Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 18, 2022

Strong inflationary pressures as a result of a depreciating currency and public finance issues have begun to have a severe impact on demand and business activity in Ghana's private sector.

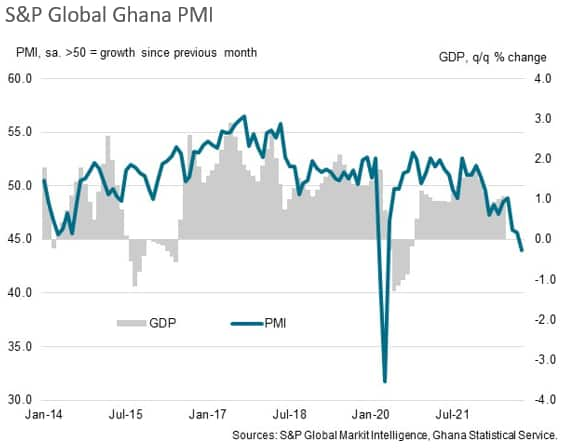

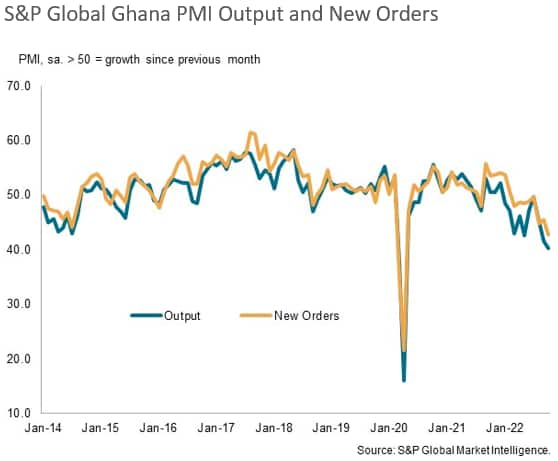

The S&P Global Ghana PMI dropped to its lowest in two-and-a-half years in October, with the latest decline only exceeded during the initial wave of the COVID-19 pandemic across almost nine years of data collection.

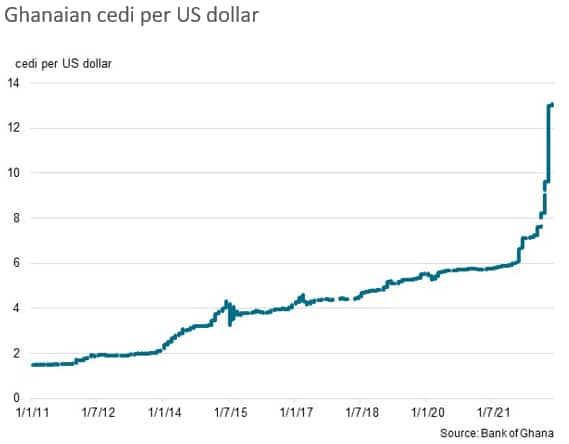

Concerns around national debt levels in an environment of rising interest rates across much of the world and strength of the US dollar have contributed to a marked weakening of the Ghanaian cedi. In fact, the currency has more than halved in value against the dollar over the course of 2022 so far.

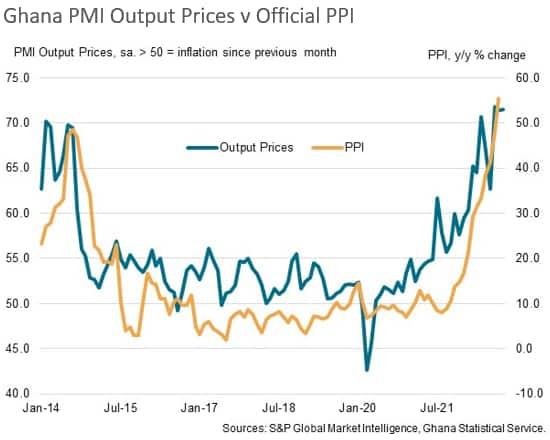

Currency weakness has exacerbated wider inflationary pressures, with steep price rises evident across both PMI and official inflation data. The PMI showed input costs for businesses rising at the fastest pace in around eight years during August, with inflation remaining elevated in the following two months as well. This has fed through to rising selling prices, with charge inflation running at the sharpest rates since the survey began in January 2014 in recent months.

The PMI data has tracked well against official inflation numbers. Producer prices were up 55.4% year-on-year in September, with consumer prices up 40.4% year-on-year in October, the highest in 19 years.

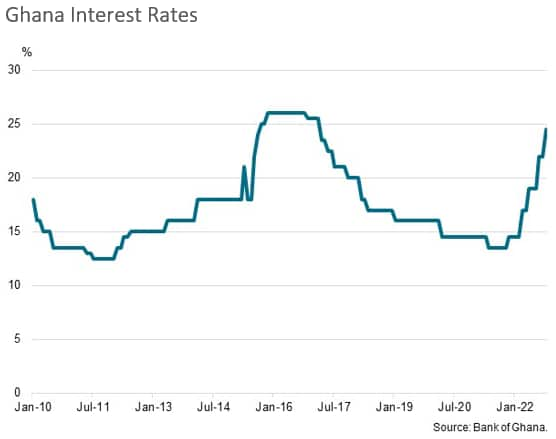

Efforts to tame inflation by the Bank of Ghana have seen interest rates hiked regularly over the course of 2022 so far, hitting a five-and-a-half year high of 24.5% in October and adding further financial pressures to the economy.

Price pressures have had a severe impact on demand according to the PMI survey. New orders have decreased in each of the past eight months, with the contraction in October the sharpest in the survey's history outside of the first wave of the COVID-19 pandemic in early-2020. Subsequently, business activity has also been scaled back substantially, and to a pace unprecedented outside of the initial pandemic outbreak.

Pressure on finances also led firms to cut back on staffing levels and purchasing activity, while business confidence slumped to a two-and-a-half year low. Overall, these data highlight how Ghana's fiscal problems have translated into challenges in the real economy, putting severe strain on households and businesses.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 016

andrew.harker@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location