Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Jul, 2022

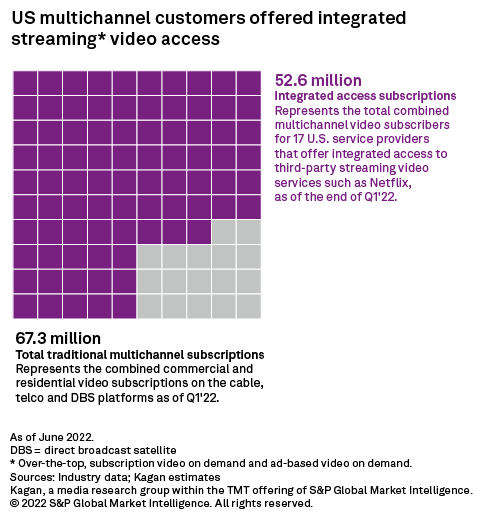

With traditional set-top boxes on the wane, the number of integrated apps from a group of top U.S. multichannel operators collectively remained unchanged since 2021. Four integrated streaming apps are available per set-top box on average, with approximately 78% of the traditional video universe being offered access to at least one over-the-top service. However, operators are moving away from the legacy technology to app-based OTT streaming, where traditional set-top box equipment is no longer necessary.

These alternative set-tops include smart TVs and streaming sticks and boxes like Roku and Android TV. This trend is underscored by the recent partnership between Comcast Corp. and Charter Communications Inc. to produce a nationally available streaming box, the name to be determined. Industry trends, such as the waning interest in traditional set-top boxes and business consolidations, subsequently trimmed our list down to 17 operators from the original 22 in the previous year.

By application, Netflix Inc.'s Netflix was available from all 17 boxes of our shortened list, with Comcast and Cox set-tops offering the highest number of streaming apps at 11 each. Alphabet Inc.'s YouTube was the second-most common integrated streaming app at 15, followed by Amazon.com Inc.'s Amazon Prime Video with 10 and Walt Disney Co.'s Hulu with eight. Disney+ was only available through two of the set-tops, and virtual multichannel service Paramount Global's Pluto TV was only on four. Peacock, Xumo and Paramount+ were only available through Comcast and Cox set-tops. The move to other forms of video streaming access lines up with Kagan's capex forecast through 2025, where consumer premise equipment expenses are projected to be on a downward slope due to the reduced spending on set-top boxes.

This newest collection of integrated streaming apps showed stagnant growth in the combined subscriptions to traditional multichannel services offering access to at least one major subscription video-on-demand or ad-based video-on-demand app.

The annual compilation exclusively encompasses traditional multichannel video programming distributors only. Information regarding the virtual multichannel category (e.g., Xfinity Stream, DIRECTV Stream) is excluded from our dataset.

The greater benefit of integrating more apps for multichannel operators is unclear. Operators may have revenue-sharing agreements with streaming services. However, app integration has not been proven to slow down subscriber defections across the video industry.

Multichannel Trends is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.