Indonesian government. Deputy Minister of State-Owned Enterprises Pahala Nugraha Mansury said 3 August that Cirata would be a pilot for the development of renewable energy plants in other parts of the archipelago of 17,508 islands as Indonesia targets a 23% share of power generation for renewables by 2025. To put that in context, at the end of 2020, Indonesia had 3 GW of installed renewable capacity, or 4.4% of its overall generation fleet, according to IHS Markit data. Of the 3 GW of renewable capacity, 2.1 GW was geothermal. (IHS Markit Net-Zero Business Daily's Keiron Greenhalgh)

- The latest GDP statistics for the second quarter of 2021 showed that the Philippines economy grew by 11.8% year-on-year, after five consecutive quarters of contraction, the recovery is dampened by new COVID-19 cases. (IHS Markit Economist Rajiv Biswas)

- Private consumption was a key driver for the return to positive year-on-year growth in the second quarter of 2021, as household final consumption expenditure rebounded by 7.2% year-on-year, although government final expenditure fell by 4.9% y/y. Exports grew by 27% y/y in the second quarter of 2021, helped by the economic rebound in key global markets, including the US, EU and China.

- An important stabilizing factor for the Philippines economy has been overseas worker remittances by Filipinos working abroad, which remained quite stable during 2020, down only 0.8% y/y, and equivalent to around 10% of GDP.

- Economic conditions had gradually improved in the fourth quarter of 2020 and during the first half of 2021, with manufacturing output rising by 22.3% y/y in the second quarter of 2021. However, the recent severe escalation in the pandemic has created renewed uncertainty about the momentum of economic recovery in the remaining months of 2021.

- The IHS Markit Philippines Manufacturing PMI fell from 50.8 in June to 50.4 in July, still registering slightly above the 50.0 no-change threshold that separates expansion from contraction. This followed declines seen in April and May, when escalating daily new cases had resulted in protracted lockdown measures, impacting economic activity. The protracted virus-related restrictions in the Philippines have contributed to weak domestic demand and softer consumption spending in July.

Posted 12 August 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.