Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Nov, 2016 | 13:00

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

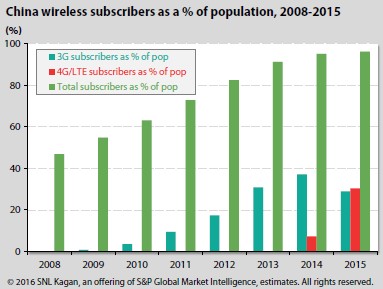

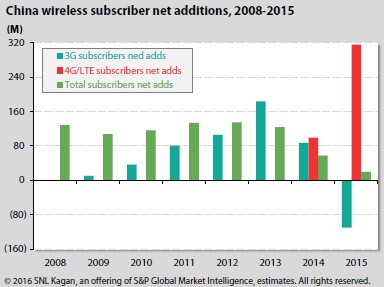

As the world's most populous country, China ended 2015 with 1.31 billion wireless subscribers, according to the Ministry of Industry and Information Technology (MIIT), a telecom regulatory body. Since 2008, the market's wireless subscriber base has more than doubled from 618.5 million, rising at double-digit rates until growth slowed in 2014 and 2015. Wireless penetration, defined as wireless subscribers as a percentage of total population, reached 96.3% as of year-end 2015, indicating wireless services were accessible to the vast majority of the general public, including more than 600 million people living in rural areas.

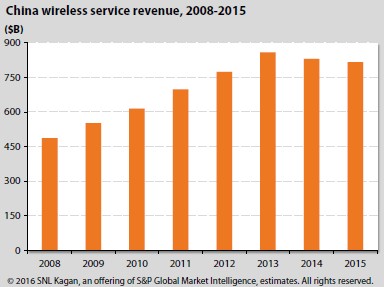

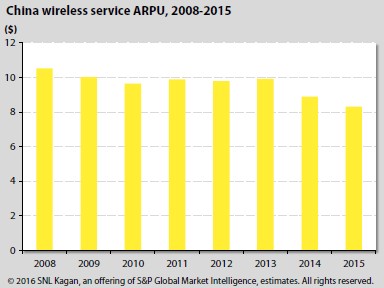

Due to slowed subscriber growth and declines in wireless service ARPUs, the market's aggregate wireless service revenue has dropped for two consecutive years since reaching an estimated $858.26 billion at the end of 2013, ending 2015 with a wireless market economy of $816.53 billion. Aggregate wireless service ARPU during 2015 was estimated at $8.32 per month, compared to $10.53 in 2008. SNL Kagan analysis indicates wireless service ARPU and revenue declines are mainly attributable to the contraction of economies of voice and SMS/MMS businesses as social media apps, such as Tencent Holdings Ltd.'s WeChat and Microsoft Corp.'s Skype, continue to gain momentum, serving as competitive alternatives to voice and messaging services.

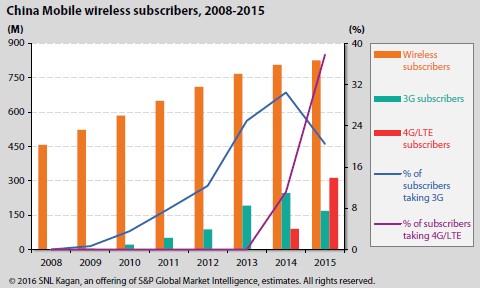

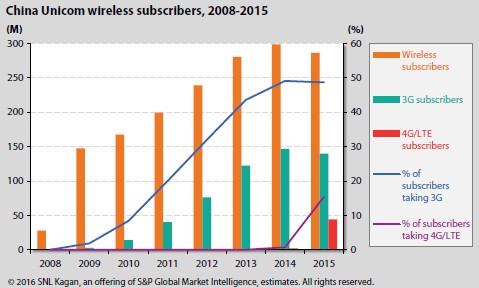

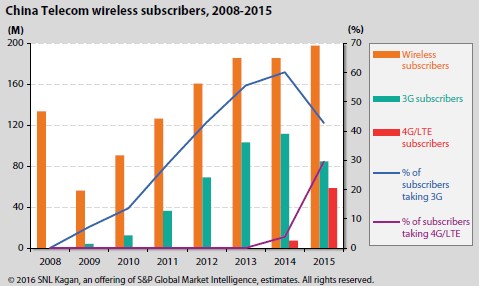

China's wireless market is divided among three state-owned telecommunications firms: China Mobile Ltd., China Unicom and China Telecom. As of 2015, China Mobile was the largest of the three, claiming 826.2 million wireless subscribers, a 63% share of the market. China Mobile is also the world's No. 1 wireless telecommunications operator in terms of network capacity and subscriber base.

All three providers started to offer 3G services in 2009, and later 4G/LTE services in 2014. By year-end 2015, China had 393.7 million 3G and 414.9 million 4G/LTE subscribers, accounting for 30.6% and 29.6% of total wireless subscribers, respectively. 3G subscribers began to decline as 4G/LTE was deployed in 2014, with the latter seeing strong 318.0% growth year-on-year during 2015. As of year-end 2015, China Mobile led the market in both 3G and 4G/LTE subscribers, at 169.4 million and 312.3 million, respectively.

China Mobile

As the market leader, China Mobile commenced 3G operations and network upgrades from 2G in 2009, with 3.4 million subscribers taking 3G services during the initial year of deployment, supported by 80,000 3G base stations covering 238 cities across the country. The carrier also launched value-added services leveraging its 3G network, including video calling, video messaging, video conferencing and video-on-demand. Its 3G base stations increased to 280,000 by 2012 and reached 450,000 by 2013, covering all cities at county level or above nationwide. As a result of 3G expansion, smartphone adoption and wireless data traffic grew rapidly; traditional businesses including voice, SMS and MMS started to decline as mobile Internet gained momentum.

Full commercialization of 4G services began in 2014, following the issuance of a 4G license to China Mobile in December 2013. The company actively developed its 4G business by deploying 720,000 4G base stations, with nationwide coverage in almost all cities and counties, as well as data hotspot coverage in developed rural towns and villages. It began migrating customers from 2G and 3G networks to 4G, and it launched a series of 4G multimedia services, including music, video and gaming.

By year-end 2015, China Mobile reported 312.3 million 4G customers on the world's largest 4G network, which consists of 1.1 million 4G base stations, covering 1.2 billion people in areas across the country above the rural town level, as well as data hotspots in villages, high-speed railways, underground subways, and key scenic spots. As China Mobile continued to transform its businesses from voice-centric to data-centric, revenue from data services surpassed revenue from voice for the first time ever in 2015.

China Unicom

China Unicom is the second-largest wireless carrier in the market. The company merged with China Netcom during the national telecommunications restructuring in 2008. In October 2009, it began rolling out commercial 3G services in 285 cities and expanded to 335 cities by the end of the year. As part of its mobile Internet services, China Unicom also promoted mobile music, mobile TV and instant communication. In 2011, the company introduced and promoted mid- and low-end smartphones, and enriched the offering of customized handsets.

By 2012, the number of China Unicom's 3G base stations had reached 331,000, with its network covering all cities throughout China, including most townships in the central and eastern regions of China and developed townships in western China. During 2013, the number of 3G base stations increased to 407,000, and the 3G network coverage rate in townships increased to 96%.

In light of intensified competition from domestic rivals, China Unicom launched 4G services at the end of 2014 and focused on subscriber migration to 4G during 2015. The company reported 44.2 million 4G subscribers as of year-end 2015, or 15.4% of its total wireless customer base, trailing both China Mobile and China Telecom. During 2015, 306,000 China Unicom 4G base stations were built, bringing its total to 399,000.

China Telecom

Fixed-line telco operator China Telecom entered the wireless market by acquiring China Unicom's CDMA business in June 2008, with a strategy of targeting mainly mid-to-high-end mobile subscribers. The carrier was granted a 3G license in January 2009, launching commercial 3G services under the e-Surfing brand in April 2009, with a network covering 342 cities and more than 2,000 counties nationwide.

As the company adhered to a smartphone-led strategy, Chine Telecom's 3G subscribers grew significantly, reaching 111.6 million by year-end 2014, or 60.1% of its total wireless subscriber base, the highest 3G adoption rate among all three carriers. In July 2014, the company commenced 4G operations in 56 trial cities followed by full commercial service launch, positioned to target mid-to-high-end users in mainly urban areas, while shifting 3G service focus to mid-to-low-end users in rural areas. It also introduced a series of 4G-dedicated data traffic products emphasizing video, music and gaming.

In July 2015, China Telecom launched the e-Surfing 4G+ service with 300 Mbps download speeds, paralleling its efforts to expand 4G coverage nationwide, which led the number of 4G customers to increase to 58.5 million by year-end 2015, or 29.5% of its total wireless subscriber base. Within its existing customer base, the company has started to migrate 3G users to 4G, causing the number of 3G subscribers to decline.

Wireless Investor is a regular feature providing exclusive research and commentary from Media & Communications (SNL Kagan), an offering of S&P Global Market Intelligence.