Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 3 Sep, 2021

By Erik Keith

With GPON having achieved peak deployment, an array of 10G PON technologies are queued up to overtake GPON as the dominant PON solution; collectively, 10G PON will surpass GPON within the coming year. Of the multiple 10G PON options, Kagan's forecast shows XGS-PON becoming the most popular 10G PON variant worldwide over the next three years, based on port/unit shipments. At this point, many operators and their systems vendor suppliers have conceded that the next big step in PON technology will be 50G. But there is another, intermediate option worth examining: 25G PON, for which Nokia Corp. is the chief proponent.

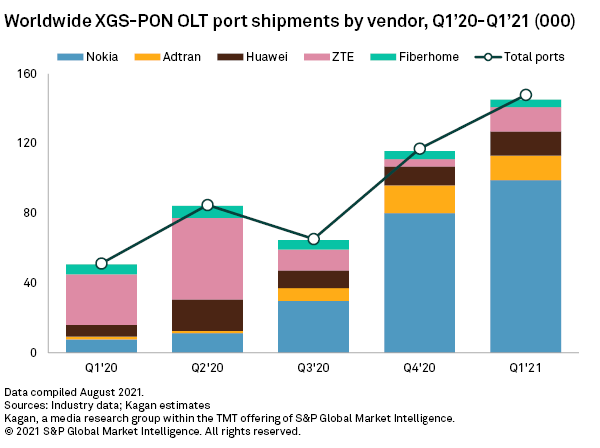

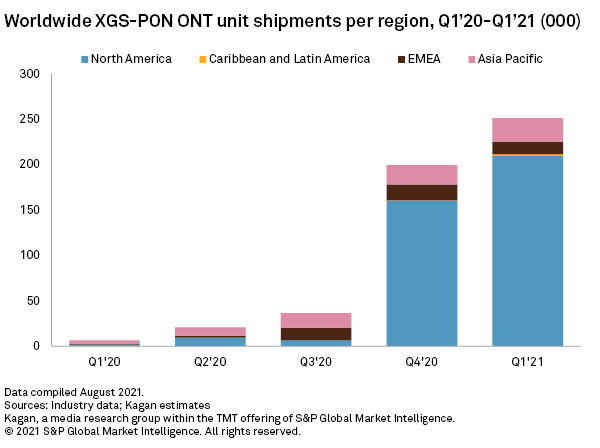

Nokia's leadership of the emerging XGS-PON market is evidenced by the more than 300,000 XGS-PON optical line terminal, or OLT, ports it has shipped, and more than 1 million optical network terminal, or ONT, units shipped through second quarter 2021. With more than half of its OLT ports supporting multi-PON — i.e., line cards capable of supporting GPON, XGS-PON and 25G PON — the stage has effectively been set for operators to upgrade to 25G PON when desired/warranted. To be fair, almost every other contender in the PON market offers a multi-PON or combo-PON OLT solution within its portfolio.

Fiber access: from 1G to 10G PON

Fiber-to-the-home, or FTTH, after more than two decades of large-scale commercial deployment, has been established as the endgame technology for fixed broadband access. First-generation FTTH, e.g., BPON, was leveraged by early adopter operators of all sizes, from tier 1 to tier 3 telcos, most notably Verizon Communications Inc. in the U.S.

Outside of Japan (where Ethernet PON, or EPON, and now 10G EPON are dominant), it was Gigabit PON, or GPON, that catalyzed the mass market growth of fiber access technology. And while early mass-market FTTH deployments in China, the world's largest telecom market, were also EPON, the tipping point for GPON overtaking EPON worldwide materialized when Chinese operators switched to GPON.

GPON overtook EPON as the number one PON/FTTH technology worldwide in the early 2010s and has maintained this position for more than a decade. During the course of this year, 10G PON technologies are expected to collectively overtake GPON as the most widely deployed fiber access solutions, as highlighted in our most recent fixed broadband forecast.

Of these 10G PON variants, XG-PON1 is off to an early lead in terms of both OLT port and ONT unit shipments, driven primarily by the massive Chinese market. Outside of China, however, it is XGS-PON that is gaining momentum quickly. By 2024, XGS-PON is expected to become the most popular FTTH technology shipped worldwide.

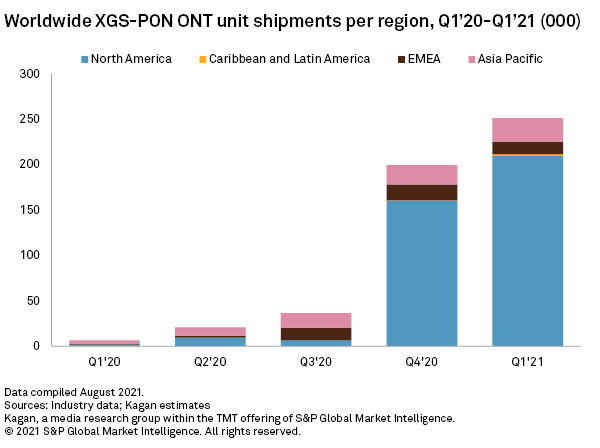

What is evident from the chart above is that Nokia has become the clear leader in the XGS-PON market. There are two key factors for this outcome. The first is accelerated operator investment in XGS-PON, with more operators choosing Nokia versus rival vendors. The second is the official bans by various governments, due to national security concerns, on the purchase of 5G and other networking gear from Chinese vendors, most notably Huawei Technologies Co. Ltd. and ZTE Corp. This includes the next generation of PON technology.

Beyond 10G PON

So, what do the XGS-PON shipments of one vendor, Nokia, have to do with 25G or 50G PON?

First, the 25G PON proposition is anchored by its smooth upgrade path. Operators investing in multi-PON line cards (which support GPON, XGS-PON and 25G PON optics) for the OLTs can move from XGS-PON to 25G PON with a software upgrade. This is enabled by Nokia's Quillion chipset, which will presumably be leveraged (or licensed) by other systems vendors that support 25G PON. To this end, Nokia was instrumental in the creation of the 25GS-PON Multi-Source Agreement, or 25GS-PON MSA, which is spearheading the industry's development and deployment of 25G PON technology. At present, other key FTTH systems vendors that have joined the MSA include CommScope Holding Co. Inc., DZS Inc., Ciena Corp., TiBiT Communications Inc. and Zyxel Communications Corp.

Second, 25G PON can co-exist with both GPON and XGS-PON simultaneously, on the same fiber network and outside plant. This bolsters the smooth migration path proposition of 25G PON for operators that want to upgrade from XGS-PON without having to execute the dreaded "forklift upgrade," which means swapping out all of their existing OLT equipment for new (50G PON) gear. In contrast, 50G PON can co-exist, based on the current specification, on the same fiber with either GPON or XGS-PON, but not both simultaneously.

Third, the transition from 10G PON, regardless of the specific standard, to 50G PON may come too late in the game for some operator roadmaps, for example, those supporting wireless backhaul services for 5G networks. While XGS-PON is just getting off the ground and will take three to five years to become the most widely deployed PON technology worldwide, some operators are not sold on the idea that 50G PON will actually be the next big step in PON evolution.

Fourth, according to the "Path to 50G PON" roadmap of the China Academy of Information and Communications Technology, or CAICT, mass market implementation of 50G PON technology is not expected until 2029. This is important because the Chinese operators and systems vendors — as demonstrated by their voting record in the International Telecommunication Union, or ITU — were instrumental in preventing 25G PON from becoming an ITU standard, and setting the stage for the 50G PON standard.

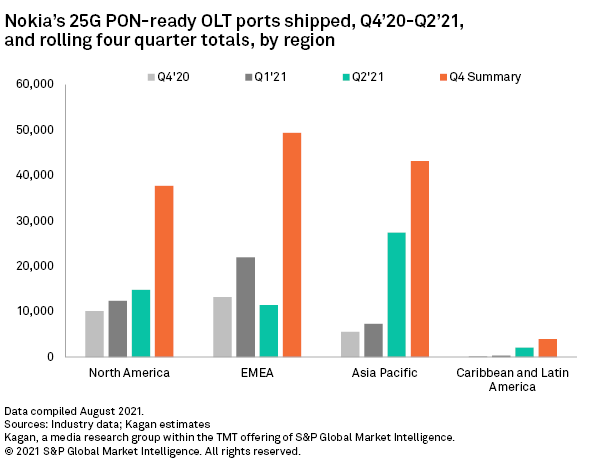

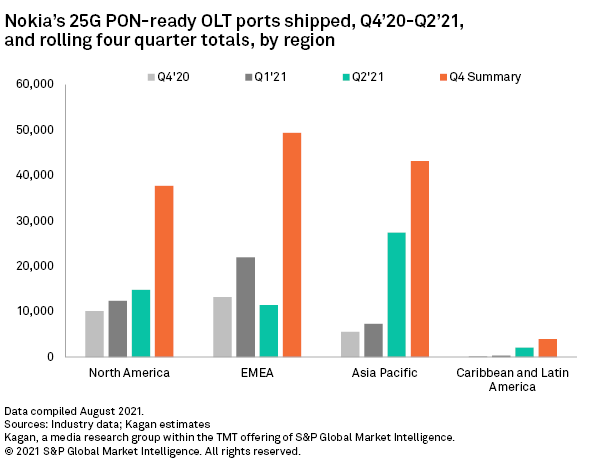

As of first quarter 2021, Nokia became the first (and only) vendor to report shipments of 25G PON-ready ports (including those delivered in 2020). This data reflects the fact that half of Nokia's multi-PON line cards are shipped with the vendor's multi-PON optics, which enable operators to upgrade to 25G PON via software upgrade.

To be clear, 50G PON is already on track to be the next major ITU PON standard. More specifically, the ITU-T (the ITU's Telecommunication Standardization Sector) has settled on the G.hsp.50pmd specification for 50G. But as mentioned above, not every operator is convinced that 50G is the ideal next-generation PON solution.

In fact, a growing number of high-profile operators are actively engaged in the development of 25G PON, including Chorus Ltd., Chunghwa Telecom and NBN Co Ltd., which are founding members of the 25GS-PON MSA. The MSA has also added AT&T Inc., TELUS Corp., Proximus, OptiComm Ltd. and INEA SA, and more than doubled its membership to 39 companies as of August 2021.

In addition to the service providers, systems vendors and components suppliers that have joined the MSA, the fact that CableLabs is also a member signals the merit of 25G PON as a potential technology path for cable operators evaluating the integration of, or migration to, PON technology. This is no surprise, as the 25G-PON specification leverages the IEEE 802.3ca 25G EPON standard, in conjunction with a transmission convergence, or TC, layer extension of XGS-PON.

Finally, while 50G PON is not expected to be ready for the mass market until the last few years of this decade, 25G PON has already been deployed in a live operator network. In May 2021, Belgium's Proximus connected the Antwerp Port Authority (Havenhuis) building with the operator's Antwerp central office, with Proximus staking claim to operating the fastest network in the world (>20 Gbps). More recently, in July 2021, it was announced that Openreach Ltd., the wholesale subsidiary of British Telecom, has tested Nokia's 25G PON technology at its Adastral Park lab in Ipswich, U.K., and the operator will initiate field trials in December 2021.

As such, 25G PON is already in live (albeit small-scale) operator networks, thanks to multiple congruencies with existing GPON and XGS-PON implementations. And while 50G PON will undoubtedly be leveraged extensively in the future, right now that future is almost a decade away. In the meantime, 25G PON, effectively a "turbo-charged" version of XGS-PON, provides operators with a cost-effective PON evolution/migration/upgrade proposition which may make too much sense to ignore.

What is evident from the chart above is that Nokia has become the clear leader in the XGS-PON market. There are two key factors for this outcome. The first is accelerated operator investment in XGS-PON, with more operators choosing Nokia versus rival vendors. The second is the official bans by various governments, due to national security concerns, on the purchase of 5G and other networking gear from Chinese vendors, most notably Huawei Technologies Co. Ltd. and ZTE Corp. This includes the next generation of PON technology.

Beyond 10G PON

So, what do the XGS-PON shipments of one vendor, Nokia, have to do with 25G or 50G PON?

First, the 25G PON proposition is anchored by its smooth upgrade path. Operators investing in multi-PON line cards (which support GPON, XGS-PON and 25G PON optics) for the OLTs can move from XGS-PON to 25G PON with a software upgrade. This is enabled by Nokia's Quillion chipset, which will presumably be leveraged (or licensed) by other systems vendors that support 25G PON. To this end, Nokia was instrumental in the creation of the 25GS-PON Multi-Source Agreement, or 25GS-PON MSA, which is spearheading the industry's development and deployment of 25G PON technology. At present, other key FTTH systems vendors that have joined the MSA include CommScope Holding Co. Inc., DZS Inc., Ciena Corp., TiBiT Communications Inc. and Zyxel Communications Corp.

Second, 25G PON can co-exist with both GPON and XGS-PON simultaneously, on the same fiber network and outside plant. This bolsters the smooth migration path proposition of 25G PON for operators that want to upgrade from XGS-PON without having to execute the dreaded "forklift upgrade," which means swapping out all of their existing OLT equipment for new (50G PON) gear. In contrast, 50G PON can co-exist, based on the current specification, on the same fiber with either GPON or XGS-PON, but not both simultaneously.

Third, the transition from 10G PON, regardless of the specific standard, to 50G PON may come too late in the game for some operator roadmaps, for example, those supporting wireless backhaul services for 5G networks. While XGS-PON is just getting off the ground and will take three to five years to become the most widely deployed PON technology worldwide, some operators are not sold on the idea that 50G PON will actually be the next big step in PON evolution.

Fourth, according to the "Path to 50G PON" roadmap of the China Academy of Information and Communications Technology, or CAICT, mass market implementation of 50G PON technology is not expected until 2029. This is important because the Chinese operators and systems vendors — as demonstrated by their voting record in the International Telecommunication Union, or ITU — were instrumental in preventing 25G PON from becoming an ITU standard, and setting the stage for the 50G PON standard.

As of first quarter 2021, Nokia became the first (and only) vendor to report shipments of 25G PON-ready ports (including those delivered in 2020). This data reflects the fact that half of Nokia's multi-PON line cards are shipped with the vendor's multi-PON optics, which enable operators to upgrade to 25G PON via software upgrade.

To be clear, 50G PON is already on track to be the next major ITU PON standard. More specifically, the ITU-T (the ITU's Telecommunication Standardization Sector) has settled on the G.hsp.50pmd specification for 50G. But as mentioned above, not every operator is convinced that 50G is the ideal next-generation PON solution.

In fact, a growing number of high-profile operators are actively engaged in the development of 25G PON, including Chorus Ltd., Chunghwa Telecom and NBN Co Ltd., which are founding members of the 25GS-PON MSA. The MSA has also added AT&T Inc., TELUS Corp., Proximus, OptiComm Ltd. and INEA SA, and more than doubled its membership to 39 companies as of August 2021.

In addition to the service providers, systems vendors and components suppliers that have joined the MSA, the fact that CableLabs is also a member signals the merit of 25G PON as a potential technology path for cable operators evaluating the integration of, or migration to, PON technology. This is no surprise, as the 25G-PON specification leverages the IEEE 802.3ca 25G EPON standard, in conjunction with a transmission convergence, or TC, layer extension of XGS-PON.

Finally, while 50G PON is not expected to be ready for the mass market until the last few years of this decade, 25G PON has already been deployed in a live operator network. In May 2021, Belgium's Proximus connected the Antwerp Port Authority (Havenhuis) building with the operator's Antwerp central office, with Proximus staking claim to operating the fastest network in the world (>20 Gbps). More recently, in July 2021, it was announced that Openreach Ltd., the wholesale subsidiary of British Telecom, has tested Nokia's 25G PON technology at its Adastral Park lab in Ipswich, U.K., and the operator will initiate field trials in December 2021.

As such, 25G PON is already in live (albeit small-scale) operator networks, thanks to multiple congruencies with existing GPON and XGS-PON implementations. And while 50G PON will undoubtedly be leveraged extensively in the future, right now that future is almost a decade away. In the meantime, 25G PON, effectively a "turbo-charged" version of XGS-PON, provides operators with a cost-effective PON evolution/migration/upgrade proposition which may make too much sense to ignore.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Already a client?

Already a client?