Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 27, 2025

By Tim Zawacki

The calendar-year 2024 underwriting results of the largest US state workers' compensation insurance fund speak to the strength and resilience of the market as a whole.

California's State Compensation Insurance Fund, according to materials posted in advance of a Feb. 26 board meeting, posted a net underwriting profit for a second consecutive year — no small accomplishment for a company that as both an insurer of last resort and a competitive market participant has a history of sizable losses.

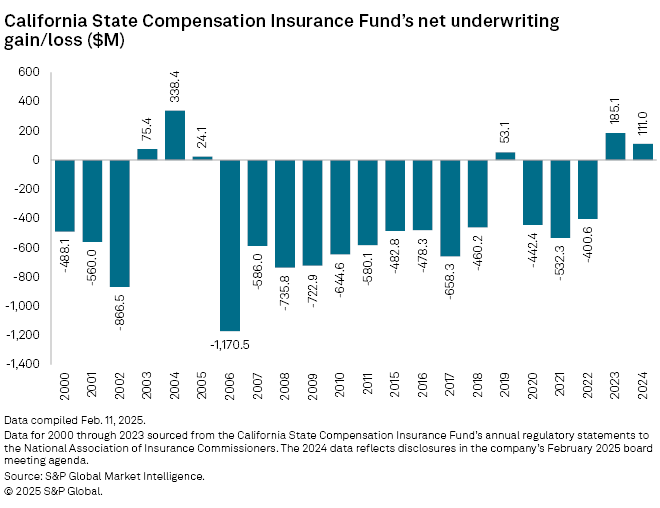

Operating in the traditionally challenging California workers' comp market, State Fund only once generated an underwriting profit from the start of 2006 through the end of 2022. Its 16 annual underwriting losses during that stretch each exceeded $300 million and cumulatively totaled $9.21 billion. While its 2024 net underwriting profit shrunk by approximately 39.9% from 2023, to $111 million, State Fund last posted positive underwriting results in successive years from 2003 through 2005.

The US workers' comp business is on track to generate a calendar-year combined ratio in 2024 that is well below long-term averages for a remarkable 10th consecutive year. Favorable prior-year reserve development has contributed significantly to this outperformance, complemented by relatively benign claims frequency and severity trends.

Favorable reserve development and ongoing top-line headwinds characterized 2024 results for State Fund and private carriers alike.

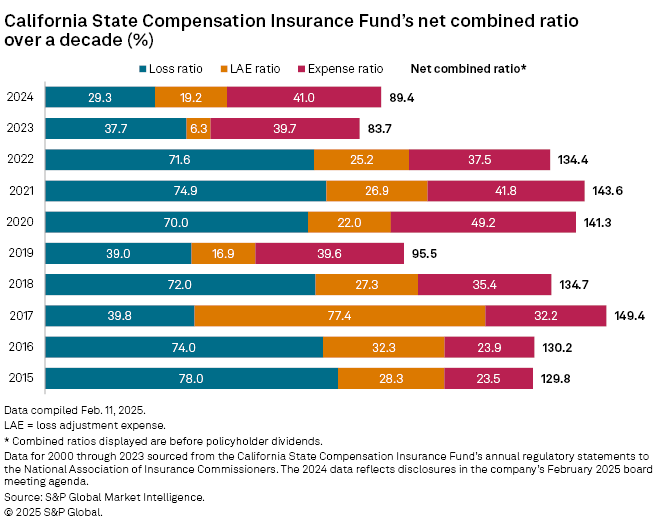

State Fund's net losses and loss adjustment expenses (LAE) increased 4.7% in 2024 at the same time as its earned premiums slipped nearly 4.8%. In turn, its loss and LAE ratio of 48.5% marked an increase of 4.4 percentage points from 2023's 44.1% but remained at exactly one-half of 2022's result.

The company said it released $496 million in loss reserves in 2024, compared with $448 million in 2023. The 2023 figure is in line with the $448.1 million in favorable loss and defense and cost-containment expense reserve development that appeared on Schedule P of State Fund's 2023 annual statement. State Fund further reported $48 million in favorable LAE development as compared with a year-earlier result of $200 million, which aligned with the adjusting and other redundancy that showed on its annual statement. The favorable loss and defense and cost-containment expense development in the aggregate and as a percentage of prior-year-end surplus (6.9%) stands as State Fund's highest in a calendar year since 2019.

All told, State Fund posted a combined ratio of 102.5%, or 89.4% excluding a net amount of $142 million in policyholder dividends paid out during 2024. Its combined ratio before dividends in 2023 was 83.7%. The underlying combined ratio, excluding both dividends and prior-year development, improved to an estimated 139.5% from 140.6% in 2023.

The company faces additional challenges on the top line in 2025 after its net premiums earned declined for a third straight year in 2024. An overall rate decrease of 8.3% took effect Dec. 1, 2024. State Fund continued to rank as California's largest workers' comp insurer with 9.6% market share in 2023, but its lead over No. 2 Evergreen Parent LP (AmTrust Financial) narrowed considerably.

Rate decreases and favorable development have impacted workers' comp carriers across the industry to varying degrees. And those private companies that have reported fourth-quarter 2024 results have issued a mix of optimism and pessimism about what 2025 will bring.

Loss severity trends have generally been held in check as medical cost inflation continues to lag the US Consumer Price Index overall. In 2024, the Consumer Price Index rose 2.9%. Categories relevant to workers' comp claims such as physicians services and medicinal drugs showed considerably slower growth, though hospital services ran hotter. Loss severity has generally been held in check amid mixed trends in drivers of medical costs. In the Feb. 12 release of the US Consumer Price Index for January, month-over-month increases in categories relevant to workers' comp claims such as hospital services and medicinal drugs exceeded the 0.7% overall rise in consumer prices, but the physicians' services category increased only 0.1%.

Several carriers indicated that claims frequency declined in 2024, continuing a long-running trend.

"[It is the] same story that we've seen for many years now," Old Republic International Corp. President and CEO Craig Smiddy said during a Jan. 23 conference call.

W. R. Berkley Corp. President and CEO W. Robert Berkley Jr., who has been speaking cautiously about the workers' comp outlook for a number of years, said during a Jan. 27 conference call that he has been surprised by how "remarkably negative" claims frequency trends have remained. But, he added, "I continue to be concerned about medical cost and medical trend, and it is hard for me to imagine that the workers' comp market will be insulated from that reality indefinitely."

American Financial Group Inc. CFO Brian Hertzman said during a Feb. 5 conference call that his company is taking a "sort of tempered view of the potential for favorable development" in 2025 as its guidance for the year incorporates a higher loss pick in the business line and expectations for a "lower but still strong" level of profitability.

Cincinnati Financial Corp. President and CEO Stephen Spray offered comments during a Feb. 11 conference call about how workers' comp margins have remained strong despite rate headwinds.

"I've been talking about the deterioration of work comp pricing for I don't know how long now, and calendar year wise, the results continue to be favorable," he said. "So, we'll take it."

Carriers have benefitted from higher employee wages, helping to mitigate the impact of rate decreases on written and earned premiums. But for a company like State Fund, when it is implementing a rate decrease of the size of its December 2024 action, any top-line growth will be difficult to achieve. Based on the downward 2024 trend and the prospective impact of that rate action, the company seems destined to post its lowest amount of net premiums written in a year since 2012 when it last fell short of the $1 billion threshold.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.