Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 19, 2021

By Mike Wiman

US-Mexico Cross-Border Trade via Mexico Customs BOL Data

Source: IHS Markit PIERS

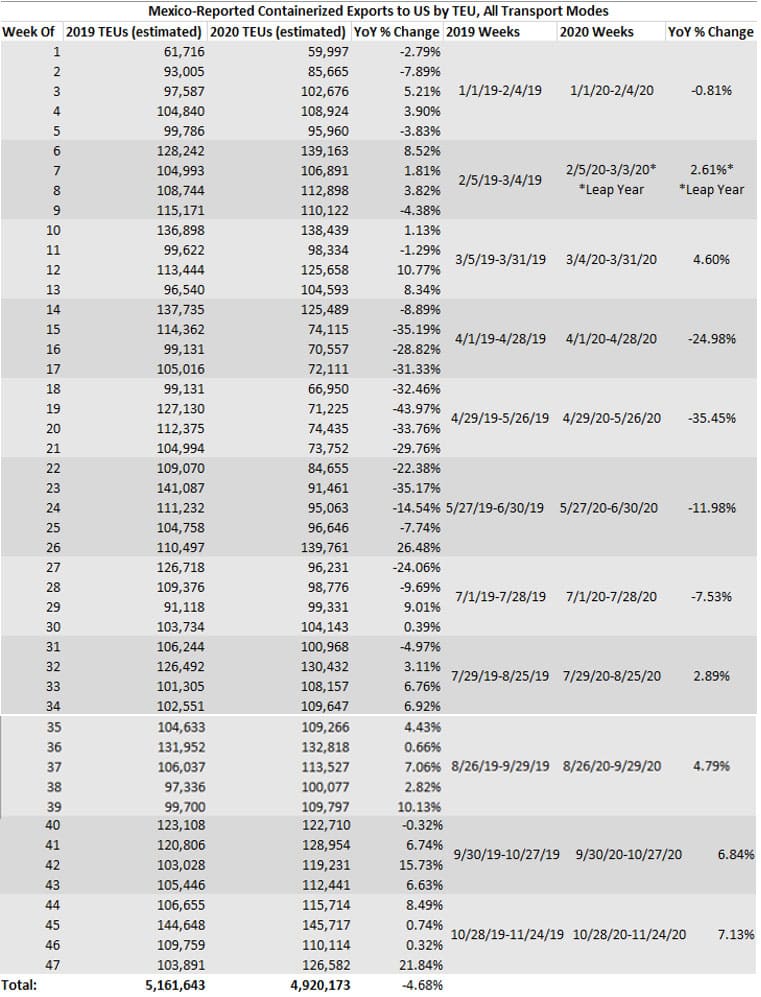

Mexico Customs bill of lading (BOL) data allows us to track US-Mexico cross-border trade using all transport modes such as truck, rail, maritime, pipeline and air. With data now available through November 2020 (week 47), we can continue to monitor rates of COVID-19 disruption and recovery YTD 2020 compared to 2019.

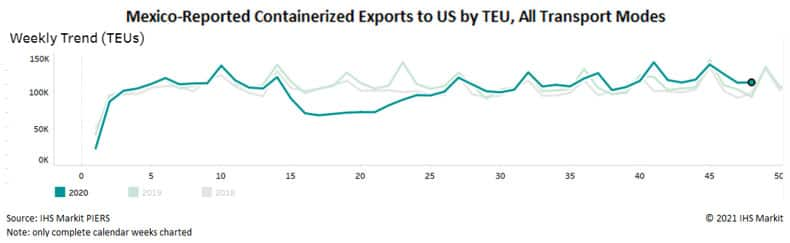

Widespread global COVID impacts struck around mid-March for many of the world's countries. Mexico specifically didn't impose large-scale quarantines until the last week of March 2020 (week 13), so export volumes were relatively flat through week 13 even as the quarantines affected trade for many other countries of the world. However, the export contraction reflected significantly in April 2020 (weeks 14-17) and worsened into May 2020 (weeks 18-21), with recovery signs reflecting in June 2020 (weeks 22-26) and July (weeks 27-30).

August (weeks 31-34) reflected the first month since March for which YoY growth in TEU exports was observed (2.89% growth) compared to the same period in 2019. Weeks 32-39 showed growth in the 0-10% range. In fact, in week 47, the last full week in November, exports grew at the strongest rate (21.84%) since week 26 (26.48%), the last week in June.

Thinking back to the uncertainty affecting the trade outlook in early 2020, it is interesting to note that aggregate containerized export volumes from Mexico to the US are down less than 5% over 2019 levels YoY.

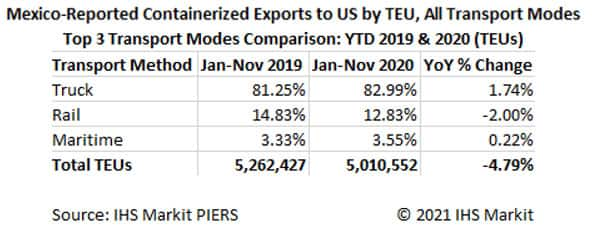

Most cross-border containerized goods are moved by truck (~83%), followed by rail (~13%) then maritime (~4%), with little change YOY even throughout the pandemic disruption and subsequent recovery.

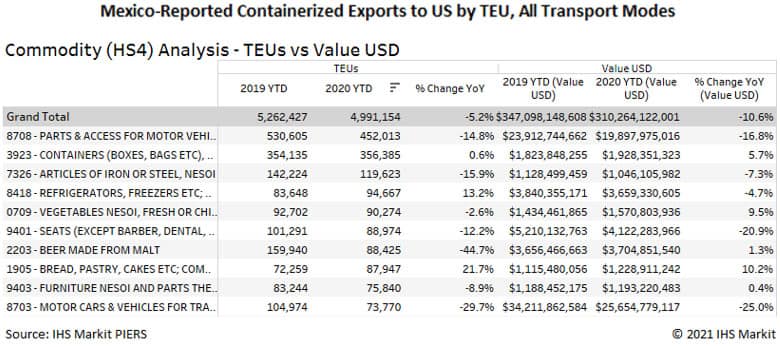

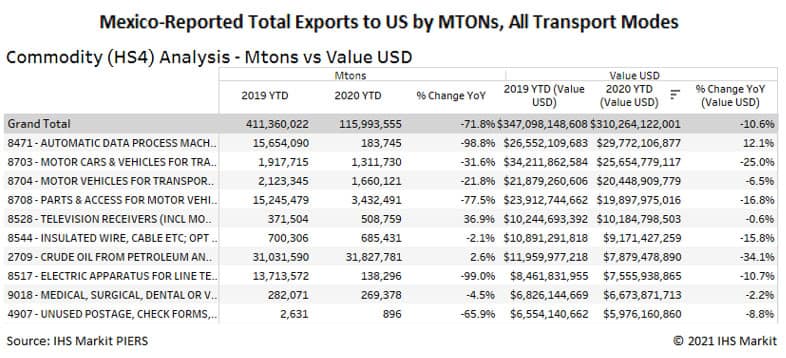

Analyzing the same period using metric tons (MTONs), which contains cargos both containerized and non-, we can quantify the beginning of the recovery, disproportionately affecting different industries and their companies. The first 47 weeks of the year showed a 10.6% decrease by total value in USD.

By USD value, the top five Mexico export commodities for YTD 2020 are in the areas of data processing machines, motor vehicles and parts, Insulated wire and cable and crude oil. Exports of passenger vehicles (HS 8703) fell 25% YoY. Automatic data process machines (HS 8471) grew 12.1% YoY for the same comparison period.

Crude oil (HS 2709) export volumes increased 2.6% MTONs YoY 2019 to 2020, but the crash in crude oil prices globally resulted in a decline of 34.1% by value.

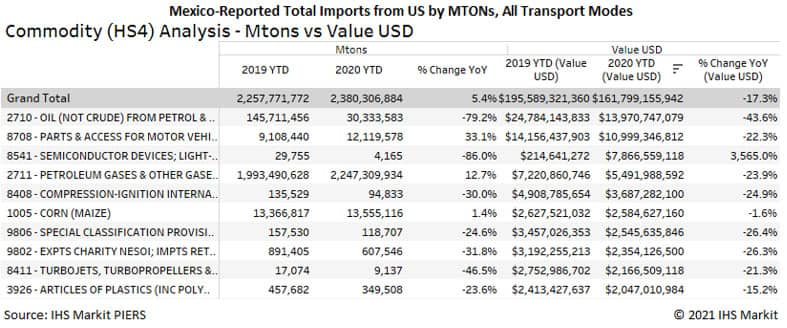

Mexico carries a trade surplus with the US, exporting more than it imports from its neighbor. For the first 47 weeks of the year, Mexico increased import MTONs from the US by 5.4% YoY 2019 to 2020 but decreased import value by 17.3% USD overall, with wide swings depending on the specific commodity category.

December 2020 data is not expected to be released until approximately January 24, 2021. The December 2019 baseline TEU volumes for comparison purposes were approximately 477,313, a 0.54% MoM increase over November 2019 volumes.

When we initiated this monthly series in mid-2020, we sought to use international trade data as a resource to measure the rates of disruption and recovery due to the relatively new phenomenon known as COVID-19, with a particular focus on Mexico-US cross-border trade. At the time the series was introduced, there were widespread reports of shortages of some consumer staples, amid speculation about possible changes in consumer panic buying behavior and/or upstream supply shortages. Analyzing trade data on a regular basis has helped us to quantify the YoY and MoM changes in containerized and non-containerized good transported from Mexico to US and the reverse trade direction. The recovery now appears to be well underway and relatively consistent as we draw the series to a close. We hope that you have found value in the analysis provided.

For additional information about subscription options for IHS Markit Maritime & Trade products including the data used for this data series, please feel free to contact your IHS Markit Account Manager or our Customer Care team.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 19 January 2021 by Mike Wiman, Director, Industry Solutions, Maritime & Trade, S&P Global Market Intelligence

How can our products help you?