Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Oct, 2025

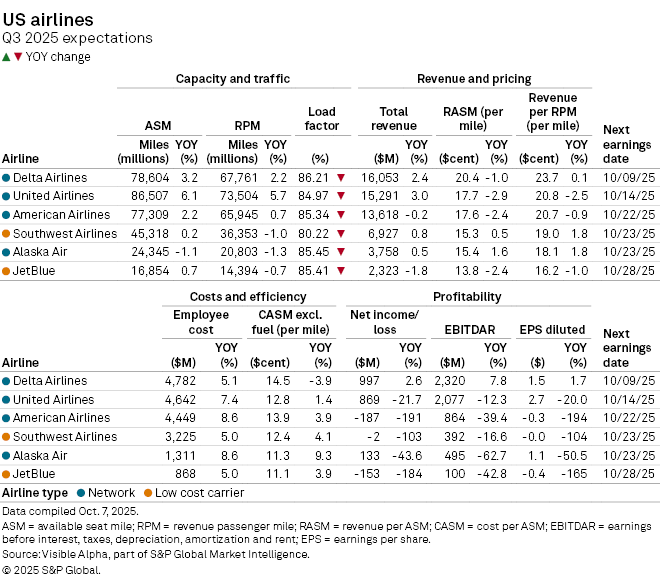

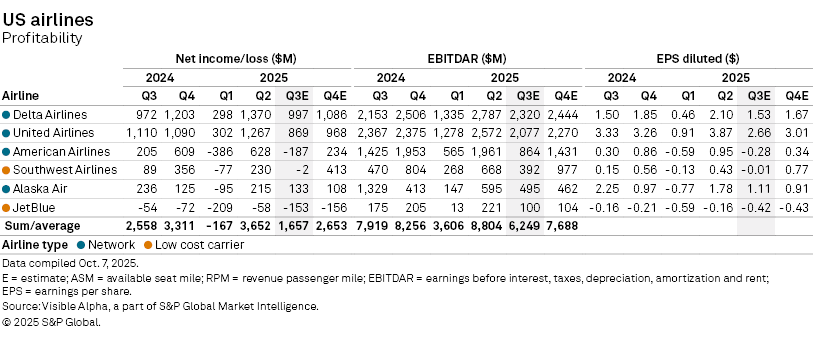

US airlines will kick off third quarter earnings season on Thursday, October 9, with Delta reporting first, followed by peers through to JetBlue on Tuesday, October 28. Visible Alpha’s consensus estimates highlight mixed expectations across key players in the industry, with analysts expecting moderate earnings as steady travel demand is offset by weaker pricing and costs.

Delta Air Lines Inc. (NYSE: DAL) and United Airlines Holdings Inc. (NASDAQ: UAL) are expected to deliver modest revenue growth of 2–3%, underpinned by higher capacity and resilient traffic. However, lower revenue per mile and rising unit costs are expected to pressure margins, with Delta’s EBITDAR expected to be up 8% but United’s down 12%.

American Airlines Group Inc. (NASDAQ: AAL) is expected to continue to lag peers, with revenue projected to slip 0.2% year-over-year and a net loss of $187 million, reflecting soft yields and elevated costs.

Low-cost carrier, Southwest Airlines Co. (NYSE: LUV) faces similar margin strain despite flat capacity, while Alaska Air Group Inc. (NYSE: ALK) is forecast to see a sharp 50% decline in earnings per share, even as revenue edges higher. JetBlue Airways Corp. (NASDAQ: JBLU) remains in the red, with analysts expecting another quarterly loss amid pricing pressure and capacity discipline.

Overall, profit growth is expected to be constrained by cost inflation and weaker pricing power, suggesting limited earnings momentum, even as travel volumes remain robust.

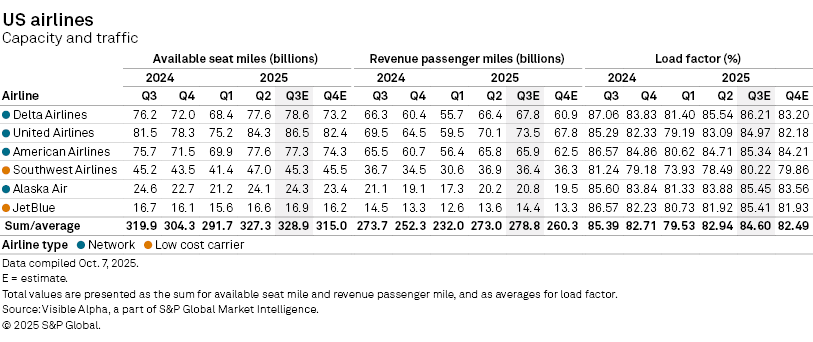

Capacity and trafficCapacity and traffic expectations for Q3 2025 indicate that airlines are maintaining robust passenger volumes, with total revenue passenger miles (RPM) across major carriers projected at 278.8 billion, up from 273.7 billion in Q3 2024, while total available seat miles (ASM) are expected to rise to 328.9 billion from 319.9 billion a year ago.

Network carriers such as Delta (ASM +3.1%, RPM +2.2%) and United (ASM +6.1%, RPM +5.7%) are expected to lead capacity growth, whereas low-cost carriers like Southwest and JetBlue show more modest expansions.

The overall load factor remains high

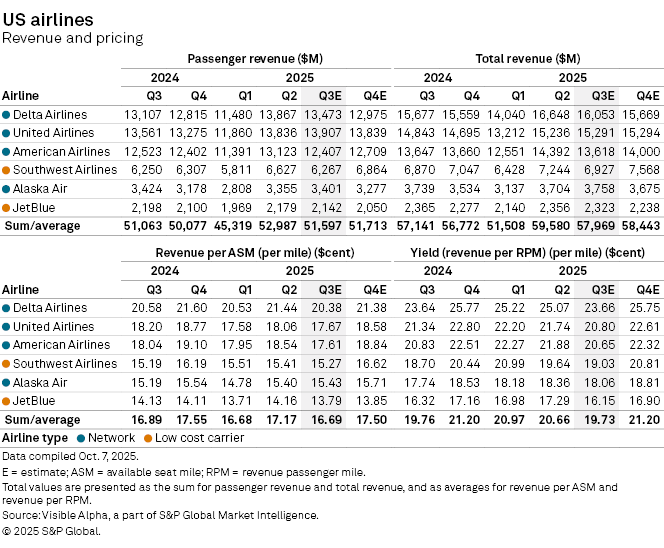

Looking at the revenue and pricing expectations for Q3 2025, total passenger revenue

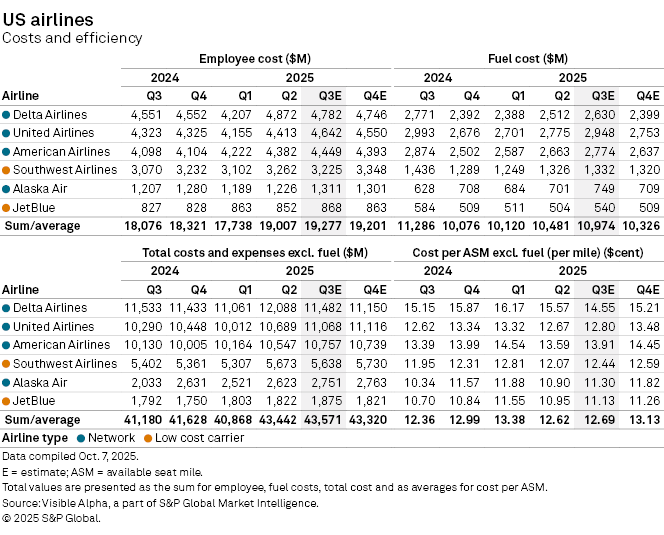

Cost and efficiency metrics show a mixed environment in Q3 2025, with rising employee expenses and fuel costs contributing to pressure on margins, even as capacity and traffic remain robust.

Total employee costs across major carriers

Meanwhile, total costs and expenses excluding fuel are projected to rise 6%

Net income across major carriers

Overall, US airlines are poised for moderate earnings, with expectations for Q3 2025 looking considerably weaker than Q3 2024. While passenger demand and travel volumes remain robust—supported by sustained leisure travel and steady corporate bookings—the industry continues to grapple with margin pressures. Substantially higher employee costs are expected to weigh on profitability, offsetting the benefits of stable capacity and disciplined pricing.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Capital IQ Pro.

– Access Visible Alpha estimates on Delta Airlines, United Airlines, American Airlines, Southwest Airlines, Alaska, and JetBlue Airways.

– To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section.