Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 05, 2023

By Pollyanna De Lima and Rafael Amiel

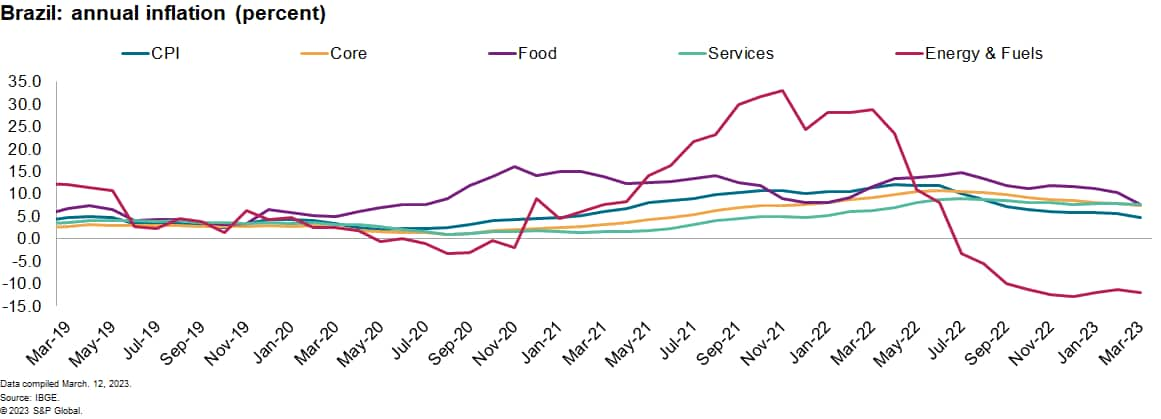

Annual inflation in Brazil reached 4.7% in March, the lowest since January 2021, as the impact of external shocks continues to vanish. While still above the Central Bank of Brazil (Banco Central do Brasil: BCB)'s target of 3.25%, inflation is now within the current 1.5% tolerance band.

Brazil's inflation will converge to the BCB's target, set at 3% for 2024, only in the third quarter of 2025. Still, the BCB may begin to slash the policy rate as early as the second half of 2023 as the current rate is significantly high, and lagged effects of previous monetary tightening will continue to work.

President Luiz Inácio Lula da Silva's criticism of the monetary policy and the BCB's independence have brought obstacles to the natural path of easing policy and cutting rates; the positive impact of the monetary policy is based on reputation and trust that the central bank has the ability and willingness to bring price stability and manage shocks. Now, a cut in the policy rate may appear as if the bank yielded to political pressure. At its latest meeting, the BCB has even talked about the possibility of rate increases if inflation goes out of control.

Before the new administration took over in early January, S&P Global Market Intelligence was forecasting a rate cut in the second quarter of 2023. It now stands at the third quarter of 2023 and may move to the fourth quarter because of unwanted political pressure by the Lula government.

On a positive note, the government has presented a new fiscal framework that, if approved and followed by the government, will bring more fiscal certainty and improve public finances significantly. This has been the BCB's major concern in recent months and an upside risk for inflation, as highlighted by the central bank. A large fraction of public debt is indexed to inflation and to the policy rate. A one-percentage-point decline in the policy (the selic rate) would save the government 40.6 billion Brazilian reais ($8 billion), or 0.4% of GDP in interest payments; similarly, a one-percentage-point decrease in the consumer price index would save the government 17.6 billion reais, or 0.17% of GDP. Moving to relative price stability or 3% inflation with a policy rate of 7% can save the government 3.0-3.5% of GDP in interest payments — a sizable amount.

Some near-term stickiness

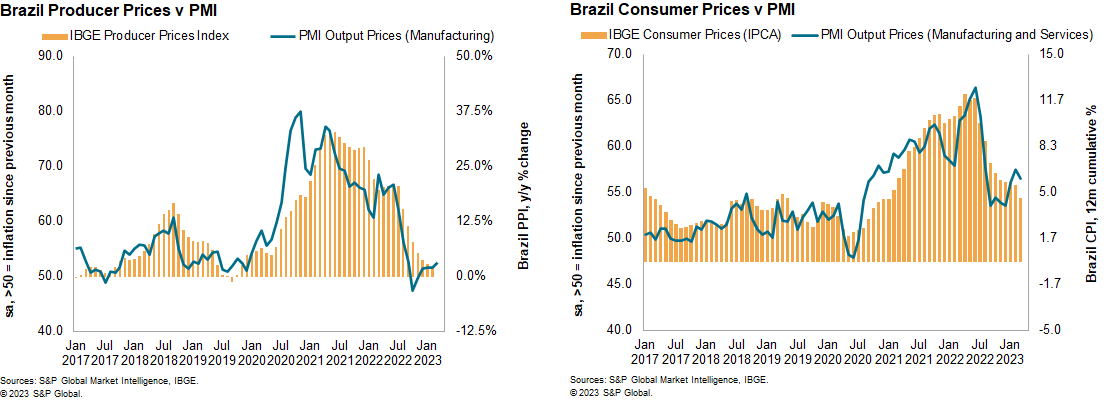

Brazil's inflationary environment remains under pressure. Survey data from S&P Global Market Intelligence points to some degree of stickiness in the near term and a reduced likelihood of convergence toward the BCB's mid-target of 3.25% before the end of 2024.

Although well below the highs seen in the first half of 2022, Purchasing Managers' Index price indices remain prominent by historical standards as firms continue to report upward pressure from weakness of the Brazilian real exchange rate, wage bills, borrowing costs and the reinstatement of taxation. Purchasing Managers' Index survey participants particularly indicated elevated prices for food, materials, transportation and utilities in March. Strong cost burdens again translated into higher charges for goods and services.

The latest S&P Global Business Outlook data also showed that a net balance of +37% of companies foresee higher input costs in the year ahead, up from +36% in late 2022 and above both the global and emerging market averages of +30% and +18%, respectively. With staff cost inflation expectations also intensifying, the net balance of companies planning to lift their output charges rose from +35% to +37%. Fueling inflation expectations were public policy uncertainty, currency weakness, elevated interest rates, tax changes and the ongoing war in Ukraine. The pick-up in inflation expectations looks set to make a dent on firms' profitability, restrict investment budgets, curb economic growth and limit job creation.

Outlook

We forecast monthly inflation to average by 0.3% during the rest of the year, down from 0.6% in the past six months. The disinflationary process will continue, helped by reduced demand pressures, which is a consequence of high interest rates and the slowdown in the economy as well as the absence of external shocks. An additional pending tax on fuels may occur in June and would imply about a 4% increase in prices at the pump and having a moderate upward impact on inflation; gasoline prices in Brazil are fairly aligned with international prices. The downward correction in producer prices, however, will continue and we expect a pass-through onto domestic prices to suppress inflationary pressures.

The BCB has commented favorably on the new legislation proposed by the government. If approved by Congress and then implemented and observed by the Executive, Brazil will be posting fiscal primary surpluses from 2024. If inflation remains at current levels (between 4.5% and 5.5%), there may be room for the BCB to start slashing the policy rate, currently at 13.75%, which implies a real rate of about 8-9%.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.