Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 28, 2023

By Rajiv Biswas

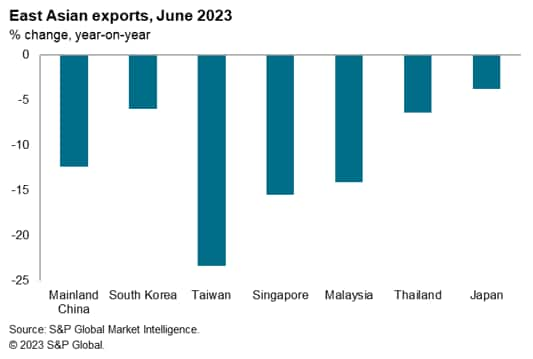

APAC merchandise exports have declined significantly in the first half of 2023, due to weak demand in the US and Western Europe and sluggish economic recovery in mainland China. Latest evidence from S&P Global Purchasing Managers surveys for June also signalled that new export orders have remained weak across many APAC economies in mid-2023, indicating continuing headwinds in the second half of 2023 for APAC merchandise exports.

However, the gradual recovery of international tourism in the APAC region is resulting in improving service sector exports for economies such as Thailand, Malaysia and Singapore, helping to mitigate the negative impact of weak goods exports.

The slump in APAC merchandise exports during the first half of 2023 reflects weak economic growth in the US and Western Europe, as well as sluggish recovery in domestic demand in mainland China.

The downturn in global electronics orders has been a significant factor that has hit APAC exports. Electronics manufacturing is a significant part of manufacturing exports for many APAC industrial economies, including Japan, mainland China, South Korea, Malaysia, Singapore, Taiwan, Vietnam, Thailand and Philippines.

Manufacturing export orders in the G4 economies of the US, Eurozone, UK and Japan have continued to show contraction throughout the first seven months of 2023, according to latest PMI survey evidence.

According to latest trade data from South Korea's Ministry of Trade, Industry and Energy, South Korea's merchandise exports showed a contraction of 6% year-on-year (y/y) in June 2023. For the first half of 2023, South Korean exports fell by 12.3% y/y. Exports of semiconductors fell by 28% y/y in June, reflecting weakening global demand for consumer electronics as well as falling NAND and DRAM prices, while exports of displays were down by 15.6% y/y. Petrochemicals exports also declined significantly, contracting by 22% y/y. However, auto exports were buoyant, rising by 58% y/y in June.

With the moderate pace of recovery continuing to constrain domestic demand in mainland China, total South Korean merchandise exports to that key market fell by 19% y/y in June. South Korean exports to ASEAN fell by 13.9% y/y in June, hit by impact of the slump in Vietnam's electronics exports on South Korean manufacturing supply chains. This indicated the important role of South Korean electronics firms in electronics and electrical goods manufacturing in Vietnam, with large-scale imports of electronics and electrical components from South Korea.

Reflecting the continued weakness of South Korean manufacturing exports, the seasonally adjusted South Korea Manufacturing Purchasing Managers' Index (PMI) dropped from 48.4 in May to 47.8 in June.

Mainland China's merchandise exports also recorded a large decline in June, falling by 12.4% y/y, reflecting weakness in the key US and EU markets. Mainland China's exports to the US fell by 23.7% y/y in June measured in USD terms, while exports to the EU fell by 12.9% y/y. Mainland China's exports to ASEAN also fell sharply, declining by 16.9% y/y in June.

In Singapore, non-oil domestic exports fell by 15.5% y/y in June, with electronic exports declining by 15.9% y/y. Pharmaceuticals exports fell by 29.5% y/y, while petrochemicals exports contracted by 34% y/y.

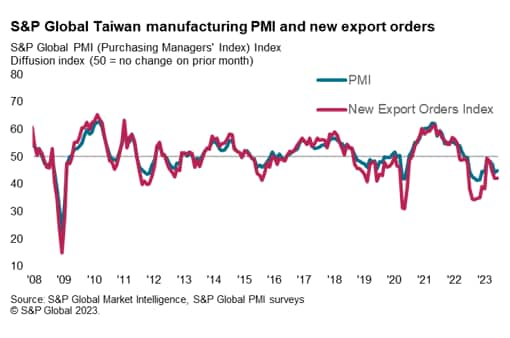

Strong exports were a key driver of Taiwan's rapid economic growth during 2021 and the first half of 2022. However, exports have weakened sharply since mid-2022. In the first six months of 2023, Taiwan's merchandise exports fell by 18% y/y, with exports in the month of June declining by 23.4% y/y. Total exports to mainland China and Hong Kong SAR were down by 26% y/y in the first half of 2023, with a decline of 22% y/y in the month of June. Mainland China and Hong Kong SAR together accounted for 37% of Taiwan's total exports.

The S&P Global Taiwan Manufacturing Purchasing Managers' Index (PMI) registered at 44.8 in June, similar to May's reading of 44.3, well below the neutral mark of 50.0. The reading remained consistent with very contractionary business conditions. The headline index has now posted in negative territory for just over a year. The latest PMI survey results showed that production at Taiwanese manufacturing firms fell for the fifteenth month in a row in June, and at a rapid pace. Companies frequently mentioned cutting output volumes due to a drop in sales.

The weakness of Taiwan's manufacturing sector was also reflected in Taiwan's Industrial Production Index for June, which fell by 16.6% y/y, with the manufacturing production index down by 17.2% y/y.

In contrast to other North-east Asian economies, Japan's merchandise exports in yen value terms have been relatively resilient during the first half of 2023, increasing by 3.1% y/y and rising by 1.5% y/y in the month of June. However, when measured in USD terms, June exports showed a small decline of 3.8% y/y. Japan's relatively resilient export performance was helped by strong exports to the US, which rose by 11% y/y in the first half of 2023 in yen value terms. Exports to the US were buoyed a large rise in exports of autos, which increased by 36% y/y in the first half of 2023 in yen value and by 12% y/y in quantity terms. Japanese exports in yen value terms have been helped by the sharp depreciation of the Japanese yen against the USD since January 2022. The yen has declined from JPY 115 per USD on 1st January 2022 to JPY 140 per USD by 26th July 2023.

Japan's exports to the EU in the first half of 2023 also showed strong growth in value terms, rising by 12.5% y/y, and remaining strong in June, with an increase of 15.0% y/y. Exports to the Middle East have also been buoyant, up by 35.6% y/y in the first half of 2023 and up by 30% y/y in June. However, the strong export growth to these markets was offset by weakness in APAC markets, with Japanese exports to mainland China down by 8.6% y/y in the first half of 2023 and declining by 11% y/y in June. Exports to South Korea fell by 6.1% y/y in the first half of 2023, while exports to Taiwan fell by 10.2% y/y. However, exports to India surged, rising by 33.7% y/y.

Amongst APAC commodity exporting nations, Malaysia had recorded rapid export growth in 2022, with merchandise exports rising by 25% y/y. Exports of manufactured goods rose by 22% y/y during 2022, boosted by exports of electrical and electronic products, which rose by 30%. Rising world commodity prices also boosted commodities exports, with mining exports up by 68% y/y due to strong exports of oil and gas, while agricultural exports rose by 23%.

In 2023, the pace of Malaysian goods export growth has weakened, reflecting base year effects as well as the economic slowdown in key markets, notably the US and EU. For the first half of 2023, goods exports fell by 4.5% y/y, with exports of agricultural goods down by 25% y/y due to lower exports of palm oil products. In June, goods exports fell by 14.1% y/y.

As mainland China is Malaysia's largest export market, accounting for 15.5% of total exports, the weak recovery in China has constrained exports, with Malaysian exports to China down by 8.8% y/y in the first half of 2023. Exports to the US were more resilient during the first half of 2023, down only 2.2% y/y, helped by robust exports of electrical and electronic goods.

After strong growth in 2022, Indonesian exports have fallen sharply in recent months, with June exports down by 21% y/y. Reflecting lower global oil and gas prices, exports of oil and gas fell by 18.7% y/y. However other non-oil and gas exports also fell sharply, down by 21.3% y/y.

The downturn in global electronics demand since mid-2022 has increasingly been impacting on APAC electronics exports, which are an important part of manufacturing exports for many APAC industrial economies.

S&P Global survey data indicates that the global electronics manufacturing industry is continuing to face headwinds from the weak pace of global economic growth. The headline seasonally adjusted S&P Global Electronics PMI posted 47.6 in June, down slightly from 47.9 in May to signal continued contraction in the global electronics sector.

Weakening global economic growth momentum has impacted on consumer demand for electronics, with soft demand in mainland China also contributing to weak new orders for electronics in many APAC economies.

Latest PMI surveys for G4 advanced economies as well as APAC economies in mid-2023 continue to indicate weak manufacturing orders, signalling continued headwinds for manufacturing exports in the near-term. In South Korea and Taiwan, export orders have been soft in recent months, particularly due to weak demand conditions for global electronics as well as chemicals.

However, some improvement in the electronics cycle could evolve during the second half of 2023 and early 2024, due to declining inventories of chips held by manufacturers as well as the rollout of new smartphone models for Christmas season sales in North America and Western Europe.

Furthermore, a mitigating factor to the downturn in merchandise exports is that service sector exports have been improving during the first half of 2023, notably in some APAC economies that have traditionally had large international tourism revenue prior to the COVID-19 pandemic. The reopening of international borders in many APAC countries during 2022 had already allowed a gradual restart of international tourism during the second half of 2022, but momentum has been building significantly during the first half of 2023.

Despite near term headwinds, the medium-term outlook for APAC exports remains favourable. An important support for APAC export growth will be rapid growth in intra-APAC trade, buoyed by rapidly rising consumer markets in large Asian emerging markets, including India, Indonesia, Vietnam and Philippines.

The medium-term prospects are also expected to be favourable for APAC electronics exports. The outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.