Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 03, 2023

The number of refugees being hosted by the Baltics has added almost 3% to the local population and, accounting for reported intentions to stay, nearly 1% to the working-age cohort. Addressing high refugee unemployment will be the main challenge in 2023, with no low-hanging fruit.

The number of Ukrainian refugees across Europe, excluding Russia and Belarus, had stood at 5.2 million as of March 14, 2023, of which around 4.9 million are currently registered for the European Union's temporary protection scheme or similar national arrangements, according to figures from UN High Commissioner for Refugees (UNHCR). Some refugees could be double counted if they registered in one country before moving onwards to another.

As a proportion of the local population, Czechia and Poland are hosting the largest share of refugees in Central Europe and the Balkans. By comparison, the three Baltic states are hosting far fewer absolute numbers, although their share in the local population is still substantial, at 3.3% in Estonia, 2.7% in Lithuania, and 2.5% in Latvia.

Following the initial surge in March-April 2022, new border crossings of Ukrainian refugees into the Baltic states have gradually petered out. Comments from the Latvian interior ministry suggest a fivefold decrease in the number of crossings as of mid-February 2023. According to displacement surveys conducted by the International Organization for Migration (IOM), most of the respondents in Latvia reported entering the country through the Russian border, while most of the respondents in Lithuania had entered through the Polish border.

How many intend to stay?

According to a UNHCR report published in September 2022, only 13% of the surveyed refugees intended to return to Ukraine in the next three months to reunite with their families. Of the remaining, a majority hoped to return one day when safety concerns diminish. The UNHCR report covered 43 countries and 4,800 surveys.

The IOM covers a much smaller sample — under 1,000 respondents — but reports refugee intentions in each individual country. The latest reports covering Latvia and Lithuania, published in December 2022, show an average of 31% of respondents intending to remain in their respective host countries. This is up from an average of 25% in the previous reports, mainly driven by an increase in the positive response rate in Latvia. Estonia is not covered.

The IOM surveys also report that most of the respondents are women and that an average of 85% of the respondents are in the 18-59 years age group. National source data for the three Baltic countries corroborate the gender distribution of Ukrainian refugees being skewed towards women but report a much lower 61% average for the working-age cohort.

What does this mean for local labor markets?

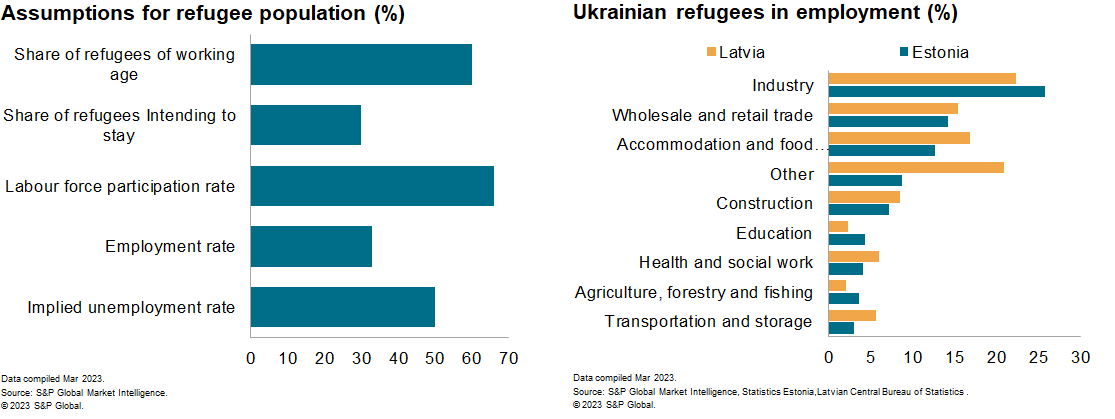

Guided by survey results and press releases from national sources, we assume that 60% of the refugees currently registered for temporary protection in the three Baltic states are of working age. Of these, we assume that 30% intend to stay in their current host countries this year. This gives us an estimated refugee influx amounting to an average 0.7% of local working-age population.

According to the latest labor market review published by the Estonian central bank (Eesti Pank), around 70% of the refugees were participating in the labor market in the second and third quarters of 2022. We assume an average 66% participation rate, adjusting downwards for the high share of women and children in the refugee population. In other words, the number of refugees expected to participate in the labor markets amount to an average of 0.6% of local labor force.

The Estonian labor market review also shows a gradual increase in the employment rate for refugees, to 38.9% in the third quarter of 2022, but still well below the 80% figure for local women. An October press release from the Central Statistical Bureau of Latvia suggests a lower employment rate of 26.8% for refugees in that country.

Erring on the side of caution while also accounting for the likely increase in employment over time, we assume an average employment rate of 33%. This means that the estimated refugee employment in the Baltics amounts to an average 0.3% of current local employment.

As a byproduct of our estimations, we are left with a very high 50% refugee unemployment rate, which is broadly in line with the two-quarter average quoted by the Estonian labor market review. This translates into an average 0.3 percentage-point increase for the overall Baltic unemployment rates relative to 2022, assuming no changes in employment conditions for the locals.

The challenge for 2023 is to increase the absorption of refugees in the Baltic labor markets, not helped by the full-year annual GDP declines forecast for the three countries this year. Estonian and Latvian data show that the industrial sector has employed the largest number of refugees by far, followed by wholesale and retail trade, accommodation and catering services, and construction work. Services demanding higher qualifications, such as finance, education, and healthcare, rank lower, signaling the need for reskilling or upskilling of available labor.

Although not covered in the estimations above, the influx of Russian businesses and skilled labor in the Baltics, especially Lithuania, further complicates job prospects for Ukrainian refugees while also affecting local labor market conditions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.