Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 13 May, 2021

What are the key themes we expect to shape credit and markets in the H2 2021 and beyond?

1: The economic recovery

Markets are reaching new highs on economic recovery in the U.S. and across the world. Government stimulus efforts are bolstering global economies and the prospects for reopening from lockdowns has consumers ready to unleash pent-up demand. A new wave of retail traders – spurred in part by direct government payments – is also helping markets climb. Still, whether the spurt of activity has created a bubble that could pop later is a key question in the minds of investors.

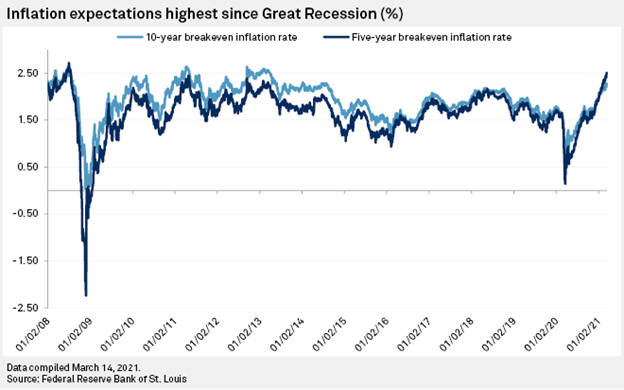

2: Inflation expectations

Inflation remains a central indicator for the economy, affecting a range of concerns from consumer prices, wages and how central banks will continue to respond to the crisis.

In the U.S., inflation lags the Federal Reserve's long-term target and is one of many factors contributing to the central bank's pledge to continue supporting the economy. A central question on the minds of many is what happens when that support dries up and will the current momentum in the economy be able to sustain itself beyond that point.

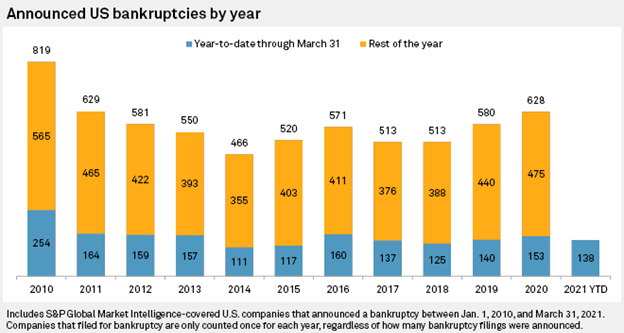

3: Corporate credit

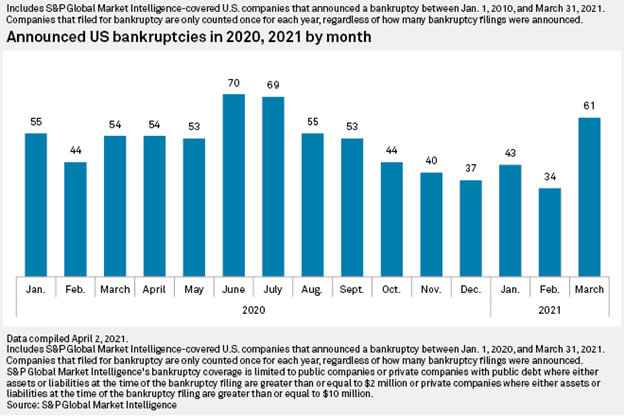

After a wave of bankruptcies and a spike in the likelihood and frequency of defaults, the hits to corporate credit in 2020 are receding.

Bankruptcies are slowing and a variety of factors from a recovering economy to government support mean companies are less likely to default than they were during the height of the crisis. Corporations are starting to see their credit recover as the number of rising stars pulled into investment-grade ratings from high-yield are growing, and downgrades into junk territory are falling.

In conclusion, the pandemic dealt huge blows to credit and markets in 2020, eroding both in just a matter of months. As the world continues to work toward getting the virus under control, conditions are ripe for a strong recovery that will not only reverse last year’s decline, but bolster economies and markets for months to come.

A key theme to watch in the 2H 2021 is whether that momentum persists past the waves of monetary support and initial reopening boom or if the bottom falls out of the recovery once governments cease efforts to prop up growth.