Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Aug, 2025

By Melissa Otto

NVIDIA Corp. (NASDAQ: NVDA) will report fiscal Q2 2026 results on Wednesday, August 27, 2025, after the market close. Here are the key numbers that we’re watching.

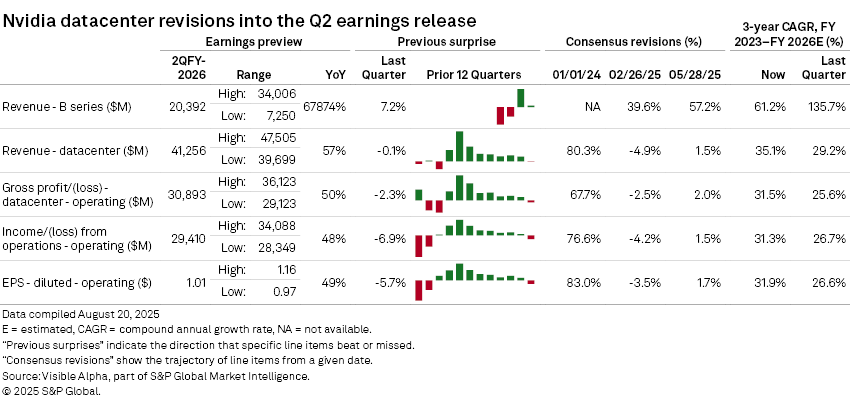

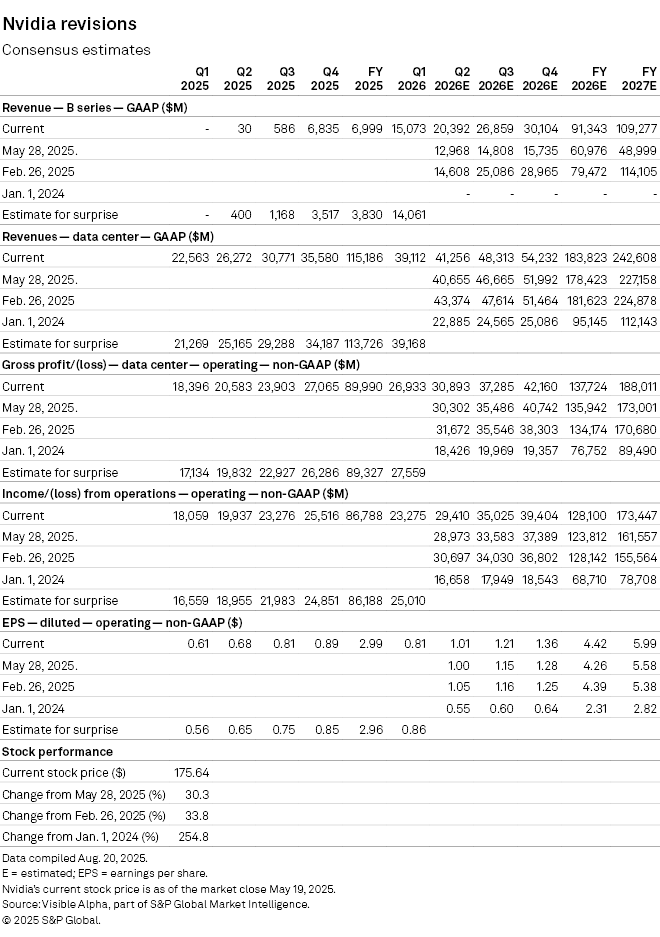

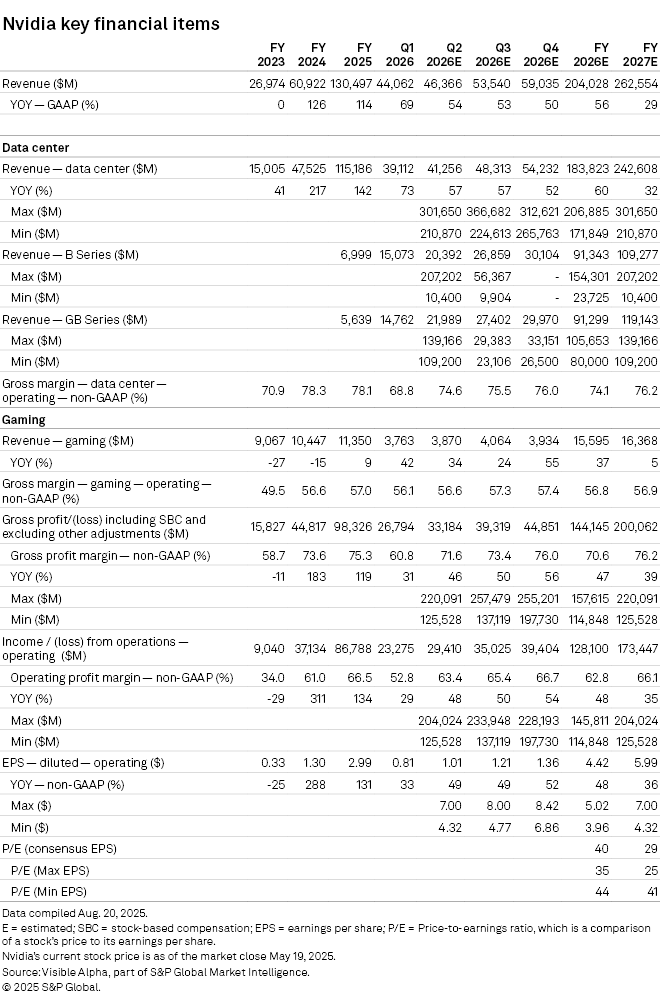

Total revenue of $46.4 billion is expected for Fiscal Q2 2026, according to Visible Alpha consensus. Revenue growth is driven by optimism about Nvidia’s Data Center segment, Q2 expected top line performance of which increased by almost 50% to $41.3 billion since January 2024. Since the February quarter, however, expected revenue for Q2 has moderated and based on Visible Alpha consensus, Data Center revenue estimates in Q2 2026 range from $39.7 billion to $47.5 billion.

Anticipated revenue growth is driven by strong demand for its GPUs from cloud service providers and the move to accelerated computing in AI data centers. There are questions around the outlook for Nvidia’s new solution, Blackwell, which claims to significantly reduce energy consumption and cost for customers, including concerns about the timing of Blackwell’s growth and its total addressable market (TAM). This is reflected in the revenue estimates for the new B-series. Forecasts from 11 sources range from $7.3 billion to $34.0 billion in Q2, with consensus at $20.4 billion.

This has triggered debate about the Data Center segment's future performance. Blackwell revenue should increase to $91.3 billion this year, from $7 billion in 2024, but consensus ranges from $23.7 billion to $154.3 billion. It will be important to see Q2’s Blackwell performance and outlook for Q2 and the rest of FY 2026. The FY 2026 B-series expectations have moved higher, while total Data Center revenue for FY 2026 increased to $183.8 billion from $178.4 billion last quarter. This could be attributed to the higher 27 source count for the Data Center revenues, compared to the 11 sources that provide estimates for the B-series, suggesting some analysts may simply reflect Blackwell in their Data Center estimate instead of breaking it out separately.

Visible Alpha consensus for the gross profit of this segment in Q2 26 has remained between $30.0 billion and $31.0 billion, due to the higher costs associated with the Blackwell ramp. The consensus gross profit margin for the Data Center segment for FY 2026 continued to decrease, falling over 100bps to 74.1% from the 75.2% estimated at the end of last quarter. The figure stood at 78% in FY 2024 and FY 2025. The operating profit margin for FY 2026 and FY 2027 is also projected to move lower from 2024's 66.5%, due to the lower gross margin and higher expenses. These dynamics in consensus margins are causing the expected FY 2026 consensus P/E to be 40x and to range from 35x to 44x.

The stock traded up 30.3% since the last release and is up 33.8% since February. Nvidia stock price is up around 254.8% since January 2024. Could the Q2 release provide the next positive catalyst for the stock, or are expectations largely priced in for now?

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Nvidia.

– To receive email alerts for future Visible Alpha articles, select Melissa Otto under the Authors section.