Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 10, 2020

Headline news in this pandemic-induced recession has been the performance of recreational vehicles (shipments up 31% through September), and boats (powerboat sales up 21%). What is lost in the hype is the relative size of these markets. Shipments of motor vehicles are roughly US$30 billion. The value of shipments of ships and boats combined was US$24 billion.

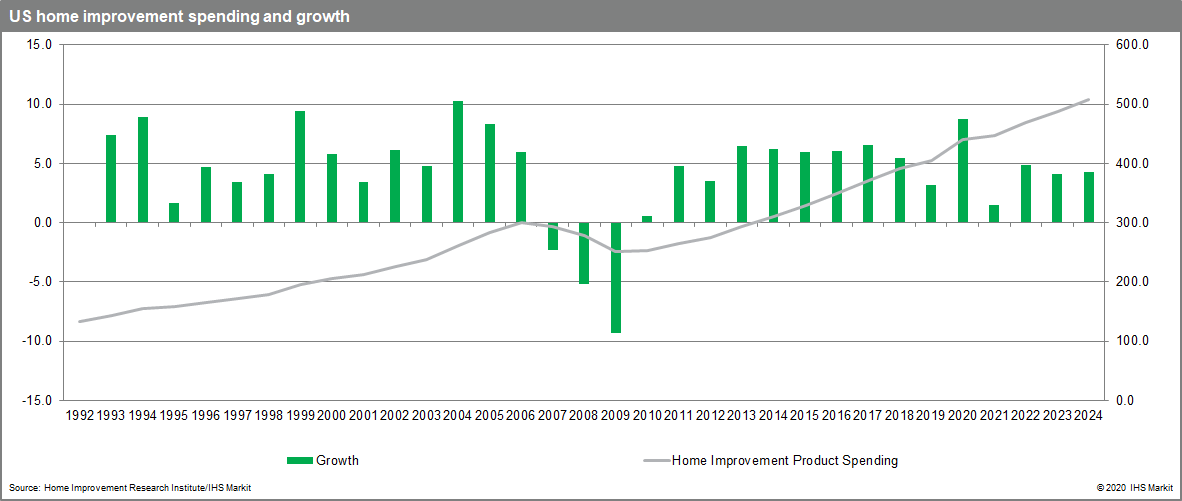

The US home improvement market represents a $440 billion opportunity for products alone, according to research conducted for the Home Improvement Research Institute by IHS Markit. To put this in perspective, shipments of food products were US$529 billion in 2019.

Recessions are not kind to home improvement spending, as the chart below indicates. The Great Financial Recession of 2008-09 resulted in three years of home improvement spending declines, compounding into double digit losses. Yet home improvement and its supply chain are one of the few bright spots in the US economy, with home improvement product sales expected to rise 8.7%. It is fair to ask why, and more importantly, can it continue?

The irony is that in the steepest and deepest recession in US history, the conditions are actually positive for investing in one's home. In a typical recession, incomes collapse, home values stagnate or fall, household wealth withers and consumer confidence collapses. Home improvement, and even some home maintenance is deferred.

The first notable feature of this recession is the occupational impact; it fell squarely on the retail, hospitality, and personal service sectors. Workers in these industries typically have lower incomes, are often entry level and are renters, not homeowners. Meanwhile, professional and business services employees were likely to be able to switch to remote work and maintain their incomes.

Moreover, the policy response to the recession was quick and large. Interest rates were cut to essentially zero, the Fed unleashed massive liquidity and the federal government sent incentive checks to many households in addition to increasing unemployment insurance. The net result of relative job security among homeowners, combined with low financing costs and even a cash infusion was to alleviate the negative household income effect seen in virtually all recessions.

Importantly, the housing market was in balance prior to the recession. Indeed, one could argue that it was in shortage. Mortgage forgiveness practices prevented those who did lose jobs from dumping homes onto the market, at least for 2020. The desire to leave cities for suburbs and rural areas actually increased the demand for housing in some markets. Accordingly, home prices have continued to rise, and homes are typically a family's most important financial asset. As such, the incentive to invest in that asset is clear. Additionally, while financial markets have seen considerable volatility, there has not been a market collapse, so overall household balance sheets remained relatively strong.

The income and wealth effects only explain why the home improvement market might remain stable. The boom comes from additional factors. The most obvious is that families were confined to their homes for months and continue to have limited options outside the home. The first instinct was to catch up on tasks that had been planned or desired anyway - painting a room or upgrading fixtures. However, as it became clear that this was a event of some duration, larger needs (or wants) took over. Home offices became necessary, especially for families with two working spouses and children engaged in remote learning. The paucity of chances to dine out created the necessity (or opportunity) to cook more at home, and kitchen renovations have become popular. Gym closures prompted some homeowners to create home gyms, or at least work out areas. The inability to travel turned the backyard into weekend and vacation space leading to investments in decks, landscaping, gardens and even pools.

The lack of meals away from home and vacation travel also created space in family budgets for home improvement spending. In an economic sense, we have seen a massive transfer of spending from leisure activities to home improvement.

Finally, the surge in home improvement spending was augmented by demographics. At one end of the age spectrum, the disproportionate impact of the pandemic on elderly housing led many seniors to reconsider the option of staying in their own home. To do so required investments to accommodate their individual disabilities, such as ramps and modifications to doors, hallways and fixtures to deal with mobility issues. At the other end of the spectrum, Millennials have become the largest home buying demographic. The shortage of new housing, combined with rising home costs for those just starting their careers, means that this new wave of homeowners is buying existing homes. Indeed, existing home sales performed well in 2019 and, while down in 2020, are holding up better than in past recessions. Existing homes generally require some work, most commonly painting, kitchens and baths. Millennials are also addicted to technology, so home automation items have also proved popular.

The net result has meant good fortunes for retailers engaged in home improvement items. The nature of many home improvement products is that they do not lend themselves well to e-commerce, so this has been a rare source of growth for the retail sector. It has also been good news for the manufacturers of these products and their supply chains. This has been very apparent in lumber prices, where strong demand combined with production shutdowns in the spring, have sent pricing soaring.

The important question is whether, and how long, the home improvement boom can last.

As one considers the factors that got us here, there is reason for optimism. We will not see another spike in growth, but we can expect the strong level of activity to continue into 2021.

The demographics are the most certain - the generational shift of Millennials is a long-term event, and will transform the overall economy, not just home improvement spending. Home automation products are clear winners as they are adopted across the age and income spectrum to improve security, energy efficiency and overall quality of life.

The stimulus incentive is less certain. We do expect interest rates to remain low for several years, however, additional federal spending is widely regarded as necessary, but the size and timing of any package remains unclear. The slowing of economic growth in the third quarter and a final outcome of a protracted political season may allow an agreement in the coming month. The increasing unemployment rate amongst those not in the retail or personal service sector is a concern that could impact homeowner confidence, although one that we expect to fade as economic growth continues.

It appears that the expected resurgence of the pandemic in the fall and winter is upon us, with new high levels of infections and increasing hospitalizations. Restrictions are once again being imposed in some states on restaurants, gatherings and other out-of-home activities. The belief of most medical experts is that there are several months of pandemic-induced challenges in front of us. Indeed, we are already seeing conferences scheduled for the first half of 2021 being moved to the second half of the year. This suggests that homeowner behavior is likely to continue well into 2021. Indeed, the move to working from home may be permanent for many individuals. As such, not only will the desire (and necessity) of doing more at home continue, the spending choices associated with that change - more income assigned to the home rather than leisure activities - is also likely to persist.

There is also reason to believe that pent-up demand will increase the duration of the home improvement surge. The very same shortage of contractors that led to the housing shortage is also limiting their ability to undertake home renovations with many contractors reporting being booked into 2021 already. While most home improvement products are bought by do-it-yourself (DIY) consumers, about a third of the product market is purchased by professional contractors. This does suggest the potential for differential outcomes by product in 2021 - products used mostly by professionals, such as dimensional lumber and HVAC may outperform more traditionally DIY products such as paint. Still, this will be a matter of gradation, we do not expect any home improvement product to experience a material retreat.

If medical advances progress as expected, the impact of the pandemic will fade in 2022, and with it some of the stimulus and household budget allocation decisions that favor home improvement. However, if the pandemic impact becomes limited, that will also allow stronger economic growth, which is historically correlated with home improvement spending. We expect home improvement spending to continue at a high level in the medium term (next five years) with some moderation in growth.

Posted 10 November 2020 by Scott Hazelton, Director, Construction, S&P Global Market Intelligence