Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 05, 2023

Our S&P Global Market Intelligence banking risk experts provide insight into events impacting the financial sector in emerging markets in April.

Credit growth will likely increase in mainland China in 2023 despite directions to curb loan rises.

There had been mixed signals from the Chinese authorities, from some banks being directed to slow down loan disbursements at the end of February due to the very fast credit growth after the abrupt departure from strict COVID-19 policies to the reserve requirement ratio cut in mid-March to boost lending. We judge that, on balance, credit growth will likely remain strong in 2023 because the authorities are keen to continue to stabilize the economic growth, but credit growth is likely to slow slightly in the second quarter to taper back from the very fast growth in January of above 17%.

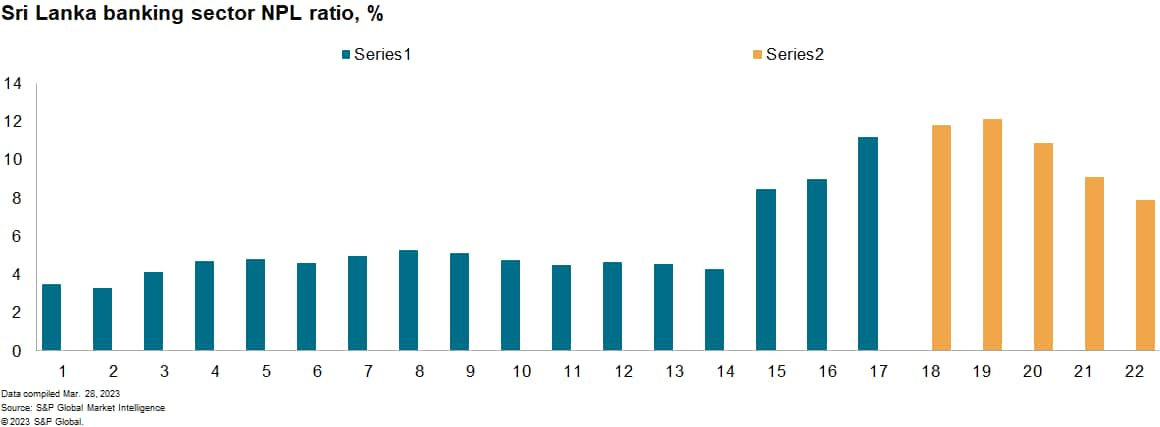

Asset quality review in Sri Lanka will be supported by government-led capital injections.

Since the IMF approved an extended fund facility arrangement for Sri Lanka in mid-March, it is likely that the IMF will also be willing to support bank recapitalization efforts by providing more loans to the country after the asset quality review that started in early 2023. The central bank and the government will be better placed to grant capital injections if required to banks with stronger fundamentals, such as better risk management. Under IMF guidelines, weaker banks are likely to be absorbed by stronger banks and privatization of struggling state-owned banks is unlikely, given a lack of buying interest.

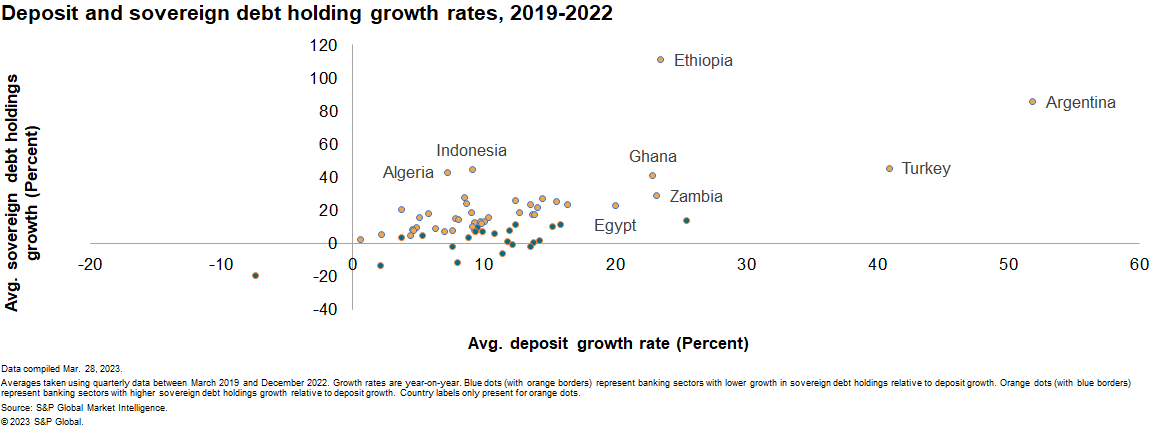

European banks stand in a better position today, but risk of contagion will remain over the coming months.

Considering recent events in the US and Switzerland, there are risks for this contagion to spread across Europe. A higher savings rate during the COVID-19 pandemic, which translated into ample bank liquidity invested into sovereign debt holdings that carry a beneficial risk weight, has resulted in banks presently sitting on unrealized losses on these bonds because of monetary policy tightening. We expect sectors that are still undergoing policy rate hikes and those with an elevated exposure to sovereign bonds to be at most risk over the coming months, including sectors with shallower credit markets that limited the ability of banks to convert abundant liquidity into loans. However, European banking sectors stand in a better position today than prior to the global financial crisis in terms of capital adequacy, prudential lending standards, and liquidity buffers. As such, our analysts do not view these unrealized losses as materially concerning nor do they threaten bank solvency on their own, unless a mass depositor redemption materializes and fire sale effects from bond liquidation further depress the value of banks' sovereign bond holdings.

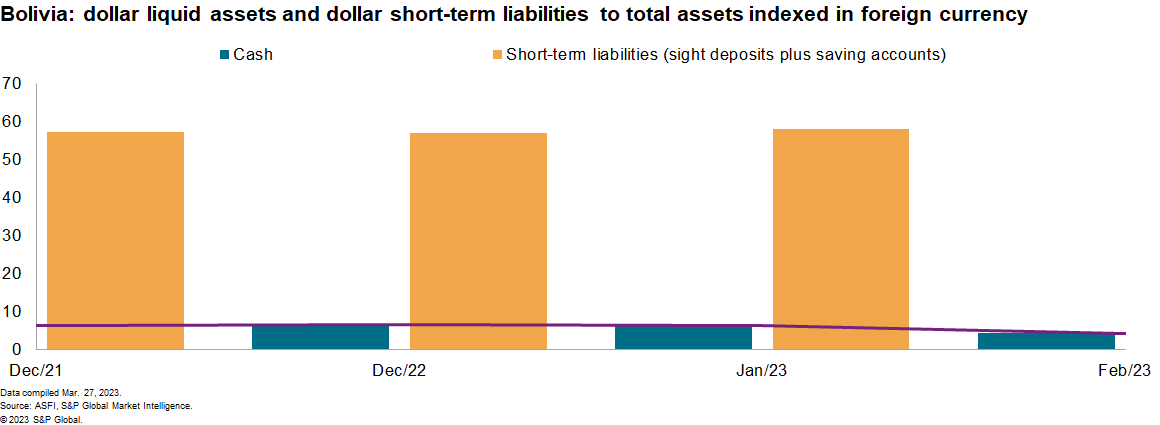

Bolivia's dollar deposit strains will continue as worldwide liquidity shortages persist.

There have been dollar shortages in Bolivia since late February of this year, leading to long queues forming outside of banks and even the central bank directly offering dollars to customers to calm demands. However, the measures have not reassured people with queues remaining; international reserves continue to decline and are unlikely to be replenished soon, likely leading to a currency devaluation going forward, potentially affecting borrowers of the dollar, intensifying capital controls, and instituting deposit withdrawal limits.

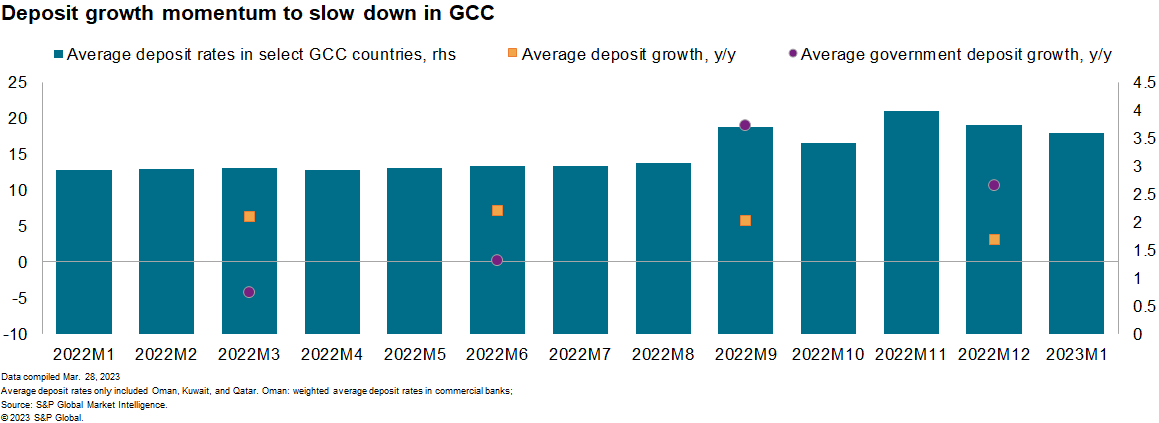

Gulf Cooperation Council (GCC) banks to compete for more deposits but profitability will stay robust.

Although we expect policy rate hikes to continue to support profitability in the GCC, particularly in banking sectors like Saudi Arabia that have a higher proportion of non-interest earning deposits, the pace of improvement is likely to slow this year relative to 2022 as banks raise deposit interest rates to attract more domestic funding while international financial markets stay tight. Term deposits and government deposits in particular are likely to be highly sought after to lock in longer-term funding domestic funding, narrowing loan-to-deposit interest rate spreads in some markets.

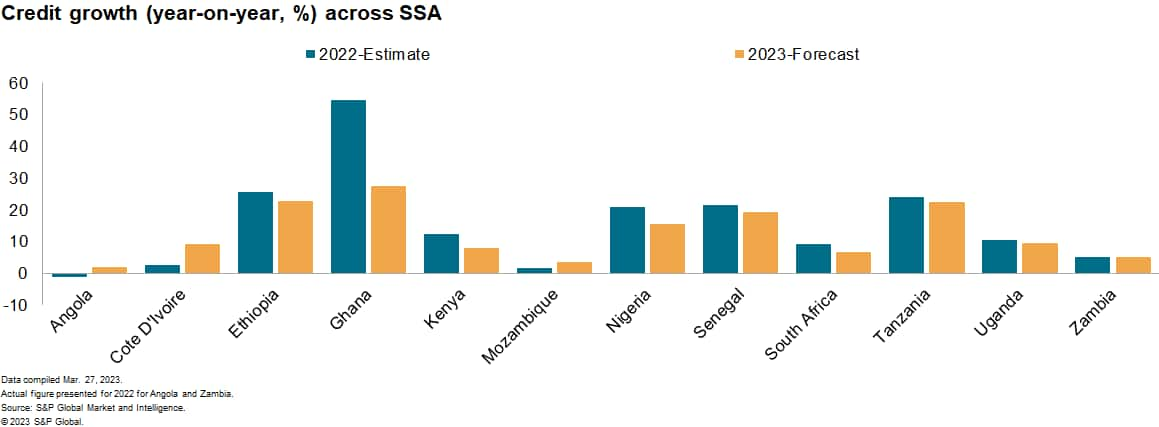

Credit growth in Sub-Saharan Africa (SSA) is expected to slow down in view of higher asset-quality risks.

S&P Global Market Intelligence projects a slowdown of credit growth in SSA in 2023. Slower global demand is negatively impacting SSA's exports, likely furthering the deterioration of banks' asset quality metrics. This combined with increased cost of living, monetary tightening, withdrawal of COVID-19 forbearance in most banking sectors in SSA, and market hesitation stemming from the fall of SVB and Credit Suisse is limiting available funding. Banks are therefore likely to tighten credit standards as stresses facing companies and households will negatively affect the debt-service capacity of borrowers, causing a higher incidence of default payments.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.