Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 03, 2025

By Iuri Struta

| Tech companies integrating AI into their systems could see significant cost savings in coming years. Source: Laurence Dutton/E+ via Getty Images |

Cost savings from AI-driven efficiencies are rarely reflected in software companies' profitability forecasts, yet they could soon become a significant catalyst as firms frenetically push for the adoption of GenAI tools.

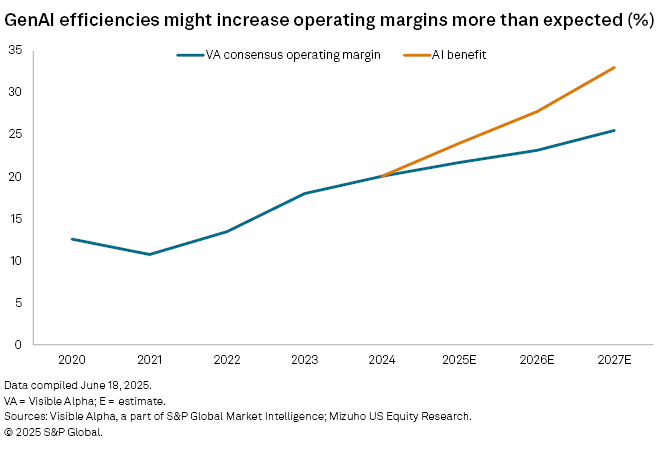

According to a recent report by Mizuho analysts, efficiencies generated by AI could lead to an improvement of up to 7.5% in operating margins at software companies in its universe by 2027 in a moderately optimistic scenario.

Since most analysts have yet to incorporate potential savings from GenAI technologies into their models, this could leave room for upside surprises to earnings this and next year, provided current estimates remain accurate and no economic shocks occur. An improvement in margins in the range projected by Mizuho would raise the median margin for 2027 from the current Visible Alpha estimate of 25.5% to 33%. The Visible Alpha list includes 72 companies in the application software category with a market capitalization higher than $2 billion.

“There are anecdotal examples of efficiency enhancements, but enterprise-wide impact has not materialized yet," said Melissa Otto, a head of research at Visible Alpha. "The chatter is that next year may be the time that this starts.".

|

– Learn about Visible Alpha | S&P Global. – To receive email alerts for future Visible Alpha articles, select Melissa Otto under the Authors section. |

Savings surprises

Mizuho analysts note that AI efficiencies and savings are not just "theoretical." Intuit Inc., Dayforce Inc., Twilio Inc. and ZoomInfo Technologies Inc. have already identified savings related to AI initiatives.

"Our investments in AI capabilities have delivered nearly $90 million in annualized efficiencies in the first half of the year," Intuit CFO Sandeep Singh Aujla said during a fiscal second-quarter earnings call.

The CFO explained that Intuit is leveraging AI for expert training, matching customers to experts, automating workforce operations and eliminating data entry. "They're using AI agents to deliver done-for-you experiences, and this has contributed to a 20% reduction in the contact rate for TurboTax product support year to date," Aujla said. "We're also seeing improved coding productivity with up to 40% faster coding using GenAI code assistance, driving faster innovation for our customers."

Many other companies say they use AI to drive efficiencies, but rarely disclose exact numbers.

"These examples highlight how AI is already driving meaningful cost reductions and operational improvements, positioning software companies for sustained margin expansion," Mizuho analysts said.

Register for our exclusive webinar on July 15 to learn about the record funding being raised by generative AI startups in 2025. Market experts from S&P Global Market Intelligence and Synthesia Ltd. will break down the latest funding totals for the second quarter, discuss product developments that continue to fuel generative AI capabilities, and provide a first-hand account of how a new round of funding and valuation has impacted a leading firm in this space.

Klarna approach

Klarna Bank AB (publ), a buy-now-pay-later company, has been vocal about leveraging AI for efficiency gains. Since adopting AI internally two years ago, Klarna's workforce has decreased from approximately 5,500 to 3,400, with CEO Sebastian Siemiatkowski anticipating a further reduction to around 2,000. Despite this, Klarna maintains over 20% annual growth, with revenue per employee increasing from $340,000 to over $800,000.

Daniel Greaves, corporate communications lead at Klarna, told S&P Global Market Intelligence in an interview that all departments, except IT, have proportionally reduced staff. IT remains unchanged to facilitate AI tool integration, reflecting Klarna's shift toward a tech-oriented company. Currently, 96% of Klarna employees utilize AI tools, Greaves said.

Klarna adopted a bottom-up approach to AI implementation, showering employees with AI tools to discover practical applications. This strategy significantly impacted customer service.

"A large part of customer service requests are pretty straightforward — like confirm when payment was made — so the AI agent is handling those straightforward requests now," Greaves said. "AI is now also dealing with more complicated requests."

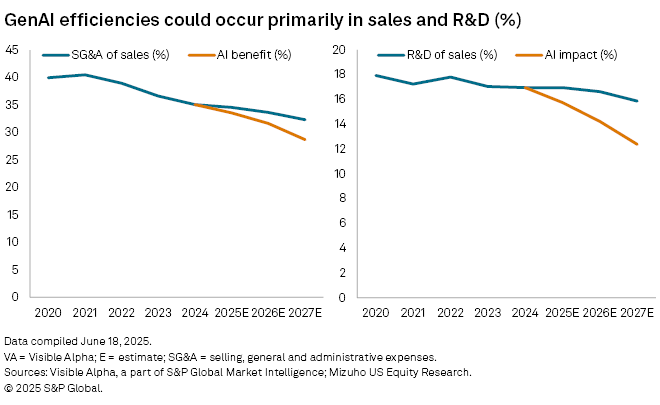

Beyond leading large language models from OpenAI LLC, Anthropic PBC and Mistral AI SAS, numerous AI solutions have emerged to serve specific organizational functions. Sales and marketing are popular areas for custom chatbots, with coding or research and development and customer service also gaining traction. Greaves says Klarna continuously tests new market solutions to enhance efficiency.

Looking ahead

Numerous vertical software companies are integrating AI capabilities into their platforms. For example, customer relationship management provider Salesforce Inc. introduced Einstein GPT to boost sales productivity, ZoomInfo launched ZoomInfo Copilot, and HubSpot Inc. incorporated Clearbit AI as a chatbot. These companies use their chatbots for internal improvements and sell them to customers.

An unanswered question is the true cost of running AI chatbots. Foundation model creators like OpenAI and Anthropic are incurring significant costs with inference and development, and they are burning through billions of dollars. This could prompt a revision of LLM pricing.

At the same time, AI project abandonment rates are rising. According to a recent S&P Global Market Intelligence 451 Research survey, the percentage of companies abandoning the majority of their AI initiatives before they reach production has surged from 17% to 42% year over year. Organizations, on average, reported that 46% of projects are scrapped between proof of concept and broad adoption.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Visible Alpha is a part of S&P Global Market Intelligence.