Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 May, 2017 | 10:15

By Eric Turner

Highlights

Two key themes have emerged as digital lenders work on how to offer sustained profitability in addition to an innovative business model.

Ten years into the age of digital lending in the U.S., the sector is still trying to figure out how to offer sustained profitability, in addition to an innovative business model.

To that end, two key themes — expense control and borrower quality — have emerged at two of the nation's largest digital lenders.

Steps toward profitability showed up in first-quarter earnings. LendingClub Corp. reported a GAAP net loss of $29.8 million, improving from a net loss of $32.3 million in the fourth quarter of 2016. On Deck Capital Inc. also narrowed its GAAP net loss to $11.1 million from $35.9 million in the prior quarter. A comparison to year-ago results tells a different story. LendingClub turned a $4.1 million profit in the first quarter of 2016, during a period of record originations and before news broke of internal problems at the company. On Deck reported a net loss of $12.6 million for the same period.

Though these two companies do not represent the digital lending market as a whole, their relative maturity, large size, and different operating models offer insights into the challenges and opportunities facing the sector.

Credit quality in focus

Both On Deck Capital and LendingClub reiterated their commitment to improving borrower credit quality during their respective first-quarter 2017 earnings calls. By tightening credit funnels and adjusting rates charged to borrowers, they aim to increase risk-adjusted returns on loans.

Some critics argue that marketplace lenders like LendingClub can put growth ahead of loan quality because they do not retain credit risk. But credit quality is important for attracting investors, since demand for marketplace loans will decrease if losses exceed expectations.

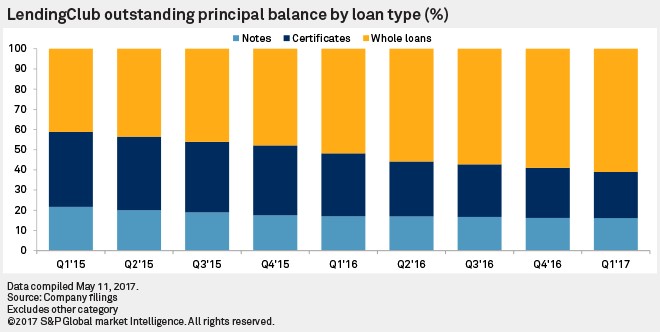

This has become particularly important as the marketplace lending industry has shifted toward an institutional investor base. The majority of the principal balance on outstanding loans originated through the Lending Club platform now consists of whole loans, which are purchased primarily by banks and other institutional investors.

LendingClub tightened underwriting standards in 2016 and has increased interest rates for select loans over time, prioritizing higher-quality borrowers and attractive risk-adjusted returns. The company adjusted interest rates throughout 2016 and into 2017, with the most impact on lower-rated borrowers. LendingClub grades borrowers on a scale from A through G, with A being the best credit quality. LendingClub also reduced the maximum debt-to-income ratio for borrowers in June 2016, primarily impacting borrowers in the E through G range.

Unlike marketplace lenders, hybrid and direct lenders are directly impacted by losses in loan portfolios, which is a challenge as they refine their underwriting software and test new products.

As On Deck has shifted from a mix of marketplace and direct funding to a primarily direct model, credit quality has taken on even more importance.

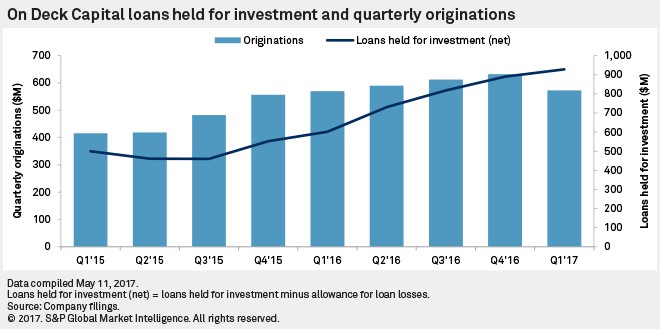

In the fourth quarter of 2016, On Deck saw its provision rate — equal to loan loss provisions divided by new loan originations held for investment, net of new loans sold — jump sequentially to 10.2% from 6.9% due to higher-than-expected losses in seasoned, longer-maturity loans. The provision rate is impacted by both new originations and changes for loans originated in prior periods. Through credit tightening, management reduced this number to 8.7% for the first quarter of 2017, while targeting 7% in the long-term.

The fourth quarter of 2016 also saw the reserve ratio, or the amount of loan loss allowances relative to unpaid principal balance, jump sequentially to 11.2% from 9.8% before landing at 11.5% in the first quarter of 2017.

Operating costs remain an attractive target for savings

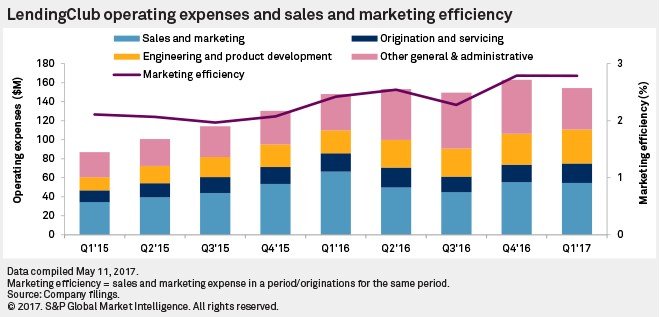

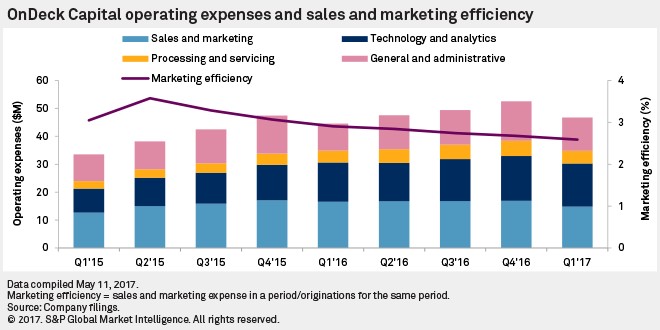

Operating expenses continue to drag on digital lenders, and balancing sales and marketing expense with origination growth remains an issue. But both LendingClub and On Deck accomplished significant sequential reductions in operating expenses in the first quarter of 2017, which had become a focus for management at the end of 2016.

Marketplace lenders generate significant income from fees on originations and are therefore more sensitive to growth slowdowns. Despite a year-over-year decline in sales and marketing expense at LendingClub in the first quarter of 2017, the ratio of such expense to quarterly originations increased from 2.4% to 2.8% over the same period. The ratio remained flat sequentially in the first quarter of 2017.

As LendingClub looks to reignite growth throughout the rest of 2017, sales and marketing expenses will likely move higher since the company needs to achieve higher application volumes than before tightening its credit mix to capture the right borrowers. It will be important to keep an eye on the previously mentioned ratio to ensure that new originations are obtained in an efficient manner, especially as the company aims for positive adjusted EBITDA later this year.

Because lenders like On Deck collect the majority of their revenue from recurring interest, they have a slight cushion from the impacts of slowing growth and can therefore be more strategic in their sales and marketing. This is a relatively short-term cushion since loans will roll off the balance sheet over time and must be replaced.

On Deck reduced expenses across the board sequentially in the first quarter of 2017. Sales and marketing expense fell 12.4% from the fourth quarter of 2016 and 10.4% from the prior-year period. The ratio of sales and marketing expense to quarterly originations has been steadily falling since the fourth quarter of 2015, suggesting increasing efficiency in acquiring new loans.

On Deck is targeting $45 million in expense cuts throughout 2017. Its cost-cutting program is expected to result in headcount reduction of 27% in the first half of the year. It comes on the heels of pressure from activist investor Marathon Partners and should help management meet the goal of achieving GAAP profitability during the second half of 2017.

Looking beyond publicly traded On Deck and LendingClub, we see positive news from private companies like Prosper Marketplace Inc., which signed an agreement with a consortium of investors for the purchase of up to $5 billion of loans, and Social Finance Inc., which recently raised $500 million as it marches toward an eventual IPO.

Profitability at digital lending bellwethers On Deck and LendingClub could boost interest in the sector and pave the way for private companies to go public.

Already a client? Continue reading the full report here.