Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 01, 2021

A strong headline PMI reading masked just how tough business conditions are for manufacturers at the moment. Although demand remains strong, as witnessed by a further solid improvement in new order inflows, supply chains continue to deteriorate at a worrying rate. Shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half.

At first glance, manufacturers in the eurozone had a bumper month in November. The IHS Markit Eurozone Manufacturing PMI increased from 58.3 in October to 58.4, marking the first rise in the headline index since June. The latest reading was not only far above the 50.0 no change level, but also almost seven points higher than the survey's per-pandemic long-run average of 51.7

However, the details behind the headline PMI tell a far more worrying picture.

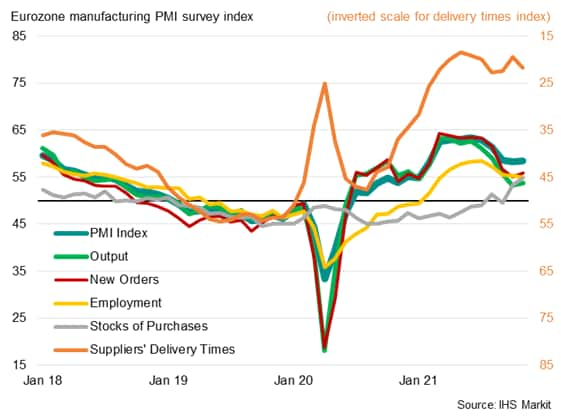

Although demand remained strong, as witnessed by a further solid improvement in new order inflows during November, supply chains continued to deteriorate at a worrying rate. Supply delays spiked to a record high in May 2021 and have since continued to deteriorate at rates surpassing anything ever seen prior to the pandemic.

These shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half. At 53.5, the average output index reading for far in the fourth quarter is only slightly above the pre-pandemic long-run average of 52.9.

A record rise in inventories meanwhile reflected increased efforts by manufacturers to build safety stocks, in turn driven by fears of ongoing shortages of inputs in coming months.

The interplay of these PMI survey measures of output, new orders, suppliers' delivery times and inventories are illustrated in chart 1 below. Note that all of these variables, plus employment, are components used in the calculation of the headline PMI.

Chart 1: Eurozone Manufacturing PMI and its five components

The lengthening of supplier lead-times - normally considered a positive development associated with improving demand in the manufacturing economy (but at present reflecting the pandemic supply shock) - can clearly be seen to have boosted the headline PMI well above the output index, the latter trailing new orders growth in recent months.

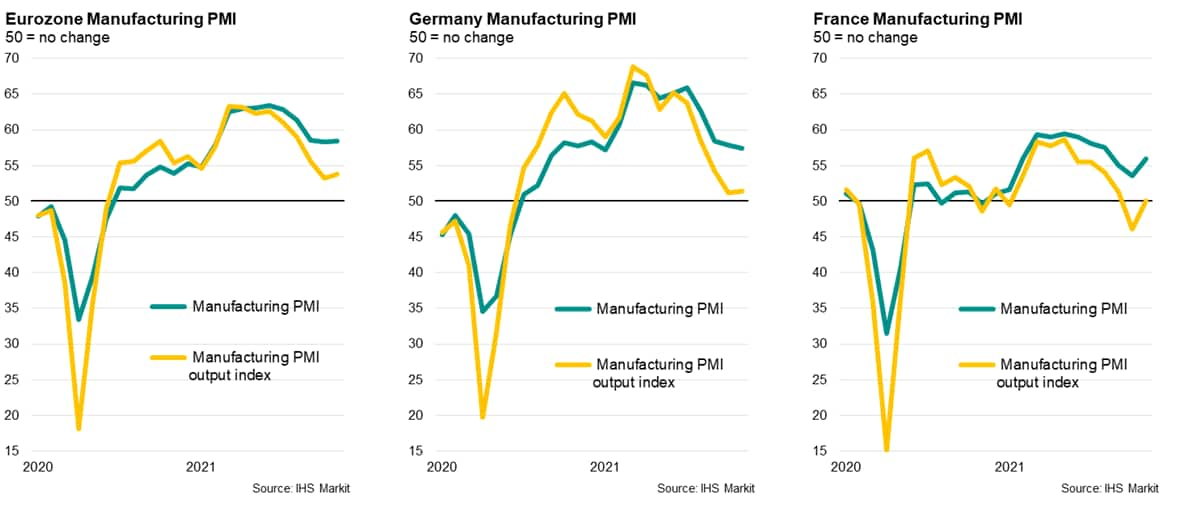

As chart 2 showed more clearly, this 'overstatement' of manufacturing production growth by the headline PMI relative to the survey's actual output index since the summer months is evident not just for the eurozone, but is especially visible for France and Germany.

In France, for example, production stalled in November having fallen in October, contrasting with headline PMI readings well above the 50.0 no-change level.

In Germany, production growth likewise has more or less stalled so far in the fourth quarter, contrasting with the stronger (albeit moderating) headline PMI.

Chart 2: Diverging manufacturing PMI and output indices

Because the survey's output index is a pure measure of production growth while the headline PMI was designed as a broader barometer of the overall 'health' of the manufacturing economy, the output index exhibits a higher correlation with official manufacturing production data than the headline PMI (see chart 3).

Read more about how to interpret the headline PMI and its component sub-indices.

It is the constriction of output relative to new orders which also helps to explain why price pressures are currently so strong. With demand once again outstripping supply, the November PMI survey saw a continuing sellers' market, pushing prices charged for manufactured goods higher and at a rate surpassing anything previously recorded in almost two decades. Higher factory gate prices also suggest consumer inflation has further to rise.

As long as output continues to lag new orders, prices will have a tendency to rise. Only by watching the PMI sub-indices will these inflationary signals be observed.

Chart 3: Eurozone manufacturing PMI output index vs. official production growth

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.