Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 4 Feb, 2022

Highlights

* All four agencies saw double-digit organic growth in the first nine months of the year, but only Publicis and IPG have passed pre-pandemic revenue levels.

* Agencies have set environmental, social and governance goals, focusing more on social and governmental policies that relate more directly to the industry. The big four score above S&P's industry ESG Rating average and increased their reporting transparency in the last year.

The ad industry continued its positive trajectory in the third quarter of 2021, with the big four ad groups, The Interpublic Group of Cos. Inc., Omnicom Group Inc., Publicis Groupe SA and WPP PLC, continuing to report year-over-year double-digit organic growth. In the nine months ending in September, IPG and Publics surpassed pre-pandemic revenue levels of the nine months ending September 2019, while Omnicom and WPP were just shy of reaching their equivalent 2019 levels, mainly due to lower revenues in the U.S.

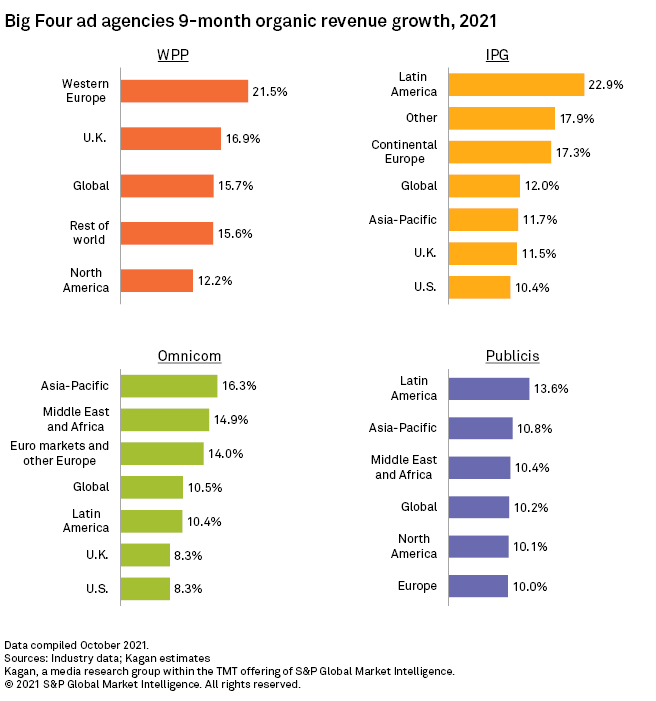

Of the four agencies, WPP saw the highest organic net revenue growth, of 15.7%, in the first nine months of 2021. Western Europe performed best, with organic revenue growth at 21.5%, while North America had the slowest growth, at 12.2%. The company reported year-to-date net revenues of £7.54 billion, slightly below the £7.92 billion reported net revenues in the nine months ending in September 2019.

IPG saw organic net revenues grow by 12.0% in the past nine months, reaching $6.56 billion net revenues, exceeding its pre-pandemic net revenue levels of the same period in 2019 by $367 million. The U.S., with a net organic growth of 10.4%, produced $239.8 million of that excess, and accounted for 64.1% of the company's global net revenues. Latin America and Other Markets had the highest growth, at 22.9% and 17.9%, respectively, closely followed by Continental Europe with a 17.3% organic net revenue growth.

Omnicom's gross global revenues for the first nine months of the year reached $10.43 billion, a 3.5% decline from the same period in 2019 but a 10.8% increase from 2020. Organic growth for the period was at 10.5%, with Asia-Pacific faring best at a 16.3% organic growth. U.S. gross revenues remained below pre-pandemic levels, with an 8.3% organic growth rate versus 2020, while Continental Europe and the United Kingdom had year-on-year organic revenue growth of 14.0% and 8.3%, respectively, exceeding revenues of the same period in 2019.

Publicis Groupe accumulated €7.56 billion net revenues in the first nine months of 2021, resulting in a 10.2% organic growth versus 2020 and 2.0% versus 2019. Similar to IPG, Latin America was the fastest-growing region, with organic growth of 13.6%. All other regions experienced organic growth of 10% to 11%. Compared to 2019 revenues, the U.S. and Asia-Pacific were the only two regions that surpassed pre-pandemic performance, with the U.S. revenues substantially benefiting from Epsilon's 13.0% growth.

Focus on ESG

The big four agencies have developed extensive ESG agendas and goals in the past year. For the ad industry, while environmental impact plays an important role, social action bears more weight, due to its customer-centric business, cultural impact and data privacy. Among the big four agencies, IPG and Publicis each publish an annual corporate social responsibility, or CSR, report, to meet both the Global Reporting Initiative, or GRI, standards and Sustainability Accounting Standards Board, or SASB, Advertising & Marketing sustainability accounting standards. Omnicom and WPP also publish CSR reports with references to selected GRI standards, while Omnicom has also committed to publish a SASB report by the end of 2021.

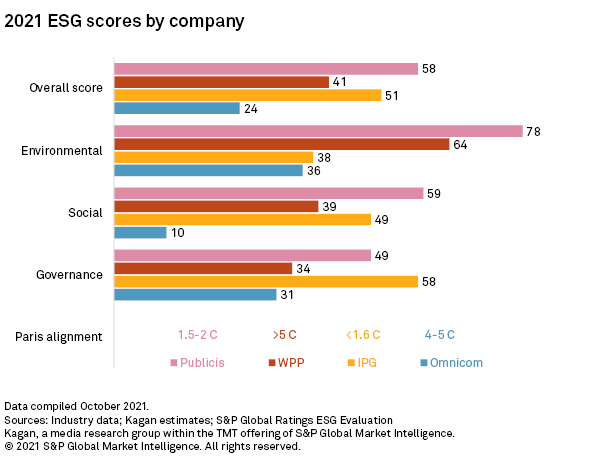

According to the S&P Global Ratings ESG Evaluation, Publicis Group ranks first in ESG with a 58/100 overall score, followed by IPG, WPP and, lastly, Omnicom. All four agencies rank above the Media, Movies & Entertainment industry average rating of 19/100. In the overall ESG score for each company in the industry, governance weighs 44%, social 39% and environment 17%.

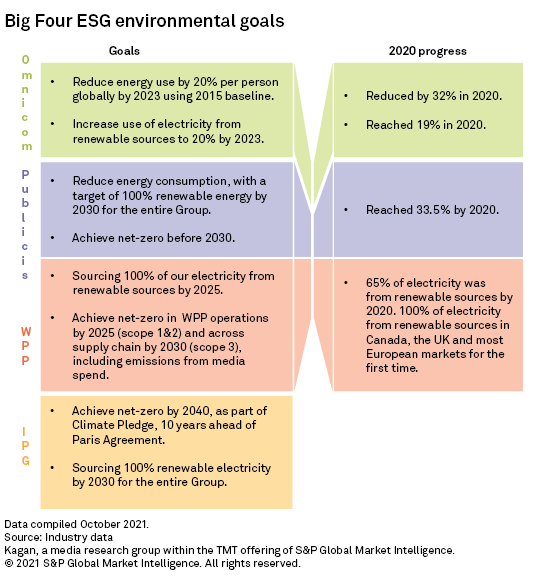

In terms of environmental impact, all four companies have set goals to reduce their emissions in accordance with the Paris Agreement on climate change. They focus on reducing their energy consumption, increasing their reliance on renewable energy sources and limiting their carbon footprint. Common steps include decreasing real estate footprint and office emissions, reducing transport, especially air travel, and minimizing waste while increasing recycling. While the companies continue to make progress to reduce energy consumption, 2020 results are skewed due to the COVID-19 pandemic, making it difficult to accurately measure the true progress.

All four groups are members of Ad Net Zero, an initiative the U.K. Advertising Association, or AA, launched to reach net-zero carbon emissions in the development, production and media placement of global advertising by the end of 2030. According to AA's latest Ad Net Zero report, "the average annual operational carbon footprint of an individual in a U.K. advertising agency is 3.4 tonnes CO2e," which primarily stem from business travel and office energy use, both key targets for the ad agency groups. To support and provide training and measuring tools such as the carbon calculator, the association founded Ad Green.

Media companies have also begun publishing employee diversity statistics, including senior and executive breakdowns. They have launched committees and training programs on diversity and inclusion. Social responsibility extends to company operations as well, with IPG committing 20% of its media spend to diversity in business ownership and at least 5% to Black-owned media. Similarly, Omnicom committed to increase its spend on minority-owned vendors.