Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Jul, 2023

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

See S&P Global Commodity Insights' most recent market outlooks for copper , gold , iron ore , lithium and cobalt , nickel and zinc .

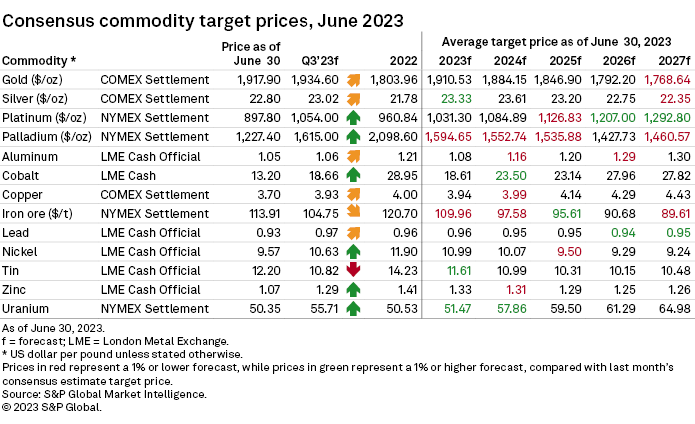

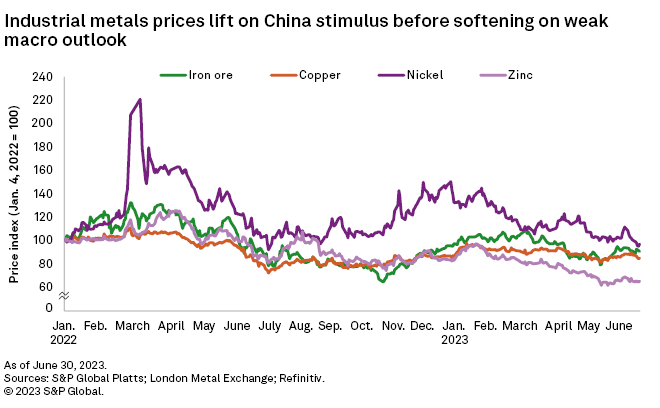

Industrial metals prices rallied in June on expectations for further stimulus support for China's stalling economic recovery, with measures seeking to boost consumer demand in the property and manufacturing sectors. Consequently, the September quarter consensus price forecasts are mostly above prevailing market price levels. The release of more disappointing economic data in China, however, has latterly tempered some of the optimism around the government's policy effectiveness to sufficiently boost its economy. Alongside the prospect of further interest rates hikes in the US and Europe, the ensuing global economic uncertainty has triggered downward revisions to consensus price estimates for industrial metals in full-year 2023, but upgrades for gold and silver.

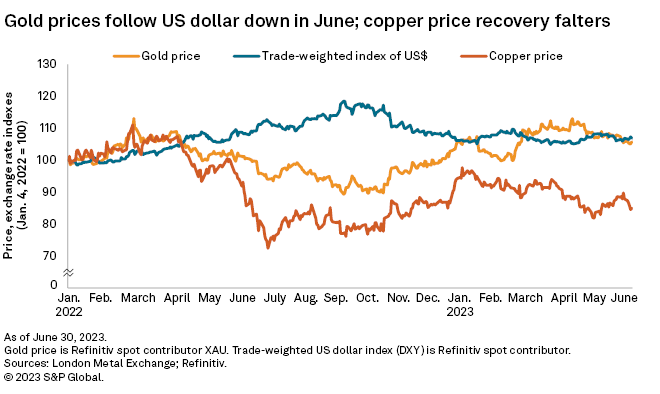

Industrial metals prices rose in the first half of June, supported by a pause to US interest rate hikes and a consequently weakening dollar, as well as demand recovery in China — buoyed by further stimulus support for its economy. Some of the recent price gains were given up in the latter half of June, however, as investors factored in slower global manufacturing and doubts around the effectiveness of China's stimulus in their outlook for metals demand. Global macroeconomic headwinds helped to arrest the slide in gold prices, just as geopolitical tensions intensified in Russia following the aborted military uprising by Wagner fighters June 24.

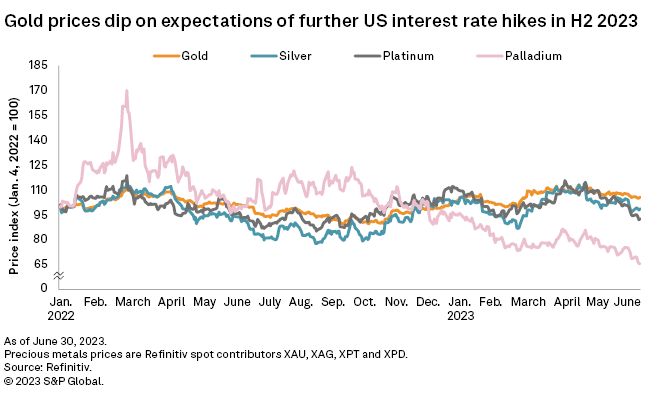

Gold prices dropped to a three-month low in June, following the US Federal Reserve's hawkish pause to interest rates hikes as US inflation moderated to 4% in May. Robust US jobs data, however, provided fresh impetus for Fed Chairman Jerome Powell to signal that there will be no let-up in the battle to curb inflation, fueling expectations for further rate hikes in the second half, the first of which could be as early as July. However, gold's safe-haven investment status helped lift demand and prices at month-end. Bolstered by the uncertain economic and geopolitical backdrop, the consensus price forecast for gold has been revised 0.7% higher in 2023 to $1,911 per ounce.

With risk-off sentiment weighing on the broader precious metals sector in June, silver prices followed gold lower. The gold-silver price ratio averaged at 83.1 for the month, up from 82.3 in May, with the manufacturing slowdown weighing more heavily on silver's industrial demand component. Nevertheless, the outlook for silver is more compelling, with consensus price forecasts upgraded by an average of 1.0% in 2023 and 2024, with the expected ramp-up in production of silver-containing solar panels to be a key driver of demand.

Platinum prices fell to an eight-month low of $894 per metric ton (t) June 29, with sentiment dampened by the weakness in the manufacturing sector and broader economy. Underlying fundamentals remain strong, however, amid robust demand and tight supply, which is expected to result in a major deficit in the market this year. Consensus price forecasts for platinum are on a rising trend across 2023–27, supported by tightening emissions legislation and potential emerging demand from growth in the hydrogen economy.

The slide in palladium prices continued in June, reaching their lowest level since December 2018. Demand remains under pressure, as challenging economic conditions pose downside risk for the automotive sector and substitution for platinum in gasoline vehicles continues to erode palladium usage. Palladium supply has also held up well despite power constraints in South Africa threatening disruptions. Further, reports about key producer Nornickel expecting the palladium market to move into a surplus also weighed on sentiment, with consensus price forecasts downgraded by an average of 4.0% in 2023 and 2024.

London Metal Exchange (LME) copper prices rallied to a two-month high of $8,670/t June 22 spurred by US dollar weakness and improving demand in China, which led to a sharp decline in Shanghai Futures Exchange copper stocks. A slew of announcements from China's government signaling further economic stimulus was initially supportive for prices, before the release of weak manufacturing and consumer data meant that copper prices ended the month where they started, at $8,210/t. With growing surpluses expected to emerge in the copper market near term, consensus price forecasts have been downgraded by an average of 0.7% across 2023–25. Copper demand growth — led by the global energy transition — is, however, projected to outpace supply growth from 2026, resulting in upgrades to price forecasts.

The LME zinc cash price rose to $2,485/t June 16 on supply pressure following Boliden's announcement that it would close its Tara zinc mine in Ireland — Europe's largest mine — citing low prices and high energy costs. While a weakening US dollar also helped support zinc prices, momentum waned through the month amid heightened concerns around global economic growth. With economic headwinds expected to weigh on zinc demand, consensus price estimates have been downgraded by an average of 1.0% through to 2026.

Following a short-lived price rally, the LME nickel price dropped to a current-year low in June but still was at a premium to China battery-grade nickel sulfate prices. Market sentiment was initially buoyed by a surprise reduction in short-term interest rates by China's central bank, and the Fed keeping US rates on hold. Prices then pulled back as sentiment waned on expectations of further rate hikes in the US and Europe and a more sober recovery outlook in China. Strong supply growth in Indonesia and China, amid a challenging electric vehicles sales environment, saw battery-grade nickel sulfate prices in China drop faster than the LME benchmark. With a wealth of nickel supply in the pipeline, growing market surpluses are expected, which underlies downgrades to consensus price forecasts averaging 0.3% across 2023–27.

Cobalt prices moved higher in June, boosted by rising demand for cobalt-containing EV batteries, restocking and tightness in cobalt availability. Cobalt suppliers have been reluctant to offer material at low or discounted prices, reducing the number of available cobalt units, which has driven up cobalt chemical and metal production costs. Consensus price forecasts for cobalt point to a rise in the September quarter, although the full-year 2023 estimate is downgraded by 0.5%. The sluggish global economy is weighing on cobalt demand in the consumer electronics sector, requiring EV sales to accelerate to maintain the cobalt price recovery.

Despite the S&P Global Platts IODEX 62% Fe iron ore price rallying 20% to $116.65 per dry metric ton June 9, from a six-month low in May, on the news of further economic stimulus in China, iron ore prices struggled to maintain momentum in the month. Sentiment was dampened by weak consumer confidence and shifting expectations for a slow-paced recovery in China's beleaguered property sector, now estimated to potentially take several years. The pace of China's iron ore imports is expected to slow amid the prospect of further cuts in domestic steel production, while strong growth is expected in shipments from Brazil, Australia and India through year-end and into 2024. These factors underlie the downward trend for iron ore consensus price forecasts from 2023 to 2027.

Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.