Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Sep, 2023

Four of Europe's most valuable domestic TV sports rights contracts — for the German Bundesliga, Italy's Serie A, France's Ligue 1 and the English Premier League — are coming up for tender, each with its own unique set of characteristics.

The bidding strategy of Comcast Corp.'s Sky Group will influence renewal rates of the Bundesliga, Serie A and EPL contracts, with Sky Group holding rights to a majority of games across all three. Meanwhile, Canal+ is looking to recapture a major share of Ligue 1 rights in France after losing out to Amazon.com Inc. in Ligue 1's last rights auction.

Collectively, Amazon and rival streamer DAZN have a stake in all four leagues' sports rights contracts, and the streaming platforms will be looking to grow their positions. Apple Inc.'s Apple TV+ may also look to explore European opportunities after sealing a global deal with Major League Soccer.

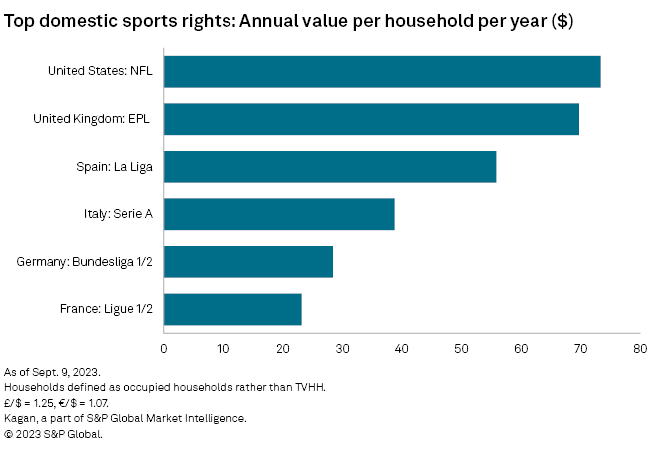

➤ Together, the four European sports rights deals — covering the German Bundesliga, Italy's Serie A, France's Ligue 1 and the English Premier League (EPL) — are worth about €4.5 billion ($4.81 billion) per year.

➤ Intricate competition dynamics, high historical valuations and the potential for new distribution partnerships make the auction outcomes difficult to predict.

➤ Ligue 1 should see a sizeable improvement from its current, undervalued contract. The outcomes of the other auctions are more uncertain, with the EPL most likely to secure improved terms.

Preparations for the 2023 auctions have not gone smoothly. Ligue 1 is already up for tender, while the other three are moving forward later this year. Serie A started its bidding but then paused the activity amid low initial offers. Bundesliga will move forward with its rights auction in the fall after delays related to club objections to the league partnering with private equity firms. The EPL is expected to start its bidding last, and it may expand the number of games on offer in an effort to attract higher bids.

The Serie A and Bundesliga tenders arrive at an unfortunate moment for both leagues. Key bidder Sky Group is primarily focused on retaining a majority of EPL rights in the UK when that contract comes up later this year, and Sky's EPL-first strategy has likely taken some heat out of the other two tenders.

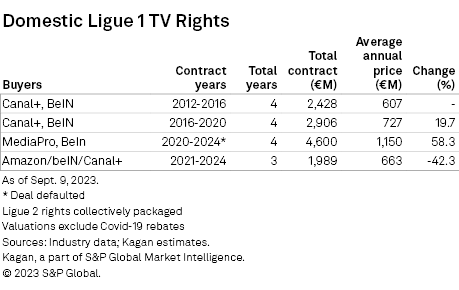

Meanwhile, the contract for France's Ligue 1 is starting out undervalued following its collapsed 2020–2024 contract, known as The MediaPro Fiasco, which resulted in the reauctioning of the 2021–2024 seasons. Amazon landed a cut-price deal for 80% of games under the expiring contract.

Germany's Bundesliga

The German Football League (DFL) is responsible for the operation of the Bundesliga. Since 2021, the league has been exploring the sale of a 25% stake in its media rights business to private equity firms, and reports indicate that Bridgepoint, CVC Capital Partners and KKR may be interested. However, club objections have held up the sale of domestic media rights for the Bundesliga and Bundesliga 2 for the 2025–2026 season onwards. The Bundesliga is moving forward with the sale of the rights overseas.

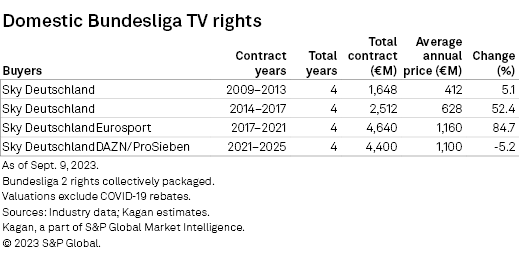

Comcast's Sky Deutschland GmbH controls the majority of Bundesliga matches, with streamer DAZN carrying the remaining key events. A concern for the league is Comcast's commitment to the German market after almost a year of speculation that Sky Deutschland could be spun off.

Meanwhile, the auction presents an opportunity for DAZN to combine its Champions League rights with a majority of Bundesliga matches, which would make it the must-have service for domestic soccer fans. Other bidders could include Amazon, Warner Bros. Discovery Inc. or Dyn Media, a locally focused sports streaming platform founded by former Bundesliga chief executive Christian Seifert and publisher Axel Springer. The Dyn Media platform launched on Aug. 23.

It is plausible that an incumbent rights holder or a new bidder may prepare an offer with a strategic partner. DAZN, for example, has partnered with Telecom Italia in Italy and may pursue a similar strategy in Germany. Sky Deutschland, which in Germany lacks the multiplay offer it enjoys in the UK, may consider partnering with a mobile operator. The industry has seen the success of the Jio-Viacom18 tie-up in India.

Italy's Serie A

In Italy, DAZN and Sky control Serie A rights, with streamer DAZN as the senior partner. The league has failed to attract offers that meet its target of €1 billion per season due to tepid competition. As a result, Serie A delayed its rights auction until Oct. 15 and suggested that it may pursue its own direct-to-consumer product if that becomes the league's most lucrative option.

France's Ligue 1

The Professional Football League (LFP) in France also hopes to land a deal worth €1 billion per season. The Ligue 1 tender will include two packages of live rights, a simpler proposition than previous tenders, which included as many as seven different sets of games. With this strategy, the league aims to put the problems of the 2020–2024 auction behind it.

Key bidders to watch will include Canal+, which will want to recapture the league's major rights package, and Amazon, which broadcasts 80% of Ligue 1 games under the present arrangement and may want to make a longer-term commitment to premium sports rights in France. Other interest will likely come from beIN Sports, and potentially Warner Bros. Discovery and DAZN.

England's Premier League

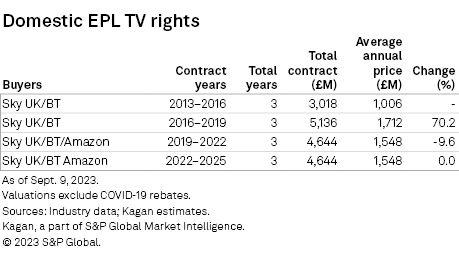

The domestic renewal of EPL rights could take place as early as this autumn. The EPL contract is one of the most expensive in the world on a per-household basis, behind only the NFL in the US. Especially considering rights to England's second-tier and lower leagues are sold separately, unlike other Europe leagues, English domestic soccer rights' valuations are extremely high in global terms.

Comcast's Sky Group has most likely prioritized the imminent EPL renewal over new agreements for its soccer contracts in Italy and Germany. The current EPL deal, covering 2022–2025, is worth £1.55 billion per season and was agreed on the same terms as the previous 2019–2022 contract, struck during the uncertainty of the COVID-19 pandemic. This time, the competition will be different. Incumbent minor rights holder BT Sport is under the TNT Sports brand, and the EPL rights auction will be the first test of Warner Bros. Discovery's sports ambitions since it took control of BT Sports. Presently, Amazon showcases only a small set of EPL rights covering two game weeks, so the auction will show if Amazon is willing to increase its sports rights spending to become a leading domestic player. DAZN is another potential bidder in the EPL's home market; however, the DAZN service lacks the subscriber base and content slate in the UK that it possesses in Germany.

The EPL sells live rights to all 380 of its matches to broadcasters overseas. In the UK, it only offers 200 of the 380 matches due to the 3 p.m. Saturday blackout, a rule prohibiting live match broadcasts during a two-hour window designed to support in-person attendance at football league grounds. A key component of this auction will be whether the number of available matches increases, with media speculation suggesting as many as 60 games extra games could be sold. There are some stakeholders that would welcome the removal of the Saturday blackout because the 3 p.m. games have attracted viewers of illegal pirated feeds or unlicensed foreign broadcasts of matches not available in the UK.

One European league that has finalized a domestic rights renewal is the Dutch Eredivisie. Walt Disney Co., which inherited a 10-year joint venture between the league and Fox Sports that was due to mature in 2025, has struck a deal for a further five seasons under the ESPN Eredivisie brand, guaranteeing the league at least €135 million per season before add-ons, up from €80 million per season.

Economics of Networks is a regular feature from Kagan, a part of S&P Global Market Intelligence.

Article amended at 8:37 a.m. ET on Sept. 21, 2023, to clarify that the Dyn Media platform launched on Aug. 23, 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.