Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 23, 2024

Small and medium shippers in South Korea are being guaranteed vessel space for spot cargo on Asia to Europe and Mediterranean services after the South Korean government launched an initiative to counter the disruption caused by Red Sea diversions.

That comes as the government of Vietnam also announced a range of measures to help the country's shippers in the face of spiraling costs and service disruptions.

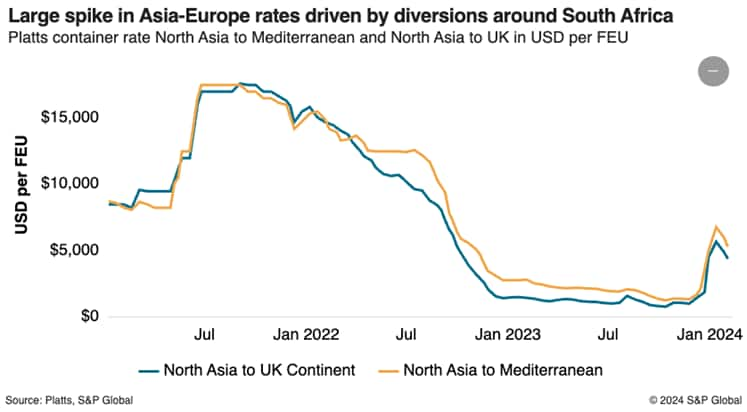

Shippers are facing both a capacity shortage and soaring freight rates on westbound services due to extended transits as vessels sail around the Cape of Good Hope in southern Africa to avoid drone and missile attacks in and around the Red Sea launched by Houthi militants based in Yemen. Sailing schedules show the diversions away from the Suez Canal add about 10 to 21 days on the westbound loop, depending on the service.

South Korea's Oceans and Fisheries Ministry said it would provide 400 TEUs of spot capacity specifically for small and medium-sized enterprises on each sailing linking South Korea with Europe and the Mediterranean. A further 1,100 TEUs of capacity would be guaranteed for cargo owners seeking to utilize long-term contracts, the ministry said in a statement announcing the launch of the program last Friday.

The ministry said the aim was to support shippers "that are experiencing difficulties in import and export logistics due to the Yemeni rebel crisis."

"Small and medium-sized enterprises will be able to secure space to load export volumes on ships, and freight rate stability will be guaranteed through long-term contract support," it said.

Shippers with spot cargoes can apply online to choose the routing and date of departure, while those seeking long-term contracts can contact the Korea International Trade Association and the country's Small and Medium Business Corporation. After carriers began diverting vessels from the Red Sea, the ministry created an emergency response team to limit the impact of capacity shortages and rising freight rates on exporters and importers.

"We are continuing to provide practical support through the emergency response team to ensure that there are no disruptions in domestic import and export logistics, such as the introduction of temporary vessels and the provision of dedicated shipping space for small and medium-sized enterprises," Oceans and Fisheries Minister Kang Do-hyung said in the statement.

The ministry's move came a week after HMM agreed, after consultation with the ministry, to deploy four extra loaders to ease the capacity crunch facing South Korean exporters. The ministry said HMM would deploy one 11,000-TEU ship on Asia-Europe and three vessels of between 4,000 to 6,000 TEUs on Asia-Mediterranean routes.

In Vietnam, the country's Maritime Administration was tasked last week by the Transport Ministry to look for ways to help shippers in a series of short- and longer-term proposals. Those include asking carriers to justify soaring freight rates on European and North American services after the cost of shipping a 40-foot container from Ho Chi Minh to the US West Coast climbed to $2,650 in early January, while rates rose to $4,900 per FEU to Europe.

Other measures include encouraging carriers to return empty containers to Vietnam, enacting possible policy changes to incentivize carriers to launch new services and increase the number of port calls on mainline east-west services and simplifying customs procedures for export and import cargo.

Port calls skipped

Forwarders said carriers have skipped calls at ports in Asia, especially South Korea and Vietnam, both to maintain schedule reliability to offset longer transits and because of blank sailings during the Lunar New Year holiday period.

"In Vietnam, blank sailings and omissions are mainly affecting Haiphong. There are fewer blank sailings impacting Ho Chi Minh," Fredrik Nyberg, director of network development for FIBS Logistics in Hong Kong, told the Journal of Commerce.

Nyberg estimated that carriers have reduced capacity on Asia-Europe services by about 10% ahead of the Lunar New Year, which starts Feb. 10. Cargo bookings remain strong, however.

"Instead of the usual cancellations, we're seeing bookings being accepted to be rolled over into the Lunar New Year holiday week for outbound departures," a senior executive for an Asia-focused freight forwarder told the Journal of Commerce.

"Blank sailings and port omissions are common in the current market due to vessel rerouting and schedule changes," the source said. "Carriers may omit calling at the last minute to catch up the vessel's schedule."

The executive said those changes can disproportionately affect shippers in South Korea, Japan and northern China, including Dalian, Qingdao and Xingang, because of the limited number of weekly services compared with Shanghai or Shenzhen.

"Usually, carriers only have one or two services a week [from] Korea, Japan or Dalian and Qingdao, so if there are blank sailings and port omissions there are no alternatives for shippers nor back up plans by carriers," the source said.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?