Major equity indices closed higher across the world today. US government bonds closed lower, while European bonds were significantly higher. iTraxx-Europe and CDX-NA both closed sharply tighter across IG and high yield, retracing most of the widening that occurred last week. The US dollar, gold, and silver closed higher, while oil and gold were lower on the day.

Americas

- US equity markets closed sharply higher; Russell 2000 +3.4%, Nasdaq +3.0%, S&P 500 +2.4%, and DJIA +2.0%.

- U.S. stocks surged Monday, giving the S&P 500 its best day in nearly nine months, as a weekslong advance in government-bond yields stalled and eased investors' jitters over rising interest rates. (WSJ)

- 10yr US govt bonds closed +1bp/1.43% yield and 30yr bonds +4bps/2.19% yield.

- CDX-NAIG closed -3bps/53bps and CDX-NAHY -17bps/293bps.

- DXY US dollar index closed +0.2%/91.04.

- Gold closed -0.3%/$1,723 per ounce, silver +0.9%/$26.68 per ounce, and copper +0.5%/$4.11 per pound.

- Crude oil closed -1.4%/$60.64 per barrel.

- The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers' Index (PMI) posted 58.6 in February, down from 59.2 in January but broadly in line with the earlier released 'flash' estimate of 58.5. The marked improvement in the health of the manufacturing sector was the second strongest in almost 11 years. (IHS Markit Economist Chris Williamson)

- The rate of production growth was among the fastest in six years while new order growth was among the fastest seen over the past three years.

- Also helping to buoy the headline PMI figure was a substantial lengthening of supplier delivery times amid significant supply chain disruption. Ordinarily a signal of improving operating conditions, longer lead times for inputs reportedly stemmed from supplier shortages and transportation delays due to COVID-19 restrictions. The extent to which wait times lengthened was the greatest since data collection began in May 2007.

- The rate of input price inflation accelerated to the sharpest since April 2011. Higher raw material prices, notably for steel, and increased transportation costs were widely linked to the rise.

- Monthly US GDP rose 1.4% in January. This was the first increase since October; monthly GDP declined in November and was essentially flat in December. The increase in January was essentially accounted for by a large increase in personal consumption expenditures (PCE). Outside of PCE, increases in other domestic final sales were roughly offset by decreases in net exports and nonfarm inventory investment. The level of GDP in January was 3.7% above the fourth-quarter average at an annual rate. Increases of 0.2% per month (not annualized) over February and March underlie our latest forecast of 4.5% annualized GDP growth in the first quarter. (US Macro Team)

- Total US construction spending rose 1.7% in January, beating both our estimate and consensus expectations. Previous months were revised higher. (IHS Markit Economist Ben Herzon and Lawrence Nelson)

- Core construction spending rose 1.4% in January, a shade more than we expected. The cumulative gain over November and December was revised higher.

- Since reaching a recent trough last May, total construction spending has trended higher at an annual rate of 17.1%. This has pushed total construction spending well above its pre-pandemic peak.

- Growth in total spending since May has been more than accounted for by private residential construction spending. Historically low mortgage rates and accelerating demand for suburban homes are helping to fuel a surge in new home construction.

- Of interest in today's report was unexpected strength in the implicit real average cost per single-family start (a series that we calculate). This translates into more single-family value put-in-place over the coming 12 months.

- Private nonresidential construction, by contrast, is weakening. Since May, spending on private nonresidential structures has declined at a 7.6% annual rate. The weakness is widespread, as most major categories in this sector have declined since May.

- Public construction spending has been firming in recent months, with both federal and state/local construction spending trending higher since September.

- Autonomous vehicle (AV) sensor maker Velodyne Lidar has reported a net loss of USD111.5 million in the fourth quarter of 2020. This loss is attributable to stock-based compensation expenses for employees amounting to USD91.3 million. The company's revenues shrank to USD17.8 million in the fourth quarter, a decrease of 5.9% year on year (y/y). The fall in revenues was the result of reduced production capabilities at its manufacturing sites due to COVID-19 pandemic, which affected company's ability to fulfill certain customers' orders. Velodyne shipped 4,237 sensor units in the fourth quarter of 2020. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Aurora Technologies is acquiring OURS Technology, a LiDAR startup founded in 2017 by a team of University of California-Berkeley researchers and PhDs, for an undisclosed amount. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. OURS employs frequency modulated continuous wave (FMCW) technology that can measure distance as well as instant velocity without losing range, allowing the vehicles to see further and faster, such as at highway speeds. This technology will support Aurora to drive down costs and scale operations in launching its autonomous truck to the market, reports Bloomberg. This is Aurora's second LiDAR acquisition in less than two years, following purchase of Blackmore in 2019. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- PQ Group Holdings today announced an agreement to sell its sodium silicate and silica derivatives business, called performance chemicals, to a partnership established by private equity firm Cerberus Capital Management (New York, New York) and Koch Minerals and Trading for $1.1 billion. Proceeds from the deal will fund a special dividend of $2.50-3.25/share that will be paid to PQ shareholders when the deal closes, which is expected later this year. The divestiture is part of a plan by PQ to focus on the company's catalysts and refining services businesses. Last year, as part of the plan, PQ sold its microspheres unit, called performance materials, to private equity firm The Jordan Company. (IHS Markit Chemical Advisory)

- The House Agriculture Committee last week voiced bipartisan commitment to ensuring farmers are rewarded for adopting practices that fight climate change, but the nearly five-hour hearing also showcased lingering partisan differences over the urgency of the issue and the need for new agricultural climate initiatives. (IHS Markit Food and Agricultural Policy's JR Pegg)

- EPA estimates some 10% of the total US greenhouse gas emissions come from agriculture, but American Farm Bureau Federation President Zippy Duvall told the committee that statistic is misleading. Carbon sequestered from forestland management and agricultural practices "more than offset agriculture's contribution to total emissions," Duvall said. "However, many of agriculture's carbon sequestration efforts are not directly assigned to the agriculture sector. It is certain that if the carbon sequestration efforts of US farmers and ranchers were assigned to agriculture … our contributions to greenhouse gas emissions would be much lower."

- Democrats are expected to lead the legislative agenda on climate and Rep. Abigail Spanberger (D-Va.) told colleagues she plans to reintroduce a bipartisan bill that would direct USDA to create a certification program to help farmers and forest landowners participate in private carbon markets.

- Canada's current-account deficit decreased $3.2 billion to $7.3 billion from an upwardly revised $10.5 billion deficit in the previous quarter. (IHS Markit Economist Chul-Woo Hong)

- The goods-account deficit shrank by $0.3 billion, partly due to the stronger account surpluses in metals ores and non-metallic mineral products, and energy products.

- The services account balance tipped to surplus once again as the commercial services' smaller surplus was enough to offset to bigger reduction in the other sub-account deficits.

- The primary income surplus rose by $2.9 billion to $3.1 billion while the secondary income deficit edged up to $1.2 billion.

- Plans to cut Colombia's carbon emissions by more than 50% by 2030 are realistic, if it adopts and delivers on a complex, multi-faceted strategy, according to President Ivan Duque Márquez. Speaking to IHS Markit Vice Chairman and Pulitzer Prize-winning author Daniel Yergin on the opening day of CERAWeek by IHS Markit, Márquez outlined a series of actions he said would put Colombia on that path: increase its renewable generation portfolio; clean up its transportation sector; protect the tropical rainforest; institute greater recycling; and ramp up its circular economy. Non-conventional renewables accounted for 0.2% of the Colombian electricity mix when Márquez took power in August 2018. A grand total of 35 megawatts (MW), he said. Currently, Colombia has 1 gigawatt (GW) of non-conventional renewables generation and expects to reach 2.5 GW by 2022, he said. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

Europe/Middle East/Africa

- European equity markets closed higher; Spain +1.9%, Italy +1.8%, and France/Germany/UK +1.6%.

- 10yr European govt bonds closed substantially higher; Italy -10bps, France -9bps, Spain -8bps, and Germany/UK -7bps.

- iTraxx-Europe closed -3bps/48bps and iTraxx-Xover -16bps/248bps.

- Brent crude closed -1.1%/$63.69 per barrel.

- Volkswagen Commercial Vehicles (VWCV) has announced that it is working on the development and implementation of autonomous technology as it plans to introduce autonomous systems for traffic use in 2025. VWCV has invested in Argo AI, which focuses on developing commercial autonomous vehicle (AV) systems and has brought its subsidiary AID (Autonomous Intelligent Driving) into Argo AI. VWCV will integrate Argo's AV system onto its all-electric ID. BUZZ, which is set for world premiere next year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- French passenger car registrations recorded a steeper decline in February, according to the latest data published by the French Automobile Manufacturers' Committee (Comité des Constructeurs Français d'Automobiles: CCFA). The market contracted by 20.9% year on year (y/y) to 132,637 units, and there was no impact from working days this month. This has now meant that registrations in the year to date (YTD) are now down by 14.2% y/y to 259,017 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Spanish pharmaceutical company Grifols on 1 March announced the acquisition of 25 plasma donation centers in the United States from US company BPL Plasma (subsidiary of Bio Products Laboratory Holdings Limited). The total cost of the transaction has been stated as USD370 million. According to Grifols, the acquisition has already received the necessary regulatory approvals and will allow an immediate increase in capacity by 1 million liters per year. The newly acquired plasma centers are authorized by the US FDA as well as by the UK's Medicines and Healthcare Products Regulatory Agency (MHRA). The Spanish firm is a global leader in the manufacture of plasma-derived therapeutics. The transaction is in line with Grifols' expansion and diversification strategy, bringing the total number of plasma collection facilities globally to 344. (IHS Markit Life Sciences' Ewa Oliveira da Silva)

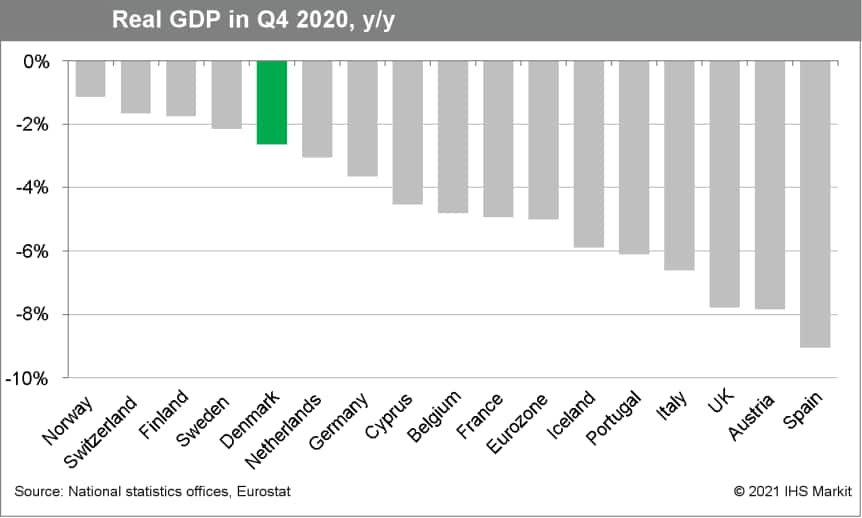

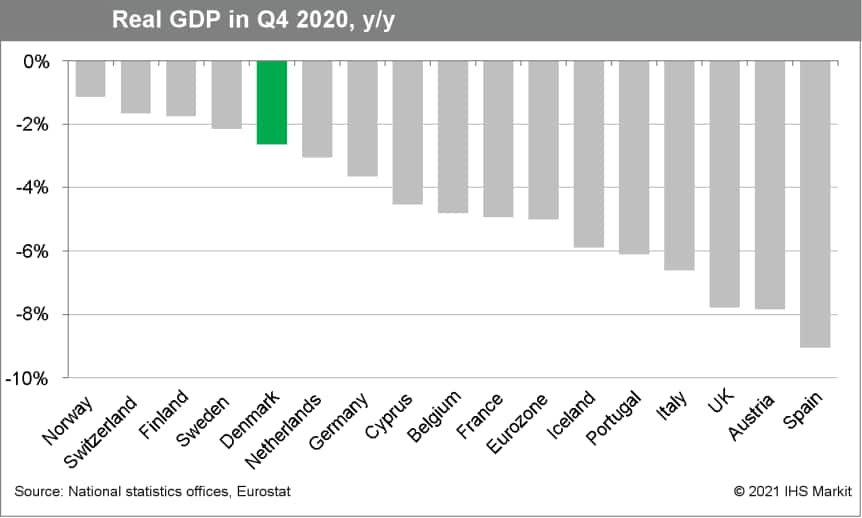

- In a detailed release, Statistics Denmark confirmed that the Danish economy grew by 0.6% q/q in the fourth quarter of 2020. This is the same rate of growth as indicated in the "flash" release in mid-February and puts Denmark among the top performers in Western Europe. The Scandinavian economies have done particularly well throughout the pandemic. (IHS Markit Economist Daniel Kral)

- The detailed breakdown reveals that growth was driven by domestic demand (see Table), which goes against the initial assessment accompanying the "flash" estimate, suggesting exports and production-side of the economy were the main growth drivers. Private consumption was up by 1.2% q/q, government consumption up by 6.8% q/q and fixed investment by 0.9% q/q. Inventories were a drag.

- Strong domestic demand pushed up imports of goods and services, which were up by 1.8% q/q, while exports dropped by 0.6% q/q. Unlike in the second quarter, net trade was thus a drag on headline growth.

- Poland's fourth-quarter 2020 GDP growth was confirmed at -2.8% year on year (y/y), in line with the "flash" estimate from mid-February. In seasonally adjusted terms, GDP dropped by 0.7% quarter on quarter (q/q), far less than during the first wave of COVID-19. (IHS Markit Economist Sharon Fisher)

- Growth was negatively affected in late 2020 by a decline in private consumption (down 2.7% q/q) and fixed investment (down 2.6% q/q), which were hit by COVID-19-related restrictions and general uncertainty.

- Inventories, net exports, and government consumption had a positive effect on growth. Although fixed investment declined, gross capital formation jumped 17.4% q/q, signaling a surge in inventories.

- Poland's quarterly labor survey indicates that the unemployment rate moderated in the fourth quarter of 2020, reaching 3.1%, down from 3.3% during the previous quarter. The unemployment rate edged downwards to 3.2% in 2020 as a whole from 3.3% in 2019.

- Poland continues to face considerable uncertainty in 2021, stemming from risks associated with the COVID-19 pandemic (domestic and external) and the slow pace of vaccinations across Europe. IHS Markit remains cautious about the prospects for a strong recovery in 2021, and our full-year GDP growth forecast currently stands at 3.0%, well below the latest consensus figure (at 3.9%).

- A notable tightening of Turkey's monetary policy since early November began to reduce demand for imports as 2021 opened. According to data from the Turkish Statistical Institute, merchandise imports contracted by 5.9% year on year (y/y) in January 2021. (IHS Markit Economist Andrew Birch)

- With imports contracting, the merchandise-trade deficit narrowed by nearly USD1.5 billion y/y, to USD3.035 billion in January 2021.

- Previously, in 2020, expansionary economic policies sustained import growth, fueling a dramatic widening of the merchandise trade deficit, which triggered external financing issues.

- IHS Markit expects that monetary policy will remain restrictive throughout at least the first half of 2021. As long as that monetary policy remains restrictive, merchandise imports will remain limited.

- South African energy and chemical company Sasol announced on 26 February that it has reached a final investment decision to develop the USD760-million Temane natural gas project in Mozambique's Inhambane province. However, this positive development is unlikely to offset the loss to the country's economic growth and continued pressure on external liquidity stemming from the negative development of the longer-than-expected delays to the larger liquefied natural gas (LNG) projects located in Mozambique's Cabo Delgado province. (IHS Markit Country Risk's Thea Fourie and Eva Renon)

- Because of the security situation, energy majors ENI and Total's LNG projects in Cabo Delgado province face growing delays. IHS Markit's LNG analyst team has pushed back its expected start dates for Total's LNG project from February to November 2025 and for ENI's Coral floating LNG (FLNG) project from September 2022 (ENI's official start date) to 2023.

- Future external debt payments, including past international bonds, remain reliant on successful development of key LNG projects and face high non-payment risk.

- State revenue shortages given delayed LNG development threaten public-sector project delays and cancellation.

- If President Felipe Nyusi's ally is not selected as the ruling Mozambique Liberation Front (Frente de Libertação de Moçambique: FRELIMO) party's presidential candidate in 2022 for the 2024 elections, the risk of contract alteration for foreign investors will increase.

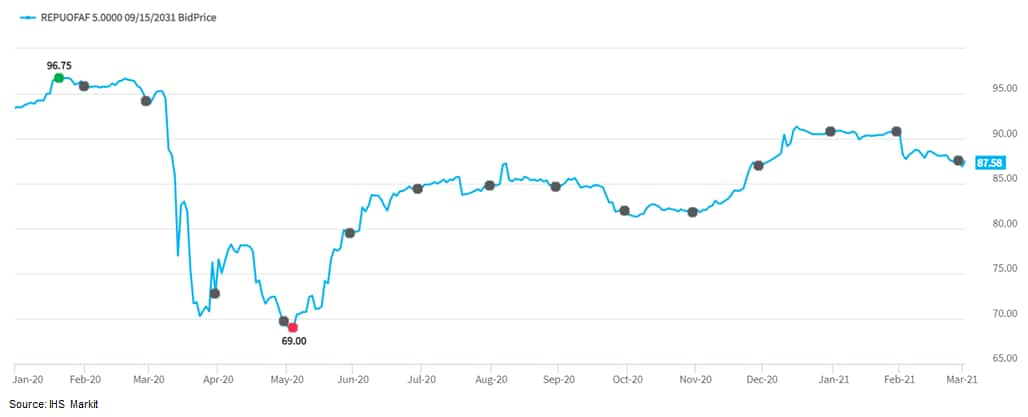

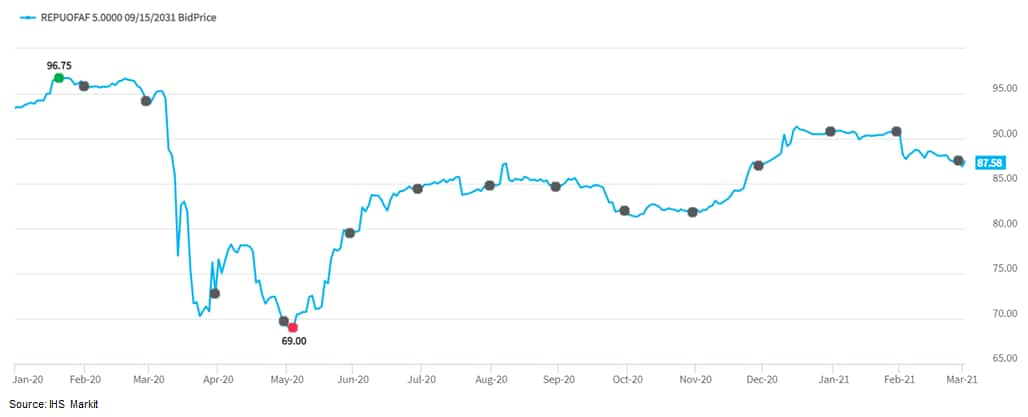

- The Republic of Mozambique's 5.0% 9/2031 closed at a price 0f 87.58 today, which is a +27% increase from the 5 May low close of a 69.00 price per the below Price Viewer chart.

Asia-Pacific

- APAC equity markets closed higher; Japan +2.4%, Australia +1.7%, Hong Kong +1.6%, India +1.5%, and Mainland China +1.2%.

- LNG has a very strong future in the energy transition, Cheniere LNG President and CEO Jack Fusco and JOGMEC Chairman and CEO Tesuhiro Hosono said during a session at CERAWeek by IHS Markit on 1 March. (IHS Markit Climate and Sustainability News' Kevin Adler)

- The Asia-Pacific region will be the driver of LNG demand, said Fusco, in the session titled, "What Are the Fuels of the Future?"

- "There's huge demand growth potential in Asia right now," Fusco told IHS Markit Chief Strategist for Oil and Gas Michael Stoppard. "If you look at China's five-year electrification plan, they want to take their share of power from natural gas combined-cycle [generation] from 8% to 15%. If they are successful, that could be [the demand equivalent of] three more Chenieres. The demand is phenomenal for the product."

- At the same time that the company is eyeing demand growth, Cheniere is committing to improving the environmental footprint of LNG, to keep it relevant in a world in which many nations have announced net-zero carbon emissions by 2050 or 2060. In February, Cheniere said it would begin to disclose the carbon emissions of its LNG on a per-cargo basis in 2022, the first US producer to make such a promise.

- This carbon dioxide-equivalent disclosure will encapsulate the entire value chain, Fusco said, and it will include methane emissions as well. "We are uniquely situated to influence [carbon emissions] because we buy the gas, transport the gas, liquefy the gas, and in some cases deliver all the way to the customer's flange," he said. "So, we are in a great position … to be able to monitor, validate, and report on those emissions, but also to clean up those emissions and make LNG a sustainable fuel."

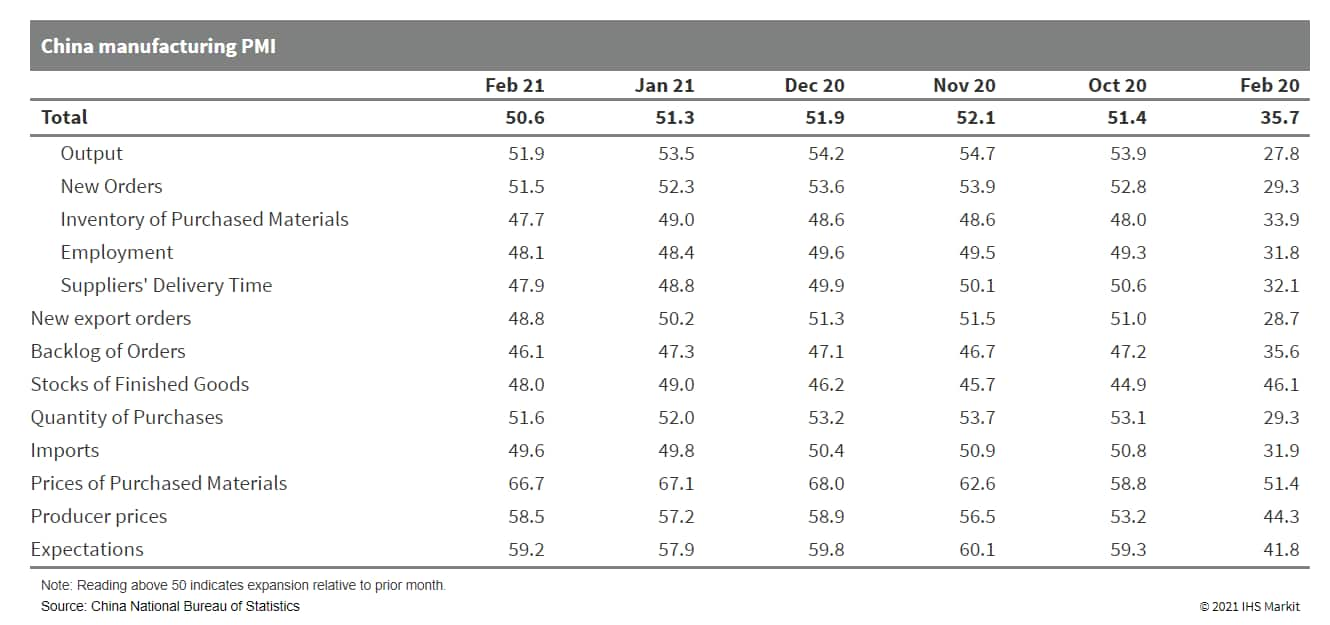

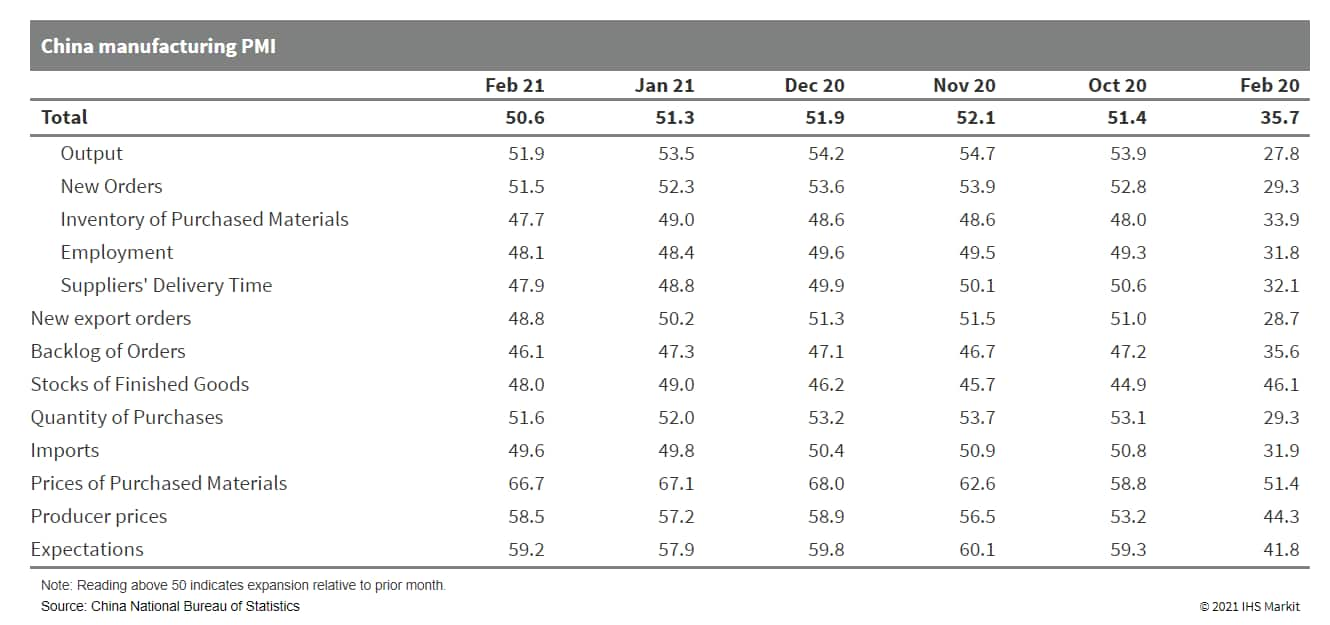

- China's official manufacturing Purchasing Managers' Index (PMI) fell by 0.7 point to 50.6 in February, the third consecutive month of decline since December 2020. The decline largely reflects disruptions due to the Lunar New Year holiday; however, the seasonal decline this year was softer compared with the decline recorded during the same period in 2018, when the Lunar New Year also fell in the month of February. Meanwhile, the manufacturing PMI has been in expansion territory for a year. (IHS Markit Economist Yating Xu)

- China's non-manufacturing Business Activity Index dropped by 1.2 points to sit at 51.6 in February, with the services and construction indexes both having declined. The construction sector's Businesses Activity Index was down by 5.3 points, a steeper contraction than the 3-point decline registered in February 2018, while the expectation index for construction activities rose significantly, compared with the sharp decline registered in January.

- The services PMI dropped by 1.0 point to 50.8, a softer decline than that observed in February 2018. Owing to the government's "stay-put" advisory during the Lunar New Year holiday, the transportation and hotel sectors remained in deep contraction, while growth in the catering, retail, and entertainment sectors accelerated and the monetary financing and telecommunications sectors maintained robust growth.

- Chinese carmaker Dongfeng Motor has launched autonomous taxi trials in Wuhan, the capital of central China's Hubei Province. The automaker has deployed 40 autonomous vehicles (AVs), named RoboTaxi, in the city's economic and technological development zone. The vehicle is integrated with Beidou navigation and positioning system and an environmental perception system, which involves high-definition cameras, LiDAR, and millimeter-wave radar. The 5G-based supercomputer helps in accurately monitoring various traffic scenarios. Safety supervisors will be onboard but will take over driving in case of emergency only, reports Xinhua News Agency. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese startup Xpeng Motor is set to roll out a new standard-range rear-wheel-drive model variant based on the P7. The new model will be equipped with lithium iron phosphate (LFP) batteries. In the P7 product line-up, the entry-level model, the long-range rear-wheel-drive P7 with a 70.8-kWh lithium-ion battery pack, is able to deliver a range of 586 kilometers (km), according to the company. In comparison, the LFP battery-powered P7 is expected to have a range of 480 km from a smaller 60.2-kWh battery pack. For customers who do not have high expectations of driving range, the new model, which will be priced lower than the long-range P7, should make an appealing offering. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Nissan Motor has partnered with Suzhou HSR New Town to deploy intelligent mobility solutions. This will include development of intelligent connected networks and transport to support Chinese city Suzhou's intelligent transport initiative. The companies also plan to test autonomous vehicles (AVs) for future commercial services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

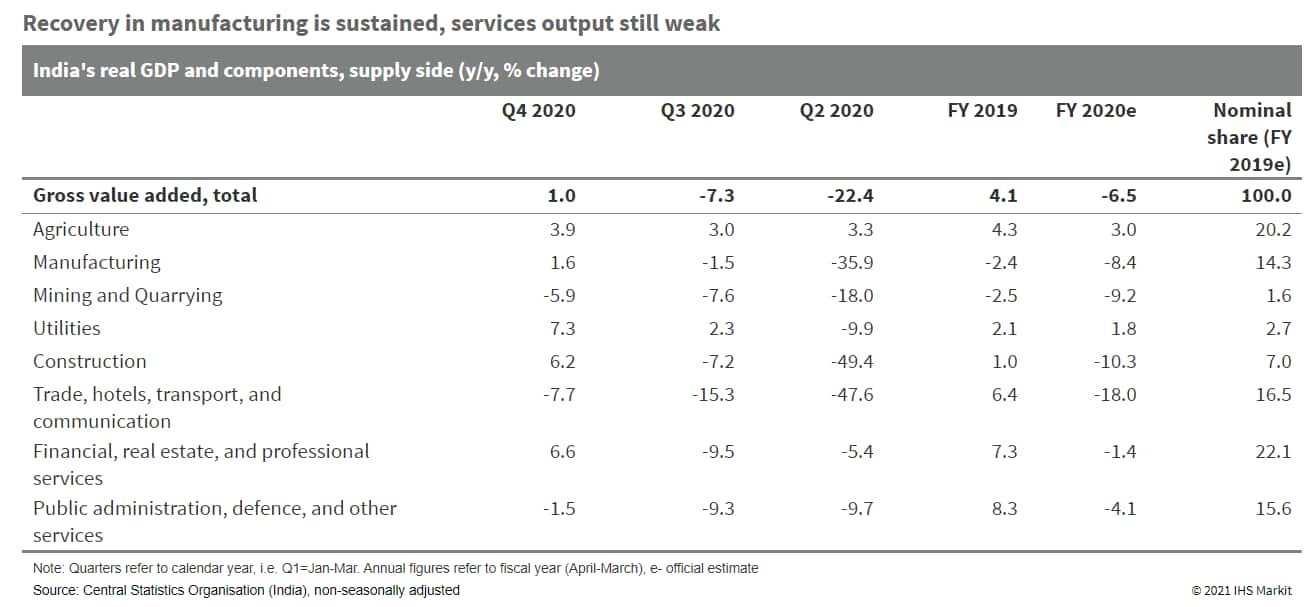

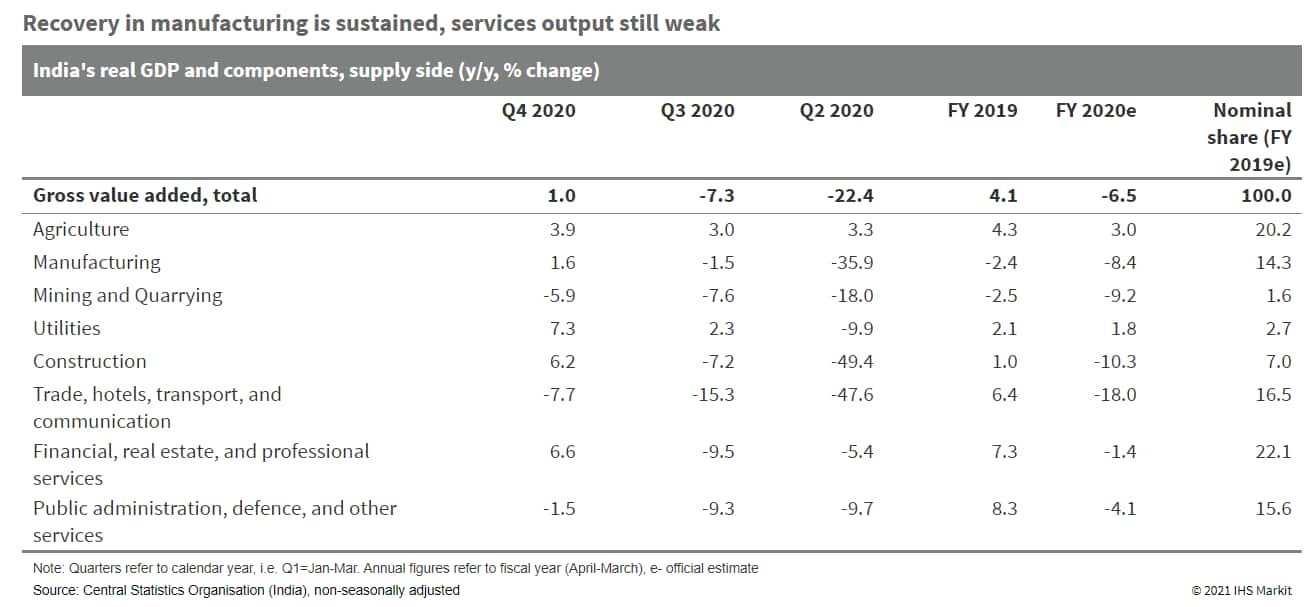

- India's return to modest Q4 GDP growth of 0.4% y/y follows two quarters of contraction inflicted by the COVID-19 virus pandemic and the strict lockdown measures that were imposed in response. The revised government data showed a deeper 24.4% y/y contraction in the worst-affected April-June 2020 quarter (against a previous estimate of a 23.9% y/y contraction) and a marginally smaller fall of 7.3% y/y in the July-September 2020 quarter (against a 7.5% y/y contraction reported earlier). (IHS Markit Economist Hanna Luchnikava-Schorsch)

- Household expenditure continued to shrink in the December quarter but the contraction has narrowed substantially, as falling numbers of new daily COVID-19 infections and easing mobility restrictions since September allowed consumers to return to shops during the busy festival season. As a result, real consumer spending dipped 2.4% y/y compared with a contraction of 11.3% y/y in the previous quarter.

- The fall in real government spending also narrowed sharply to 1.1% y/y from a contraction of 24.0% y/y, as the government ramped up spending in the last two months of the quarter after recovering tax collections helped to finance the stimulus measures announced through the year. Monthly central government revenue and expenditure data showed 38.7% y/y growth in total spending and 72.7% y/y growth in net tax revenue in November-December.

- Easing lockdown restrictions and the ramp-up in government spending also drove the recovery in fixed investment, which posted growth of 2.6% y/y in the three months to December. In addition, record profits reported by firms during the quarter as a result of falling costs helped to boost private investment. Nevertheless, real fixed investment remains far below its pre-pandemic level following a severe contraction in the April-June 2020 quarter.

- The contraction in exports deepened again to 4.6% y/y in the October-December quarter due to renewed lockdowns in many of India's largest export markets.

- Indian Oil has announced plans to expand the capacity of its refinery at Panipat, India, from 15 million metric tons/year (MMt/y), to 25 MMt/y. The company will also build a polypropylene (PP) unit and a catalytic dewaxing unit at the site. The cost of the project is 329.46 billion Indian rupees ($4.45 billion). The plan is the latest in a series of projects approved by Indian Oil to improve integration with petrochemicals at the company's refinery sites. The capacity of the planned PP facility has not been disclosed. (IHS Markit Chemical Advisory)

- India's Union minister for road transport and highways, Nitin Gadkari, has revealed that the government may further hike custom duty on auto components in a bid to promote localization. According to a report by the Business Today, Gadkari urged automakers to increase localization to 100%, up from around 70% currently. He said, "I urge both vehicle and auto component manufacturers to increase localization of components to the maximum. Not maximum, my expectation is to make it 100%. We are fully competent in all the things. Even, I am requesting automobile manufacturing companies to take it very seriously otherwise for imports of components we will think in the direction to increase more customs duty on that." The latest 2021/22 Union budget proposes a rise in the custom duty on selected imported components to 15%, up from the current 7.5-10%. (IHS Markit AutoIntelligence's Isha Sharma)

- As per IHS Markit's Commodities at Sea, Indian iron ore fines and pellet exports during January 2021 stood at 4.9mt (up 13% y/y). Shipments to China (Mainland) for the reported month stood at 3.3mt or 67% of total exports from the country. During the first 27-days of February 2021, Indian iron ore and pellet exports stood at 3.8mt (4.2mt on a 30-Day basis, up 25% y/y). Out of total Indian iron ore and pellet exports share of China (Mainland) was 76% of total exports. (IHS Markit Maritime and Trade's Pranay Shukla)

Posted 01 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.