Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 28, 2025

By Lillian Federico and Jim Davis

Despite hurdles faced by other suitors in recent years, Blackstone Infrastructure Partners LP has entered into an agreement to purchase TXNM Energy Inc. The proposed acquisition will be subject to review by regulators at the Public Utility Commission of Texas and the New Mexico Public Regulation Commission. Various federal agencies are also required to approve the proposed transaction before it can proceed.

➤ The proposal comes a little less than 18 months after Avangrid Inc. terminated a transaction to acquire TXNM Energy (TXNME), then known as PNM Resources Inc. (PNMR). That transaction was proposed in 2020, approved by the Texas commission (PUC) in 2021 and languished before New Mexico regulators for more than two years. The purchase price for this deal is about 39% higher than Avangrid's unsuccessful merger bid.

➤ Both Texas and New Mexico have relatively stringent merger review standards. Even so, Avangrid and PNMR were able to eventually reach an agreement with Texas stakeholders that was ultimately approved by the PUC. The agreement called for enhanced corporate governance conditions, and customers were to receive rate credits following the transaction's close. By contrast, the New Mexico commission (PRC) rejected the transaction despite certain commitments made by the companies, and Avangrid terminated the deal while appeals were pending.

➤ TXNME and Blackstone Infrastructure Partners (BI) will likely need to make substantial regulatory commitments to garner approval for the proposed transaction. The Texas review will probably result in commitments similar to those in the prior proceeding. While adhering to a strict standard, the PUC has been consistent with the types of commitments required. New Mexico presents a somewhat more uncertain landscape, as the structure of the PRC has changed since the prior transaction was reviewed. However, the PRC's pending review of Bernhard Capital Partners Management LP entity Saturn Utilities Holdco LLC's proposed purchase New Mexico Gas Co. Inc. from Emera Inc., initiated in October 2024, may provide some insights.

➤ While the Texas and New Mexico jurisdictions have very different dynamics for energy utilities, Regulatory Research Associates views the two regulatory climates as restrictive from an investor point of view. RRA expects that substantial corporate governance and ratemaking commitments will likely be required to secure approvals from state regulators for the instant transaction. Typical merger-related commitments, such as ratepayer credits, allocation of synergy savings and other ring-fencing commitments, have not yet been discussed but may be offered once the companies tender their formal requests for approval to the various regulatory authorities in the fall of 2025.

Transaction overview

Through the proposed transaction announced May 19, BI would acquire TXNME for a total enterprise value of $11.5 billion, including the assumption of existing TXNME debt. The acquisition price reflects a per-share price of $61.25, representing a 23% premium to the 30-day volume-weighted average price of the stock as of March 5, the day prior to the news of a developing deal becoming public.

BI stated that it will finance the deal entirely with equity and noted that it does not anticipate increasing TXNM Energy leverage levels to fund the purchase. As part of the arrangement, BI states that it is investing $400 million through the purchase of 8 million newly issued shares of TXNM Energy common stock at $50 per share, by way of a private placement agreement, to support TXNM Energy's "industry-leading growth plans." That share purchase is expected to be executed in June.

Also, in conjunction with the transaction, TXNME is expected to issue an additional $400 million of new equity prior to the close of the deal.

The companies have stated that they expect the deal to close in the second half of 2026.

Once the deal is completed, TXNME CEO and Executive Chair Pat Collawn will step down, with Don Tarry to assume those roles. Tarry is currently the President and Chief Operating Officer of TXNME. The change was part of a management transition that predated the merger announcement.

Regarding the deal, BI management stated: "We are long-term investors who back industry-leading companies using our perpetual capital to support economic development. We are focused on being great long-term partners to the communities in which we invest, and we look forward to having the opportunity to engage in meaningful dialogue about how we can create win-win, growth-oriented investments across both states."

Regulatory approvals

In addition to Texas and New Mexico regulators, the proposed transaction is subject to review by federal regulators including the Nuclear Regulatory Commission, the Federal Communications Commission, the Department of Justice via the Hart-Scott-Rodino Act and the Federal Energy Regulatory Commission. TXNME shareholders also need to approve the transaction.

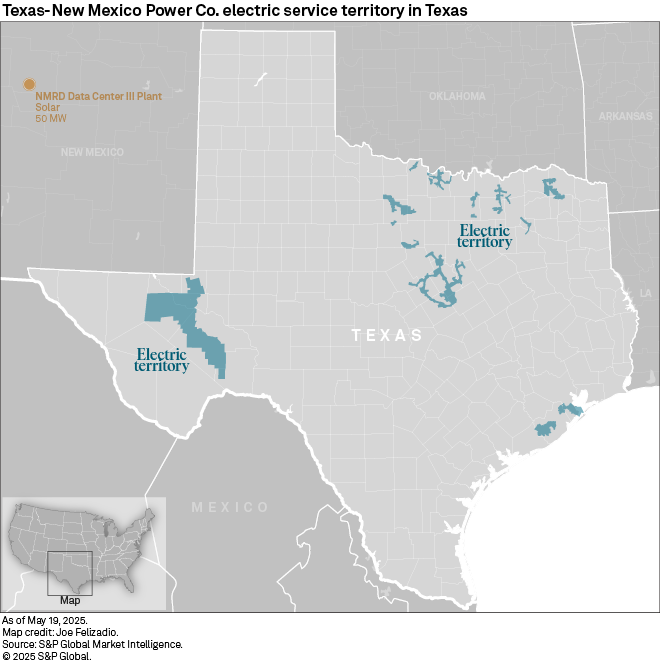

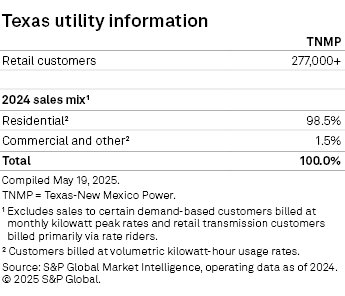

Based in Albuquerque, NM, TXNME is a utility holding company with two regulated utility subsidiaries — Texas-New Mexico Power Co. and Public Service Co. of New Mexico (PSNM). In Texas, Texas-New Mexico Power provides electric transmission and distribution (T&D) utility service to more than 277,000 retail customers within the Electric Reliability Council of Texas Inc. In addition, TXNME owns unregulated generation assets that sell power into the ERCOT market; these operations are separate from the utility.

Generation service is competitively provided; retail electric providers package T&D service with generation supply and make the bundled service available to customers. The T&D utilities do not have provider-of-last-resort obligations.

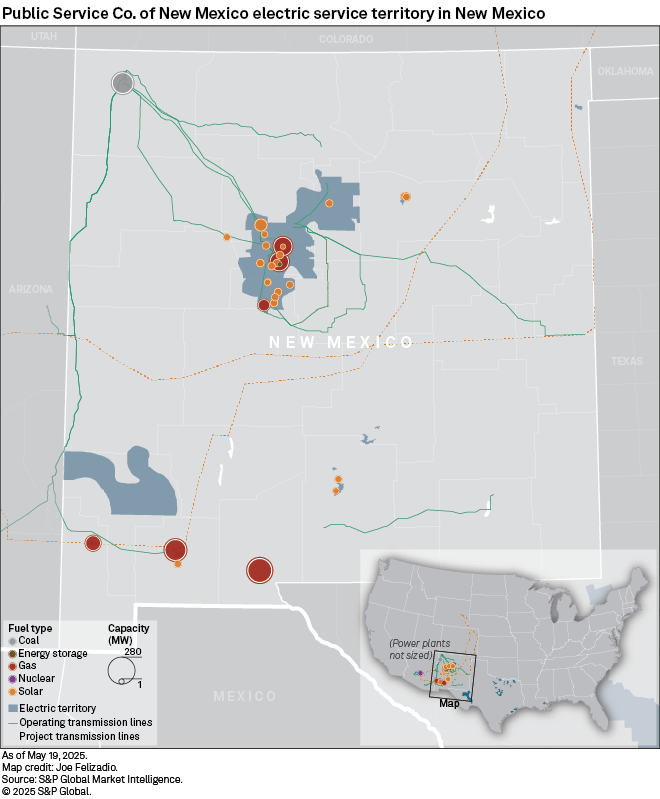

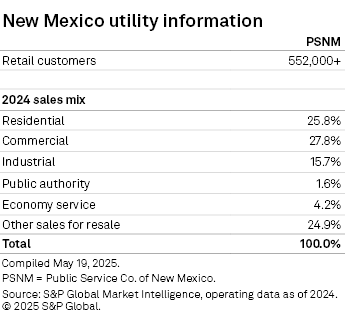

In New Mexico, PSNM provides vertically integrated electric utility service to more than 552,000 retail electric customers. PSNM also provides wholesale transmission services and sells electricity in the wholesale market.

TXNME's utility business lines in Texas and New Mexico have very different regulatory structures. Overall, RRA views the regulatory climate for energy utilities in Texas and New Mexico as more restrictive than average from an investor perspective. While both the Public Utility Commission of Texas and the New Mexico Public Regulation Commission are known for being exacting in their reviews of proposed mergers, the New Mexico regulators rejected Avangrid's proposed acquisition of TXNME predecessor PNMR in 2021. Notably, on Aug. 5, 2024, PNMR rebranded as TXNM Energy Inc.

Texas PUC merger review criteria

The Texas PUC has had review authority over mergers since 2007. Statutory authority applies to changes of control involving as little as 1% of voting securities or transactions valued at $10 million.

The law requires the commission to determine whether the action is consistent with the public interest. In reaching its determination, the commission is to consider the reasonable value of the property, facilities or securities to be acquired, disposed of, merged, transferred or consolidated and determine whether the public utility will receive consideration equal to the reasonable value of the assets when it sells, leases or transfers assets.

The PUC must also consider whether the transaction will adversely affect the health or safety of customers or employees, result in the transfer of jobs of citizens of Texas to workers domiciled outside the state or result in the decline of service. If the commission finds that a transaction is not in the public interest, the commission may take the effect of the transaction into consideration in ratemaking proceedings and disallow this effect if the transaction will unreasonably impact rates or service.

In addition, the PUC must find that the transaction is in the public interest, after considering whether the transaction would adversely affect the reliability or cost of service of the utility.

Since TXNM owns competitive generation assets, the PUC must determine that the transaction would not result in a violation of Section 39.154 of the utility code, which prohibits a power generation company from owning or controlling more than 20% of the installed generation capacity available to serve a specific power region. If the commission finds that the transaction as proposed would violate Section 39.154, the PUC may conditionally approve the transaction provided that they sufficiently modify the proposal to mitigate any potential market power abuses.

The law calls for the PUC to rule on a proposed transaction within 180 days after a merger filings is deemed complete and compliant with the PUC's filing rules; however, the PUC may extend this deadline by up to 60 days "if the commission determines the extension is needed to evaluate additional information, to consider actions taken by other jurisdictions concerning the transaction, to provide for administrative efficiency or for other good cause. If the commission has not made a determination before the expiration of the deadline provided by or extended under this subsection, the transaction is considered approved." If the PUC has not ruled by the end of the extended period, the transaction would be deemed approved.

RRA perspective on TX regulation

RRA views the Texas regulatory climate for electric utility investors as more restrictive than average, implying a higher-than-average degree of regulatory risk.

The returns on equity authorized for electric utilities in Texas have declined over the past few years and have been somewhat below prevailing industry averages for each industry segment. Regulatory lag is a challenge as the PUC relies on test periods that are historical at the time a case is filed. Though several mechanisms are in place that allow the utilities to update rates on an interim basis between rate cases to reflect new investments, these adjustments are also based on historical test years. Most recent rate cases have been settled; even so, more than half have extended well beyond the statutory time period for a decision.

State law requires the utilities to file for base rate reviews no less frequently than every 48 months, but the PUC may grant extensions at its discretion. TXNM has not had a rate case since 2018. Under the PUC rules, a case would have been conducted in 2022, but the PUC has granted three annual extensions. As a result, TXNM is expected to file a rate case by the end of 2025, but additional extensions may be granted due to the expected merger filing.

The framework in Texas has been the subject of intensive public and legislative scrutiny over the past five years or so due to severe weather impacts and concerns regarding resource adequacy. Turnover at the commission and two prolonged vacancies on the five-member panel contribute to the level of risk. This uncertainty comes at a time when the PUC is grappling with the mandates imposed by the legislature in the 2021 and 2023 sessions, additional requirements that are likely to come out of the pending 2025 session and challenges created by increasing demand from high-volume users, such as datacenters.

RRA accords Texas regulation of electric utilities a Below Average/1 ranking.

New Mexico PRC merger review criteria

A merger transaction is to be approved unless the PRC finds that it is unlawful or inconsistent with the public interest. The PRC has identified four principal factors it must consider when reviewing a proposed merger or acquisition: whether the transaction provides benefits to utility customers; whether the PRC's jurisdiction will be preserved; whether the quality of service will be diminished; and whether the transaction will result in the improper subsidization of non-utility activities.

Regarding change of control, state statutes specify that, with the consent of the PRC, a "public utility may sell, lease, rent, purchase or acquire any public utility plant or property constituting an operating unit or system or any substantial part thereof; provided, however, that this … shall not be construed to require authorization for transactions in the ordinary course of business."

The change of control statutes also specify that the "stock of a public utility or public utility holding company may be acquired" after obtaining the PRC's "prior express authorization."

Notably, there is no statutory time frame under which the PRC is required to render a decision regarding a merger/acquisition proposal.

RRA's view of NM regulatory environment

RRA views the New Mexico regulatory environment for energy utilities as relatively restrictive from an investor point of view and accords the state a Below Average/1 ranking. PRC equity return authorizations have generally either approximated or been below prevailing industry averages when established.

Regulatory lag has been a persistent issue for the state's utilities, as rate cases generally take more than a year to conclude. Although the use of fully forecast test years has ceased to be a contentious issue, PRC rate decisions are frequently challenged through an appeal process that, in some cases, has taken two or more years to conclude. The state's utilities have typically failed to earn their authorized returns.

The state's electricity market has not been restructured and the electric utilities remain vertically integrated.

New Mexico's renewable portfolio standard enacted in 2019 mandates that retail generation sold in the state be supplied 100% from zero-carbon emitting resources by 2045. The law also allows the utilities to seek PRC approval to securitize costs associated with the early retirement/abandonment of coal-fired generation assets.

The PRC has at times been receptive to mergers. However, the commission rejected Avangrid Inc.'s proposed acquisition involving PSNM in 2021. That deal was ultimately scrapped early in 2024 while a protracted appellate process was pending before the state Supreme Court.

Prior transaction

In January 2024, with an appellate review pending, Avangrid Inc. formally ended its pursuit of acquiring PNMR. At the time that Avangrid pulled away from the deal, the New Mexico Supreme Court was in the process of reviewing an appeal of the PRC's 2021 order rejecting the proposed transaction.

That deal, through which Avangrid sought to acquire PNMR for $8.3 billion, had secured all necessary regulatory approvals to proceed, with the exception of the PRC.

Regulators in Texas approved the transaction in May 2021. The PUC adopted a unanimous settlement that incorporated numerous regulatory commitments including, among other things, customer rate credits, a corporate management restructuring agreement, formalized non-competition/divestiture agreements pertaining to affiliate entities operating within ERCOT, as well as numerous ringfencing measures.

In a December 2021 order, the PRC rejected the merger. While the commission acknowledged that the deal did offer some short-term customer benefits, it soured on the proposal primarily over concerns arising from Avangrid's/Iberdrola's handling of various utility service quality and reliability issues. The PRC also expressed concerns regarding the potential for utility subsidization of non-utility businesses.

It is important to note that the composition of the PRC was considerably altered following the commission's rejection of the proposed transaction. Under a 2020 constitutional amendment that became effective Jan. 1, 2023, the PRC transitioned from a five-member elected body to a three-member body appointed by the governor, subject to Senate confirmation. Also notable was Gov. Michelle Lujan Grisham's (D) support of the proposed acquisition.

At one point in early 2023, various parties involved in the merger, including the newly established PRC, had filed a motion to withdraw the pending appeal of the 2021 order rejecting the deal and asked the court to remand the case to the commission for further review. However, the court rejected the motion and continued to review the appellate case. Avangrid subsequently allowed the parties' merger agreement to lapse in early 2024, asserting at that time that "there is still no clear timing on the resolution of the court review."

Another aspect of the prior deal worth noting involves PRC Chairman Patrick O'Connell (R). In January 2023, shortly after joining the commission, O'Connell voluntarily recused himself from involvement in the PNMR/Avangrid merger proceeding. Prior to joining the PRC, he provided testimony in the commission's review of the merger on behalf of Western Resource Advocates advocating for approval of the deal. He also previously worked for PSNM.

Data visualization by Rameez Ali and Joseph Reyes.

For US-generating asset valuation and prospecting, see Power Evaluator.

Data visualizations by Chrisallen Villanueva.This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment