Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 11, 2021

By Chris Fenske

All major European and most US equity indices closed higher, while APAC was mixed on Friday. US government bonds closed slightly lower and benchmark European bonds were sharply higher. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar, oil, natural gas, silver, and copper closed higher, while gold was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Most major US equity indices closed higher except DJIA closing flat; Russell 2000 +1.1%, Nasdaq +0.4%, and S&P 500 +0.2%.

2. 10yr US govt bonds closed +1bp/1.45% yield and 30yr bonds +1bp/2.14% yield.

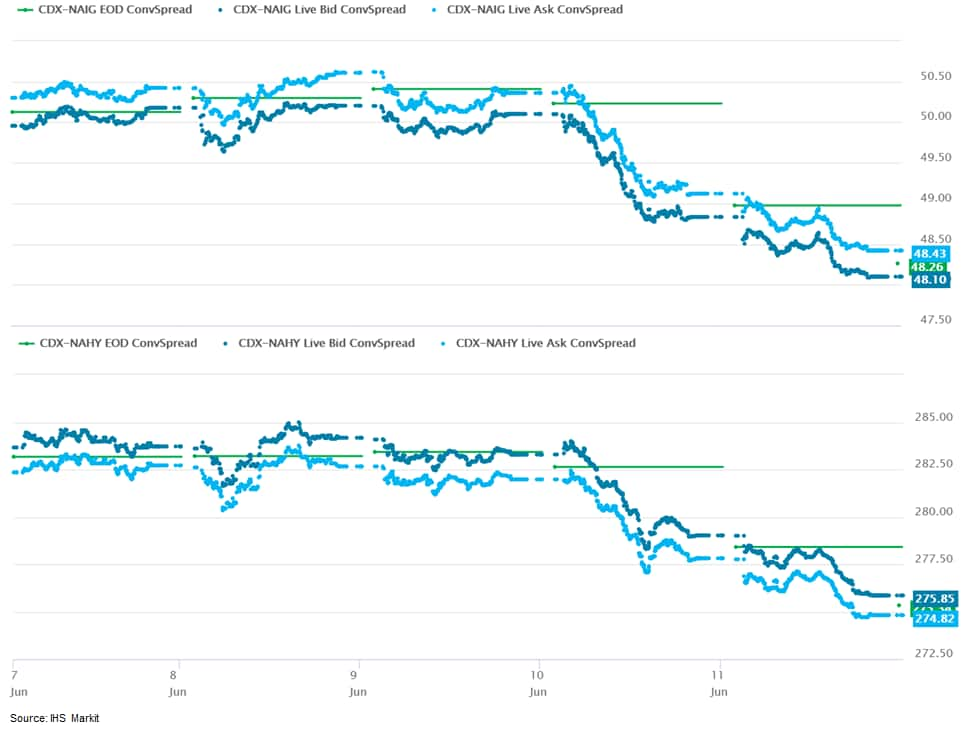

3. CDX-NAIG closed -1bp/48bps and CDX-NAHY -3bps/275bps, which is -2bps and -8bps week-over-week, respectively.

4. DXY US dollar index closed +0.5%/90.56.

5. Gold closed -0.9%/$1,880 per troy oz, silver +0.4%/$28.15 per troy oz, and copper +1.2%/$4.54 per pound.

6. Crude oil closed +0.9%/$70.91 per barrel and natural gas closed +4.7%/$3.30 per mmbtu.

7. The US University of Michigan Consumer Sentiment Index rose 3.5 points (4.2%) to 86.4 in the preliminary June reading, erasing a portion of a 5.4-point decrease in May. The reading suggests that consumers have not lost confidence in the recovery despite rising prices, and is consistent with our expectation for robust consumer spending growth in the second quarter. (IHS Markit Economists David Deull and James Bohnaker)

a. The June increase in consumer sentiment was driven mainly by expectations, the index for which rose 5.0 points to 83.8, a new pandemic-era high. The index measuring views on the present situation rose 1.2 points to 90.6.

b. Supporting the increase in expectations was a record high in the proportion of respondents expecting a further decline in the unemployment rate. The mean expected probability of an increase in respondents' personal income rose to 54%, just short of its pandemic-era high.

c. The expected one-year inflation rate stepped back to 4.0% from a reading of 4.6% the prior month. The expected 5-to-10-year inflation rate fell 0.2 percentage point to 2.8%. Despite this moderation, prices remain highly salient to consumers; the measure of net negative references to prices of homes, autos, and durable goods was the most pronounced since 1974.

d. The increase in consumer sentiment was expressed entirely by upper-income households. The index of sentiment for households earning more than $75,000 a year rose 5.9 points to 92.8, while sentiment for households earning less fell by 1.1 points to 78.2, the lowest since February.

e. Views on buying conditions for big-ticket items worsened to multidecade lows in June. The index of buying conditions for large household durable goods rose 5 points to 116, but that of vehicles fell 11 points to 89, while that of homes dove 16 points to 74. Both were the lowest since 1982.

f. Price pressures remain concerning for consumers, especially those with low incomes, but tight labor markets and equity markets scraping record highs are supporting expectations for continued recovery.

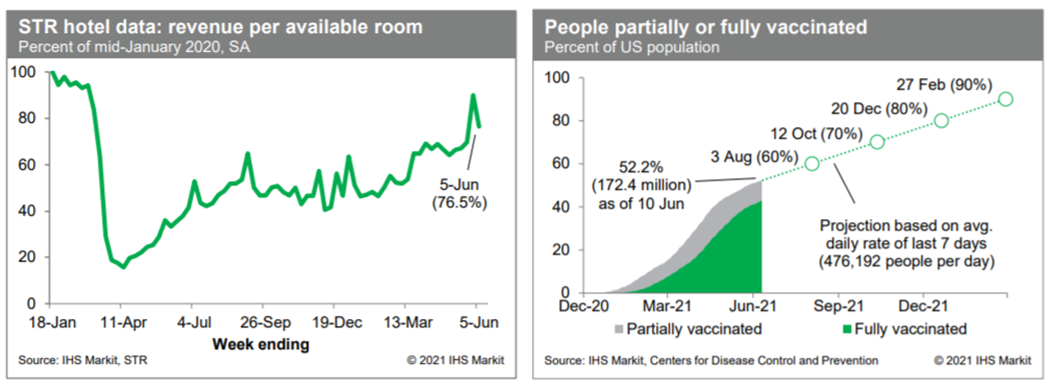

8. Revenues at US hotels last week, after seasonal adjustment, were about 76.5% of the mid-January 2020 level (our estimate based on weekly data from STR). This is down from the prior week, likely reflecting volatility due to the timing of the Memorial Day weekend. Still, averaged over the last two weeks, hotel activity is up considerably from earlier in the spring. Meanwhile, averaged over the last seven days, about 476,000 people per day received a first (or only) dose of a COVID-19 vaccination, down somewhat from an average daily rate of about 482,000 per day over the prior week. As of yesterday, 172.4 million US residents, or about 52% of the population, were at least partially vaccinated against COVID-19. At the current rate, the US would achieve widespread vaccination (70-80%) by this fall. (IHS Markit Economists Ben Herzon and Joel Prakken)

9. Three members of the US FDA's Peripheral and Central Nervous System Drugs Advisory Committee have now resigned in protest at the agency's decision to approve US firm Biogen's Aduhelm (aducanumab-avwa) for Alzheimer's disease (AD). The first member to resign was Dr Joel Perlmutter, a neurologist from the Washington University School of Medicine in St. Louis. His resignation was shortly followed by those of Dr David Knopman, who is a clinical neurologist from the Mayo Clinic, and Dr Aaron Kesselheim, who is a professor of medicine at Harvard Medical School. According to CNBC, Kesselheim's resignation letter described Aduhelm's approval as "probably the worst drug approval decision in recent US history". The resignation letter also claimed that the FDA is not "presently capable of adequately integrating the Committee's scientific recommendations into its approval decisions", and that Aduhelm's approval "will undermine the care of [AD] patients, public trust in the FDA, the pursuit of therapeutic innovation, and the affordability of the health care system". (IHS Markit Life Sciences' Milena Izmirlieva)

10. US almond shipments in the first 10 months of the 2020-21 crop year (August 2020-May 31 2021) reached a record level of 2.448 billion pounds, more than has been shipped in any year in 12 months. (IHS Markit Food and Agricultural Commodities' Julian Gale)

a. In his monthly letter to industry members, Richard Waycott, president and chief executive of the ABC, remarked: "All regions of the world performed well during the month. Increases in western Europe were led by Spain, Italy and the Netherlands. In the Middle East, the UAE, Turkey and Saudi Arabia experienced strong demand. Asian shipments were boosted by higher imports in China, Vietnam, Japan and a more modest increase in India. Morocco continued to amaze importing over 11 million pounds in the month, up from 2.3 million pounds last year."

b. The May position report from the Almond Board of California (ABC) showed that domestic shipments last month were at 69.89 million pounds versus 57.15 million pounds in May 2020.

c. This brought domestic shipments for the 10-month period to 671.94 million pounds, 3.7% up from the 647.6 million pounds reached in the August 2019-May 31 2020 period.

d. Export volumes reached 149.51 million pounds this May compared with 96.73 million pounds in the same month a year ago, bringing the seasonal export total to 1.77 billion pounds from 1.37 billion pounds in the first 10 months of 2019-20 - an increase of 29.7%.

e. The total shipments of 2.448 billion pounds were 21.4% up from 2.016 billion pounds achieved in August 2019-May 31, 2020.

11. Beep, in partnership with Local Motors, has launched autonomous shuttle trials at Yellowstone National Park in the United States, according to a company statement. These trials form part of an autonomous shuttle program, called T.E.D.D.Y (The Electric Driverless Demonstration in Yellowstone), to test the feasibility and sustainability of autonomous mobility. The autonomous shuttle Olli, developed by Local Motors, will travel on two routes until 31 August, gathering important information such as ridership, route optimization, and overall vehicle operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

12. Waymo has partnered with transportation logistics company J.B. Hunt to launch an autonomous truck pilot in Texas, United States, according to a company statement. Under this partnership, Waymo Via, the company's trucking and cargo transportation service, will be autonomously hauling freight on the I-45 corridor between facilities in Houston and Fort Worth for one of JB Hunt's customers. The trucks will be powered by the Waymo Driver autonomous platform, although a commercially licensed driver and a software technician will be on-board to monitor operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

1. Most major European equity indices closed higher; France +0.8%, Germany +0.8%, Spain +0.8%, UK +0.7%, and Italy +0.3%.

2. 10yr European govt bonds closed higher; Italy -5bps, UK -4bps, France/Spain -3bps, and Germany -2bps.

3. iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -5bps/231bps, which is -2bps and -13bps week-over-week, respectively.

4. Brent crude closed +0.2%/$72.69 per barrel.

5. Bank for International Settlements (BIS) Thursday (10 June) started a consultation regarding capital treatment for banking sector exposures to crypto-currency assets, proposing the maximum 1,250% capital weighting for unregulated mechanisms. The BIS's proposals, open for consultation until 10 September, suggest two categories for crypto-assets. Those in Group 1 must meet four conditions (IHS Markit Economist Brian Lawson):

a. First, they must be either a tokenized traditional asset or be permanently linked within narrow boundaries to a traditional asset.

b. Second, they must be subject to a clearly defined and enforceable legal framework within a specified jurisdiction.

c. Third, they must be designed and operated in a way to "manage any material risks", including the provision of "robust risk governance and risk control policies" in areas such as anti-money laundering (AML)/combating the financing of terrorism (CFT) and fraud, alongside operational risk and credit, market, and liquidity controls.

d. Fourth, entities that operate the crypto-asset must be subject to official regulation and supervision.

6. The Office for National Statistics (ONS) reports that the UK economy grew by 2.3% month on month (m/m) in April, after a 2.1% m/m gain in March. (IHS Markit Economist Raj Badiani)

a. GDP shrank by 1.5% quarter on quarter (q/q) in the first three months of 2021.

b. GDP was still 3.8% below the level before the first COVID-19-related lockdown in February 2020.

c. The figure for April this year was marginally below the market consensus, which had predicted a 2.4% m/m gain during the month.

d. A breakdown by type of output reveals that the services sector increased by 3.4% m/m in April but was still 4.1% lower than the February 2020 level.

e. Consumer-facing services grew by 12.7% m/m as COVID-19-related restrictions eased throughout April, returning to a level last seen during their initial recovery peak in October 2020.

f. Retail sales volumes grew by 9.2% m/m in April, lifted by the reopening of all non-essential retail from 12 April in England and Wales and from 26 April in Scotland.

g. Meanwhile, accommodation and food and beverages service activities grew by 68.6% m/m and 39.0% m/m, respectively. A key change was that pubs, restaurants, and cafés were able to serve customers in outdoor seating areas from 12 April. Other personal service activities (including hairdressing) grew by 63.5% m/m in April as hairdressing reopened in England on the same day.

h. The ONS reports that consumer-facing services were 5.9% below their pre-pandemic levels (February 2020), while all other services were 3.7% below their pre-pandemic levels.

7. Daimler AG, BASF, Fairphone, and Volkswagen Group have created a partnership, the German Society for International Cooperation (Deutsche Gesellschaft fur Internationale Zusammenarbeit: GIZ), to bring together stakeholders to ensure responsible lithium mining in Chile's Sala de Atacama watershed. According to a joint press statement, the partnership "intends to foster a dialogue among local stakeholders, generating and synthesizing scientific facts and seeking solutions in a participatory manner". According to the statement, the world's largest lithium reserves and a large part of lithium production are in this area of Chile, but the region's ecosystem is fragile. The group states that there is a lack of consensus on the impacts and risks of lithium mining and economic activity in the region, with particular concern over shifts in the water and brine tables. (IHS Markit AutoIntelligence's Stephanie Brinley)

8. French payroll employment rose by 89,000, or 0.3% quarter on quarter (q/q), during the first quarter of 2021, according to figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). This followed a decline of 0.1% during the final three months of 2020. (IHS Markit Economist Diego Iscaro)

a. Employment was driven by the private sector, which added nearly 89,000 new jobs during the first quarter (+0.5% q/q).

b. The construction sector added around 20,000 new jobs (+1.4% q/q), while employment in the manufacturing sector was stable. Employment in the service sector rose by 48,000 (+0.4% q/q).

c. Despite the first-quarter rise, employment in the private sector remains 243,400 below its level during the fourth quarter of 2019. Only employment in the construction sector is higher than before the pandemic. On the other hand, employment in the public sector declined by 2,700. Public-sector employment has still increased by 33,600 since the start of the pandemic.

9. The Italian government is spearheading a program that will commit EUR1 billion (USD1.22 billion) of funding to the construction of a 'Gigafactory' to make battery cells for battery electric vehicles (BEVs), according to a Reuters report. As part of this initiative, the Italian government has sent a proposal to the European Union (EU) to access EUR600 million from its EU Recovery Funds aimed at boosting economic growth across the bloc in the post-COVID-19 environment. However, according to Italian government sources, the state is looking to bolster this figure to over EUR1 billion through private investment, with Stellantis being at the center of these plans. (IHS Markit AutoIntelligence's Tim Urquhart)

10. CBD of Denver, listed on the US OTC exchange, has started to build a factory in its Swiss headquarters, focused on warehousing its products for the European markets. The plant will have a processing capacity of 24 tons of hemp annually, producing CBD products with European hemp. "We were dependent on external partners and with this expansion we are improving our service," the sales manager of CBD of Denver, Pascal Siegenthaler, said. The company produces and commercializes CBD products with its Rockflowr and BlackPearlCBD brands. Its revenues totaled USD30 million, 22% more year-on-year, from June 2020-May 2021. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

Asia-Pacific

1. Major APAC equity markets closed mixed; South Korea +0.8%, Hong Kong +0.4%, India +0.3%, Australia +0.1%, Japan 0%, and Mainland China -0.6%.

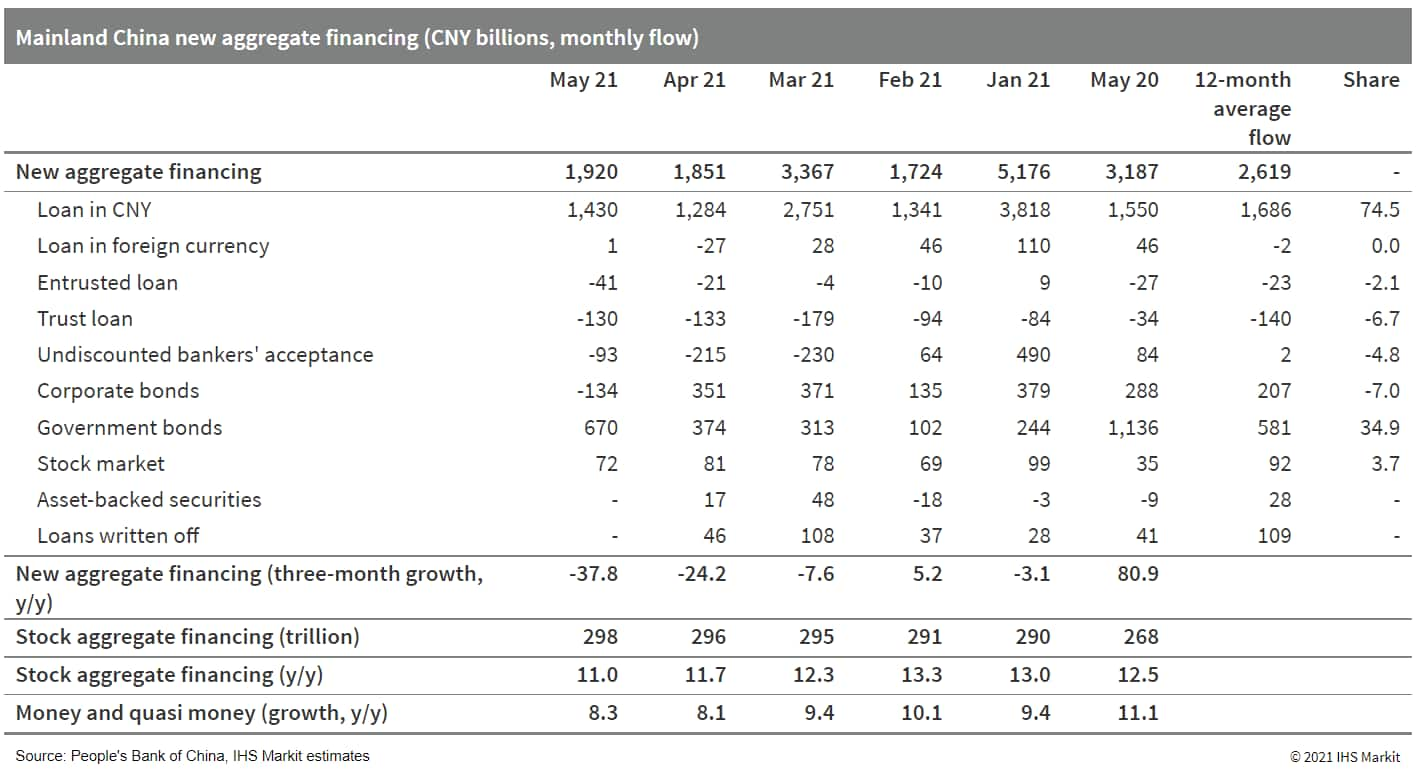

2. Mainland China's total social financing (TSF) - the broadest measure of net new financing to the real economy - amounted to CNY1.92 trillion (USD298 billion) in May, according to the People's Bank of China (PBOC). Owing to the relatively high baseline, the May TSF reading marks a year-on-year (y/y) decline of CNY1.27 trillion, although it remains higher than the comparable 2019 level by CNY208.1 billion. Stock TSF reached CNY298 trillion in May, up by 11.0% y/y -marking the third consecutive month of stock TSF growth rate decline. (IHS Markit Economist Lei Yi)

a. The year-on-year new TSF decline in May was broad across sub-categories, led by government and corporate bonds. Fiscal spending has stayed on the lower end so far this year, and notably the pace of special-purpose bond issuance has remained sluggish.

b. However, government bond issuance did post a significant month-on-month (m/m) increase in May, which may suggest a pickup in momentum in the second half of the year. On the corporate front, net new TSF from corporate bonds registered a negative reading in May, the lowest reading since mid-2017; this may be the result of the financial de-risking campaign weighing on leverage buildup, with debt expansion of property developers and implicit local government debt being major targets.

c. Broad money supply (M2) expanded 8.3% y/y in May, up by 0.2 percentage point from the prior month. M1 grew by 6.1% y/y, down 0.1 percentage point from April.

3. Chinese telecoms equipment giant Huawei Technologies aims to offer driverless passenger car solutions by 2025, reports China Daily. Wang Jun, senior executive at Huawei's smart vehicle unit, said, "Driverless vehicles are the ultimate goal of autonomous driving, and we are working to make passenger vehicles driverless in 2025". (IHS Markit Automotive Mobility's Surabhi Rajpal)

4. China's ride-hailing giant Didi Chuxing (DiDi) made public its filing for US stock market listing. According to a report by Reuters, DiDi could raise around USD10 billion and seek a valuation of close to USD10 billion for its initial public offering (IPO). In its filing, DiDi revealed slower revenue growth between 2019 and 2020 due to COVID-19 pandemic-related lockdowns imposed all over the globe. In 2020, DiDi reported revenue of CNY141.7 billion (USD22.2 billion), down from CNY154.8 billion (USD24.2 billion) a year earlier. Net loss in 2020 amounted to CNY10.6 billion (USD1.6 billion), compared with CNY9.7 billion (USD1.5 billion) in 2019. However, DiDi made a solid start in 2021, as business reopened in China. Revenue more than doubled to CNY42.2 billion (USD6.6 billion) for the quarter ending 31 March, from CNY20.5 billion (USD3.2 billion) a year earlier. (IHS Markit Automotive Mobility's Surabhi Rajpal)

5. Chinese electric vehicle (EV) startup AIWAYS is preparing to enter the Italian market with local partner Koelliker Group and plans to introduce its electric sport utility vehicle (SUV), the U5, in the country later this year, reports electrive.com. The automaker is said to have shipped around 2,500 vehicles to Europe since May 2020. Alex Klose, executive vice-president of overseas operations at AIWAYS, said, "Our exciting product and their [Koelliker's] proven track record in sales and marketing of foreign cars will give us the best chance of attracting Italian electric car buyers to the Aiways brand." (IHS Markit AutoIntelligence's Nitin Budhiraja)

6. Japan's current Business Survey Index (BSI) for large enterprises fell by 0.2 point to -4.7 in the Business Outlook Survey for the second quarter of 2021. The BSI for large manufacturing declined to -1.4, marking the first negative figure in four quarters, largely reflecting the negative effects of semiconductor shortages on auto manufacturers. (IHS Markit Economist Harumi Taguchi)

a. The contractions in BSIs for manufacturing and non-manufacturing groupings narrowed for all sized enterprises, except for large manufacturing. However, the resurgence of COVID-19 and the negative impacts of the state of emergency continued to dampen business conditions for a broad range of industries, particularly for small-sized enterprises.

b. Projected sales and ordinary profits for all industries in fiscal year (FY) 2021/22 (ending in March 2022) were revised down to a 2.8% year-on-year (y/y) rise from a 3.2% y/y increase and to a 6.8% y/y rise from an 8.8% y/y increase, respectively, reflecting the negative effects of supply-chain disruptions and prolonged containment measures.

c. Fixed investment plans in FY 2021/22 for manufacturing were revised up to a 10.7% y/y rise from a 7.9% y/y increase thanks largely to robust plans of chemical, non-ferrous metal, production machinery, and some other groupings. A downward revision for fixed investment plans for non-manufacturing largely reflected weaker plans in retail sales, real estate, and services (such as amusement and life-related services).

7. South Korea's 'hangover-release' drinks market was worth KRW250 billion (USD225 million) in 2019, up 60% from 2016 as the previous customer base of 30-40 year-olds has now extended to people in their 20s. Currently, HK inno.N leads the market with its Hutgae Condition, which has a 44% market share, followed by Grammy's Dawn 808 with 32%, and Dong-A Pharmaceutical's Morning Power with 14%. After selling three million cans in just half a year after the introduction of carbonated 'Kaesugang', Lotte Chilsung Beverage has recently launched its 'Kesu Kwang Phan'. The drink contains seven types of Jeju-derived ingredients, which are claimed to be excellent in hangover relief, such as green tea leaves, five types of seaweed, mandarin peel and patented hangover relief ingredients. The company plans to establish a 'Big 5' system for these drinks. (IHS Markit Food and Agricultural Commodities' Mainbayar Badarch)

8. India is set to install nearly 20.2 GW of wind power capacity through 2025, raising capacity in the world's fourth-largest wind power market by more than 50% from the 39.2 GW currently up and running, according to a study released 10 June. The study, published by the Global Wind Energy Council (GWEC), and titled India Wind Energy Market Outlook 2025, found a 10.3-GW pipeline of projects in federal (or central) and state markets is expected to drive installations until 2023. After 2023 though, growth is likely be pushed forward by almost 10 GW of capacity awarded to wind projects through mainly hybrid tenders, it said. Hybrid tenders combine wind and solar in an effort produce a higher capacity utilization factor. Through 2025, 90% of new installed wind capacity will come from federal government tenders, GWEC said. While GWEC expects installed Indian wind capacity to total 59.4 GW at the end of 2025, it said there is a chance under an "ambitious case projection" model that as much as 62.9 GW of capacity could be up and running by that point. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

Posted 11 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.