Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 26, 2021

By Chulwoo Hong

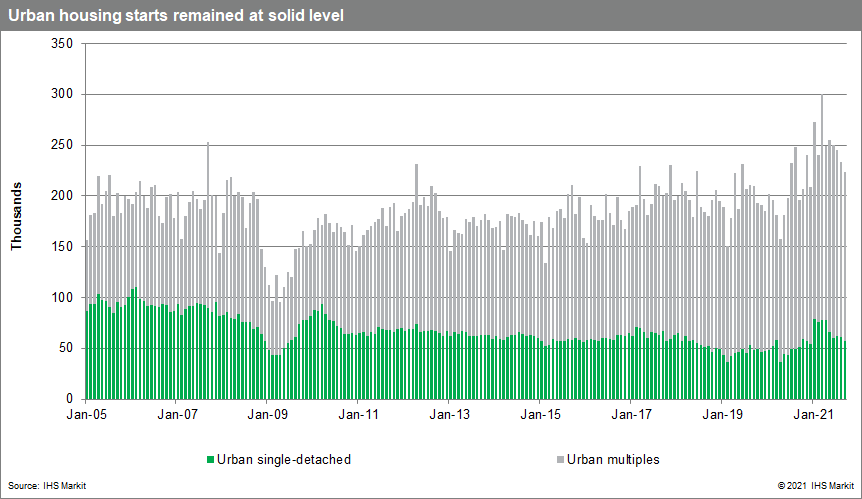

Movement in housing starts varied across segments and provinces in the month. Notable changes include the big drop in British Columbia's starts thanks to the outsized decline in Vancouver's multiples. Yet, urban single starts in British Columbia rebounded 9.6% m/m after declining in the previous five months. The 8.5% m/m decline in Ontario's housing starts was due to losses outside of Toronto. Saskatchewan's housing starts hit a 14-month high with a rebounding surge in multiples.

The number of residential building permits sharply dropped in August, mainly due to the plunge in multiples, which supports our forecast of a modestly decreasing trend of housing starts in the short term partly due to the slow population growth. Together with a modest downward revision for the second quarter's housing starts and the lower-than-expected third-quarter results, downside risks to the housing starts forecast is greater with some regional variances. However, national housing starts in the fourth quarter will likely be firmly higher than last year's level. Plus, while growth in total dwellings under construction decelerated to the slowest pace since December 2020 owing to the decrease in housing starts, the record-high level of residential buildings under construction will likely bring milder growth than the previous quarter's increase for real business investment in new residential construction in the near term.

Posted 26 October 2021 by Chulwoo Hong, Sr. Economist, Research advisory specialty solutions, S&P Global Market Intelligence