Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jan, 2016 | 07:00

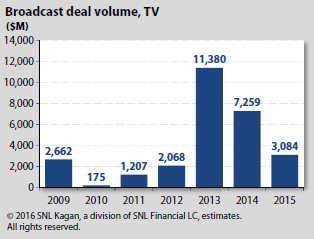

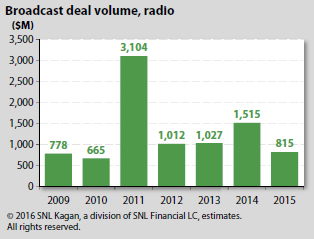

Broadcast station M&A volume reached $486.8 million in the fourth quarter of 2015. Radio reached $160.4 million while TV registered deals worth $326.4 million. The total seems low compared to the more than $3 billion of the previous quarter, but it is still more than the deal volume of the first half of the year.

There were no billion-dollar deals in Q4 and only one transaction of more than $100 million, but with 37 transactions of $1 million or more, Q4 delivered a similarly solid number of million-dollar deals as the previous quarter (38 deals over $1 million).

The TV market ended the year with an average 8.4x forward seller’s multiple (0.1 point higher than at the end of Q3). The radio cash flow multiple remained unchanged at 6.7x.

The top TV deal and the only hundred-million-dollar deal of the quarter was Nexstar Broadcasting Group Inc.’s $130 million/8.4x c.f. acquisition of the CBS outlets in the West Virginia markets of Charleston-Huntington, Bluefield-Beckley-Oak Hill and Wheeling, as well as the NBC affiliate in Clarksburg, W.Va., from West Virginia Media Holdings.

Sinclair Broadcast Group Inc. was the highest bidder for a TV station cluster jointly serving Nebraska’s Lincoln- Hastings-Kearney market that was put up for auction by the Pappas Liquidating Trust. The station group includes ABC affiliates KFXL-TV in Lincoln and KHGI-TV in Kearney and four translators (one full power, one Class-A and two low power).

In a twist to the usual spectrum aggregator model, LocusPoint Networks LLC sold three of its stations — WMJF-CD in Baltimore, W33BY in Detroit and WBNF-CD in Buffalo, N.Y. — to HME Equity Fund II LLC for $23.75 million. LocusPoint and its backers Blackstone Group had acquired the stations in 2012-2014 for a total of $4.83 million and may have wanted to earn a return on some of the capital invested to date, and/or concentrate on a smaller number of high-demand markets. As a group, the stations went for 90 cents/MHz/pop and $8.62/TV home, versus the levels of 11 cents to 27 cents at which LocusPoint acquired them.

The last large TV deal of the year was TEGNA Inc.'s $23.6 million re-acquisition of three TV stations. In 2013, when Gannett Co. bought Belo Corp., it spun off seven of the acquired stations to Sander Media LLC to comply with TV/newspaper cross-ownership caps. Now that Gannett has been split into publishing (Gannett Co. Inc.) and TV (TEGNA Inc.) ,TEGNA acted on a purchase option to bring back WHAS (ABC) in Louisville, Ky.; KGW (NBC) in Portland, Ore.; and KMSB (FOX) in Tucson, Ariz.

The top news in the radio sector was the second-largest radio deal of the year, Wilks Broadcast Group LLC’s $54.0 million/8.1x c.f. sale of its three-station cluster in the Denver market to sports and real estate mogul Stan Kroenke's Kroenke Sports & Entertainment LLC. Wilks, who is exiting the radio business, also found buyers for its Columbus, Ohio, stations. The company sold WLVQ to Saga Communications Inc. for $13.0 million/7.4x while Radio One Inc. purchased WHOK and WZOH for $2.0 million.

Gray Television Inc. was the other top radio seller in the fourth quarter spinning off its 11 FM, two AM stations and four translators acquired in the deal for Schurz Communications Inc. to Neuhoff Family Limited Partnership, Mid-West Family Broadcasting Group and HomeSlice Media Group LLC for a total of $16.0 million.