Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 15, 2025

By Anna Duquiatan

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

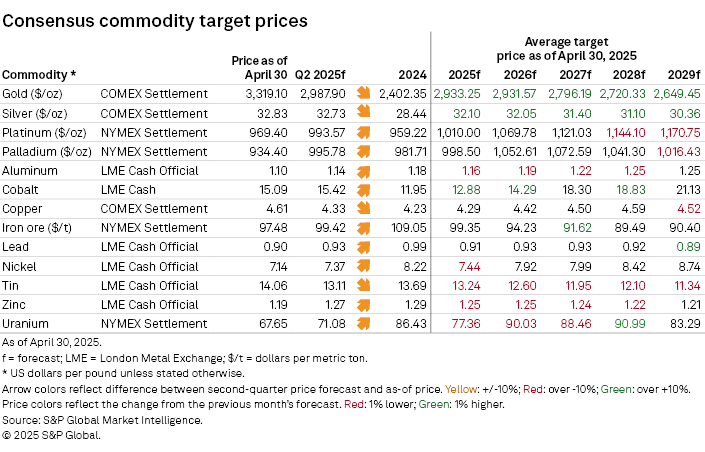

Erratic changes in the global trade landscape continued to drive demand for safe-haven assets, triggering sharp upgrades to consensus price targets for gold and silver through 2029. By contrast, accumulating trade obstacles as the US expanded tariffs and prompted retaliatory actions from other nations stifled demand sentiment for base metals, paring down consensus price expectations. However, supply concerns and hints of near-term upbeat economic activity in China drove some upside momentum for cobalt, copper and iron ore price outlooks.

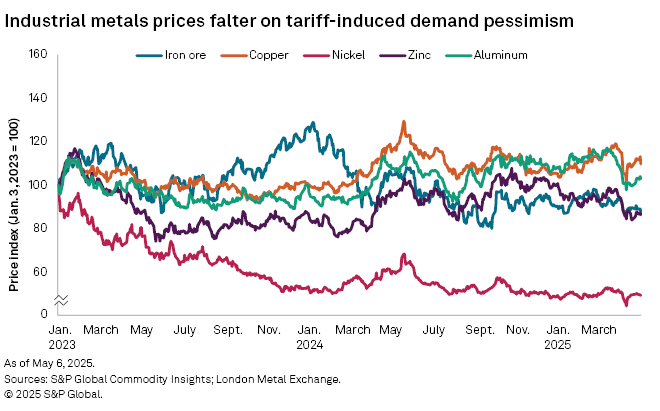

The trade friction escalated April 2 when US President Donald Trump unveiled so-called "reciprocal" tariffs on most of its trade partners, with a baseline of 10% and additional country-specific levies as high as 50%, effective April 9. The baseline tariffs entered into effect, but, with the exception of China, the country-specific add-ons were suspended on the same day for 90 days to allow for negotiations. The US set 145% tariffs on goods from China, while China imposed 125% import duties on US products. These developments drove volatility across base metals markets through April, with prices falling to their monthly lows as the new tariff policy approached implementation before trimming losses as the 90-day pause suggested a temporary softening of Trump's trade policies. Meanwhile, the gold price continued to hit new peaks amid investors' flight to safety.

Pending investigations under Section 232 of the Trade Expansion Act of 1962 — a likely precursor to the imposition of US tariffs — are further pressuring the demand prospects for industrial metals. Investigations were initiated March 10 for copper and April 22 for critical minerals, including aluminum, cobalt, nickel, palladium, platinum and zinc, which are covered in this report.

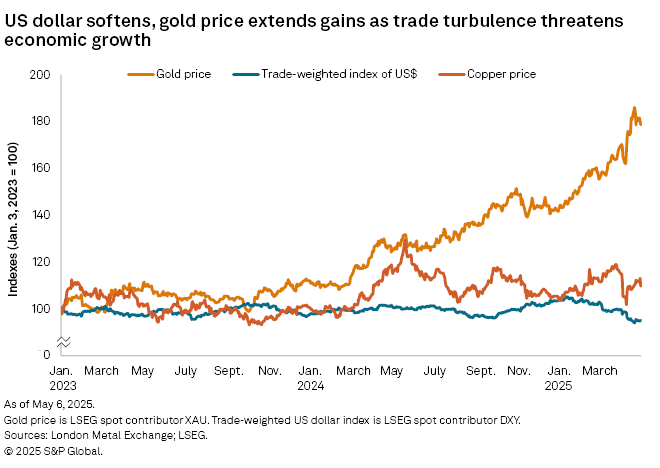

US economic activity is already showing signs of a slowdown amid tariff worries, with the manufacturing purchasing managers' index (PMI) in contractionary territory for the second consecutive month in April at 48.7 and the consumer confidence index at its lowest level in almost five years at 86.0. The trade-weighted index of the US dollar fell to 98.28 on April 21 — a low not seen since September 2019 — providing some support for industrial metals prices. In China, manufacturing PMIs remained in expansionary territory in March, while the stubbornly weak domestic property sector showed hints of improvement, with real estate investment, new house prices and floor space under construction declining at a slower rate in the March quarter compared to December 2024. However, a tariff-induced economic slowdown threatens to undermine improvements in China's manufacturing and property sectors, which was reflected in weaker April PMIs.

Rising input costs, supply chain disruptions, stifled consumption levels and shifting trade flows could cascade beyond the US. Outside of the inflationary pressures fueling US recession worries, global economic growth prospects have turned bearish. In its May 1 research note, S&P Global Ratings downgraded its 2025 global GDP growth forecast to 2.7% from 3.0%.

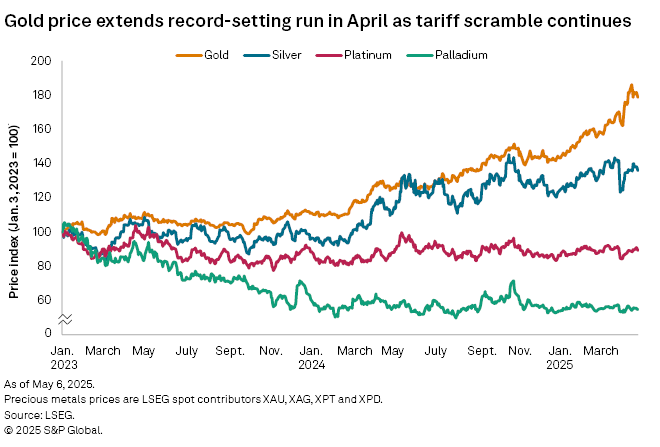

The softer economic outlook has supported gold prices. After setting 20 record highs in the first quarter, the London Bullion Market Association gold price extended its rally into April, reaching a new peak at $3,433.55 per ounce on April 22. The ongoing trade turmoil continues to drive tailwinds for the gold price, as heightened prospects of inflation in the US and slower global economic growth fuel safe-haven demand. Amid deteriorating consumer sentiment and fears of a possible recession in the US, the US dollar weakened. Central bank demand for gold remained robust in February, while physically backed gold exchange-traded funds' total assets under management continued to rise to $345 billion in March, with monthly inflows led by North America. Consensus price forecasts for gold have been raised for every year across 2025–29, with an average upgrade of 9.8%.

The price of silver fluctuated in early April, reaching $33.99/oz on April 2 before falling to $29.59/oz on April 4. It stabilized to trade on either side of $33/oz from April 11–30. Silver derives support from a combination of a persistent structural market deficit and safe-haven demand amid evolving geopolitical and global trade tensions. According to the Silver Institute, 2025 marks the fifth consecutive year of supply deficit in the silver market, although industrial demand is expected to be flat after reaching record highs in recent years. Silver's industrial applications make it susceptible to economic uncertainties, however. Silver consensus price forecasts have also been adjusted higher through 2029, albeit less than for gold prices, with an average upgrade of 4.4%.

Platinum and palladium prices moved in tandem throughout April within the $900-$1,000/oz range. Consensus price expectations for 2025–29 show platinum holding a premium over palladium, though average targets have been downgraded 1.4% for platinum and a modest 0.3% for palladium. US tariffs on complete vehicles and auto parts that entered into effect April 2 and May 3, respectively, have dampened demand sentiments for platinum and palladium, which are both used in vehicle catalytic converters. However, supply challenges could limit the downside, with the platinum market expected to face a supply deficit despite the anticipated impacts of the trade disruptions, while the palladium market could see output cuts as some producers opt to curtail operations due to low prices.

The London Metal Exchange three-month copper price dropped to $8,588 per metric ton on April 8, its lowest level in over a year, on the heels of the US government unveiling wide-ranging and higher-than-expected tariffs on its trade partners. As President Trump called for a 90-day pause on tariffs beyond the 10% baseline and duties imposed on China, the LME 3M copper price recovered and held above $9,000/t from April 11–30. While US inventory building ahead of tariff implementation is driving upside momentum in the near term, the longer-term implications of the evolving trade risks on consumption levels and global economic growth have dampened market sentiment. Investment funds' net long position on copper declined in April. While manufacturing activity slowed in the US, manufacturing in China was upbeat in the first quarter, and the country's property sector showed hints of improvement. However, escalating trade tensions could impact China's exports and undermine the apparent upturn. Limiting the downside on prices, the copper concentrate spot treatment charge (TC) reached a new record low of negative $41.7/t April 25, suggesting ongoing concentrate market tightness could result in refined production cuts. However, with tariff-induced negative implications for demand carrying sway, copper consensus price expectations have been downgraded 0.4% on average over the five-year forecast horizon.

Tariff-related demand pessimism prevailed over supply worries and dragged on the LME 3M zinc price, which dropped to a monthly average of $2,642.79/t in April. Ongoing tightness in the raw materials market provided some support for zinc prices, however. Teck Resources Ltd. and Korea Zinc Co. Ltd. settled the 2025 annual benchmark TC at a record low of $80/t, reflecting an ongoing concentrate supply squeeze that could lead to reduced refined production. Although inventory building in the US ahead of potential tariffs was observed, longer-term prospects for demand are gloomy. Tariff concerns have already impacted US economic activity, with the domestic manufacturing PMI in contraction and consumer confidence declining. Accumulating trade restrictions have fueled pessimism over economic growth prospects for not only the US but also its trade partners. Zinc consensus price targets have been adjusted 1.3% lower on average for 2025–29.

The LME 3M closing nickel price tumbled to its lowest level in almost five years at $14,082.79/t April 9 before recovering to above $15,000/t April 11 and holding that level through the close of the month. The ongoing trade friction continued to drag on the nickel price, despite news of potential supply-side headwinds in Indonesia. On April 11, Indonesia announced a hike in royalty tax rates on domestic nickel producers effective April 26, potentially further disincentivizing production already pressured by declining nickel prices and rising production costs. With the pending US government investigations of critical mineral imports, front-loading ahead of potential tariffs could be bullish for nickel in the short term, but longer-term demand erosion amid slowing economic growth could exacerbate the anticipated primary nickel market oversupply, which is projected to persist through 2030. Consensus price forecasts for nickel have been downgraded 0.5% on average through 2029.

The LME 3M aluminum price fell below support at $2,600/t to an eight-month low of $2,316/t April 9. It trimmed losses as the month unfolded and averaged $2,403.92/t April 10–30. US aluminum demand has remained resilient, with the benchmark Platts-assessed US Midwest aluminum premium to LME cash price at 38.45 cents/lb on April 24, a level near the peak of 41.75 cents/lb recorded in early March. Platts is part of S&P Global Commodity Insights. Outside the US, demand appears to be contracting. The Platts-assessed Japan CIF spot premium to LME cash fell to its lowest level in a year at $134/t April 29 amid news of possible output cuts by domestic original equipment manufacturers in May, while inventory drawdowns in global exchange warehouses have slowed in February and March. Investor funds' net long positions in LME aluminum shrank in April. With intensifying trade friction jeopardizing supply chains and global economic growth prospects, stifled consumption levels could widen the anticipated aluminum market supply overhang. Consensus price expectations for aluminum have been lowered 1.7% on average for 2025–29.

The Platts-assessed European cobalt metal price consolidated at $16.00/lb in April. Heightening trade risks fueled somber demand prospects for cobalt, but the ongoing export ban imposed by the Democratic Republic of Congo — with an initial implementation period of four months from its start in February — kept prices supported. DRC exports of cobalt already faltered 0.3% year over year in February, before the export ban came into effect. Plug-in electric vehicle sales and traction battery production were strong in the March quarter, but emerging trade barriers from the US tariffs on complete vehicles and auto parts, as well as potential import duties on critical minerals, could negatively impact demand moving forward. Already, some automakers are either suspending or shifting production lines in response to tariff uncertainties, while some jurisdictions are easing EV sales targets to reduce financial pressures on car manufacturers. With limited options for expanding cobalt production, the US is engaged in talks with the DRC for a potential minerals-for-security deal. Cobalt consensus price targets were raised 2.7% on average for the five-year forecast horizon.

The Platts IODEX 62% Fe iron ore price averaged $99.76 per dry metric ton in April, down 2.6% month over month amid deteriorating US-China trade relations. While near-term indicators in China drive bullish sentiments, longer-term prospects are less supportive. A persistent decline in the China property sector stabilized in the March quarter, while PMIs showed domestic manufacturing largely remaining in expansionary territory. However, barriers to Chinese exports could drag on iron ore demand, with the country bearing the brunt of US tariffs. China iron ore imports fell 7.8% year over year during the March quarter, due in part to weather-related supply disruptions in Australia. As China's exports are redirected from the US to other markets, it will likely have a cascading effect, dampening sentiments over global economic growth. Meanwhile, efforts to reduce steel production in China in response to domestic oversupply would also lower iron ore demand. Consensus price expectations for iron ore have been adjusted 0.9% lower for 2025.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.