Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jul, 2016 | 09:00

Highlights

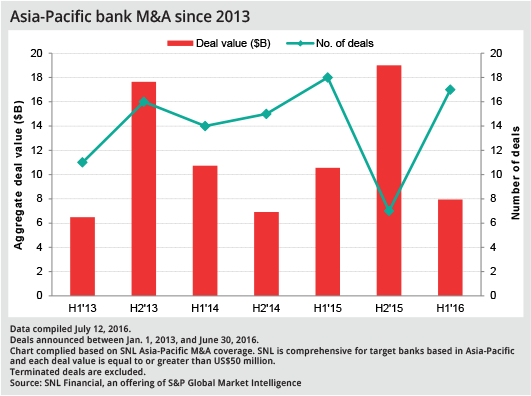

Asia-Pacific banks' deal activity was more subdued in the first half than a year ago, as the aggregate disclosed deal value fell to US$7.94 billion from US$10.56 billion.

Editor's note: This analysis is comprehensive for deals where the target bank is based in the Asia-Pacific region and the deal value is equal to or greater than US$50 million.

Asia-Pacific banks' deal activity was more subdued in the first half than a year ago, as the aggregate disclosed deal value fell to US$7.94 billion from US$10.56 billion. In the first six months of 2016, there were 17 disclosed deals involving SNL Financial-covered Asia-Pacific banks, nearly at par with the 18 deals disclosed in the prior-year period.

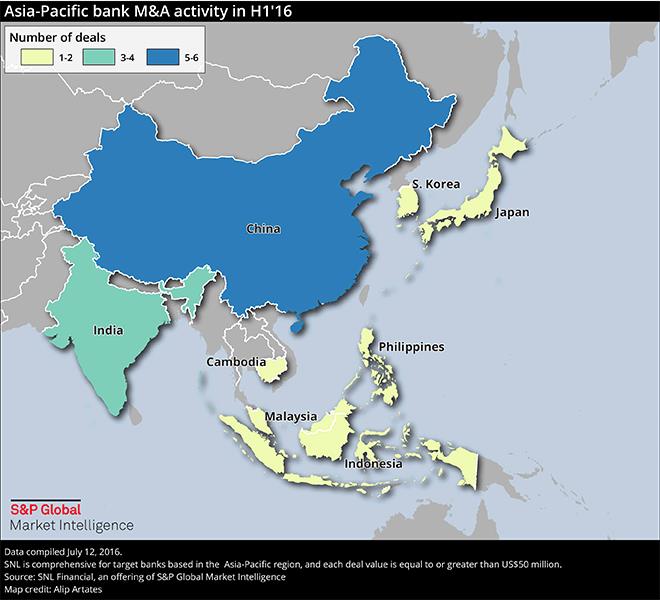

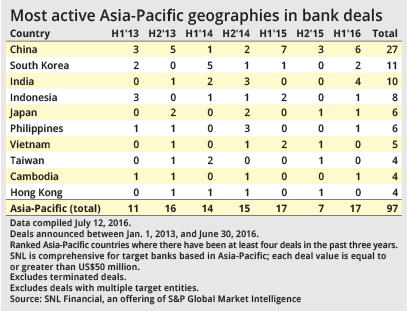

Leading the pack are deals involving Chinese firms, totaling six deals in the first half. Chinese firms have been involved in 27 banking deals since 2013 with a total deal value of US$29.29 billion.

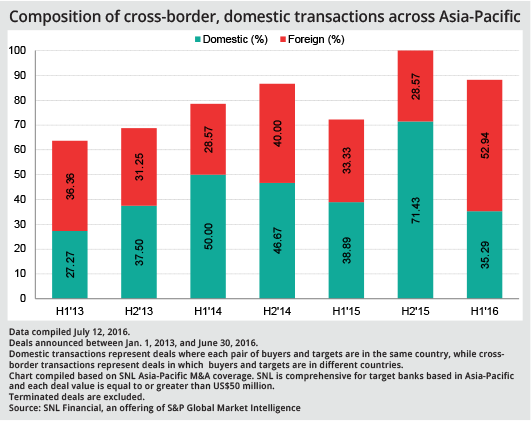

China Life Insurance Co. Ltd.'s agreement to purchase shares ofChina Guangfa Bank Co. Ltd. from Citigroup Inc. and IBM Credit LLC for a total of US$3.56 billion was the biggest disclosed deal in the half.#learnMoreAbout("sector-intelligence-1")There was an uptick in the proportion of cross-border transactions in the first half compared to a year ago. Transactions between deal participants from different countries made up 52.94% of deals in the half, compared to just 33.33% in the first half of 2015.

A number of those cross-border deals involved Indian banks, which also saw more deal activity in the first half than in 2015, with some foreign investors opting to sell their stakes in Indian banks. Sumitomo Mitsui Banking Corp. sold 18.1 million shares in Kotak Mahindra Bank Ltd. to Canada Pension Plan Investment Board for a deal amounting to US$168.8 million. Undisclosed buyers also brought shares in the bank for US$134.4 million.

One Indian banking deal involved local insurer Life Insurance Corp. of India raising its stake in IDBI Bank Ltd. to 14.37% from 7.21%. IDBI Bank has been the subject of rumored deals as the government is reportedly moving ahead with plans to dilute its stake in the bank to below 50%.

Meanwhile, South Korea's two banking deals were due to foreign buyers moving into the country's savings bank space. Taiwan's Yuanta Commercial Bank Co. Ltd. acquired HanShin Savings Bank for US$112.2 million, while a unit of New York-based J.C. Flowers & Co. LLC agreed to acquire HK Savings Bank for US$186.6 million.