Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jul, 2016 | 09:00

Highlights

Probably for the immediate one or two quarters profitability would still be weak, not as weak as in the [fiscal] third and fourth quarters, but still weak, said Amit Pandey, a credit analyst at S&P Global Ratings.

Loan growth is not as fast for some of the public sector banks, so NPL ratios will go up. The pace may not be as sharp as 2015, but at least for one year it should go up.

Indian public sector banks will have to experience a few more quarters of pain before they are able to recover from a mountain of bad debt stemming from the Reserve Bank of India's measures to strengthen the banking system.

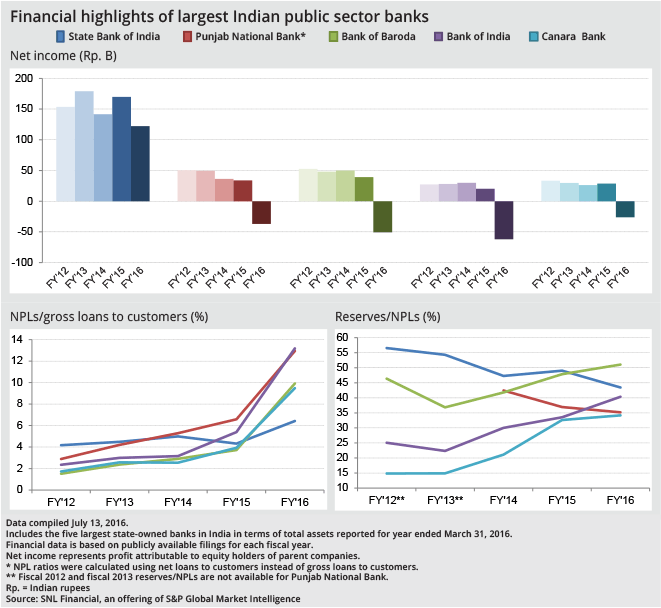

Four of the five largest government-run banks reported losses for the fiscal year ended March 31, with Bank of India reporting the steepest loss at 62.04 billion rupees. Meanwhile, India's largest lender, State Bank of India, saw its net income dip to 122.25 billion rupees from 169.94 billion rupees in the prior-year period.

As the impact of the RBI's asset quality review reverberates through the system, state-run lenders are unlikely to see relief anytime soon and taking more provisions for nonperforming loans will continue to constrain earnings.

Probably for the immediate one or two quarters profitability would still be weak, not as weak as in the [fiscal] third and fourth quarters, but still weak," said Amit Pandey, a credit analyst at S&P Global Ratings. "My sense is some of the public sector banks would be showing better profitability next year."

The steep decline in profitability at public sector lenders followed a push by the central bank to clean up their balance sheets. The RBI began the review of banks' asset quality in April 2015, after which it asked banks to properly classify bad loans and take more provisions for such loans.

The RBI gave banks until March 2017 to have "clean and fully provisioned balance sheets," directing them to increase provisioning by 2.5% every quarter to 15% by then, starting in April.

Following the review, banks saw their nonperforming assets shoot up. The central bank said gross NPAs in the banking sector went up to 7.6% of gross advances in March from 5.1% in September 2015.

Among state-run banks, Bank of India reported an NPL ratio of 13.18% for the fiscal year, more than double the 5.39% it reported in the prior year. Punjab National Bank saw its NPL ratio climb to 12.37% year over year from 6.44% in the prior-year period.

"Loan growth is not as fast for some of the public sector banks, so NPL ratios will go up. The pace may not be as sharp as 2015, but at least for one year it should go up," Pandey said.

The RBI expects gross NPAs at banks to rise to 8.5% of total assets by March 2017 from 7.6% in March under its baseline stress test scenario. Under more adverse conditions, the gross NPA ratio may further increase to 9.3% by March 2017, the central bank said in its financial stability report released June 28.

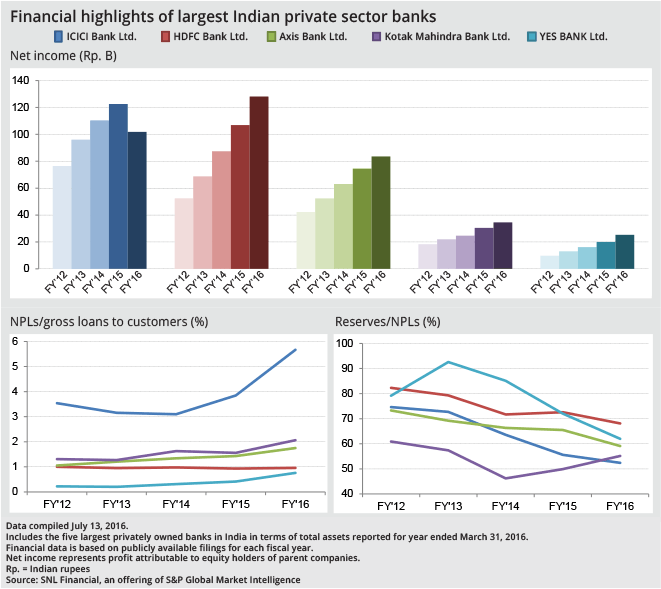

Public sector banks are not the only ones suffering from rising bad loans. Their private sector peers also saw NPL ratios increase for the fiscal year ended March 31, though they are thought to be better equipped to handle the rising bad loan situation.

"The profitability and capitalization of these banks are much higher than what it is for public sector banks so they can absorb some of these credit costs better. They have more retail component, they have a higher fee component in their earnings," Pandey said. "So I think the pressure is there, it's just that the ability to absorb the pressure is a little bit more than their public sector peers."

As painful as things are for lenders, the central bank is looking down the road.

"Pending the change in attitude, which I think will come as banks turn to unlocking the value in NPAs, we are working with them to sequence the most obvious actions up front. However, the end game is clear to everyone and bounded. We do not envisage a sequence of [asset quality reviews]," outgoing RBI Governor Raghuram Rajan said in a February speech.

It is not clear when bad times will come to an end for banks. Pandey noted that a turnaround for public sector banks is difficult and will require a combination of factors including fixing up troubled sectors, such as construction and steel; cleaning up banks' books; and improving governance in the public sector banks. Creating a bank board bureau is also another option to help boost banks' performance.

"So I think it's a combination of everything, and everything has to fall in line to get to a turnaround," he said.

As of July 15, US$1 was equivalent to 67.08 Indian rupees.