Most major US and European equity indices closed higher, while APAC was mixed. The US bond market was closed in observance of Veteran's Day. Benchmark European bonds closed lower and European iTraxx closed almost flat on the day across IG and high yield. The US dollar, natural gas, oil, gold, silver, and copper were all higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for DJIA -0.4%; DJIA -0.4%, S&P 500 +0.1%, Nasdaq +0.5%, and Russell 2000 +0.8%.

- DXY US dollar index closed +0.3%/95.18.

- Gold closed +0.8%/$1,864 per troy oz, silver +2.1%/$25.30 per troy oz, and copper +1.8%/$4.40 per pound.

- Crude oil closed +0.3%/$81.59 per barrel and natural gas closed +5.4%/$5.25 per mmbtu.

- Hospitals in some parts of the U.S. are already starting to see the impact of an autumn wave of COVID-19 infections, the latest sign that the health-care system still faces serious pressure from the virus, even in places that have achieved relatively high vaccination rates. Intensive-care unit beds occupied by COVID-19 patients are climbing in 12 states from two weeks earlier, with most of them in a contiguous strip running from Arizona and New Mexico, through the Great Plains and into Minnesota. In several Western states, many doctors and nurses haven't caught their breath from the last round of infections. (Bloomberg)

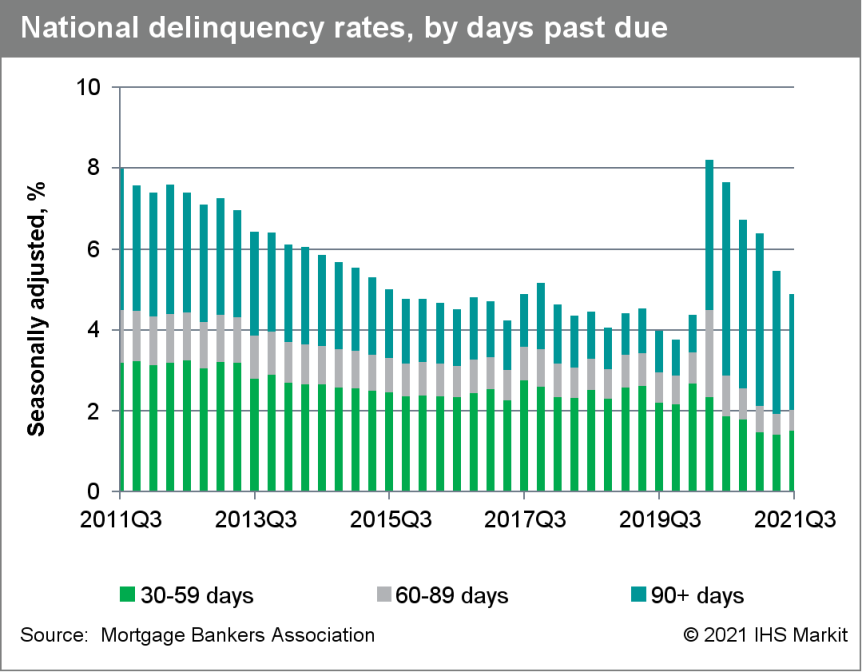

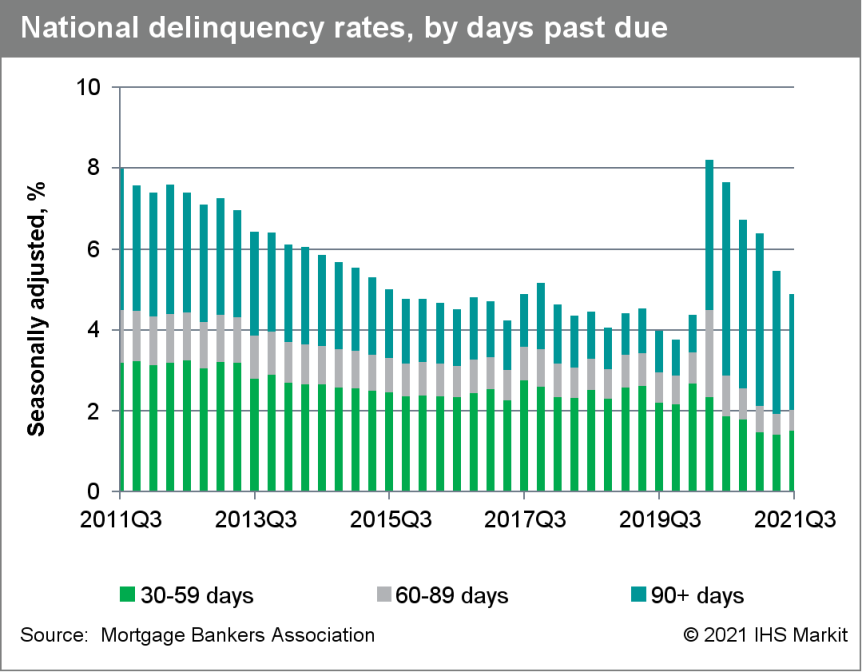

- The US seasonally adjusted delinquency rate fell 59 basis points from the second quarter and 277 basis points from a year earlier to 4.88%; it was 3.77% at the end of 2019, the last quarter not impacted by the pandemic. (IHS Markit Economist Patrick Newport)

- The serious delinquency rate—loans more than 90 days delinquent or in foreclosure—was 3.40%, down 63 basis points from a year earlier; it was 1.76% in the fourth quarter of 2019.

- The percentage of loans in the foreclosure process was 0.46%, down 13 basis points from a year earlier and the lowest reading since the fourth quarter of 1981.

- The seasonally adjusted 30-day delinquency rate increased 10 basis points to 1.51%; the 60-day delinquency rate was unchanged at a record low 0.52%; the 90-day delinquency rate plunged 68 basis points to 2.85%.

- The seasonally adjusted rate on new foreclosures slipped to a historically low 0.03%—almost zero.

- The largest delinquency rate decreases: Nevada (98 basis points), Hawaii (83 basis points), New Jersey (74 basis points), Maryland (72 basis points), and Connecticut (71 basis points).

- The worst performers: Louisiana (118 basis points increase), Wyoming (3 basis points increase), Iowa (5 basis points decrease), Montana (10 basis points decrease) and West Virginia (14 basis points decrease).

- The key to understanding this report is that the Mortgage Bankers Association (MBA) considers loans in forbearance to be delinquent because "the payment was not made based on the original terms of the mortgage." A forbearance delays, not forgives, mortgage payments. About 1 million borrowers were on forbearance plans at the end of October.

- Noble Corporation and Maersk Drilling entered into combination agreement. The combined company will be named Noble Corporation. Shareholders of Noble Corporation and Maersk Drilling will each own 50% of the outstanding shares of the combined company. The combination has been approved by the boards of both companies and will be headed by Robert W. Eifler, Noble's current CEO. The larger Noble will have a seven-member board of directors with balanced representation from both companies. The combined company will have a modern, high-end fleet of floaters and jackup rigs across benign and harsh environments able to meet the needs of customers in the most attractive oil and gas basins. The combined company will be headquartered in Houston, and will maintain an operating presence in Stavanger, Norway, to retain proximity to North Sea customers. (IHS Markit Upstream Costs and Technology's Vishnu Gupta Kothuri)

- US Environmental Protection Agency (EPA) administrator Michael Regen has said the regulatory agency plans to propose a "really aggressive" final rule on model-year (MY) 2023-26 light-vehicle emissions, which it expects to be "more legally durable", media reports state. According to the reports, the White House is beginning an inter-agency review of the drafted rule and plans to impose new requirements in December. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The EPA's proposal released in August received some criticism that actual emission reductions could be cut by various provisions. Regan said that the August proposal gave the EPA "a little bit more time to continue to do our own analysis" as it drafts a proposal on the final regulation.

- The administrator says the agency is looking to develop a stronger rule with less risk of legal challenges. He reportedly said, "It's one thing to want to propose something that feels good or that - quote, unquote - may be the right thing to do from a subjective standpoint. But the right thing to do is to follow the law, follow the science and build the strongest technical record… Some in the past, I think, have thought you have to come out with the strongest possible solution in the beginning and have the comment period support that original theory. We believe we're coming out with something that is really aggressive, but we also anticipate that comments from industry, from technology providers and from NGOs will just give us more information so the final rule is more legally durable."

- The EPA administrator's latest remarks provided no clear insight into the changes that might be incorporated into the final emissions rule. However, the suggestion is that the final rule could be more stringent than the proposal released in August, or some of the credits for off-cycle efficiencies and methods for calculating credits could change.

- Ford researchers have invented a patent-pending method of cooling cables at electric vehicle (EV) charging stations, potentially reducing charging times. The work was undertaken in collaboration with researchers at Purdue University in West Lafayette, Indiana (United States). According to a company statement, the new technology uses liquid as an active cooling agent, extracting heat as the liquid changes to vapor and potentially enabling higher current. Ford believes that the new technology, in combination with in-development vehicle charging technology, could reduce average EV recharging times. Michael Degner, senior technical leader, Ford Research and Advanced Engineering, said, "Today, chargers are limited in how quickly they can charge an EV's battery due to the danger of overheating. Charging faster requires more current to travel through the charging cable. The higher the current, the greater the amount of heat that has to be removed to keep the cable operational." The key difference between the new technology Ford and Purdue are working on and current liquid-cooled technology is that the cable uses liquid as an active cooling agent, which can help extract more heat from the cable as it changes from liquid to vapor. Although the automaker provided no specific timeline on when the technology might be commercialized, Ford said it could "one day" deliver more power than today's re-charging systems and could "eventually lead to recharging EVs as quickly as conventional gas station fill-ups". (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup Kodiak Robotics has raised USD125 million in a Series B funding round, according to a company statement. This brings the company's total raised capital to date to USD165 million. New investors such as SIP Global Partners, Lightspeed Venture Partners, Battery Ventures, CRV, Muirwoods Ventures, Harpoon Ventures, StepStone Group, Gopher Asset Management, Walleye Capital, and Aliya Capital Partners, as well as previous investments from Bridgestone Americas and BMW i Ventures, were involved in this latest round of financing. Kodiak Robotics plans to use the infused capital to double its employee headcount by adding at least 85 new people over the next 12 months. The funds will also be used to expand its autonomous service capabilities from coast to coast and to add 15 new autonomous trucks to its fleet, resulting in a total of 25. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A Texas judge has temporarily blocked state health officials from banning sales of delta-8 THC, handing a major win to hemp industry interests who argue the "light weed" cannabinoid is legal under state law and the 2018 Farm Bill. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Travis County Judge Jan Soifer sided with Austin-based Hometown Heroes and found the Texas Department of State Health Services (DSHS) overstepped its authority when it declared delta-8 a controlled substance under state law. The company filed suit last month against DSHS, arguing it failed to follow proper procedures and did not adequately notify retailers of its new policy.

- The state agency made its decision on delta-8 last year and held a public hearing in October 2020, but no one participated in the hearing and hemp interests criticized officials for not providing adequate notification. DSHS says it posted a clarification on the policy last month at the request of the hemp industry - state officials say Texas hemp law bars delta-8 products as it only legalized products containing hemp, which is defined by the 2018 Farm Bill as cannabis that contains 0.3% or less delta-9 THC.

- Hometown Heroes and other Texas hemp interests aren't convinced and the lawsuit alleges DSHS "modified the Schedule of Controlled Substances in blatant violation of state law through multiple errors and in a manner that failed to properly notify the public of its significant positional change."

- Soifer agreed with the request for a preliminary injunction and said the plaintiffs had asserted a "valid claim … for declaratory and injunctive relief." The state is expected to appeal the decision, which unless reversed will be in place until the litigation is resolved─a trial date has been set for January 28, 2022.

- Belize completed its cash tender offer to repurchase USD553 million of its 2034 issue at a discount, which it described as reducing its indebtedness by "approximately USD250 million (representing approximately 12% of Belize's GDP)". (IHS Markit Economist Brian Lawson)

- The repurchase was at 55% of nominal value, with 87% of bondholders having agreed to participate in the tender.

- The remaining bondholders, reported by BBN agency as being largely from Venezuela, will now be forcibly repaid under the bond's collective action clause, but without accrued interest.

- On 5 November, it announced settlement of the transaction using funds "provided by a subsidiary of The Nature Conservatory" (TNC) as part of the latter's Blue Bonds for Ocean Conservation Program (BBOC).

- The transaction was supported by the United States International Development Finance Corporation (DFC), which provided USD610 million in "political risk insurance" to cover both principal and interest payments on USD364 million of new Blue Bonds.

Europe/Middle East/Africa

- Most major European equity indices higher except for Spain -0.5%; UK +0.6%, Italy +0.3%, France +0.2%, and Germany +0.1%.

- Most 10yr European govt bonds closed lower except for UK flat; France +1bp, Germany +2bps,

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +1bp/248bps.

- Brent crude closed +0.3%/$82.87 per barrel.

- The European Parliament's Agriculture Committee (AGRI) is pushing for farming products to be covered in the EU's new carbon border tax on high-emitting imports. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- AGRI published its draft opinion on the European Commission's proposed Carbon Border Adjustment Mechanism (CBAM) where one amendment to the legal texts called for EU agriculture imports to be included in the future levy.

- "The scope of the CBAM should be extended to agricultural products without undue delay," AGRI's document reads.

- On 14 July, the European Commission published its CBAM proposal which initially included fertilizers as the main target area related to agriculture - with the EU executive largely concerned about emissions linked to producing ammonia, urea, nitric acid and ammonium nitrate.

- AGRI's Zbigniew Kuźmiuk (European Conservatives and Reformists) drafted the opinion and said during a meeting on 9 November that including agriculture in the CBAM can create a fairer marketplace for EU farmers.

- The CBAM wants EU trading partners to fill out CO2 certificates which correspond to the price that would have been paid if the imported products were produced following European CO2 rules, namely the EU's Emissions Trading System (ETS), where carbon is expressed in €/ton of CO2 emitted.

- AGRI's draft opinion argues that agricultural products should be included in this approach since the sector will already be both directly and indirectly affected by CBAM's inclusion of other sectors, notably fertilizers, but also steel and aluminum.

- Daimler Truck and TotalEnergies have signed a formal agreement under which the two companies will collaborate on creating a hydrogen fuel-cell network to fuel hydrogen trucks, according to a company statement. The partners will "collaborate in the development of ecosystems for heavy-duty trucks running on hydrogen, with the intent to demonstrate the attractiveness and effectiveness of trucking powered by clean hydrogen." The collaboration will focus on hydrogen sourcing and logistics, delivering hydrogen in service stations, development of hydrogen-based trucks, and building a potential customer base for the vehicles. Daimler Truck CEO Karin Rådström said, "We are fully committed to the Paris Climate Agreement, and we want to actively contribute to the decarbonization of road freight transport in the European Union. Regarding the long-haul freight segment, we are convinced that CO2-neutral transportation will be enabled in the future by hydrogen-powered fuel cell trucks as well as purely battery-powered trucks. In order to make this possible, we want to establish a pan-European hydrogen ecosystem together with strong partners such as TotalEnergies. I am fully convinced that this collaboration will play a key role in our intensified activities on the road toward hydrogen-powered trucking." (IHS Markit AutoIntelligence's Tim Urquhart)

- Italy's UniCredit has reached an agreement with local Turkish conglomerate Koc Holding to sell its remaining 20% stake in YapiKredi bank by March 2022. Under the terms of the agreement, reported by Reuters, Koc will buy an 18% stake for EUR300 million (USD346 million) and the remaining 2% will be sold in the market. According to a statement released by UniCredit, the deal will have a "low single-digit positive impact" on its capital buffers. (IHS Markit Banking Risk's Alyssa Grzelak)

- UniCredit has been divesting from non-core assets to boost its capital buffers over the last four years; its decision to sell its remaining stake in YapiKredi had been expected since it changed its ownership structure in 2019.

- YapiKredi's market share within Turkey has slipped over the last five years as state-owned banks significantly lent out their private and foreign-owned peers. The bank is now Turkey's sixth largest, accounting for 7.5% of total sector assets.

- UniCredit's intention to sell its remaining stake in YapiKredi makes it unlikely that it would inject capital into YapiKredi in the interim, leaving Koc Holdings as the primary source of solvency support. Given Koc's dependence on the Turkish market, it is uncertain whether Koc would be able to provide emergency solvency support to YapiKredi in the event of a future crisis.

- Siemens Gamesa Renewable Energy (SGRE), part of Siemens Energy, has developed a project capable of producing green hydrogen directly from wind, independently from the grid, in so called "island mode". The plant can also operate connected to the grid. The Brande Hydrogen pilot project in Denmark is producing its first green hydrogen as part of the testing and commissioning phase. Project partner Everfuel now distributes it to hydrogen stations in Denmark, enabling a growing number of zero emission vehicles, such as fuel cell taxis, to operate on a 100% green fuel supply. (IHS Markit U \pstream Costs and Technology's Kamila Langklep)

- Earlier in 2021, the Danish authorities granted SGRE's Brande Hydrogen test site status as official regulatory test zone, allowing activities to operate outside the existing electricity regulations and enabling research into how to develop an island-mode capable system of offshore hydrogen production at turbine level.

- The Brande Hydrogen setup couples an existing onshore SGRE wind turbine with an electrolyzer stack from electrolysis partner Green Hydrogen Systems. SGRE is also using the Brande Hydrogen site to explore whether integrating new battery technology as an upgrade to the co-located turbine and electrolyzer can contribute to grid stability and help address issues around the variability of wind. This combination has the potential to expand the output of existing wind projects. Batteries can store energy in a way that allows electrolyzers to run for longer and produce more green hydrogen. If there is a grid connection, the batteries can distribute the renewable energy to the grid rather than the electrolyzer when conditions allow, easing bottlenecks and providing flexibility.

- The battery, turbine and electrolyzer setup has the potential to enable the production of industrial-scale volumes of green hydrogen in the near term. Innovations and learnings from the Brande Hydrogen test site will be shared with partners to build use cases for larger-scale green hydrogen production.

- Ride-hailing firm Bolt's CEO Markus Villig has said that Africa has been one of the company's main targets for expansion, reports Reuters. He added that a lack of transport infrastructure and a growing population make Africa a lucrative market for car sharing. Villig said, "The growth opportunity for us as a company is much bigger (in Africa) than what it would be in a developed country where everybody has cars and public transport is available." Bolt has 75 million customers in 45 countries and is primarily active in Eastern European and African cities. The company, which operates food delivery and ride-hailing services, recently entered the car-sharing market to diversify its revenue streams. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Egypt's annual urban inflation decelerated in October to 6.3% down from its 20-month high of 6.6% in September, while the monthly urban inflation increased to 1.5% compared to 1.1%. The slowdown in headline inflation is attributed to weaker non-food price inflation, which fell to 3.7% on yearly basis in October from 4.6% on yearly basis in September according to data published by the Central Agency for Public Mobilization and Statistics (CAPMAS) on 10 November. (IHS Markit Economist Yasmine Ghozzi)

- CAPMAS indicated that annual inflation for the whole country recorded 7.3% in October, compared to 8% in September and 6.4% in August. Fuel price increases (along with food) have been among the most cited reasons for inflation rising recently by CAPMAS.

- The decrease went against expectations of inflation continuing its upward trend through Q4 2021 owing to the government raising the cost of natural gas for manufacturers by 28% and gasoline prices for motorists in October. The government's fuel pricing committee raised the price of fuel by EGP0.25 for the third time in 2021 in response to surging international costs, while maintaining the price for diesel unchanged at EGP6.75 per liter to avoid any huge impact on the prices of fuel and food. These prices are unlikely to feed through to consumers instantly, but fertilizer and chemicals producers insinuated they could raise their prices by up to 20% to keep their operating margins.

- The rise in inflation for October is due to an increase in the prices of the meat and poultry group by 6.6%, the dairy, cheese, and eggs group by 3.3%, the fish and seafood group by 1.9%, and the cereal and bread group by 1.4%. The increase was also seen in the group of expenses on private transportation by 1.8%, the group of newspapers, books, and stationery by 13.1%, the group of pre-primary and basic education by 19.5%, the group of higher education by 16.7%, the education group for general and technical secondary school by 5.3%, and the ready meals group by 0.6%.

- The prices of fruits and vegetables decreased by 6.4% and 4.8% respectively.

- The annual core inflation rate recorded 5.2% in October 2021, compared to 4.8% in September 2021, according to the Central Bank of Egypt (CBE)'s statement. On a monthly basis, core inflation recorded 2.1% in October, and 0.4% in September.

- Mozambique's finance minister, Adriano Afonso Maleiane, presented the Proposed Economic and Social Plan and State Budget for 2022 to parliament on 15 October. The 2022 state budget makes provision for spending commitments of MZN450.6 billion (USD7.1 billion), while government domestic income is expected to total MZN298.9 billion during the year. The 2022 budget adds an ambitious MZN86.8 billion in donations to domestic revenue, leaving the Mozambican government's expected overall revenue up by 28.8% year on year (y/y) to MZN385.7 billion. The fiscal deficit (including donations) is expected to trail down to 5.2% of GDP in 2022, from an estimated 6.3% of GDP in 2021. If donations are excluded, the fiscal deficit is expected to be closer to 13.5% of GDP by end-2022. (IHS Markit Economist Thea Fourie)

- Current expenditure makes up the bulk of the Mozambican government's spending objective, accounting for 25.3% of GDP, followed by planned investment at 10.2% of GDP and financial transactions at 4.5% of GDP. The 2022 state budget shows personnel costs taking up 13.7% of GDP, followed by debt servicing costs at 4.0% of GDP and current transfers at 3.1% of GDP.

- Project-related donations are expected to make the largest contribution to the anticipated increase in overall donations to 6.5% of GDP in 2022, from 2.7% of GDP in 2021, followed by donations for special programs in the energy and resources sectors of the economy.

- The 2022 state budget prioritizes ongoing funding for the reconstruction of Mozambique's northern province of Cabo Delgado, including the rehabilitation of ports, road networks, water supply, bridges, and acquisition of 10 generators. In addition, rehabilitation of fish markets and provision of input kits for the general population to restart economic activity are prioritized. Project-related donations, funding for special programs, and access to multilateral funding will finance these programs, in IHS Markit's view.

Asia-Pacific

- Major APAC equity indices closed mixed; Mainland China +1.2%, Hong Kong +1.0%, Japan +0.6%, South Korea -0.2%, Australia -0.6%, and India -0.7%.

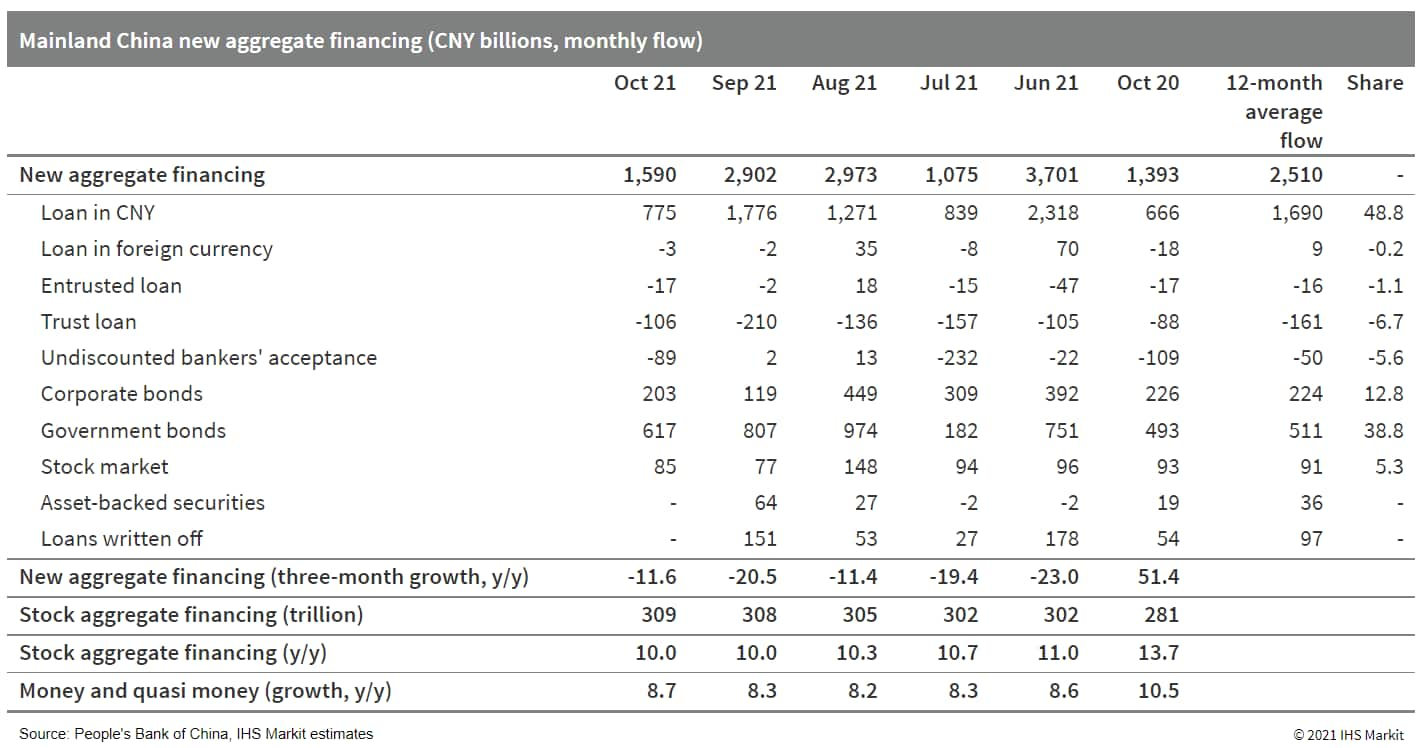

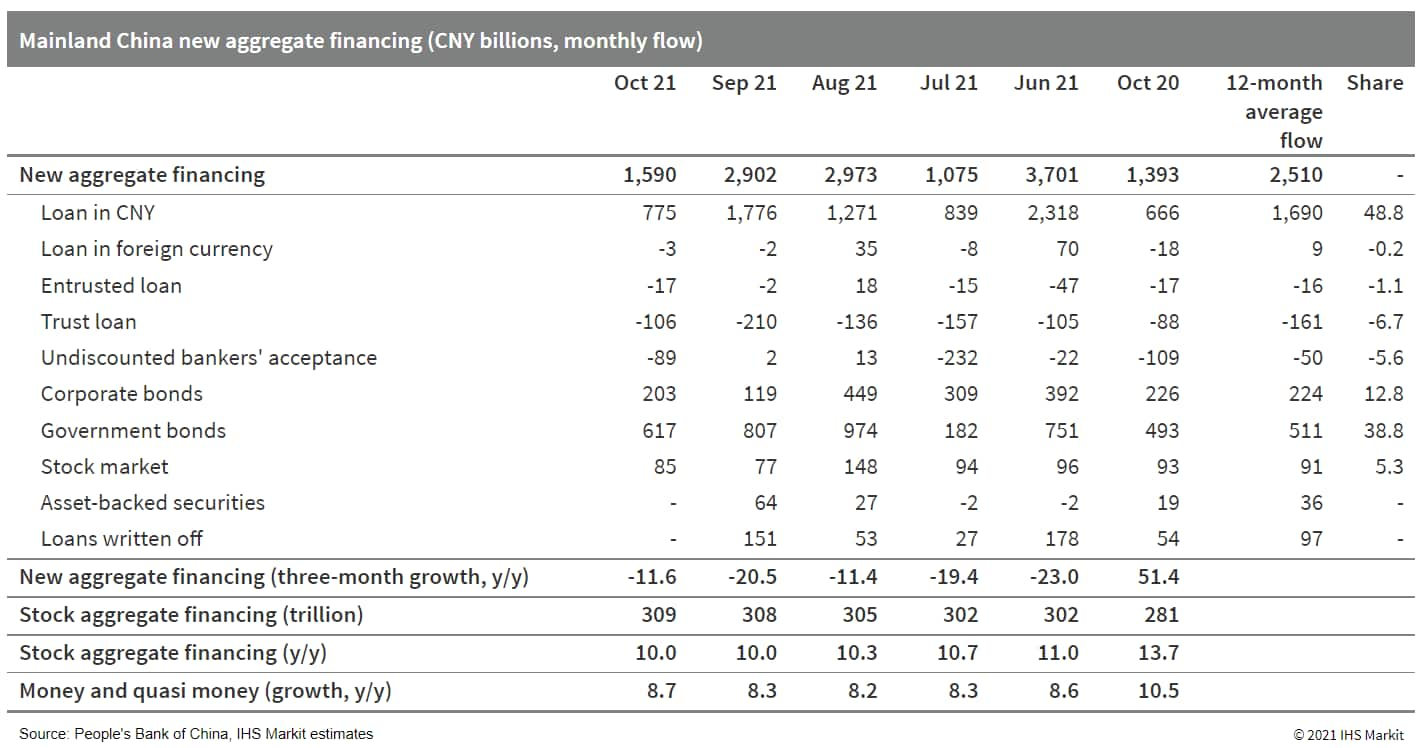

- Mainland China's new total social financing (TSF), the broadest measure of net new financing to the real economy, came in at CNY1.59 trillion (USD247.45 billion) in October, up CNY197 billion year on year (y/y) and higher than the comparable 2019 level by CNY721.9 billion, according to the People's Bank of China (PBOC). Through the end of October, stock TSF expanded by 10.0% y/y, unchanged from the month-ago reading. (IHS Markit Economist Lei Yi)

- Government bond issuance, which increased CNY123.6 billion y/y, led the year-on-year new TSF pickup in October. Note that this is a reversal from the past three months, as government bond issuance was the major driver behind the year-on-year decline in new TSF over the third quarter. However, despite signs of acceleration in government bond issuance since August, fiscal spending may have yet to pick up given the CNY1.11 trillion increase in fiscal deposits in October.

- Regarding bank loans, year-on-year contraction persisted for corporate medium-to-long-term borrowing in October. Households, on the other hand, registered a year-on-year increase in medium-to-long-term borrowing in October, after staying in contraction territory over the past five months. This can attributed to the marginal easing in mortgage rules by the authorities to arrest the cooling home sales and broad property sector moderation (see mainland China: 22 October 2021: Mainland China's coal shortage eased and mortgage rates decline under policy support, relieving downturn pressure in Q4).

- Broad money supply (M2) grew by 8.7% y/y in October, up by 0.4 percentage point from September. M1 expanded by 2.8% y/y in October, down by 0.9 percentage point from the prior month and marking the ninth month of consecutive decline.

- Cumulatively, new TSF totaled CNY26.34 trillion in the first 10 months of 2021, lower by CNY4.67 trillion y/y, yet higher than the comparable 2019 level by CNY4.86 trillion. New bank loans amounted to CNY17.55 trillion through October, up by CNY598 billion y/y.

- New vehicle sales in mainland China fell year on year (y/y) for a fifth consecutive month during October, due to softer demand for passenger vehicles and commercial vehicles (CVs). According to data released by the China Association of Automobile Manufacturers (CAAM), new vehicle sales on a wholesale basis decreased 9.4% y/y to 2.333 million units last month, while production was down by 8.8% y/y to 2.33 million units. In the year to date (YTD; January to October), new vehicle sales are up 6.4% y/y to 20.97 million units, while production volumes are up 5.4% y/y to 20.587 million units. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Sales of new energy vehicles (NEVs), which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), increased 134.9% y/y to 383,000 units in October. Sales of passenger NEVs grew 142.2% y/y to 366,000 units in October, while sales of commercial NEVs increased 44.8% y/y to around 18,000 units. Within the NEV passenger car category, sales of BEVs were up 139.4% y/y to 298,000 units in October, while sales of passenger PHEVs stood at 67,000 units, up 155.5% y/y. In the YTD, NEV sales in China are up 176.6% y/y to 2.542 million units.

- New vehicle sales in China declined y/y for a fifth consecutive month in October, although the sales improved compared with the volumes in previous months on account of national holidays in China during the first week of October, when consumers are offered a lot of deals on purchases of new vehicles. During October, the semiconductor supply shortage continued to impact on vehicle production; however, the situation has improved compared with earlier months.

- According to IHS Markit's latest forecasts, vehicle production losses in mainland China as a result of this issue stood at 364,000, 420,000, and 685,000 units, respectively, during the first, second, and third quarters of this year.

- AutoX has collaborated with Spark Connected to deploy wirelessly powered sensors in its Level 4 autonomous vehicles (AVs), according to a company statement. Spark Connected's automotive grade wireless power solutions portfolio includes first-generation Beast 1.0, Beast 2.0, and newly introduced Phoenix. These sensors will enable AutoX's AVs to perceive and understand the world around them. Dr. Jewel Li, COO at AutoX, said, "Spark Connected's innovative and unique wireless power technology is key for us because it allows for a robust and durable power source with no mechanical connections. The automotive grade Phoenix solution is in line with our high safety standards, while allowing us the flexibility of mechanical design and the reliability to deliver worry-free power to our vehicle sensors." AutoX claims that its AV platform, AutoX Driver, can handle the densest and most dynamic traffic conditions in cities around the world. The company recently released a new video demonstrating how its fully autonomous robotaxis are capable of handling rush-hour conditions in China's urban village in Shenzhen. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Thai-based oil and gas conglomerate PTT Plc and Chinese electric vehicle (EV) startup Hozon have entered into an agreement to expand Thailand's EV market, reports Reuters. The partnership includes distributing Hozon's vehicles and exploring opportunities for production with PTT and Foxconn's facility in the country. "The agreement will show Thailand's EV production capacity and ability to grow the regional market," said Twarath Sutabutr, chief inspector-general at the Thai Energy Ministry, who presided over the signing of the deal, adding, "There could also be new opportunities such as business-to-business deals, like if ride-hailing companies want to use new EVs." The Thai government holds a 51.1% stake in PTT. A shift to EVs is part of PTT's vision to expand new business and increase renewable power use, highlights the report. This latest development is in line with the Thai government's aim to boost the alternative-powertrain vehicle sector, one of the country's target industries. By 2030, the government aims for EVs to account for 30% of domestic vehicle production. (IHS Markit AutoIntelligence's Jamal Amir)

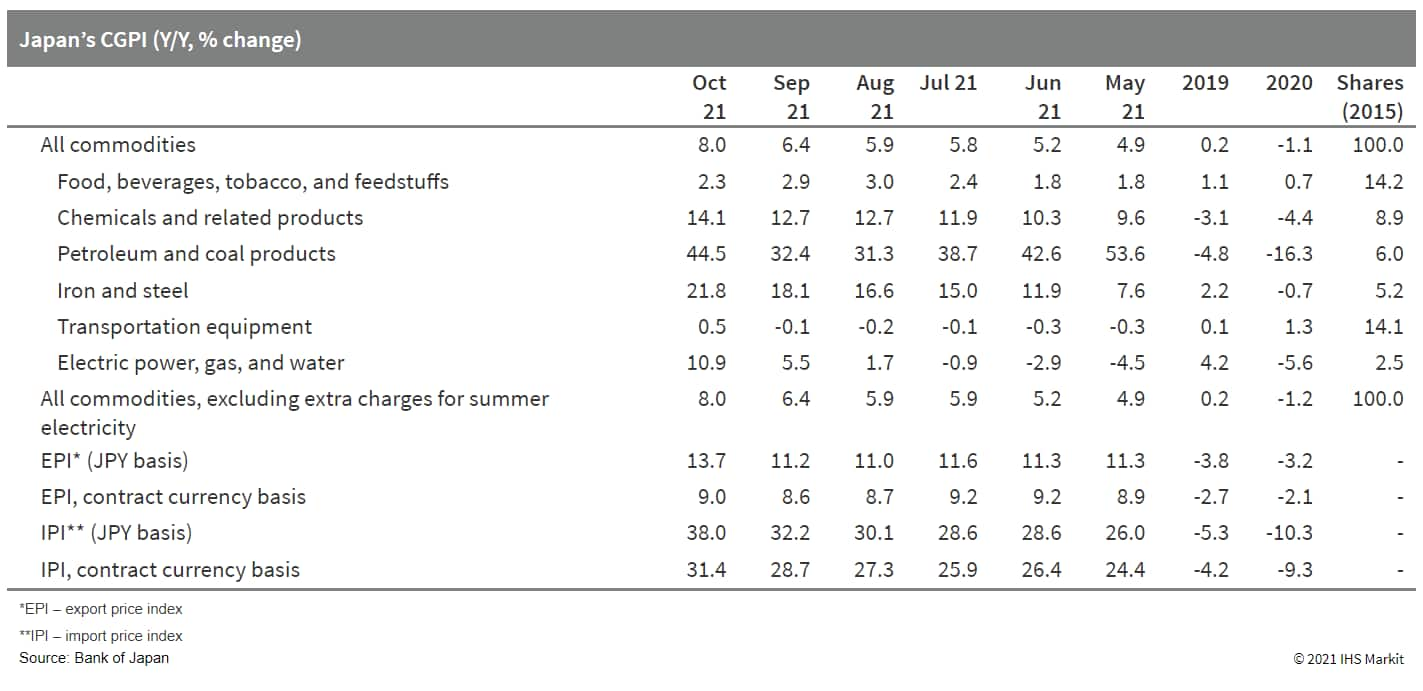

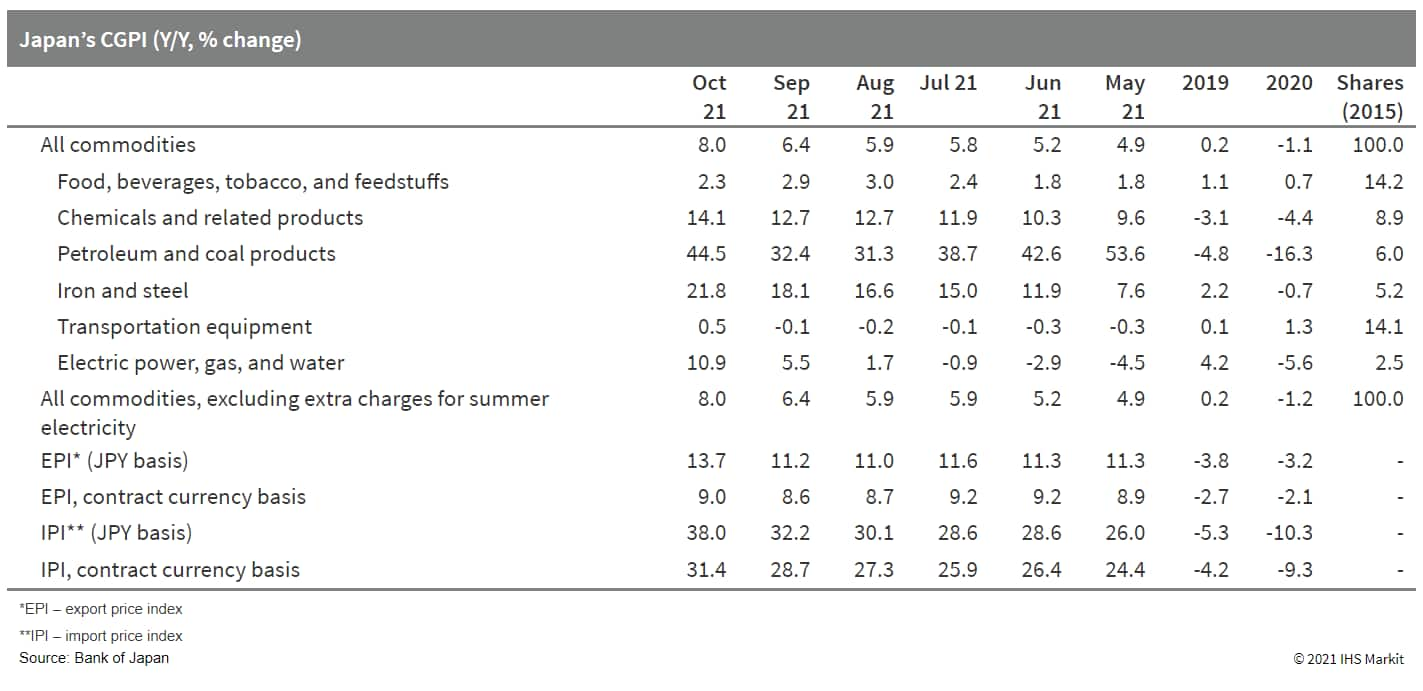

- Japan's Corporate Goods Price Index (CGPI) rose by 1.0% month on month (m/m) on a seasonally adjusted basis (calculated by IHS Markit) in October, and the year-on-year (y/y) figure moved up to 8.0% in October from 6.4% in September. (IHS Markit Economist Harumi Taguchi)

- The major reason behind the surge was a 44.5% y/y rise in petroleum and coal products, while double-digit increases for chemicals and related products, iron and steel, non-ferrous metals, and lumber and wood products were also major drivers behind the fastest growth since December 1980.

- While rising commodity prices have boosted import prices, fueling corporate goods prices, the weak yen was also a factor behind a faster rise in import prices based in yen (up 38.0% y/y), which outpaced the increase on a contract currency basis (up 31.4% y/y). A modest rise for final goods prices (up 3.8% y/y) relative to significant increases in raw material prices (up 63.0% y/y) suggests that rising input costs are squeezing margins.

- India, along with other major automotive markets such as China, the United States, Japan, France, Germany, and South Korea, has refused to sign an agreement on zero-emission vehicles at the COP26 climate summit in Glasgow (United Kingdom). The accord seeks to end the production and sales of vehicles that are powered by fossil-fuel-based internal combustion engines (ICEs) by between 2035 and 2040, according to ET Auto India. Only 24 countries are reported to have signed up to this timeline, with the UK among these having the largest production base. Although India is committed to the promotion of electric vehicles, it is not fully prepared to commit to zero emissions by 2040 as it is too dependent on coal-fired thermal plants to meet its power requirements, which are expected to increase in the next decade as the economy continues on its growth path. Last week, Indian Prime Minister Narendra Modi announced at the COP26 that India aimed to achieve net zero emissions of greenhouse gases by 2070. (IHS Markit AutoIntelligence's Nitin Budhiraja)

Posted 11 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.